Key Insights

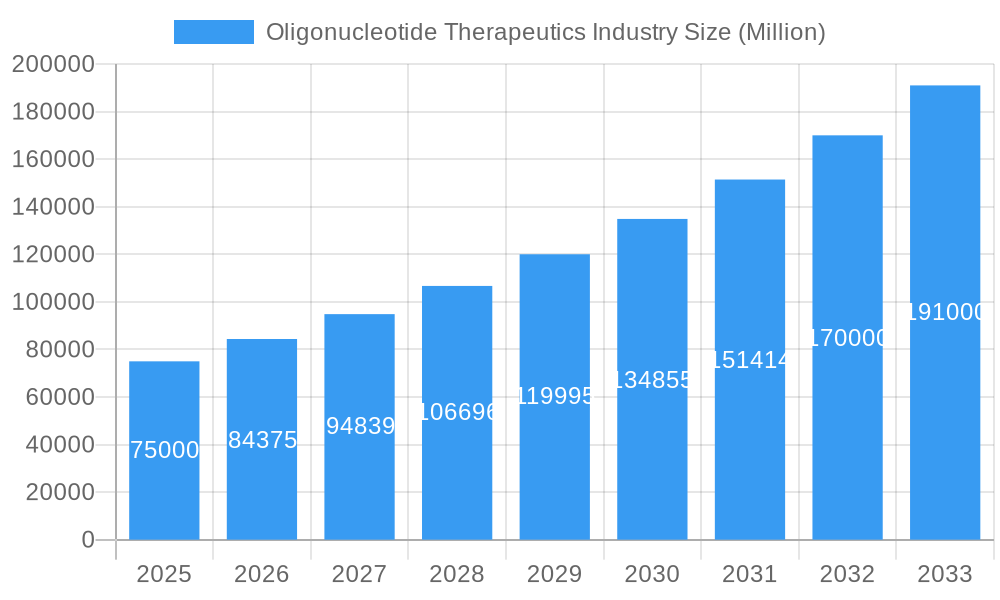

The global Oligonucleotide Therapeutics market is projected for substantial growth, expected to reach $7.19 billion by 2025, with a significant Compound Annual Growth Rate (CAGR) of 19.7% from 2025 to 2033. This expansion is driven by the rising incidence of genetic disorders, accelerated R&D in genetic medicine, and broadening therapeutic applications in oncology, rare diseases, and infectious diseases. Technological advancements in synthesis and a deeper understanding of disease mechanisms are fostering innovation in novel oligonucleotide-based therapies. The market comprises Synthesized Oligonucleotide Products and Reagents as primary segments, supported by essential Equipment and Services. Key applications include Research, Diagnostics for precise disease detection, and transformative Therapeutics.

Oligonucleotide Therapeutics Industry Market Size (In Billion)

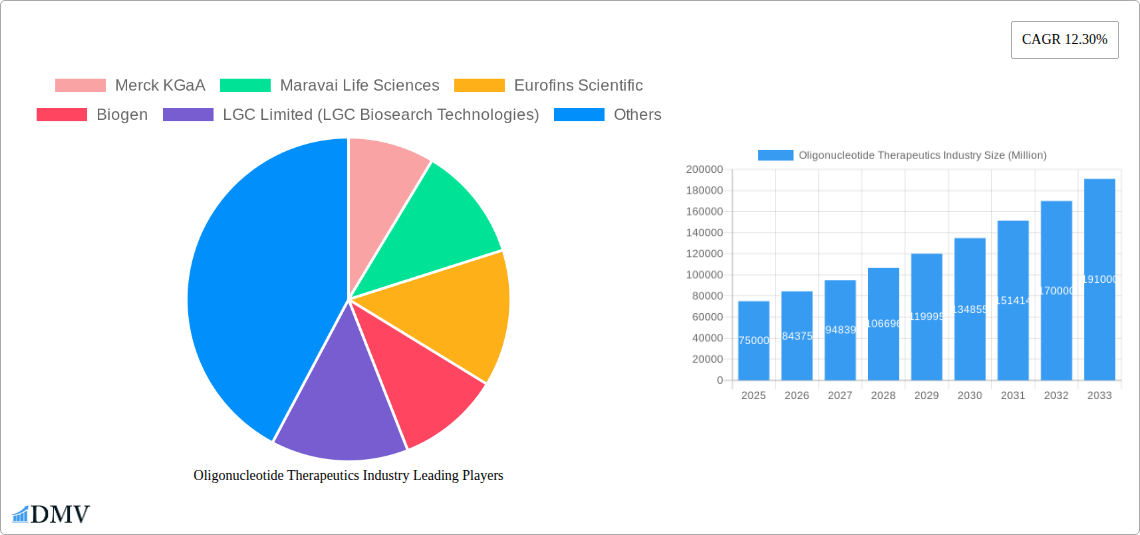

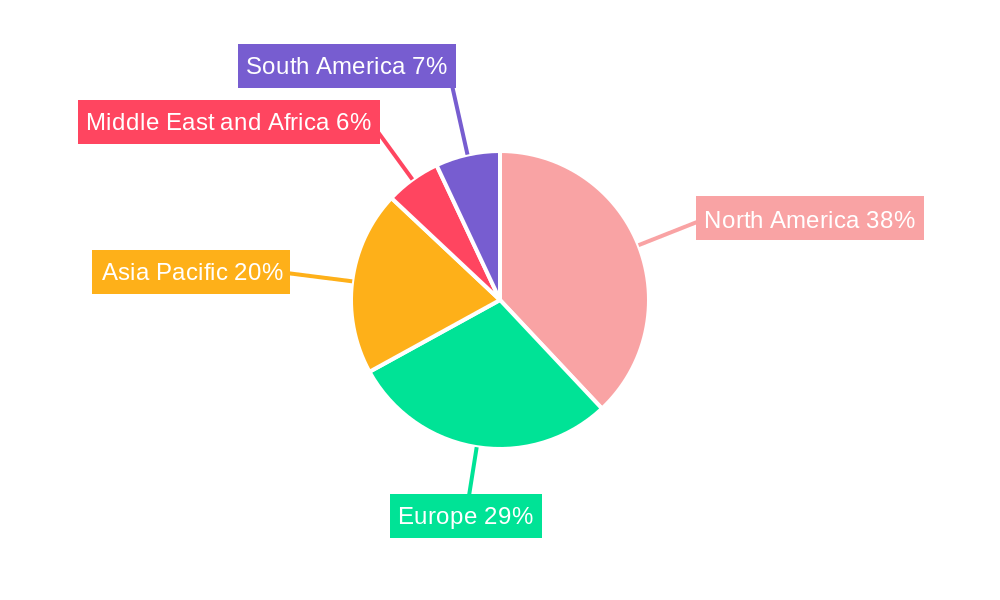

Key industry players like Thermo Fisher Scientific, Merck KGaA, and Agilent Technologies are actively pursuing R&D, strategic partnerships, and portfolio enhancements to strengthen their market positions. North America currently leads, owing to robust biotechnology investments and a high prevalence of genetic diseases. The Asia Pacific region is anticipated to experience the most rapid growth, propelled by increasing healthcare spending, heightened awareness of genetic disorders, and supportive government initiatives. Challenges include high synthesis and manufacturing costs, complex regulatory processes, and potential off-target effects, necessitating rigorous quality control. However, advancements in next-generation sequencing and CRISPR technology are poised to address these issues, ushering in an era of personalized and effective oligonucleotide therapeutics.

Oligonucleotide Therapeutics Industry Company Market Share

Explore the Oligonucleotide Therapeutics Industry: Market Size, Growth, and Forecast.

Oligonucleotide Therapeutics Industry Market Composition & Trends

The Oligonucleotide Therapeutics Industry is a rapidly expanding and dynamic sector within the global biopharmaceutical landscape. This comprehensive report delves into the intricate market composition and prevailing trends that are shaping its future. We analyze the competitive landscape, highlighting key players and their market share distribution, estimated at XXX Million in 2025. The report identifies innovation catalysts, including advancements in synthesis technologies and delivery mechanisms, alongside the evolving regulatory frameworks that govern therapeutic development. Substitute products and their potential impact are thoroughly examined, providing stakeholders with a holistic view of market threats. Furthermore, we profile end-user segments, from academic research institutes to pharmaceutical and biotechnology companies, understanding their unique demands and adoption patterns. Mergers and acquisitions (M&A) activities are a significant indicator of industry consolidation and strategic growth, with M&A deal values projected to reach XXX Million by 2033.

- Market Concentration: Analysis of market share held by leading companies.

- Innovation Catalysts: Identification of technological advancements driving new therapeutic development.

- Regulatory Landscapes: Overview of current and upcoming regulations impacting the industry.

- Substitute Products: Assessment of alternative therapeutic modalities.

- End-User Profiles: Detailed segmentation of key consumers and their needs.

- M&A Activities: Evaluation of strategic partnerships and acquisitions.

Oligonucleotide Therapeutics Industry Industry Evolution

The Oligonucleotide Therapeutics Industry is undergoing a remarkable transformation, driven by unprecedented scientific breakthroughs and a growing demand for novel treatment modalities. This section provides an in-depth analysis of the industry's evolution from 2019 to 2033, with a base year of 2025. The market growth trajectories are meticulously charted, revealing an impressive compound annual growth rate (CAGR) of approximately XX% from the historical period of 2019-2024 to the forecast period of 2025-2033. Technological advancements in oligonucleotide synthesis, including solid-phase synthesis and enzymatic methods, have dramatically increased efficiency and reduced costs, making these therapies more accessible. Innovations in delivery systems, such as lipid nanoparticles (LNPs) and viral vectors, are crucial for overcoming biological barriers and improving therapeutic efficacy. Shifting consumer demands, fueled by an increasing prevalence of genetic disorders and unmet medical needs in areas like oncology, rare diseases, and infectious diseases, are accelerating the adoption of oligonucleotide-based treatments. The ability of oligonucleotides to target specific genetic sequences offers a high degree of precision, a key factor in their growing appeal over traditional small molecules or biologics. The market is witnessing a surge in clinical trial activity, with a significant number of oligonucleotide drug candidates progressing through various stages of development. This pipeline expansion, coupled with successful commercial launches, is a testament to the industry's robust growth. Furthermore, the increasing investment from venture capital firms and pharmaceutical giants underscores the immense commercial potential and scientific validation of this therapeutic class. The evolution also encompasses the development of more sophisticated analytical techniques for quality control and the establishment of specialized manufacturing capabilities to meet the rising global demand for these complex molecules. The industry's journey is marked by a continuous pursuit of improved safety profiles, enhanced pharmacokinetic properties, and broader therapeutic applications, solidifying its position as a cornerstone of modern medicine.

Leading Regions, Countries, or Segments in Oligonucleotide Therapeutics Industry

The Oligonucleotide Therapeutics Industry is characterized by regional and segmental dominance, with specific areas and product types spearheading innovation and market penetration. North America, particularly the United States, has consistently emerged as a leading region due to its robust healthcare infrastructure, substantial R&D investments, and a strong presence of leading pharmaceutical and biotechnology companies. The region benefits from supportive government initiatives, favorable regulatory pathways, and a high concentration of academic research institutions driving groundbreaking discoveries in oligonucleotide therapeutics.

Within the Product Type segment, Synthesized Oligonucleotide Products are currently dominating the market. This dominance is driven by their critical role as the active pharmaceutical ingredients in a wide array of oligonucleotide-based drugs. The demand for custom-synthesized oligonucleotides for research, preclinical studies, and clinical trials remains exceptionally high. The market for Reagents and Equipment is also significant, as these are essential for the synthesis, purification, and analysis of oligonucleotides, supporting the entire value chain. Services, including contract manufacturing and analytical services, are witnessing substantial growth as companies increasingly outsource specialized tasks to expert providers.

In terms of Application, the Therapeutics segment is the primary growth engine. The successful development and commercialization of oligonucleotide drugs for various diseases, including rare genetic disorders, neurological conditions, and certain cancers, are propelling this segment forward. The Diagnostics application is also gaining traction, with oligonucleotides playing a vital role in nucleic acid-based diagnostic tests. The Research application continues to be a foundational segment, providing the essential tools and materials for scientific exploration.

The End-user landscape is dominated by Pharmaceutical and Biotechnology Companies. These entities are at the forefront of drug discovery, development, and commercialization of oligonucleotide therapeutics. Academic Research Institutes are crucial for early-stage research and the discovery of novel therapeutic targets. Hospital and Diagnostic Laboratories are increasingly adopting oligonucleotide-based diagnostics and are potential future prescribers of oligonucleotide therapies.

- Key Drivers for North American Dominance:

- High R&D expenditure by pharmaceutical and biotech giants.

- Supportive regulatory environment (e.g., FDA).

- Presence of leading academic research centers.

- Significant venture capital funding for startups.

- Dominance of Synthesized Oligonucleotide Products:

- Essential component for all oligonucleotide therapeutics.

- Growing pipeline of oligonucleotide drugs.

- Advancements in synthesis technologies enhancing efficiency and scale.

- Therapeutics as the Primary Application:

- Successful clinical trials and commercial approvals.

- Addressing unmet medical needs in various disease areas.

- High therapeutic potential for genetic and chronic diseases.

- Pharmaceutical and Biotechnology Companies as Key End-Users:

- Major drivers of innovation and investment.

- Leading the development of novel oligonucleotide drug candidates.

- Strategic partnerships for manufacturing and commercialization.

Oligonucleotide Therapeutics Industry Product Innovations

Product innovations in the Oligonucleotide Therapeutics Industry are revolutionizing patient care. Advances in synthesis technologies have led to the development of novel oligonucleotide chemistries, such as locked nucleic acids (LNAs) and peptide nucleic acids (PNAs), offering enhanced stability, binding affinity, and reduced immunogenicity. Delivery system innovations, including lipid nanoparticles (LNPs) and targeted delivery vehicles, are crucial for improving intracellular uptake and reducing off-target effects, thereby enhancing therapeutic efficacy and safety profiles. These innovations are enabling the development of oligonucleotide therapeutics for a broader range of diseases, including cancers, neurological disorders, and infectious diseases, with demonstrated performance metrics like improved target engagement and reduced dosage requirements.

Propelling Factors for Oligonucleotide Therapeutics Industry Growth

The Oligonucleotide Therapeutics Industry's growth is propelled by a confluence of powerful factors. Technological advancements in oligonucleotide synthesis, purification, and delivery are making these complex molecules more viable and effective. The increasing understanding of genetic diseases and the development of precision medicine approaches are creating a significant demand for oligonucleotide-based therapies that can target specific genetic sequences. Favorable regulatory pathways and increased investment from pharmaceutical companies and venture capitalists are accelerating drug development and commercialization. The successful clinical outcomes of existing oligonucleotide drugs have further validated the therapeutic potential of this class, inspiring further research and development.

Obstacles in the Oligonucleotide Therapeutics Industry Market

Despite its immense potential, the Oligonucleotide Therapeutics Industry faces several obstacles. The complex manufacturing processes for oligonucleotides can be costly and challenging to scale, impacting production efficiency and affordability. Delivery remains a significant hurdle, as effectively transporting oligonucleotides to target cells and tissues within the body can be difficult, leading to limitations in therapeutic reach and potential off-target effects. Stringent regulatory approval processes for novel therapies require extensive preclinical and clinical testing, extending development timelines and increasing costs. Furthermore, intense competition from established therapeutic modalities and the emergence of new players in the oligonucleotide space create market pressures.

Future Opportunities in Oligonucleotide Therapeutics Industry

The Oligonucleotide Therapeutics Industry is poised for substantial future growth, with numerous emerging opportunities. The expansion into new therapeutic areas, such as autoimmune diseases, cardiovascular conditions, and age-related macular degeneration, presents significant untapped potential. Advancements in artificial intelligence (AI) and machine learning are expected to accelerate drug discovery and design, enabling the identification of novel oligonucleotide targets and the optimization of therapeutic candidates. The development of innovative delivery platforms, including nanotechnology-based solutions and in vivo gene editing technologies, will further enhance the efficacy and broaden the applicability of oligonucleotide therapeutics. Emerging markets in Asia-Pacific and other developing regions offer new avenues for market expansion as healthcare infrastructure and access to advanced treatments improve.

Major Players in the Oligonucleotide Therapeutics Industry Ecosystem

- Agilent Technologies

- Biogen

- Bio-Synthesis Inc

- Danaher Corporation

- Eurofins Scientific

- GenScript

- Kaneka Corporation (Eurogentec)

- LGC Limited (LGC Biosearch Technologies)

- Maravai Life Sciences

- Merck KGaA

- Sarepta Therapeutics Inc

- Thermo Fisher Scientific

Key Developments in Oligonucleotide Therapeutics Industry Industry

- July 2022: WuXi STA, a subsidiary of WuXi AppTec, launched a new large-scale oligonucleotide and peptide manufacturing facility at its Changzhou campus. This new launch enhances its capacity and capability to meet the fast-growing customer needs for oligonucleotide and peptide therapeutics development and manufacturing worldwide.

- April 2022: Bachem entered a strategic collaboration with Eli Lilly & Company to develop and manufacture active pharmaceutical ingredients based on oligonucleotides, a rising new class of complex molecules. Under the agreement, Bachem provides the appropriate engineering infrastructure and expertise to implement Lilly's novel oligonucleotide manufacturing technology.

Strategic Oligonucleotide Therapeutics Industry Market Forecast

The strategic Oligonucleotide Therapeutics Industry market forecast anticipates robust growth, driven by continuous innovation and expanding therapeutic applications. Future opportunities lie in overcoming existing delivery challenges and exploring novel chemistries to enhance efficacy and safety. The increasing prevalence of genetic disorders and the growing demand for targeted therapies will fuel market expansion. Investments in advanced manufacturing technologies and strategic collaborations between pharmaceutical giants and specialized oligonucleotide manufacturers will be crucial for meeting the escalating global demand. The forecast indicates a significant upward trajectory, positioning oligonucleotide therapeutics as a cornerstone of future precision medicine.

Oligonucleotide Therapeutics Industry Segmentation

-

1. Product Type

- 1.1. Synthesized Oligonucleotide Products

- 1.2. Reagents

- 1.3. Equipment

- 1.4. Services

-

2. Application

- 2.1. Research

- 2.2. Diagnostics

- 2.3. Therapeutics

-

3. End-user

- 3.1. Academic Research Institutes

- 3.2. Pharmaceutical and Biotechnology Companies

- 3.3. Hospital and Diagnostic Laboratories

Oligonucleotide Therapeutics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Oligonucleotide Therapeutics Industry Regional Market Share

Geographic Coverage of Oligonucleotide Therapeutics Industry

Oligonucleotide Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Investments and R&D Expenditure in Pharmaceutical and Biotechnology Companies; The Use of Synthesized Oligonucleotides in Molecular Diagnostics and Clinical Applications

- 3.3. Market Restrains

- 3.3.1. High Treatment Cost of Oligonucleotides; Lack of Skilled Professionals and Research Support in Undeveloped Countries

- 3.4. Market Trends

- 3.4.1. Therapeutic Segment Expected to Register a High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oligonucleotide Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Synthesized Oligonucleotide Products

- 5.1.2. Reagents

- 5.1.3. Equipment

- 5.1.4. Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Research

- 5.2.2. Diagnostics

- 5.2.3. Therapeutics

- 5.3. Market Analysis, Insights and Forecast - by End-user

- 5.3.1. Academic Research Institutes

- 5.3.2. Pharmaceutical and Biotechnology Companies

- 5.3.3. Hospital and Diagnostic Laboratories

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Oligonucleotide Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Synthesized Oligonucleotide Products

- 6.1.2. Reagents

- 6.1.3. Equipment

- 6.1.4. Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Research

- 6.2.2. Diagnostics

- 6.2.3. Therapeutics

- 6.3. Market Analysis, Insights and Forecast - by End-user

- 6.3.1. Academic Research Institutes

- 6.3.2. Pharmaceutical and Biotechnology Companies

- 6.3.3. Hospital and Diagnostic Laboratories

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Oligonucleotide Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Synthesized Oligonucleotide Products

- 7.1.2. Reagents

- 7.1.3. Equipment

- 7.1.4. Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Research

- 7.2.2. Diagnostics

- 7.2.3. Therapeutics

- 7.3. Market Analysis, Insights and Forecast - by End-user

- 7.3.1. Academic Research Institutes

- 7.3.2. Pharmaceutical and Biotechnology Companies

- 7.3.3. Hospital and Diagnostic Laboratories

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Oligonucleotide Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Synthesized Oligonucleotide Products

- 8.1.2. Reagents

- 8.1.3. Equipment

- 8.1.4. Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Research

- 8.2.2. Diagnostics

- 8.2.3. Therapeutics

- 8.3. Market Analysis, Insights and Forecast - by End-user

- 8.3.1. Academic Research Institutes

- 8.3.2. Pharmaceutical and Biotechnology Companies

- 8.3.3. Hospital and Diagnostic Laboratories

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Oligonucleotide Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Synthesized Oligonucleotide Products

- 9.1.2. Reagents

- 9.1.3. Equipment

- 9.1.4. Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Research

- 9.2.2. Diagnostics

- 9.2.3. Therapeutics

- 9.3. Market Analysis, Insights and Forecast - by End-user

- 9.3.1. Academic Research Institutes

- 9.3.2. Pharmaceutical and Biotechnology Companies

- 9.3.3. Hospital and Diagnostic Laboratories

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Oligonucleotide Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Synthesized Oligonucleotide Products

- 10.1.2. Reagents

- 10.1.3. Equipment

- 10.1.4. Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Research

- 10.2.2. Diagnostics

- 10.2.3. Therapeutics

- 10.3. Market Analysis, Insights and Forecast - by End-user

- 10.3.1. Academic Research Institutes

- 10.3.2. Pharmaceutical and Biotechnology Companies

- 10.3.3. Hospital and Diagnostic Laboratories

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Merck KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Maravai Life Sciences

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eurofins Scientific

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Biogen

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LGC Limited (LGC Biosearch Technologies)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danaher Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GenScript

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sarepta Therapeutics Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermo Fisher Scientific

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio-Synthesis Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Agilent Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kaneka Corporation (Eurogentec)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Merck KGaA

List of Figures

- Figure 1: Global Oligonucleotide Therapeutics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Oligonucleotide Therapeutics Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Oligonucleotide Therapeutics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 4: North America Oligonucleotide Therapeutics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Oligonucleotide Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Oligonucleotide Therapeutics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Oligonucleotide Therapeutics Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Oligonucleotide Therapeutics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Oligonucleotide Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Oligonucleotide Therapeutics Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Oligonucleotide Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 12: North America Oligonucleotide Therapeutics Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 13: North America Oligonucleotide Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 14: North America Oligonucleotide Therapeutics Industry Volume Share (%), by End-user 2025 & 2033

- Figure 15: North America Oligonucleotide Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Oligonucleotide Therapeutics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Oligonucleotide Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Oligonucleotide Therapeutics Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Oligonucleotide Therapeutics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 20: Europe Oligonucleotide Therapeutics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 21: Europe Oligonucleotide Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Oligonucleotide Therapeutics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 23: Europe Oligonucleotide Therapeutics Industry Revenue (billion), by Application 2025 & 2033

- Figure 24: Europe Oligonucleotide Therapeutics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Oligonucleotide Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Oligonucleotide Therapeutics Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Oligonucleotide Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 28: Europe Oligonucleotide Therapeutics Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 29: Europe Oligonucleotide Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Europe Oligonucleotide Therapeutics Industry Volume Share (%), by End-user 2025 & 2033

- Figure 31: Europe Oligonucleotide Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Oligonucleotide Therapeutics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Oligonucleotide Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Oligonucleotide Therapeutics Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Oligonucleotide Therapeutics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Oligonucleotide Therapeutics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Oligonucleotide Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Oligonucleotide Therapeutics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 39: Asia Pacific Oligonucleotide Therapeutics Industry Revenue (billion), by Application 2025 & 2033

- Figure 40: Asia Pacific Oligonucleotide Therapeutics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Oligonucleotide Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Oligonucleotide Therapeutics Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Oligonucleotide Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 44: Asia Pacific Oligonucleotide Therapeutics Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 45: Asia Pacific Oligonucleotide Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 46: Asia Pacific Oligonucleotide Therapeutics Industry Volume Share (%), by End-user 2025 & 2033

- Figure 47: Asia Pacific Oligonucleotide Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Oligonucleotide Therapeutics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Oligonucleotide Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Oligonucleotide Therapeutics Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Oligonucleotide Therapeutics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Oligonucleotide Therapeutics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Oligonucleotide Therapeutics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Oligonucleotide Therapeutics Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 60: Middle East and Africa Oligonucleotide Therapeutics Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 61: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 62: Middle East and Africa Oligonucleotide Therapeutics Industry Volume Share (%), by End-user 2025 & 2033

- Figure 63: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East and Africa Oligonucleotide Therapeutics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Oligonucleotide Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Oligonucleotide Therapeutics Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Oligonucleotide Therapeutics Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 68: South America Oligonucleotide Therapeutics Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 69: South America Oligonucleotide Therapeutics Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 70: South America Oligonucleotide Therapeutics Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 71: South America Oligonucleotide Therapeutics Industry Revenue (billion), by Application 2025 & 2033

- Figure 72: South America Oligonucleotide Therapeutics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: South America Oligonucleotide Therapeutics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Oligonucleotide Therapeutics Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Oligonucleotide Therapeutics Industry Revenue (billion), by End-user 2025 & 2033

- Figure 76: South America Oligonucleotide Therapeutics Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 77: South America Oligonucleotide Therapeutics Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 78: South America Oligonucleotide Therapeutics Industry Volume Share (%), by End-user 2025 & 2033

- Figure 79: South America Oligonucleotide Therapeutics Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: South America Oligonucleotide Therapeutics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Oligonucleotide Therapeutics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Oligonucleotide Therapeutics Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 6: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 7: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 14: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 15: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 24: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 25: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 28: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 29: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: France Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Spain Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 45: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 46: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 48: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 49: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Australia Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 64: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 65: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 66: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 67: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 68: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 69: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: GCC Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 78: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 79: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 80: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 81: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by End-user 2020 & 2033

- Table 82: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 83: Global Oligonucleotide Therapeutics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 84: Global Oligonucleotide Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Brazil Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: Argentina Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Oligonucleotide Therapeutics Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Oligonucleotide Therapeutics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oligonucleotide Therapeutics Industry?

The projected CAGR is approximately 19.7%.

2. Which companies are prominent players in the Oligonucleotide Therapeutics Industry?

Key companies in the market include Merck KGaA, Maravai Life Sciences, Eurofins Scientific, Biogen, LGC Limited (LGC Biosearch Technologies), Danaher Corporation, GenScript, Sarepta Therapeutics Inc , Thermo Fisher Scientific, Bio-Synthesis Inc, Agilent Technologies, Kaneka Corporation (Eurogentec).

3. What are the main segments of the Oligonucleotide Therapeutics Industry?

The market segments include Product Type, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.19 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Investments and R&D Expenditure in Pharmaceutical and Biotechnology Companies; The Use of Synthesized Oligonucleotides in Molecular Diagnostics and Clinical Applications.

6. What are the notable trends driving market growth?

Therapeutic Segment Expected to Register a High CAGR.

7. Are there any restraints impacting market growth?

High Treatment Cost of Oligonucleotides; Lack of Skilled Professionals and Research Support in Undeveloped Countries.

8. Can you provide examples of recent developments in the market?

July 2022: WuXi STA, a subsidiary of WuXi AppTec, launched a new large-scale oligonucleotide and peptide manufacturing facility at its Changzhou campus. This new launch enhances its capacity and capability to meet the fast-growing customer needs for oligonucleotide and peptide therapeutics development and manufacturing worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oligonucleotide Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oligonucleotide Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oligonucleotide Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Oligonucleotide Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence