Key Insights

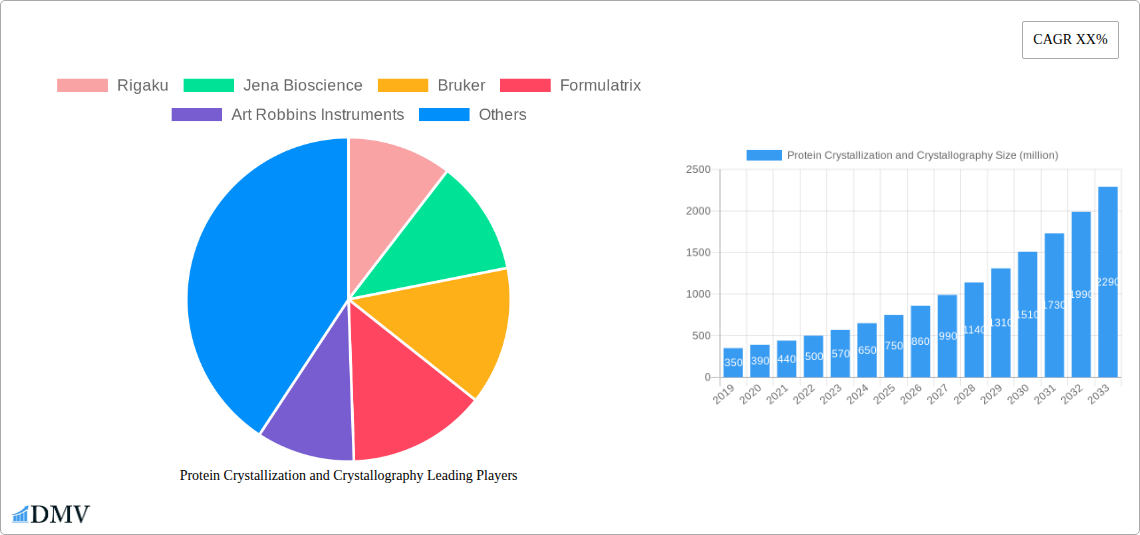

The Protein Crystallization and Crystallography market is poised for significant expansion, projected to reach approximately \$750 million by 2025. This robust growth is fueled by a Compound Annual Growth Rate (CAGR) of around 15%, indicating a dynamic and rapidly evolving sector. The increasing demand for advanced drug discovery and development, particularly in the pharmaceutical and biotechnology industries, is a primary driver. These sectors rely heavily on protein crystallography to elucidate the three-dimensional structures of target proteins, enabling the rational design of more effective and safer therapeutics. Academic institutions are also playing a crucial role, driving fundamental research and innovation in protein science. The market is segmented into Reagents/Consumables and Instruments, with both segments experiencing steady demand. Instruments, including X-ray diffractometers and crystallizers, represent a substantial portion of the market due to their high cost and specialized nature, while reagents and consumables, such as crystallization kits and screening solutions, contribute to recurring revenue streams.

Further amplifying market growth are key trends like the advancement in high-throughput screening (HTS) technologies, which accelerate the crystallization process, and the integration of artificial intelligence (AI) and machine learning (ML) for predicting crystallization outcomes and analyzing structural data. The growing prevalence of chronic diseases and the ongoing quest for novel treatments for unmet medical needs are creating an ever-increasing pipeline of drug candidates that necessitate detailed structural analysis. However, the market is not without its restraints. The high initial investment costs for sophisticated instrumentation and the need for specialized expertise can pose a barrier to entry for smaller organizations. Stringent regulatory requirements for drug development can also indirectly influence the pace of adoption of new technologies. Nonetheless, the overwhelming benefits of protein crystallography in understanding disease mechanisms and developing targeted therapies ensure its continued prominence and growth trajectory.

Protein Crystallization and Crystallography Market Insights: Unlocking Structural Biology's Potential (2019-2033)

This comprehensive report provides an in-depth analysis of the global Protein Crystallization and Crystallography market, a critical field enabling the structural determination of biomolecules. Examining market dynamics from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand market composition, industry evolution, regional dominance, product innovation, growth drivers, obstacles, and future opportunities. With an estimated market size projected to reach XX million by 2033, this study delves into the intricate interplay of technologies, applications, and key players shaping the future of structural biology.

Protein Crystallization and Crystallography Market Composition & Trends

The Protein Crystallization and Crystallography market exhibits a moderate to high concentration, driven by a blend of established players and emerging innovators. Innovation catalysts are primarily fueled by the relentless pursuit of higher resolution protein structures and accelerated drug discovery timelines. The regulatory landscape, particularly concerning pharmaceutical applications, plays a pivotal role, influencing validation processes and market entry. Substitute products, while limited in directly replicating the comprehensive structural information provided by crystallography, may include cryo-electron microscopy (Cryo-EM) and nuclear magnetic resonance (NMR) spectroscopy, each offering complementary insights. End-user profiles span pharmaceutical companies, biotechnology companies, and academic institutions, all leveraging these techniques for drug design, target validation, and fundamental biological research. Mergers and acquisitions (M&A) activities are significant, reflecting strategic consolidation and expansion efforts. Notable M&A deals have been valued in the range of XX million. Market share distribution within the major product segments (Reagents/Consumables vs. Instruments) is highly competitive.

- Market Share Distribution:

- Instruments segment: XX%

- Reagents/Consumables segment: XX%

- M&A Activity Drivers:

- Acquisition of innovative technologies.

- Expansion into new geographic markets.

- Vertical integration of product portfolios.

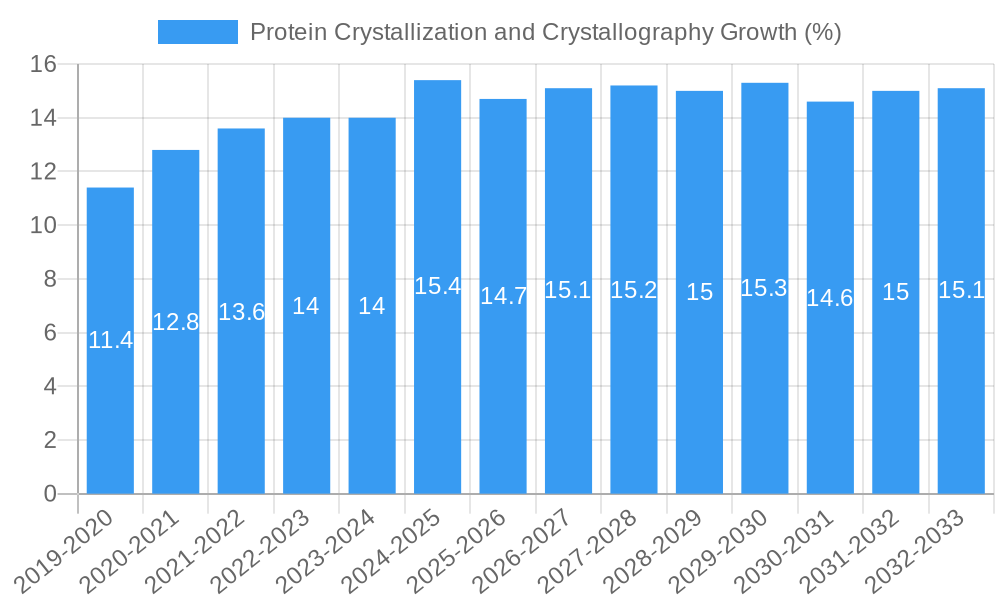

Protein Crystallization and Crystallography Industry Evolution

The Protein Crystallization and Crystallography industry has witnessed remarkable evolution throughout the historical period (2019-2024) and is poised for significant growth in the forecast period (2025-2033). Market growth trajectories have been consistently upward, propelled by advancements in synchrotron radiation sources, automation, and data processing algorithms. Technological advancements, particularly in X-ray crystallography instrumentation and software, have drastically reduced sample requirements, improved data acquisition speed, and enhanced structure determination capabilities. Shifting consumer demands are characterized by an increasing need for high-throughput crystallization screening, robust structure-based drug design solutions, and accessible, user-friendly platforms. The adoption of automated liquid handling systems and robotic crystallization platforms has surged, allowing for the screening of millions of conditions per experiment. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Key adoption metrics include the increasing number of crystal structures deposited in public databases, such as the Protein Data Bank (PDB), which has seen an annual influx of XX million new entries. Furthermore, the growing complexity of therapeutic targets, including membrane proteins and intrinsically disordered proteins, necessitates sophisticated structural biology techniques like advanced protein crystallization and crystallography. The integration of artificial intelligence and machine learning in data analysis and prediction of crystallization success further propels the industry forward. The increasing global investment in life sciences research, particularly in areas like precision medicine and biologics development, directly translates into sustained demand for protein crystallization and crystallography services and products.

Leading Regions, Countries, or Segments in Protein Crystallization and Crystallography

The Pharmaceutical application segment demonstrably leads the Protein Crystallization and Crystallography market, driven by its critical role in small molecule and biologic drug discovery and development. This dominance is further amplified by substantial R&D investments from major pharmaceutical corporations seeking to identify novel drug targets and optimize lead compounds. The segment benefits from a robust pipeline of new therapeutics and a continuous need to understand drug-target interactions at the atomic level.

Dominant Application Segment: Pharmaceutical

- Key Drivers in Pharmaceutical:

- High R&D Expenditure: Pharmaceutical companies invest XX million annually in drug discovery, with a significant portion allocated to structural biology.

- Demand for Novel Therapies: The pursuit of treatments for unmet medical needs fuels the demand for high-resolution structural data.

- Biologics Development: The rising prominence of monoclonal antibodies and other protein-based therapeutics necessitates advanced characterization techniques.

- Regulatory Requirements: FDA and EMA guidelines often require detailed structural information for drug approval.

- Key Drivers in Pharmaceutical:

The Instruments type segment also holds a significant market share, as cutting-edge instrumentation is fundamental to achieving high-quality structural data. This includes advanced X-ray diffractometers, detectors, and microfluidic crystallization devices. The substantial capital investment required for these instruments, often running into millions for high-end systems, reflects their critical importance.

Dominant Type Segment: Instruments

- Key Drivers in Instruments:

- Technological Advancements: Continuous innovation in X-ray sources, detectors, and automation drives instrument sales, with new systems costing upwards of XX million.

- Need for High-Throughput Screening: Automation and robotics in instruments enable faster and more efficient crystallization experiments.

- Synchrotron Facility Investments: The development and upgrades of synchrotron facilities worldwide necessitate state-of-the-art crystallography equipment.

- Academic and Research Institute Purchases: These institutions are major buyers of advanced crystallography instruments to support fundamental research.

- Key Drivers in Instruments:

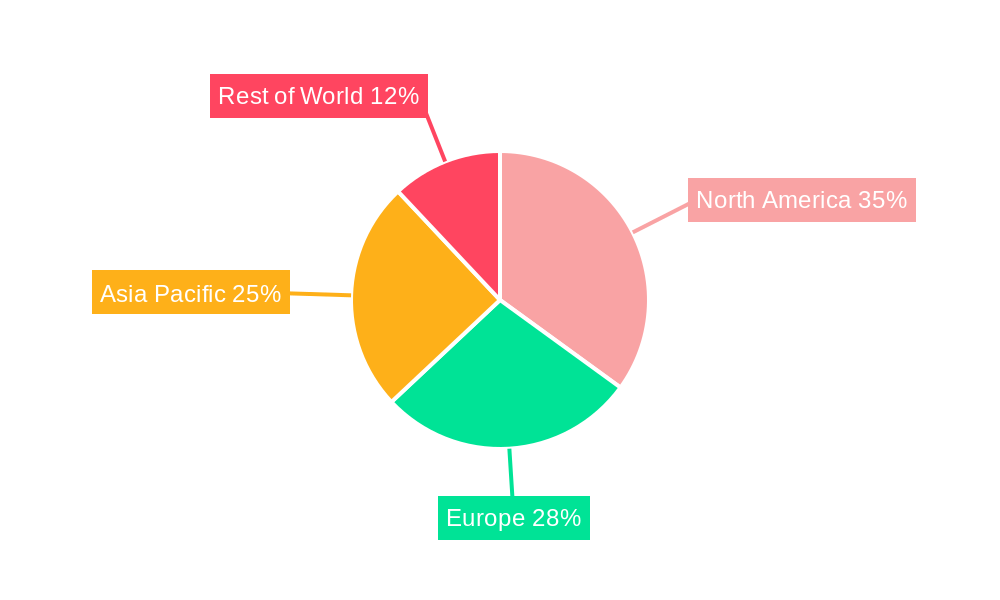

North America and Europe are leading geographic regions due to the presence of major pharmaceutical and biotechnology hubs, alongside well-funded academic institutions. Asia-Pacific is emerging as a rapidly growing region due to increasing government support for life sciences research and the expansion of contract research organizations (CROs).

Protein Crystallization and Crystallography Product Innovations

Recent product innovations in Protein Crystallization and Crystallography focus on enhancing throughput, accuracy, and ease of use. Advances in microfluidic crystallization devices allow for the generation of nanoliter-scale crystals, reducing precious protein consumption. Automated liquid handlers, capable of dispensing XX million unique conditions in a single run, are transforming experimental efficiency. Furthermore, novel crystallization screening kits and additives provide broader coverage of crystallization conditions, improving success rates for notoriously difficult proteins. Software advancements integrating machine learning for predicting crystallization outcomes and analyzing diffraction data are also key differentiators, offering performance metrics like XX% improvement in crystallization success rates.

Propelling Factors for Protein Crystallization and Crystallography Growth

The growth of the Protein Crystallization and Crystallography market is propelled by several key factors. The escalating demand for biologics and personalized medicine necessitates a deeper understanding of protein structures. Technological advancements in X-ray sources, detectors, and automated systems have made crystallography more accessible and efficient. Furthermore, substantial government funding for life sciences research and an increasing number of drug discovery collaborations between academia and industry provide a strong economic impetus. Regulatory agencies also increasingly emphasize structural data for drug approval processes, further driving adoption.

- Technological Innovations: Improved resolution and speed.

- Economic Factors: Increased R&D spending, growing biologics market.

- Regulatory Support: Emphasis on structural data for drug development.

Obstacles in the Protein Crystallization and Crystallography Market

Despite robust growth, the Protein Crystallization and Crystallography market faces several obstacles. The high cost of advanced instrumentation, with some systems exceeding XX million, can be a significant barrier for smaller research groups. The complex nature of protein crystallization itself, with its trial-and-error approach, can lead to lower-than-desired success rates and extended experimental timelines. Supply chain disruptions for specialized reagents and consumables can also impact operational efficiency. Moreover, the competitive landscape with emerging alternative structural biology techniques like Cryo-EM, while complementary, can sometimes present perceived alternatives.

- High Capital Investment: Cost of advanced instrumentation.

- Technical Challenges: Inherent difficulties in protein crystallization.

- Supply Chain Vulnerabilities: Dependence on specialized components.

Future Opportunities in Protein Crystallization and Crystallography

Future opportunities in the Protein Crystallization and Crystallography market lie in the development of integrated platforms that combine automated crystallization with in-situ data collection. The expansion of cryo-electron microscopy sample preparation techniques adapted for crystallography presents a unique synergy. Furthermore, the growing application of protein structure data in areas like enzyme engineering, synthetic biology, and the development of diagnostics offers new market avenues. The increasing demand for structural insights into complex protein-protein interactions and membrane proteins will continue to fuel innovation.

- Integrated Workflow Solutions: Combining automation and data analysis.

- Emerging Applications: Enzyme engineering, synthetic biology.

- Focus on Difficult Targets: Membrane proteins, transient complexes.

Major Players in the Protein Crystallization and Crystallography Ecosystem

- Rigaku

- Jena Bioscience

- Bruker

- Formulatrix

- Art Robbins Instruments

- Molecular Dimensions

- Tecan

- FEI

- MiTeGen

- QIAGEN

Key Developments in Protein Crystallization and Crystallography Industry

- 2023 January: Formulatrix launches a new generation of automated liquid handling systems, significantly increasing crystallization screening throughput, enabling the screening of XX million conditions per day.

- 2023 April: Rigaku introduces an advanced X-ray diffractometer with enhanced detector sensitivity, improving data quality for micro- and nano-crystalline samples.

- 2022 November: Bruker announces a strategic partnership with a leading AI company to accelerate structure determination through advanced data analysis algorithms, achieving XX% faster analysis times.

- 2022 July: Jena Bioscience expands its portfolio of crystallization reagents with novel screening kits designed for membrane proteins, a notoriously challenging class of targets.

- 2021 December: Molecular Dimensions releases a new series of micro-well plates with enhanced surface properties to minimize protein adsorption and improve crystal growth.

- 2021 October: QIAGEN acquires a specialized proteomics company, enhancing its offerings in protein purification and sample preparation for structural studies.

- 2020 March: Art Robbins Instruments unveils an innovative robotic system for automated crystal harvesting and mounting, streamlining the workflow from crystallization to data collection.

- 2019 September: FEI (now Thermo Fisher Scientific) showcases advancements in direct electron detectors for cryo-EM that also show promise in optimizing crystallography data acquisition.

Strategic Protein Crystallization and Crystallography Market Forecast

The strategic outlook for the Protein Crystallization and Crystallography market remains exceptionally strong. The increasing reliance on structural biology for rational drug design, coupled with ongoing technological innovations, will continue to be the primary growth catalysts. The market is poised to benefit from expanded applications in areas like vaccine development and the biopharmaceutical industry's growing pipeline of complex protein-based therapies. Investments in advanced synchrotron facilities and the integration of AI in data analysis will further enhance efficiency and success rates. The market is projected to witness sustained growth driven by a combination of technological sophistication and increasing demand for high-resolution molecular insights.

Protein Crystallization and Crystallography Segmentation

-

1. Application

- 1.1. Pharmaceutical

- 1.2. Biotechnology companies

- 1.3. Academic institutions

- 1.4. Others

-

2. Types

- 2.1. Reagents/Consumables

- 2.2. Instruments

Protein Crystallization and Crystallography Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Protein Crystallization and Crystallography REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Protein Crystallization and Crystallography Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical

- 5.1.2. Biotechnology companies

- 5.1.3. Academic institutions

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Reagents/Consumables

- 5.2.2. Instruments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Protein Crystallization and Crystallography Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical

- 6.1.2. Biotechnology companies

- 6.1.3. Academic institutions

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Reagents/Consumables

- 6.2.2. Instruments

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Protein Crystallization and Crystallography Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical

- 7.1.2. Biotechnology companies

- 7.1.3. Academic institutions

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Reagents/Consumables

- 7.2.2. Instruments

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Protein Crystallization and Crystallography Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical

- 8.1.2. Biotechnology companies

- 8.1.3. Academic institutions

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Reagents/Consumables

- 8.2.2. Instruments

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Protein Crystallization and Crystallography Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical

- 9.1.2. Biotechnology companies

- 9.1.3. Academic institutions

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Reagents/Consumables

- 9.2.2. Instruments

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Protein Crystallization and Crystallography Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical

- 10.1.2. Biotechnology companies

- 10.1.3. Academic institutions

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Reagents/Consumables

- 10.2.2. Instruments

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Rigaku

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jena Bioscience

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bruker

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Formulatrix

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Art Robbins Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Molecular Dimensions

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tecan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FEI

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MiTeGen

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 QIAGEN

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Rigaku

List of Figures

- Figure 1: Global Protein Crystallization and Crystallography Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Protein Crystallization and Crystallography Revenue (million), by Application 2024 & 2032

- Figure 3: North America Protein Crystallization and Crystallography Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Protein Crystallization and Crystallography Revenue (million), by Types 2024 & 2032

- Figure 5: North America Protein Crystallization and Crystallography Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Protein Crystallization and Crystallography Revenue (million), by Country 2024 & 2032

- Figure 7: North America Protein Crystallization and Crystallography Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Protein Crystallization and Crystallography Revenue (million), by Application 2024 & 2032

- Figure 9: South America Protein Crystallization and Crystallography Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Protein Crystallization and Crystallography Revenue (million), by Types 2024 & 2032

- Figure 11: South America Protein Crystallization and Crystallography Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Protein Crystallization and Crystallography Revenue (million), by Country 2024 & 2032

- Figure 13: South America Protein Crystallization and Crystallography Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Protein Crystallization and Crystallography Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Protein Crystallization and Crystallography Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Protein Crystallization and Crystallography Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Protein Crystallization and Crystallography Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Protein Crystallization and Crystallography Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Protein Crystallization and Crystallography Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Protein Crystallization and Crystallography Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Protein Crystallization and Crystallography Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Protein Crystallization and Crystallography Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Protein Crystallization and Crystallography Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Protein Crystallization and Crystallography Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Protein Crystallization and Crystallography Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Protein Crystallization and Crystallography Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Protein Crystallization and Crystallography Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Protein Crystallization and Crystallography Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Protein Crystallization and Crystallography Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Protein Crystallization and Crystallography Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Protein Crystallization and Crystallography Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Protein Crystallization and Crystallography Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Protein Crystallization and Crystallography Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Protein Crystallization and Crystallography Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Protein Crystallization and Crystallography Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Protein Crystallization and Crystallography Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Protein Crystallization and Crystallography Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Protein Crystallization and Crystallography Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Protein Crystallization and Crystallography Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Protein Crystallization and Crystallography Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Protein Crystallization and Crystallography Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Protein Crystallization and Crystallography Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Protein Crystallization and Crystallography Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Protein Crystallization and Crystallography Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Protein Crystallization and Crystallography Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Protein Crystallization and Crystallography Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Protein Crystallization and Crystallography Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Protein Crystallization and Crystallography Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Protein Crystallization and Crystallography Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Protein Crystallization and Crystallography Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Protein Crystallization and Crystallography Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Protein Crystallization and Crystallography?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Protein Crystallization and Crystallography?

Key companies in the market include Rigaku, Jena Bioscience, Bruker, Formulatrix, Art Robbins Instruments, Molecular Dimensions, Tecan, FEI, MiTeGen, QIAGEN.

3. What are the main segments of the Protein Crystallization and Crystallography?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Protein Crystallization and Crystallography," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Protein Crystallization and Crystallography report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Protein Crystallization and Crystallography?

To stay informed about further developments, trends, and reports in the Protein Crystallization and Crystallography, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence