Key Insights

The European small satellite market is experiencing significant expansion, driven by a growing need for cost-effective and adaptable space solutions across various industries. The market is projected to reach €1.33 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 16.1% from 2025 to 2033. Key growth drivers include advancements in miniaturization and cost-efficient propulsion systems, particularly electric propulsion, enhancing accessibility for both commercial and governmental users. The dynamic NewSpace sector, characterized by increased private investment, is fostering innovation, competition, and reduced launch costs. The expanding adoption of small satellites for Earth observation, communication, and navigation applications, including environmental monitoring, precision agriculture, and IoT connectivity, is further accelerating market growth. Germany, France, and the United Kingdom are leading national markets due to established space infrastructure and supportive government initiatives. Challenges include regulatory complexities and the demand for a skilled workforce.

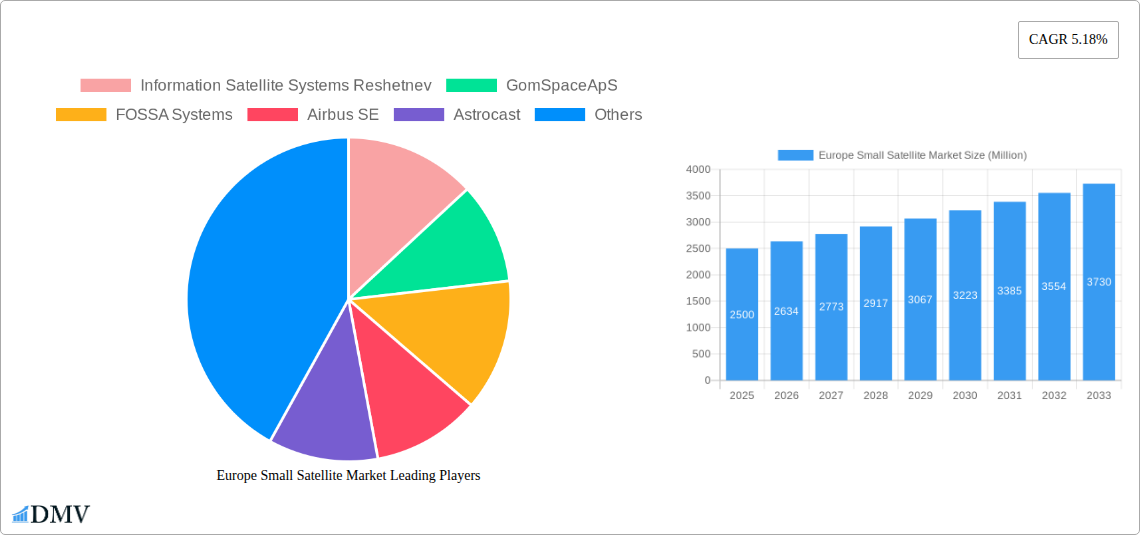

Europe Small Satellite Market Market Size (In Billion)

Despite these hurdles, the European small satellite market demonstrates a robust long-term outlook. The increasing affordability and versatility of small satellites are creating new application opportunities. Continued innovation in propulsion and launch technologies will further lower entry barriers, attracting a broader range of participants. Government support for space exploration and commercialization will provide additional momentum. Leading European companies such as Airbus SE, OHB SE, and GomSpace ApS highlight the region's competitive standing. The focus on Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) reflects the demand for near-real-time data and global coverage. Integration of advanced sensors and payloads will enhance satellite capabilities, driving wider adoption across diverse sectors.

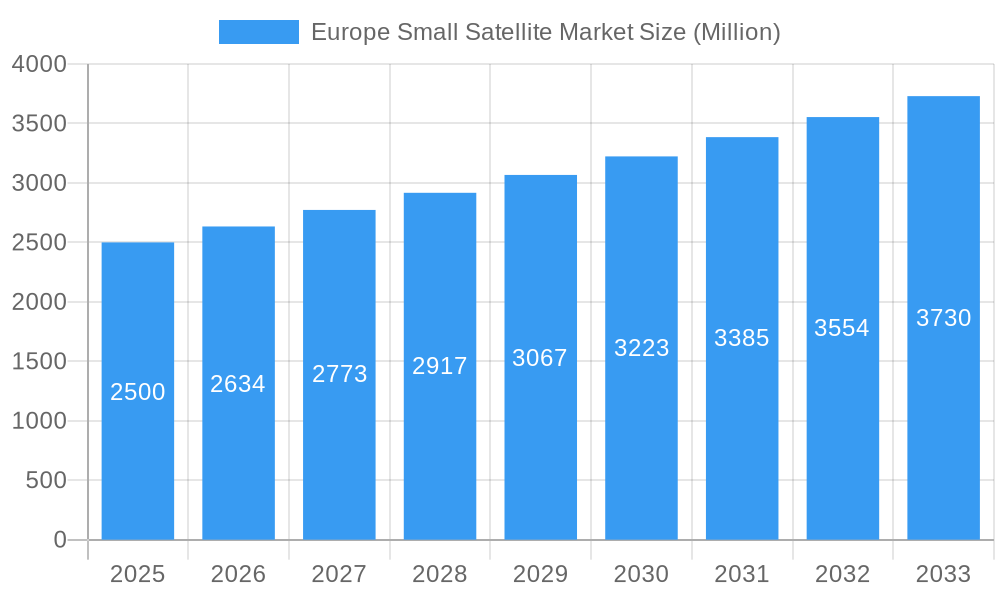

Europe Small Satellite Market Company Market Share

European Small Satellite Market: Key Trends, Growth Drivers, and Forecasts (2025-2033)

This comprehensive report offers an in-depth analysis of the European small satellite market, detailing its current status, future projections, and key industry players. Covering market size, segmentation, technological innovations, and growth catalysts, this research provides stakeholders with essential insights to navigate this rapidly evolving sector. The analysis spans from 2019 to 2033, with a specific focus on the 2025 base year and projects a market value of €1.33 billion by 2033.

Europe Small Satellite Market Composition & Trends

The European small satellite market exhibits a dynamic interplay of factors influencing its growth and development. Market concentration is moderate, with several key players holding significant shares, but a growing number of smaller, innovative companies are emerging. Technological advancements, particularly in electric propulsion and miniaturized payloads, are driving innovation. The regulatory landscape, while evolving, generally supports the growth of the small satellite sector, although complexities in licensing and spectrum allocation remain. Substitute products are limited, given the unique capabilities of small satellites for specific applications. The end-user profile is diversified, encompassing commercial entities, military & government organizations, and research institutions. Mergers and acquisitions (M&A) activity has been relatively robust, with deal values reaching xx Million in 2024. This activity demonstrates the consolidation trend within the industry and indicates a strategic push towards expansion and technological integration.

- Market Share Distribution (2024): Airbus SE (25%), OHB SE (15%), GomSpace ApS (10%), Others (50%)

- M&A Deal Value (2019-2024): xx Million

Europe Small Satellite Market Industry Evolution

The European small satellite market has experienced significant growth over the past few years, driven by several factors. Technological advancements, such as the development of more efficient electric propulsion systems and smaller, lighter payloads, have reduced launch costs and increased the accessibility of space. This has led to a surge in the number of small satellites being launched, fueling market expansion. Consumer demand is shifting towards more specialized and tailored satellite services, prompting innovation in applications such as Earth observation, communication, and navigation. The market is witnessing increasing adoption of miniaturized components and software-defined radios, streamlining manufacturing and deployment processes. Growth rates have been consistently strong, with a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, and this trend is expected to continue during the forecast period. The adoption of small satellites for various applications has significantly increased, with a notable increase in the number of commercial contracts.

Leading Regions, Countries, or Segments in Europe Small Satellite Market

The report identifies key leading segments and regions within the European small satellite market. While specific market share data requires detailed analysis within the full report, several dominant trends emerge.

- Dominant Region: Germany, followed by France and the UK, leading in terms of manufacturing, launch capabilities, and R&D activities.

- Dominant Application Segment: Earth Observation currently holds the largest market share, driven by increasing demand for high-resolution imagery and environmental monitoring.

- Dominant Propulsion Technology: Electric propulsion is experiencing rapid adoption due to its cost-effectiveness and efficiency, particularly in smaller satellites.

- Dominant Orbit Class: LEO (Low Earth Orbit) dominates, offering advantages in terms of accessibility, lower latency, and reduced launch costs.

- Dominant End-User: The commercial sector leads, driven by the increasing demand for satellite-based services in various industries.

Key Drivers:

- Government Funding and Support: Significant investments in space technology research and development across various European nations.

- Private Investment: Increased private sector participation and venture capital funding for small satellite startups and companies.

- New Applications: Emerging opportunities in areas such as IoT, precision agriculture, and environmental monitoring.

Europe Small Satellite Market Product Innovations

Recent product innovations focus on miniaturization, increased payload capacity, and improved power efficiency. Software-defined radios enable flexible payload configurations, enhancing operational capabilities. The adoption of CubeSat technology facilitates rapid prototyping and testing. Advances in electric propulsion technology, particularly in the development of highly efficient thrusters, are extending the operational lifespan of small satellites. These innovations are enhancing the functionality and cost-effectiveness of small satellites, further stimulating market growth.

Propelling Factors for Europe Small Satellite Market Growth

Several key factors are propelling the growth of the European small satellite market. Technological advancements, such as miniaturization and improved propulsion systems, are significantly reducing launch costs and operational expenses. The increasing demand for high-resolution imagery and data for various applications, coupled with the growing adoption of IoT, is driving market expansion. Favorable regulatory environments in several European countries are also stimulating market growth.

Obstacles in the Europe Small Satellite Market Market

Despite its growth potential, the European small satellite market faces several challenges. Regulatory complexities surrounding spectrum allocation and licensing can hinder market expansion. Supply chain disruptions, particularly concerning critical components, can impact production schedules and increase costs. Intense competition among numerous market players, both established and emerging, creates pressure on profit margins. These factors can collectively impede the growth trajectory of the European small satellite market.

Future Opportunities in Europe Small Satellite Market

The future of the European small satellite market presents considerable opportunities. The increasing integration of small satellites with IoT networks is set to unlock new applications across numerous sectors. Advancements in AI and machine learning will enhance data processing and analysis capabilities. New market segments, particularly in areas such as space-based internet and Earth observation for precision agriculture, offer lucrative growth prospects.

Major Players in the Europe Small Satellite Market Ecosystem

- Information Satellite Systems Reshetnev

- GomSpace ApS

- FOSSA Systems

- Airbus SE

- Astrocast

- OHB SE

- SatRev

- Thale

- Alba Orbital

Key Developments in Europe Small Satellite Market Industry

- November 2021: FOSSA Systems partners with ienai SPACE for the use of electric thrusters in picosatellites. This partnership highlights the growing importance of electric propulsion technology in the small satellite sector.

- January 2022: SatRevolution launched two satellites, STORK 3 (an Earth-imaging nanosatellite) and SteamSat 2. This demonstrates the increasing deployment of small satellites for Earth observation applications.

- June 2022: Falcon 9 launched Globalstar FM15 to low-Earth orbit. This launch underscores the continued reliance on established launch providers for deploying small satellites.

Strategic Europe Small Satellite Market Market Forecast

The European small satellite market is poised for continued robust growth, fueled by technological advancements, expanding applications, and increasing private and public investments. Future opportunities lie in the development of next-generation small satellite constellations for various applications, including broadband internet access and precise Earth observation. The market is expected to experience significant expansion, driven by both established players and innovative startups. This dynamic landscape offers substantial growth potential for companies involved in the design, manufacturing, launch, and operation of small satellites.

Europe Small Satellite Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Europe Small Satellite Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

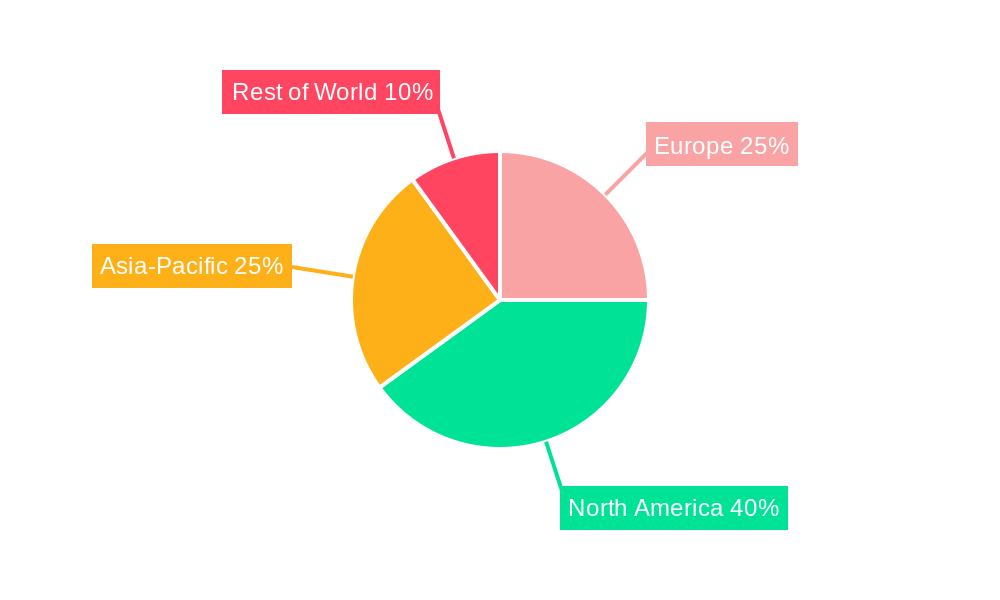

Europe Small Satellite Market Regional Market Share

Geographic Coverage of Europe Small Satellite Market

Europe Small Satellite Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Small Satellite Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Information Satellite Systems Reshetnev

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GomSpaceApS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FOSSA Systems

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Airbus SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astrocast

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OHB SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SatRev

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alba Orbital

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Information Satellite Systems Reshetnev

List of Figures

- Figure 1: Europe Small Satellite Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Small Satellite Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Small Satellite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Small Satellite Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Europe Small Satellite Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Small Satellite Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Europe Small Satellite Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Small Satellite Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Europe Small Satellite Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Europe Small Satellite Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Europe Small Satellite Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Europe Small Satellite Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Small Satellite Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Small Satellite Market?

The projected CAGR is approximately 16.1%.

2. Which companies are prominent players in the Europe Small Satellite Market?

Key companies in the market include Information Satellite Systems Reshetnev, GomSpaceApS, FOSSA Systems, Airbus SE, Astrocast, OHB SE, SatRev, Thale, Alba Orbital.

3. What are the main segments of the Europe Small Satellite Market?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2022: Falcon 9 launched Globalstar FM15 to low-Earth orbit from Space Launch Complex 40 (SLC-40) at Cape Canaveral Space Force Station in Florida.January 2022: SatRevolution launched two satellites STORK 3 and SteamSat 2. STORK 3 is an Earth-imaging nanosatellite.November 2021: FOSSA Systems partners with ienai SPACE for the use of electric thrusters in picosatellites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Small Satellite Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Small Satellite Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Small Satellite Market?

To stay informed about further developments, trends, and reports in the Europe Small Satellite Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence