Key Insights

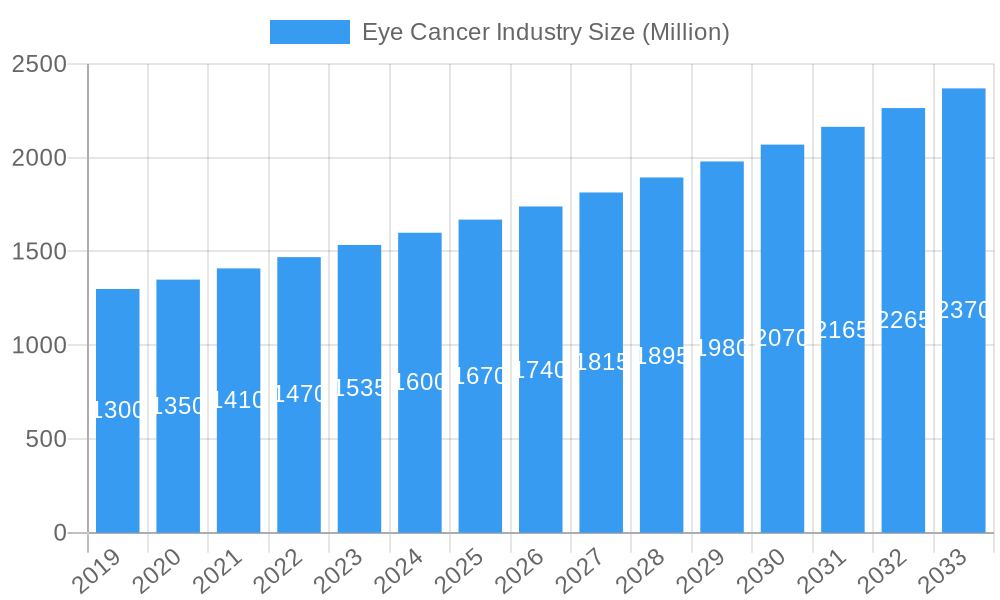

The global eye cancer market is poised for significant expansion, projected to reach approximately \$1.85 million and grow at a robust Compound Annual Growth Rate (CAGR) of 4.45% from 2019 to 2033. This growth is primarily fueled by an increasing incidence of eye cancers, advancements in diagnostic technologies leading to earlier detection, and the development of innovative treatment modalities. The market is segmented across various treatment types, including surgery, radiation therapy, laser therapy, cryotherapy, chemotherapy, and bone marrow transplantation/stem cell transplant, reflecting a multifaceted approach to managing these complex conditions. Furthermore, the market distinguishes between non-hereditary and hereditary types of retinoblastoma, and between intraocular and extraocular stages of the disease, underscoring the need for tailored therapeutic strategies. Key market drivers include rising awareness campaigns, growing investment in research and development for novel therapies, and an aging global population, which often correlates with an increased risk of certain eye cancers.

Eye Cancer Industry Market Size (In Billion)

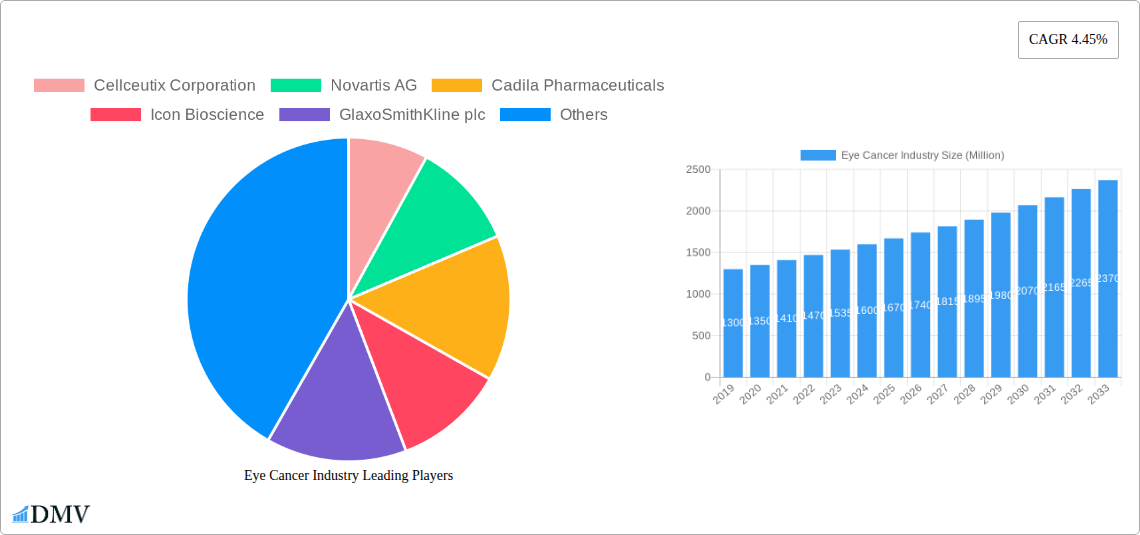

The competitive landscape is characterized by the presence of several prominent pharmaceutical and biotechnology companies, including Novartis AG, GlaxoSmithKline plc, Pfizer Inc., and Johnson & Johnson, actively involved in the development and commercialization of eye cancer treatments. Emerging trends point towards personalized medicine, with a focus on targeted therapies and immunotherapies, offering more precise and less invasive treatment options. However, the market faces certain restraints, such as the high cost of advanced treatment procedures and drugs, limited access to specialized care in developing regions, and the potential for treatment-related side effects. Despite these challenges, the outlook for the eye cancer market remains optimistic, driven by ongoing innovation and a growing demand for effective treatment solutions, particularly in regions like North America and Europe, which currently lead in market share due to advanced healthcare infrastructure and higher healthcare expenditure.

Eye Cancer Industry Company Market Share

Eye Cancer Industry Market Composition & Trends

The eye cancer market is characterized by dynamic growth and evolving treatment modalities, driven by increasing cancer incidence and advancements in diagnostic and therapeutic technologies. Market concentration is moderate, with key players investing heavily in R&D to develop novel treatments and improve patient outcomes. Innovation catalysts include breakthroughs in targeted therapies, immunotherapy, and early detection methods. The regulatory landscape is a critical factor, with stringent approval processes for new drugs and devices, impacting market entry and product lifecycles. Substitute products, such as advanced supportive care and genetic counseling, also play a role in the overall treatment strategy. End-user profiles are diverse, encompassing pediatric patients with retinoblastoma, adults with ocular melanomas, and individuals at high risk for developing eye cancers. Mergers and acquisitions (M&A) activities are a significant trend, with deal values anticipated to reach several Million as companies seek to expand their portfolios and gain market share.

- Market Share Distribution: Detailed analysis of key players' market penetration across various treatment segments will be provided.

- M&A Deal Values: Anticipated M&A deal values are estimated to be in the range of $100 Million to $500 Million during the forecast period.

- Key Innovation Drivers: Focus on precision medicine, AI-driven diagnostics, and novel drug delivery systems.

Eye Cancer Industry Industry Evolution

The eye cancer industry has witnessed substantial evolution, driven by a confluence of scientific progress, demographic shifts, and healthcare policy changes. The historical period from 2019 to 2024 saw steady growth, fueled by increasing awareness of eye cancers and the development of more effective treatment regimens. The base year, 2025, marks a pivotal point where advanced therapeutic approaches are gaining significant traction. Looking ahead, the forecast period from 2025 to 2033 promises accelerated growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 7-9%. This expansion is underpinned by a surge in research and development, leading to the approval and adoption of innovative drugs and treatment protocols. Technological advancements, including the refinement of gene therapies and liquid biopsy techniques for early detection, are transforming the diagnostic and therapeutic landscape. Shifting consumer demands, particularly a greater emphasis on preserving vision and improving quality of life, are influencing treatment choices and pushing for less invasive, more targeted interventions. The market is moving away from generalized chemotherapy towards personalized treatment plans tailored to the genetic makeup of the tumor and the patient. This transition is facilitated by a growing understanding of the molecular underpinnings of various eye cancers, enabling the development of drugs that specifically target oncogenic pathways. Furthermore, the increasing prevalence of age-related eye conditions that can predispose individuals to certain eye cancers is also contributing to market expansion. The global burden of cancer, coupled with an aging population, presents a sustained demand for effective eye cancer management solutions.

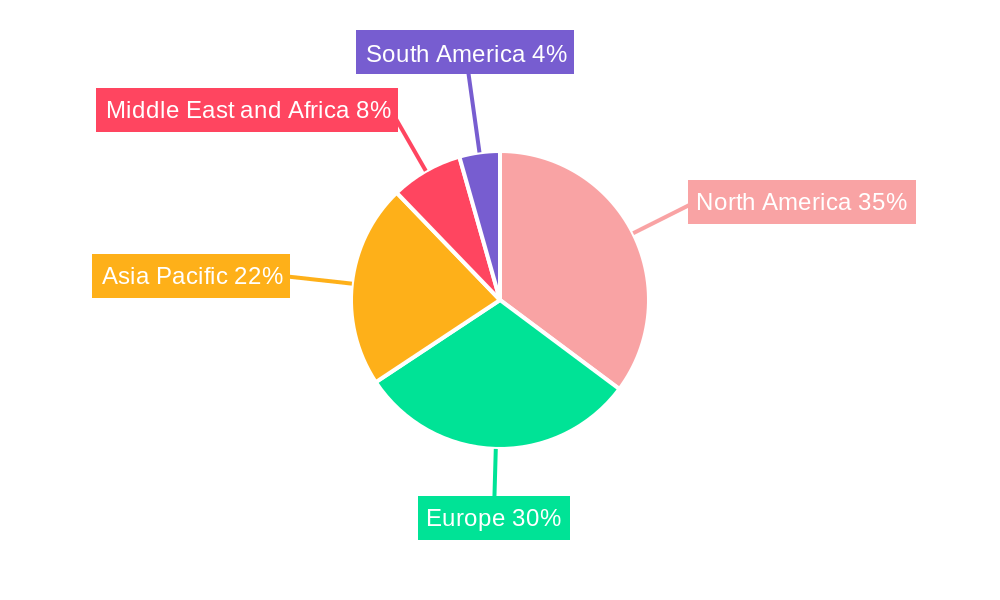

Leading Regions, Countries, or Segments in Eye Cancer Industry

The global eye cancer market is experiencing robust growth, with North America currently leading in terms of market share and revenue generation. This dominance is attributed to several key factors, including a well-established healthcare infrastructure, significant investment in R&D by pharmaceutical giants, and a high prevalence of eye cancer diagnoses. The region benefits from advanced medical technologies, early adoption of innovative treatments, and supportive government initiatives focused on cancer research and patient care.

Within the treatment types, surgery continues to be a cornerstone of eye cancer management, particularly for localized tumors. However, the market is witnessing a significant rise in the adoption of radiation therapy and chemotherapy, especially for more advanced or aggressive forms of eye cancer. Targeted therapies and immunotherapies are also carving out substantial market segments, driven by their improved efficacy and reduced side effects compared to traditional treatments.

In terms of retinoblastoma, non-hereditary retinoblastoma accounts for a larger proportion of cases globally, though hereditary forms require specialized and often lifelong monitoring. The growing understanding of genetic predispositions is leading to increased demand for genetic testing and preventive strategies for hereditary retinoblastoma.

For staging, intraocular retinoblastoma is the most commonly diagnosed stage, allowing for earlier intervention. However, the management of extraocular retinoblastoma presents greater challenges and necessitates more aggressive therapeutic approaches, driving innovation in systemic treatments.

Key Drivers of Dominance in North America:

- Investment Trends: Substantial private and public funding allocated to cancer research and development, estimated to be over $500 Million annually.

- Regulatory Support: Favorable regulatory pathways for novel drug approvals by the FDA, accelerating market access.

- Advanced Healthcare Infrastructure: Presence of leading cancer research centers and specialized ophthalmology departments.

- High Patient Awareness: Increased public awareness and screening programs contributing to early detection.

- Technological Adoption: Rapid integration of cutting-edge diagnostic tools and treatment technologies, including advanced imaging and robotic surgery.

The market for radiation therapy is projected to grow significantly, driven by advancements in precision radiation techniques like proton therapy, which offers targeted treatment with minimal damage to surrounding healthy tissues. Similarly, the chemotherapy segment is evolving with the development of more potent and less toxic chemotherapeutic agents, as well as novel drug delivery systems that enhance efficacy and reduce systemic side effects. The bone marrow transplantation/stem cell transplant segment, though niche, is crucial for managing advanced or recurrent eye cancers, with ongoing research aimed at improving transplant success rates and reducing complications. The increasing sophistication of treatments for both intraocular and extraocular retinoblastoma further fuels the growth of these respective segments.

Eye Cancer Industry Product Innovations

The eye cancer industry is witnessing a wave of groundbreaking product innovations aimed at improving treatment efficacy and patient outcomes. Novel targeted therapies, such as small molecule inhibitors that specifically block oncogenic pathways in ocular tumors, are demonstrating promising results with reduced systemic toxicity. Advances in immunotherapy are also revolutionizing treatment, with checkpoint inhibitors and CAR-T cell therapies showing potential in combating advanced eye cancers. Furthermore, innovative drug delivery systems, including sustained-release implants and nanoparticles, are enhancing drug penetration to the tumor site and prolonging therapeutic effects. The development of advanced diagnostic tools, such as AI-powered imaging analysis and liquid biopsy techniques, is enabling earlier and more accurate detection of eye cancers, paving the way for timely intervention and personalized treatment strategies. These innovations collectively contribute to a paradigm shift in eye cancer management, moving towards more precise, effective, and patient-centric care.

Propelling Factors for Eye Cancer Industry Growth

The eye cancer industry is experiencing significant growth propelled by several key factors. Technologically, advancements in precision medicine, including targeted therapies and immunotherapies, are offering more effective and less toxic treatment options. The development of sophisticated diagnostic tools, such as AI-driven imaging analysis and liquid biopsies, enhances early detection rates. Economically, increased healthcare spending globally, coupled with a growing prevalence of eye cancers and an aging population, fuels market demand. Regulatory bodies are also facilitating growth by streamlining approval processes for novel treatments, incentivizing further research and development. The expanding understanding of the genetic and molecular basis of eye cancers is a crucial catalyst, enabling the development of personalized treatment strategies and driving innovation.

Obstacles in the Eye Cancer Industry Market

Despite robust growth, the eye cancer industry faces several significant obstacles. Regulatory challenges, particularly the lengthy and costly approval processes for new drugs and devices, can hinder market entry. Supply chain disruptions, exacerbated by global events, can impact the availability and affordability of essential treatments and diagnostic tools. Competitive pressures from established players and emerging biotechnologies intensify the need for continuous innovation and cost-effective solutions. The high cost of advanced treatments, such as gene therapies and novel immunotherapies, can also limit patient access, particularly in developing economies. Furthermore, the rarity of certain eye cancers can present challenges in conducting large-scale clinical trials, impacting the speed of research and development.

Future Opportunities in Eye Cancer Industry

The eye cancer industry is poised for significant future opportunities. The growing pipeline of novel targeted therapies and immunotherapies promises to revolutionize treatment paradigms for various eye cancers. Emerging markets, with their increasing healthcare expenditure and rising cancer incidence, offer substantial untapped potential. Advancements in artificial intelligence and machine learning are creating opportunities for more accurate and earlier diagnosis, as well as personalized treatment planning. The development of non-invasive diagnostic techniques, such as advanced optical coherence tomography and genetic testing, will further expand the market. Furthermore, increasing awareness and advocacy efforts for rare cancers are driving greater investment in research and patient support, creating a more conducive environment for innovation and growth.

Major Players in the Eye Cancer Industry Ecosystem

- Cellceutix Corporation

- Novartis AG

- Cadila Pharmaceuticals

- Icon Bioscience

- GlaxoSmithKline plc

- Teva Pharmaceutical Industries Ltd

- Johnson & Johnson

- RXi Pharmaceuticals

- Merck & Co

- Baxter International Inc

- Bristol-Myers Squibb Company

- Pfizer Inc

Key Developments in Eye Cancer Industry Industry

- September 2022: Researchers at UT Southwestern and the University of Miami discovered a molecule, estrogen-related receptor gamma (ESRRG), that is hyperactive and promotes tumor cell survival in retinoblastoma. Blocking ESRRG, the team reported in Science Advances, kills retinoblastoma cells, offering a potential new therapeutic target.

- May 2022: The UK's National Health Service launched a new test to detect a rare form of eye cancer, called retinoblastoma, in unborn babies. This test allows treatment to be started as soon as the baby is born and may help to save their eyesight, representing a significant advancement in early detection and intervention for this pediatric cancer.

Strategic Eye Cancer Industry Market Forecast

The strategic eye cancer market forecast indicates a period of sustained and accelerated growth from 2025 to 2033. This expansion will be driven by the continuous development and adoption of innovative treatment modalities, including targeted therapies, immunotherapies, and advanced surgical techniques. Increased investment in research and development, coupled with a growing understanding of the molecular mechanisms of eye cancers, will fuel a robust pipeline of novel therapeutics. Favorable regulatory environments in key regions and rising healthcare expenditure globally will further bolster market demand. The increasing prevalence of eye cancers, particularly in aging populations, and a growing focus on early diagnosis and personalized treatment approaches will collectively shape a dynamic and promising future for the eye cancer industry. The market is projected to reach several Billion by 2033.

Eye Cancer Industry Segmentation

-

1. Treatment Type

- 1.1. Surgery

- 1.2. Radiation therapy

- 1.3. Laser Therapy

- 1.4. Cryotherapy

- 1.5. Chemotherapy

- 1.6. Bone Marrow Transplantation/Stem Cell Transplant

-

2. Type of Retinoblastoma

- 2.1. Non-hereditary Retinoblastoma

- 2.2. Hereditary Retinoblastoma

-

3. Type of Staging

- 3.1. Intraocular Retinoblastoma

- 3.2. Extraocular Retinoblastoma

Eye Cancer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Eye Cancer Industry Regional Market Share

Geographic Coverage of Eye Cancer Industry

Eye Cancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Remission and the Chance of Recurrence of Retinoblastoma; Increasing Public Awareness on Retinoblastoma

- 3.3. Market Restrains

- 3.3.1. Side Effects of Retinoblastoma Surgery and High Cost of Treatment in Developing Countries

- 3.4. Market Trends

- 3.4.1. Non-hereditary Retinoblastoma is Expected to hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Eye Cancer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 5.1.1. Surgery

- 5.1.2. Radiation therapy

- 5.1.3. Laser Therapy

- 5.1.4. Cryotherapy

- 5.1.5. Chemotherapy

- 5.1.6. Bone Marrow Transplantation/Stem Cell Transplant

- 5.2. Market Analysis, Insights and Forecast - by Type of Retinoblastoma

- 5.2.1. Non-hereditary Retinoblastoma

- 5.2.2. Hereditary Retinoblastoma

- 5.3. Market Analysis, Insights and Forecast - by Type of Staging

- 5.3.1. Intraocular Retinoblastoma

- 5.3.2. Extraocular Retinoblastoma

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6. North America Eye Cancer Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Treatment Type

- 6.1.1. Surgery

- 6.1.2. Radiation therapy

- 6.1.3. Laser Therapy

- 6.1.4. Cryotherapy

- 6.1.5. Chemotherapy

- 6.1.6. Bone Marrow Transplantation/Stem Cell Transplant

- 6.2. Market Analysis, Insights and Forecast - by Type of Retinoblastoma

- 6.2.1. Non-hereditary Retinoblastoma

- 6.2.2. Hereditary Retinoblastoma

- 6.3. Market Analysis, Insights and Forecast - by Type of Staging

- 6.3.1. Intraocular Retinoblastoma

- 6.3.2. Extraocular Retinoblastoma

- 6.1. Market Analysis, Insights and Forecast - by Treatment Type

- 7. Europe Eye Cancer Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Treatment Type

- 7.1.1. Surgery

- 7.1.2. Radiation therapy

- 7.1.3. Laser Therapy

- 7.1.4. Cryotherapy

- 7.1.5. Chemotherapy

- 7.1.6. Bone Marrow Transplantation/Stem Cell Transplant

- 7.2. Market Analysis, Insights and Forecast - by Type of Retinoblastoma

- 7.2.1. Non-hereditary Retinoblastoma

- 7.2.2. Hereditary Retinoblastoma

- 7.3. Market Analysis, Insights and Forecast - by Type of Staging

- 7.3.1. Intraocular Retinoblastoma

- 7.3.2. Extraocular Retinoblastoma

- 7.1. Market Analysis, Insights and Forecast - by Treatment Type

- 8. Asia Pacific Eye Cancer Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Treatment Type

- 8.1.1. Surgery

- 8.1.2. Radiation therapy

- 8.1.3. Laser Therapy

- 8.1.4. Cryotherapy

- 8.1.5. Chemotherapy

- 8.1.6. Bone Marrow Transplantation/Stem Cell Transplant

- 8.2. Market Analysis, Insights and Forecast - by Type of Retinoblastoma

- 8.2.1. Non-hereditary Retinoblastoma

- 8.2.2. Hereditary Retinoblastoma

- 8.3. Market Analysis, Insights and Forecast - by Type of Staging

- 8.3.1. Intraocular Retinoblastoma

- 8.3.2. Extraocular Retinoblastoma

- 8.1. Market Analysis, Insights and Forecast - by Treatment Type

- 9. Middle East and Africa Eye Cancer Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Treatment Type

- 9.1.1. Surgery

- 9.1.2. Radiation therapy

- 9.1.3. Laser Therapy

- 9.1.4. Cryotherapy

- 9.1.5. Chemotherapy

- 9.1.6. Bone Marrow Transplantation/Stem Cell Transplant

- 9.2. Market Analysis, Insights and Forecast - by Type of Retinoblastoma

- 9.2.1. Non-hereditary Retinoblastoma

- 9.2.2. Hereditary Retinoblastoma

- 9.3. Market Analysis, Insights and Forecast - by Type of Staging

- 9.3.1. Intraocular Retinoblastoma

- 9.3.2. Extraocular Retinoblastoma

- 9.1. Market Analysis, Insights and Forecast - by Treatment Type

- 10. South America Eye Cancer Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Treatment Type

- 10.1.1. Surgery

- 10.1.2. Radiation therapy

- 10.1.3. Laser Therapy

- 10.1.4. Cryotherapy

- 10.1.5. Chemotherapy

- 10.1.6. Bone Marrow Transplantation/Stem Cell Transplant

- 10.2. Market Analysis, Insights and Forecast - by Type of Retinoblastoma

- 10.2.1. Non-hereditary Retinoblastoma

- 10.2.2. Hereditary Retinoblastoma

- 10.3. Market Analysis, Insights and Forecast - by Type of Staging

- 10.3.1. Intraocular Retinoblastoma

- 10.3.2. Extraocular Retinoblastoma

- 10.1. Market Analysis, Insights and Forecast - by Treatment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cellceutix Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Novartis AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cadila Pharmaceuticals

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Icon Bioscience

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GlaxoSmithKline plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teva Pharmaceutical Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Johnson & Johnson

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 RXi Pharmaceuticals*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Merck & Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Baxter International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bristol-Myers Squibb Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Cellceutix Corporation

List of Figures

- Figure 1: Global Eye Cancer Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Eye Cancer Industry Revenue (Million), by Treatment Type 2025 & 2033

- Figure 3: North America Eye Cancer Industry Revenue Share (%), by Treatment Type 2025 & 2033

- Figure 4: North America Eye Cancer Industry Revenue (Million), by Type of Retinoblastoma 2025 & 2033

- Figure 5: North America Eye Cancer Industry Revenue Share (%), by Type of Retinoblastoma 2025 & 2033

- Figure 6: North America Eye Cancer Industry Revenue (Million), by Type of Staging 2025 & 2033

- Figure 7: North America Eye Cancer Industry Revenue Share (%), by Type of Staging 2025 & 2033

- Figure 8: North America Eye Cancer Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Eye Cancer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Eye Cancer Industry Revenue (Million), by Treatment Type 2025 & 2033

- Figure 11: Europe Eye Cancer Industry Revenue Share (%), by Treatment Type 2025 & 2033

- Figure 12: Europe Eye Cancer Industry Revenue (Million), by Type of Retinoblastoma 2025 & 2033

- Figure 13: Europe Eye Cancer Industry Revenue Share (%), by Type of Retinoblastoma 2025 & 2033

- Figure 14: Europe Eye Cancer Industry Revenue (Million), by Type of Staging 2025 & 2033

- Figure 15: Europe Eye Cancer Industry Revenue Share (%), by Type of Staging 2025 & 2033

- Figure 16: Europe Eye Cancer Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Eye Cancer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Eye Cancer Industry Revenue (Million), by Treatment Type 2025 & 2033

- Figure 19: Asia Pacific Eye Cancer Industry Revenue Share (%), by Treatment Type 2025 & 2033

- Figure 20: Asia Pacific Eye Cancer Industry Revenue (Million), by Type of Retinoblastoma 2025 & 2033

- Figure 21: Asia Pacific Eye Cancer Industry Revenue Share (%), by Type of Retinoblastoma 2025 & 2033

- Figure 22: Asia Pacific Eye Cancer Industry Revenue (Million), by Type of Staging 2025 & 2033

- Figure 23: Asia Pacific Eye Cancer Industry Revenue Share (%), by Type of Staging 2025 & 2033

- Figure 24: Asia Pacific Eye Cancer Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Eye Cancer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Eye Cancer Industry Revenue (Million), by Treatment Type 2025 & 2033

- Figure 27: Middle East and Africa Eye Cancer Industry Revenue Share (%), by Treatment Type 2025 & 2033

- Figure 28: Middle East and Africa Eye Cancer Industry Revenue (Million), by Type of Retinoblastoma 2025 & 2033

- Figure 29: Middle East and Africa Eye Cancer Industry Revenue Share (%), by Type of Retinoblastoma 2025 & 2033

- Figure 30: Middle East and Africa Eye Cancer Industry Revenue (Million), by Type of Staging 2025 & 2033

- Figure 31: Middle East and Africa Eye Cancer Industry Revenue Share (%), by Type of Staging 2025 & 2033

- Figure 32: Middle East and Africa Eye Cancer Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Eye Cancer Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Eye Cancer Industry Revenue (Million), by Treatment Type 2025 & 2033

- Figure 35: South America Eye Cancer Industry Revenue Share (%), by Treatment Type 2025 & 2033

- Figure 36: South America Eye Cancer Industry Revenue (Million), by Type of Retinoblastoma 2025 & 2033

- Figure 37: South America Eye Cancer Industry Revenue Share (%), by Type of Retinoblastoma 2025 & 2033

- Figure 38: South America Eye Cancer Industry Revenue (Million), by Type of Staging 2025 & 2033

- Figure 39: South America Eye Cancer Industry Revenue Share (%), by Type of Staging 2025 & 2033

- Figure 40: South America Eye Cancer Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Eye Cancer Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Eye Cancer Industry Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 2: Global Eye Cancer Industry Revenue Million Forecast, by Type of Retinoblastoma 2020 & 2033

- Table 3: Global Eye Cancer Industry Revenue Million Forecast, by Type of Staging 2020 & 2033

- Table 4: Global Eye Cancer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Eye Cancer Industry Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 6: Global Eye Cancer Industry Revenue Million Forecast, by Type of Retinoblastoma 2020 & 2033

- Table 7: Global Eye Cancer Industry Revenue Million Forecast, by Type of Staging 2020 & 2033

- Table 8: Global Eye Cancer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Eye Cancer Industry Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 13: Global Eye Cancer Industry Revenue Million Forecast, by Type of Retinoblastoma 2020 & 2033

- Table 14: Global Eye Cancer Industry Revenue Million Forecast, by Type of Staging 2020 & 2033

- Table 15: Global Eye Cancer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Eye Cancer Industry Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 23: Global Eye Cancer Industry Revenue Million Forecast, by Type of Retinoblastoma 2020 & 2033

- Table 24: Global Eye Cancer Industry Revenue Million Forecast, by Type of Staging 2020 & 2033

- Table 25: Global Eye Cancer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Eye Cancer Industry Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 33: Global Eye Cancer Industry Revenue Million Forecast, by Type of Retinoblastoma 2020 & 2033

- Table 34: Global Eye Cancer Industry Revenue Million Forecast, by Type of Staging 2020 & 2033

- Table 35: Global Eye Cancer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Eye Cancer Industry Revenue Million Forecast, by Treatment Type 2020 & 2033

- Table 40: Global Eye Cancer Industry Revenue Million Forecast, by Type of Retinoblastoma 2020 & 2033

- Table 41: Global Eye Cancer Industry Revenue Million Forecast, by Type of Staging 2020 & 2033

- Table 42: Global Eye Cancer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Eye Cancer Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Eye Cancer Industry?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Eye Cancer Industry?

Key companies in the market include Cellceutix Corporation, Novartis AG, Cadila Pharmaceuticals, Icon Bioscience, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd, Johnson & Johnson, RXi Pharmaceuticals*List Not Exhaustive, Merck & Co, Baxter International Inc, Bristol-Myers Squibb Company, Pfizer Inc.

3. What are the main segments of the Eye Cancer Industry?

The market segments include Treatment Type, Type of Retinoblastoma, Type of Staging.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Remission and the Chance of Recurrence of Retinoblastoma; Increasing Public Awareness on Retinoblastoma.

6. What are the notable trends driving market growth?

Non-hereditary Retinoblastoma is Expected to hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Side Effects of Retinoblastoma Surgery and High Cost of Treatment in Developing Countries.

8. Can you provide examples of recent developments in the market?

September 2022: researchers at UT Southwestern and the University of Miami discovered a molecule, estrogen-related receptor gamma, or ESRRG that is hyperactive and promotes tumor cell survival in retinoblastoma. Blocking ESRRG, the team reported in Science Advances, kills retinoblastoma cells.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Eye Cancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Eye Cancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Eye Cancer Industry?

To stay informed about further developments, trends, and reports in the Eye Cancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence