Key Insights

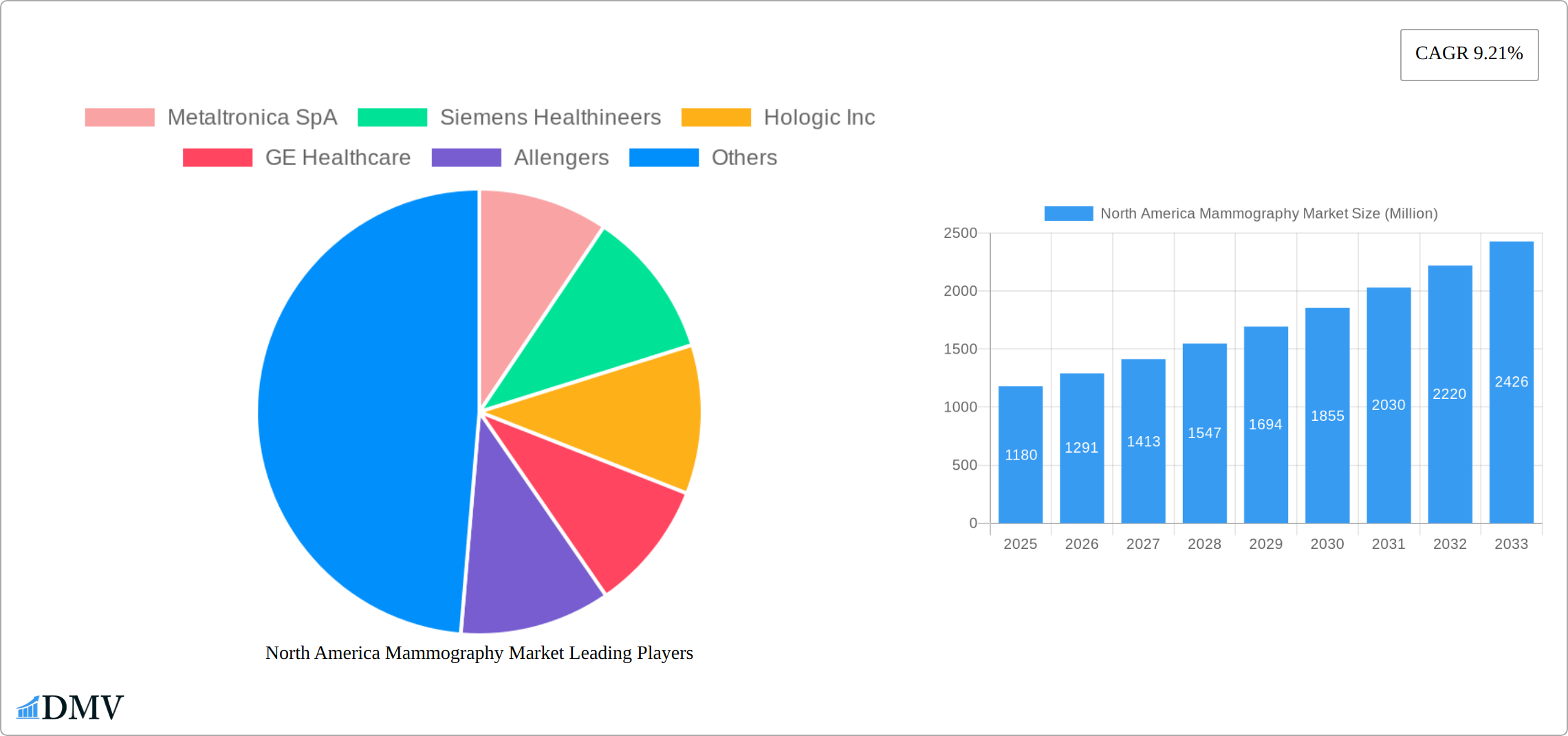

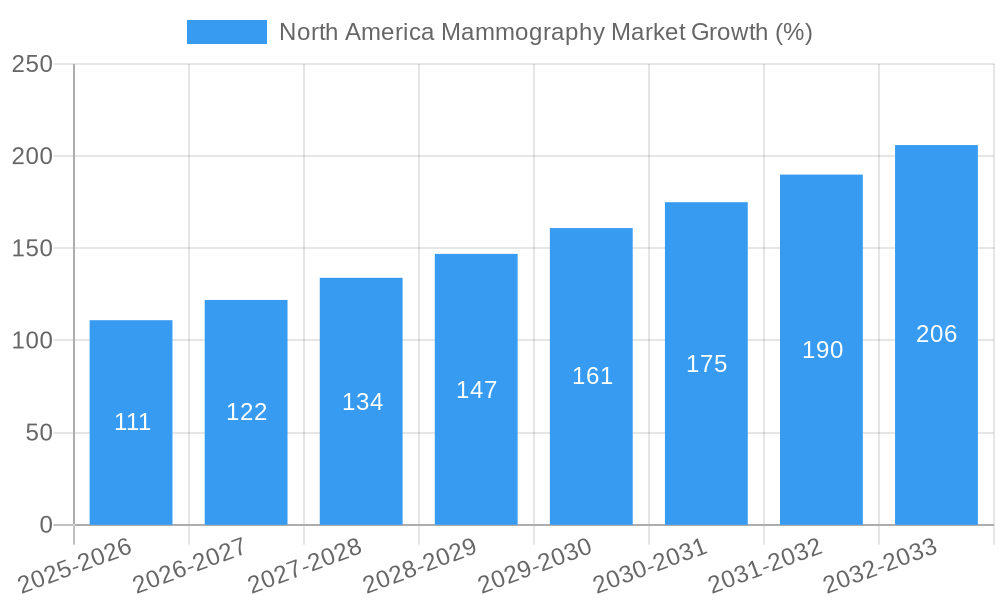

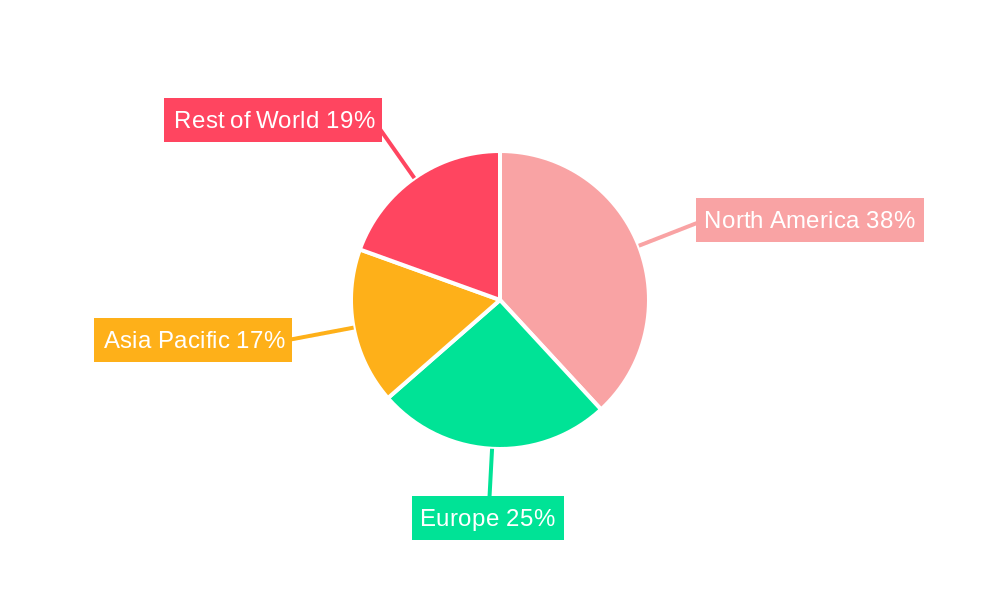

The North American mammography market, valued at approximately $1.18 billion in 2025, is projected to experience robust growth, driven by a rising prevalence of breast cancer, increasing awareness of early detection, and technological advancements in mammography systems. The market's Compound Annual Growth Rate (CAGR) of 9.21% from 2019 to 2025 indicates a strong upward trajectory, expected to continue through 2033. Key growth drivers include the increasing adoption of digital mammography systems, which offer superior image quality and efficient workflow compared to analog systems. The rising demand for advanced techniques like breast tomosynthesis, providing superior lesion detection, is also significantly fueling market expansion. Furthermore, the increasing number of hospitals, specialty clinics, and diagnostic centers, coupled with rising healthcare expenditure, contributes to the market's positive outlook. Growth may be slightly tempered by factors such as the high cost of advanced mammography equipment and the need for skilled radiologists to interpret the images.

Within the segmented market, digital mammography systems currently dominate, followed by analog systems, with breast tomosynthesis gaining significant traction due to improved diagnostic accuracy. Hospitals constitute the largest end-user segment, reflecting the central role these facilities play in breast cancer screening and diagnosis. Major market players such as Siemens Healthineers, Hologic Inc., and GE Healthcare are driving innovation and competition, leading to continuous improvements in mammography technology and accessibility. The North American market is expected to remain a dominant force globally due to its advanced healthcare infrastructure, high healthcare expenditure, and proactive approach to breast cancer screening and prevention. The forecast period of 2025-2033 anticipates continued market expansion driven by technological innovations, and a growing emphasis on preventive healthcare.

North America Mammography Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North America mammography market, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this study unravels market dynamics, technological advancements, and future growth potential. The market is projected to reach xx Million by 2033, showcasing significant growth opportunities.

North America Mammography Market Composition & Trends

This section delves into the competitive landscape of the North America mammography market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a moderately concentrated structure, with key players holding significant market share.

- Market Share Distribution (2025): Hologic Inc. holds an estimated xx% market share, followed by Siemens Healthineers at xx%, GE Healthcare at xx%, and others. The remaining market share is distributed among numerous smaller players.

- Innovation Catalysts: Ongoing technological advancements, particularly in digital mammography, breast tomosynthesis, and AI-powered image analysis, are driving market growth.

- Regulatory Landscape: Stringent regulatory approvals and reimbursement policies influence market access and adoption rates. The FDA's role in approving new technologies is a critical factor.

- Substitute Products: While no direct substitutes exist, advancements in alternative breast cancer screening methods could potentially impact market growth.

- End-User Profiles: Hospitals dominate the market, followed by specialty clinics and diagnostic centers. The increasing prevalence of breast cancer is a key driver for demand across all end-users.

- M&A Activity: Recent M&A activity, such as Intelerad's acquisition of PenRad Technologies (August 2022), highlights the strategic importance of software solutions and workflow optimization in the sector. The total value of M&A deals in the market between 2019 and 2024 is estimated at xx Million.

North America Mammography Market Industry Evolution

This section provides a comprehensive analysis of the North America mammography market's growth trajectory, technological advancements, and evolving consumer demands from 2019 to 2033. The market witnessed robust growth during the historical period (2019-2024), primarily driven by an aging population, increased breast cancer awareness, and technological innovations. The CAGR during this period was approximately xx%.

The forecast period (2025-2033) is expected to show a continued, albeit slightly moderated, growth rate, projected at approximately xx% CAGR. This moderation is partly due to the already high penetration of digital mammography systems in developed regions. However, the adoption of advanced technologies such as breast tomosynthesis and AI-powered image analysis will continue to fuel market growth. The increasing demand for improved diagnostic accuracy and reduced healthcare costs will also drive market expansion. The shift towards value-based care models will influence the adoption of cost-effective solutions and efficient workflows.

Leading Regions, Countries, or Segments in North America Mammography Market

The North American mammography market is a significant and growing sector, with the United States firmly establishing its dominance. This leadership is propelled by a confluence of factors including a substantial and aging demographic, the persistent high incidence of breast cancer, and a robust, well-established healthcare infrastructure. Canada, while a smaller market in comparison, remains a crucial contributor and exhibits steady growth.

Key Growth Catalysts:

- Rising Breast Cancer Incidence and Awareness: The persistent and, in some demographics, increasing incidence of breast cancer, coupled with heightened public and medical awareness, directly fuels the demand for routine screening and diagnostic mammography.

- Supportive Regulatory Frameworks and Reimbursement Landscape: Favorable government policies, including comprehensive reimbursement schedules for screening and diagnostic mammograms, alongside initiatives aimed at promoting early detection and preventative care, significantly bolster market expansion.

- Pioneering Technological Advancements: The continuous adoption and integration of cutting-edge technologies such as advanced digital mammography systems and the increasingly prevalent 3D mammography (breast tomosynthesis) are pivotal drivers, enhancing diagnostic accuracy and patient outcomes.

- Expanding Healthcare Infrastructure: Continuous investment in upgrading and expanding healthcare facilities, particularly in outpatient imaging centers and diagnostic clinics, ensures greater accessibility to mammography services.

Factors Underpinning Market Leadership:

The United States' commanding position in the North American mammography market is largely attributable to its significantly higher per capita healthcare expenditure compared to Canada. This economic advantage translates into greater accessibility to state-of-the-art medical technologies, including advanced mammography systems. Furthermore, the extensive and sophisticated healthcare infrastructure, characterized by a high density of specialized imaging centers and hospitals, plays a vital role. The inherently higher prevalence of breast cancer within the US population, coupled with aggressive screening protocols, naturally elevates the demand for mammography services, solidifying the nation's market leadership.

Dominant Product Segments:

- Digital Mammography Systems: This segment continues to lead due to its superior image resolution, enhanced interpretability, efficient digital workflow integration, and compatibility with Picture Archiving and Communication Systems (PACS).

- 3D Mammography (Breast Tomosynthesis): This advanced technology is experiencing rapid market penetration. Its ability to provide clearer images by reducing tissue overlap, leading to improved detection rates for subtle cancers and a significant reduction in callback rates and false positives, makes it a highly sought-after modality.

Primary End-User Sectors:

- Hospitals: Hospitals remain the largest end-user segment, owing to their comprehensive diagnostic capabilities, extensive patient volumes, and the integration of mammography services within broader oncology and women's health departments.

- Outpatient Imaging Centers: These specialized centers are also significant contributors, offering dedicated mammography services with a focus on patient convenience and accessibility.

North America Mammography Market Product Innovations

Recent innovations focus on improving image quality, reducing radiation exposure, and enhancing workflow efficiency. This includes advancements in digital mammography systems, tomosynthesis technology, AI-powered image analysis tools, and the development of user-friendly software for image management and reporting. Unique selling propositions include faster scan times, reduced radiation dose, improved diagnostic accuracy, and streamlined workflows leading to enhanced patient care and radiologist productivity. Companies are increasingly incorporating AI capabilities for automatic lesion detection and computer-aided diagnosis.

Propelling Factors for North America Mammography Market Growth

Several factors drive growth in the North American mammography market:

- Technological advancements: Improvements in image quality, reduced radiation dose, and faster scan times drive adoption.

- Increased breast cancer awareness: Public health campaigns emphasizing early detection contribute to higher screening rates.

- Favorable reimbursement policies: Government support for mammography screening makes it more accessible.

- Aging population: The growing number of women in the higher-risk age groups increases demand.

Obstacles in the North America Mammography Market

Despite its robust growth, the North American mammography market faces several impediments:

- High Capital Investment for Advanced Equipment: The substantial initial cost associated with acquiring cutting-edge mammography systems, particularly 3D tomosynthesis units, can be a significant barrier for smaller imaging facilities and those in underserved regions.

- Complex and Varying Reimbursement Policies: Navigating the intricacies of reimbursement policies from diverse public and private payers, including potential fluctuations in coverage and payment rates, can impact the financial viability of imaging providers.

- Shortage of Specialized Radiologists and Technicians: A persistent deficit in the number of highly trained and experienced radiologists with expertise in mammography interpretation, as well as qualified mammography technicians, can create capacity constraints and affect the quality of care.

- Patient Compliance and Access Issues: Ensuring consistent screening compliance among at-risk populations, particularly in rural or socioeconomically disadvantaged areas, and addressing potential barriers to access, such as transportation or awareness, remain ongoing challenges.

Future Opportunities in North America Mammography Market

Emerging opportunities include:

- Increased adoption of AI-powered image analysis: AI is expected to improve diagnostic accuracy and efficiency.

- Expansion into underserved regions: Reaching remote areas with mobile mammography units can improve access.

- Development of personalized screening strategies: Tailoring screening protocols based on individual risk factors.

Major Players in the North America Mammography Market Ecosystem

- Metaltronica SpA

- Siemens Healthineers

- Hologic Inc

- GE Healthcare

- Allengers

- PLANMED OY

- Carestream Health

- Koninklijke Philips NV

- Fujifilm Holdings Corporation

- IMS GIOTTO S P A

Key Developments in North America Mammography Market Industry

- August 2022: Intelerad Medical Systems significantly enhanced its mammography software portfolio and market reach through the strategic acquisition of PenRad Technologies, further solidifying its position in radiology workflow solutions.

- May 2022: US Radiology Specialists demonstrated a commitment to advancing breast imaging by partnering with Volpara Health. This collaboration aims to implement state-of-the-art breast density assessment technology and sophisticated patient communication software, thereby improving diagnostic accuracy and patient engagement.

Strategic North America Mammography Market Forecast

The North America mammography market is poised for continued growth, driven by technological advancements, increasing breast cancer awareness, and favorable reimbursement policies. The adoption of AI and personalized screening strategies will further enhance market expansion. Opportunities exist in expanding access to underserved populations and developing innovative solutions to improve diagnostic accuracy and efficiency. The market is expected to experience a healthy CAGR throughout the forecast period, reaching xx Million by 2033.

North America Mammography Market Segmentation

-

1. Product Type

- 1.1. Digital Systems

- 1.2. Analog Systems

- 1.3. Breast Tomosynthesis

- 1.4. Film Screen Systems

- 1.5. Other Product Types

-

2. End Users

- 2.1. Hospitals

- 2.2. Specialty Clinics

- 2.3. Diagnostic Centers

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Mammography Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Mammography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of Breast Cancer; Technological Advancements in the Field of Breast Imaging

- 3.3. Market Restrains

- 3.3.1. Risk of Adverse Effects from Radiation Exposure

- 3.4. Market Trends

- 3.4.1. The Digital Mammography Segment is Expected to Account for the Largest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Systems

- 5.1.2. Analog Systems

- 5.1.3. Breast Tomosynthesis

- 5.1.4. Film Screen Systems

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals

- 5.2.2. Specialty Clinics

- 5.2.3. Diagnostic Centers

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Digital Systems

- 6.1.2. Analog Systems

- 6.1.3. Breast Tomosynthesis

- 6.1.4. Film Screen Systems

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End Users

- 6.2.1. Hospitals

- 6.2.2. Specialty Clinics

- 6.2.3. Diagnostic Centers

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Digital Systems

- 7.1.2. Analog Systems

- 7.1.3. Breast Tomosynthesis

- 7.1.4. Film Screen Systems

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End Users

- 7.2.1. Hospitals

- 7.2.2. Specialty Clinics

- 7.2.3. Diagnostic Centers

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Digital Systems

- 8.1.2. Analog Systems

- 8.1.3. Breast Tomosynthesis

- 8.1.4. Film Screen Systems

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End Users

- 8.2.1. Hospitals

- 8.2.2. Specialty Clinics

- 8.2.3. Diagnostic Centers

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. United States North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Mammography Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Metaltronica SpA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Siemens Healthineers

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hologic Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 GE Healthcare

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Allengers

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 PLANMED OY

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Carestream Health

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Koninklijke Philips NV

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Fujifilm Holdings Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 IMS GIOTTO S P A

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Metaltronica SpA

List of Figures

- Figure 1: North America Mammography Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mammography Market Share (%) by Company 2024

List of Tables

- Table 1: North America Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 4: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Mammography Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Mammography Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 13: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 17: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Mammography Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Mammography Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 21: North America Mammography Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Mammography Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mammography Market?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the North America Mammography Market?

Key companies in the market include Metaltronica SpA, Siemens Healthineers, Hologic Inc, GE Healthcare, Allengers, PLANMED OY, Carestream Health, Koninklijke Philips NV, Fujifilm Holdings Corporation, IMS GIOTTO S P A.

3. What are the main segments of the North America Mammography Market?

The market segments include Product Type, End Users, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of Breast Cancer; Technological Advancements in the Field of Breast Imaging.

6. What are the notable trends driving market growth?

The Digital Mammography Segment is Expected to Account for the Largest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Risk of Adverse Effects from Radiation Exposure.

8. Can you provide examples of recent developments in the market?

In August 2022, Intelerad Medical Systems, a leading global provider of enterprise medical imaging solutions, acquired PenRad Technologies, Inc., a software provider for enhancing productivity for breast imaging and lung screening. The acquisition will expand Intelerad's product offerings for mammography and lung analytics, optimizing workflows for radiologists and boosting health outcomes for patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mammography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mammography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mammography Market?

To stay informed about further developments, trends, and reports in the North America Mammography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence