Key Insights

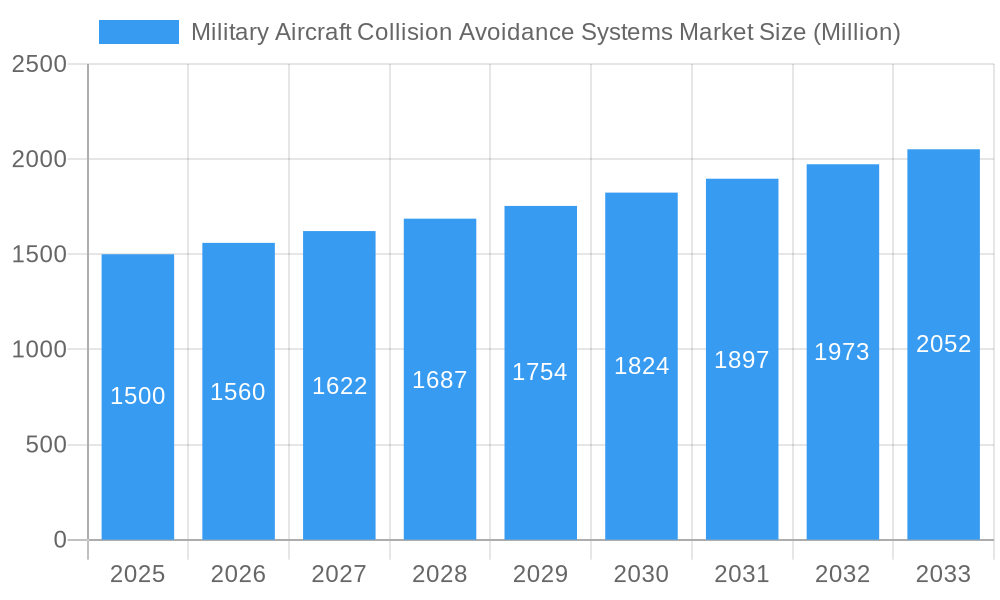

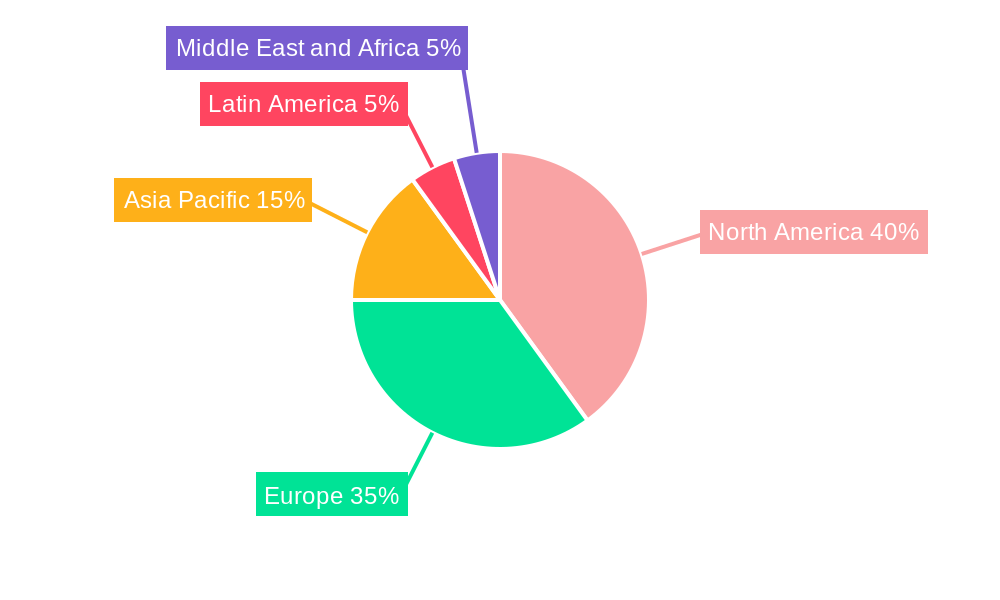

The Military Aircraft Collision Avoidance Systems (MACAS) market is experiencing robust growth, driven by increasing military aircraft operations globally and a heightened focus on enhancing flight safety. The market, estimated at $XX million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.00% throughout the forecast period (2025-2033). Several factors contribute to this expansion. Firstly, advancements in technology, such as the integration of sophisticated sensors and improved data processing capabilities in systems like Traffic Collision Avoidance Systems (TCAS), Terrain Awareness and Warning Systems (TAWS), and Synthetic Vision Systems (SVS), are enhancing situational awareness and reducing the risk of mid-air collisions. Secondly, the rising deployment of unmanned aircraft systems (UAS) in military operations necessitates robust collision avoidance solutions, further stimulating market growth. Furthermore, stringent safety regulations imposed by international aviation authorities are driving the adoption of advanced MACAS across various aircraft types. The market is segmented by system type (Radars, TCAS, TAWS, CWS, OCAS, SVS) and aircraft type (manned and unmanned), with significant opportunities existing in both segments. Regional variations exist, with North America and Europe currently dominating the market due to higher defense budgets and technological advancements; however, the Asia-Pacific region is poised for significant growth driven by increasing military modernization efforts.

Military Aircraft Collision Avoidance Systems Market Market Size (In Billion)

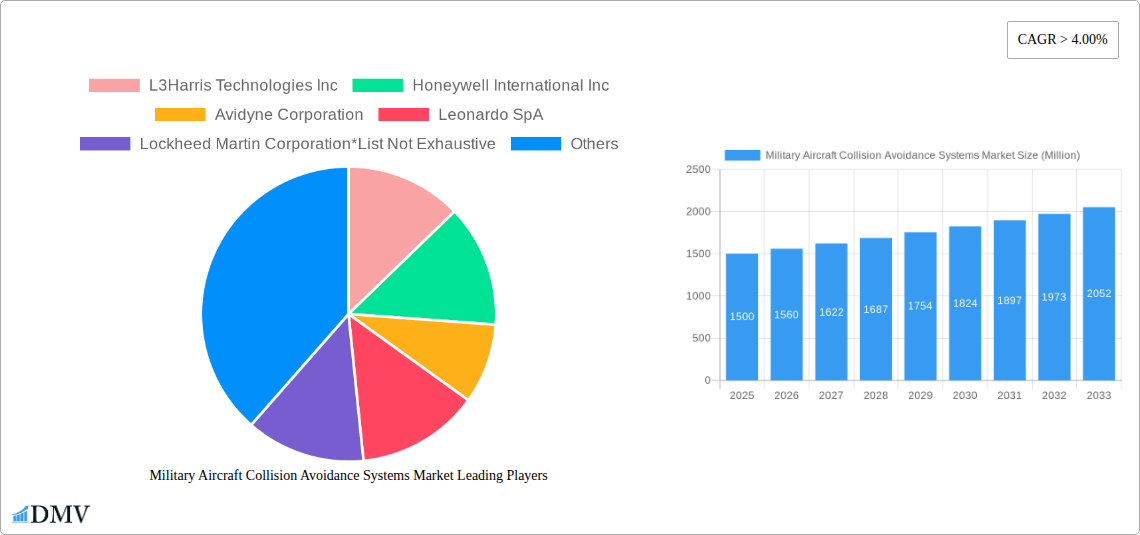

Competition within the MACAS market is intense, with leading players like L3Harris Technologies Inc, Honeywell International Inc, and Lockheed Martin Corporation vying for market share through continuous innovation and strategic partnerships. The market is also witnessing the emergence of specialized companies focused on niche areas within the MACAS landscape. The primary restraint on market growth could be the high initial investment required for MACAS implementation, particularly for legacy aircraft retrofits. However, the long-term benefits of enhanced safety and reduced accident rates are likely to outweigh the initial costs, driving sustained adoption. The forecast period will see significant technological advancements, likely leading to the development of more integrated and cost-effective MACAS, further propelling market expansion. The focus will continue to be on improving system reliability, accuracy, and interoperability, particularly in complex airspace environments.

Military Aircraft Collision Avoidance Systems Market Company Market Share

Military Aircraft Collision Avoidance Systems Market: A Comprehensive Analysis (2019-2033)

This insightful report provides a deep dive into the dynamic Military Aircraft Collision Avoidance Systems market, offering a comprehensive analysis of market trends, technological advancements, and key players shaping its future. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this critical sector. The market is projected to reach xx Million by 2033, experiencing significant growth driven by increasing military spending and technological innovations.

Military Aircraft Collision Avoidance Systems Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory frameworks, and market dynamics impacting the Military Aircraft Collision Avoidance Systems market. The market exhibits a moderately concentrated structure, with key players holding significant market share. For instance, L3Harris Technologies Inc., Honeywell International Inc., and Lockheed Martin Corporation collectively account for an estimated xx% of the market. This concentration is influenced by high barriers to entry, including substantial R&D investments and stringent regulatory approvals.

Market Concentration & M&A Activity:

- Market Share Distribution: L3Harris Technologies Inc. (xx%), Honeywell International Inc. (xx%), Lockheed Martin Corporation (xx%), Others (xx%).

- M&A Activity: The past five years have witnessed a moderate level of M&A activity, with total deal values estimated at xx Million. These acquisitions have primarily focused on consolidating technologies and expanding geographic reach.

Innovation Catalysts & Regulatory Landscape:

- The market is driven by continuous innovation in radar technology, including the development of advanced collision avoidance systems that utilize AI and machine learning.

- Stringent safety regulations imposed by international aviation authorities significantly influence system design and adoption. These regulations drive demand for sophisticated and reliable collision avoidance systems.

- Substitute products, like enhanced pilot training programs, are limited in their effectiveness and do not fully replace the need for robust collision avoidance systems.

- End-users primarily comprise military forces globally, with procurement decisions influenced by budgetary constraints and defense modernization strategies.

Military Aircraft Collision Avoidance Systems Market Industry Evolution

The Military Aircraft Collision Avoidance Systems market has witnessed robust growth over the historical period (2019-2024), primarily driven by technological advancements and increasing demand from military and defense sectors. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during this period. This growth is further anticipated to accelerate in the forecast period (2025-2033) owing to factors such as increasing investments in defense modernization programs globally, rising geopolitical tensions requiring enhanced situational awareness, and the emergence of unmanned aerial vehicles (UAVs) demanding sophisticated collision avoidance capabilities. The adoption rate of advanced systems like TCAS and Synthetic Vision Systems is expected to grow by xx% annually, driven by their improved performance and enhanced safety features. Technological innovations such as improved sensor fusion, AI-powered threat detection, and advanced data processing are streamlining operations and improving overall effectiveness. Shifting consumer demands towards improved safety and reduced operational costs fuel this market growth.

Leading Regions, Countries, or Segments in Military Aircraft Collision Avoidance Systems Market

The North American region holds a dominant position in the Military Aircraft Collision Avoidance Systems market, accounting for an estimated xx% of the global market share in 2025. This dominance is attributed to several key factors:

Key Drivers for North American Dominance:

- High military spending and robust defense budgets.

- Strong presence of major system integrators and manufacturers.

- Progressive regulatory support for technological advancements in aviation safety.

Regional Breakdown & Segment Analysis:

- System Type: Radars currently represent the largest segment, followed by TCAS and TAWS. Synthetic Vision Systems are experiencing rapid growth due to their enhanced situational awareness capabilities.

- Aircraft Type: The manned aircraft segment currently dominates, although the unmanned aircraft segment is poised for significant growth due to the increasing deployment of UAVs in military operations. Growth in UAVs is estimated at xx% annually over the forecast period.

- Europe and Asia-Pacific are also significant markets, experiencing growth driven by increasing investments in defense modernization and the adoption of advanced collision avoidance systems. The Asia-Pacific region's growth is projected at xx% CAGR, fueled by increasing defense expenditure from China and India.

Military Aircraft Collision Avoidance Systems Market Product Innovations

Recent innovations focus on enhancing situational awareness, improving system reliability, and reducing the weight and power consumption of collision avoidance systems. Miniaturized sensors, improved algorithms, and the integration of AI and machine learning are key features of the latest product offerings. The unique selling propositions lie in the enhanced accuracy, reliability, and the ability to integrate seamlessly with existing aircraft systems. These advancements contribute to improved safety, reduced operational costs, and increased efficiency in military operations.

Propelling Factors for Military Aircraft Collision Avoidance Systems Market Growth

The market's growth is fueled by several key factors: increasing military spending globally, particularly in regions experiencing heightened geopolitical tensions; the growing adoption of unmanned aerial vehicles (UAVs) demanding robust collision avoidance systems; and the continuous development of advanced technologies like AI-powered threat detection and sensor fusion, enhancing situational awareness and safety. Stringent safety regulations and a focus on minimizing mid-air collisions further drive market expansion.

Obstacles in the Military Aircraft Collision Avoidance Systems Market

Despite promising prospects, several challenges hinder market growth. High initial investment costs for advanced systems can constrain adoption, especially in countries with limited defense budgets. Supply chain disruptions and the availability of critical components can also impact production and delivery timelines. Intense competition among established players and the emergence of new entrants create pressure on pricing and profit margins.

Future Opportunities in Military Aircraft Collision Avoidance Systems Market

Emerging opportunities include the integration of advanced sensor technologies, such as LiDAR and infrared sensors, to enhance system performance and situational awareness. The development of cost-effective and lightweight systems for smaller UAVs presents a significant growth area. Expansion into new markets, particularly in developing countries upgrading their military capabilities, promises further market growth. The integration of collision avoidance systems with other aircraft management systems offers significant value addition.

Major Players in the Military Aircraft Collision Avoidance Systems Market Ecosystem

Key Developments in Military Aircraft Collision Avoidance Systems Market Industry

- Q1 2023: L3Harris Technologies Inc. launched a new generation of its TCAS system with enhanced capabilities.

- Q3 2022: Honeywell International Inc. announced a strategic partnership with a leading sensor manufacturer to improve its radar systems.

- Q4 2021: Lockheed Martin Corporation completed the acquisition of a smaller company specializing in UAV collision avoidance systems. (Further details on acquisitions and partnerships would be included in the full report.)

Strategic Military Aircraft Collision Avoidance Systems Market Forecast

The Military Aircraft Collision Avoidance Systems market is poised for continued growth, driven by technological innovations, increasing military spending, and the growing adoption of unmanned aerial vehicles. Future opportunities lie in the development of more sophisticated systems utilizing AI and machine learning to enhance situational awareness and prevent mid-air collisions. The market's potential is significant, with substantial growth projected over the forecast period.

Military Aircraft Collision Avoidance Systems Market Segmentation

-

1. System Type

- 1.1. Radars

- 1.2. TCAS

- 1.3. TAWS

- 1.4. CWS

- 1.5. OCAS

- 1.6. Synthetic Vision Systems

-

2. Aircraft Type

- 2.1. Manned Aircraft

- 2.2. Unmanned Aircraft

Military Aircraft Collision Avoidance Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Military Aircraft Collision Avoidance Systems Market Regional Market Share

Geographic Coverage of Military Aircraft Collision Avoidance Systems Market

Military Aircraft Collision Avoidance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Unmanned Aircraft Segment is Anticipated to Growth with Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Military Aircraft Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by System Type

- 5.1.1. Radars

- 5.1.2. TCAS

- 5.1.3. TAWS

- 5.1.4. CWS

- 5.1.5. OCAS

- 5.1.6. Synthetic Vision Systems

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Manned Aircraft

- 5.2.2. Unmanned Aircraft

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by System Type

- 6. North America Military Aircraft Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by System Type

- 6.1.1. Radars

- 6.1.2. TCAS

- 6.1.3. TAWS

- 6.1.4. CWS

- 6.1.5. OCAS

- 6.1.6. Synthetic Vision Systems

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Manned Aircraft

- 6.2.2. Unmanned Aircraft

- 6.1. Market Analysis, Insights and Forecast - by System Type

- 7. Europe Military Aircraft Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by System Type

- 7.1.1. Radars

- 7.1.2. TCAS

- 7.1.3. TAWS

- 7.1.4. CWS

- 7.1.5. OCAS

- 7.1.6. Synthetic Vision Systems

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Manned Aircraft

- 7.2.2. Unmanned Aircraft

- 7.1. Market Analysis, Insights and Forecast - by System Type

- 8. Asia Pacific Military Aircraft Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by System Type

- 8.1.1. Radars

- 8.1.2. TCAS

- 8.1.3. TAWS

- 8.1.4. CWS

- 8.1.5. OCAS

- 8.1.6. Synthetic Vision Systems

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Manned Aircraft

- 8.2.2. Unmanned Aircraft

- 8.1. Market Analysis, Insights and Forecast - by System Type

- 9. Latin America Military Aircraft Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by System Type

- 9.1.1. Radars

- 9.1.2. TCAS

- 9.1.3. TAWS

- 9.1.4. CWS

- 9.1.5. OCAS

- 9.1.6. Synthetic Vision Systems

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Manned Aircraft

- 9.2.2. Unmanned Aircraft

- 9.1. Market Analysis, Insights and Forecast - by System Type

- 10. Middle East and Africa Military Aircraft Collision Avoidance Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by System Type

- 10.1.1. Radars

- 10.1.2. TCAS

- 10.1.3. TAWS

- 10.1.4. CWS

- 10.1.5. OCAS

- 10.1.6. Synthetic Vision Systems

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Manned Aircraft

- 10.2.2. Unmanned Aircraft

- 10.1. Market Analysis, Insights and Forecast - by System Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Avidyne Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leonardo SpA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lockheed Martin Corporation*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thales Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Garmin Aerospace

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Northrop Grumman

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sandel Avionics Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Collins Aerospace (Raytheon Technologies Corporation)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Military Aircraft Collision Avoidance Systems Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by System Type 2025 & 2033

- Figure 3: North America Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by System Type 2025 & 2033

- Figure 4: North America Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 5: North America Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 6: North America Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by System Type 2025 & 2033

- Figure 9: Europe Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by System Type 2025 & 2033

- Figure 10: Europe Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 11: Europe Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by System Type 2025 & 2033

- Figure 15: Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by System Type 2025 & 2033

- Figure 16: Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 17: Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 18: Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by System Type 2025 & 2033

- Figure 21: Latin America Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by System Type 2025 & 2033

- Figure 22: Latin America Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 23: Latin America Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 24: Latin America Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by System Type 2025 & 2033

- Figure 27: Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by System Type 2025 & 2033

- Figure 28: Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Aircraft Type 2025 & 2033

- Figure 29: Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 30: Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by System Type 2020 & 2033

- Table 2: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 3: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by System Type 2020 & 2033

- Table 5: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 6: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by System Type 2020 & 2033

- Table 10: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 11: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Russia Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by System Type 2020 & 2033

- Table 18: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 19: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: India Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: China Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: South Korea Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by System Type 2020 & 2033

- Table 26: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 27: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Brazil Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by System Type 2020 & 2033

- Table 31: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Aircraft Type 2020 & 2033

- Table 32: Global Military Aircraft Collision Avoidance Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Egypt Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Military Aircraft Collision Avoidance Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Military Aircraft Collision Avoidance Systems Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Military Aircraft Collision Avoidance Systems Market?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, Avidyne Corporation, Leonardo SpA, Lockheed Martin Corporation*List Not Exhaustive, Thales Group, Garmin Aerospace, Northrop Grumman, Sandel Avionics Inc, Collins Aerospace (Raytheon Technologies Corporation).

3. What are the main segments of the Military Aircraft Collision Avoidance Systems Market?

The market segments include System Type, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Unmanned Aircraft Segment is Anticipated to Growth with Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Military Aircraft Collision Avoidance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Military Aircraft Collision Avoidance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Military Aircraft Collision Avoidance Systems Market?

To stay informed about further developments, trends, and reports in the Military Aircraft Collision Avoidance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence