Key Insights

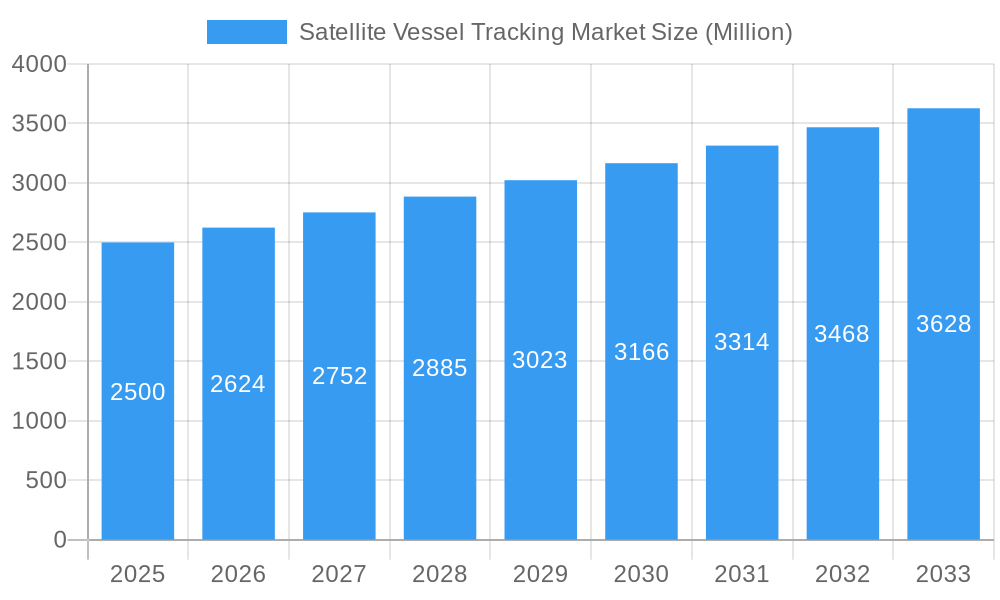

The global satellite vessel tracking market is experiencing robust growth, driven by increasing maritime security concerns, the need for enhanced operational efficiency in shipping, and the rising adoption of advanced technologies like IoT and AI in the maritime sector. The market, currently valued at approximately $XX million (estimating a reasonable value based on typical market sizes for similar technologies and the provided CAGR), is projected to exhibit a compound annual growth rate (CAGR) of 4.96% from 2025 to 2033. This growth is fueled by several key factors, including the growing demand for real-time vessel location tracking for improved safety and security, stricter regulatory compliance requirements for maritime operations, and the increasing adoption of satellite-based communication systems in remote areas. The market segmentation reveals a strong demand across various satellite orbits (GEO, LEO, MEO), with LEO potentially showing higher growth due to its ability to provide higher resolution tracking and more frequent updates. Key satellite subsystems contributing to market growth include propulsion hardware, satellite buses, solar arrays, and structures. Significant end-user segments are the commercial and military/government sectors, with commercial shipping companies leading the demand. Vessel size also impacts market demand, with segments spanning below 10kg, 10-100kg, and 100-500kg payloads experiencing varying growth rates based on specific application needs. Leading companies like Spire Global, Indra Sistemas, and Kongsberg are driving innovation and market expansion through advanced technology integration and strategic partnerships.

Satellite Vessel Tracking Market Market Size (In Billion)

The market's growth trajectory is influenced by several factors. While technological advancements and increasing affordability of satellite-based services are key drivers, potential restraints include the high initial investment costs associated with satellite technology and potential regulatory hurdles. Future trends are likely to involve greater integration of AI and machine learning for enhanced data analysis and predictive capabilities, development of miniaturized and low-cost satellites, and expansion into new applications such as environmental monitoring and illegal fishing detection. The competitive landscape is dynamic, with established players facing competition from innovative startups specializing in advanced satellite technologies and data analytics. Geographic growth is anticipated across diverse regions, with developing economies in Asia and Africa presenting lucrative growth opportunities, driven by increasing maritime activities and infrastructure development.

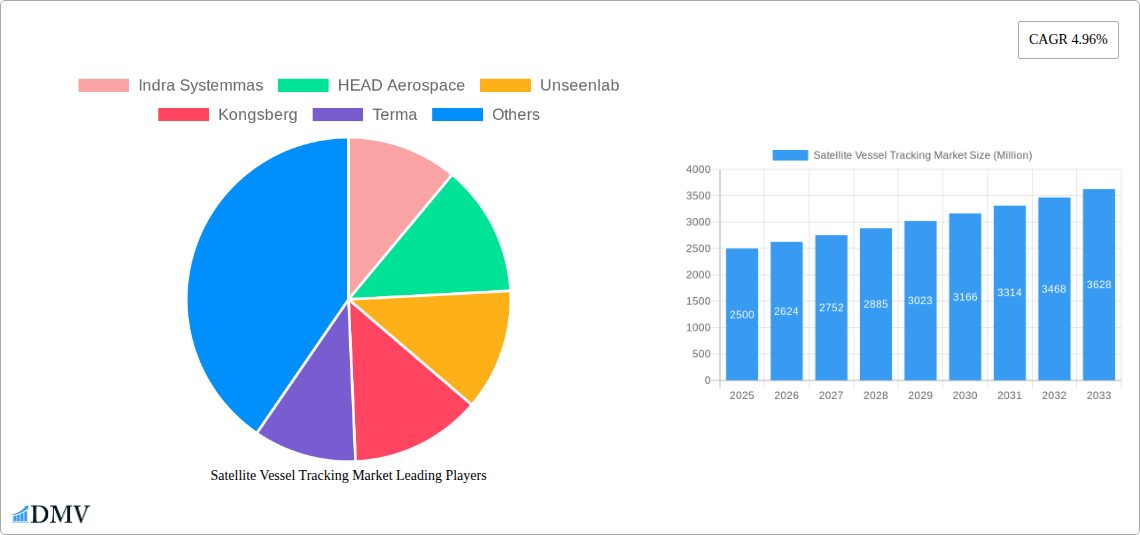

Satellite Vessel Tracking Market Company Market Share

Satellite Vessel Tracking Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Satellite Vessel Tracking Market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report is essential for stakeholders, investors, and industry professionals seeking a deep understanding of this rapidly evolving market. The global market size is projected to reach xx Million by 2033.

Satellite Vessel Tracking Market Composition & Trends

The Satellite Vessel Tracking market is characterized by moderate concentration, with key players like Indra Systemmas, HEAD Aerospace, Unseenlab, Kongsberg, Terma, Kleos Space, SRT marine, Hawkeye, Indian Space Research Organisation (ISRO), and Spire Global Inc vying for market share. Market share distribution is currently skewed towards established players, with Indra Systemmas and HEAD Aerospace holding a significant portion (xx%). However, the emergence of smaller, innovative companies is increasing competition.

Several factors drive market innovation, including the need for enhanced maritime security, improved vessel tracking efficiency, and the increasing adoption of IoT technologies. Regulatory landscapes vary by region, influencing market access and operational compliance. Substitute technologies, such as AIS (Automatic Identification System), exist but lack the comprehensive coverage and data accuracy offered by satellite-based solutions. The market exhibits a diverse end-user profile, including commercial shipping, military and government agencies, and other sectors like fishing and offshore energy.

M&A activities have played a significant role in shaping the market landscape. While precise deal values are confidential in many cases, significant transactions have resulted in consolidations and expansions of market capabilities. Examples include the strategic acquisitions of companies specializing in ground station infrastructure or advanced data analytics.

- Market Concentration: Moderately concentrated, with a few major players holding significant shares.

- Innovation Catalysts: Enhanced maritime security, improved vessel tracking efficiency, IoT integration.

- Regulatory Landscape: Varies across regions, impacting market access and operations.

- Substitute Products: AIS systems offer limited coverage compared to satellite tracking.

- End-User Profile: Commercial shipping, military/government, fishing, offshore energy.

- M&A Activity: Significant transactions driving consolidation and expansion of market capabilities. Total M&A deal value in the last 5 years: xx Million.

Satellite Vessel Tracking Market Industry Evolution

The Satellite Vessel Tracking market has experienced substantial growth driven by increasing demand for real-time vessel monitoring and enhanced maritime domain awareness. Over the historical period (2019-2024), the market exhibited a Compound Annual Growth Rate (CAGR) of xx%, with the global market size exceeding xx Million in 2024. This growth trajectory is projected to continue into the forecast period (2025-2033), with an anticipated CAGR of xx%, reaching a projected market size of xx Million by 2033.

Technological advancements are central to market evolution. The miniaturization of satellite technology, improvements in sensor accuracy, and the development of advanced data analytics capabilities are all contributing to a more efficient and effective vessel tracking ecosystem. Furthermore, the increasing adoption of cloud-based platforms and AI-powered solutions is enhancing data processing and analysis, leading to improved decision-making for end-users. Shifting consumer demands are increasingly focused on cost-effectiveness, real-time data access, and comprehensive data analytics. This necessitates continuous innovation and investment in more efficient and user-friendly solutions.

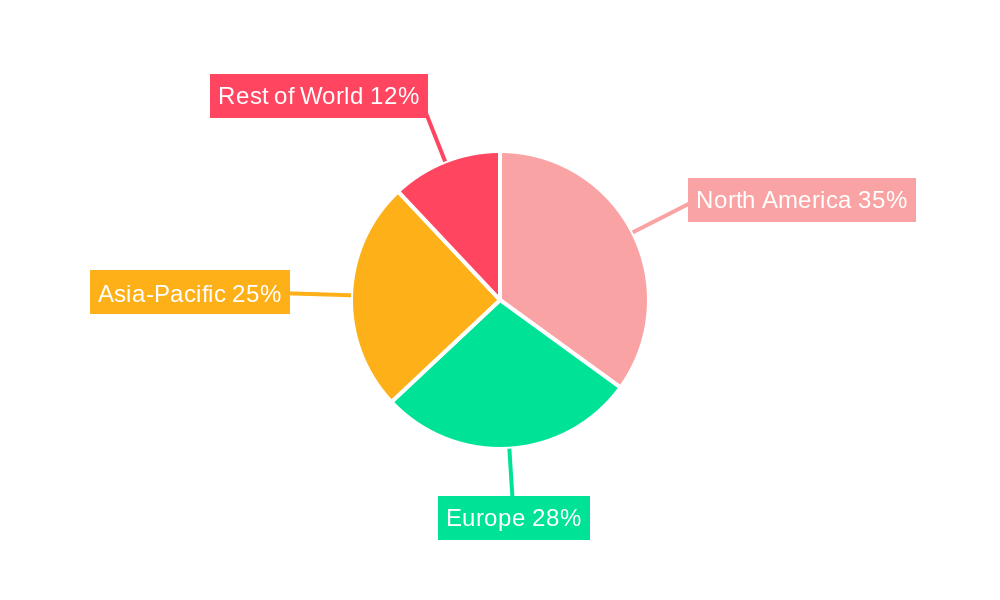

Leading Regions, Countries, or Segments in Satellite Vessel Tracking Market

The Satellite Vessel Tracking market is characterized by its evolving global landscape and distinct segmentation. While specific regional breakdowns are often proprietary, key trends and dominant segments offer valuable insights into market dynamics.

- Orbit Class: Low Earth Orbit (LEO) satellites are increasingly favored for vessel tracking due to their capacity for higher revisit rates and superior spatial resolution, enabling more frequent and detailed data acquisition. This contrasts with Geostationary Earth Orbit (GEO) and Medium Earth Orbit (MEO) satellites, which offer broader coverage but less frequent updates.

- Satellite Subsystem: The Satellite Bus & Subsystems segment remains a foundational component and the largest market share holder. These core elements are critical for the overall functionality, power, communication, and structural integrity of any tracking satellite.

- End User: The Commercial sector continues to be the primary driver of demand, propelled by the surge in global shipping volumes, the imperative for optimized fleet management, and enhanced supply chain visibility. Simultaneously, the Military & Government segment is experiencing significant expansion, driven by escalating requirements for robust maritime domain awareness, national security, and the enforcement of international regulations.

- Satellite Mass: The 10-100kg satellite mass category is anticipated to dominate. This is largely attributable to advancements in miniaturization and CubeSat technology, which allow for cost-effective deployment of satellites with sophisticated capabilities, offering a compelling balance between performance and affordability for specialized tracking missions.

Key Market Drivers:

- Investment Trends: Robust and sustained investment from both governmental bodies and private enterprises in space-based technologies, including Earth observation and communication constellations, is a significant catalyst for innovation and market expansion.

- Regulatory Support: Favorable government policies and international initiatives aimed at enhancing maritime security, combating illegal fishing, and promoting the digitalization of maritime operations directly stimulate the demand for advanced satellite vessel tracking solutions.

Satellite Vessel Tracking Market Product Innovations

Recent innovations in satellite vessel tracking involve improved sensor technology, enhanced data analytics, and integration with IoT platforms. The market is witnessing the emergence of smaller, more cost-effective satellites with improved data resolution and real-time tracking capabilities. Unique selling propositions often include advanced data processing, user-friendly interfaces, and the ability to provide comprehensive vessel information beyond basic location data, including speed, heading, and even potential distress signals. The integration of AI and machine learning is enhancing predictive analytics and threat detection capabilities.

Propelling Factors for Satellite Vessel Tracking Market Growth

The Satellite Vessel Tracking market's upward trajectory is underpinned by a confluence of technological, economic, and regulatory advancements:

- Technological Advancements: Continuous innovation in satellite technology, including the development of smaller, more powerful sensors, improved signal processing capabilities, and sophisticated data analytics platforms, is leading to increased accuracy, reduced latency, and more actionable insights. The miniaturization of satellite components further contributes to cost efficiencies.

- Economic Factors: The persistent growth in international trade, coupled with the increasing reliance on global maritime transport for supply chains, necessitates reliable and comprehensive vessel monitoring. Efficient tracking ensures operational continuity, optimizes logistics, and mitigates risks in the maritime sector.

- Regulatory Influences: Stringent global and regional regulations concerning maritime safety, environmental protection (e.g., emissions monitoring), and security (e.g., anti-piracy, illegal activities) are compelling stakeholders to adopt advanced tracking systems to ensure compliance and operational integrity.

Obstacles in the Satellite Vessel Tracking Market

Challenges include:

- Regulatory hurdles: Varying international regulations and licensing requirements create complexities for market access and operations.

- Supply chain disruptions: Dependence on specialized components and manufacturing processes can lead to delays and cost increases.

- Competitive pressures: Intense competition amongst established players and emerging startups impacts pricing and market share.

Future Opportunities in Satellite Vessel Tracking Market

Emerging opportunities include:

- Expansion into new markets: Untapped potential exists in developing countries and emerging economies with growing maritime activity.

- Technological advancements: The integration of AI, machine learning, and advanced sensor technologies will further enhance system capabilities and accuracy.

- Data-driven services: The market is poised to leverage the increasing availability of vessel data to offer enhanced analytics and predictive modeling.

Major Players in the Satellite Vessel Tracking Market Ecosystem

The satellite vessel tracking market is populated by a diverse range of entities, from established aerospace companies to innovative startups. Key players contributing to the ecosystem include:

- Indra Systemas

- HEAD Aerospace

- Unseenlab

- Kongsberg

- Terma

- Kleos Space

- SRT Marine

- Hawkeye

- Indian Space Research Organisation (ISRO)

- Spire Global Inc.

Key Developments in Satellite Vessel Tracking Market Industry

- December 2022: HEAD Aerospace Group successfully launched the HEAD-2H satellite, expanding its Skywalker constellation's maritime vessel tracking capabilities. This launch significantly enhanced the company’s position in the market.

- October 2021: HEAD Aerospace Group expanded its capacity with a new Ground Receiving Station in Europe, improving data reception and processing efficiency. This development strengthens data coverage and potentially market share.

Strategic Satellite Vessel Tracking Market Forecast

The Satellite Vessel Tracking market is poised for sustained growth, driven by technological innovations, increasing demand for maritime security, and the expansion of global trade. The market's future potential is significant, with numerous opportunities in various segments and regions. Continued investment in research and development, coupled with strategic partnerships, will further accelerate market growth and solidify the position of key players in the coming years.

Satellite Vessel Tracking Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. Below 10 Kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Satellite Vessel Tracking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Satellite Vessel Tracking Market Regional Market Share

Geographic Coverage of Satellite Vessel Tracking Market

Satellite Vessel Tracking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Satellite Vessel Tracking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. Below 10 Kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. North America Satellite Vessel Tracking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6.1.1. 10-100kg

- 6.1.2. 100-500kg

- 6.1.3. Below 10 Kg

- 6.2. Market Analysis, Insights and Forecast - by Orbit Class

- 6.2.1. GEO

- 6.2.2. LEO

- 6.2.3. MEO

- 6.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 6.3.1. Propulsion Hardware and Propellant

- 6.3.2. Satellite Bus & Subsystems

- 6.3.3. Solar Array & Power Hardware

- 6.3.4. Structures, Harness & Mechanisms

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Commercial

- 6.4.2. Military & Government

- 6.4.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 7. South America Satellite Vessel Tracking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 7.1.1. 10-100kg

- 7.1.2. 100-500kg

- 7.1.3. Below 10 Kg

- 7.2. Market Analysis, Insights and Forecast - by Orbit Class

- 7.2.1. GEO

- 7.2.2. LEO

- 7.2.3. MEO

- 7.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 7.3.1. Propulsion Hardware and Propellant

- 7.3.2. Satellite Bus & Subsystems

- 7.3.3. Solar Array & Power Hardware

- 7.3.4. Structures, Harness & Mechanisms

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Commercial

- 7.4.2. Military & Government

- 7.4.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 8. Europe Satellite Vessel Tracking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 8.1.1. 10-100kg

- 8.1.2. 100-500kg

- 8.1.3. Below 10 Kg

- 8.2. Market Analysis, Insights and Forecast - by Orbit Class

- 8.2.1. GEO

- 8.2.2. LEO

- 8.2.3. MEO

- 8.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 8.3.1. Propulsion Hardware and Propellant

- 8.3.2. Satellite Bus & Subsystems

- 8.3.3. Solar Array & Power Hardware

- 8.3.4. Structures, Harness & Mechanisms

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Commercial

- 8.4.2. Military & Government

- 8.4.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 9. Middle East & Africa Satellite Vessel Tracking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 9.1.1. 10-100kg

- 9.1.2. 100-500kg

- 9.1.3. Below 10 Kg

- 9.2. Market Analysis, Insights and Forecast - by Orbit Class

- 9.2.1. GEO

- 9.2.2. LEO

- 9.2.3. MEO

- 9.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 9.3.1. Propulsion Hardware and Propellant

- 9.3.2. Satellite Bus & Subsystems

- 9.3.3. Solar Array & Power Hardware

- 9.3.4. Structures, Harness & Mechanisms

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Commercial

- 9.4.2. Military & Government

- 9.4.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 10. Asia Pacific Satellite Vessel Tracking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 10.1.1. 10-100kg

- 10.1.2. 100-500kg

- 10.1.3. Below 10 Kg

- 10.2. Market Analysis, Insights and Forecast - by Orbit Class

- 10.2.1. GEO

- 10.2.2. LEO

- 10.2.3. MEO

- 10.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 10.3.1. Propulsion Hardware and Propellant

- 10.3.2. Satellite Bus & Subsystems

- 10.3.3. Solar Array & Power Hardware

- 10.3.4. Structures, Harness & Mechanisms

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Commercial

- 10.4.2. Military & Government

- 10.4.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Indra Systemmas

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HEAD Aerospace

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unseenlab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kongsberg

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Terma

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kleos Space

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SRT marine

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hawkeye

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Indian Space Research Organisation (ISRO)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Spire Global Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Indra Systemmas

List of Figures

- Figure 1: Global Satellite Vessel Tracking Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Satellite Vessel Tracking Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 3: North America Satellite Vessel Tracking Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 4: North America Satellite Vessel Tracking Market Revenue (undefined), by Orbit Class 2025 & 2033

- Figure 5: North America Satellite Vessel Tracking Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 6: North America Satellite Vessel Tracking Market Revenue (undefined), by Satellite Subsystem 2025 & 2033

- Figure 7: North America Satellite Vessel Tracking Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 8: North America Satellite Vessel Tracking Market Revenue (undefined), by End User 2025 & 2033

- Figure 9: North America Satellite Vessel Tracking Market Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Satellite Vessel Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 11: North America Satellite Vessel Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Satellite Vessel Tracking Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 13: South America Satellite Vessel Tracking Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 14: South America Satellite Vessel Tracking Market Revenue (undefined), by Orbit Class 2025 & 2033

- Figure 15: South America Satellite Vessel Tracking Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 16: South America Satellite Vessel Tracking Market Revenue (undefined), by Satellite Subsystem 2025 & 2033

- Figure 17: South America Satellite Vessel Tracking Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 18: South America Satellite Vessel Tracking Market Revenue (undefined), by End User 2025 & 2033

- Figure 19: South America Satellite Vessel Tracking Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: South America Satellite Vessel Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America Satellite Vessel Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Satellite Vessel Tracking Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 23: Europe Satellite Vessel Tracking Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 24: Europe Satellite Vessel Tracking Market Revenue (undefined), by Orbit Class 2025 & 2033

- Figure 25: Europe Satellite Vessel Tracking Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 26: Europe Satellite Vessel Tracking Market Revenue (undefined), by Satellite Subsystem 2025 & 2033

- Figure 27: Europe Satellite Vessel Tracking Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 28: Europe Satellite Vessel Tracking Market Revenue (undefined), by End User 2025 & 2033

- Figure 29: Europe Satellite Vessel Tracking Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Satellite Vessel Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Europe Satellite Vessel Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Satellite Vessel Tracking Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 33: Middle East & Africa Satellite Vessel Tracking Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 34: Middle East & Africa Satellite Vessel Tracking Market Revenue (undefined), by Orbit Class 2025 & 2033

- Figure 35: Middle East & Africa Satellite Vessel Tracking Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 36: Middle East & Africa Satellite Vessel Tracking Market Revenue (undefined), by Satellite Subsystem 2025 & 2033

- Figure 37: Middle East & Africa Satellite Vessel Tracking Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 38: Middle East & Africa Satellite Vessel Tracking Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: Middle East & Africa Satellite Vessel Tracking Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East & Africa Satellite Vessel Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East & Africa Satellite Vessel Tracking Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Satellite Vessel Tracking Market Revenue (undefined), by Satellite Mass 2025 & 2033

- Figure 43: Asia Pacific Satellite Vessel Tracking Market Revenue Share (%), by Satellite Mass 2025 & 2033

- Figure 44: Asia Pacific Satellite Vessel Tracking Market Revenue (undefined), by Orbit Class 2025 & 2033

- Figure 45: Asia Pacific Satellite Vessel Tracking Market Revenue Share (%), by Orbit Class 2025 & 2033

- Figure 46: Asia Pacific Satellite Vessel Tracking Market Revenue (undefined), by Satellite Subsystem 2025 & 2033

- Figure 47: Asia Pacific Satellite Vessel Tracking Market Revenue Share (%), by Satellite Subsystem 2025 & 2033

- Figure 48: Asia Pacific Satellite Vessel Tracking Market Revenue (undefined), by End User 2025 & 2033

- Figure 49: Asia Pacific Satellite Vessel Tracking Market Revenue Share (%), by End User 2025 & 2033

- Figure 50: Asia Pacific Satellite Vessel Tracking Market Revenue (undefined), by Country 2025 & 2033

- Figure 51: Asia Pacific Satellite Vessel Tracking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 2: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 3: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 7: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 8: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: United States Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Mexico Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 15: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 16: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 17: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Brazil Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Argentina Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 23: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 24: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 25: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Germany Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: France Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Italy Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Spain Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Russia Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Benelux Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Nordics Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 37: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 38: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 39: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 40: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: Turkey Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Israel Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: GCC Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: North Africa Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: South Africa Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Mass 2020 & 2033

- Table 48: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Orbit Class 2020 & 2033

- Table 49: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Satellite Subsystem 2020 & 2033

- Table 50: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 51: Global Satellite Vessel Tracking Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 52: China Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 53: India Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Japan Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 55: South Korea Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 57: Oceania Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Satellite Vessel Tracking Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Satellite Vessel Tracking Market?

The projected CAGR is approximately 9.89%.

2. Which companies are prominent players in the Satellite Vessel Tracking Market?

Key companies in the market include Indra Systemmas, HEAD Aerospace, Unseenlab, Kongsberg, Terma, Kleos Space, SRT marine, Hawkeye, Indian Space Research Organisation (ISRO), Spire Global Inc.

3. What are the main segments of the Satellite Vessel Tracking Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: HEAD Aerospace Group (HEAD) successfully launched the HEAD-2H satellite. Building upon the satellite-based VDES-system, HEAD Aerospace's Skywalker constellation will provide maritime vessel positioning, operating status monitoring, dual narrow-band communication, etc. to global customers.October 2021: HEAD Aerospace Group expands capacity with Ground Receiving Station in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Satellite Vessel Tracking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Satellite Vessel Tracking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Satellite Vessel Tracking Market?

To stay informed about further developments, trends, and reports in the Satellite Vessel Tracking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence