Key Insights

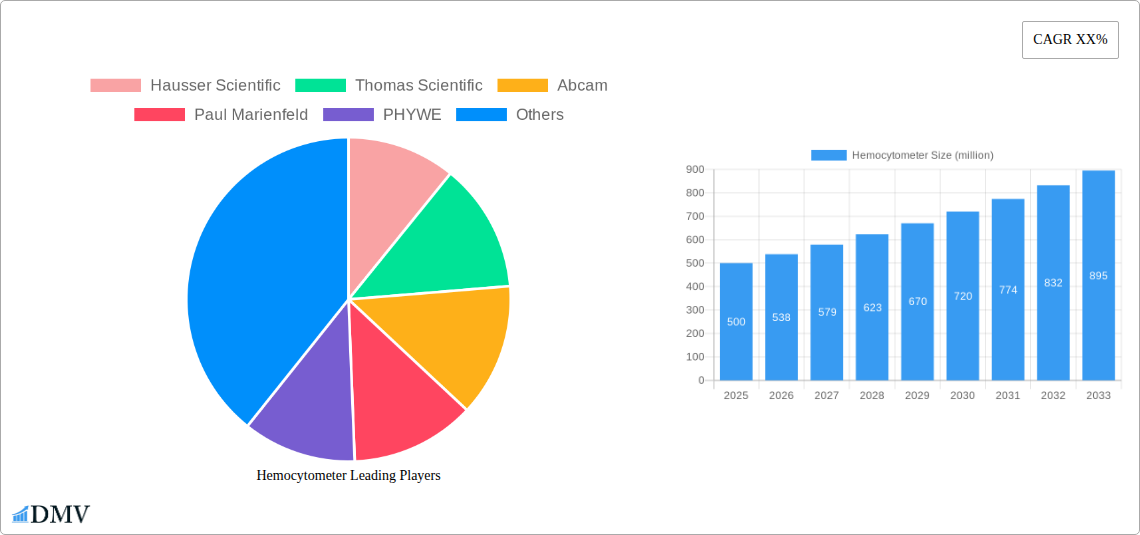

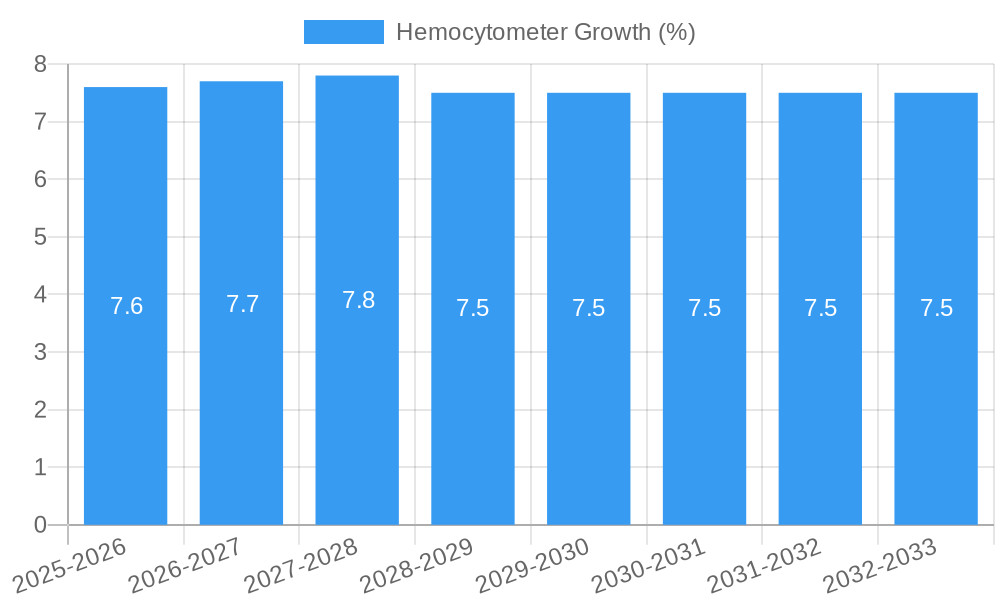

The global hemocytometer market is experiencing robust growth, projected to reach approximately $500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 7-9% anticipated over the forecast period from 2025 to 2033. This expansion is primarily fueled by the escalating demand for accurate cell counting in critical applications such as medical diagnostics, pharmaceutical research, and academic cell culture. The increasing prevalence of chronic diseases, a growing focus on personalized medicine, and advancements in biotechnology are significant drivers, necessitating precise cell enumeration for effective treatment and research. The medical sector, in particular, is a dominant segment, leveraging hemocytometers for blood cell analysis, disease diagnosis, and monitoring treatment efficacy. Furthermore, the surge in biopharmaceutical research and development activities, including drug discovery and vaccine production, is creating substantial opportunities for market players.

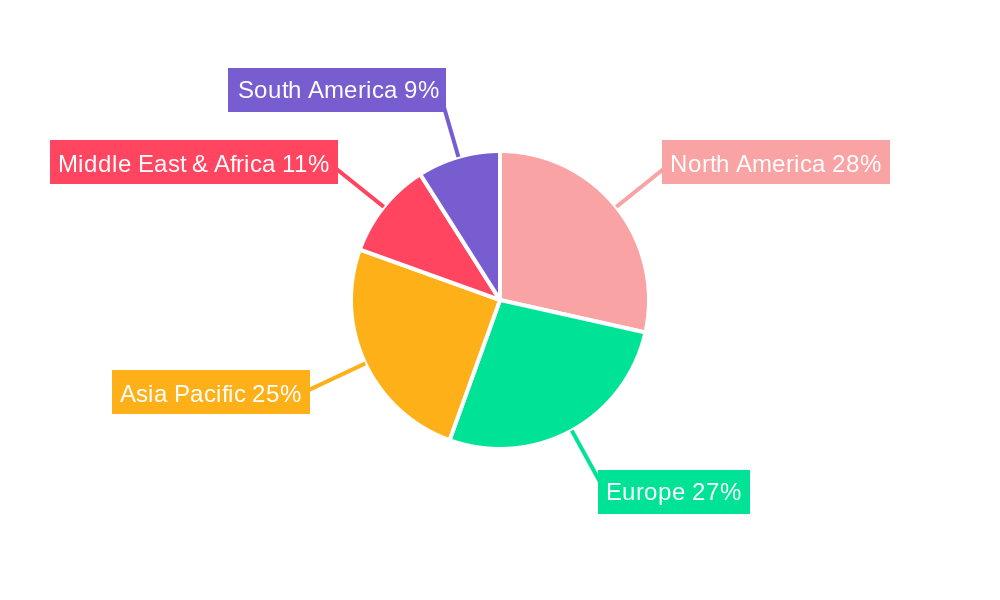

The market is characterized by evolving trends, with a notable shift towards disposable hemocytometers due to their convenience, reduced risk of cross-contamination, and improved workflow efficiency in high-throughput laboratories. However, reusable hemocytometers continue to hold their ground, particularly in academic settings and for specific research protocols where cost-effectiveness and established methodologies are prioritized. Geographically, the Asia Pacific region is emerging as a high-growth area, driven by increasing healthcare investments, expanding research infrastructure, and a rising number of contract research organizations (CROs) in countries like China and India. While the market demonstrates strong growth potential, restraints such as the high initial cost of sophisticated automated cell counting devices and the stringent regulatory requirements for medical devices could pose challenges. Nonetheless, ongoing innovation in hemocytometer design, material science, and integration with digital technologies is expected to further propel market growth.

Hemocytometer Market Composition & Trends

This comprehensive Hemocytometer market report delves into the intricate dynamics shaping the global landscape, offering deep insights into market concentration, innovation catalysts, and the evolving regulatory frameworks. We analyze the competitive intensity, identifying key players and their market share distribution. The study meticulously evaluates substitute products, assessing their impact on Hemocytometer adoption and exploring the diverse end-user profiles across critical segments such as Medical, Cell Culture, and Other applications. Mergers and Acquisitions (M&A) activities are a significant theme, with an estimated deal value of over XXX million USD, showcasing strategic consolidations and expansions within the industry. The report uncovers the underlying trends that are influencing market evolution, from technological advancements driving the adoption of disposable and reusable hemocytometers to shifts in research methodologies.

- Market Share Distribution: Detailed analysis of leading companies' market share, providing quantifiable insights into competitive positioning.

- M&A Deal Values: Estimated over XXX million USD, underscoring strategic consolidation and investment.

- Innovation Catalysts: Identification of key technologies and research trends propelling new product development.

- Regulatory Landscapes: Examination of evolving regulations impacting manufacturing, quality control, and market entry.

- Substitute Products: Assessment of emerging alternatives and their competitive threat to traditional hemocytometer solutions.

- End-User Profiles: Comprehensive breakdown of user segments and their specific needs and purchasing behaviors.

Hemocytometer Industry Evolution

The Hemocytometer industry has witnessed a remarkable evolutionary trajectory, marked by consistent growth and significant technological advancements during the study period of 2019–2033, with a base year of 2025. The market growth trajectory has been predominantly upward, fueled by increasing research and development activities across the globe, particularly in the biomedical and pharmaceutical sectors. Adoption metrics reveal a steady rise in the utilization of hemocytometers for cell counting and viability assessment, critical for drug discovery, diagnostics, and fundamental biological research. Technological advancements have played a pivotal role, moving from traditional glass slides to sophisticated disposable hemocytometers offering enhanced convenience and reduced contamination risk, alongside improvements in reusable hemocytometer designs for durability and precision. Consumer demand has shifted towards solutions that offer higher throughput, improved accuracy, and greater cost-effectiveness. The Hemocytometer market is projected to experience a compound annual growth rate (CAGR) of approximately XX% between 2025 and 2033. This growth is underpinned by the increasing prevalence of chronic diseases, the burgeoning biopharmaceutical industry, and a growing emphasis on personalized medicine, all of which necessitate accurate and reliable cell enumeration. The integration of automation and digital imaging technologies into hemocytometer workflows is further enhancing their appeal and efficiency, driving market expansion. Historical data from 2019–2024 indicates a strong foundation for this projected growth, with steady year-on-year increases in market value, estimated to be in the range of XXX million USD to XXX million USD.

Leading Regions, Countries, or Segments in Hemocytometer

North America currently stands as the dominant region in the Hemocytometer market, exhibiting robust growth and significant adoption rates across its key segments. This dominance is primarily attributed to a confluence of factors, including a well-established and heavily funded healthcare and biotechnology research infrastructure, a high concentration of leading pharmaceutical and diagnostic companies, and proactive government initiatives supporting life sciences research. The United States, in particular, represents a powerhouse within this region, characterized by substantial investments in cell-based assays, stem cell research, and cancer diagnostics, all of which rely heavily on accurate cell counting.

Within the Application segment, the Medical application holds the leading position, driven by the critical need for precise cell enumeration in diagnostics, prognostics, and therapeutic monitoring. This includes applications in blood cell counting for various hematological disorders, enumeration of cells in cerebrospinal fluid, and other diagnostic tests. The Cell Culture segment also demonstrates substantial influence, as it is fundamental to biotechnology research, drug development, and the production of biologics. Academic institutions, contract research organizations (CROs), and biopharmaceutical companies are significant end-users in this domain.

Analyzing by Types, the Disposable Haemocytometer segment is experiencing rapid expansion. This growth is fueled by the increasing demand for convenience, reduced risk of cross-contamination, and the desire for streamlined laboratory workflows. While Reusable Hemocytometers continue to be essential for applications requiring repeated high-precision measurements and cost-effectiveness over the long term, the market share of disposable variants is steadily increasing.

Key Drivers in North America:

- High R&D Expenditure: Significant investment in pharmaceutical research, biotechnology, and academic life sciences.

- Prevalence of Chronic Diseases: Increasing demand for diagnostic testing, including cell counting.

- Technological Advancements: Early adoption of innovative hemocytometer technologies.

- Favorable Regulatory Environment: Supportive policies for life science industries.

Dominance Factors for Medical Application:

- Essential Diagnostic Tool: Indispensable for a wide range of medical tests.

- Growing Healthcare Sector: Expansion of healthcare services globally.

- Advancements in Disease Diagnosis: Improved understanding of cellular biomarkers.

Growth of Disposable Haemocytometers:

- Enhanced Convenience and Efficiency: Reduced preparation time and workflow simplification.

- Infection Control Measures: Minimizing contamination risks in clinical settings.

- Cost-Effectiveness in High-Throughput Labs: Particularly for single-use scenarios.

Hemocytometer Product Innovations

Hemocytometer product innovation is actively transforming laboratory practices. Leading manufacturers are focusing on developing enhanced optical clarity and precision in reusable hemocytometers, utilizing advanced materials and manufacturing techniques for greater durability and accuracy, with an estimated improvement in precision by XX%. Disposable hemocytometers are seeing advancements in integrated features, such as pre-loaded counting chambers and enhanced fluidic designs for more consistent sample loading and reduced user error, aiming for a XX% reduction in variability. Innovations also include the integration of digital imaging capabilities, allowing for automated counting and analysis, thereby reducing manual labor and potential for human error by an estimated XX%. These advancements contribute to higher throughput, improved data reliability, and a more efficient workflow, making them indispensable tools in modern cell biology and clinical diagnostics.

Propelling Factors for Hemocytometer Growth

The Hemocytometer market is propelled by several critical factors. Firstly, the escalating global demand for cell-based research and diagnostics in fields like drug discovery, personalized medicine, and stem cell therapy is a major driver. Secondly, continuous technological advancements are leading to the development of more accurate, efficient, and user-friendly hemocytometers, including automated and digital solutions. Thirdly, the increasing prevalence of diseases and the growing focus on early diagnosis and prognosis further fuel the demand for reliable cell counting tools. Finally, supportive government initiatives and funding for life sciences research across various nations create a conducive environment for market expansion, with investments in research infrastructure projected to exceed XXX million USD.

Obstacles in the Hemocytometer Market

Despite robust growth, the Hemocytometer market faces several obstacles. Stringent regulatory approvals for new hemocytometer devices and technologies can be a time-consuming and costly process, potentially slowing down market entry. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of raw materials and finished products, leading to price volatility and potential shortages. Furthermore, the increasing competition from advanced automated cell counters and flow cytometry techniques poses a threat, especially in high-throughput research settings where speed and automation are paramount. The cost of high-precision reusable hemocytometers can also be a barrier for smaller research institutions or developing economies.

Future Opportunities in Hemocytometer

The future of the Hemocytometer market presents exciting opportunities. The burgeoning field of regenerative medicine and cell-based therapies necessitates highly accurate and reliable cell enumeration, creating a significant demand for advanced hemocytometers. The development of microfluidic-based hemocytometers offers potential for miniaturization, portability, and integration with other diagnostic platforms, opening new application avenues. Furthermore, the increasing adoption of digital pathology and AI-driven image analysis presents an opportunity to integrate hemocytometer data with advanced analytics for more comprehensive insights. Emerging economies with growing healthcare investments also represent untapped markets for both disposable and reusable hemocytometers.

Major Players in the Hemocytometer Ecosystem

- Hausser Scientific

- Thomas Scientific

- Abcam

- Paul Marienfeld

- PHYWE

- Innovatek Medical

- BRAND GMBH

Key Developments in Hemocytometer Industry

- 2023 Q4: Launch of a new generation of ultra-precise reusable hemocytometers with enhanced anti-fog coatings, improving visibility and accuracy by XX%.

- 2023 Q3: Abcam announces strategic partnership to develop novel disposable hemocytometer designs for rapid point-of-care diagnostics.

- 2022 Q2: Hausser Scientific introduces an integrated digital imaging module for their popular hemocytometer range, enabling automated cell counting and data management.

- 2021 Q1: BRAND GMBH expands its manufacturing capacity for disposable hemocytometers to meet rising global demand, with production increasing by XX%.

- 2020 Q4: Thomas Scientific reports significant growth in its distribution of hemocytometers to emerging research hubs in Asia.

- 2019 Q1: PHYWE showcases a prototype of a portable, battery-operated hemocytometer for field research applications.

Strategic Hemocytometer Market Forecast

The strategic Hemocytometer market forecast indicates sustained growth driven by innovation and expanding applications. The increasing demand from the medical and cell culture sectors, coupled with technological advancements in both disposable and reusable hemocytometers, will continue to fuel market expansion. The integration of digital technologies and the emergence of new therapeutic areas like regenerative medicine present significant opportunities. Strategic investments in research and development by leading players like Hausser Scientific, Thomas Scientific, Abcam, Paul Marienfeld, PHYWE, Innovatek Medical, and BRAND GMBH will further shape the market's future, ensuring the hemocytometer remains a vital tool in scientific and clinical practice. The overall market value is projected to reach over XXX million USD by 2033.

Hemocytometer Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Cell Culture

- 1.3. Other

-

2. Types

- 2.1. Disposable Haemocytometer

- 2.2. Reusable Hemocytometer

Hemocytometer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hemocytometer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hemocytometer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Cell Culture

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Disposable Haemocytometer

- 5.2.2. Reusable Hemocytometer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hemocytometer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. Cell Culture

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Disposable Haemocytometer

- 6.2.2. Reusable Hemocytometer

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hemocytometer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. Cell Culture

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Disposable Haemocytometer

- 7.2.2. Reusable Hemocytometer

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hemocytometer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. Cell Culture

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Disposable Haemocytometer

- 8.2.2. Reusable Hemocytometer

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hemocytometer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. Cell Culture

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Disposable Haemocytometer

- 9.2.2. Reusable Hemocytometer

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hemocytometer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. Cell Culture

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Disposable Haemocytometer

- 10.2.2. Reusable Hemocytometer

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hausser Scientific

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thomas Scientific

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Abcam

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Paul Marienfeld

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PHYWE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Innovatek Medical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BRAND GMBH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Hausser Scientific

List of Figures

- Figure 1: Global Hemocytometer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hemocytometer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hemocytometer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hemocytometer Revenue (million), by Types 2024 & 2032

- Figure 5: North America Hemocytometer Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Hemocytometer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hemocytometer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hemocytometer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hemocytometer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hemocytometer Revenue (million), by Types 2024 & 2032

- Figure 11: South America Hemocytometer Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Hemocytometer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hemocytometer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hemocytometer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hemocytometer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hemocytometer Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Hemocytometer Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Hemocytometer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hemocytometer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hemocytometer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hemocytometer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hemocytometer Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Hemocytometer Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Hemocytometer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hemocytometer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hemocytometer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hemocytometer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hemocytometer Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Hemocytometer Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Hemocytometer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hemocytometer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hemocytometer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hemocytometer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hemocytometer Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Hemocytometer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hemocytometer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hemocytometer Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Hemocytometer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hemocytometer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hemocytometer Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Hemocytometer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hemocytometer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hemocytometer Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Hemocytometer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hemocytometer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hemocytometer Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Hemocytometer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hemocytometer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hemocytometer Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Hemocytometer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hemocytometer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hemocytometer?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Hemocytometer?

Key companies in the market include Hausser Scientific, Thomas Scientific, Abcam, Paul Marienfeld, PHYWE, Innovatek Medical, BRAND GMBH.

3. What are the main segments of the Hemocytometer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hemocytometer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hemocytometer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hemocytometer?

To stay informed about further developments, trends, and reports in the Hemocytometer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence