Key Insights

The Singapore luxury residential real estate market, encompassing apartments, condominiums, villas, and landed houses, is poised for significant expansion. With a current market size estimated at 15.8 billion, the sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.8% between the base year of 2024 and 2033. This upward trajectory is driven by Singapore's robust economic standing, attracting affluent individuals, sustained demand from domestic and international buyers, inherent land scarcity, and government support for infrastructure and premium housing. Evolving lifestyle preferences for enhanced amenities and sustainable features further influence market dynamics.

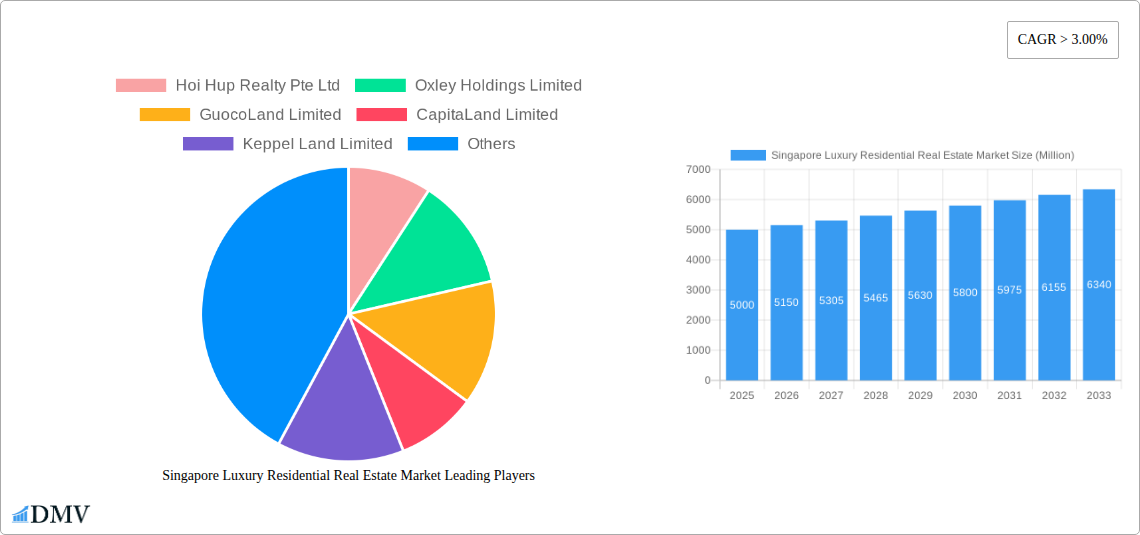

Singapore Luxury Residential Real Estate Market Market Size (In Billion)

Despite headwinds from property cooling measures like the Additional Buyer's Stamp Duty (ABSD) and Loan-to-Value (LTV) ratios, along with global economic uncertainties and interest rate volatility, the luxury segment is expected to remain resilient. Strong demand and constrained supply, particularly in prime areas like the Central Business District (CBD) and near integrated resorts, will continue to attract substantial investment. The market segments into apartments/condominiums and villas/landed houses, catering to diverse buyer profiles. Prominent developers including Hoi Hup Realty, Oxley Holdings, GuocoLand, CapitaLand, Keppel Land, MCC Land, Bukit Sembawang Estates, City Developments, MCL Land, and Allgreen Properties are instrumental in shaping this evolving landscape.

Singapore Luxury Residential Real Estate Market Company Market Share

Singapore Luxury Residential Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Singapore luxury residential real estate market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this comprehensive study unveils market trends, growth drivers, and future opportunities within this lucrative sector. The report meticulously examines market composition, leading players, and emerging innovations, providing a robust foundation for strategic decision-making. Total market value in 2025 is estimated at xx Million, projected to reach xx Million by 2033.

Singapore Luxury Residential Real Estate Market Composition & Trends

This section delves into the competitive landscape of Singapore's luxury residential market, examining market concentration, innovative drivers, regulatory influences, and the role of mergers and acquisitions (M&A). We analyze the market share distribution among key players such as CapitaLand Limited, City Developments Limited, and Hoi Hup Realty Pte Ltd, alongside other prominent developers like Keppel Land Limited, GuocoLand Limited, Oxley Holdings Limited, MCC Land Limited, Bukit Sembawang Estates Limited, MCL Land, and Allgreen Properties Limited. The report further explores the impact of government regulations, the prevalence of substitute products, and the evolving profiles of end-users in this high-net-worth segment.

- Market Concentration: Analysis of market share distribution among top players (e.g., CapitaLand holds an estimated xx% market share in 2025).

- Innovation Catalysts: Examination of technological advancements and design innovations impacting luxury development.

- Regulatory Landscape: Assessment of government policies and their influence on market dynamics and pricing.

- Substitute Products: Evaluation of alternative investment options and their competitive impact.

- End-User Profiles: Detailed analysis of the demographic and psychographic characteristics of luxury homebuyers.

- M&A Activities: Review of significant M&A deals within the study period (2019-2024), including deal values (e.g., a xx Million acquisition in 2022).

Singapore Luxury Residential Real Estate Market Industry Evolution

This section provides a comprehensive overview of the Singapore luxury residential real estate market's evolution from 2019 to 2033. We analyze historical growth trajectories (2019-2024), incorporating data on sales volume, average prices, and investment trends. We then project future growth rates (2025-2033), considering factors such as technological advancements in construction and design, evolving consumer preferences (e.g., increased demand for sustainable features), and macroeconomic influences. Specific data points on growth rates and adoption of smart home technologies will be included. The impact of shifting consumer demands, specifically towards sustainable and technologically advanced properties, will be assessed. The analysis will further examine the role of emerging technologies, like 3D printing and BIM, in shaping the industry’s future.

Leading Regions, Countries, or Segments in Singapore Luxury Residential Real Estate Market

This section identifies the dominant segments within the Singapore luxury residential market, focusing on Apartments and Condominiums and Villas and Landed Houses. We analyze the factors contributing to the market leadership of each segment, including investment trends, government policies, and consumer preferences.

- Apartments and Condominiums: Analysis of factors driving growth, including prime locations, upscale amenities, and developer strategies.

- Villas and Landed Houses: Examination of factors contributing to market dominance, including exclusivity, land scarcity, and high capital appreciation.

- Key Drivers:

- Investment Trends: Analysis of foreign and domestic investment patterns.

- Regulatory Support: Impact of government policies on land supply and development approvals.

- Demand-Supply Dynamics: Assessment of market equilibrium and price fluctuations.

Singapore Luxury Residential Real Estate Market Product Innovations

This section highlights recent product innovations within the Singapore luxury residential market. We discuss the application of new technologies in construction, interior design, and smart home integration, including examples of unique selling propositions (USPs) offered by developers. Examples include the integration of sustainable building materials, advanced security systems, and personalized smart home features. We will also analyze the performance metrics of these innovations, evaluating their impact on property values and consumer satisfaction.

Propelling Factors for Singapore Luxury Residential Real Estate Market Growth

Several factors are driving the growth of the Singapore luxury residential real estate market. These include robust economic growth, government policies supporting development, and the increasing affluence of high-net-worth individuals. Furthermore, technological advancements in construction and design contribute to improved building quality, energy efficiency, and enhanced living experiences. Specific examples include the implementation of green building standards and the use of smart home technology. The attractiveness of Singapore as a global hub for business and finance also plays a significant role.

Obstacles in the Singapore Luxury Residential Real Estate Market Market

Despite the growth potential, challenges exist within the Singapore luxury residential real estate market. These include stringent government regulations concerning land use and development, potential supply chain disruptions impacting construction timelines and costs, and intense competition among developers. The impact of these challenges on project profitability and market stability will be quantified where possible. For example, regulatory hurdles can lead to increased development costs, while supply chain disruptions may cause project delays and increase expenses.

Future Opportunities in Singapore Luxury Residential Real Estate Market

The future of the Singapore luxury residential market presents several opportunities. These include the growing demand for sustainable and technologically advanced properties, the expansion into new luxury developments outside the core central area, and the potential for specialized luxury housing catering to niche market segments (e.g., family-oriented luxury condos). The exploration of new technologies in building design and management will continue to shape the market landscape.

Major Players in the Singapore Luxury Residential Real Estate Market Ecosystem

- Hoi Hup Realty Pte Ltd

- Oxley Holdings Limited

- GuocoLand Limited

- CapitaLand Limited

- Keppel Land Limited

- MCC Land Limited

- Bukit Sembawang Estates Limited

- City Developments Limited

- MCL Land

- Allgreen Properties Limited

Key Developments in Singapore Luxury Residential Real Estate Market Industry

- 2022 Q4: Launch of a new luxury condominium development by CapitaLand Limited, featuring sustainable design features and smart home technology.

- 2023 Q1: Merger between two smaller developers, resulting in increased market share and project pipeline. (Details to be added upon completion of study.)

- 2024 Q2: Announcement of a significant government investment in infrastructure development near prime residential areas, stimulating increased demand. (Details to be added upon completion of study.)

Strategic Singapore Luxury Residential Real Estate Market Forecast

The Singapore luxury residential real estate market is poised for continued growth, driven by robust economic fundamentals, technological innovation, and a strong demand for high-end properties. The focus on sustainability and smart home integration will likely shape future development trends. The market is expected to experience strong capital appreciation, making it an attractive investment destination for both domestic and international buyers. The forecast period anticipates sustained growth despite potential regulatory adjustments and global economic uncertainties.

Singapore Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

Singapore Luxury Residential Real Estate Market Segmentation By Geography

- 1. Singapore

Singapore Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of Singapore Luxury Residential Real Estate Market

Singapore Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization; Government initiatives

- 3.3. Market Restrains

- 3.3.1. High property prices; Regulatory challenges

- 3.4. Market Trends

- 3.4.1. UHNWI in Asia Driving the Demand for Luxury Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hoi Hup Realty Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oxley Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GuocoLand Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CapitaLand Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Keppel Land Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MCC Land Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bukit Sembawang Estates Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 City Developments Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MCL Land

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allgreen Properties Limited**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoi Hup Realty Pte Ltd

List of Figures

- Figure 1: Singapore Luxury Residential Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Singapore Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Singapore Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Luxury Residential Real Estate Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Singapore Luxury Residential Real Estate Market?

Key companies in the market include Hoi Hup Realty Pte Ltd, Oxley Holdings Limited, GuocoLand Limited, CapitaLand Limited, Keppel Land Limited, MCC Land Limited, Bukit Sembawang Estates Limited, City Developments Limited, MCL Land, Allgreen Properties Limited**List Not Exhaustive.

3. What are the main segments of the Singapore Luxury Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization; Government initiatives.

6. What are the notable trends driving market growth?

UHNWI in Asia Driving the Demand for Luxury Properties.

7. Are there any restraints impacting market growth?

High property prices; Regulatory challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Singapore Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence