Key Insights

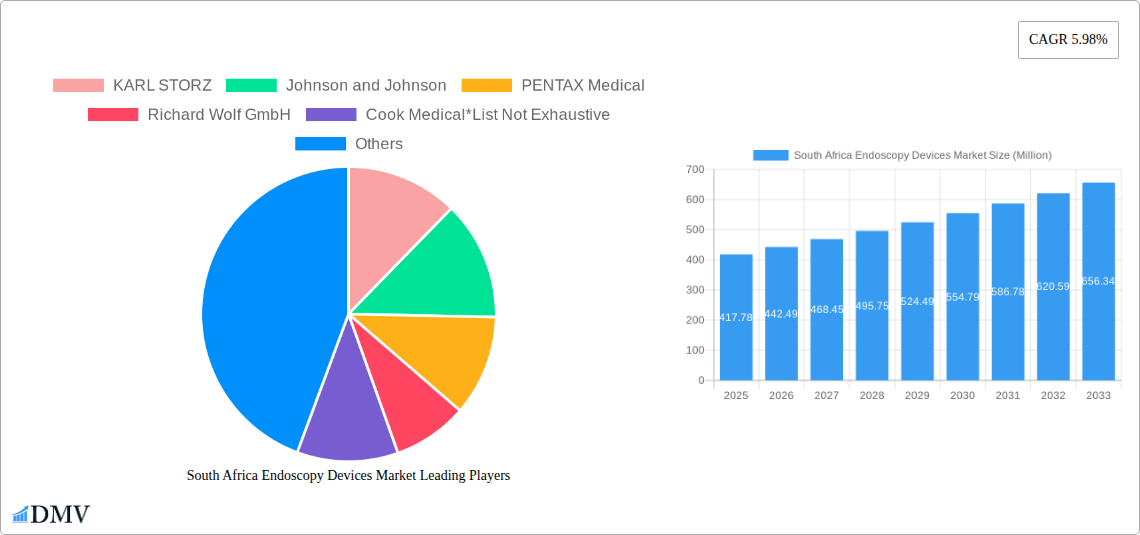

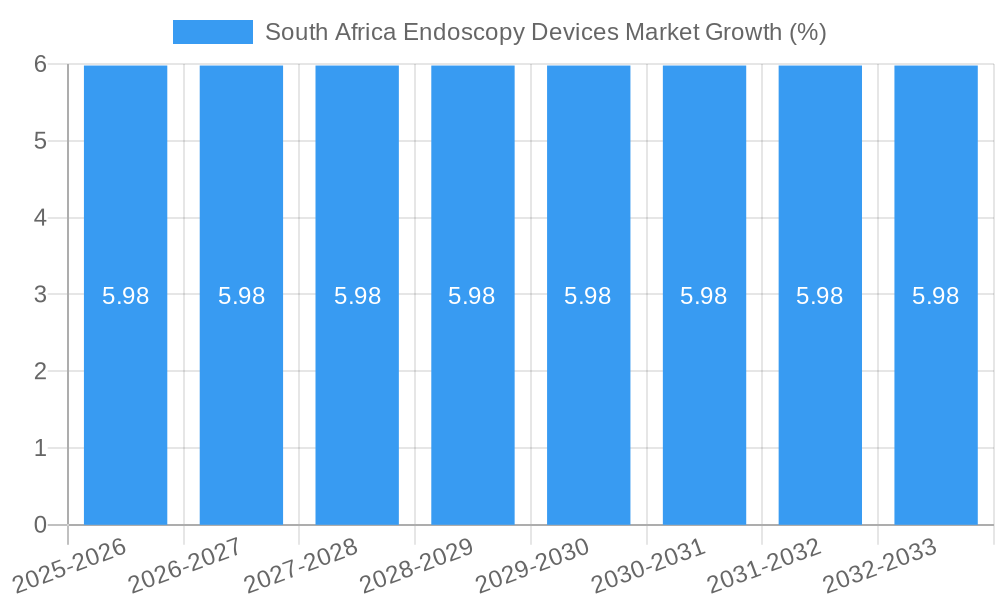

The South African endoscopy devices market is poised for significant growth, projecting a market size of USD 417.78 million and a robust Compound Annual Growth Rate (CAGR) of 5.98% during the forecast period of 2025-2033. This expansion is primarily driven by the increasing prevalence of chronic diseases, such as gastrointestinal disorders and respiratory conditions, which necessitate minimally invasive diagnostic and therapeutic procedures. Advancements in endoscopic technology, including high-definition imaging, robotic-assisted endoscopy, and improved maneuverability of instruments, are further fueling market adoption. The growing emphasis on early disease detection and personalized treatment approaches, coupled with increasing healthcare expenditure and government initiatives to enhance diagnostic capabilities, are key contributors to this positive market trajectory. Furthermore, the rising demand for outpatient procedures, driven by cost-effectiveness and patient convenience, will also play a crucial role in market expansion.

The market is segmented across various device types, with Endoscopes and Endoscopic Operative Devices expected to witness the highest demand. Applications in Gastroenterology and Pulmonology are anticipated to dominate the market, reflecting the burden of related diseases in South Africa. Orthopedic Surgery and Cardiology applications are also expected to grow steadily due to the increasing adoption of arthroscopic and cardiac endoscopic procedures. Key players such as KARL STORZ, Johnson and Johnson, and Boston Scientific Corporation are actively investing in research and development to introduce innovative solutions, expand their product portfolios, and strengthen their distribution networks within the region. However, challenges such as the high cost of advanced endoscopic equipment and the need for skilled personnel to operate them could pose some restraints to rapid market penetration. Nevertheless, the overall outlook for the South African endoscopy devices market remains optimistic, driven by unmet medical needs and the continuous pursuit of improved patient outcomes.

South Africa Endoscopy Devices Market: Comprehensive Report & Forecast (2019-2033)

Gain unparalleled insights into the dynamic South Africa Endoscopy Devices Market with this in-depth report. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this analysis delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, major players, and key industry developments. Optimized with high-ranking keywords such as "endoscopy devices South Africa," "medical devices market," "gastroenterology endoscopy," "pulmonology endoscopy," and "orthopedic surgery endoscopy," this report is crucial for stakeholders seeking to navigate and capitalize on the burgeoning healthcare sector in South Africa.

South Africa Endoscopy Devices Market Market Composition & Trends

The South Africa Endoscopy Devices Market is characterized by a moderate level of concentration, with leading global players holding significant market share. Innovation is a key catalyst, driven by advancements in imaging technology, miniaturization, and the increasing demand for minimally invasive procedures across various medical specialties. The regulatory landscape, while evolving, prioritizes patient safety and device efficacy, influencing product development and market entry strategies. Substitute products, though present in some niche applications, are largely outpaced by the precision and diagnostic capabilities offered by modern endoscopy. End-user profiles encompass a spectrum of healthcare providers, from large public hospitals to specialized private clinics, all seeking enhanced diagnostic accuracy and patient outcomes. Mergers and acquisition (M&A) activities are instrumental in consolidating market presence and expanding product portfolios.

- Market Share Distribution: Leading companies account for approximately 65% of the total market share, with significant contributions from KARL STORZ, Johnson and Johnson, and PENTAX Medical.

- M&A Deal Values: While specific deal values are proprietary, strategic acquisitions in the medical device sector within South Africa have historically ranged from $5 Million to $50 Million, indicating a robust market for consolidation and growth.

- Innovation Catalysts:

- Development of high-definition (HD) and 4K endoscopy.

- Introduction of single-use endoscopes to mitigate infection risks.

- Integration of artificial intelligence (AI) for diagnostic assistance.

- Regulatory Landscape: Strict adherence to medical device regulations overseen by the South African Health Products Regulatory Authority (SAHPRA) is paramount for market access.

South Africa Endoscopy Devices Market Industry Evolution

The South Africa Endoscopy Devices Market has witnessed a substantial evolution, driven by a confluence of technological advancements, rising healthcare expenditure, and an increasing prevalence of chronic diseases necessitating diagnostic and therapeutic interventions. Historically, the market was dominated by rigid endoscopes; however, the advent of flexible endoscopy marked a transformative shift, enabling less invasive examinations and treatments. Over the study period (2019-2033), we project a compound annual growth rate (CAGR) of approximately 6.2%, fueled by an increasing patient pool and a growing awareness of the benefits of endoscopic procedures. The base year, 2025, serves as a pivotal point, with projected market revenue of $280 Million. Key growth trajectories are shaped by the demand for advanced visualization equipment and sophisticated endoscopic operative devices. The adoption of robotic-assisted endoscopy, though in its nascent stages, is poised to become a significant future trend, further enhancing precision and reducing recovery times. Furthermore, government initiatives aimed at improving healthcare infrastructure and accessibility are directly impacting the demand for modern diagnostic and surgical tools, including endoscopy devices. The economic landscape of South Africa, with its emerging middle class and increasing investment in private healthcare, also plays a crucial role in driving market expansion. The COVID-19 pandemic, while initially disruptive, also accelerated the adoption of telemedicine and remote diagnostics, indirectly benefiting the market for advanced endoscopic imaging solutions. The increasing focus on preventive healthcare and early disease detection further propels the demand for screening procedures, a primary application for endoscopy devices, particularly in gastroenterology and pulmonology. The market's evolution is also characterized by a growing emphasis on cost-effectiveness and the development of solutions suitable for diverse healthcare settings across the nation, from urban centers to more remote areas.

Leading Regions, Countries, or Segments in South Africa Endoscopy Devices Market

The South Africa Endoscopy Devices Market demonstrates significant dominance within the Gastroenterology application segment. This supremacy is driven by the high incidence of gastrointestinal disorders such as inflammatory bowel disease (IBD), peptic ulcers, and various forms of gastrointestinal cancers, which necessitate regular endoscopic surveillance and intervention. The accessibility and diagnostic accuracy of endoscopes in visualizing the upper and lower gastrointestinal tracts make them indispensable tools for gastroenterologists. Within the Type of Device segment, Endoscopes themselves represent the largest share, as they form the foundational component of any endoscopic procedure. However, the market is witnessing robust growth in Endoscopic Operative Devices due to the increasing trend towards interventional endoscopy, where therapeutic procedures are performed during diagnostic examinations.

Dominant Application Segment: Gastroenterology

- Key Drivers:

- High prevalence of gastrointestinal diseases, including colorectal cancer screening programs.

- Advancements in endoscopic techniques for polyp removal, stenting, and foreign body retrieval.

- Growing demand for minimally invasive diagnostic and therapeutic solutions.

- Increased awareness among patients regarding early detection of GI cancers.

- Substantial investment in gastroenterology departments within private hospitals.

- In-depth Analysis: The ability of endoscopes to directly visualize the lumen of the digestive tract, coupled with the availability of advanced biopsy tools and therapeutic accessories, solidifies gastroenterology's leading position. Procedures like colonoscopies and gastroscopies are among the most frequently performed endoscopic examinations in the country.

- Key Drivers:

Dominant Device Type Segment: Endoscopes

- Key Drivers:

- Continued innovation in imaging technology (HD, 4K) enhancing visualization.

- Development of specialized endoscopes for specific anatomical regions.

- Integration of features like narrow-band imaging (NBI) for improved lesion detection.

- Growing adoption of flexible and video endoscopes over older rigid models.

- In-depth Analysis: The fundamental role of endoscopes as the primary visual instrument ensures their consistent market leadership. The demand is further amplified by the need for versatile devices that can be employed across multiple applications, though specialized endoscopes are increasingly gaining traction.

- Key Drivers:

South Africa Endoscopy Devices Market Product Innovations

Product innovations in the South Africa Endoscopy Devices Market are intensely focused on enhancing diagnostic precision, improving patient comfort, and streamlining clinical workflows. The integration of high-definition (HD) and 4K imaging technologies has revolutionized visual clarity, enabling clinicians to detect subtle abnormalities with unprecedented accuracy. Furthermore, the development of cost-effective, single-use endoscopes, such as the NUVIS Single-Use Arthroscope, is a significant advancement, addressing concerns around cross-contamination and reprocessing costs, particularly relevant in surgical settings like orthopedic surgery. Advancements in endoscopic operative devices now allow for more complex therapeutic interventions, from delicate tissue biopsies to the placement of stents and dilation of strictures, directly within the endoscopic procedure.

Propelling Factors for South Africa Endoscopy Devices Market Growth

The South Africa Endoscopy Devices Market is propelled by several key factors. Technologically, the continuous advancement in imaging resolution (HD, 4K), miniaturization of scopes, and the integration of AI for diagnostic support are driving adoption. Economically, increasing healthcare expenditure, a growing middle class with enhanced access to private healthcare, and rising insurance coverage create a favorable demand environment. Regulatory support for the adoption of advanced medical technologies, coupled with government initiatives to improve public healthcare infrastructure, also plays a crucial role. The rising burden of non-communicable diseases, particularly in gastroenterology and pulmonology, further necessitates advanced diagnostic tools.

Obstacles in the South Africa Endoscopy Devices Market Market

Despite robust growth, the South Africa Endoscopy Devices Market faces certain obstacles. High acquisition costs for state-of-the-art endoscopic equipment can be a barrier, especially for smaller healthcare facilities or public hospitals with limited budgets. The need for specialized training for healthcare professionals to operate advanced endoscopy systems also presents a challenge. Furthermore, supply chain disruptions, though less prevalent now than during peak pandemic periods, can still impact the availability of essential devices and accessories. The presence of counterfeit or substandard devices, though actively combatted by regulatory bodies, remains a concern for market integrity.

Future Opportunities in South Africa Endoscopy Devices Market

Emerging opportunities in the South Africa Endoscopy Devices Market are abundant. The increasing demand for minimally invasive surgical procedures across specialties like orthopedics and gynecology presents a significant growth avenue. The development and adoption of artificial intelligence (AI)-powered diagnostic endoscopy tools, capable of real-time analysis and anomaly detection, hold immense potential. Expansion into less developed regions within South Africa, focusing on providing affordable and accessible endoscopic solutions, represents a largely untapped market. Furthermore, the growing trend of remote patient monitoring and telemedicine may necessitate advanced endoscopic imaging solutions for remote consultations and follow-ups.

Major Players in the South Africa Endoscopy Devices Market Ecosystem

- KARL STORZ

- Johnson and Johnson

- PENTAX Medical

- Richard Wolf GmbH

- Cook Medical

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

Key Developments in South Africa Endoscopy Devices Market Industry

- November 2022: Integrated Endoscopy unveiled the second-generation NUVIS Single-Use Arthroscope, a groundbreaking 4K, cost-effective, single-use endoscope for arthroscopic surgery, now available in the global market, including South Africa. This development signifies a major step towards enhanced surgical safety and accessibility in orthopedics.

- February 2022: Karl Storz, a leading manufacturer of endoscopes, joined the IFC's Africa Medical Equipment Facility, marking a significant step in supporting Africa's healthcare providers as they bolster their services in response to the challenges posed by the COVID-19 pandemic. This partnership is expected to improve access to essential medical equipment, including advanced endoscopy solutions.

Strategic South Africa Endoscopy Devices Market Market Forecast

The strategic forecast for the South Africa Endoscopy Devices Market is exceptionally promising, driven by sustained technological innovation and increasing healthcare investments. The market is poised for continued growth, fueled by the rising prevalence of gastrointestinal, pulmonary, and orthopedic conditions requiring advanced diagnostic and therapeutic interventions. The strategic emphasis on minimally invasive procedures and the growing adoption of high-definition and single-use endoscopy will be key growth catalysts. Anticipated advancements in AI integration and robotic-assisted endoscopy will further enhance the market's potential, driving revenue growth to an estimated $490 Million by 2033.

South Africa Endoscopy Devices Market Segmentation

-

1. Type of Device

- 1.1. Endoscopes

- 1.2. Endoscopic Operative Device

- 1.3. Visualization Equipment

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Orthopedic Surgery

- 2.4. Cardiology

- 2.5. ENT Surgery

- 2.6. Gynecology

- 2.7. Neurology

- 2.8. Others Applications

South Africa Endoscopy Devices Market Segmentation By Geography

- 1. South Africa

South Africa Endoscopy Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Endoscopy for Treatment and Diagnosis; Growing Preference for Minimally-invasive Surgeries; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Technicians; Infections Caused by Few Endoscopes

- 3.4. Market Trends

- 3.4.1. Endoscopy Visualization Equipment Segment is Expected to Witness Rapid Growth in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.2. Endoscopic Operative Device

- 5.1.3. Visualization Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Orthopedic Surgery

- 5.2.4. Cardiology

- 5.2.5. ENT Surgery

- 5.2.6. Gynecology

- 5.2.7. Neurology

- 5.2.8. Others Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. South Africa South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 KARL STORZ

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Johnson and Johnson

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 PENTAX Medical

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Richard Wolf GmbH

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cook Medical*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Boston Scientific Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fujifilm Holdings Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 KARL STORZ

List of Figures

- Figure 1: South Africa Endoscopy Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Endoscopy Devices Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: South Africa Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South Africa Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa Endoscopy Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa Endoscopy Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa Endoscopy Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa Endoscopy Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa Endoscopy Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa Endoscopy Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 13: South Africa Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: South Africa Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Endoscopy Devices Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the South Africa Endoscopy Devices Market?

Key companies in the market include KARL STORZ, Johnson and Johnson, PENTAX Medical, Richard Wolf GmbH, Cook Medical*List Not Exhaustive, Boston Scientific Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the South Africa Endoscopy Devices Market?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 417.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Endoscopy for Treatment and Diagnosis; Growing Preference for Minimally-invasive Surgeries; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

Endoscopy Visualization Equipment Segment is Expected to Witness Rapid Growth in the Market Studied.

7. Are there any restraints impacting market growth?

Lack of Skilled Technicians; Infections Caused by Few Endoscopes.

8. Can you provide examples of recent developments in the market?

November 2022: Integrated Endoscopy, a groundbreaking medical device company at the forefront of 4K, cost-effective, single-use endoscope development for arthroscopic surgery, proudly unveiled the second-generation NUVIS Single-Use Arthroscope. This innovative 4K endoscope is a pioneering solution tailored for arthroscopic surgical procedures, now available in the global market, including South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Endoscopy Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Endoscopy Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Endoscopy Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Endoscopy Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence