Key Insights

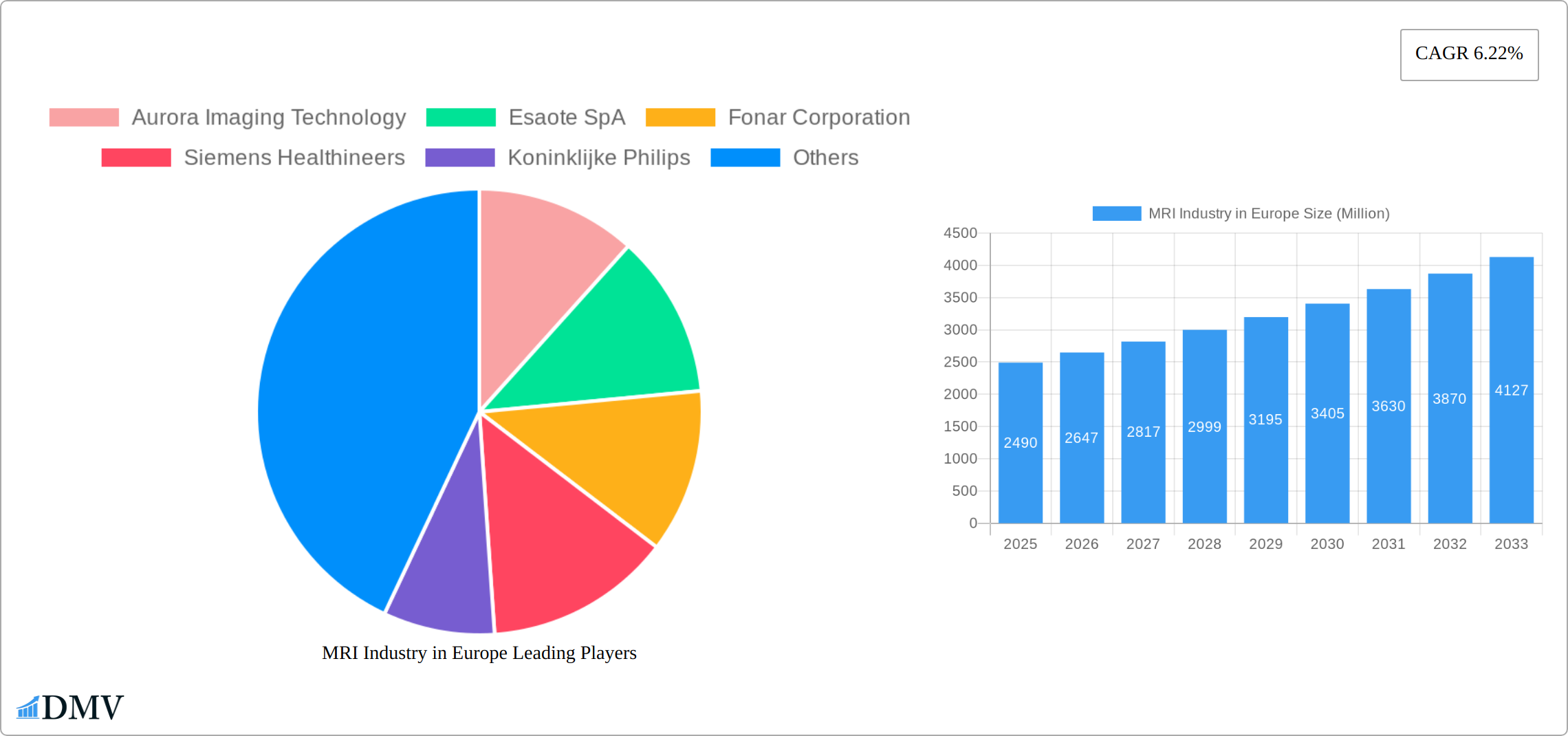

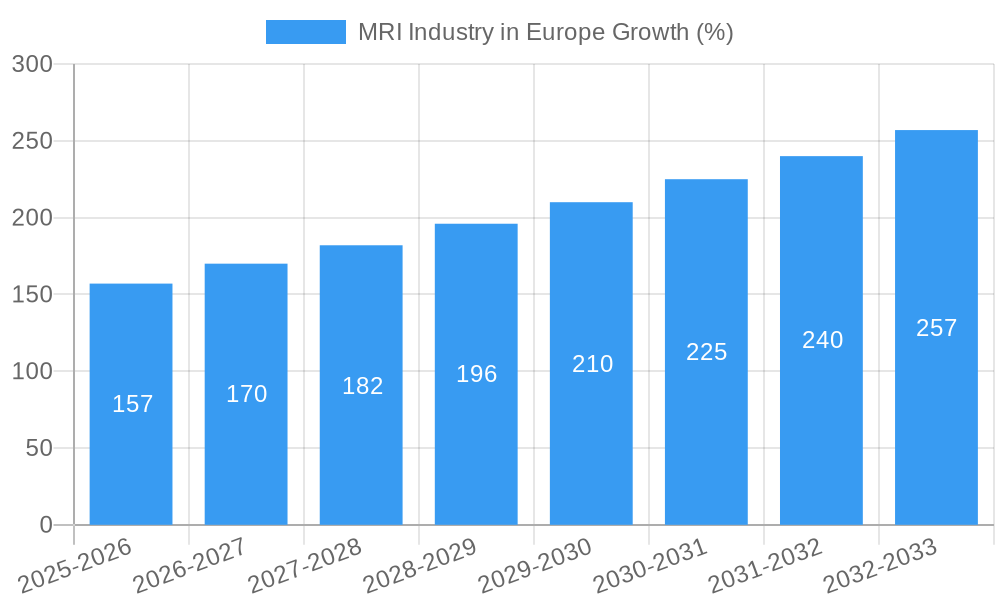

The European MRI market, valued at €2.49 billion in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases necessitating advanced diagnostics, technological advancements leading to improved image quality and faster scan times, and increasing government initiatives promoting healthcare infrastructure development. The market's compound annual growth rate (CAGR) of 6.22% from 2025 to 2033 indicates a significant expansion, with the market size expected to surpass €4 billion by 2033. Several factors contribute to this growth. The aging population in Europe leads to a higher incidence of conditions like neurological disorders and cardiovascular diseases, fueling demand for MRI scans. Furthermore, the increasing adoption of minimally invasive procedures necessitates precise imaging, driving the demand for high-field strength MRI systems. Technological advancements, such as artificial intelligence-powered image analysis and improved workflow efficiency, further contribute to market expansion. Segmentation analysis reveals that high-field MRI systems and applications in oncology and neurology are driving the majority of the market growth. Competition among key players like Siemens Healthineers, Philips, and GE Healthcare fuels innovation and accessibility.

However, certain challenges exist. High costs associated with MRI systems and their maintenance remain a significant restraint, particularly for smaller healthcare facilities. Furthermore, the availability of skilled radiologists and technicians to operate and interpret MRI scans can limit market penetration in certain regions. Regulatory hurdles and reimbursement policies also play a role in the overall market growth. Nevertheless, ongoing technological advancements, coupled with increasing healthcare expenditure and a growing awareness of the benefits of MRI technology, are expected to mitigate these restraints and drive substantial growth in the European MRI market throughout the forecast period. The competitive landscape remains dynamic, with established players constantly striving for innovation and market share, leading to further expansion and improved accessibility of MRI technology across various healthcare settings in Europe.

MRI Industry in Europe: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the European MRI industry, covering market trends, leading players, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers critical insights for stakeholders seeking to navigate this dynamic sector. The European MRI market, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting substantial growth potential.

MRI Industry in Europe Market Composition & Trends

The European MRI market is characterized by a moderately concentrated landscape, with key players like Siemens Healthineers, Philips, and GE Healthcare holding significant market share. However, the presence of several smaller, specialized companies fosters innovation and competition. Market share distribution fluctuates based on technological advancements, regulatory approvals, and successful M&A activities. Recent M&A deals have involved values ranging from xx Million to xx Million, signifying significant industry consolidation.

- Market Concentration: Moderately concentrated, with top 3 players holding approximately xx% of market share in 2025.

- Innovation Catalysts: Continuous advancements in MRI technology, including higher field strength systems and AI-powered image analysis.

- Regulatory Landscape: Stringent regulatory frameworks concerning medical device approvals and data privacy influence market dynamics.

- Substitute Products: Alternative imaging technologies like CT and ultrasound pose competitive pressure.

- End-User Profiles: Hospitals, diagnostic imaging centers, and research institutions constitute the primary end-users.

- M&A Activities: Strategic acquisitions and mergers are driving consolidation and expansion within the market.

MRI Industry in Europe Industry Evolution

The European MRI industry has witnessed robust growth driven by technological advancements and increased demand for advanced diagnostic imaging. The historical period (2019-2024) showcased a Compound Annual Growth Rate (CAGR) of approximately xx%, primarily fueled by the adoption of higher field strength MRI systems offering superior image quality. The market is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), driven by factors such as an aging population, rising prevalence of chronic diseases, increasing healthcare expenditure, and technological innovations. The shift towards minimally invasive procedures and personalized medicine further fuels market growth. Technological advancements, such as the integration of AI and machine learning, are enhancing diagnostic accuracy and efficiency, accelerating the adoption of MRI across various applications. Consumer demand is shifting towards faster scan times, improved comfort, and more efficient workflow solutions.

Leading Regions, Countries, or Segments in MRI Industry in Europe

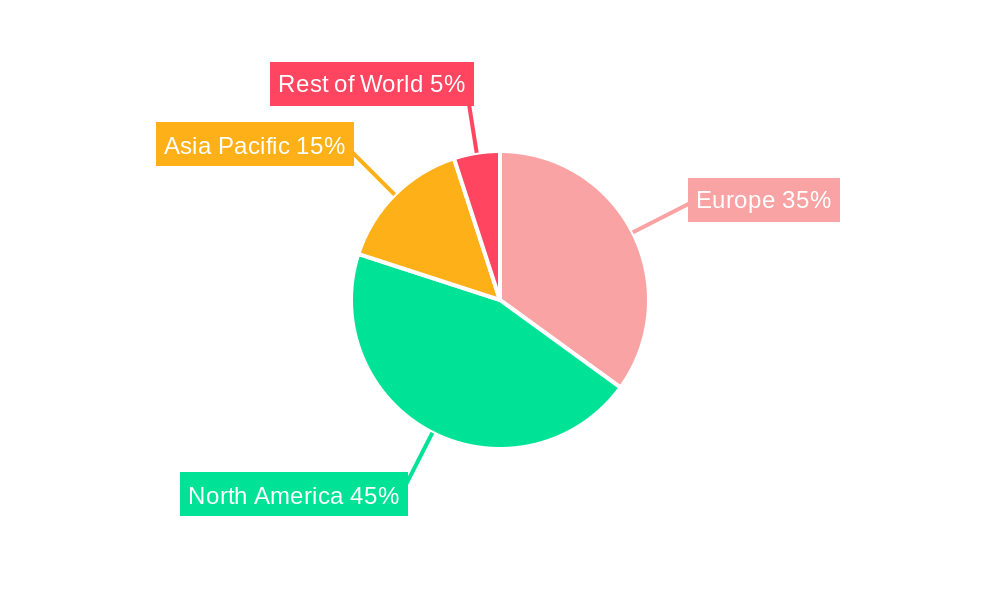

Germany, France, and the United Kingdom stand out as the preeminent markets within Europe for Magnetic Resonance Imaging (MRI) systems. This leadership is underpinned by their sophisticated healthcare infrastructures, substantial healthcare expenditure, and a dense network of advanced diagnostic imaging centers. The demand is further fueled by increasing awareness of early disease detection and the need for precise diagnostic tools.

- By Architecture: Closed MRI systems continue to hold a dominant market share, estimated at approximately 85-90%, owing to their unparalleled image quality and diagnostic accuracy. However, open MRI systems are experiencing a significant surge in adoption. Their key advantage lies in enhanced patient comfort, reduced anxiety, and improved accessibility for individuals with claustrophobia or those requiring interventional procedures.

- By Field Strength: The market is witnessing robust growth in high and ultra-high field strength MRI systems (3T and above). These advanced systems are crucial for providing exceptional image resolution, detailed anatomical visualization, and valuable functional information essential for complex neurological, oncological, and cardiac diagnoses.

- By Application: Oncology and neurology remain the leading application segments, reflecting the persistent burden of cancer and neurological disorders across Europe. Musculoskeletal imaging is also exhibiting strong and steady growth, driven by an aging population and increased sports-related injuries. Furthermore, the demand for advanced cardiac MRI is on a clear upward trajectory, propelled by groundbreaking technological advancements, including ultra-fast cardiac MRI protocols that reduce scan times and motion artifacts.

Key growth drivers for these leading segments include substantial and ongoing investments in modernizing healthcare infrastructure, coupled with supportive government policies that actively promote the adoption of cutting-edge medical technologies. Significant funding allocated to research and development within the medical imaging sector further fuels innovation. The dominance of specific segments is attributable to factors such as their higher diagnostic accuracy, broader clinical applicability across a range of conditions, and the increasing patient preference for minimally invasive and precise diagnostic methods.

MRI Industry in Europe Product Innovations

Recent innovations focus on improving image quality, reducing scan times, enhancing patient comfort, and integrating advanced software for AI-powered image analysis. Open MRI systems, with their reduced claustrophobia factor, represent a significant advancement. Ultra-high field MRI systems offer unparalleled image detail, while advancements in coil technology and sequence optimization contribute to faster and more efficient scans. The integration of AI algorithms is enabling automated image analysis, improving diagnostic accuracy and workflow efficiency.

Propelling Factors for MRI Industry in Europe Growth

The European MRI industry is experiencing dynamic growth propelled by a confluence of factors. Continuous technological advancements are at the forefront, including the development of more powerful and efficient higher field strength systems and the integration of artificial intelligence (AI)-powered image analysis tools that enhance diagnostic speed and precision. The rising global prevalence of chronic diseases, coupled with an aging demographic across Europe, is significantly escalating the demand for sophisticated diagnostic imaging solutions. Government initiatives, including substantial funding programs aimed at upgrading healthcare infrastructure and facilitating technological adoption, play a pivotal role in market expansion. Moreover, increasing healthcare expenditure across the continent and the progressive implementation of value-based healthcare models, which prioritize patient outcomes and cost-effectiveness, are collectively fostering a conducive environment for the MRI market's sustained growth.

Obstacles in the MRI Industry in Europe Market

Despite its robust growth trajectory, the European MRI industry faces several notable obstacles. The substantial capital investment required for the procurement and ongoing maintenance of MRI systems presents a significant barrier to entry, particularly for smaller healthcare facilities and those with limited financial resources. Furthermore, stringent regulatory frameworks and the often lengthy approval processes for new technologies can impede their timely market introduction. Disruptions within global supply chains and persistent shortages of critical components can impact manufacturing timelines and the overall availability of MRI equipment. The highly competitive landscape, characterized by the presence of established global players, also poses a considerable challenge for market entrants. Collectively, these constraints are estimated to contribute to an approximate 5-10% reduction in the potential market growth annually.

Future Opportunities in MRI Industry in Europe

The integration of AI and machine learning in MRI image analysis offers significant opportunities for improved diagnostic accuracy and efficiency. The development of mobile and portable MRI systems can expand accessibility to underserved populations. Focus on personalized medicine and targeted therapies will further drive demand for advanced MRI applications. The exploration of new applications, such as advanced neuroimaging and cardiovascular research, presents further expansion prospects.

Major Players in the MRI Industry in Europe Ecosystem

- Aurora Imaging Technology

- Esaote SpA

- Fonar Corporation

- Siemens Healthineers

- Koninklijke Philips

- Neusoft Medical Systems Co Ltd

- Canon Medical Systems Corporation

- GE Healthcare (GE Company)

- Bruker Corporation

- Fujifilm Corporation (Hitachi Medical Systems)

Key Developments in MRI Industry in Europe Industry

- July 2021: Philips collaborated with the Spanish National Center for Cardiovascular Research to develop a new ultra-fast cardiac MRI protocol, potentially revolutionizing cardiac MRI applications. This collaboration enhanced Philips’ market position and fostered innovation in the field.

- October 2021: Esaote launched the Magnifico Open, a total body open MRI system. This launch expanded Esaote’s product portfolio and strengthened its competitive standing by addressing both clinical needs and operational/financial concerns.

Strategic MRI Industry in Europe Market Forecast

The European MRI market is robustly positioned for continued and accelerated growth. This expansion will be primarily driven by the sustained integration of groundbreaking technological advancements, the demographic shift towards an older population with increasing healthcare needs, and the consistent rise in overall healthcare spending. Emerging technologies, such as sophisticated AI-driven image analysis platforms that promise enhanced diagnostic accuracy and efficiency, alongside the development of more compact, patient-friendly, and accessible MRI systems, are set to be key catalysts for further market penetration. The market's inherent potential is substantial, presenting significant and lucrative opportunities for both established industry leaders and innovative new entrants. Strategic agility, a commitment to continuous innovation, and the forging of robust partnerships will be absolutely critical for navigating this competitive yet rapidly expanding landscape and achieving sustained success.

MRI Industry in Europe Segmentation

-

1. Architecture

- 1.1. Closed MRI Systems

- 1.2. Open MRI Systems

-

2. Field Strength

- 2.1. Low Field MRI Systems

- 2.2. Medium Field MRI Systems

- 2.3. Very Hig

-

3. Application

- 3.1. Oncology

- 3.2. Neurology

- 3.3. Cardiology

- 3.4. Gastroenterology

- 3.5. Musculoskeletal

- 3.6. Other Applications

MRI Industry in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

MRI Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Introduction of Hybrid MRI Systems; Availability of Universal health Coverage in Europe; Increasing Emphasis on Early Diagnosis

- 3.3. Market Restrains

- 3.3.1. High Cost of MRI Systems; Declining Helium Availability

- 3.4. Market Trends

- 3.4.1. Open MRI Systems Segment is Expected to Grow with High CAGR Over the Forecast Period in the Europe Magnetic Resonance Imaging (MRI) Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. Closed MRI Systems

- 5.1.2. Open MRI Systems

- 5.2. Market Analysis, Insights and Forecast - by Field Strength

- 5.2.1. Low Field MRI Systems

- 5.2.2. Medium Field MRI Systems

- 5.2.3. Very Hig

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oncology

- 5.3.2. Neurology

- 5.3.3. Cardiology

- 5.3.4. Gastroenterology

- 5.3.5. Musculoskeletal

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. Germany MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Architecture

- 6.1.1. Closed MRI Systems

- 6.1.2. Open MRI Systems

- 6.2. Market Analysis, Insights and Forecast - by Field Strength

- 6.2.1. Low Field MRI Systems

- 6.2.2. Medium Field MRI Systems

- 6.2.3. Very Hig

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Oncology

- 6.3.2. Neurology

- 6.3.3. Cardiology

- 6.3.4. Gastroenterology

- 6.3.5. Musculoskeletal

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Architecture

- 7. United Kingdom MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Architecture

- 7.1.1. Closed MRI Systems

- 7.1.2. Open MRI Systems

- 7.2. Market Analysis, Insights and Forecast - by Field Strength

- 7.2.1. Low Field MRI Systems

- 7.2.2. Medium Field MRI Systems

- 7.2.3. Very Hig

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Oncology

- 7.3.2. Neurology

- 7.3.3. Cardiology

- 7.3.4. Gastroenterology

- 7.3.5. Musculoskeletal

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Architecture

- 8. France MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Architecture

- 8.1.1. Closed MRI Systems

- 8.1.2. Open MRI Systems

- 8.2. Market Analysis, Insights and Forecast - by Field Strength

- 8.2.1. Low Field MRI Systems

- 8.2.2. Medium Field MRI Systems

- 8.2.3. Very Hig

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Oncology

- 8.3.2. Neurology

- 8.3.3. Cardiology

- 8.3.4. Gastroenterology

- 8.3.5. Musculoskeletal

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Architecture

- 9. Italy MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Architecture

- 9.1.1. Closed MRI Systems

- 9.1.2. Open MRI Systems

- 9.2. Market Analysis, Insights and Forecast - by Field Strength

- 9.2.1. Low Field MRI Systems

- 9.2.2. Medium Field MRI Systems

- 9.2.3. Very Hig

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Oncology

- 9.3.2. Neurology

- 9.3.3. Cardiology

- 9.3.4. Gastroenterology

- 9.3.5. Musculoskeletal

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Architecture

- 10. Spain MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Architecture

- 10.1.1. Closed MRI Systems

- 10.1.2. Open MRI Systems

- 10.2. Market Analysis, Insights and Forecast - by Field Strength

- 10.2.1. Low Field MRI Systems

- 10.2.2. Medium Field MRI Systems

- 10.2.3. Very Hig

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Oncology

- 10.3.2. Neurology

- 10.3.3. Cardiology

- 10.3.4. Gastroenterology

- 10.3.5. Musculoskeletal

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Architecture

- 11. Rest of Europe MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Architecture

- 11.1.1. Closed MRI Systems

- 11.1.2. Open MRI Systems

- 11.2. Market Analysis, Insights and Forecast - by Field Strength

- 11.2.1. Low Field MRI Systems

- 11.2.2. Medium Field MRI Systems

- 11.2.3. Very Hig

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Oncology

- 11.3.2. Neurology

- 11.3.3. Cardiology

- 11.3.4. Gastroenterology

- 11.3.5. Musculoskeletal

- 11.3.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Architecture

- 12. Germany MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 13. France MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 14. Italy MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Sweden MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe MRI Industry in Europe Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Aurora Imaging Technology

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Esaote SpA

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Fonar Corporation

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 Siemens Healthineers

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Koninklijke Philips

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Neusoft Medical Systems Co Ltd

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Canon Medical Systems Corporation*List Not Exhaustive

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 GE Healthcare (GE Company)

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Bruker Corporation

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Fujifilm Corporation (Hitachi Medical Systems)

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Aurora Imaging Technology

List of Figures

- Figure 1: MRI Industry in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: MRI Industry in Europe Share (%) by Company 2024

List of Tables

- Table 1: MRI Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 3: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 4: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 5: MRI Industry in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 6: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe MRI Industry in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 15: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 16: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 17: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 18: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 19: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 20: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 21: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 23: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 24: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 25: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 26: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 27: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 28: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 29: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 30: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 31: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 32: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 33: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 34: MRI Industry in Europe Revenue Million Forecast, by Architecture 2019 & 2032

- Table 35: MRI Industry in Europe Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 36: MRI Industry in Europe Revenue Million Forecast, by Application 2019 & 2032

- Table 37: MRI Industry in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MRI Industry in Europe?

The projected CAGR is approximately 6.22%.

2. Which companies are prominent players in the MRI Industry in Europe?

Key companies in the market include Aurora Imaging Technology, Esaote SpA, Fonar Corporation, Siemens Healthineers, Koninklijke Philips, Neusoft Medical Systems Co Ltd, Canon Medical Systems Corporation*List Not Exhaustive, GE Healthcare (GE Company), Bruker Corporation, Fujifilm Corporation (Hitachi Medical Systems).

3. What are the main segments of the MRI Industry in Europe?

The market segments include Architecture, Field Strength, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Introduction of Hybrid MRI Systems; Availability of Universal health Coverage in Europe; Increasing Emphasis on Early Diagnosis.

6. What are the notable trends driving market growth?

Open MRI Systems Segment is Expected to Grow with High CAGR Over the Forecast Period in the Europe Magnetic Resonance Imaging (MRI) Market.

7. Are there any restraints impacting market growth?

High Cost of MRI Systems; Declining Helium Availability.

8. Can you provide examples of recent developments in the market?

In July 2021, Philips collaborated with the Spanish National Center for Cardiovascular Research for a new ultra-fast cardiac MRI protocol to develop a magnetic resonance (MR) imaging technique that could potentially revolutionize the use of MR imaging in cardiology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MRI Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MRI Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MRI Industry in Europe?

To stay informed about further developments, trends, and reports in the MRI Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence