Key Insights

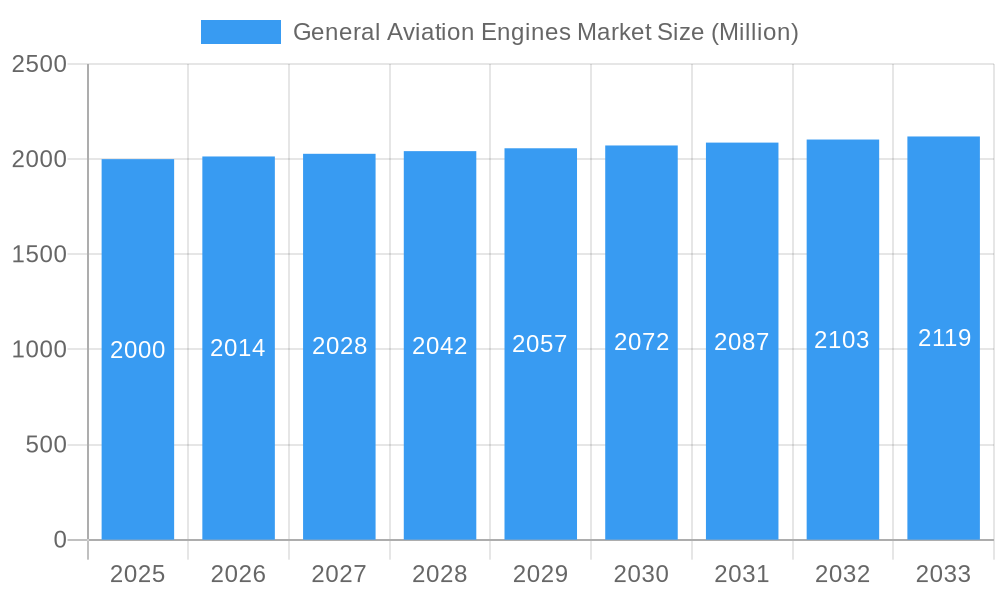

The General Aviation Engines market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven primarily by the increasing demand for general aviation aircraft for various applications, including business travel, flight training, and recreational flying. This growth is further fueled by technological advancements leading to the development of more fuel-efficient and environmentally friendly engines, as well as increasing investments in infrastructure supporting general aviation. The market is segmented by aircraft engine type (fixed-wing and rotorcraft) and key players are strategically focusing on innovation and partnerships to expand their market share. North America currently holds a significant portion of the market due to a large existing fleet and robust general aviation infrastructure. However, emerging markets in Asia-Pacific are poised for significant growth in the coming years, fueled by expanding economies and increasing air travel demand. While the overall CAGR of 0.69% suggests moderate growth, specific segments, such as advanced piston engines or those incorporating hybrid-electric technology, may exhibit higher growth rates. The market faces certain restraints, including fluctuating fuel prices, regulatory hurdles, and economic conditions that can impact investment in new aircraft and engine upgrades.

General Aviation Engines Market Market Size (In Billion)

Despite these restraints, the long-term outlook for the General Aviation Engines market remains positive. The continued development of lighter, more efficient engines, coupled with the rising popularity of general aviation, suggests a sustained growth trajectory over the forecast period (2025-2033). The major players, including Honeywell, Pratt & Whitney, Safran, and Rolls-Royce, are expected to remain key competitors, focusing on product differentiation and expansion into new geographical markets. This competitive landscape will likely drive innovation and further enhance the overall market performance. The consistent expansion of the general aviation sector and its supporting infrastructure across various regions will continue to drive demand for reliable and efficient engines, contributing to the market's healthy progression throughout the forecast period.

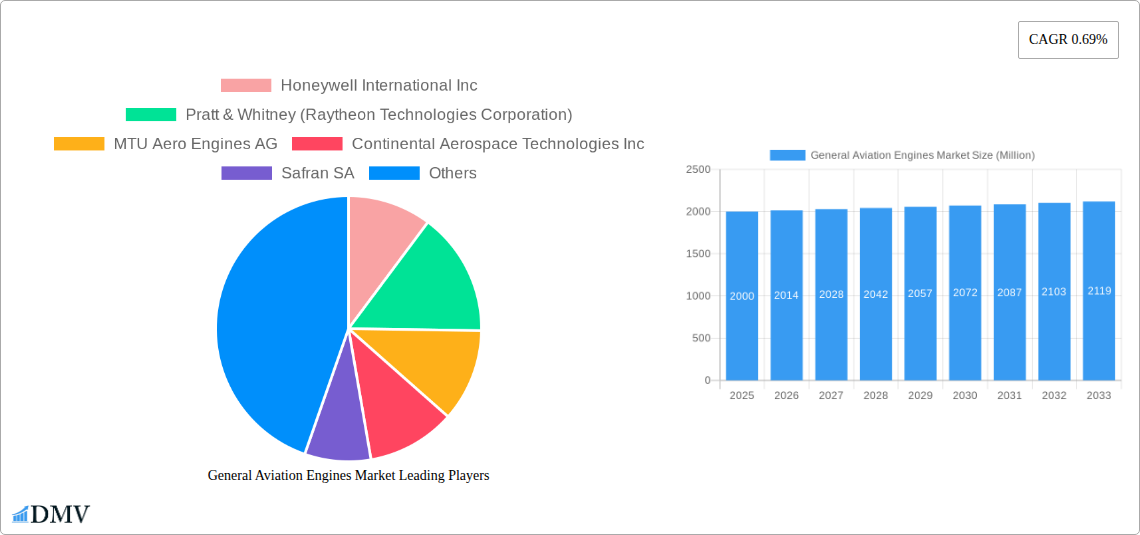

General Aviation Engines Market Company Market Share

General Aviation Engines Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the General Aviation Engines Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects from 2019 to 2033. With a focus on key segments like fixed-wing and rotorcraft engines, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic industry. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

General Aviation Engines Market Composition & Trends

The General Aviation Engines market is characterized by a moderately concentrated landscape, with key players like Honeywell International Inc, Pratt & Whitney (Raytheon Technologies Corporation), and Safran SA holding significant market share. However, the presence of several regional and specialized players fosters competition and innovation. The market's growth is propelled by increasing demand for general aviation aircraft, particularly in emerging economies, along with technological advancements in engine efficiency and sustainability.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025.

- Innovation Catalysts: Stringent emission regulations and the drive for fuel efficiency are driving innovation in lightweight, fuel-efficient engine designs and the adoption of sustainable aviation fuels (SAF).

- Regulatory Landscape: International and regional regulations regarding emissions and noise pollution significantly impact engine design and adoption.

- Substitute Products: While limited, alternative propulsion systems like electric and hybrid-electric engines pose a potential long-term threat.

- End-User Profiles: The primary end-users include general aviation operators, commercial flight schools, air taxi services, and government agencies.

- M&A Activities: The past five years have seen xx Million in M&A activity, primarily focused on consolidating smaller engine manufacturers and securing technological expertise. Examples include [insert specific examples if available, otherwise omit].

General Aviation Engines Market Industry Evolution

The General Aviation Engines market has witnessed robust growth over the past five years, driven by increasing demand from both developed and developing nations. Technological advancements, including the introduction of more fuel-efficient and quieter engines, have been a significant driver. Growth rates have averaged approximately xx% annually during the historical period (2019-2024), with a projected slowdown to xx% annually during the forecast period (2025-2033) due to market saturation in certain segments. This deceleration, however, is countered by the burgeoning market for sustainable aviation fuels and the continued expansion of the general aviation fleet in emerging markets. The shift in consumer demand is towards increased efficiency, reduced maintenance costs, and environmentally friendly operations. Adoption of advanced materials and digital technologies for engine health monitoring is also gaining traction, improving operational efficiency and reducing downtime.

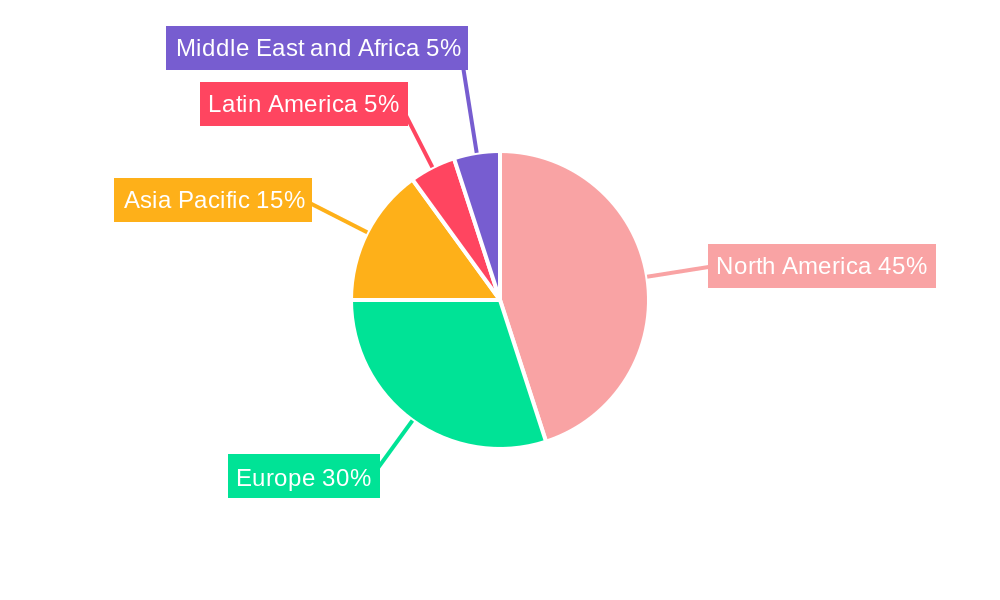

Leading Regions, Countries, or Segments in General Aviation Engines Market

The North American region currently dominates the General Aviation Engines market, driven by a large and established general aviation fleet, strong regulatory support for industry growth, and significant investments in research and development. However, the Asia-Pacific region is projected to exhibit the highest growth rate during the forecast period due to increasing demand for air travel and the expansion of general aviation infrastructure.

- Fixed-wing Aircraft Engines: This segment constitutes a larger market share due to the high demand for single and twin-engine piston aircraft and turboprop aircraft. Key growth drivers include increasing private and commercial flight activities and robust investments in flight training institutions.

- Rotorcraft Engines: While a smaller segment compared to fixed-wing, the rotorcraft engine market shows promising growth, driven by increasing demand from emergency medical services, law enforcement, and offshore transportation sectors.

- Dominance Factors: North America's dominance stems from a mature general aviation industry, substantial R&D spending, and a strong regulatory framework. The Asia-Pacific region's growth trajectory is fueled by rapid economic expansion and burgeoning tourism. Europe maintains a significant presence due to its strong aerospace industry and commitment to sustainability.

General Aviation Engines Market Product Innovations

Recent product innovations focus on enhanced fuel efficiency, reduced emissions, and improved reliability. Advanced materials, such as lighter alloys and composites, are being integrated into engine designs to improve performance and reduce weight. The incorporation of advanced sensors and data analytics enables real-time monitoring of engine health, optimizing maintenance schedules and minimizing downtime. This leads to improved operational efficiency and cost savings for operators. Specific innovations include the use of more efficient combustion chambers and the development of hybrid-electric propulsion systems that are currently under research and development.

Propelling Factors for General Aviation Engines Market Growth

Several factors are propelling the growth of the general aviation engines market. Technological advancements, particularly in engine efficiency and reduced emissions, are key drivers. The increasing demand for general aviation aircraft, especially in emerging economies, contributes to market expansion. Furthermore, favorable government policies and initiatives promoting general aviation development further stimulate growth. Examples include tax incentives for aircraft purchases and investments in airport infrastructure.

Obstacles in the General Aviation Engines Market

The General Aviation Engines market faces several challenges. Stringent emission regulations impose significant design constraints and increase development costs. Supply chain disruptions, particularly the availability of raw materials and specialized components, can impact production and delivery timelines. Intense competition from established and emerging players creates price pressures and necessitates continuous innovation to maintain a competitive edge.

Future Opportunities in General Aviation Engines Market

Significant opportunities exist in the General Aviation Engines market. The growing demand for sustainable aviation fuels (SAF) presents a substantial market opportunity for engine manufacturers to develop and adapt engines for SAF compatibility. The development of hybrid-electric and fully electric propulsion systems holds the potential to revolutionize the industry. Expansion into emerging markets, particularly in Asia and Africa, offers significant growth potential.

Major Players in the General Aviation Engines Market Ecosystem

- Honeywell International Inc

- Pratt & Whitney (Raytheon Technologies Corporation)

- MTU Aero Engines AG

- Continental Aerospace Technologies Inc

- Safran SA

- Williams International Co L L C

- Rolls-Royce plc

- General Electric Company

- IHI Corporation

- United Engine Corporation (Rostec)

Key Developments in General Aviation Engines Market Industry

- July 2022: Textron Aviation Special Missions introduced the Cessna Citation Longitude marine patrol aircraft, powered by a Honeywell HTF7700L Turbofan engine, highlighting the continued demand for high-performance turbofan engines in specialized applications.

- February 2022: Safran Helicopter Engines' MoU with ST Engineering to study sustainable aviation fuel (SAF) in helicopter engines signifies the industry's commitment to environmental sustainability and the potential for market expansion with SAF adoption.

- February 2022: Embraer, Wideroe, and Rolls-Royce's research partnership focusing on zero-emissions aircraft demonstrates a proactive approach to addressing future environmental regulations and the potential for disruptive technological advancements.

Strategic General Aviation Engines Market Forecast

The General Aviation Engines market is poised for continued growth, driven by technological advancements, increasing demand, and the transition towards sustainable aviation. The focus on fuel efficiency, reduced emissions, and advanced engine monitoring systems will shape future market trends. The adoption of SAF and the potential development of electric propulsion systems will create significant opportunities for innovation and growth in the coming decade. The market is expected to experience a compounded annual growth rate (CAGR) of xx% during the forecast period, driven by strong demand from emerging markets and a growing focus on sustainability within the general aviation sector.

General Aviation Engines Market Segmentation

-

1. Aircraft Engine Type

-

1.1. Fixed-wing Aircraft Engine

- 1.1.1. Turbofan

- 1.1.2. Turboprop

- 1.1.3. Piston

-

1.2. Rotorcraft Engine

- 1.2.1. Turbine

-

1.1. Fixed-wing Aircraft Engine

General Aviation Engines Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

General Aviation Engines Market Regional Market Share

Geographic Coverage of General Aviation Engines Market

General Aviation Engines Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Fixed-wing Aircraft Engines to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global General Aviation Engines Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 5.1.1. Fixed-wing Aircraft Engine

- 5.1.1.1. Turbofan

- 5.1.1.2. Turboprop

- 5.1.1.3. Piston

- 5.1.2. Rotorcraft Engine

- 5.1.2.1. Turbine

- 5.1.1. Fixed-wing Aircraft Engine

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 6. North America General Aviation Engines Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 6.1.1. Fixed-wing Aircraft Engine

- 6.1.1.1. Turbofan

- 6.1.1.2. Turboprop

- 6.1.1.3. Piston

- 6.1.2. Rotorcraft Engine

- 6.1.2.1. Turbine

- 6.1.1. Fixed-wing Aircraft Engine

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 7. Europe General Aviation Engines Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 7.1.1. Fixed-wing Aircraft Engine

- 7.1.1.1. Turbofan

- 7.1.1.2. Turboprop

- 7.1.1.3. Piston

- 7.1.2. Rotorcraft Engine

- 7.1.2.1. Turbine

- 7.1.1. Fixed-wing Aircraft Engine

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 8. Asia Pacific General Aviation Engines Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 8.1.1. Fixed-wing Aircraft Engine

- 8.1.1.1. Turbofan

- 8.1.1.2. Turboprop

- 8.1.1.3. Piston

- 8.1.2. Rotorcraft Engine

- 8.1.2.1. Turbine

- 8.1.1. Fixed-wing Aircraft Engine

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 9. Latin America General Aviation Engines Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 9.1.1. Fixed-wing Aircraft Engine

- 9.1.1.1. Turbofan

- 9.1.1.2. Turboprop

- 9.1.1.3. Piston

- 9.1.2. Rotorcraft Engine

- 9.1.2.1. Turbine

- 9.1.1. Fixed-wing Aircraft Engine

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 10. Middle East and Africa General Aviation Engines Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 10.1.1. Fixed-wing Aircraft Engine

- 10.1.1.1. Turbofan

- 10.1.1.2. Turboprop

- 10.1.1.3. Piston

- 10.1.2. Rotorcraft Engine

- 10.1.2.1. Turbine

- 10.1.1. Fixed-wing Aircraft Engine

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Engine Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pratt & Whitney (Raytheon Technologies Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MTU Aero Engines AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Continental Aerospace Technologies Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Safran SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Williams International Co L L C

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rolls-Royce plc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Electric Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IHI Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 United Engine Corporation (Rostec)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global General Aviation Engines Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America General Aviation Engines Market Revenue (Million), by Aircraft Engine Type 2025 & 2033

- Figure 3: North America General Aviation Engines Market Revenue Share (%), by Aircraft Engine Type 2025 & 2033

- Figure 4: North America General Aviation Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America General Aviation Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe General Aviation Engines Market Revenue (Million), by Aircraft Engine Type 2025 & 2033

- Figure 7: Europe General Aviation Engines Market Revenue Share (%), by Aircraft Engine Type 2025 & 2033

- Figure 8: Europe General Aviation Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe General Aviation Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific General Aviation Engines Market Revenue (Million), by Aircraft Engine Type 2025 & 2033

- Figure 11: Asia Pacific General Aviation Engines Market Revenue Share (%), by Aircraft Engine Type 2025 & 2033

- Figure 12: Asia Pacific General Aviation Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific General Aviation Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America General Aviation Engines Market Revenue (Million), by Aircraft Engine Type 2025 & 2033

- Figure 15: Latin America General Aviation Engines Market Revenue Share (%), by Aircraft Engine Type 2025 & 2033

- Figure 16: Latin America General Aviation Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America General Aviation Engines Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa General Aviation Engines Market Revenue (Million), by Aircraft Engine Type 2025 & 2033

- Figure 19: Middle East and Africa General Aviation Engines Market Revenue Share (%), by Aircraft Engine Type 2025 & 2033

- Figure 20: Middle East and Africa General Aviation Engines Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa General Aviation Engines Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global General Aviation Engines Market Revenue Million Forecast, by Aircraft Engine Type 2020 & 2033

- Table 2: Global General Aviation Engines Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global General Aviation Engines Market Revenue Million Forecast, by Aircraft Engine Type 2020 & 2033

- Table 4: Global General Aviation Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global General Aviation Engines Market Revenue Million Forecast, by Aircraft Engine Type 2020 & 2033

- Table 8: Global General Aviation Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: France General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global General Aviation Engines Market Revenue Million Forecast, by Aircraft Engine Type 2020 & 2033

- Table 15: Global General Aviation Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Asia Pacific General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global General Aviation Engines Market Revenue Million Forecast, by Aircraft Engine Type 2020 & 2033

- Table 22: Global General Aviation Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Brazil General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Latin America General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global General Aviation Engines Market Revenue Million Forecast, by Aircraft Engine Type 2020 & 2033

- Table 26: Global General Aviation Engines Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: United Arab Emirates General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Saudi Arabia General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Middle East and Africa General Aviation Engines Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the General Aviation Engines Market?

The projected CAGR is approximately 0.69%.

2. Which companies are prominent players in the General Aviation Engines Market?

Key companies in the market include Honeywell International Inc, Pratt & Whitney (Raytheon Technologies Corporation), MTU Aero Engines AG, Continental Aerospace Technologies Inc, Safran SA, Williams International Co L L C, Rolls-Royce plc, General Electric Company, IHI Corporation, United Engine Corporation (Rostec).

3. What are the main segments of the General Aviation Engines Market?

The market segments include Aircraft Engine Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Fixed-wing Aircraft Engines to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: Textron Aviation Special Missions introduced the Cessna Citation longitude marine patrol aircraft, which is powered by a Honeywell HTF7700L Turbofan engine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "General Aviation Engines Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the General Aviation Engines Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the General Aviation Engines Market?

To stay informed about further developments, trends, and reports in the General Aviation Engines Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence