Key Insights

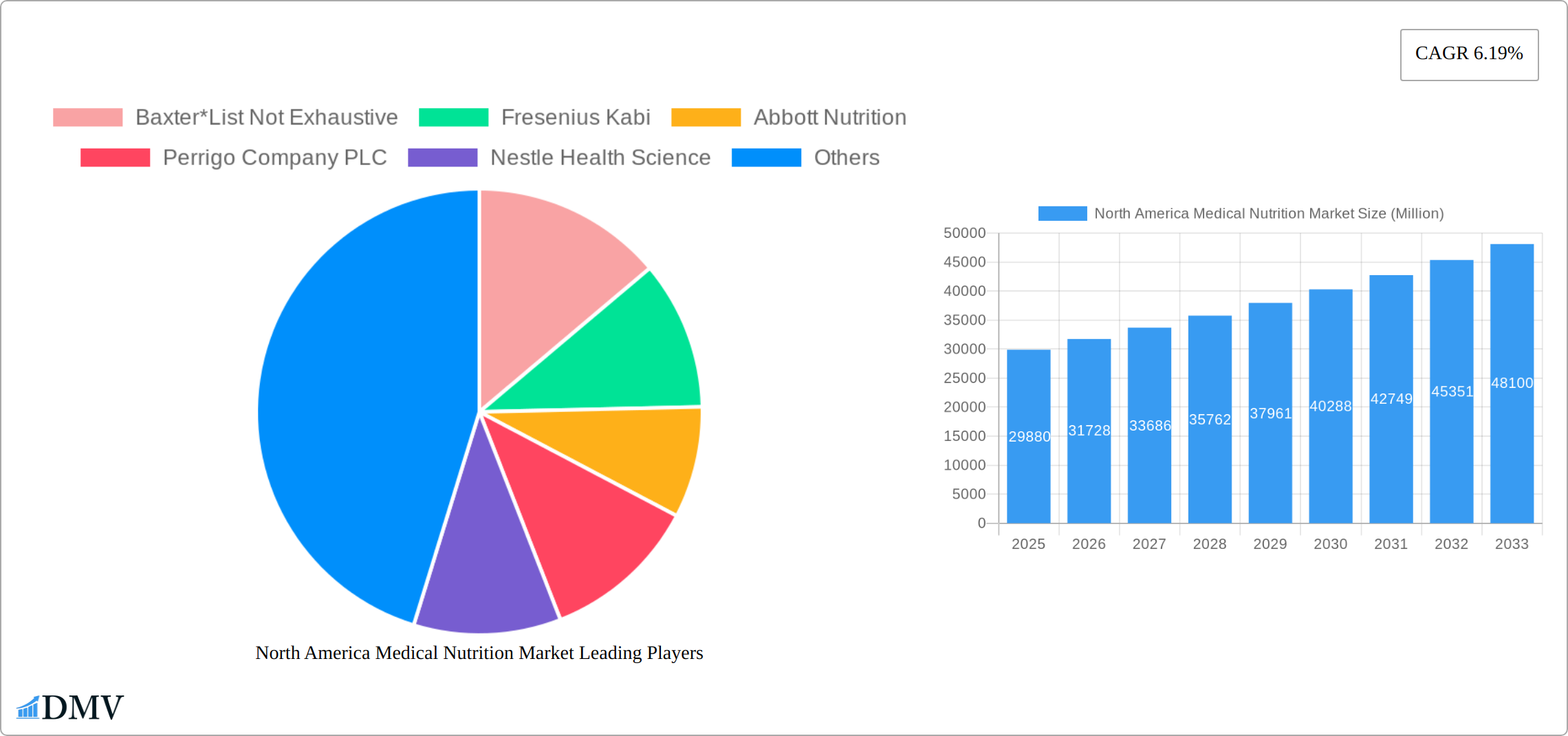

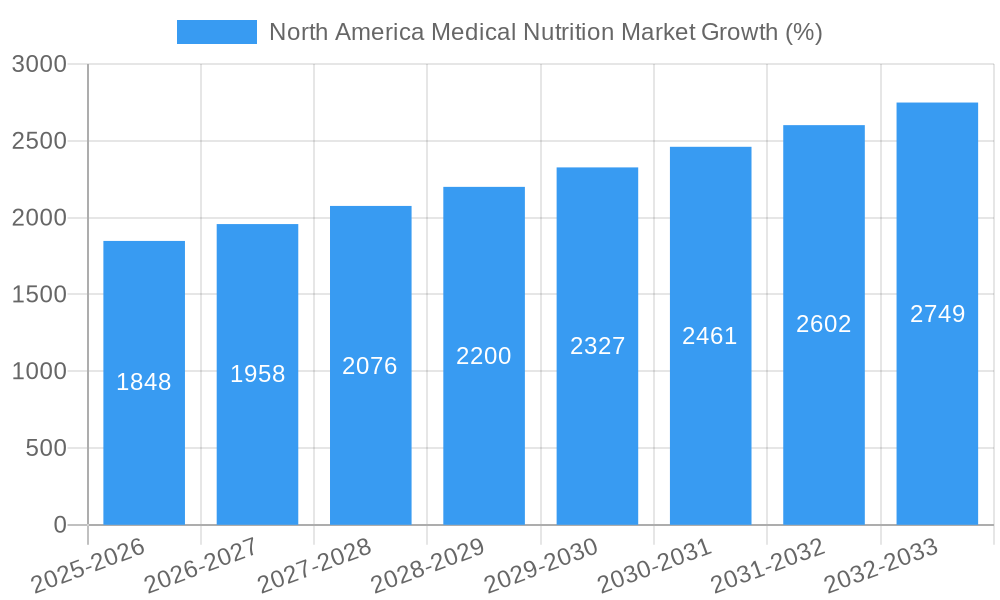

The North America medical nutrition market, valued at approximately $29.88 billion in 2025, is projected to experience robust growth, driven by a confluence of factors. An aging population, increasing prevalence of chronic diseases like diabetes, obesity, and cancer, and rising healthcare expenditure are key drivers. The growing awareness of the importance of nutritional support in managing these conditions, coupled with advancements in medical nutrition formulations (e.g., specialized enteral and parenteral nutrition solutions), fuels market expansion. Furthermore, the increasing demand for convenient and efficient home healthcare solutions contributes to market growth. The market is segmented by route of administration (oral/enteral, parenteral), application (malnutrition, metabolic disorders, gastrointestinal diseases, neurological diseases, cancer, other indications), and end-user (pediatric, adult). The oral/enteral route holds a significant market share due to its ease of administration and cost-effectiveness, while parenteral nutrition is experiencing growth due to its suitability for patients with severe digestive issues. Competition in the market is intense, with major players like Baxter, Fresenius Kabi, Abbott Nutrition, and Nestle Health Science vying for market share through product innovation, strategic partnerships, and acquisitions. The focus is shifting towards personalized nutrition solutions tailored to individual patient needs and clinical conditions, enhancing market prospects.

The significant market growth is expected to continue throughout the forecast period (2025-2033), with a compound annual growth rate (CAGR) of 6.19%. While regulatory hurdles and pricing pressures might pose some challenges, the overall market outlook remains positive, particularly in the United States, which constitutes the largest segment within North America. The increasing emphasis on preventative healthcare and the rising adoption of telemedicine are expected to further drive market growth. Future developments in the medical nutrition sector will likely include the introduction of more innovative products with enhanced efficacy and safety profiles, further catering to the evolving needs of patients and healthcare professionals. The market will likely witness a consolidation trend as larger players acquire smaller companies to gain access to new technologies and expand their product portfolios.

North America Medical Nutrition Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America medical nutrition market, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future trends and market size, projected to reach xx Million by 2033.

North America Medical Nutrition Market Composition & Trends

This section delves into the intricate structure of the North American medical nutrition market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze market share distribution among key players like Baxter, Fresenius Kabi, Abbott Nutrition, and others, revealing the competitive landscape. The report also assesses the impact of regulatory changes on market growth and explores the influence of substitute products. Finally, we examine recent M&A activity, providing insights into deal values and their implications for market consolidation.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% market share in 2024.

- Innovation Catalysts: Advancements in nutritional science, personalized nutrition solutions, and technological improvements in product delivery systems are key innovation drivers.

- Regulatory Landscape: FDA regulations and guidelines significantly impact market access and product development.

- Substitute Products: The market faces competition from alternative nutritional approaches and home-prepared diets.

- End-User Profiles: The report details end-user preferences and needs across pediatric and adult segments.

- M&A Activities: Analysis of recent M&A deals reveals a growing trend towards consolidation, with deal values totaling xx Million in the last five years.

North America Medical Nutrition Market Industry Evolution

The North American medical nutrition market is experiencing robust growth, projected to reach [Insert Projected Market Value] by 2033, exhibiting a compound annual growth rate (CAGR) of [Insert CAGR]% from 2019 to 2033. This expansion is fueled by a confluence of factors, including the increasing prevalence of chronic diseases, a rapidly aging population, and rising healthcare expenditures. Technological advancements, such as personalized nutrition formulations, advanced delivery systems (including ready-to-use formats and improved packaging), and innovative product designs focused on improved taste and texture to enhance patient compliance, are significantly shaping market dynamics. Consumer preferences are also evolving, with a growing demand for convenient, easily digestible, and tailored nutritional solutions that address specific dietary needs and health conditions. This analysis delves into these trends, providing a detailed examination of market segmentation, key players, and future growth prospects.

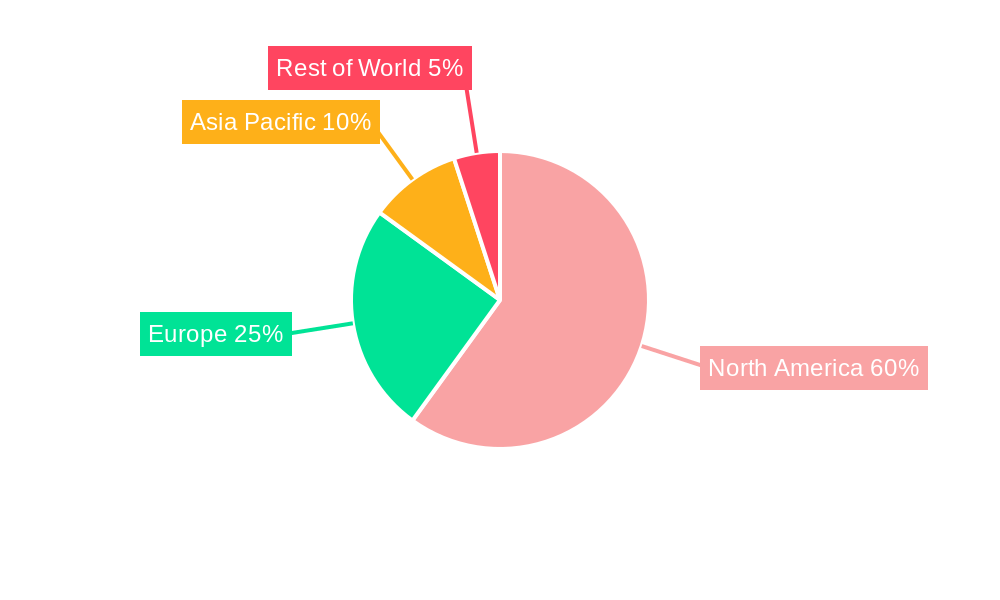

Leading Regions, Countries, or Segments in North America Medical Nutrition Market

The North American medical nutrition market is geographically diverse, with significant variations in growth rates and market share across different regions and countries. This section analyzes the key drivers behind the dominance of specific segments, considering factors such as investment trends, regulatory landscapes, and healthcare infrastructure.

- By Route of Administration: The oral and enteral segment maintains its leading position, driven by its affordability and convenience. Parenteral nutrition, while holding a significant share, particularly within hospital settings, is experiencing slower growth compared to oral and enteral options due to associated costs and administration complexities.

- By Application: Nutritional support for malnutrition remains the largest market segment, reflecting the widespread prevalence of this condition. Substantial growth is anticipated in nutritional support for gastrointestinal and metabolic disorders, and increasingly, neurological diseases, driven by rising incidence rates and increased awareness of specialized nutritional needs.

- By End User: While the adult segment currently commands a larger market share, the pediatric segment is poised for accelerated growth, fueled by a heightened awareness of the critical role of nutrition in child development and the increasing prevalence of pediatric nutritional deficiencies.

Key Drivers:

- Increased prevalence of chronic diseases: The rising incidence of chronic conditions such as diabetes, obesity, cardiovascular diseases, and cancer is a major driver, necessitating specialized medical nutrition solutions for managing these conditions.

- Growing geriatric population: The aging population in North America necessitates increased nutritional support for age-related health issues, including malnutrition, sarcopenia, and impaired nutrient absorption.

- Government initiatives and regulatory support: Government initiatives focused on promoting healthy eating habits, supporting research and development in medical nutrition, and improving access to nutritional care are significant catalysts for market growth.

- Technological advancements: Ongoing innovation in product formulation, delivery systems, and personalized nutrition plans is driving market expansion and enhancing product appeal.

North America Medical Nutrition Market Product Innovations

The North American medical nutrition market is characterized by continuous product innovation. Manufacturers are focusing on developing specialized formulas that cater to highly specific dietary needs and health conditions. This includes advancements in taste and texture to improve patient compliance, along with improvements in delivery systems, packaging, and shelf life. Personalized nutrition plans and improved digestibility are key differentiators, boosting product appeal and enhancing market competitiveness. The emphasis on patient-centric product development underscores the evolving market landscape, prioritizing efficacy and convenience.

Propelling Factors for North America Medical Nutrition Market Growth

Several factors are driving the expansion of the North America medical nutrition market. Technological advancements lead to the development of more effective and convenient products. Economic factors, including increased healthcare spending and rising disposable incomes, are boosting demand. Favorable regulatory policies and initiatives promoting healthy eating contribute to market growth.

Obstacles in the North America Medical Nutrition Market

Despite the considerable growth potential, several challenges hinder the market's progress. Stringent regulatory requirements for product approvals can lead to prolonged development timelines and increased costs. Supply chain disruptions, exacerbated by recent global events, can impact product availability and pricing. Furthermore, intense competition among established and emerging players generates pricing pressures and necessitates continuous innovation for market differentiation.

Future Opportunities in North America Medical Nutrition Market

The North America medical nutrition market presents several promising opportunities. Expanding into niche segments, such as personalized nutrition and specialized formulas for rare diseases, offers substantial potential. Developing innovative delivery systems and exploring new technologies will improve product efficacy and convenience. Targeting underserved populations and regions can unlock significant market expansion.

Major Players in the North America Medical Nutrition Market Ecosystem

- Baxter

- Fresenius Kabi

- Abbott Nutrition

- Perrigo Company PLC

- Nestle Health Science

- BASF SE

- Danone S.A. (Nutricia)

- B Braun Melsungen AG

- Baxter Healthcare

- Reckitt Benckiser

Key Developments in North America Medical Nutrition Market Industry

- April 2022: Abbott Laboratories resumed limited distribution of metabolic nutrition formulas for infants following FDA approval after a production halt.

- January 2022: Guardion Health Sciences, Inc. launched a new branded Shopify store to enhance the direct-to-consumer sales of its Viactiv product line.

- [Add other recent key developments with dates and brief descriptions]

Strategic North America Medical Nutrition Market Forecast

The North America medical nutrition market is poised for robust growth, driven by technological innovation, increasing prevalence of chronic diseases, and supportive regulatory environments. Future opportunities lie in personalized nutrition, specialized formulas, and convenient delivery systems. The market's significant potential and expanding consumer base ensure continued expansion throughout the forecast period.

North America Medical Nutrition Market Segmentation

-

1. Route of Administration

- 1.1. Oral and Enteral

- 1.2. Parenteral

-

2. Application

- 2.1. Nutritional Support for Malnutrition

- 2.2. Nutritional Support for Metabolic Disorders

- 2.3. Nutritional Support for Gastrointestinal Diseases

- 2.4. Nutritional Support for Neurological Diseases

- 2.5. Nutritional Support in Cancer

- 2.6. Nutritional Support in Other Indications

-

3. End User

- 3.1. Pediatric

- 3.2. Adult

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Medical Nutrition Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Medical Nutrition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Metabolic Disorders; High Healthcare Spending by Government and Private Foundations; Growing Aging Population in North American Countries

- 3.3. Market Restrains

- 3.3.1. Imprecise Perception about Clinical Nutrition; Reduction in Birth Rates

- 3.4. Market Trends

- 3.4.1. Pediatric Segment Expects to Register a High CAGR in the North America Clinical Nutrition Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral and Enteral

- 5.1.2. Parenteral

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Nutritional Support for Malnutrition

- 5.2.2. Nutritional Support for Metabolic Disorders

- 5.2.3. Nutritional Support for Gastrointestinal Diseases

- 5.2.4. Nutritional Support for Neurological Diseases

- 5.2.5. Nutritional Support in Cancer

- 5.2.6. Nutritional Support in Other Indications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pediatric

- 5.3.2. Adult

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. United States North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6.1.1. Oral and Enteral

- 6.1.2. Parenteral

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Nutritional Support for Malnutrition

- 6.2.2. Nutritional Support for Metabolic Disorders

- 6.2.3. Nutritional Support for Gastrointestinal Diseases

- 6.2.4. Nutritional Support for Neurological Diseases

- 6.2.5. Nutritional Support in Cancer

- 6.2.6. Nutritional Support in Other Indications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pediatric

- 6.3.2. Adult

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7. Canada North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7.1.1. Oral and Enteral

- 7.1.2. Parenteral

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Nutritional Support for Malnutrition

- 7.2.2. Nutritional Support for Metabolic Disorders

- 7.2.3. Nutritional Support for Gastrointestinal Diseases

- 7.2.4. Nutritional Support for Neurological Diseases

- 7.2.5. Nutritional Support in Cancer

- 7.2.6. Nutritional Support in Other Indications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pediatric

- 7.3.2. Adult

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8. Mexico North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8.1.1. Oral and Enteral

- 8.1.2. Parenteral

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Nutritional Support for Malnutrition

- 8.2.2. Nutritional Support for Metabolic Disorders

- 8.2.3. Nutritional Support for Gastrointestinal Diseases

- 8.2.4. Nutritional Support for Neurological Diseases

- 8.2.5. Nutritional Support in Cancer

- 8.2.6. Nutritional Support in Other Indications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pediatric

- 8.3.2. Adult

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9. United States North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Medical Nutrition Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Baxter*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fresenius Kabi

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Abbott Nutrition

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Perrigo Company PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nestle Health Science

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 BASF SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Danone S A (Nutricia)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 B Braun Melsungen AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Baxter Healthcare

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Reckitt Benckiser

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Baxter*List Not Exhaustive

List of Figures

- Figure 1: North America Medical Nutrition Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Medical Nutrition Market Share (%) by Company 2024

List of Tables

- Table 1: North America Medical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Medical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 3: North America Medical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Medical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: North America Medical Nutrition Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Medical Nutrition Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America Medical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America Medical Nutrition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America Medical Nutrition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America Medical Nutrition Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Medical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 12: North America Medical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Medical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: North America Medical Nutrition Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: North America Medical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Medical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 17: North America Medical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: North America Medical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 19: North America Medical Nutrition Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: North America Medical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: North America Medical Nutrition Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 22: North America Medical Nutrition Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: North America Medical Nutrition Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: North America Medical Nutrition Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: North America Medical Nutrition Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Medical Nutrition Market?

The projected CAGR is approximately 6.19%.

2. Which companies are prominent players in the North America Medical Nutrition Market?

Key companies in the market include Baxter*List Not Exhaustive, Fresenius Kabi, Abbott Nutrition, Perrigo Company PLC, Nestle Health Science, BASF SE, Danone S A (Nutricia), B Braun Melsungen AG, Baxter Healthcare, Reckitt Benckiser.

3. What are the main segments of the North America Medical Nutrition Market?

The market segments include Route of Administration, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Metabolic Disorders; High Healthcare Spending by Government and Private Foundations; Growing Aging Population in North American Countries.

6. What are the notable trends driving market growth?

Pediatric Segment Expects to Register a High CAGR in the North America Clinical Nutrition Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Imprecise Perception about Clinical Nutrition; Reduction in Birth Rates.

8. Can you provide examples of recent developments in the market?

In April 2022, Abbott released limited quantities of metabolic nutrition formulas for infants in the market after the approval of the United States Food and Drug Administration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Medical Nutrition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Medical Nutrition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Medical Nutrition Market?

To stay informed about further developments, trends, and reports in the North America Medical Nutrition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence