Key Insights

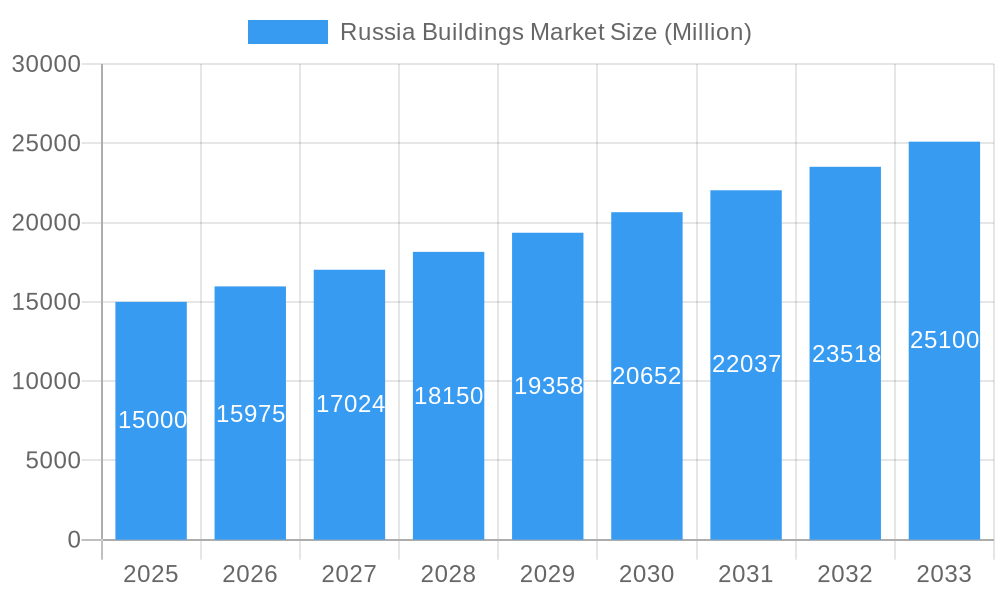

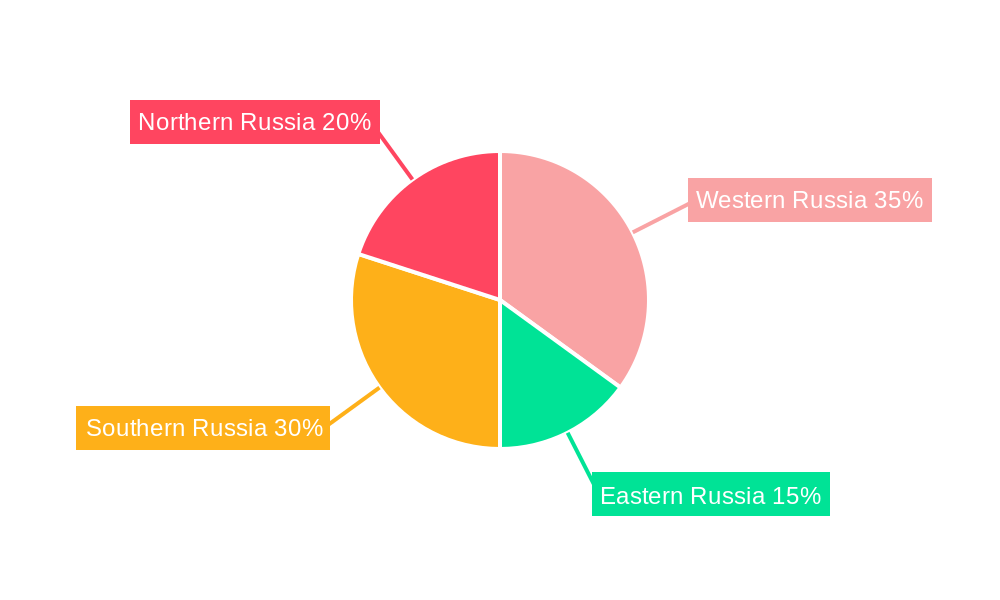

The Russian buildings market is projected to reach $184.43 billion by 2025, with a compound annual growth rate (CAGR) of 3.09% from 2025 to 2033. Key growth drivers include rapid urbanization, sustained population increases in major cities, and significant government-led infrastructure development initiatives. These factors stimulate demand across residential, commercial, and industrial construction sectors, alongside transportation network expansions. Rising disposable incomes and improved living standards further bolster demand for high-quality residential properties. While challenges such as fluctuating material costs due to geopolitical influences and potential skilled labor shortages exist, ongoing investments and adaptive market strategies are expected to mitigate these impacts. The market is segmented by material type, including concrete, glass, metal, and timber, and by application, such as residential, commercial, and others. Concrete remains the leading material due to its cost-effectiveness and versatility. Residential construction currently dominates the market share, though commercial construction is anticipated to experience substantial growth, driven by economic development and increased foreign investment. Leading companies like LSR Group, Atlaca Group, Segezha Group, AECON, PIK Group, K Modul, Setl Group, Renaissance Construction, INSI Holding, Story House, and Pallada Eco are strategically positioned to capitalize on this growth by focusing on material sourcing, construction efficiency, and innovative project design. Regional growth disparities are evident, with Western and Southern Russia demonstrating higher growth rates attributed to greater economic activity and investment.

Russia Buildings Market Market Size (In Billion)

The market's future outlook remains positive, contingent upon macroeconomic stability and global events. Fluctuations in energy prices and international sanctions may affect material costs, but the long-term growth trend is robust, driven by the ongoing need for new housing and infrastructure in Russia. Market evolution will be shaped by material sourcing diversification, advancements in construction techniques, and the integration of sustainable building practices. The increasing adoption of prefabricated construction and modular building systems is expected to enhance efficiency and shorten project timelines. Market competitiveness will drive companies to prioritize innovation, cost-efficiency, and superior project delivery. Continuous monitoring of geopolitical dynamics and domestic economic policies is essential for refining future growth projections.

Russia Buildings Market Company Market Share

Russia Buildings Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Russia Buildings Market, encompassing market size, growth drivers, key players, and future outlook. With a comprehensive study period spanning 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report covers a market valued at xx Million USD in 2025, projecting significant growth over the forecast period.

Russia Buildings Market Market Composition & Trends

This section delves into the competitive landscape of the Russia Buildings Market, examining market concentration, innovation, regulatory frameworks, and mergers & acquisitions (M&A) activity. The report analyzes the market share distribution amongst key players, including LSR Group St Petersburg, Atlaca Group, Segezha Group, AECON, PIK Group of Companies, K Modul, Setl Group St Petersburg, Renaissance Construction, INSI Holding, Story House, and Pallada Eco (list not exhaustive).

- Market Concentration: The market exhibits a [Describe Market Concentration: e.g., moderately concentrated structure] with the top 5 players accounting for approximately xx% of the total market share in 2024.

- Innovation Catalysts: Government initiatives promoting sustainable construction and technological advancements in prefabrication are driving innovation.

- Regulatory Landscape: Analysis of building codes, permits, and environmental regulations impacting market dynamics.

- Substitute Products: Examination of alternative building materials and construction methods and their impact on market share.

- End-User Profiles: Detailed segmentation of end-users across residential, commercial, and other applications (industrial, institutional, infrastructure).

- M&A Activities: Comprehensive review of significant M&A deals, including the April 2022 acquisition of YIT Corporation by Etalon Group for USD 65.53 Million, highlighting deal values and their strategic implications. The average deal value in the sector over the historical period (2019-2024) is estimated at xx Million USD.

Russia Buildings Market Industry Evolution

This section analyzes the historical and projected growth trajectory of the Russia Buildings Market, examining technological advancements, shifting consumer preferences, and emerging trends. The report details market growth rates for each segment (residential, commercial, etc.) and analyzes the adoption rates of new technologies, such as modular construction and prefabrication. This analysis includes a detailed review of factors influencing market expansion and contraction across the historical period (2019-2024), which saw a [describe overall market trend –e.g., period of moderate growth followed by a period of contraction] with a CAGR of xx%. The forecast period (2025-2033) projects [describe projected growth trend –e.g., steady growth driven by increased infrastructure spending and urban development], with a projected CAGR of xx%. Specific examples of technological advancement include the increasing adoption of sustainable building materials and the rise of modular construction techniques, as highlighted by the January 2022 launch of Dubldom's TOPOL 27 modular house.

Leading Regions, Countries, or Segments in Russia Buildings Market

This section identifies the dominant regions, countries, and segments within the Russia Buildings Market. The analysis considers market size, growth rates, and key drivers for each segment, categorized by material type (Concrete, Glass, Metal, Timber, Other) and application (Residential, Commercial, Other).

- By Material Type: Concrete consistently dominates due to its cost-effectiveness and widespread availability. However, growing demand for sustainable building materials is increasing the share of timber and other materials.

- By Application: The residential segment holds the largest market share, driven by population growth and urbanization. The commercial segment is also witnessing significant growth due to rising investments in infrastructure.

- Key Drivers:

- Residential Segment: Increased government support for affordable housing initiatives, rising disposable incomes, and population growth in major cities are key drivers.

- Commercial Segment: Growing investments in retail spaces, office buildings, and hospitality projects fuel market expansion.

- Concrete: Cost-effectiveness, durability, and readily available supply continue to drive its dominance.

- Timber: Increasing focus on sustainable and environmentally friendly building materials is boosting the adoption rate of timber.

Russia Buildings Market Product Innovations

Recent innovations focus on sustainable and efficient building solutions. Prefabricated modular buildings, incorporating ready-to-assemble components, are gaining traction, significantly reducing construction time and costs. The introduction of the Dubldom TOPOL 27 modular house exemplifies this trend, showcasing fully furnished, compact, and environmentally conscious designs. Further innovations involve the integration of smart technologies to enhance building performance and energy efficiency.

Propelling Factors for Russia Buildings Market Growth

The Russia Buildings Market is experiencing growth driven by several key factors. Increased government spending on infrastructure projects, particularly in urban areas, is a significant driver. Furthermore, the growing demand for affordable housing and commercial spaces, fueled by population growth and economic expansion, contributes significantly. Technological advancements, like prefabrication and sustainable building materials, are also boosting market growth.

Obstacles in the Russia Buildings Market Market

Several challenges hinder the Russia Buildings Market's growth. Economic fluctuations and sanctions impact investment and construction activities. Supply chain disruptions, particularly for imported materials, can lead to project delays and increased costs. Furthermore, stringent regulatory requirements and obtaining necessary permits can present hurdles for developers. The impact of these factors on market growth is estimated at xx% in 2024.

Future Opportunities in Russia Buildings Market

The future of the Russia Buildings Market holds promising opportunities. The increasing adoption of sustainable building practices and the focus on energy-efficient construction presents significant potential for growth. Further developments in prefabrication and modular construction, along with government support for innovative technologies, will continue to drive market expansion. The expansion into new geographic areas and the growing demand for specialized building types, such as eco-friendly and smart homes, provide additional opportunities.

Major Players in the Russia Buildings Market Ecosystem

- LSR group St Petersburg

- Atlaca Group

- Segezha Group

- AECON

- PIK Group of Companies

- K Modul

- Setl Group St Petersburg

- Renaissance Construction

- INSI Holding

- Story House

- Pallada Eco

Key Developments in Russia Buildings Market Industry

- April 2022: Etalon Group's acquisition of YIT Corporation for USD 65.53 Million signifies a major consolidation in the market, indicating a shift towards larger players and increased adoption of prefabrication technologies.

- January 2022: Dubldom's launch of the TOPOL 27 modular house highlights the growing trend toward prefabricated and sustainable housing solutions.

Strategic Russia Buildings Market Market Forecast

The Russia Buildings Market is poised for continued growth, driven by government initiatives, technological advancements, and increasing demand for housing and commercial spaces. Despite challenges, the long-term outlook remains positive, with significant potential for market expansion and increased investment in sustainable and innovative building solutions. The predicted CAGR for the forecast period indicates a robust market with promising opportunities for stakeholders.

Russia Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Russia Buildings Market Segmentation By Geography

- 1. Russia

Russia Buildings Market Regional Market Share

Geographic Coverage of Russia Buildings Market

Russia Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets

- 3.3. Market Restrains

- 3.3.1. Shortage of Raw Materials

- 3.4. Market Trends

- 3.4.1. The Demand for Prefabricated Building is Increasing in Russia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Buildings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LSR group St Petersburg

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Atlaca Group **List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Segezha Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AECON

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PIK Group of Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 K Modul

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Setl Group St Petersburg

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Renaissance Construction

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 INSI Holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Story House

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pallada Eco

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 LSR group St Petersburg

List of Figures

- Figure 1: Russia Buildings Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russia Buildings Market Share (%) by Company 2025

List of Tables

- Table 1: Russia Buildings Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Russia Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russia Buildings Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Russia Buildings Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Russia Buildings Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Russia Buildings Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Buildings Market?

The projected CAGR is approximately 3.09%.

2. Which companies are prominent players in the Russia Buildings Market?

Key companies in the market include LSR group St Petersburg, Atlaca Group **List Not Exhaustive, Segezha Group, AECON, PIK Group of Companies, K Modul, Setl Group St Petersburg, Renaissance Construction, INSI Holding, Story House, Pallada Eco.

3. What are the main segments of the Russia Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 184.43 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing construction spending by governments; Growing popularity of interior design and architecture is likely to increase the demand for polymer sheets.

6. What are the notable trends driving market growth?

The Demand for Prefabricated Building is Increasing in Russia.

7. Are there any restraints impacting market growth?

Shortage of Raw Materials.

8. Can you provide examples of recent developments in the market?

April 2022: Etalon Group (one of Russia's largest and longest-established development and construction companies) acquired YIT Corporation (a construction company) for a maximum consideration of RUB 4,597 million (USD 65.53 million). In terms of the development of construction technologies, the Etalon company's priority is the construction of ready-to-assemble modular multi-story buildings using on-site prefabrication technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Buildings Market?

To stay informed about further developments, trends, and reports in the Russia Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence