Key Insights

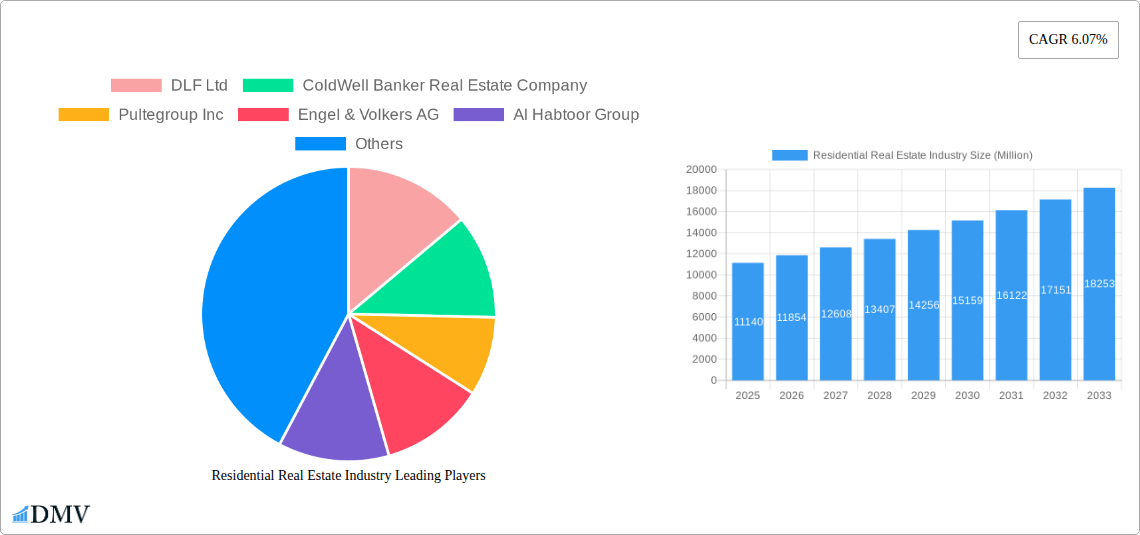

The global residential real estate market, valued at $11.14 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.07% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing urbanization and population growth, particularly in developing economies within Asia-Pacific and the Middle East, are creating a significant demand for housing. Secondly, favorable government policies, including tax incentives and infrastructure development initiatives in various regions, are stimulating market activity. Furthermore, rising disposable incomes and changing lifestyles, leading to a preference for larger and more luxurious homes, particularly in segments like landed houses and villas, are contributing to market growth. Finally, the emergence of innovative technologies in real estate, such as online property platforms and proptech solutions, are streamlining transactions and increasing market transparency.

Residential Real Estate Industry Market Size (In Billion)

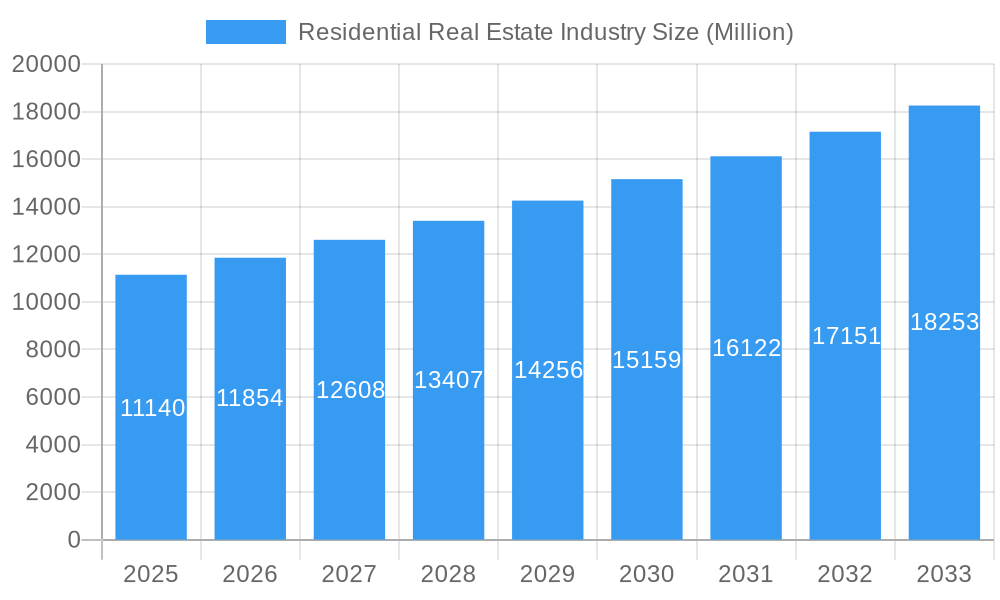

However, the market also faces certain challenges. Rising interest rates and inflation are impacting affordability, potentially slowing down demand in certain segments and regions. Supply chain disruptions and material cost increases are impacting construction timelines and project costs. Moreover, economic uncertainty and geopolitical instability in several regions pose potential risks to market stability. Despite these headwinds, the long-term outlook for the residential real estate sector remains positive, driven by enduring demographic trends and increasing investment in the sector. The market segmentation shows a strong preference for apartments and condominiums in urban areas but also notable demand for landed houses and villas in suburban and rural locations, reflecting the diverse needs and preferences of homebuyers globally. The top players in the market, including DLF Ltd, ColdWell Banker, and PulteGroup, are actively adapting to changing market conditions to maintain their market share.

Residential Real Estate Industry Company Market Share

Residential Real Estate Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global residential real estate industry, projecting a market value exceeding $XX Million by 2033. The study period covers 2019-2033, with 2025 serving as both the base and estimated year. We delve into market composition, evolution, key players, and future opportunities, offering invaluable insights for stakeholders across the sector. The report leverages robust data analysis, encompassing historical data (2019-2024) and forecasting the period 2025-2033, delivering actionable intelligence for informed decision-making.

Residential Real Estate Industry Market Composition & Trends

This section examines the current market landscape, analyzing market concentration, key innovation drivers, regulatory influences, substitute products, end-user preferences, and significant M&A activities. We explore the distribution of market share amongst leading players and quantify the value of major mergers and acquisitions. The analysis covers the diverse segments of the market, including apartments and condominiums, and landed houses and villas.

Market Concentration: The residential real estate market exhibits a moderately concentrated structure, with a few major players commanding significant market share. DLF Ltd, for instance, holds an estimated xx% market share in India, while Coldwell Banker's global reach contributes significantly to its overall share. This concentration is further influenced by regional variations.

Innovation Catalysts: Technological advancements such as PropTech platforms, VR/AR for virtual property tours, and AI-driven property valuations are disrupting the industry, improving efficiency and customer experience.

Regulatory Landscape: Varying regulations across countries significantly impact market dynamics. Stringent building codes and zoning regulations in certain regions can influence supply and pricing.

Substitute Products: While direct substitutes are limited, alternative housing options such as co-living spaces and rental platforms exert competitive pressure on traditional residential markets.

End-User Profiles: The report segments end-users based on demographics, income levels, and lifestyle preferences, revealing distinct preferences for different property types and locations.

M&A Activity: The last five years have seen significant M&A activity, with deal values exceeding $XX Million. Notable transactions include [Insert Specific Example of a significant M&A deal in the residential real estate industry if one is known, otherwise use “xx”].

Residential Real Estate Industry Industry Evolution

This section charts the evolutionary trajectory of the residential real estate industry, focusing on market growth trajectories, technological integration, and the evolving needs and preferences of consumers. The analysis incorporates key data points, including historical and projected growth rates, adoption rates for new technologies, and shifts in consumer demand.

[Insert 600 words analyzing market growth trajectories, technological advancements and shifting consumer demands with specific data points like growth rates and adoption metrics. Examples could include discussion of the increasing popularity of sustainable housing, smart home technology adoption rates, growth of online property portals and their impact, or the effects of changing demographics on housing demand.]

Leading Regions, Countries, or Segments in Residential Real Estate Industry

This section identifies the dominant regions, countries, or segments within the residential real estate market, focusing on apartments and condominiums and landed houses and villas. The analysis highlights key factors driving dominance, including investment trends and regulatory support.

Apartments and Condominiums: [Insert analysis of the dominant region/country for apartments and condominiums (e.g., "Asia-Pacific, particularly China and India, dominate the global market for apartments and condominiums.") ]

- Key Drivers:

- Robust urbanization and population growth

- Increased affordability relative to landed properties

- Government initiatives promoting affordable housing

- Key Drivers:

Landed Houses and Villas: [Insert analysis of the dominant region/country for landed houses and villas (e.g., "North America and Western Europe continue to be leading markets for landed houses and villas.") ]

- Key Drivers:

- Strong demand for luxury properties

- Preference for spacious living and private outdoor spaces

- High disposable incomes in certain regions

- Key Drivers:

[Insert detailed paragraphs (approximately 300-400 words) analyzing dominance factors for each property segment, providing insights into market size, growth rates and specific market characteristics].

Residential Real Estate Industry Product Innovations

The residential real estate industry is witnessing a wave of product innovation, driven by technological advancements and evolving consumer preferences. Smart home integration, sustainable building materials, and prefabricated construction methods are transforming the sector. Unique selling propositions now include energy-efficient designs, advanced security systems, and personalized living spaces, enhancing both functionality and value.

Propelling Factors for Residential Real Estate Industry Growth

Several factors are driving the growth of the residential real estate industry. Technological advancements, economic expansion in key regions, and supportive government policies all play crucial roles. For instance, the increasing adoption of PropTech solutions is streamlining processes and attracting investment, while government incentives for affordable housing are boosting demand in several markets. Furthermore, economic growth in developing economies fuels demand for housing.

Obstacles in the Residential Real Estate Industry Market

Despite its growth potential, the residential real estate market faces several challenges. Regulatory hurdles, such as lengthy approval processes and complex zoning laws, can hinder development. Supply chain disruptions, particularly in the wake of recent global events, impact material costs and project timelines. Intense competition, both domestically and internationally, further complicates the market. These factors have contributed to a xx% increase in construction costs over the past [number] years, impacting project feasibility.

Future Opportunities in Residential Real Estate Industry

The future holds significant opportunities for growth in the residential real estate market. Expanding into emerging markets in Africa and Southeast Asia presents considerable potential. The integration of cutting-edge technologies, such as AI-powered property management and sustainable building practices, will further enhance market efficiency and attractiveness. Meeting the growing demand for affordable housing and environmentally conscious homes will shape future development.

Major Players in the Residential Real Estate Industry Ecosystem

- DLF Ltd

- Coldwell Banker Real Estate Company

- Pultegroup Inc

- Engel & Völkers AG

- Al Habtoor Group

- Savills PLC

- Lennar Corporation

- Raubex Group Ltd

- IJM Corporation Berhad

- Hochtief Corporation

- Sun Hung Kai Properties Ltd

- Christie International Real Estate

- Sotheby's International Realty Affiliates LLC

- Dr. Horton

Key Developments in Residential Real Estate Industry Industry

November 2023: Tata Realty and Infrastructure's ambitious plan to develop over 50 projects across India, Sri Lanka, and the Maldives, encompassing more than 51 million square feet, signals significant growth potential in the South Asian market. This expansion will impact market dynamics by increasing supply and potentially influencing prices.

December 2023: The Ashwin Sheth group's planned expansion into the MMR region of India highlights the ongoing growth and investment opportunities in this major metropolitan area. This development will directly increase competition and potentially influence local market conditions.

Strategic Residential Real Estate Industry Market Forecast

The residential real estate industry is poised for sustained growth over the next decade. The confluence of technological advancements, increasing urbanization, and supportive government policies creates a positive outlook. Emerging markets and the rising demand for sustainable and technologically integrated housing present significant opportunities. The market is expected to witness substantial growth, driven by factors outlined in the preceding sections, leading to a projected market value of $XX Million by 2033.

Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. United Arab Emirates

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East

-

6. Latin America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of Latin America

- 7. Rest of the World

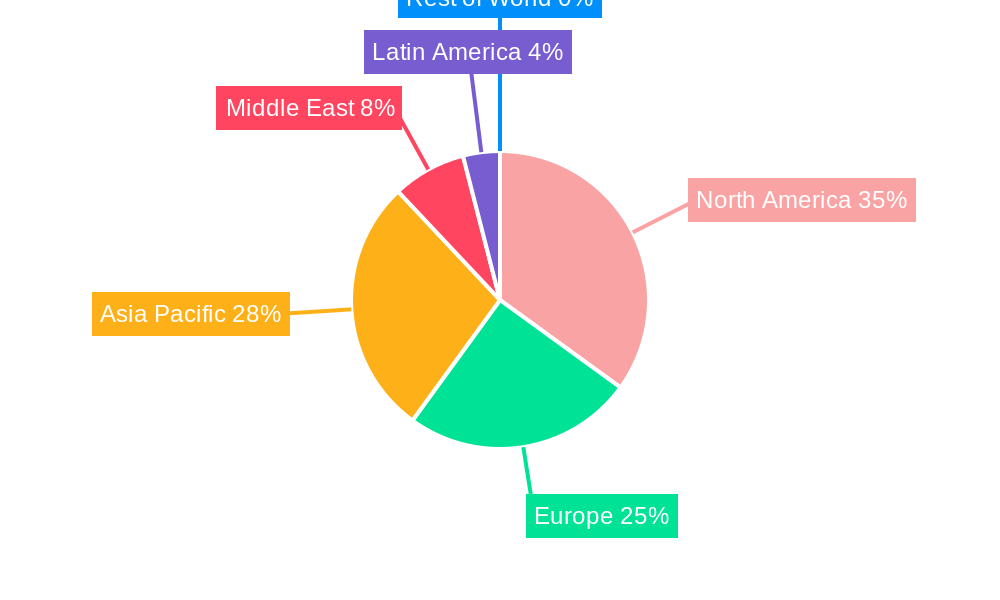

Residential Real Estate Industry Regional Market Share

Geographic Coverage of Residential Real Estate Industry

Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization; Government initiatives

- 3.3. Market Restrains

- 3.3.1. High property prices; Regulatory challenges

- 3.4. Market Trends

- 3.4.1. Increased urbanization and homeownership by elderly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. United Arab Emirates

- 5.2.6. Latin America

- 5.2.7. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United Arab Emirates Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Latin America Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Apartments and Condominiums

- 11.1.2. Landed Houses and Villas

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of the World Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Apartments and Condominiums

- 12.1.2. Landed Houses and Villas

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 DLF Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ColdWell Banker Real Estate Company

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Pultegroup Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Engel & Volkers AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Al Habtoor Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Savills PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Lennar Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Raubex Group Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 IJM Corporation Berhad

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hochtief Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Sun Hung Kai Properties Ltd**List Not Exhaustive

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Christie International Real Estate

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Sotheby International Realty Affiliates LLC

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Dr Hortons

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 DLF Ltd

List of Figures

- Figure 1: Global Residential Real Estate Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: United Arab Emirates Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: United Arab Emirates Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: United Arab Emirates Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: United Arab Emirates Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Latin America Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 23: Latin America Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Residential Real Estate Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Residential Real Estate Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Residential Real Estate Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Rest of the World Residential Real Estate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: China Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Japan Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: South Korea Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Australia Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Saudi Arabia Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Africa Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Middle East Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Latin America Residential Real Estate Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Industry?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Residential Real Estate Industry?

Key companies in the market include DLF Ltd, ColdWell Banker Real Estate Company, Pultegroup Inc, Engel & Volkers AG, Al Habtoor Group, Savills PLC, Lennar Corporation, Raubex Group Ltd, IJM Corporation Berhad, Hochtief Corporation, Sun Hung Kai Properties Ltd**List Not Exhaustive, Christie International Real Estate, Sotheby International Realty Affiliates LLC, Dr Hortons.

3. What are the main segments of the Residential Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization; Government initiatives.

6. What are the notable trends driving market growth?

Increased urbanization and homeownership by elderly.

7. Are there any restraints impacting market growth?

High property prices; Regulatory challenges.

8. Can you provide examples of recent developments in the market?

December 2023: The Ashwin Sheth group is planning to expand its residential and commercial portfolio in the MMR (Mumbai Metropolitan Area) region, India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence