Key Insights

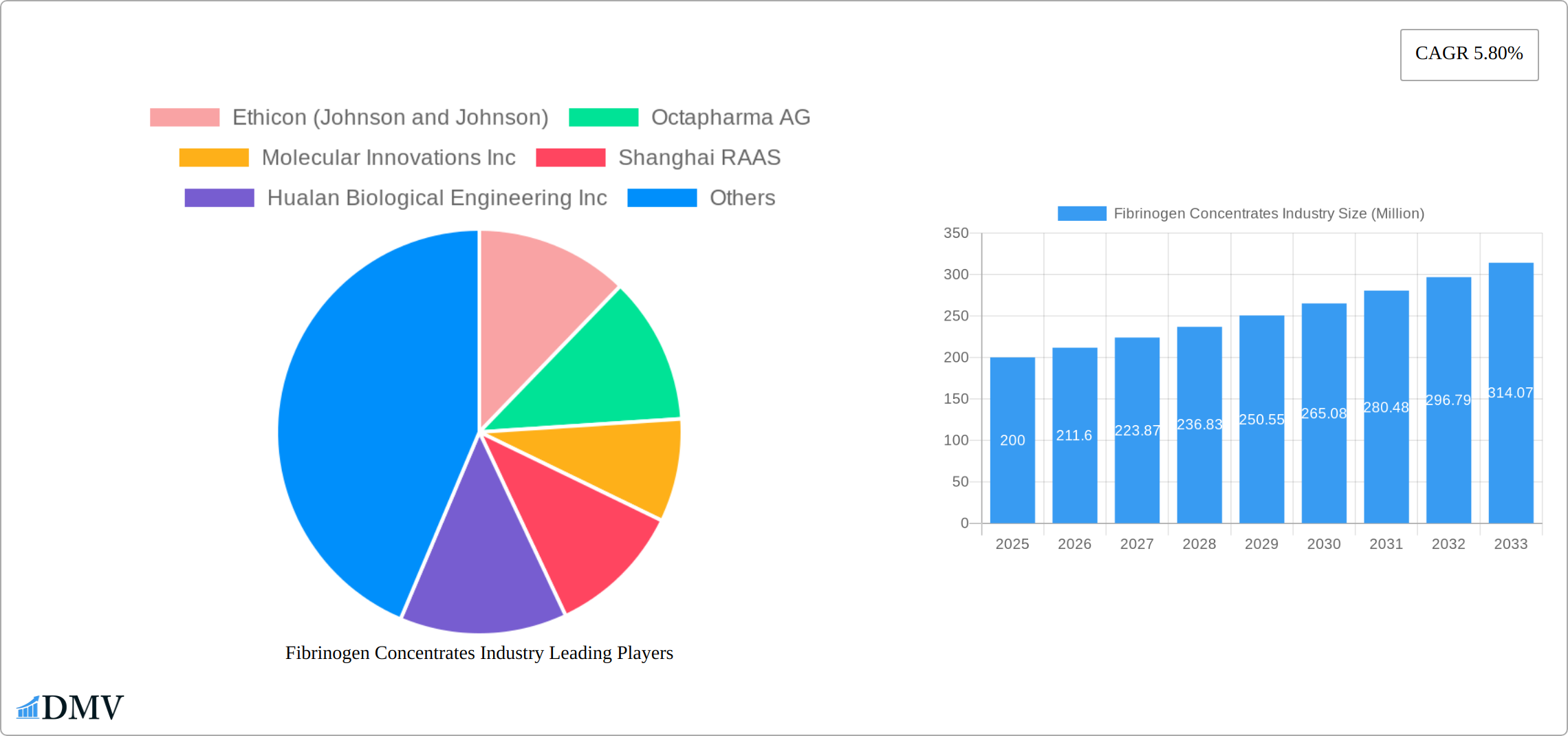

The Fibrinogen Concentrates market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.80% from 2025 to 2033. This expansion is fueled by several key factors. Increasing prevalence of congenital fibrinogen deficiencies, coupled with a rising number of surgical procedures requiring fibrinogen supplementation, significantly contributes to market demand. Advancements in manufacturing technologies are leading to the development of safer and more effective fibrinogen concentrates, further bolstering market growth. Moreover, the growing awareness among healthcare professionals regarding the benefits of fibrinogen concentrates in managing bleeding complications is driving adoption across various healthcare settings. Geographical expansion, particularly in emerging economies with expanding healthcare infrastructures, also presents significant opportunities for market growth. However, challenges such as the high cost of fibrinogen concentrates and stringent regulatory approvals can potentially restrain market expansion.

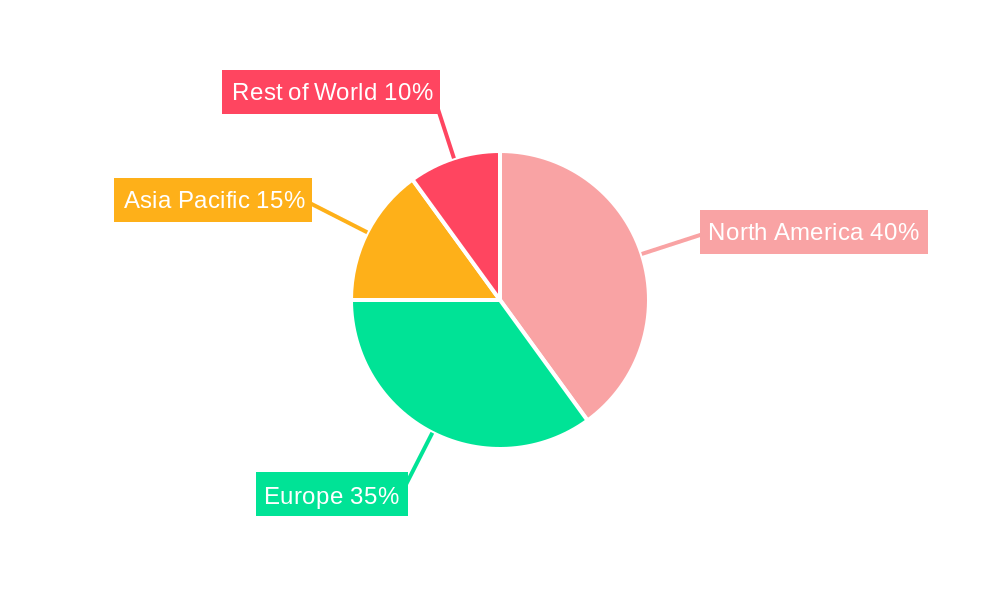

Competitive dynamics within the fibrinogen concentrates market are shaped by the presence of both established pharmaceutical giants like Ethicon (Johnson & Johnson), Octapharma AG, and Baxter International Inc., and specialized biotechnology companies such as Molecular Innovations Inc. and Hualan Biological Engineering Inc. These companies are engaged in continuous research and development to enhance product efficacy and safety, leading to a competitive landscape focused on innovation and product differentiation. The market is segmented by indication (congenital fibrinogen deficiency, surgical procedures) and geography, with North America and Europe currently dominating market share. However, the Asia-Pacific region is anticipated to show considerable growth potential in the coming years due to increasing healthcare spending and a rising prevalence of target conditions. Future market trends will likely include a focus on personalized medicine approaches, the development of novel fibrinogen concentrate formulations, and the exploration of biosimilars to address cost-related challenges.

Fibrinogen Concentrates Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Fibrinogen Concentrates industry, offering a comprehensive overview of market dynamics, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and an estimated year of 2025. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. This report is essential for stakeholders seeking to understand this evolving market and make informed strategic decisions. The global market size in 2025 is estimated at $XX Million.

Fibrinogen Concentrates Industry Market Composition & Trends

The fibrinogen concentrates market demonstrates a moderately concentrated structure, dominated by key players such as Ethicon (Johnson & Johnson), Octapharma AG, and CSL Behring, who collectively hold a substantial market share. The precise distribution, however, is dynamic and varies considerably across geographical regions and specific market segments. Our estimations suggest that the top five companies control approximately 60% of the global market as of 2025. This concentrated landscape is largely attributed to the stringent regulatory hurdles for new market entrants and the substantial capital investment demanded for research and development activities.

Innovation serves as a pivotal growth driver, with ongoing research and development efforts focused on creating novel fibrinogen concentrates boasting enhanced efficacy and superior safety profiles. Regulatory frameworks exhibit significant variability across different geographical markets, thereby influencing market access strategies and product approval timelines. While limited, the availability of substitute products exerts an undeniable influence on pricing dynamics and overall market competition. The primary end-users of fibrinogen concentrates encompass hospitals, surgical centers, and blood banks, with demand primarily fueled by the escalating prevalence of surgical procedures and a growing incidence of bleeding disorders. This demand is further amplified by the increasing aging global population and the resulting increase in age-related bleeding disorders.

Mergers and acquisitions (M&A) activity within the sector has maintained a moderate pace in recent years, with transaction values ranging from $XX Million to $XX Million. While precise figures for smaller transactions often remain undisclosed, larger acquisitions and strategic partnerships clearly reflect the ongoing consolidation trend within the industry. This consolidation is expected to continue, further shaping the competitive landscape.

- Market Concentration: Top 5 players control approximately 60% of the market in 2025, indicating significant market concentration.

- Innovation: Continuous focus on improving efficacy, safety, and ease of administration through advanced formulations and delivery systems.

- Regulatory Landscape: Stringent and geographically diverse regulations present both challenges and opportunities for market access.

- Substitute Products: The presence of limited alternatives influences pricing strategies and the intensity of competition.

- End-Users: Hospitals, surgical centers, and blood banks remain the primary consumers, driven by increasing surgical procedures and bleeding disorders.

- M&A Activity: Moderate yet impactful M&A activity signals ongoing industry consolidation and strategic positioning.

Fibrinogen Concentrates Industry Industry Evolution

The fibrinogen concentrates market has exhibited consistent growth throughout the historical period (2019-2024), primarily driven by the rising number of surgical procedures and a heightened understanding of both congenital and acquired fibrinogen deficiencies. The compound annual growth rate (CAGR) during this period is estimated at XX%. Significant technological advancements, particularly in purification and formulation techniques, have resulted in safer and more efficacious products. This positive trajectory is projected to continue, with a projected CAGR of XX% anticipated during the forecast period (2025-2033), leading to an estimated market value of $XX Million by 2033. This growth is further propelled by increased market penetration in emerging economies and the introduction of innovative therapies targeting specific patient populations. A notable trend is the growing preference for convenient and user-friendly products, stimulating innovation in product formulations and delivery systems.

Leading Regions, Countries, or Segments in Fibrinogen Concentrates Industry

North America currently holds the largest market share in the fibrinogen concentrates industry, driven by high healthcare expenditure, advanced medical infrastructure, and a significant prevalence of surgical procedures. Europe follows closely, while Asia-Pacific exhibits significant growth potential due to expanding healthcare infrastructure and increasing awareness of bleeding disorders.

By Indication:

- Surgical Procedures: This segment dominates the market due to the high volume of surgical procedures performed globally, particularly in developed countries. Key drivers include increasing demand for minimally invasive surgeries, where effective haemostasis is crucial, and advancements in surgical techniques requiring fibrinogen supplementation.

- Congenital Fibrinogen Deficiency: This segment exhibits a smaller market size but a significant growth potential due to the increasing diagnosis rate and growing awareness of the condition. Research and development efforts targeting specific patient populations within this segment are expected to increase market penetration.

Key Drivers (both segments):

- High prevalence of bleeding disorders and surgical procedures.

- Increasing healthcare expenditure and improved healthcare infrastructure.

- Growing awareness and improved diagnosis of fibrinogen deficiencies.

- Technological advancements and product innovations leading to better treatment options.

- Favorable regulatory environment supporting the market growth.

Fibrinogen Concentrates Industry Product Innovations

Recent innovations in fibrinogen concentrates have focused on improving product purity, reducing the risk of adverse events, and enhancing ease of administration. New formulations offer improved shelf life and stability, while advancements in purification techniques minimize the risk of viral transmission. The development of products tailored to specific patient populations, such as those with congenital fibrinogen deficiencies or those undergoing specific types of surgical procedures, represent important advancements. These innovations are driving higher adoption rates and increased market penetration.

Propelling Factors for Fibrinogen Concentrates Industry Growth

The fibrinogen concentrates market is propelled by several key factors. The increasing prevalence of chronic diseases and an aging global population are driving the demand for effective haemostatic agents. Advancements in surgical techniques and an increasing number of complex surgical procedures contribute to a higher need for fibrinogen supplementation. Favorable regulatory environments in many countries are accelerating product approvals, while rising healthcare expenditure, particularly in developing economies, further fuels market expansion.

Obstacles in the Fibrinogen Concentrates Industry Market

Several significant obstacles impede the growth of the fibrinogen concentrates market. The stringent regulatory requirements and substantial costs associated with product development and approval processes create significant barriers to market entry for new competitors. Furthermore, supply chain vulnerabilities and the inherent complexities of manufacturing and distributing these highly specialized products can impact market stability. The presence of intense competition among established players, coupled with the emergence of new entrants, presents additional challenges to market participants.

Future Opportunities in Fibrinogen Concentrates Industry

Promising future opportunities exist through market expansion into developing economies, where healthcare infrastructure is continuously improving and awareness of bleeding disorders is gradually increasing. The development of novel fibrinogen concentrates with superior efficacy, enhanced safety profiles, and tailored applications for specific patient subpopulations presents a major avenue for growth. The integration of advanced technologies, such as personalized medicine approaches, offers another significant area for future market expansion and innovation.

Major Players in the Fibrinogen Concentrates Industry Ecosystem

- Ethicon (Johnson & Johnson) [Ethicon]

- Octapharma AG [Octapharma]

- Molecular Innovations Inc

- Shanghai RAAS

- Hualan Biological Engineering Inc

- LFB

- Enzo Life Sciences Inc

- GC Biopharma

- Baxter International Inc [Baxter]

- CSL Behring [CSL Behring]

- ProFibrix BV

- ThermoFisher Scientific [ThermoFisher Scientific]

- List Not Exhaustive

Key Developments in Fibrinogen Concentrates Industry Industry

- August 2020: Fibryga (Human Fibrinogen Concentrate, HFC), manufactured by Octapharma Canada, received approval from Health Canada for use during surgical procedures to treat acquired fibrinogen deficiency (AFD).

- June 2022: Biotest AG successfully provided an interim analysis of the Phase III AdFIrst (Adjusted Fibrinogen Replacement Strategy) trial with fibrinogen in patients with acquired fibrinogen deficiency.

Strategic Fibrinogen Concentrates Industry Market Forecast

The fibrinogen concentrates market is poised for sustained growth, fueled by the factors previously discussed. The future opportunities are substantial, particularly in emerging markets and through the development of innovative therapies addressing specific patient needs. The market is expected to witness significant expansion in the coming years, driven by continuous technological advancements and a steadily rising demand for effective haemostatic agents. The strategic outlook for the industry remains positive, with further market consolidation and the emergence of novel product offerings anticipated throughout the forecast period.

Fibrinogen Concentrates Industry Segmentation

-

1. Indication

- 1.1. Congenital Fibrinogen Deficiency

- 1.2. Surgical Procedure

Fibrinogen Concentrates Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Fibrinogen Concentrates Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Blood Disorders; Increasing Product Approvals

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Surgery Segment is Expected to Register Significant Growth in the Fibrinogen Concentrate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indication

- 5.1.1. Congenital Fibrinogen Deficiency

- 5.1.2. Surgical Procedure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. GCC

- 5.2.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Indication

- 6. North America Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Indication

- 6.1.1. Congenital Fibrinogen Deficiency

- 6.1.2. Surgical Procedure

- 6.1. Market Analysis, Insights and Forecast - by Indication

- 7. Europe Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Indication

- 7.1.1. Congenital Fibrinogen Deficiency

- 7.1.2. Surgical Procedure

- 7.1. Market Analysis, Insights and Forecast - by Indication

- 8. Asia Pacific Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Indication

- 8.1.1. Congenital Fibrinogen Deficiency

- 8.1.2. Surgical Procedure

- 8.1. Market Analysis, Insights and Forecast - by Indication

- 9. Middle East Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Indication

- 9.1.1. Congenital Fibrinogen Deficiency

- 9.1.2. Surgical Procedure

- 9.1. Market Analysis, Insights and Forecast - by Indication

- 10. GCC Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Indication

- 10.1.1. Congenital Fibrinogen Deficiency

- 10.1.2. Surgical Procedure

- 10.1. Market Analysis, Insights and Forecast - by Indication

- 11. South America Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Indication

- 11.1.1. Congenital Fibrinogen Deficiency

- 11.1.2. Surgical Procedure

- 11.1. Market Analysis, Insights and Forecast - by Indication

- 12. North America Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Rest of Europe

- 14. Asia Pacific Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 Australia

- 14.1.5 South Korea

- 14.1.6 Rest of Asia Pacific

- 15. Middle East Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. GCC Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 South Africa

- 16.1.2 Rest of Middle East

- 17. South America Fibrinogen Concentrates Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 Brazil

- 17.1.2 Argentina

- 17.1.3 Rest of South America

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Ethicon (Johnson and Johnson)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Octapharma AG

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Molecular Innovations Inc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Shanghai RAAS

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Hualan Biological Engineering Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 LFB

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Enzo Life Sciences Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 GC Biopharma

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Baxter International Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 CSL Behring

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 ProFibrix BV

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 ThermoFisher Scientific*List Not Exhaustive

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.1 Ethicon (Johnson and Johnson)

List of Figures

- Figure 1: Global Fibrinogen Concentrates Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: GCC Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: GCC Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Fibrinogen Concentrates Industry Revenue (Million), by Indication 2024 & 2032

- Figure 15: North America Fibrinogen Concentrates Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 16: North America Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Fibrinogen Concentrates Industry Revenue (Million), by Indication 2024 & 2032

- Figure 19: Europe Fibrinogen Concentrates Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 20: Europe Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Fibrinogen Concentrates Industry Revenue (Million), by Indication 2024 & 2032

- Figure 23: Asia Pacific Fibrinogen Concentrates Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 24: Asia Pacific Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East Fibrinogen Concentrates Industry Revenue (Million), by Indication 2024 & 2032

- Figure 27: Middle East Fibrinogen Concentrates Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 28: Middle East Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Middle East Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: GCC Fibrinogen Concentrates Industry Revenue (Million), by Indication 2024 & 2032

- Figure 31: GCC Fibrinogen Concentrates Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 32: GCC Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: GCC Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: South America Fibrinogen Concentrates Industry Revenue (Million), by Indication 2024 & 2032

- Figure 35: South America Fibrinogen Concentrates Industry Revenue Share (%), by Indication 2024 & 2032

- Figure 36: South America Fibrinogen Concentrates Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: South America Fibrinogen Concentrates Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 3: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: South Africa Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 32: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United States Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Canada Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Mexico Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 37: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Germany Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: United Kingdom Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Italy Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Spain Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Europe Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 45: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Japan Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Australia Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Asia Pacific Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 53: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 54: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 55: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: South Africa Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Rest of Middle East Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Indication 2019 & 2032

- Table 59: Global Fibrinogen Concentrates Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Fibrinogen Concentrates Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fibrinogen Concentrates Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Fibrinogen Concentrates Industry?

Key companies in the market include Ethicon (Johnson and Johnson), Octapharma AG, Molecular Innovations Inc, Shanghai RAAS, Hualan Biological Engineering Inc, LFB, Enzo Life Sciences Inc, GC Biopharma, Baxter International Inc, CSL Behring, ProFibrix BV, ThermoFisher Scientific*List Not Exhaustive.

3. What are the main segments of the Fibrinogen Concentrates Industry?

The market segments include Indication.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Blood Disorders; Increasing Product Approvals.

6. What are the notable trends driving market growth?

Surgery Segment is Expected to Register Significant Growth in the Fibrinogen Concentrate Market.

7. Are there any restraints impacting market growth?

Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

In June 2022, Biotest AG successfully provided an interim analysis of the Phase III AdFIrst (Adjusted Fibrinogen Replacement Strategy) trial with fibrinogen in patients with acquired fibrinogen deficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fibrinogen Concentrates Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fibrinogen Concentrates Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fibrinogen Concentrates Industry?

To stay informed about further developments, trends, and reports in the Fibrinogen Concentrates Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence