Key Insights

The European remote sensing satellite market, projected to reach 19.8 billion by 2024, is set for significant expansion. Driven by a compound annual growth rate (CAGR) of 11.5% from 2024 to 2033, the market's growth is underpinned by escalating demand for high-resolution Earth observation data across critical sectors including environmental monitoring, precision agriculture, urban planning, and defense. Key growth enablers include advancements in satellite miniaturization and cost reductions in components like propulsion systems, solar arrays, and satellite buses, facilitating the proliferation of small satellite constellations. Government-led initiatives fostering space exploration and technological development within the European Union further bolster market expansion. Notable growth segments include Low Earth Orbit (LEO) constellations for Earth observation and the commercial sector's increasing utilization of remote sensing data for business intelligence. Germany, France, and the United Kingdom are anticipated to lead the European market due to their mature space industries and strong R&D capabilities, complemented by growing investments from other European nations shaping a dynamic market landscape.

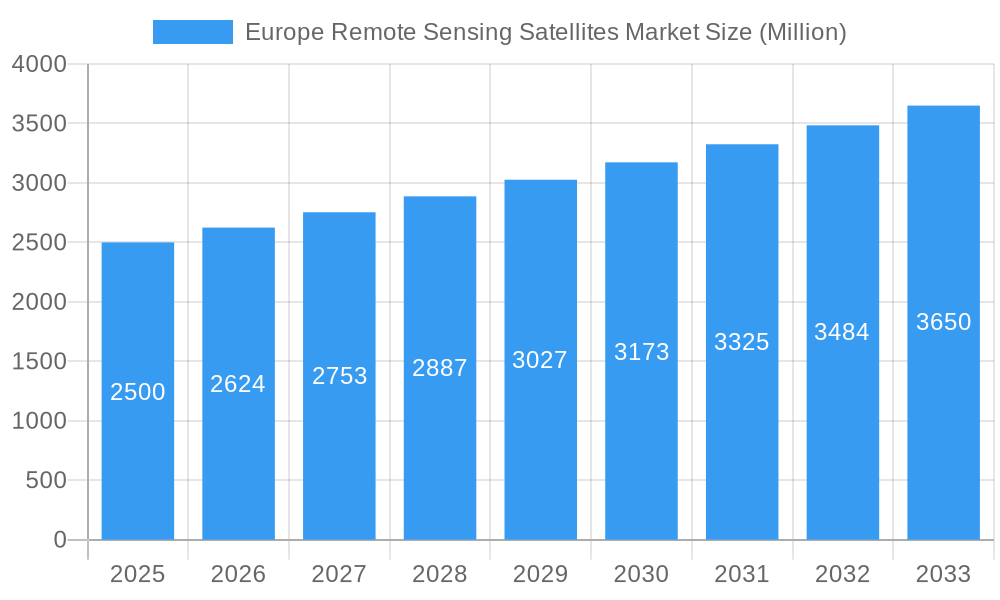

Europe Remote Sensing Satellites Market Market Size (In Billion)

Despite a promising outlook, the market faces potential restraints such as substantial upfront investment for satellite development and launch, which may challenge emerging players. Evolving regulations concerning space debris and complex international space law could also influence market trajectory. The competitive environment, featuring established entities like Airbus SE, Lockheed Martin Corporation, and Maxar Technologies Inc., alongside innovative newcomers such as GomSpace ApS and Planet Labs Inc., adds further complexity. Nevertheless, the trend towards greater accessibility and affordability of satellite technology, coupled with sustained demand for remote sensing data, forecasts a robust long-term growth trajectory for the European remote sensing satellite market. Market segmentation by satellite mass (e.g., 10-100kg, 100-500kg) highlights the diverse applications and technological advancements driving market evolution.

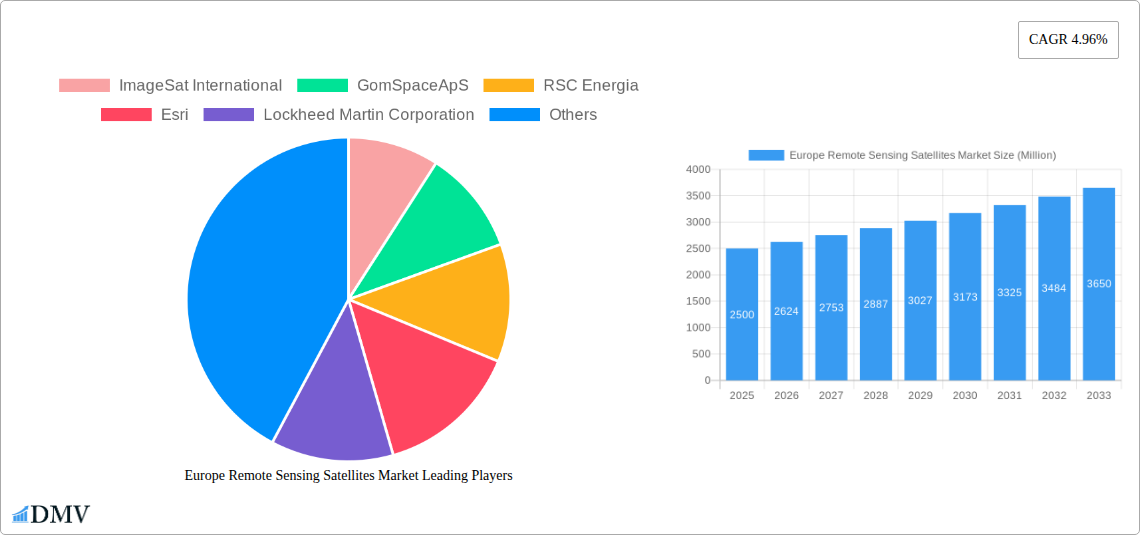

Europe Remote Sensing Satellites Market Company Market Share

Europe Remote Sensing Satellites Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Remote Sensing Satellites Market, offering a comprehensive overview of market dynamics, key players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. This report is essential for stakeholders seeking to understand the evolving landscape of this crucial sector and make informed strategic decisions. The market is projected to reach xx Million by 2033.

Europe Remote Sensing Satellites Market Composition & Trends

The Europe Remote Sensing Satellites Market is characterized by a moderately concentrated landscape, with key players such as Airbus SE, Maxar Technologies Inc, and Lockheed Martin Corporation holding significant market share. However, the emergence of innovative startups and the increasing accessibility of space technologies are fostering competition. Market share distribution in 2025 is estimated as follows: Airbus SE (xx%), Maxar Technologies Inc (xx%), Lockheed Martin Corporation (xx%), and others (xx%). The regulatory landscape, while evolving, generally supports the growth of the sector, though specific regulations vary across European nations. Substitute products, such as aerial photography, are present but offer limited comparable capabilities. The market exhibits significant M&A activity, with deal values exceeding xx Million in recent years, driven by the pursuit of technological advancements and market expansion. End-user profiles are diverse, encompassing commercial entities, military & government agencies, and other sectors like research and environmental monitoring.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Catalysts: Technological advancements, government funding, and private investment.

- Regulatory Landscape: Supportive but varies across European countries.

- Substitute Products: Aerial photography and other geospatial data sources.

- End-User Profiles: Commercial, Military & Government, Research, Environmental Monitoring.

- M&A Activity: Significant, with deal values exceeding xx Million in recent years.

Europe Remote Sensing Satellites Market Industry Evolution

The Europe Remote Sensing Satellites Market has witnessed substantial growth over the past few years, driven by factors such as increasing demand for high-resolution imagery, advancements in satellite technology, and growing government investments in space-based infrastructure. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace (projected CAGR of xx%). Technological advancements, particularly in miniaturization, improved sensor technology, and data analytics, are transforming the sector. Consumer demand is shifting towards higher resolution, more frequent data acquisition, and cost-effective solutions. The integration of AI and machine learning is further enhancing the analytical capabilities of remote sensing data. The increased adoption of cloud-based platforms for data processing and storage is also driving market growth.

Leading Regions, Countries, or Segments in Europe Remote Sensing Satellites Market

The dominance within the Europe Remote Sensing Satellites Market varies across segments.

Satellite Subsystems: The Satellite Bus & Subsystems segment currently holds the largest market share due to the higher cost and complexity involved in these components. The Propulsion Hardware and Propellant segment is expected to witness significant growth driven by increasing demand for higher maneuverability and longer operational life of satellites.

End-User: The Military & Government segment leads in terms of revenue and investment due to their critical need for high-quality geospatial intelligence.

Satellite Mass: The 100-500kg segment currently dominates due to a balance between payload capacity and launch costs.

Orbit Class: LEO (Low Earth Orbit) satellites are the most prevalent, driven by their ability to provide high-resolution imagery and frequent revisit times. However, GEO (Geostationary Earth Orbit) satellites are increasing in demand for continuous monitoring applications.

Key Drivers:

- Significant Government Investments: European nations are heavily investing in space programs and remote sensing technologies.

- Growing Commercial Demand: Increasing adoption of remote sensing data across sectors (agriculture, urban planning, etc.).

- Technological Advancements: Continuous improvements in sensor technology, data processing, and analytics.

Europe Remote Sensing Satellites Market Product Innovations

Recent innovations include the development of smaller, more affordable CubeSats equipped with advanced sensors for enhanced data acquisition and analytics. These miniaturized satellites lower the barrier to entry for various organizations, driving market growth. Further advancements in hyperspectral imaging and AI-powered data analysis improve the accuracy and utility of remote sensing data. The integration of advanced communication technologies ensures seamless and efficient data transmission. This leads to better resolution, improved data accuracy, and a wider range of applications across diverse sectors.

Propelling Factors for Europe Remote Sensing Satellites Market Growth

Technological advancements in sensor technology, data processing, and analytics are key drivers. The growing adoption of cloud-based platforms for data storage and processing is also significant. Furthermore, increasing government investment in space exploration and national security programs fuels market expansion. The commercial sector's rising demand for high-resolution imagery for applications like precision agriculture and urban planning further boosts growth.

Obstacles in the Europe Remote Sensing Satellites Market

High launch costs and the complexities associated with satellite development represent significant barriers. Supply chain disruptions can lead to delays and increased production costs. Intense competition among established players and emerging startups presents a challenge. Regulatory complexities and varying regulations across European nations can also hinder market expansion.

Future Opportunities in Europe Remote Sensing Satellites Market

The increasing integration of AI and machine learning in data analysis opens new avenues. The growing demand for Internet of Things (IoT) applications relying on satellite data creates significant market potential. Furthermore, new market segments, like climate monitoring and disaster management, offer ample opportunities for growth.

Major Players in the Europe Remote Sensing Satellites Market Ecosystem

- ImageSat International

- GomSpace ApS

- RSC Energia

- Esri

- Lockheed Martin Corporation

- Airbus SE

- Maxar Technologies Inc

- NPO Lavochkin

- ROSCOSMOS

- IHI Corp

- Thale

- Planet Labs Inc

- Northrop Grumman Corporation

- Spire Global Inc

Key Developments in Europe Remote Sensing Satellites Market Industry

- February 2023: NASA and Esri's Space Act Agreement expands access to geospatial content, fostering research and exploration.

- January 2023: Airbus Defence and Space secures a Polish contract for two high-performance Earth observation satellites, demonstrating significant market demand.

- November 2022: Launch of Kosmos 2563 by Russian Soyuz replaces early warning satellites, highlighting ongoing investments in space-based surveillance.

Strategic Europe Remote Sensing Satellites Market Forecast

The Europe Remote Sensing Satellites Market is poised for continued growth driven by technological innovation, increased government and commercial investment, and expanding applications across diverse sectors. The market's future potential is substantial, particularly in areas like environmental monitoring, disaster management, and precision agriculture. New market entrants and technological advancements will further shape this dynamic industry.

Europe Remote Sensing Satellites Market Segmentation

-

1. Satellite Mass

- 1.1. 10-100kg

- 1.2. 100-500kg

- 1.3. 500-1000kg

- 1.4. Below 10 Kg

- 1.5. above 1000kg

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. Satellite Subsystem

- 3.1. Propulsion Hardware and Propellant

- 3.2. Satellite Bus & Subsystems

- 3.3. Solar Array & Power Hardware

- 3.4. Structures, Harness & Mechanisms

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

Europe Remote Sensing Satellites Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

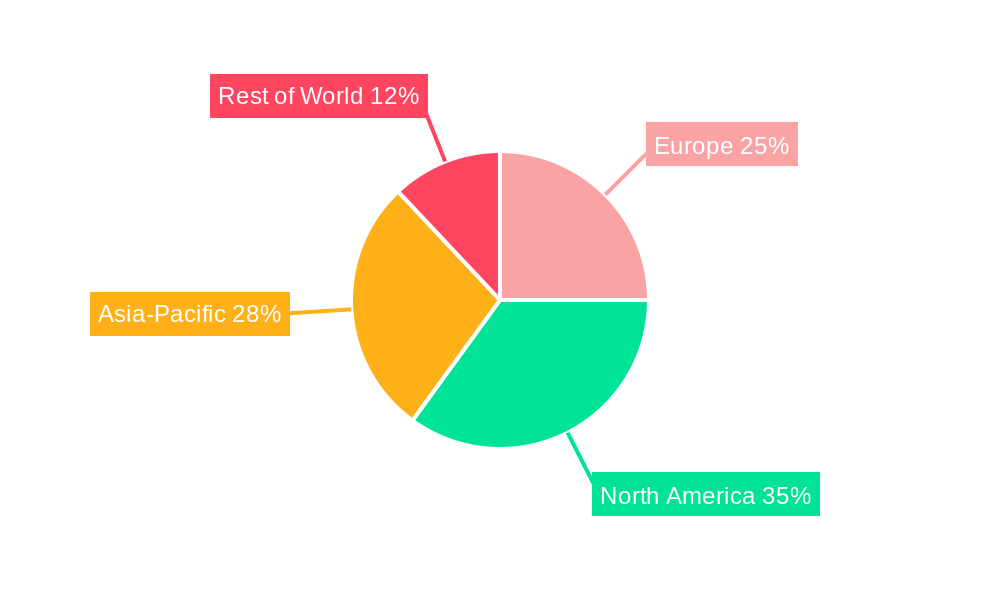

Europe Remote Sensing Satellites Market Regional Market Share

Geographic Coverage of Europe Remote Sensing Satellites Market

Europe Remote Sensing Satellites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Remote Sensing Satellites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.1.1. 10-100kg

- 5.1.2. 100-500kg

- 5.1.3. 500-1000kg

- 5.1.4. Below 10 Kg

- 5.1.5. above 1000kg

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.3.1. Propulsion Hardware and Propellant

- 5.3.2. Satellite Bus & Subsystems

- 5.3.3. Solar Array & Power Hardware

- 5.3.4. Structures, Harness & Mechanisms

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Satellite Mass

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ImageSat International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GomSpaceApS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RSC Energia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esri

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lockheed Martin Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maxar Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NPO Lavochkin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ROSCOSMOS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 IHI Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Thale

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Planet Labs Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Northrop Grumman Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Spire Global Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 ImageSat International

List of Figures

- Figure 1: Europe Remote Sensing Satellites Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Remote Sensing Satellites Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 2: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 4: Europe Remote Sensing Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 7: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 9: Europe Remote Sensing Satellites Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Europe Remote Sensing Satellites Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: France Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Remote Sensing Satellites Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Remote Sensing Satellites Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Europe Remote Sensing Satellites Market?

Key companies in the market include ImageSat International, GomSpaceApS, RSC Energia, Esri, Lockheed Martin Corporation, Airbus SE, Maxar Technologies Inc, NPO Lavochkin, ROSCOSMOS, IHI Corp, Thale, Planet Labs Inc, Northrop Grumman Corporation, Spire Global Inc.

3. What are the main segments of the Europe Remote Sensing Satellites Market?

The market segments include Satellite Mass, Orbit Class, Satellite Subsystem, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.8 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: NASA and geographic information service provider Esri will grant wider access to the space agency's geospatial content for research and exploration purposes through the Space Act Agreement.January 2023: Airbus Defence and Space has signed a contract with Poland to provide a geospatial intelligence system including the development, manufacture, launch and delivery in orbit of two high-performance optical Earth observation satellites.November 2022: Russian Soyuz launched Kosmos 2563 (Tundra 16L, Kupol 16L, EKS #6) into orbit to replace the US-K and US-KMO early warning satellites of the Oko-1 system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Remote Sensing Satellites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Remote Sensing Satellites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Remote Sensing Satellites Market?

To stay informed about further developments, trends, and reports in the Europe Remote Sensing Satellites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence