Key Insights

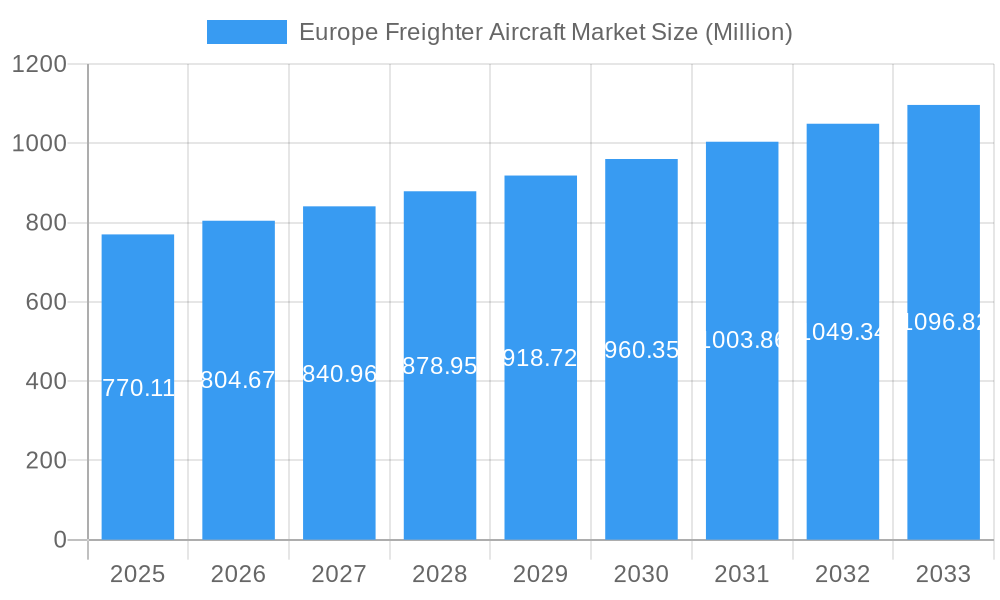

The European freighter aircraft market, valued at €770.11 million in 2025, is projected to experience robust growth, driven by the increasing demand for air freight services across Europe. This growth is fueled by the expansion of e-commerce, the need for faster delivery times for time-sensitive goods, and the ongoing recovery of the global economy post-pandemic. The market is segmented by aircraft type (dedicated cargo aircraft and converted passenger aircraft) and engine type (turboprop and turbofan), with turbofan aircraft dominating due to their capacity for longer-haul flights and larger payloads. Key players such as Airbus SE, Boeing, and Textron Inc. are actively involved in developing and supplying these aircraft, leveraging technological advancements to enhance efficiency and reduce operational costs. Germany, France, and the United Kingdom represent the largest national markets within Europe, benefiting from well-established logistics infrastructure and strong economic activity. However, factors such as fluctuating fuel prices and potential regulatory changes regarding emissions could present challenges to sustained market growth. The projected Compound Annual Growth Rate (CAGR) of 4.43% from 2025 to 2033 suggests a consistent upward trajectory, indicating a positive outlook for the sector despite potential headwinds.

Europe Freighter Aircraft Market Market Size (In Million)

The continued growth of the e-commerce sector is a significant driver, demanding increased capacity for swift and reliable delivery of goods. Furthermore, advancements in aircraft technology, such as the development of more fuel-efficient engines and the increased use of composite materials, are expected to contribute to the market's expansion. The conversion of existing passenger aircraft into freighters is also a significant trend, offering cost-effective solutions for expanding cargo capacity. This strategy also allows airlines to adapt quickly to market demands and optimize their fleet utilization. Competition among manufacturers remains intense, with companies focusing on innovation and offering tailored solutions to cater to the specific needs of various airline operators. While geopolitical uncertainties and potential economic slowdowns could pose risks, the overall trend indicates a promising outlook for the European freighter aircraft market throughout the forecast period.

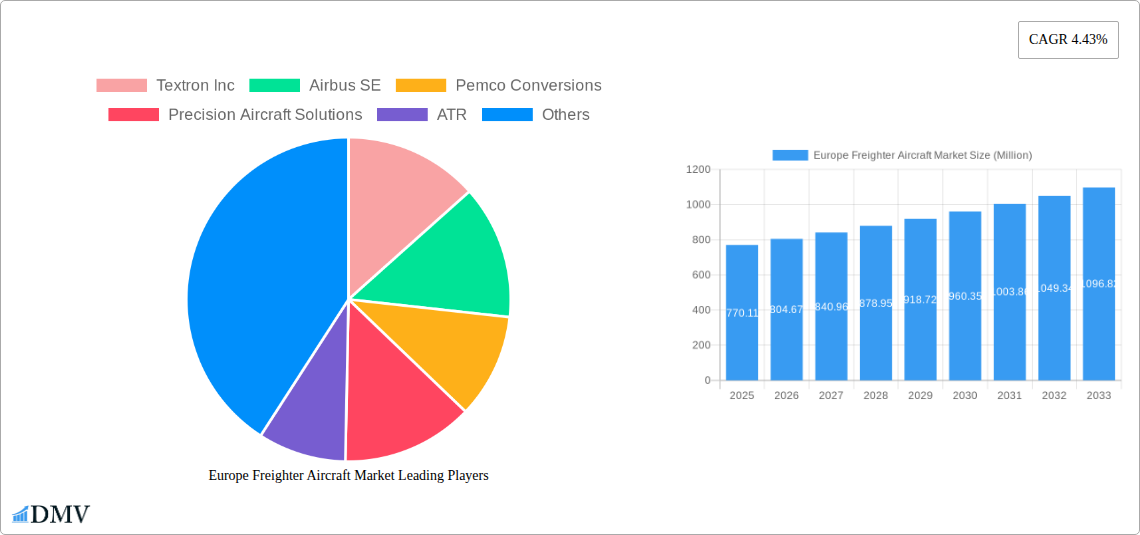

Europe Freighter Aircraft Market Company Market Share

Europe Freighter Aircraft Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe freighter aircraft market, offering a comprehensive overview of market trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines market dynamics, technological advancements, and key industry developments to provide stakeholders with actionable intelligence for informed decision-making. The market is segmented by aircraft type (Dedicated Cargo Aircraft, Derivative of Non-Cargo Aircraft) and engine type (Turboprop Aircraft, Turbofan Aircraft). Projected market value for 2025 is estimated at xx Million. This in-depth analysis covers key players such as Textron Inc, Airbus SE, Pemco Conversions, Precision Aircraft Solutions, ATR, Singapore Technologies Engineering Ltd, Aeronautical Engineers Inc, and The Boeing Company.

Europe Freighter Aircraft Market Composition & Trends

The European freighter aircraft market exhibits a moderately consolidated structure, with a few major players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological expertise, and regulatory approvals. Innovation in fuel efficiency, advanced avionics, and enhanced cargo handling systems are key catalysts driving market growth. The regulatory landscape, encompassing airworthiness certifications and environmental regulations (e.g., emissions standards), significantly impacts market dynamics. Substitute products, such as sea freight and rail transport, present competitive pressures. End-user profiles encompass express delivery companies, e-commerce giants, and traditional freight forwarders. Mergers and acquisitions (M&A) activities have played a pivotal role in shaping the market landscape, with deal values reaching xx Million in recent years.

- Market Share Distribution (2024): Airbus SE (xx%), Boeing (xx%), Other (xx%)

- M&A Deal Values (2019-2024): Total value approximately xx Million

- Key Innovation Drivers: Enhanced payload capacity, improved fuel efficiency, advanced cargo handling systems, and digitalization of logistics.

Europe Freighter Aircraft Market Industry Evolution

The European freighter aircraft market has witnessed significant evolution during the historical period (2019-2024). Growth trajectories have been influenced by factors such as the global expansion of e-commerce, the increasing demand for faster and more efficient logistics solutions, and the rise of air freight as a preferred mode of transportation for time-sensitive goods. Technological advancements, particularly in aircraft design and engine technology, have played a crucial role in improving fuel efficiency, payload capacity, and overall operational efficiency. Consumer demands for reliable, cost-effective, and environmentally responsible air freight solutions are continuously shaping industry trends. The market experienced a xx% Compound Annual Growth Rate (CAGR) between 2019 and 2024, and is projected to grow at a xx% CAGR from 2025 to 2033. Adoption of new technologies such as advanced materials and predictive maintenance has accelerated in recent years.

Leading Regions, Countries, or Segments in Europe Freighter Aircraft Market

Within the European freighter aircraft market, Germany, the United Kingdom, and France stand out as leading countries due to their robust air cargo infrastructure, thriving e-commerce sectors, and strategic geographic locations. The dedicated cargo aircraft segment holds a dominant market position, driven by specialized designs optimized for efficient cargo transportation. Turbofan aircraft dominate the engine type segment, reflecting the demand for long-range, high-capacity air freighters.

- Key Drivers for Germany: Strong industrial base, central European location, and extensive air cargo network.

- Key Drivers for UK: Significant e-commerce activity and London's role as a major air cargo hub.

- Key Drivers for France: Established air freight infrastructure and strong connections to global markets.

- Dedicated Cargo Aircraft Dominance: Superior cargo handling capabilities, specialized design features, and higher payload capacity.

- Turbofan Engine Dominance: Higher fuel efficiency for long-haul operations, larger payload capacity, and faster speeds.

Europe Freighter Aircraft Market Product Innovations

Recent innovations focus on enhancing fuel efficiency, payload capacity, and operational efficiency. Manufacturers are incorporating advanced materials, lighter-weight composites, and improved aerodynamic designs to reduce fuel consumption. Advanced avionics systems and digitalization initiatives are boosting operational efficiency and improving flight safety. Unique selling propositions emphasize reduced operational costs, increased cargo capacity, and improved environmental performance. These advancements cater to the increasing demand for sustainable and cost-effective air freight solutions.

Propelling Factors for Europe Freighter Aircraft Market Growth

The growth of the European freighter aircraft market is fueled by the explosive growth of e-commerce, requiring faster and more efficient delivery solutions. The expansion of global trade, particularly between Europe and rapidly developing economies in Asia, is a significant driver. Technological advancements leading to greater fuel efficiency and increased payload capacity are further driving market expansion. Favorable regulatory environments and government support for air cargo infrastructure development also contribute to growth.

Obstacles in the Europe Freighter Aircraft Market

Challenges include volatile fuel prices impacting operating costs, supply chain disruptions affecting aircraft production and maintenance, and intense competition among manufacturers and airlines. Stringent environmental regulations add to the complexity and cost of operations. These factors can influence pricing strategies and potentially hinder market growth.

Future Opportunities in Europe Freighter Aircraft Market

Emerging opportunities lie in the development of sustainable aviation fuels, the adoption of innovative cargo handling technologies, and the integration of advanced data analytics for optimized flight operations. Expanding into new markets with growing air freight demands and the development of specialized aircraft for niche cargo types (e.g., pharmaceuticals, perishables) also present significant growth potential.

Major Players in the Europe Freighter Aircraft Market Ecosystem

- Textron Inc

- Airbus SE

- Pemco Conversions

- Precision Aircraft Solutions

- ATR

- Singapore Technologies Engineering Ltd

- Aeronautical Engineers Inc

- The Boeing Company

Key Developments in Europe Freighter Aircraft Market Industry

- April 2023: Air France-KLM and CMA CGM Group launched a ten-year strategic air cargo partnership, combining their networks and capacity. This significantly impacts market dynamics by increasing operational efficiency and expanding market reach.

- July 2023: One Air, a new UK-based cargo airline, commenced operations with a Boeing B747 freighter, becoming the only UK airline operating this aircraft type. This development increases competition within the UK air freight market.

Strategic Europe Freighter Aircraft Market Forecast

The European freighter aircraft market is poised for robust growth in the forecast period (2025-2033), driven by e-commerce expansion, global trade growth, and technological advancements. The increasing demand for faster and more reliable air freight solutions, coupled with innovations in aircraft design and operational efficiency, will create significant market opportunities. The market's future hinges on the successful adoption of sustainable technologies and the ability to navigate the challenges posed by geopolitical instability and economic fluctuations. The market is expected to experience a xx Million increase in value by 2033.

Europe Freighter Aircraft Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Freighter Aircraft Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Freighter Aircraft Market Regional Market Share

Geographic Coverage of Europe Freighter Aircraft Market

Europe Freighter Aircraft Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Derivative of Non-Cargo Aircraft Segment is Anticipated to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Freighter Aircraft Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Airbus SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pemco Conversions

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Precision Aircraft Solutions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ATR

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Singapore Technologies Engineering Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aeronautical Engineers Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Boeing Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Europe Freighter Aircraft Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Freighter Aircraft Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Freighter Aircraft Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Freighter Aircraft Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Freighter Aircraft Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Freighter Aircraft Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Freighter Aircraft Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Freighter Aircraft Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Freighter Aircraft Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Freighter Aircraft Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Freighter Aircraft Market?

The projected CAGR is approximately 4.43%.

2. Which companies are prominent players in the Europe Freighter Aircraft Market?

Key companies in the market include Textron Inc, Airbus SE, Pemco Conversions, Precision Aircraft Solutions, ATR, Singapore Technologies Engineering Ltd, Aeronautical Engineers Inc, The Boeing Company.

3. What are the main segments of the Europe Freighter Aircraft Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 770.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Derivative of Non-Cargo Aircraft Segment is Anticipated to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

April 2023: Air France-KLM and the CMA CGM Group announced the launch of the long-term strategic air cargo partnership they made public in May 2022. The initial duration of this partnership is ten years, and Air France-KLM MartinairCargo and CMA CGM Air Cargo will combine their complementary cargo networks, full freighter capacity, and other dedicated services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Freighter Aircraft Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Freighter Aircraft Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Freighter Aircraft Market?

To stay informed about further developments, trends, and reports in the Europe Freighter Aircraft Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence