Key Insights

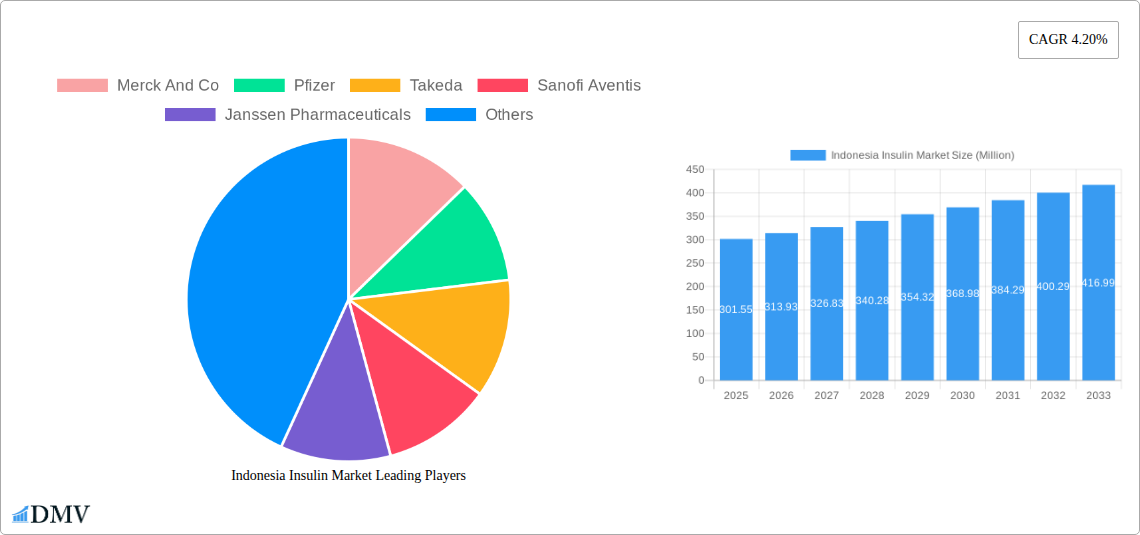

The Indonesian insulin market is poised for significant expansion, projected to reach approximately USD 301.55 million by 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of 4.20% during the forecast period of 2025-2033. This upward trajectory is primarily fueled by a confluence of factors, including the escalating prevalence of diabetes, particularly Type 2 diabetes, within the Indonesian population. Growing awareness regarding diabetes management and the availability of advanced insulin formulations are further propelling market demand. Key market drivers include the increasing disposable income, leading to greater healthcare expenditure, and the expanding healthcare infrastructure, which enhances access to essential diabetes medications. The market is segmented by Product Type, with Basal or Long-Acting Insulins and Bolus or Fast-Acting Insulins expected to dominate due to their efficacy in managing blood glucose levels. Biosimilar insulins are also gaining traction, offering more affordable treatment options and widening accessibility. Application-wise, Type 2 diabetes accounts for the largest share, reflecting its high incidence, while Type 1 diabetes also contributes significantly to market growth as management strategies evolve. Distribution channels such as hospitals and pharmacies remain dominant, supported by the growing presence of online retailers catering to the convenience-seeking consumer base.

Indonesia Insulin Market Market Size (In Million)

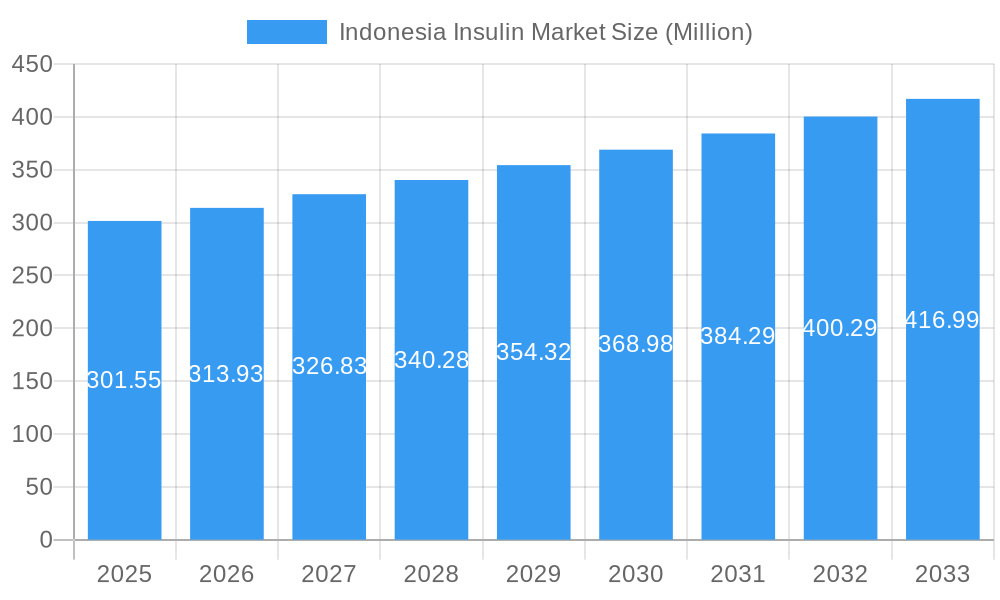

The competitive landscape is characterized by the presence of major global pharmaceutical players including Novo Nordisk A/S, Eli Lilly, Sanofi Aventis, and Merck And Co, all vying for market share through product innovation and strategic collaborations. These companies are actively engaged in research and development to introduce novel insulin therapies and expand their product portfolios to address the diverse needs of diabetic patients in Indonesia. Restraints such as the cost of advanced insulin therapies and the need for patient education on proper injection techniques and storage are being addressed through initiatives aimed at improving affordability and accessibility. Trends such as the increasing adoption of biosimilar insulins, driven by cost-effectiveness, and the growing demand for convenient delivery devices like insulin pens are shaping the market's future. Furthermore, the Indonesian government's focus on improving public health outcomes and managing non-communicable diseases like diabetes is expected to provide a supportive environment for market expansion. The forecast period will likely witness a sustained demand for insulin as the nation continues its efforts to combat the growing diabetes epidemic.

Indonesia Insulin Market Company Market Share

Indonesia Insulin Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a granular analysis of the Indonesia insulin market, delving into its current landscape, historical trajectory, and future potential. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period extending to 2033, this research offers critical insights for stakeholders, including pharmaceutical manufacturers, distributors, healthcare providers, and investors. The report leverages high-ranking keywords such as Indonesia diabetes treatment, insulin market forecast, biosimilar insulin Indonesia, type 2 diabetes management, and pharmaceutical market analysis to maximize search visibility and attract targeted audiences. Understand the dynamic forces shaping this vital healthcare sector and identify lucrative growth opportunities.

Indonesia Insulin Market Market Composition & Trends

The Indonesia insulin market exhibits a dynamic composition influenced by a mix of established global players and emerging local contenders. Market concentration remains moderate, with key companies vying for substantial market share through strategic product launches and an increasing focus on biosimilar insulin Indonesia adoption. Innovation catalysts include advancements in insulin delivery devices and the development of novel formulations aimed at improving patient adherence and therapeutic outcomes. The regulatory landscape in Indonesia is evolving, with government initiatives aimed at expanding access to affordable diabetes care, which is a significant boon for market growth. Substitute products, primarily oral antidiabetic medications, present a competitive challenge, yet the growing prevalence of diabetes, particularly type 2 diabetes management, continues to drive robust demand for insulin therapies. End-user profiles are diverse, ranging from individuals newly diagnosed with diabetes to those requiring advanced treatment intensification. Mergers and acquisitions (M&A) activities, though not yet dominant, are anticipated to increase as companies seek to expand their portfolios and market reach within this burgeoning market. Projected M&A deal values are expected to witness a significant uptick as the market matures.

Indonesia Insulin Market Industry Evolution

The Indonesia insulin market has witnessed remarkable evolution, driven by a confluence of technological advancements, shifting consumer demands, and an expanding healthcare infrastructure. Over the historical period (2019-2024) and into the projected forecast period (2025-2033), the market has experienced consistent growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. This trajectory is underpinned by a rising incidence of diabetes, largely attributed to demographic shifts, lifestyle changes, and increased awareness surrounding the disease. Technological advancements have been pivotal, with the introduction of advanced insulin pens, pre-filled syringes, and the burgeoning interest in smart insulin pens and continuous glucose monitoring (CGM) systems. These innovations not only enhance convenience and accuracy for patients but also contribute to better disease management and improved health outcomes. Consumer demands are increasingly shifting towards more patient-centric solutions, emphasizing ease of use, reduced injection frequency, and personalized treatment plans. The growing demand for biosimilar insulin Indonesia is a testament to this trend, offering a more affordable alternative to originator products and thereby improving access for a larger segment of the population. Furthermore, the expansion of healthcare facilities, coupled with increasing government and private sector investment in diabetes care, is creating a more conducive environment for market expansion. The growing adoption of digital health platforms for patient education and remote monitoring is also poised to play a significant role in the future growth of the Indonesia insulin market.

Leading Regions, Countries, or Segments in Indonesia Insulin Market

Within the Indonesia insulin market, the Type 2 Diabetes application segment stands out as the dominant force, driven by the escalating prevalence of this chronic condition across the archipelago. The market's segmentation by Product Type reveals a strong performance from Basal or Long Acting Insulins and a growing traction for Biosimilar Insulins, reflecting a dual focus on sustained glycemic control and affordability. From a Distribution Channel perspective, Pharmacies continue to be the primary access point for insulin products, although Hospitals remain crucial for initial diagnosis and complex patient management. The rise of Online Retailers is an emerging trend, offering convenience and wider accessibility, particularly in urban centers.

Dominant Application Segment:

- Type 2 Diabetes: Accounts for the largest market share due to lifestyle factors and an aging population. Government health initiatives targeting chronic disease management further bolster this segment.

- Type 1 Diabetes: While a smaller segment, it represents a stable demand for essential insulin therapies, with ongoing research into advanced treatment modalities.

Key Product Type Trends:

- Basal or Long Acting Insulins: Preferred for their convenience and consistent glycemic control, contributing significantly to market revenue.

- Biosimilar Insulins: Experiencing rapid growth due to their cost-effectiveness, making diabetes treatment more accessible to a wider population. This segment is a key driver for future market expansion.

- Bolus or Fast Acting Insulins: Essential for mealtime glucose management, maintaining steady demand.

- Traditional Human Insulins: Still hold a market share, especially in regions with lower adoption rates of advanced insulin types.

Distribution Channel Dynamics:

- Pharmacies: The cornerstone of insulin distribution, offering widespread availability and pharmacist-led patient counseling.

- Hospitals: Critical for inpatient care, insulin initiation, and management of severe diabetes-related complications.

- Online Retailers: A rapidly growing channel, providing convenience and competitive pricing, especially for established insulin users.

Indonesia Insulin Market Product Innovations

Recent product innovations in the Indonesia insulin market are centered on enhancing patient convenience and efficacy. Advancements in insulin pens offer improved dosing accuracy and a more discreet injection experience, significantly boosting patient adherence. The development and increasing adoption of biosimilar insulins represent a major breakthrough, offering high-quality, cost-effective alternatives to branded medications, thereby broadening access to essential diabetes care. Furthermore, early-stage research and development into novel insulin formulations with longer durations of action and reduced immunogenicity are also shaping the future landscape. The integration of digital technologies with insulin delivery devices, such as smart pens with connected apps for tracking doses and glucose levels, is another significant innovation poised to transform diabetes management Indonesia.

Propelling Factors for Indonesia Insulin Market Growth

Several key factors are propelling the growth of the Indonesia insulin market. The escalating prevalence of diabetes in Indonesia, particularly type 2 diabetes, driven by changing lifestyles and an aging population, is the primary growth catalyst. Government initiatives focused on improving healthcare access and affordability, including subsidies and expanded insurance coverage for diabetes management, further stimulate demand. Technological advancements in insulin delivery systems, such as pre-filled pens and biosimilar insulin Indonesia development, enhance patient compliance and offer more cost-effective treatment options. Increased health awareness among the population and rising disposable incomes also contribute to greater healthcare expenditure on chronic disease management.

Obstacles in the Indonesia Insulin Market Market

Despite robust growth, the Indonesia insulin market faces several obstacles. Regulatory hurdles and lengthy approval processes for new insulin formulations and biosimil products can impede market entry. Supply chain disruptions, exacerbated by logistical challenges in a vast archipelago, can affect product availability and lead to stockouts. Price sensitivity among a significant portion of the population remains a concern, limiting the adoption of more expensive, advanced insulin therapies. The limited awareness and understanding of newer insulin technologies and biosimilar insulin Indonesia among some healthcare professionals and patients can also hinder market penetration. Furthermore, the competitive pressure from oral antidiabetic medications continues to be a factor, although the increasing complexity of diabetes cases often necessitates insulin therapy.

Future Opportunities in Indonesia Insulin Market

The Indonesia insulin market is ripe with future opportunities. The increasing demand for biosimilar insulin Indonesia presents a significant avenue for growth, driven by its cost-effectiveness and expanding accessibility. The growing adoption of digital health technologies, including telemedicine and remote patient monitoring, offers opportunities for enhanced diabetes management and improved patient outcomes. Expansion into underserved rural areas, where diabetes prevalence is rising but access to advanced care is limited, represents a largely untapped market. The development and introduction of innovative insulin delivery devices, such as advanced insulin pumps and smart pens, catering to evolving patient needs, will also drive market expansion. Further research into combination therapies and personalized insulin regimens tailored to individual patient profiles will unlock new growth potential.

Major Players in the Indonesia Insulin Market Ecosystem

- Merck And Co

- Pfizer

- Takeda

- Sanofi Aventis

- Janssen Pharmaceuticals

- Eli Lilly

- Novartis

- AstraZeneca

- Bristol Myers Squibb

- Novo Nordisk A/S

- Boehringer Ingelheim

- Astellas

Key Developments in Indonesia Insulin Market Industry

- March 2023: Daewoong Pharmaceutical submitted a new drug application (NDA) in Indonesia, Philippines, and Thailand, the largest markets in Southeast Asia for Envlo, the SGLT2 enzyme inhibitor type new drug for diabetes.

- March 2023: Novo Nordisk announced headline results from the PIONEER PLUS trial, a phase 3b, 68-week, efficacy, and safety trial with once-daily oral semaglutide 25 mg and 50 mg versus 14 mg as add-on to a stable dose of 1–3 oral antidiabetic medicines in people with type 2 diabetes in need of treatment intensification. The trial achieved its primary endpoint by demonstrating a statistically significant and superior reduction in HbA1c at week 52 with both the 25 mg and 50 mg doses versus the 14 mg dose of oral semaglutide.

Strategic Indonesia Insulin Market Market Forecast

The strategic outlook for the Indonesia insulin market is exceptionally positive, driven by a confluence of factors that promise sustained growth and expanded opportunities. The projected increase in the prevalence of diabetes, coupled with a growing emphasis on preventive healthcare and chronic disease management, will continue to fuel demand for insulin therapies. The anticipated widespread adoption of biosimilar insulins is set to democratize access to essential treatments, significantly boosting market volume. Furthermore, ongoing advancements in drug delivery technologies and the integration of digital health solutions will enhance patient convenience and therapeutic efficacy, creating a more patient-centric market. Government support for healthcare infrastructure development and the increasing disposable incomes of the Indonesian population are also poised to play a crucial role in unlocking the market's full potential. This forecast indicates a dynamic and expanding market for insulin in Indonesia.

Indonesia Insulin Market Segmentation

-

1. Product Type

- 1.1. Basal or Long Acting Insulins

- 1.2. Bolus or Fast Acting Insulins

- 1.3. Traditional Human Insulins

- 1.4. Biosimilar Insulins

-

2. Application

- 2.1. Type 1 Diabetes

- 2.2. Type 2 Diabetes

-

3. Distribution Channel

- 3.1. Hospitals

- 3.2. Pharmacies

- 3.3. Online Retailers

Indonesia Insulin Market Segmentation By Geography

- 1. Indonesia

Indonesia Insulin Market Regional Market Share

Geographic Coverage of Indonesia Insulin Market

Indonesia Insulin Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. The Oral anti-diabetic drugs segment holds the highest market share in the Indonesia Diabetes Care Drugs Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Insulin Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Basal or Long Acting Insulins

- 5.1.2. Bolus or Fast Acting Insulins

- 5.1.3. Traditional Human Insulins

- 5.1.4. Biosimilar Insulins

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Type 1 Diabetes

- 5.2.2. Type 2 Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospitals

- 5.3.2. Pharmacies

- 5.3.3. Online Retailers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck And Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pfizer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sanofi Aventis

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Janssen Pharmaceuticals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eli Lilly

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novartis

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AstraZeneca

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Novo Nordisk A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Boehringer Ingelheim

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Astellas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Merck And Co

List of Figures

- Figure 1: Indonesia Insulin Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Insulin Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Insulin Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Indonesia Insulin Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Indonesia Insulin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Indonesia Insulin Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Indonesia Insulin Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Indonesia Insulin Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Indonesia Insulin Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia Insulin Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Indonesia Insulin Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Indonesia Insulin Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Indonesia Insulin Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Indonesia Insulin Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Indonesia Insulin Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Indonesia Insulin Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Indonesia Insulin Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia Insulin Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Insulin Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Indonesia Insulin Market?

Key companies in the market include Merck And Co, Pfizer, Takeda, Sanofi Aventis, Janssen Pharmaceuticals, Eli Lilly, Novartis, AstraZeneca, Bristol Myers Squibb, Novo Nordisk A/S, Boehringer Ingelheim, Astellas.

3. What are the main segments of the Indonesia Insulin Market?

The market segments include Product Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 301.55 Million as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

The Oral anti-diabetic drugs segment holds the highest market share in the Indonesia Diabetes Care Drugs Market in the current year.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: Daewoong Pharmaceutical submitted a new drug application (NDA) in Indonesia, Philippines, and Thailand, the largest markets in Southeast Asia for Envlo, the SGLT2 enzyme inhibitor type new drug for diabetes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Insulin Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Insulin Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Insulin Market?

To stay informed about further developments, trends, and reports in the Indonesia Insulin Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence