Key Insights

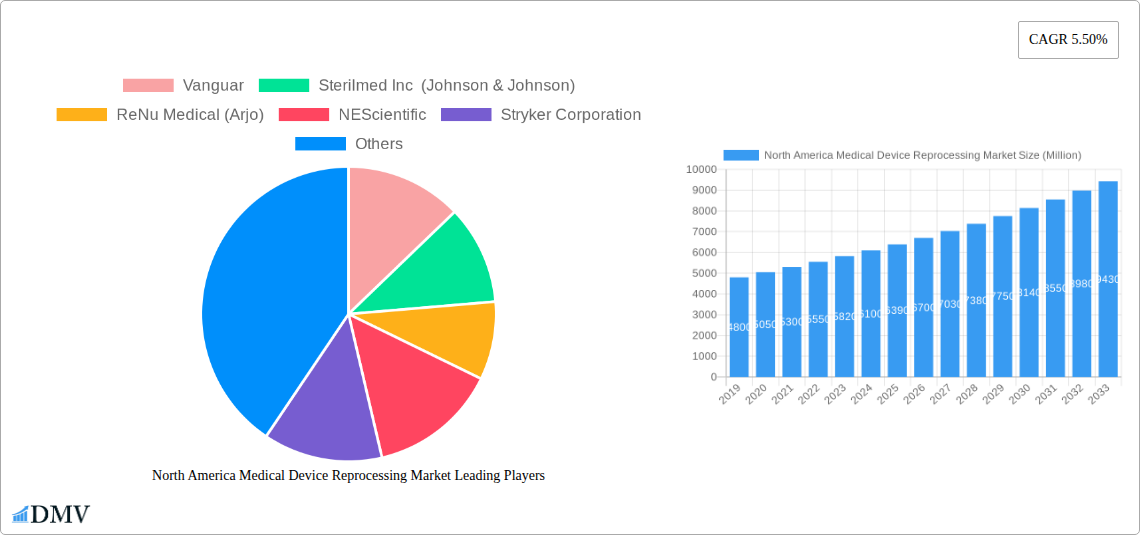

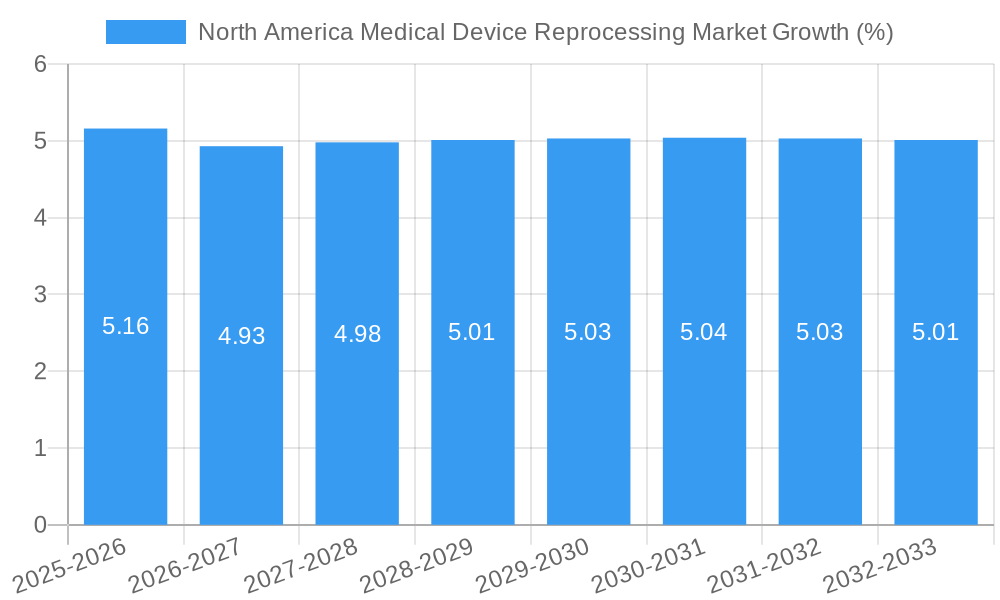

The North America medical device reprocessing market is poised for significant growth, estimated to reach approximately $6,500 million by 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 5.50% through 2033. This robust expansion is primarily fueled by increasing healthcare expenditures, a growing emphasis on cost containment within healthcare systems, and a rising awareness of the environmental benefits associated with device reprocessing. Hospitals and healthcare facilities are actively seeking ways to reduce their operational costs without compromising patient safety or quality of care, making reprocessing a highly attractive solution. The demand for reprocessed medical devices is further augmented by stringent regulatory frameworks that ensure the safety and efficacy of these products, fostering greater trust among healthcare providers and patients. The market also benefits from technological advancements in reprocessing techniques and an expanding portfolio of devices that can be safely and effectively reprocessed.

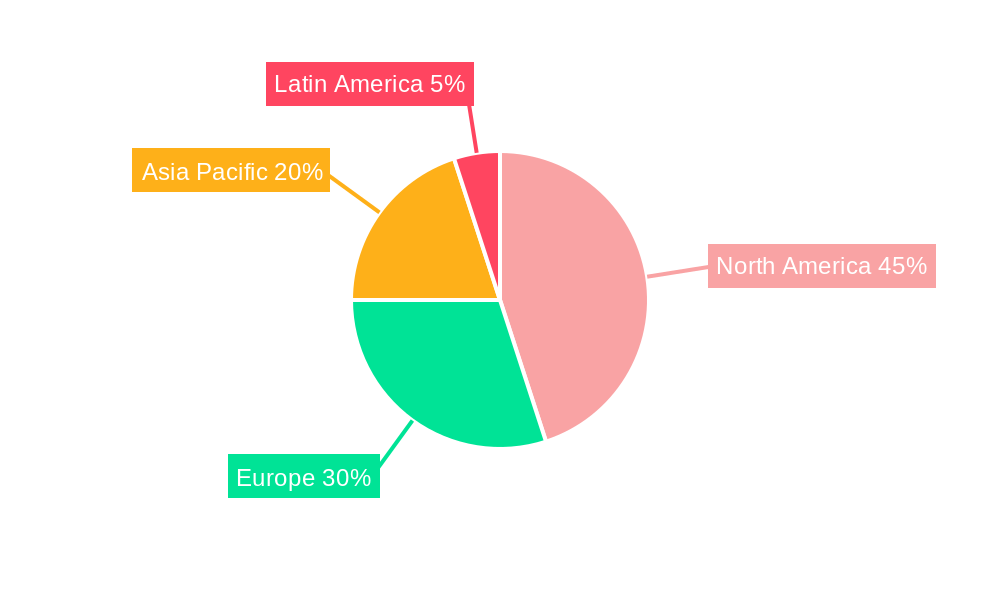

The market segmentation reveals a strong performance in Class II Devices, driven by high-volume items like pulse oximeter sensors and sequential compression sleeves, which are integral to patient monitoring and post-operative care. Catheters and guidewires also contribute significantly to this segment's growth. While Class I devices, including laparoscopic graspers and scalpels, hold a steady position, the innovation and adoption of new reprocessing technologies are more pronounced in the Class II category. Geographically, North America, encompassing the United States, Canada, and Mexico, is a dominant region, characterized by advanced healthcare infrastructure, high adoption rates of medical technologies, and established reprocessing programs. Key players such as Stryker Corporation, Sterilmed Inc. (Johnson & Johnson), and Medline Industries Inc. are actively investing in research and development, expanding their reprocessing capacities, and forging strategic partnerships to capture a larger market share. The competitive landscape is marked by a focus on regulatory compliance, quality assurance, and the development of sustainable reprocessing solutions.

This in-depth report provides a holistic view of the North America Medical Device Reprocessing Market, a critical sector driven by cost containment and sustainability initiatives. Spanning from 2019 to 2033, with a base year of 2025 and a forecast period from 2025–2033, this analysis delves into market dynamics, segmentation, regional leadership, product innovations, growth drivers, challenges, and future opportunities. It is an essential resource for stakeholders seeking to understand the evolving landscape of medical device reprocessing in the United States, Canada, and Mexico.

North America Medical Device Reprocessing Market Market Composition & Trends

The North America Medical Device Reprocessing Market exhibits a dynamic composition characterized by a concentrated yet evolving competitive landscape. Key players are actively engaged in strategic initiatives to capture market share and drive innovation. The market is influenced by stringent regulatory frameworks, emphasizing patient safety and device efficacy, which act as both a catalyst for quality improvement and a barrier to entry. Innovation is primarily driven by advancements in reprocessing technologies that enhance sterilization effectiveness and reduce cross-contamination risks, alongside the development of novel reprocessing services. Substitute products, while limited in scope for critical devices, include single-use devices, though the cost-effectiveness and environmental benefits of reprocessing are increasingly favored. End-user profiles are diverse, encompassing hospitals, ambulatory surgical centers, and clinics, all seeking to optimize operational expenses without compromising patient care. Mergers and acquisitions (M&A) are a significant trend, with a notable increase in deal values as larger entities consolidate their market presence and acquire specialized reprocessing capabilities. For instance, strategic acquisitions in the historical period (2019-2024) have seen deal values reaching several hundred million dollars as companies like Stryker Corporation and Medline Industries Inc. expand their reprocessing portfolios. Market share distribution is gradually shifting, with established reprocessing providers like Sterilmed Inc. (Johnson & Johnson) and ReNu Medical (Arjo) maintaining significant influence while new entrants focus on niche markets or advanced technological solutions.

North America Medical Device Reprocessing Market Industry Evolution

The North America Medical Device Reprocessing Market has undergone a remarkable evolution, driven by a confluence of economic pressures, technological breakthroughs, and a growing societal emphasis on sustainability. Historically, the market's trajectory has been shaped by a gradual but persistent shift away from the sole reliance on disposable medical devices, particularly in the wake of rising healthcare costs. Between 2019 and 2024, the market witnessed a steady growth rate averaging between 6% and 8% annually, fueled by the inherent cost savings that reprocessing offers over purchasing new devices. This economic imperative has been a cornerstone of industry evolution, compelling healthcare providers to explore every avenue for operational efficiency. Concurrently, technological advancements have played a pivotal role, transforming reprocessing from a rudimentary cleaning process into a sophisticated, multi-stage procedure. The adoption of advanced sterilization techniques, such as low-temperature sterilization methods and validated enzymatic cleaning processes, has significantly enhanced the safety and reliability of reprocessed devices, thereby increasing clinician confidence and patient acceptance. The market has seen a growing integration of robotics and automation in reprocessing workflows, leading to improved consistency, reduced human error, and increased throughput, with adoption metrics for automated systems exceeding 40% in major hospital networks by 2024. Shifting consumer demands, influenced by increasing environmental awareness and corporate social responsibility initiatives, have also propelled the reprocessing sector. Patients and advocacy groups are becoming more vocal about waste reduction and the environmental impact of single-use medical products, creating a favorable demand environment for reprocessing services. This evolving demand has encouraged significant investment in research and development, leading to the expansion of reprocessing capabilities for a wider array of complex medical devices, including those used in minimally invasive surgery and cardiology. The market's growth trajectory is further bolstered by the development of specialized reprocessing centers and third-party service providers that offer economies of scale and expertise, thus democratizing access to cost-effective reprocessing solutions across different healthcare settings.

Leading Regions, Countries, or Segments in North America Medical Device Reprocessing Market

The North America Medical Device Reprocessing Market is overwhelmingly dominated by the United States, which accounts for the largest share due to its expansive healthcare infrastructure, high volume of medical procedures, and a well-established network of reprocessing facilities. The United States segment is further segmented by Device Type, with Class II Devices demonstrating the most significant growth and market penetration. Within Class II Devices, Catheters and Guidewires are particularly prominent, driven by their extensive use in interventional cardiology, radiology, and other minimally invasive procedures, where reprocessing offers substantial cost savings. The demand for reprocessed pulse oximeter sensors and sequential compression sleeves also contributes significantly to the dominance of Class II devices, reflecting their widespread application in critical care and post-operative patient management.

United States Dominance:

- Investment Trends: Significant capital investment from both public and private sectors has poured into establishing and upgrading reprocessing facilities in the US, estimated to be in the hundreds of millions of dollars annually.

- Regulatory Support (Indirect): While regulations focus on safety, the robust framework implicitly supports reprocessing by setting clear guidelines, fostering trust and encouraging adoption. The FDA's oversight, though stringent, has paved the way for a mature reprocessing industry.

- Healthcare Spending: The sheer volume of healthcare expenditure in the US translates directly into a higher demand for medical devices, and consequently, a larger market for reprocessing services. Hospitals are actively seeking cost-saving measures, making reprocessing an attractive option.

- Technological Adoption: The US healthcare system is an early adopter of advanced reprocessing technologies, further solidifying its leadership.

Class II Devices as a Growth Engine:

- Catheters and Guidewires: Their complexity and cost make reprocessing a highly attractive proposition. The estimated market for reprocessed Class II devices, including these, is projected to exceed $5,000 million by 2033.

- Pulse Oximeter Sensors: These are widely used in various care settings, from hospitals to home healthcare, driving a consistent demand for reliable and cost-effective reprocessing.

- Sequential Compression Sleeves: Essential for preventing deep vein thrombosis, these are frequently utilized and a prime candidate for reprocessing, contributing to the segment's growth.

- Cost Savings: The economic advantage of reprocessing Class II devices, which are often moderately complex and used in high volumes, is a primary driver of their dominance. Savings can range from 40% to 60% compared to purchasing new.

While Canada and Mexico represent smaller but growing markets, their reprocessing sectors are still heavily influenced by the US market's trends and technological advancements. Canada's approach is characterized by a strong emphasis on public healthcare systems, where cost containment is a significant factor driving reprocessing adoption. Mexico, while having a rapidly developing healthcare sector, is still building its reprocessing infrastructure and regulatory frameworks, presenting emerging opportunities. However, the sheer scale of the US healthcare market, coupled with a more mature reprocessing industry and higher adoption rates for Class II devices, firmly establishes it as the leading region and segment within the North America Medical Device Reprocessing Market.

North America Medical Device Reprocessing Market Product Innovations

Product innovations in the North America Medical Device Reprocessing Market are primarily focused on enhancing the efficacy, safety, and efficiency of reprocessing procedures. Advancements in sterilization technologies, such as improved low-temperature plasma sterilization and advanced chemical sterilization agents, are enabling the reprocessing of a wider array of complex and heat-sensitive devices previously deemed non-reprocessable. Furthermore, the development of specialized cleaning agents and automated cleaning systems with enhanced contaminant detection capabilities are improving the thoroughness of the cleaning process, a critical step in ensuring sterility. The integration of digital tracking and validation systems allows for greater transparency and traceability throughout the reprocessing lifecycle, providing auditable records of each device's journey and sterilization status, thereby boosting stakeholder confidence and compliance. These innovations are not only expanding the scope of devices that can be safely reprocessed but are also significantly reducing turnaround times and operational costs for healthcare providers.

Propelling Factors for North America Medical Device Reprocessing Market Growth

Several key factors are propelling the growth of the North America Medical Device Reprocessing Market. The most significant driver is the increasing cost pressure on healthcare systems. Hospitals and healthcare facilities are continually seeking ways to reduce expenditure without compromising patient care, making reprocessing a highly attractive solution. Secondly, growing environmental consciousness and the push for sustainability are gaining momentum, encouraging the adoption of reprocessing as a means to reduce medical waste and its environmental impact. The expansion of reprocessing capabilities for a wider range of medical devices, driven by technological advancements, is also a crucial growth factor. Furthermore, favorable regulatory frameworks and guidelines that support and standardize the reprocessing of certain medical devices, coupled with increasing clinician and patient acceptance, contribute to market expansion. Finally, the ever-increasing volume of medical procedures performed annually directly correlates with a higher demand for medical devices, thereby fueling the need for reprocessing services.

Obstacles in the North America Medical Device Reprocessing Market Market

Despite its robust growth, the North America Medical Device Reprocessing Market faces several obstacles. Stringent regulatory compliance and evolving guidelines can pose challenges, requiring significant investment in validation and quality control processes to meet standards set by bodies like the FDA. Public perception and concerns regarding the safety of reprocessed devices, though diminishing, still represent a barrier to widespread adoption in some segments. Supply chain disruptions, as experienced globally in recent years, can impact the availability of necessary cleaning agents, sterilization consumables, and specialized equipment, potentially leading to delays and increased costs. Furthermore, limited reprocessing capabilities for certain highly complex or critical medical devices due to technical limitations or manufacturer restrictions remain a constraint. The initial investment required for setting up or upgrading reprocessing infrastructure can also be substantial, deterring smaller healthcare facilities.

Future Opportunities in North America Medical Device Reprocessing Market

The North America Medical Device Reprocessing Market is poised for significant future opportunities. The expansion of reprocessing services into new geographical markets, particularly in underserved regions within Canada and Mexico, presents substantial growth potential. The development of advanced reprocessing technologies for novel and complex medical devices, such as sophisticated robotics and advanced imaging equipment, will open up new avenues for the market. Growing awareness and demand for sustainable healthcare practices will continue to drive the adoption of reprocessing. Furthermore, strategic partnerships between reprocessing companies and medical device manufacturers could lead to innovative reprocessing solutions and wider acceptance. The increasing adoption of telehealth and remote patient monitoring, which often utilize reusable sensors and devices, also creates a growing segment for reprocessing.

Major Players in the North America Medical Device Reprocessing Market Ecosystem

- Vanguar

- Sterilmed Inc (Johnson & Johnson)

- ReNu Medical (Arjo)

- NEScientific

- Stryker Corporation

- Hygia

- SureTek Medical

- Medline Industries Inc

Key Developments in North America Medical Device Reprocessing Market Industry

- 2023: Sterilmed Inc. (Johnson & Johnson) announced expansion of its reprocessing capabilities for laparoscopic instruments, increasing capacity by 15%.

- 2023: ReNu Medical (Arjo) launched a new validation service for hospital reprocessing departments, enhancing regulatory compliance.

- 2022: Medline Industries Inc. invested significantly in upgrading its reprocessing facility in Illinois, focusing on advanced sterilization technologies.

- 2022: Stryker Corporation acquired a specialized reprocessing technology firm, expanding its portfolio for surgical devices.

- 2021: NEScientific reported a 10% increase in the reprocessing of single-use pulse oximeter sensors, highlighting growing demand.

- 2020: The FDA released updated guidance documents for medical device reprocessing, further clarifying safety and efficacy standards.

- 2019: Hygia reported sustained growth in its reprocessing services for cardiovascular devices, driven by cost-saving mandates.

Strategic North America Medical Device Reprocessing Market Market Forecast

The North America Medical Device Reprocessing Market is projected for sustained and robust growth, driven by an unwavering focus on cost containment within the healthcare sector. The increasing adoption of advanced reprocessing technologies, coupled with a growing commitment to environmental sustainability, will continue to fuel market expansion. Opportunities lie in the reprocessing of an ever-wider array of medical devices, particularly Class II devices like catheters and guidewires, as innovations enhance safety and efficiency. Strategic collaborations and a deeper integration of reprocessing into standard healthcare operational models are anticipated to solidify the market's trajectory, presenting substantial potential for stakeholders navigating this evolving landscape. The market is expected to reach an estimated value of over $15,000 million by 2033.

North America Medical Device Reprocessing Market Segmentation

-

1. Device Type

-

1.1. Class I Devices

- 1.1.1. Laparoscopic Graspers

- 1.1.2. Scalpels

- 1.1.3. Tourniquet Cuffs

- 1.1.4. Other Class I Devices

-

1.2. Class II Devices

- 1.2.1. Pulse Oximeter Sensors

- 1.2.2. Sequential Compression Sleeves

- 1.2.3. Catheters and Guidewires

- 1.2.4. Other Class II Devices

-

1.1. Class I Devices

-

2. Geography

-

2.1. North America

- 2.1.1. United States

- 2.1.2. Canada

- 2.1.3. Mexico

-

2.1. North America

North America Medical Device Reprocessing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Medical Device Reprocessing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Savings Through Reprocessing Single-use Devices; Regulatory Pressure to Reduce Volume of Medical Waste

- 3.3. Market Restrains

- 3.3.1. ; Potential of Material Alteration and Cross Infection with Reprocessed Device; Preconceived Notions Regarding the Quality of Reprocessed Single-use Medical Devices (SUDs)

- 3.4. Market Trends

- 3.4.1. Sequential Compression Sleeves by Class II Device Segment is Poised to Register Robust Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Class I Devices

- 5.1.1.1. Laparoscopic Graspers

- 5.1.1.2. Scalpels

- 5.1.1.3. Tourniquet Cuffs

- 5.1.1.4. Other Class I Devices

- 5.1.2. Class II Devices

- 5.1.2.1. Pulse Oximeter Sensors

- 5.1.2.2. Sequential Compression Sleeves

- 5.1.2.3. Catheters and Guidewires

- 5.1.2.4. Other Class II Devices

- 5.1.1. Class I Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. North America

- 5.2.1.1. United States

- 5.2.1.2. Canada

- 5.2.1.3. Mexico

- 5.2.1. North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. United States North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Medical Device Reprocessing Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Vanguar

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sterilmed Inc (Johnson & Johnson)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 ReNu Medical (Arjo)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 NEScientific

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Stryker Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hygia

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SureTek Medical

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Medline Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Vanguar

List of Figures

- Figure 1: North America Medical Device Reprocessing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Medical Device Reprocessing Market Share (%) by Company 2024

List of Tables

- Table 1: North America Medical Device Reprocessing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Medical Device Reprocessing Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 3: North America Medical Device Reprocessing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: North America Medical Device Reprocessing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Medical Device Reprocessing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Medical Device Reprocessing Market Revenue Million Forecast, by Device Type 2019 & 2032

- Table 11: North America Medical Device Reprocessing Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: North America Medical Device Reprocessing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Medical Device Reprocessing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Medical Device Reprocessing Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the North America Medical Device Reprocessing Market?

Key companies in the market include Vanguar, Sterilmed Inc (Johnson & Johnson), ReNu Medical (Arjo), NEScientific, Stryker Corporation, Hygia, SureTek Medical, Medline Industries Inc.

3. What are the main segments of the North America Medical Device Reprocessing Market?

The market segments include Device Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Savings Through Reprocessing Single-use Devices; Regulatory Pressure to Reduce Volume of Medical Waste.

6. What are the notable trends driving market growth?

Sequential Compression Sleeves by Class II Device Segment is Poised to Register Robust Growth.

7. Are there any restraints impacting market growth?

; Potential of Material Alteration and Cross Infection with Reprocessed Device; Preconceived Notions Regarding the Quality of Reprocessed Single-use Medical Devices (SUDs).

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Medical Device Reprocessing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Medical Device Reprocessing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Medical Device Reprocessing Market?

To stay informed about further developments, trends, and reports in the North America Medical Device Reprocessing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence