Key Insights

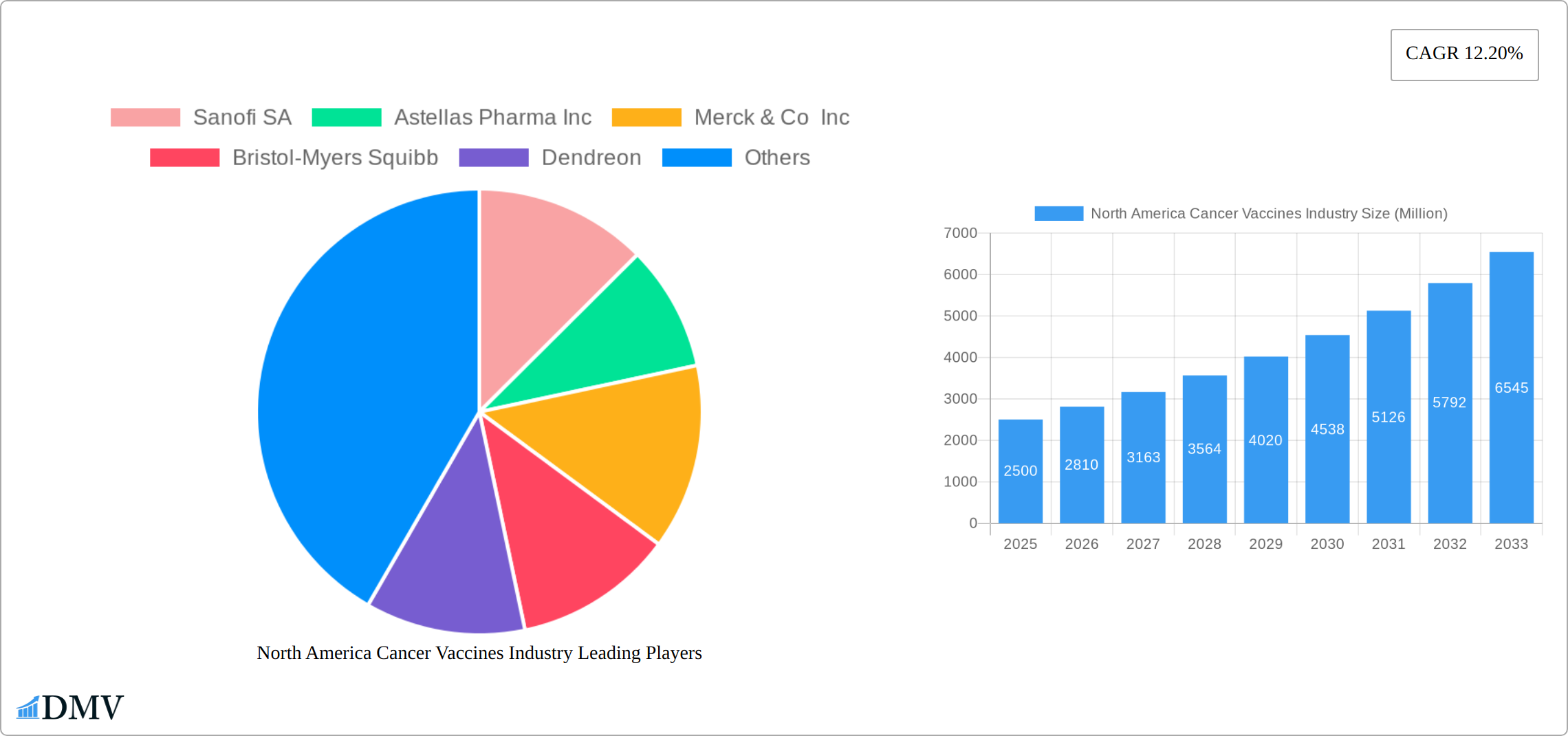

The North American cancer vaccines market, valued at approximately $2.5 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 12.2% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising prevalence of cancers like prostate and cervical cancer, coupled with an aging population, fuels the demand for effective preventative and therapeutic interventions. Secondly, advancements in vaccine technology, including recombinant, whole-cell, and viral vector vaccines, are leading to the development of more targeted and efficacious cancer vaccines. Increased research and development efforts by pharmaceutical giants like Sanofi SA, Merck & Co Inc., and Bristol-Myers Squibb are further contributing to this market growth. The market is segmented by application (prostate, cervical, and other cancers), technology (recombinant, whole-cell, viral vector, and DNA vaccines), and treatment method (preventive and therapeutic). While the high cost of development and potential side effects present certain restraints, the overall market outlook remains highly promising, particularly given the ongoing exploration of personalized cancer vaccines and immunotherapies.

The United States dominates the North American market due to its advanced healthcare infrastructure, higher research investment, and higher incidence of cancer. Canada and Mexico represent significant, albeit smaller, portions of the market, with growth expected across these regions as awareness of cancer vaccines increases and access to advanced therapies improves. The therapeutic vaccine segment is likely to show faster growth than the preventive segment, reflecting the urgent need for effective treatments for already diagnosed cancers. However, the increasing focus on cancer prevention and early detection will continue to support significant growth in the preventative vaccines segment as well. The market's future trajectory hinges on continued breakthroughs in vaccine technology, regulatory approvals, and increased public awareness of the potential benefits of cancer vaccines.

North America Cancer Vaccines Industry Market Composition & Trends

The North America cancer vaccines industry is characterized by a high concentration of key players, including Sanofi SA, Astellas Pharma Inc, Merck & Co Inc, Bristol-Myers Squibb, Dendreon, Aduro BioTech Inc, Amgen Inc, and GlaxoSmithKline PLC, who collectively hold a significant market share. The market share distribution in 2025 is estimated to be as follows: Sanofi SA at 20%, Merck & Co Inc at 18%, and GlaxoSmithKline PLC at 15%, with the remaining share split among other competitors. Innovation catalysts in this sector include substantial R&D investments aimed at developing novel vaccine technologies, with a notable increase in funding from USD 1.5 Billion in 2019 to USD 2.3 Billion in 2024.

- Regulatory Landscapes: The FDA's stringent approval processes have shaped the market, with recent guidelines favoring the development of personalized cancer vaccines.

- Substitute Products: Alternatives like immunotherapy and targeted therapies are gaining traction, yet vaccines remain pivotal due to their preventive nature.

- End-User Profiles: Hospitals and specialty clinics dominate the end-user segment, accounting for 65% of the market in 2025.

- M&A Activities: The sector has witnessed significant mergers and acquisitions, with a total deal value reaching USD 3.5 Billion in 2024, reflecting strategic consolidations to enhance product portfolios.

The market's growth is propelled by an increasing focus on preventive healthcare, with a shift towards early detection and treatment of cancer. This trend is expected to continue, driven by rising cancer incidence rates and heightened awareness.

North America Cancer Vaccines Industry Industry Evolution

The evolution of the North America cancer vaccines industry has been marked by significant growth trajectories and technological advancements over the study period from 2019 to 2033. The industry experienced a compound annual growth rate (CAGR) of 7.8% from 2019 to 2024, with projections indicating a rise to 8.5% during the forecast period of 2025 to 2033. This growth is largely attributed to the development of advanced vaccine technologies, such as recombinant cancer vaccines and viral vector-based vaccines, which have shown promising results in clinical trials.

Technological advancements have played a pivotal role in shaping the industry's evolution. The adoption of next-generation sequencing and bioinformatics has facilitated the development of personalized cancer vaccines, tailored to individual genetic profiles. This has led to an increase in the adoption rate of therapeutic vaccines, with a notable 12% rise in usage from 2020 to 2024. Consumer demand has shifted towards preventive measures, driven by increased awareness of cancer's impact on public health. This shift is evident in the growing market for preventive vaccines, which saw a 15% increase in demand over the same period.

The industry's growth has been further fueled by strategic collaborations between pharmaceutical companies and research institutions, aimed at accelerating the development of innovative cancer vaccines. These partnerships have resulted in the launch of several new products, enhancing the industry's competitive landscape and driving further innovation.

Leading Regions, Countries, or Segments in North America Cancer Vaccines Industry

The United States dominates the North American cancer vaccines market, fueled by substantial investments in research and development (R&D) and a supportive regulatory landscape. The U.S. market is projected to experience robust growth, with a compound annual growth rate (CAGR) of 9.2% anticipated from 2025 to 2033. This leadership position reflects the nation's prominent role in cancer research and the development of innovative vaccine technologies.

- Investment Trends: Investment in U.S. cancer vaccine R&D reached a significant USD 2.8 Billion in 2024, underscoring the commitment to advancing this crucial area of healthcare.

- Regulatory Support: The expedited review pathways offered by the Food and Drug Administration (FDA), such as fast-track designations, significantly accelerate the market entry of promising cancer vaccines, contributing to the overall market expansion.

Analyzing the application segments reveals that prostate cancer vaccines hold a substantial market share, estimated at 35% in 2025. This strong performance is attributed to the high incidence of prostate cancer in North America and the successful development of effective vaccines targeting this specific cancer type.

- Key Drivers for Prostate Cancer Vaccines: Increased awareness, improved screening programs, and early detection initiatives have created significant demand for preventive and therapeutic prostate cancer vaccines.

Cervical cancer vaccines represent another vital segment, commanding a 25% market share in 2025. The widespread success of vaccines like Gardasil, coupled with extensive public health vaccination campaigns, has propelled this segment's growth.

- Key Drivers for Cervical Cancer Vaccines: The success of established cervical cancer vaccines and continued public health initiatives promoting widespread vaccination have been instrumental in increasing uptake and market share.

Within the technology landscape, recombinant cancer vaccines are leading the market, capturing a 40% share in 2025. Their efficacy and favorable safety profiles have garnered significant interest among healthcare providers and patients alike.

- Key Drivers for Recombinant Cancer Vaccines: Advancements in genetic engineering techniques have significantly improved the precision, effectiveness, and safety of recombinant cancer vaccines.

Focusing on treatment methods, therapeutic cancer vaccines are poised for significant growth, with a projected CAGR of 10.1% from 2025 to 2033. This reflects the increasing demand for treatments capable of targeting existing cancers, effectively complementing the role of preventive vaccines.

- Key Drivers for Therapeutic Vaccines: The development of innovative vaccines that stimulate the immune system to combat existing tumors has driven increased adoption and market growth.

North America Cancer Vaccines Industry Product Innovations

Product innovations in the North America cancer vaccines industry have focused on enhancing vaccine efficacy and safety. Recent advancements include the development of personalized vaccines using patient-specific tumor antigens, which have shown promising results in clinical trials. These vaccines are designed to target unique cancer markers, increasing the likelihood of successful treatment outcomes. Additionally, the integration of AI and machine learning in vaccine design has streamlined the development process, enabling faster and more accurate vaccine formulations. These technological advancements not only improve performance metrics but also position the industry for future growth.

Propelling Factors for North America Cancer Vaccines Industry Growth

Several factors are propelling the growth of the North America cancer vaccines industry. Technological advancements, such as the use of recombinant DNA technology and viral vectors, have enabled the development of more effective vaccines. Economically, increased healthcare spending and government initiatives to combat cancer are driving market expansion. Regulatory influences, including streamlined approval processes for innovative vaccines, have also played a crucial role. For instance, the FDA's Breakthrough Therapy designation has accelerated the market entry of promising cancer vaccines, fostering an environment conducive to growth.

Obstacles in the North America Cancer Vaccines Industry Market

The North America cancer vaccines industry faces several obstacles that could impede its growth. Regulatory challenges, such as stringent clinical trial requirements, can delay product launches and increase development costs. Supply chain disruptions, exacerbated by global events like pandemics, have affected the availability of raw materials and manufacturing capabilities. Competitive pressures are also intense, with numerous players vying for market share, which can lead to price wars and reduced profitability. These barriers have quantifiable impacts, such as a potential 5% reduction in market growth due to regulatory delays and a 3% decrease due to supply chain issues.

Future Opportunities in North America Cancer Vaccines Industry

Emerging opportunities in the North America cancer vaccines industry include the development of vaccines for new cancer types and the expansion into untapped markets. Technological advancements, such as mRNA-based vaccines, offer potential for rapid and scalable production. Consumer trends towards personalized medicine are also driving demand for tailored cancer vaccines. These opportunities are poised to create new avenues for growth and innovation within the industry.

Major Players in the North America Cancer Vaccines Industry Ecosystem

- Sanofi SA

- Astellas Pharma Inc

- Merck & Co Inc

- Bristol-Myers Squibb

- Dendreon

- Aduro BioTech Inc

- Amgen Inc

- GlaxoSmithKline PLC

Key Developments in North America Cancer Vaccines Industry Industry

- January 2023: Sanofi SA announced the successful completion of Phase III trials for its new prostate cancer vaccine, expected to enter the market in 2025.

- March 2024: Merck & Co Inc received FDA approval for its cervical cancer vaccine, expanding its market presence.

- June 2024: Aduro BioTech Inc and Bristol-Myers Squibb formed a strategic partnership to develop a new line of recombinant cancer vaccines, enhancing their product portfolios.

Strategic North America Cancer Vaccines Industry Market Forecast

The North America cancer vaccines industry is poised for significant growth over the forecast period from 2025 to 2033, driven by technological advancements and increasing demand for preventive and therapeutic vaccines. Future opportunities in personalized medicine and the development of vaccines for new cancer types are expected to fuel market expansion. The industry's potential to revolutionize cancer treatment and prevention positions it as a key player in the healthcare sector, with a projected market size of USD 15 Billion by 2033.

North America Cancer Vaccines Industry Segmentation

-

1. Technology

- 1.1. Recombinant Cancer Vaccines

- 1.2. Whole-cell Cancer Vaccines

- 1.3. Viral Vector and DNA Cancer Vaccines

- 1.4. Other Technologies

-

2. Treatment Method

- 2.1. Preventive Vaccine

- 2.2. Therapeutic Vaccine

-

3. Application

- 3.1. Prostate Cancer

- 3.2. Cervical Cancer

- 3.3. Other Applications

-

4. Geography

-

4.1. North America

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Mexico

-

4.1. North America

North America Cancer Vaccines Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cancer Vaccines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of Cancer Cases; Rising Investments and Government Funding in the Development of Cancer Vaccines; Technological Developments in Cancer Vaccines

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines and Longer Timelines Required for Manufacturing Process; Presence of Alternative Therapies

- 3.4. Market Trends

- 3.4.1. Preventive Vaccines are Expected to a Hold Significant Market Share in the Treatment Method

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cancer Vaccines Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Recombinant Cancer Vaccines

- 5.1.2. Whole-cell Cancer Vaccines

- 5.1.3. Viral Vector and DNA Cancer Vaccines

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Treatment Method

- 5.2.1. Preventive Vaccine

- 5.2.2. Therapeutic Vaccine

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Prostate Cancer

- 5.3.2. Cervical Cancer

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North America

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Mexico

- 5.4.1. North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America North America Cancer Vaccines Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. United States North America Cancer Vaccines Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Canada North America Cancer Vaccines Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Mexico North America Cancer Vaccines Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Sanofi SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Astellas Pharma Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Merck & Co Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bristol-Myers Squibb

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Dendreon

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Aduro BioTech Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Amgen Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 GlaxoSmithKline PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Sanofi SA

List of Figures

- Figure 1: North America Cancer Vaccines Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Cancer Vaccines Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Cancer Vaccines Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Cancer Vaccines Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Cancer Vaccines Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: North America Cancer Vaccines Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 5: North America Cancer Vaccines Industry Revenue Million Forecast, by Treatment Method 2019 & 2032

- Table 6: North America Cancer Vaccines Industry Volume K Unit Forecast, by Treatment Method 2019 & 2032

- Table 7: North America Cancer Vaccines Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: North America Cancer Vaccines Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: North America Cancer Vaccines Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Cancer Vaccines Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: North America Cancer Vaccines Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Cancer Vaccines Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: North America Cancer Vaccines Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Cancer Vaccines Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: North America Cancer Vaccines Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Cancer Vaccines Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: North America Cancer Vaccines Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: North America Cancer Vaccines Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: North America Cancer Vaccines Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: North America Cancer Vaccines Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: North America Cancer Vaccines Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 22: North America Cancer Vaccines Industry Volume K Unit Forecast, by Technology 2019 & 2032

- Table 23: North America Cancer Vaccines Industry Revenue Million Forecast, by Treatment Method 2019 & 2032

- Table 24: North America Cancer Vaccines Industry Volume K Unit Forecast, by Treatment Method 2019 & 2032

- Table 25: North America Cancer Vaccines Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: North America Cancer Vaccines Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: North America Cancer Vaccines Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Cancer Vaccines Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Cancer Vaccines Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Cancer Vaccines Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: United States North America Cancer Vaccines Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United States North America Cancer Vaccines Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Canada North America Cancer Vaccines Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada North America Cancer Vaccines Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Mexico North America Cancer Vaccines Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Mexico North America Cancer Vaccines Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cancer Vaccines Industry?

The projected CAGR is approximately 12.20%.

2. Which companies are prominent players in the North America Cancer Vaccines Industry?

Key companies in the market include Sanofi SA, Astellas Pharma Inc, Merck & Co Inc, Bristol-Myers Squibb, Dendreon, Aduro BioTech Inc, Amgen Inc , GlaxoSmithKline PLC.

3. What are the main segments of the North America Cancer Vaccines Industry?

The market segments include Technology, Treatment Method, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of Cancer Cases; Rising Investments and Government Funding in the Development of Cancer Vaccines; Technological Developments in Cancer Vaccines.

6. What are the notable trends driving market growth?

Preventive Vaccines are Expected to a Hold Significant Market Share in the Treatment Method.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines and Longer Timelines Required for Manufacturing Process; Presence of Alternative Therapies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cancer Vaccines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cancer Vaccines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cancer Vaccines Industry?

To stay informed about further developments, trends, and reports in the North America Cancer Vaccines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence