Key Insights

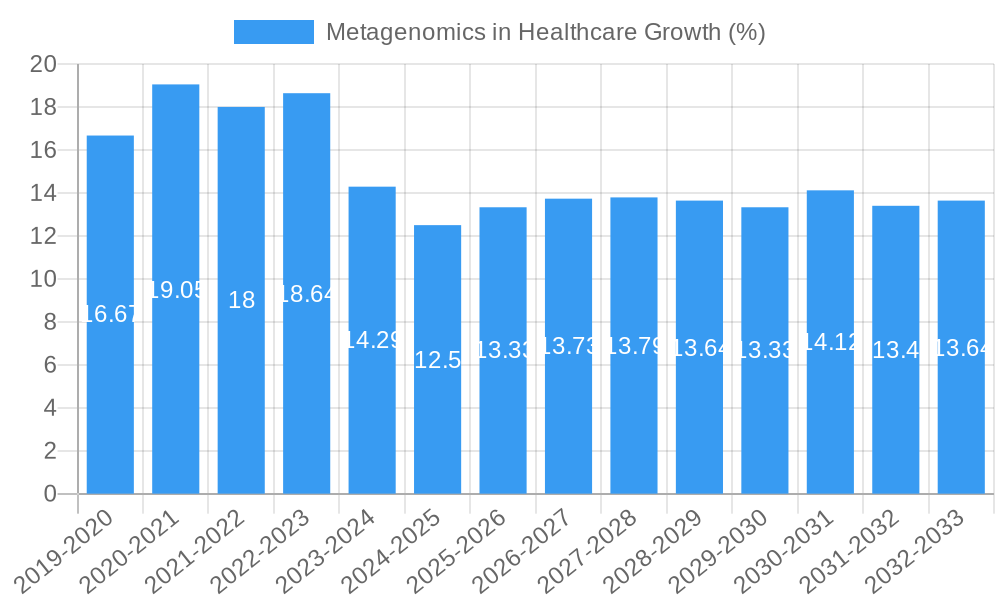

The global metagenomics market in healthcare is poised for substantial expansion, projected to reach approximately $4,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 18% anticipated through 2033. This significant market valuation and consistent growth are underpinned by a confluence of accelerating technological advancements, increasing adoption across diverse healthcare sectors, and a growing understanding of the profound impact of microbial communities on human health and disease. The pharmaceutical industry and biotechnology companies are at the forefront of leveraging metagenomic insights for drug discovery, personalized medicine development, and the identification of novel therapeutic targets. Pathology laboratories are increasingly integrating metagenomics for more accurate and comprehensive disease diagnosis, particularly in areas like infectious diseases and complex gastrointestinal disorders. Academic and research institutions continue to drive fundamental understanding in this field, fueling further innovation and application. The demand is fueled by the critical need to understand the human microbiome and its direct correlation with various health outcomes, from immune function and metabolic disorders to neurological conditions.

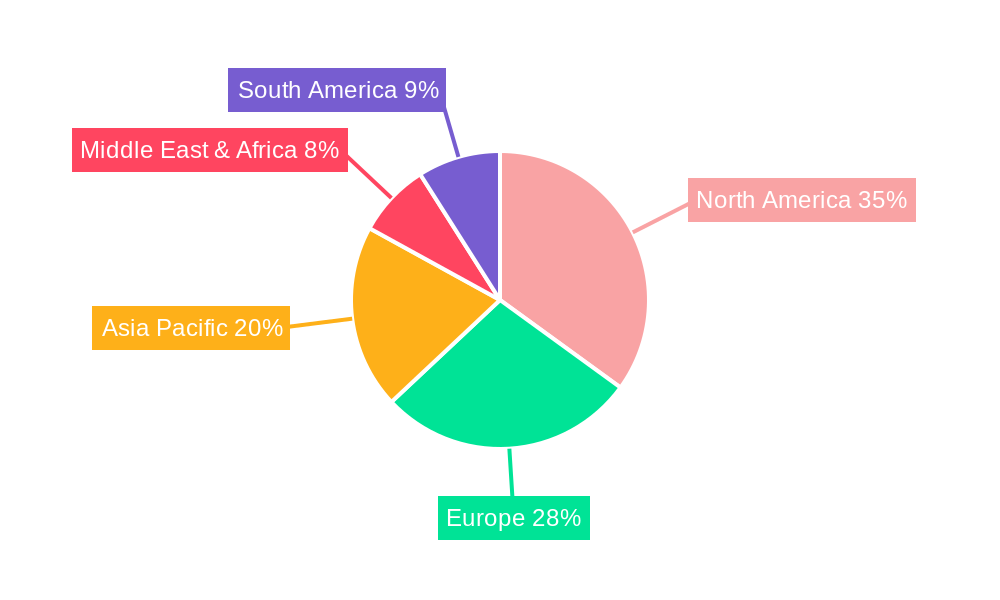

The market's growth trajectory is primarily driven by the increasing sophistication of sequencing technologies, which have dramatically reduced costs and improved efficiency, making metagenomic analysis more accessible and cost-effective. The rising prevalence of chronic diseases and the growing emphasis on preventative healthcare further bolster market expansion, as metagenomics offers a powerful tool for early detection and personalized intervention strategies. While the market exhibits immense potential, certain restraints such as the high initial investment in advanced sequencing equipment and bioinformatics infrastructure, coupled with the need for skilled personnel for data interpretation, could pose challenges. However, ongoing advancements in cloud-based bioinformatics platforms and the development of user-friendly analysis tools are gradually mitigating these hurdles. The market is segmented into Sample Extraction Kits and Metagenomics Kits, with both segments experiencing strong demand due to their crucial roles in the entire metagenomic workflow. Geographically, North America and Europe are expected to lead the market, driven by strong research infrastructure and high healthcare spending, with Asia Pacific showing particularly rapid growth due to increasing investments in healthcare and biotechnology.

This comprehensive report provides an in-depth analysis of the Metagenomics in Healthcare market, offering critical insights for stakeholders navigating this rapidly evolving sector. From sample extraction kits to advanced metagenomics kits, this study meticulously examines market trends, product innovations, and growth trajectories. Discover the latest developments and strategic forecast for the pharmaceutical industries, biotechnology companies, pathology laboratories, and academic and research laboratories. Unlock a projected market size of over $XX million by 2033, driven by significant technological advancements and increasing adoption across diverse healthcare applications.

Metagenomics in Healthcare Market Composition & Trends

The Metagenomics in Healthcare market exhibits a dynamic composition characterized by moderate to high market concentration. Key innovation catalysts include advancements in Next-Generation Sequencing (NGS) technologies and the growing understanding of the human microbiome's role in disease. Regulatory landscapes are gradually evolving to accommodate the increasing use of metagenomic data in diagnostics and therapeutics, though standardization remains a key consideration. Substitute products, such as traditional culture-based methods, are steadily being replaced by more efficient and comprehensive metagenomic approaches. End-user profiles range from large pharmaceutical giants investing in drug discovery to smaller biotechnology firms specializing in microbiome-based solutions, alongside an increasing reliance by pathology laboratories and academic research institutions for diagnostic and translational research purposes. Mergers and acquisitions (M&A) activities are anticipated to continue, with estimated deal values in the range of $XX million to $XXX million, as larger players seek to consolidate their market position and acquire innovative technologies.

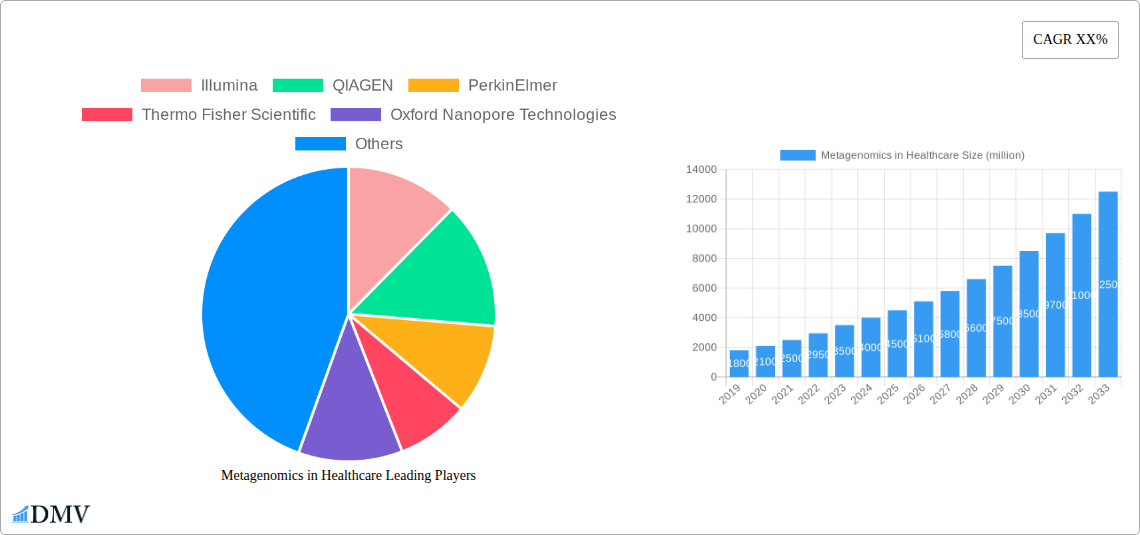

- Market Share Distribution: Leading companies like Illumina, QIAGEN, and Thermo Fisher Scientific hold significant market share, driven by their established NGS platforms and comprehensive assay portfolios.

- M&A Deal Values: Anticipated M&A activities in the forecast period (2025-2033) are projected to involve deals ranging from $XX million for early-stage acquisitions to over $XXX million for consolidation of key technologies.

- Innovation Catalysts: NGS technological advancements, AI-driven data analysis, and increasing investment in microbiome research are primary drivers.

- Regulatory Landscape: Evolving guidelines from bodies like the FDA and EMA are shaping the market, with a growing emphasis on data integrity and clinical validation.

Metagenomics in Healthcare Industry Evolution

The Metagenomics in Healthcare industry has witnessed a remarkable evolutionary trajectory, transforming from a niche research tool to a mainstream clinical and diagnostic modality. The study period, from 2019 to 2033, encompasses a transformative phase where market growth has been consistently robust, projected to reach a significant valuation by the end of the forecast period. This evolution is primarily fueled by continuous technological advancements, particularly in sequencing throughput, accuracy, and cost-effectiveness offered by leading companies such as Illumina, Thermo Fisher Scientific, and Oxford Nanopore Technologies. The base year, 2025, serves as a critical benchmark for understanding the current market dynamics and projecting future expansion.

Shifting consumer demands are also playing a pivotal role. As awareness regarding the intricate relationship between the microbiome and various health conditions – from infectious diseases and inflammatory disorders to neurological conditions and even cancer – grows, the demand for accurate and comprehensive metagenomic testing escalates. This includes applications in personalized medicine, where understanding an individual's unique microbial profile can inform treatment strategies, and in the development of novel probiotics and prebiotics. The market's growth trajectory is further supported by increasing investment in research and development by biotechnology companies, alongside the growing adoption of metagenomic sequencing by pathology laboratories for improved diagnostic capabilities and academic and research laboratories for groundbreaking discoveries. The historical period (2019-2024) laid the groundwork for this expansion, characterized by initial adoption challenges and the refinement of analytical pipelines. As we move through the estimated year of 2025 and into the forecast period (2025-2033), we anticipate sustained, high single-digit to low double-digit compound annual growth rates (CAGRs), driven by broader clinical integration and the emergence of new therapeutic applications. The introduction of advanced bioinformatics tools and cloud-based data analysis platforms has significantly democratized access to metagenomic insights, further accelerating adoption and pushing the boundaries of what's possible in healthcare.

Leading Regions, Countries, or Segments in Metagenomics in Healthcare

The Metagenomics in Healthcare market is currently dominated by North America, particularly the United States, driven by a confluence of factors including substantial government and private sector investment in life sciences research, a robust regulatory framework that encourages innovation, and the presence of leading pharmaceutical and biotechnology companies. The region's advanced healthcare infrastructure and high adoption rates for new diagnostic technologies further solidify its leading position. Within this dynamic landscape, the Pharmaceutical Industries segment emerges as a primary driver of demand, utilizing metagenomics extensively for drug discovery, development, and understanding drug-microbiome interactions. Biotechnology Companies are also significant players, focusing on developing microbiome-based therapeutics and diagnostics.

Key drivers for this regional and segmental dominance include:

- High R&D Investment: Significant capital allocation from both public and private sectors towards microbiome research and metagenomic applications, estimated in the millions of dollars annually.

- Regulatory Support: A relatively favorable regulatory environment that facilitates the approval and adoption of novel metagenomic diagnostics and therapeutics.

- Technological Adoption: Early and rapid uptake of advanced sequencing technologies and bioinformatics solutions by research institutions and clinical laboratories.

- Prevalence of Chronic Diseases: The high incidence of chronic diseases, where the microbiome is increasingly implicated, fuels the demand for diagnostic and prognostic tools.

Pathology Laboratories are experiencing rapid growth as metagenomic testing moves from research settings into routine clinical practice for infectious disease identification, antibiotic resistance profiling, and gut health assessments. Academic and Research Laboratories continue to be at the forefront of discovery, pushing the boundaries of understanding and uncovering new applications for metagenomics. In terms of product types, Metagenomics Kits represent a substantial and growing segment, offering integrated solutions for sample preparation, library construction, and sequencing, thereby streamlining workflows and reducing turnaround times for analysis. Sample Extraction Kits are foundational, with continuous innovation in their efficiency and specificity to handle diverse sample matrices, from stool and saliva to tissue and environmental samples, with projected market penetration of over XX% for advanced kits by 2028. The seamless integration of these kits with downstream analysis platforms is a critical factor for market expansion.

Metagenomics in Healthcare Product Innovations

Product innovation in the Metagenomics in Healthcare market is primarily focused on enhancing analytical accuracy, increasing throughput, and simplifying workflows. Companies are developing novel metagenomics kits with improved lysis and purification efficiencies for a wider range of sample types, including challenging clinical specimens. Advancements in sample extraction kits are yielding higher DNA yields and purity, crucial for downstream sequencing applications. Furthermore, integrated platforms that combine sample preparation, library generation, and sequencing are emerging, reducing hands-on time and potential for contamination. The integration of AI and machine learning into bioinformatics pipelines, often embedded within software solutions accompanying these kits, is revolutionizing data interpretation, enabling more precise identification of microbial species, functional analysis, and disease association with estimated improvements in diagnostic accuracy of XX%.

Propelling Factors for Metagenomics in Healthcare Growth

The Metagenomics in Healthcare market is experiencing robust growth propelled by several key factors. Technologically, continuous advancements in Next-Generation Sequencing (NGS) platforms, such as increased read lengths and reduced sequencing costs from companies like Illumina and Oxford Nanopore Technologies, are making metagenomic analysis more accessible and comprehensive. Economically, growing investments from venture capital and government grants in microbiome research and its therapeutic applications are fueling innovation and market expansion, with funding reaching hundreds of millions of dollars in the past few years. Regulatory bodies are also increasingly recognizing the diagnostic and therapeutic potential of metagenomic approaches, leading to the development of clearer guidelines and pathways for clinical adoption. Furthermore, a burgeoning understanding of the microbiome's role in a vast array of diseases, from inflammatory bowel disease to cancer and neurological disorders, is driving demand from pharmaceutical and biotechnology companies for drug discovery and development, and from healthcare providers for improved diagnostics.

Obstacles in the Metagenomics in Healthcare Market

Despite its significant growth, the Metagenomics in Healthcare market faces several obstacles. Regulatory hurdles remain a concern, as standardized protocols and clear pathways for clinical validation of metagenomic tests are still under development in many regions. The complexity of data analysis and interpretation requires specialized bioinformatics expertise, which can be a barrier for smaller laboratories and healthcare providers. Supply chain disruptions, particularly for specialized reagents and equipment, can impact the availability and cost of metagenomics kits and sample extraction kits. Intense competitive pressures among established players like QIAGEN and Thermo Fisher Scientific, alongside emerging startups, can also influence pricing and market access. Furthermore, the high initial investment required for setting up metagenomic analysis capabilities can be a restraint for some institutions, with initial setup costs potentially ranging from $XX,000 to $XXX,000.

Future Opportunities in Metagenomics in Healthcare

The future of the Metagenomics in Healthcare market is replete with opportunities. The expansion of personalized medicine, where individual microbial profiles will guide treatment decisions, presents a significant avenue for growth. The development of microbiome-based therapeutics and diagnostics for a wider range of diseases, including rare conditions and metabolic disorders, is another key area. Emerging markets in Asia-Pacific and Latin America, with their growing healthcare infrastructure and increasing focus on research, offer substantial untapped potential. Technological advancements, such as portable sequencing devices and more sophisticated AI-driven analytical tools, will further democratize access and accelerate adoption. The integration of multi-omics data, combining metagenomics with genomics, transcriptomics, and proteomics, promises deeper insights into disease mechanisms and therapeutic targets, potentially opening up new clinical applications valued in the millions of dollars.

Major Players in the Metagenomics in Healthcare Ecosystem

- Illumina

- QIAGEN

- PerkinElmer

- Thermo Fisher Scientific

- Oxford Nanopore Technologies

Key Developments in Metagenomics in Healthcare Industry

- 2023/08: Launch of a new metagenomics sequencing kit offering improved sensitivity for detecting low-abundance microbes.

- 2023/05: Acquisition of a leading bioinformatics company by a major life sciences corporation to enhance data analysis capabilities in metagenomics.

- 2022/11: FDA approval of a novel metagenomic diagnostic test for a specific gastrointestinal disorder, marking a significant step towards broader clinical adoption.

- 2022/07: Strategic partnership formed between a sequencing technology provider and a pharmaceutical company to accelerate microbiome drug discovery.

- 2021/09: Introduction of a portable nanopore sequencing device with enhanced accuracy for rapid on-site metagenomic analysis.

Strategic Metagenomics in Healthcare Market Forecast

The strategic forecast for the Metagenomics in Healthcare market anticipates continued expansion driven by escalating demand for personalized medicine and microbiome-based therapeutics. Advancements in sequencing technologies, particularly in affordability and throughput from companies like Illumina and Oxford Nanopore Technologies, alongside innovations in metagenomics kits and sample extraction kits, will be pivotal. The growing body of evidence linking the microbiome to various disease states is expected to fuel significant investment from pharmaceutical and biotechnology companies, targeting new drug development and diagnostic solutions. Regulatory bodies are anticipated to provide clearer frameworks, facilitating clinical adoption. The market is projected to witness substantial growth, reaching an estimated valuation of over $XX million by 2033, with key growth catalysts including increased research funding, technological integration, and a broadening understanding of microbial influence on human health.

Metagenomics in Healthcare Segmentation

-

1. Application

- 1.1. Pharmaceutical Industries

- 1.2. Biotechnology Companies

- 1.3. Pathology Laboratories

- 1.4. Academic and Research Laboratories

- 1.5. Others

-

2. Types

- 2.1. Sample Extraction Kits

- 2.2. Metagenomics Kits

Metagenomics in Healthcare Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Metagenomics in Healthcare REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metagenomics in Healthcare Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical Industries

- 5.1.2. Biotechnology Companies

- 5.1.3. Pathology Laboratories

- 5.1.4. Academic and Research Laboratories

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Sample Extraction Kits

- 5.2.2. Metagenomics Kits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Metagenomics in Healthcare Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical Industries

- 6.1.2. Biotechnology Companies

- 6.1.3. Pathology Laboratories

- 6.1.4. Academic and Research Laboratories

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Sample Extraction Kits

- 6.2.2. Metagenomics Kits

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Metagenomics in Healthcare Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical Industries

- 7.1.2. Biotechnology Companies

- 7.1.3. Pathology Laboratories

- 7.1.4. Academic and Research Laboratories

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Sample Extraction Kits

- 7.2.2. Metagenomics Kits

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Metagenomics in Healthcare Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical Industries

- 8.1.2. Biotechnology Companies

- 8.1.3. Pathology Laboratories

- 8.1.4. Academic and Research Laboratories

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Sample Extraction Kits

- 8.2.2. Metagenomics Kits

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Metagenomics in Healthcare Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical Industries

- 9.1.2. Biotechnology Companies

- 9.1.3. Pathology Laboratories

- 9.1.4. Academic and Research Laboratories

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Sample Extraction Kits

- 9.2.2. Metagenomics Kits

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Metagenomics in Healthcare Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical Industries

- 10.1.2. Biotechnology Companies

- 10.1.3. Pathology Laboratories

- 10.1.4. Academic and Research Laboratories

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Sample Extraction Kits

- 10.2.2. Metagenomics Kits

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Illumina

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 QIAGEN

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PerkinElmer

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oxford Nanopore Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Illumina

List of Figures

- Figure 1: Global Metagenomics in Healthcare Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Metagenomics in Healthcare Revenue (million), by Application 2024 & 2032

- Figure 3: North America Metagenomics in Healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Metagenomics in Healthcare Revenue (million), by Types 2024 & 2032

- Figure 5: North America Metagenomics in Healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Metagenomics in Healthcare Revenue (million), by Country 2024 & 2032

- Figure 7: North America Metagenomics in Healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Metagenomics in Healthcare Revenue (million), by Application 2024 & 2032

- Figure 9: South America Metagenomics in Healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Metagenomics in Healthcare Revenue (million), by Types 2024 & 2032

- Figure 11: South America Metagenomics in Healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Metagenomics in Healthcare Revenue (million), by Country 2024 & 2032

- Figure 13: South America Metagenomics in Healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Metagenomics in Healthcare Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Metagenomics in Healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Metagenomics in Healthcare Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Metagenomics in Healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Metagenomics in Healthcare Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Metagenomics in Healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Metagenomics in Healthcare Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Metagenomics in Healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Metagenomics in Healthcare Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Metagenomics in Healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Metagenomics in Healthcare Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Metagenomics in Healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Metagenomics in Healthcare Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Metagenomics in Healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Metagenomics in Healthcare Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Metagenomics in Healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Metagenomics in Healthcare Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Metagenomics in Healthcare Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Metagenomics in Healthcare Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Metagenomics in Healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Metagenomics in Healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Metagenomics in Healthcare Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Metagenomics in Healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Metagenomics in Healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Metagenomics in Healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Metagenomics in Healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Metagenomics in Healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Metagenomics in Healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Metagenomics in Healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Metagenomics in Healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Metagenomics in Healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Metagenomics in Healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Metagenomics in Healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Metagenomics in Healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Metagenomics in Healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Metagenomics in Healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Metagenomics in Healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Metagenomics in Healthcare Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metagenomics in Healthcare?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Metagenomics in Healthcare?

Key companies in the market include Illumina, QIAGEN, PerkinElmer, Thermo Fisher Scientific, Oxford Nanopore Technologies.

3. What are the main segments of the Metagenomics in Healthcare?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metagenomics in Healthcare," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metagenomics in Healthcare report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metagenomics in Healthcare?

To stay informed about further developments, trends, and reports in the Metagenomics in Healthcare, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence