Key Insights

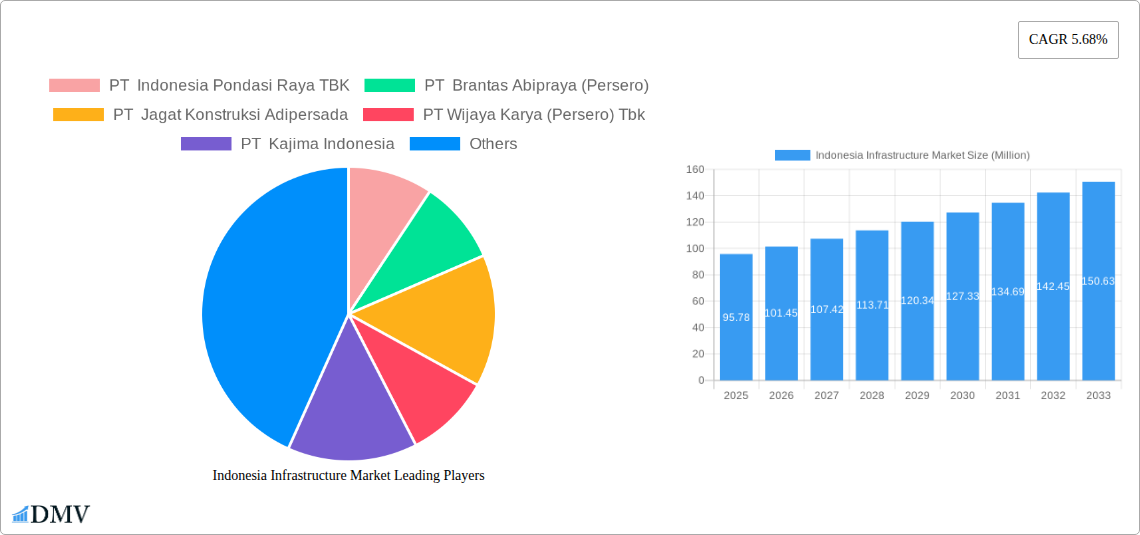

The Indonesian infrastructure market, valued at $95.78 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033. This expansion is driven by several key factors. Government initiatives focused on improving connectivity, particularly within transportation (roads, railways, ports, and airports) and utilities (electricity and water distribution), are significant catalysts. Rapid urbanization and a growing population necessitate substantial investments in social infrastructure, including housing, schools, and healthcare facilities. Furthermore, the burgeoning manufacturing sector fuels demand for robust industrial infrastructure. However, challenges remain, including securing adequate funding, navigating complex regulatory processes, and mitigating environmental concerns related to large-scale infrastructure projects. The market is segmented by infrastructure type, with transportation and utilities infrastructure likely commanding the largest shares, reflecting the government's prioritization of these sectors.

Indonesia Infrastructure Market Market Size (In Million)

Key players in the Indonesian infrastructure market include PT Indonesia Pondasi Raya TBK, PT Brantas Abipraya (Persero), PT Jagat Konstruksi Adipersada, PT Wijaya Karya (Persero) Tbk, PT Kajima Indonesia, PT Total Inti Persada, PT Hutama Karya (Persero), PT Nusantara Infrastructure Tbk, PT Jasa Marga (Persero) TBK, and PT Adhi Karya (Persero) TBK. These companies compete based on project execution capabilities, financial strength, technological expertise, and relationships with government agencies. The competitive landscape is dynamic, with opportunities for both established players and emerging firms to capitalize on the growing demand for infrastructure development. Strategic partnerships, technological advancements, and a focus on sustainable infrastructure practices will be crucial for success in this market. The forecast period suggests a consistent expansion driven by ongoing government investment and increasing private sector participation.

Indonesia Infrastructure Market Company Market Share

Indonesia Infrastructure Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesia Infrastructure Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033, representing substantial growth potential.

Indonesia Infrastructure Market Market Composition & Trends

The Indonesian infrastructure market is characterized by a moderately concentrated landscape, with several large players commanding significant market share. However, a notable number of smaller, specialized firms also contribute significantly. Market share distribution fluctuates based on project wins and government initiatives. While precise figures are unavailable for the current year, estimates based on previous years indicate that the top 5 players collectively hold approximately 40% of the market share, with the remainder distributed among numerous smaller companies. Innovation is driven by the government's focus on sustainable development and technological advancements in construction materials and project management. The regulatory landscape is evolving, aiming to improve transparency and efficiency. Substitute products are limited, with most infrastructure projects requiring specialized solutions. End-users primarily comprise government agencies, private sector companies, and public-private partnerships. M&A activity is moderate, with deal values typically ranging from xx Million to xx Million, driven by consolidation efforts and expansion strategies.

- Market Concentration: Moderately concentrated, with top 5 players holding ~40% market share.

- Innovation Catalysts: Government initiatives, sustainable development goals, technological advancements in construction.

- Regulatory Landscape: Evolving towards improved transparency and efficiency.

- Substitute Products: Limited.

- End-User Profile: Government agencies, private sector companies, and PPPs.

- M&A Activity: Moderate, deal values between xx Million and xx Million.

Indonesia Infrastructure Market Industry Evolution

The Indonesian infrastructure market has experienced significant growth in recent years, driven by sustained economic growth and government investment. Technological advancements, such as the adoption of Building Information Modeling (BIM) and digital project management tools, are improving efficiency and reducing project timelines. However, challenges remain, including skill shortages and infrastructure gaps. The market is witnessing a shift towards sustainable infrastructure projects, driven by environmental concerns and international commitments. This trend is expected to accelerate in the coming years, with increased emphasis on green building materials and renewable energy integration. The market growth trajectory shows a compound annual growth rate (CAGR) of approximately xx% from 2019 to 2024. Adoption of innovative construction technologies, while still nascent, is expected to reach xx% by 2033. Government support for infrastructure projects remains a key driving force, fostering sustained expansion.

Leading Regions, Countries, or Segments in Indonesia Infrastructure Market

The transportation infrastructure segment currently dominates the Indonesian infrastructure market, driven by substantial investment in road networks, railways, and airports. This sector's leading position stems from Indonesia's geographic characteristics, demanding efficient transportation solutions across its many islands. The government's significant financial commitment to these projects and the associated regulatory support further reinforce its prominent role. The social infrastructure segment holds considerable importance due to growing urbanization and the need for improved education, healthcare, and housing facilities. Investment trends in these areas also indicate significant growth.

- Transportation Infrastructure: Dominant segment due to government investment and geographical needs.

- Key Drivers: Government investment, regulatory support, rising urbanization, improved connectivity needs.

- Social Infrastructure: Significant growth driven by urbanization and demand for essential services.

- Key Drivers: Rising population, government focus on social development, private sector participation.

Indonesia Infrastructure Market Product Innovations

The Indonesian infrastructure market is witnessing a surge in innovative products and technologies. These innovations encompass advanced construction materials that enhance durability and sustainability, along with improved project management tools for increased efficiency. For example, the use of prefabricated components is becoming increasingly prevalent, shortening construction times and lowering costs. The integration of smart technologies, such as IoT sensors for monitoring infrastructure health, is gaining traction. This ensures proactive maintenance and extends asset lifecycles.

Propelling Factors for Indonesia Infrastructure Market Growth

Several factors contribute to the growth of the Indonesian infrastructure market. Government investment in mega-projects like the Jakarta-Bandung high-speed railway exemplifies the robust support for large-scale initiatives. Economic growth and increasing urbanization create a surge in demand for new infrastructure. Government regulations promoting sustainable practices also fuel the adoption of eco-friendly building materials and project designs.

Obstacles in the Indonesia Infrastructure Market

Land acquisition challenges, complex permitting processes, and potential supply chain disruptions can hinder project timelines and increase costs. Furthermore, competition among construction firms, particularly for large-scale projects, can impact profitability margins. The impact of these obstacles can result in cost overruns of xx Million annually.

Future Opportunities in Indonesia Infrastructure Market

The burgeoning digital economy presents significant opportunities for the development of digital infrastructure, including high-speed internet and data centers. Growing environmental awareness is creating a demand for green infrastructure solutions. The expanding middle class will drive further demand for improved housing, transportation, and utilities.

Major Players in the Indonesia Infrastructure Market Ecosystem

- PT Indonesia Pondasi Raya TBK

- PT Brantas Abipraya (Persero)

- PT Jagat Konstruksi Adipersada

- PT Wijaya Karya (Persero) Tbk

- PT Kajima Indonesia

- PT Total Inti Persada

- PT Hutama Karya (Persero)

- PT Nusantara Infrastructure Tbk

- PT Jasa Marga (Persero) TBK

- PT Adhi Karya (Persero) TBK

Key Developments in Indonesia Infrastructure Market Industry

- December 2022: JBIC and PT Pupuk Indonesia (Persero) signed an MOU to promote cooperation in hydrogen and ammonia fuel sectors, potentially driving innovation in energy infrastructure.

- April 2023: Reservoir Link Energy Bhd secured a 10-year agreement with PT Unilever Oleo Chemical Indonesia for wastewater treatment plant construction, indicating growth in the utilities infrastructure sector.

Strategic Indonesia Infrastructure Market Market Forecast

The Indonesian infrastructure market is poised for continued growth, driven by sustained government investment, economic expansion, and technological advancements. The focus on sustainable infrastructure development will shape future market dynamics. Significant investment opportunities exist in transportation, utilities, and digital infrastructure, promising lucrative returns for both domestic and international players. The market's potential extends beyond simply constructing physical infrastructure; it encompasses optimizing operations, integrating smart technologies, and fostering sustainable practices across all segments.

Indonesia Infrastructure Market Segmentation

-

1. Infrastructure Segment

- 1.1. Social Infrastructure

- 1.2. Transportation Infrastructure

- 1.3. Extraction Infrastructure

- 1.4. Manufacturing Infrastructure

- 1.5. Utilities Infrastructure

Indonesia Infrastructure Market Segmentation By Geography

- 1. Indonesia

Indonesia Infrastructure Market Regional Market Share

Geographic Coverage of Indonesia Infrastructure Market

Indonesia Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water

- 3.2.2 energy

- 3.2.3 transportation

- 3.2.4 and communications

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of quality and quantity of infrastructure

- 3.4. Market Trends

- 3.4.1. Increase in Value of Civil Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Segment

- 5.1.1. Social Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.3. Extraction Infrastructure

- 5.1.4. Manufacturing Infrastructure

- 5.1.5. Utilities Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure Segment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Indonesia Pondasi Raya TBK

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Brantas Abipraya (Persero)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Jagat Konstruksi Adipersada

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Wijaya Karya (Persero) Tbk

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Kajima Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Total Inti Persad**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Hutama Karya (Persero)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Nusantara Infrastructure Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Jasa Marga (Persero) TBK

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Adhi Karya (Persero) TBK

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PT Indonesia Pondasi Raya TBK

List of Figures

- Figure 1: Indonesia Infrastructure Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Infrastructure Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Infrastructure Market Revenue Million Forecast, by Infrastructure Segment 2020 & 2033

- Table 2: Indonesia Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Indonesia Infrastructure Market Revenue Million Forecast, by Infrastructure Segment 2020 & 2033

- Table 4: Indonesia Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Infrastructure Market?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the Indonesia Infrastructure Market?

Key companies in the market include PT Indonesia Pondasi Raya TBK, PT Brantas Abipraya (Persero), PT Jagat Konstruksi Adipersada, PT Wijaya Karya (Persero) Tbk, PT Kajima Indonesia, PT Total Inti Persad**List Not Exhaustive, PT Hutama Karya (Persero), PT Nusantara Infrastructure Tbk, PT Jasa Marga (Persero) TBK, PT Adhi Karya (Persero) TBK.

3. What are the main segments of the Indonesia Infrastructure Market?

The market segments include Infrastructure Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 95.78 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water. energy. transportation. and communications.

6. What are the notable trends driving market growth?

Increase in Value of Civil Construction.

7. Are there any restraints impacting market growth?

4.; Lack of quality and quantity of infrastructure.

8. Can you provide examples of recent developments in the market?

December 2022: The Japan Bank for International Cooperation (JBIC) signed a memorandum of understanding (MOU) with PT Pupuk Indonesia (Persero). The objectives of the MOU include promoting cooperation in sectors that use hydrogen and ammonia as fuel sources. JBIC aims to accelerate the structuring of projects for developing the supply chain of hydrogen and ammonia as a fuel source. The signing of the MOU will also promote multiple initiatives, including the Asia Zero Emissions Community (AZEC) Concept, through, for example, securing the production bases and supply chain of hydrogen and ammonia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Infrastructure Market?

To stay informed about further developments, trends, and reports in the Indonesia Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence