Key Insights

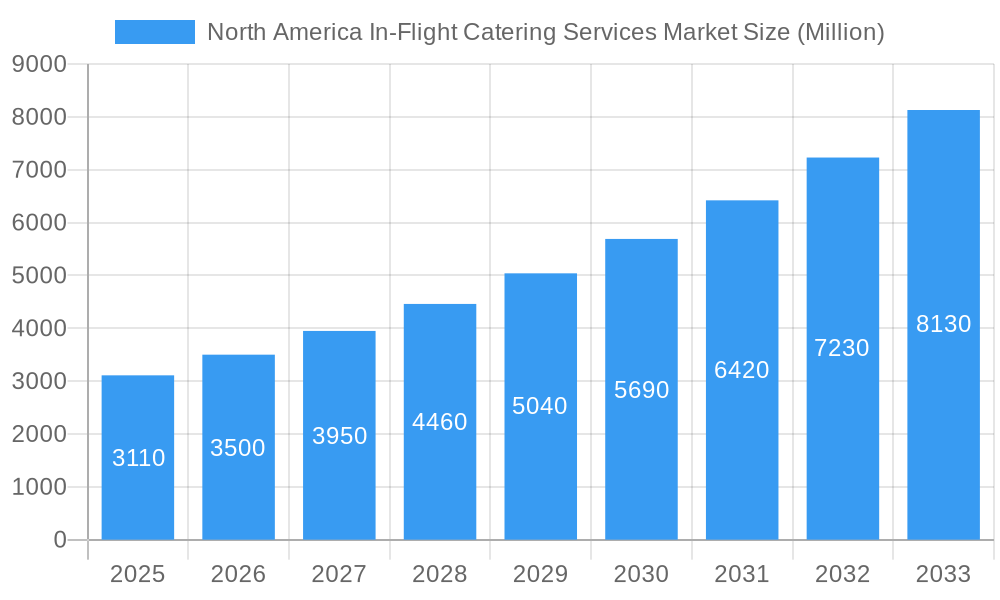

The North America in-flight catering services market, valued at $3.11 billion in 2025, is projected to experience robust growth, driven by the resurgence of air travel post-pandemic and a rising preference for premium onboard dining experiences. This expansion is further fueled by increasing airline partnerships with reputable catering companies, leading to innovative menu options and enhanced service quality. Factors such as the growing demand for healthier and customized meal choices, coupled with technological advancements in food preparation and delivery systems, are significantly contributing to market expansion. The market's segmentation likely includes various service types (e.g., economy, premium economy, business, first class), catering to diverse passenger needs and preferences. Competitive rivalry among established players like Flying Food Group, GateGroup, and Lufthansa Service Holding, alongside emerging players, fosters innovation and price competitiveness, further shaping market dynamics.

North America In-Flight Catering Services Market Market Size (In Billion)

The market's Compound Annual Growth Rate (CAGR) of 12.86% from 2025 to 2033 suggests a significant increase in market value over the forecast period. This growth trajectory is expected to be influenced by several factors. Sustained economic growth in North America, with its concomitant increase in disposable incomes and air travel frequency, will play a key role. Furthermore, the increasing adoption of airline loyalty programs and the consequent rise in premium class travel will fuel demand for higher-quality catering services. However, potential restraints include fluctuating fuel prices, stringent food safety regulations, and the potential impact of future economic downturns or unforeseen global events on air travel demand. The continuous focus on sustainability and ethical sourcing within the airline industry will likely influence the choices of catering suppliers and drive innovation in environmentally friendly practices.

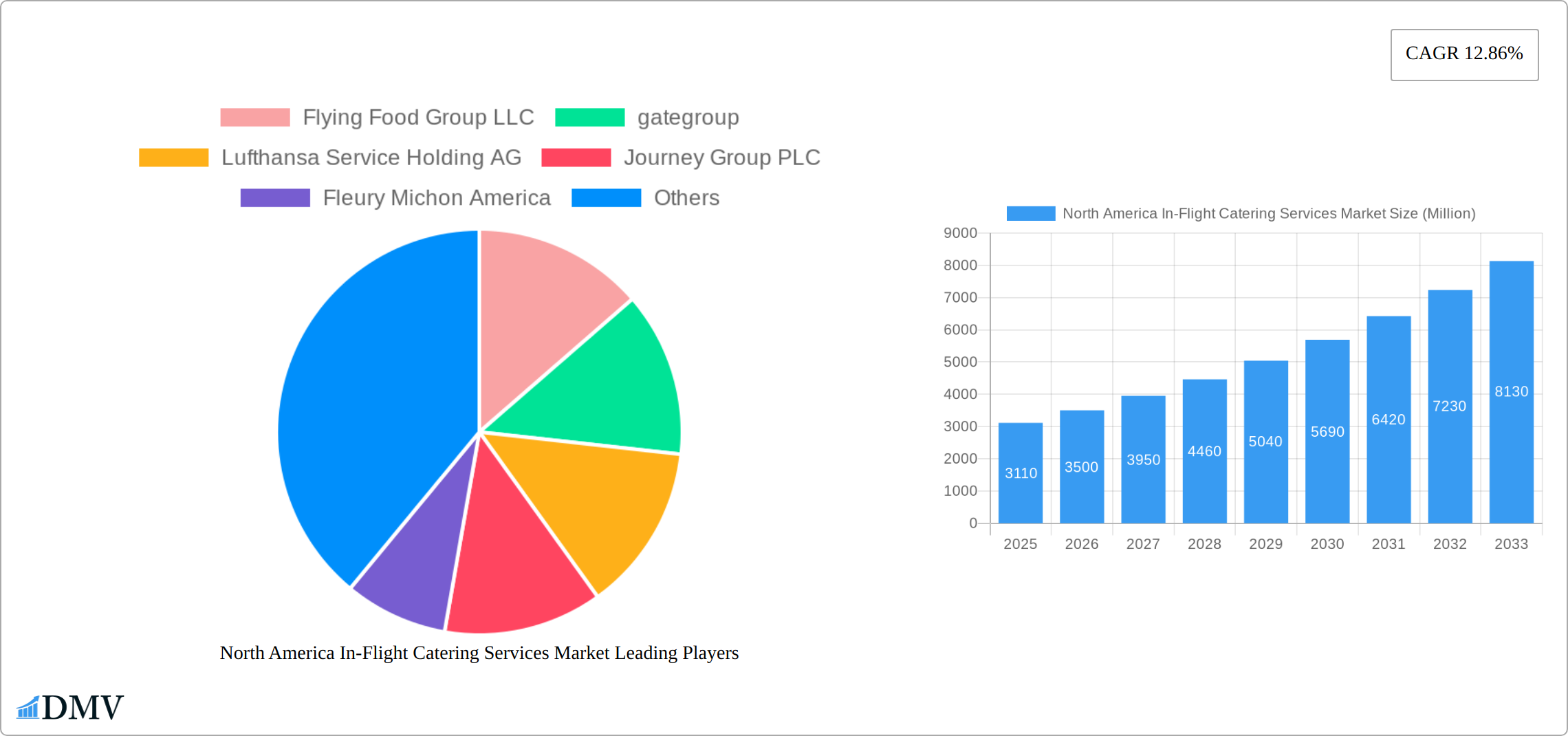

North America In-Flight Catering Services Market Company Market Share

North America In-Flight Catering Services Market Market Composition & Trends

The North America In-Flight Catering Services Market is characterized by a moderate to high level of market concentration, with a few prominent global and regional players holding a significant market share. Leading entities such as Flying Food Group LLC, gategroup, and Lufthansa Service Holding AG are at the forefront, driving innovation and setting industry standards. The market share distribution indicates that the top five companies collectively command approximately 60-65% of the market, underscoring a competitive yet consolidated landscape where strategic partnerships and operational efficiency are paramount.

- Innovation Catalysts: The relentless pursuit of innovation in this sector is primarily propelled by the imperative to meet evolving passenger expectations, stringent health and safety mandates, and the growing demand for sustainable and personalized dining experiences. Advancements in food science, including novel preservation techniques, eco-friendly packaging solutions, and allergen-aware preparation, are key areas of research and development. Companies are investing heavily in R&D to elevate meal quality, reduce food waste, and enhance the overall passenger culinary journey.

- Regulatory Landscapes: Navigating a complex web of stringent regulations concerning food safety, hygiene, and quality assurance is a critical aspect of market operations. Compliance with federal and local health authorities, such as the FDA in the United States and Health Canada, significantly influences operational protocols, supply chain management, and service delivery standards. These regulations not only ensure passenger well-being but also drive investments in advanced safety technologies and rigorous quality control measures.

- Substitute Products & Emerging Alternatives: While traditional in-flight catering remains dominant, the market is witnessing the rise of alternative and complementary offerings. Pre-packaged, ready-to-eat meals designed for grab-and-go convenience, and customizable on-demand catering services are gaining traction, particularly on short-haul and ultra-low-cost carrier routes. These alternatives cater to passengers seeking faster, more economical, or highly personalized meal solutions.

- End-User Profiles: The primary clientele for in-flight catering services are airlines, encompassing the full spectrum from major legacy carriers offering extensive services to budget-conscious low-cost carriers. There is a discernible trend towards greater demand for specialized and customized meal options, including culturally diverse cuisines, dietary-specific meals (e.g., vegan, gluten-free, kosher), and premium meal packages. This reflects a broader shift in the travel industry towards offering personalized and enriching passenger experiences.

- M&A Activities & Strategic Alliances: The North America In-Flight Catering Services Market has been a dynamic arena for mergers, acquisitions, and strategic partnerships. Significant deal values, often exceeding hundreds of millions of dollars over recent years, highlight the consolidation trend and the drive for market expansion. Notable transactions, such as gategroup's strategic acquisitions, aim to broaden service portfolios, enhance operational scale, and extend geographical footprints, thereby strengthening competitive positioning.

North America In-Flight Catering Services Market Industry Evolution

The North America In-Flight Catering Services Market has experienced robust growth, with a compound annual growth rate (CAGR) of 4.5% during the historical period from 2019 to 2024. This growth trajectory is expected to continue, with projections indicating a CAGR of 5.2% from the base year of 2025 through the forecast period ending in 2033. The market's evolution is driven by several key factors, including technological advancements, shifting consumer demands, and strategic industry developments.

Technological advancements in the sector have revolutionized in-flight catering, with innovations such as automated food preparation systems and IoT-enabled inventory management enhancing operational efficiency and reducing waste. The adoption of these technologies is estimated to increase by 30% by 2033, reflecting a significant shift towards digitalization in the industry.

Consumer demands are also evolving, with a growing preference for healthier, sustainable, and culturally diverse meal options. This shift is prompting catering services to diversify their menus and incorporate plant-based and organic offerings, which have seen a 20% increase in demand over the past three years. Additionally, the rise of premium economy and business class travel segments is driving the need for more luxurious and personalized in-flight dining experiences.

The market's growth is further supported by strategic industry developments, such as partnerships and expansions into new regions. For instance, Flying Food Group's expansion to cater to Lufthansa's flights across multiple U.S. cities has strengthened its market position and contributed to the overall growth of the industry.

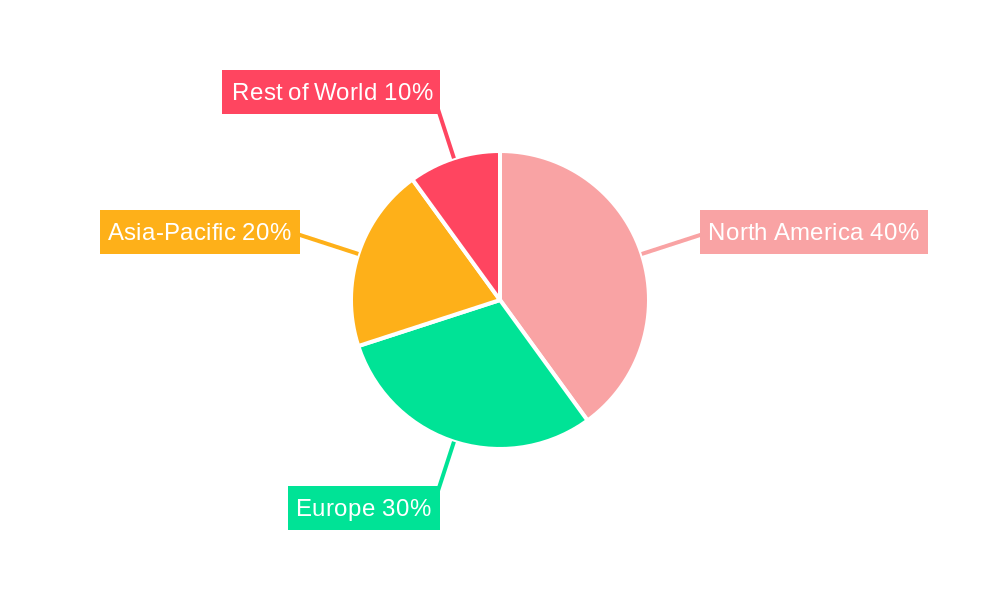

Leading Regions, Countries, or Segments in North America In-Flight Catering Services Market

The United States emerges as the dominant region in the North America In-Flight Catering Services Market, accounting for over 70% of the market share. This dominance can be attributed to several key factors:

- Investment Trends: The U.S. sees significant investments in airport infrastructure and airline services, fostering a conducive environment for the growth of in-flight catering. In 2024, investments in airport catering facilities exceeded $200 Million.

- Regulatory Support: The FAA and other regulatory bodies in the U.S. have implemented policies that encourage the development of high-quality in-flight services, including catering.

- Consumer Demand: American travelers exhibit a high demand for diverse and high-quality in-flight meal options, driving the market's growth.

In-depth analysis reveals that the U.S. market's dominance is also due to the presence of major airlines and catering companies headquartered in the country. The concentration of these entities facilitates a robust supply chain and service network, which enhances the efficiency and quality of in-flight catering services. Additionally, the U.S. market benefits from a strong economy and a high volume of both domestic and international flights, further bolstering demand for in-flight catering.

The business class segment is another leading area within the market, with a projected growth rate of 6% over the forecast period. This segment's growth is driven by an increasing number of passengers opting for premium travel experiences, where high-quality catering plays a pivotal role in their overall satisfaction.

North America In-Flight Catering Services Market Product Innovations

Product innovations in the North America In-Flight Catering Services Market are centered around enhancing meal quality, sustainability, and passenger experience. Notable innovations include the introduction of eco-friendly packaging solutions and the integration of smart technology for meal ordering and tracking. These innovations not only improve operational efficiency but also cater to the growing demand for sustainable and personalized in-flight dining experiences. The unique selling propositions of these innovations lie in their ability to reduce food waste by up to 25% and enhance passenger satisfaction through customized meal options.

Propelling Factors for North America In-Flight Catering Services Market Growth

The North America In-Flight Catering Services Market is propelled by several key factors:

- Technological Advancements: The adoption of advanced technologies like AI for meal planning and IoT for inventory management is driving efficiency and personalization in services.

- Economic Growth: Rising disposable incomes and increased air travel demand are boosting the market, with passenger numbers expected to grow by 3% annually.

- Regulatory Influence: Stricter food safety regulations are compelling companies to innovate, ensuring high-quality and safe in-flight meals.

Obstacles in the North America In-Flight Catering Services Market Market

The market faces several obstacles that could impede growth:

- Regulatory Challenges: Compliance with stringent food safety regulations increases operational costs, potentially impacting service pricing.

- Supply Chain Disruptions: Global events like pandemics can disrupt supply chains, leading to service delays and increased costs.

- Competitive Pressures: Intense competition among catering service providers can lead to price wars, affecting profitability.

Future Opportunities in North America In-Flight Catering Services Market

The North America In-Flight Catering Services Market is poised for significant growth and diversification, with numerous emerging opportunities on the horizon:

- Geographical Expansion & Untapped Markets: Significant growth potential lies in expanding service offerings into less saturated regional markets within North America, including underserved routes and emerging travel hubs in Canada and Mexico. Establishing robust local supply chains and adapting menus to regional preferences will be key to success.

- Technological Integration & Digital Transformation: The adoption of cutting-edge technologies presents transformative opportunities. Blockchain technology can revolutionize supply chain transparency and traceability, ensuring food safety and authenticity. Artificial intelligence (AI) and machine learning (ML) can enable highly personalized meal recommendations based on passenger preferences, dietary needs, and past choices, enhancing customer satisfaction and reducing waste.

- Evolving Consumer Demands & Niche Markets: The escalating global consciousness around health, wellness, and sustainability is creating lucrative niche markets. There is a rising demand for plant-based, organic, locally sourced, and ethically produced meal options. Catering to these specific dietary trends and environmental concerns can differentiate service providers and attract a growing segment of eco-conscious travelers.

- Focus on Premiumization & Experiential Dining: As the travel industry increasingly focuses on premium and experiential offerings, there's an opportunity for in-flight caterers to elevate the dining experience. This includes offering gourmet-inspired menus, collaborating with renowned chefs, and providing visually appealing and high-quality presentations that mirror fine dining establishments.

- Strategic Partnerships with Airlines & Technology Providers: Deepening collaborations with airlines to co-create innovative menu concepts and service models will be crucial. Furthermore, partnerships with food technology startups and logistics providers can streamline operations, reduce costs, and introduce novel solutions to the market.

Major Players in the North America In-Flight Catering Services Market Ecosystem

Key Developments in North America In-Flight Catering Services Market Industry

- April 2022: Flying Food Group significantly bolstered its market presence by expanding its catering services for Lufthansa, now providing double daily flights between New York JFK and Frankfurt and Munich. This strategic expansion, building upon existing contracts in Chicago, Los Angeles, Washington, and Newark, reinforces Flying Food Group's position as a key partner for major international airlines and enhances its service capabilities within crucial North American aviation hubs.

- July 2021: Newrest made a significant strategic entry into the U.S. in-flight catering market by launching operations with two of the largest American carriers, Delta Airlines and United Airlines. This development not only diversifies Newrest's global portfolio but also injects increased competition and a wider array of service options into the U.S. market, potentially influencing pricing strategies and service innovation across the industry.

- Ongoing Focus on Sustainability Initiatives: Several market players are increasingly investing in and promoting sustainable practices, including the use of biodegradable packaging, locally sourced ingredients, and waste reduction programs. These initiatives are driven by both regulatory pressures and growing consumer demand for environmentally responsible services.

- Technological Adoption for Enhanced Operations: Leading companies are investing in advanced technologies such as AI-powered inventory management, sophisticated cold chain logistics monitoring, and digital ordering platforms to improve efficiency, reduce errors, and enhance the overall passenger experience.

Strategic North America In-Flight Catering Services Market Market Forecast

The North America In-Flight Catering Services Market is projected for robust and sustained growth over the forecast period, anticipated from 2025 to 2033. Key growth catalysts include the ongoing recovery and expansion of airline networks, a resurgence in air travel demand, and the increasing passenger expectation for premium and personalized travel experiences. The market is well-positioned to capitalize on emerging opportunities presented by the growing demand for sustainable and health-conscious meal options, coupled with the integration of advanced technologies for enhanced operational efficiency and passenger personalization. Continuous innovation in menu development, a focus on food safety and quality, and strategic partnerships will be instrumental in shaping the market's trajectory towards significant growth and industry leadership.

North America In-Flight Catering Services Market Segmentation

-

1. Aircraft Seating Class

- 1.1. Economy Class

- 1.2. Business Class

- 1.3. First Class

-

2. Flight Service Type

- 2.1. Full-service Carrier

- 2.2. Low-cost Carrier

- 2.3. Hybrid and Other Flight Types

-

3. Geography

- 3.1. United States

- 3.2. Canada

North America In-Flight Catering Services Market Segmentation By Geography

- 1. United States

- 2. Canada

North America In-Flight Catering Services Market Regional Market Share

Geographic Coverage of North America In-Flight Catering Services Market

North America In-Flight Catering Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Hybrid and Other Flight Type Segment Is Expected To Witness Significant Growth During The Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America In-Flight Catering Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.1.1. Economy Class

- 5.1.2. Business Class

- 5.1.3. First Class

- 5.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 5.2.1. Full-service Carrier

- 5.2.2. Low-cost Carrier

- 5.2.3. Hybrid and Other Flight Types

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6. United States North America In-Flight Catering Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.1.1. Economy Class

- 6.1.2. Business Class

- 6.1.3. First Class

- 6.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 6.2.1. Full-service Carrier

- 6.2.2. Low-cost Carrier

- 6.2.3. Hybrid and Other Flight Types

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7. Canada North America In-Flight Catering Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.1.1. Economy Class

- 7.1.2. Business Class

- 7.1.3. First Class

- 7.2. Market Analysis, Insights and Forecast - by Flight Service Type

- 7.2.1. Full-service Carrier

- 7.2.2. Low-cost Carrier

- 7.2.3. Hybrid and Other Flight Types

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Flying Food Group LLC

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 gategroup

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Lufthansa Service Holding AG

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Journey Group PLC

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Fleury Michon America

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Cathay Pacific Catering Services (CLS Catering)

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 JetFinity

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Newrest International Group SaS

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 DNATA

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 SATS Lt

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.1 Flying Food Group LLC

List of Figures

- Figure 1: Global North America In-Flight Catering Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global North America In-Flight Catering Services Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: United States North America In-Flight Catering Services Market Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 4: United States North America In-Flight Catering Services Market Volume (Billion), by Aircraft Seating Class 2025 & 2033

- Figure 5: United States North America In-Flight Catering Services Market Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 6: United States North America In-Flight Catering Services Market Volume Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 7: United States North America In-Flight Catering Services Market Revenue (Million), by Flight Service Type 2025 & 2033

- Figure 8: United States North America In-Flight Catering Services Market Volume (Billion), by Flight Service Type 2025 & 2033

- Figure 9: United States North America In-Flight Catering Services Market Revenue Share (%), by Flight Service Type 2025 & 2033

- Figure 10: United States North America In-Flight Catering Services Market Volume Share (%), by Flight Service Type 2025 & 2033

- Figure 11: United States North America In-Flight Catering Services Market Revenue (Million), by Geography 2025 & 2033

- Figure 12: United States North America In-Flight Catering Services Market Volume (Billion), by Geography 2025 & 2033

- Figure 13: United States North America In-Flight Catering Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 14: United States North America In-Flight Catering Services Market Volume Share (%), by Geography 2025 & 2033

- Figure 15: United States North America In-Flight Catering Services Market Revenue (Million), by Country 2025 & 2033

- Figure 16: United States North America In-Flight Catering Services Market Volume (Billion), by Country 2025 & 2033

- Figure 17: United States North America In-Flight Catering Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: United States North America In-Flight Catering Services Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Canada North America In-Flight Catering Services Market Revenue (Million), by Aircraft Seating Class 2025 & 2033

- Figure 20: Canada North America In-Flight Catering Services Market Volume (Billion), by Aircraft Seating Class 2025 & 2033

- Figure 21: Canada North America In-Flight Catering Services Market Revenue Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 22: Canada North America In-Flight Catering Services Market Volume Share (%), by Aircraft Seating Class 2025 & 2033

- Figure 23: Canada North America In-Flight Catering Services Market Revenue (Million), by Flight Service Type 2025 & 2033

- Figure 24: Canada North America In-Flight Catering Services Market Volume (Billion), by Flight Service Type 2025 & 2033

- Figure 25: Canada North America In-Flight Catering Services Market Revenue Share (%), by Flight Service Type 2025 & 2033

- Figure 26: Canada North America In-Flight Catering Services Market Volume Share (%), by Flight Service Type 2025 & 2033

- Figure 27: Canada North America In-Flight Catering Services Market Revenue (Million), by Geography 2025 & 2033

- Figure 28: Canada North America In-Flight Catering Services Market Volume (Billion), by Geography 2025 & 2033

- Figure 29: Canada North America In-Flight Catering Services Market Revenue Share (%), by Geography 2025 & 2033

- Figure 30: Canada North America In-Flight Catering Services Market Volume Share (%), by Geography 2025 & 2033

- Figure 31: Canada North America In-Flight Catering Services Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Canada North America In-Flight Catering Services Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Canada North America In-Flight Catering Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Canada North America In-Flight Catering Services Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 2: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Aircraft Seating Class 2020 & 2033

- Table 3: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 4: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Flight Service Type 2020 & 2033

- Table 5: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 10: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Aircraft Seating Class 2020 & 2033

- Table 11: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 12: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Flight Service Type 2020 & 2033

- Table 13: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 18: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Aircraft Seating Class 2020 & 2033

- Table 19: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Flight Service Type 2020 & 2033

- Table 20: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Flight Service Type 2020 & 2033

- Table 21: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global North America In-Flight Catering Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global North America In-Flight Catering Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America In-Flight Catering Services Market?

The projected CAGR is approximately 12.86%.

2. Which companies are prominent players in the North America In-Flight Catering Services Market?

Key companies in the market include Flying Food Group LLC, gategroup, Lufthansa Service Holding AG, Journey Group PLC, Fleury Michon America, Cathay Pacific Catering Services (CLS Catering), JetFinity, Newrest International Group SaS, DNATA, SATS Lt.

3. What are the main segments of the North America In-Flight Catering Services Market?

The market segments include Aircraft Seating Class, Flight Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.11 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Hybrid and Other Flight Type Segment Is Expected To Witness Significant Growth During The Forecast Period..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In April 2022, Flying Food Group announced that they are catering double daily Lufthansa flights between New York JFK and Frankfurt and Munich. Moreover, the Flying Food Group also caters to Lufthansa airlines in Chicago, Los Angeles, Washington, and Newark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America In-Flight Catering Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America In-Flight Catering Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America In-Flight Catering Services Market?

To stay informed about further developments, trends, and reports in the North America In-Flight Catering Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence