Key Insights

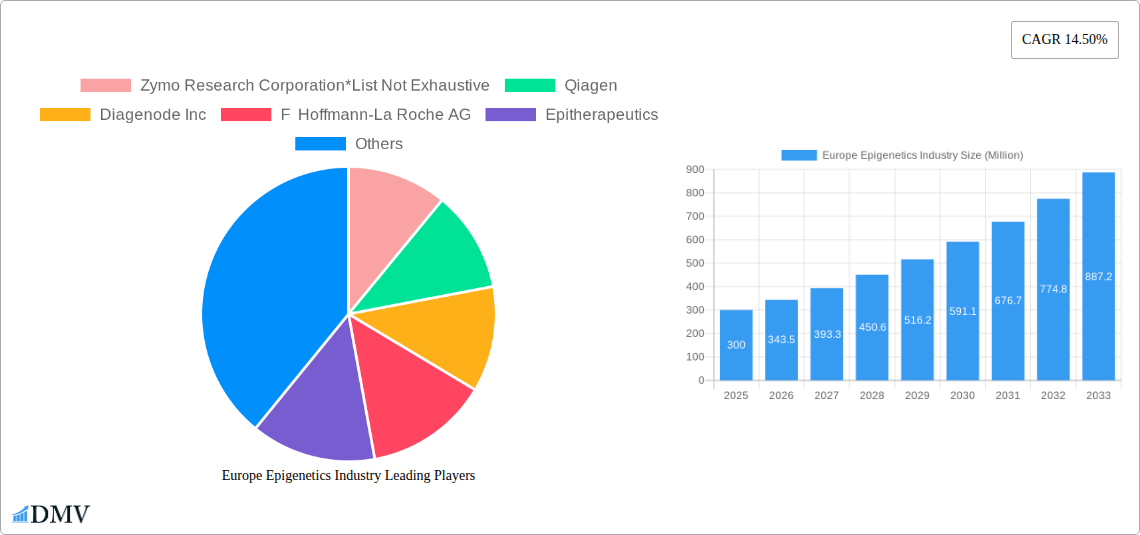

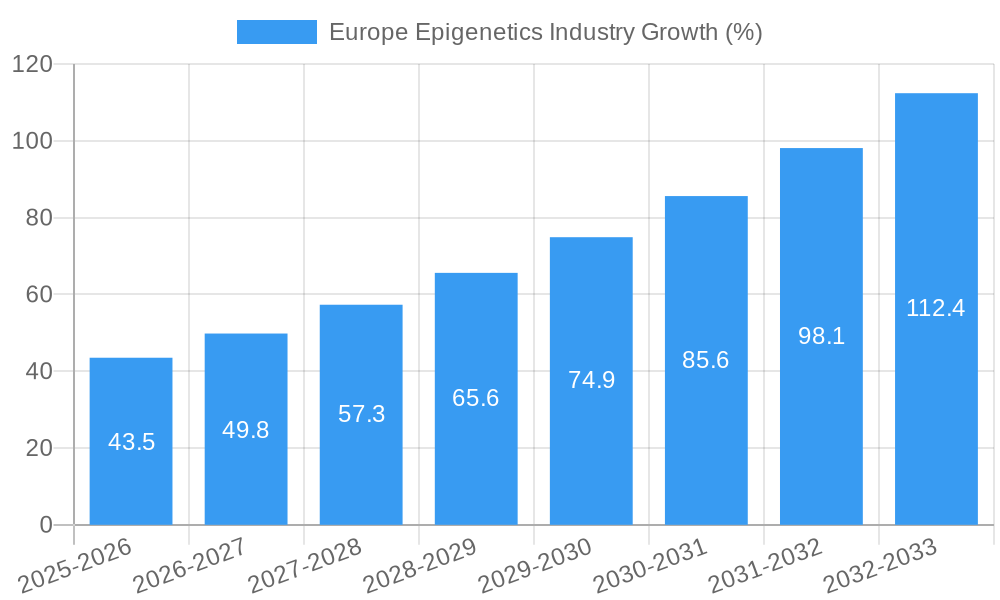

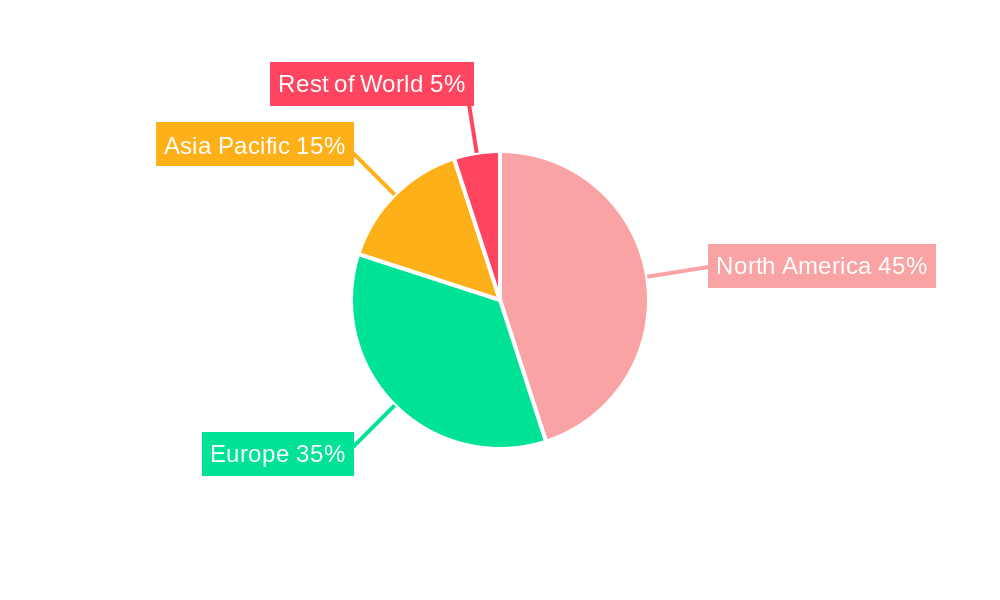

The European epigenetics market is experiencing robust growth, driven by escalating research and development activities in oncology and other therapeutic areas. The market's Compound Annual Growth Rate (CAGR) of 14.50% from 2019 to 2024 indicates a significant expansion, projected to continue throughout the forecast period (2025-2033). Key drivers include the rising prevalence of cancer and other epigenetic-related diseases, increased government funding for research initiatives, and technological advancements in epigenetic analysis techniques such as DNA methylation, histone modification assays, and next-generation sequencing. The strong performance of the market is further fueled by the development of novel epigenetic therapies, increasing collaborations between pharmaceutical companies and research institutions, and growing adoption of personalized medicine approaches. Within Europe, Germany, France, the UK, and Italy are expected to be major contributors to market growth, owing to their well-established research infrastructure and substantial investments in the life sciences sector. The market segmentation reveals a diversified landscape, with significant demand for kits, reagents (including RNA modifying enzymes), and instruments used in epigenetic research and therapeutic development. While the oncology segment currently dominates applications, the non-oncology segment, including developmental biology and other research areas, presents a significant growth opportunity.

The market's growth trajectory is further reinforced by the expanding application of epigenetics in various research fields, fostering a greater understanding of complex diseases and providing potential avenues for novel therapeutics. However, challenges remain, including the high cost of epigenetic testing and the complexity of interpreting epigenetic data. Nevertheless, ongoing technological advancements, such as the development of more sensitive and high-throughput assays, are expected to mitigate these challenges and further accelerate market expansion. The continued focus on translational research, aiming to convert epigenetic discoveries into effective therapies, will play a crucial role in shaping the future of the European epigenetics market, unlocking new opportunities for growth and innovation in the coming years. While precise market size for 2025 is not provided, a reasonable estimation based on the CAGR and market trends suggests a substantial value in the hundreds of millions of euros.

Europe Epigenetics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe epigenetics industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, leading players, and future opportunities within the European landscape. The estimated market value in 2025 is projected to be xx Million, with a forecast period spanning 2025-2033. The historical period examined is 2019-2024.

Europe Epigenetics Industry Market Composition & Trends

This section meticulously analyzes the competitive landscape of the European epigenetics market, examining market concentration, innovation drivers, regulatory frameworks, substitute product emergence, end-user profiles, and mergers & acquisitions (M&A) activities. The report features a detailed breakdown of market share distribution among key players, providing a clear picture of the competitive dynamics. For example, Illumina Inc. and Qiagen hold significant market share, while smaller companies like Epitherapeutics contribute to a more fragmented landscape. M&A deal values within the European epigenetics industry have seen fluctuations, with a reported xx Million in total deal value in 2024 (Note: Specific data points require further research to be fully accurate). Furthermore, the report will detail the impact of regulatory changes, such as those impacting clinical trials for epigenetic therapies, and the influence of substitute products, like targeted therapies, on market growth. The end-user analysis will cover research institutions, pharmaceutical companies, and diagnostic laboratories within Europe.

- Market Share Distribution (2024): Illumina Inc. (xx%), Qiagen (xx%), Thermo Fisher Scientific (xx%), Others (xx%)

- M&A Deal Value (2024): xx Million

- Key Regulatory Changes: [Specific examples of regulatory changes affecting the industry in Europe will be included here.]

- Emerging Substitute Products: [List of emerging substitute products and their potential impact will be included here.]

Europe Epigenetics Industry Industry Evolution

This section provides a comprehensive overview of the Europe epigenetics industry's evolution from 2019 to 2033. It explores the market's growth trajectory, pinpointing key milestones and charting technological advancements that have shaped the sector. The analysis will highlight the increasing adoption of next-generation sequencing (NGS) and advancements in CRISPR technology, alongside evolving consumer demands, such as the increased focus on personalized medicine and diagnostics. Specific data points regarding growth rates and adoption metrics for various technologies within the epigenetics field will be presented. For instance, the adoption rate of DNA methylation assays is expected to increase by xx% between 2025 and 2033, driven by advancements in assay sensitivity and cost reduction. The analysis also investigates the influence of major market players and their contributions to the overall industry growth. The report will also address the increasing demand for epigenetic-based diagnostics and therapies, specifically in oncology.

Leading Regions, Countries, or Segments in Europe Epigenetics Industry

This section identifies the leading regions, countries, and segments within the European epigenetics market. By utilizing detailed market segmentation, including By Technology (DNA Methylation, Histone Methylation, Histone Acetylation, Large noncoding RNA, MicroRNA modification, Chromatin Structures), By Product (Kits, Reagents, Enzymes, Instruments), and By Application (Oncology, Non-Oncology, including Developmental Biology and other research areas), this analysis pinpoints the most dominant areas.

Key Drivers (Examples):

- Germany: Strong research infrastructure and government funding for life sciences research.

- United Kingdom: High concentration of biotech companies and strong pharmaceutical industry.

- France: Significant investments in genomic research and personalized medicine initiatives.

- Oncology Segment: High prevalence of cancer and significant investment in cancer research and therapeutics.

- DNA Methylation Technology: Wide adoption due to established techniques and clinical relevance.

Dominance Factors: The dominant segments and regions are identified based on factors such as market size, technological advancements, regulatory support, investment trends, and the presence of key players. Further analysis will provide detailed explanations of the factors leading to the dominance of specific regions or segments. For example, the dominance of Germany might be attributed to a combination of strong government funding, a robust network of research institutions and a concentration of key players in the region.

Europe Epigenetics Industry Product Innovations

This section details the recent product innovations within the European epigenetics industry, emphasizing the unique selling propositions (USPs) and technological advancements that have defined the market. New assay kits with increased sensitivity and throughput, novel reagents for epigenetic modification studies and advanced instrumentation for high-throughput analysis will be highlighted. These innovations drive efficiency, accuracy and affordability, expanding applications in research and clinical settings.

Propelling Factors for Europe Epigenetics Industry Growth

The growth of the European epigenetics industry is fueled by a convergence of technological, economic, and regulatory factors. Advancements in NGS and CRISPR technologies are lowering costs and expanding the scope of epigenetic research. Increasing government funding for research and development (R&D), coupled with a growing awareness of the role of epigenetics in disease, drives market expansion. Furthermore, the increasing prevalence of chronic diseases, including cancer, creates a larger demand for epigenetic-based diagnostics and therapies.

Obstacles in the Europe Epigenetics Industry Market

Despite significant potential, the European epigenetics industry faces challenges. Strict regulatory pathways for new epigenetic therapies increase development time and costs. Supply chain disruptions can affect the availability of critical reagents and instruments. Intense competition among established players and emerging companies also poses a significant challenge. These obstacles can impact market growth and profitability.

Future Opportunities in Europe Epigenetics Industry

The future of the European epigenetics industry holds exciting possibilities. Emerging markets for epigenetic diagnostics and therapeutics in personalized medicine represent substantial growth areas. Advancements in data analytics and artificial intelligence (AI) will improve the interpretation of complex epigenetic data. Expanding collaborations between academic institutions, research organizations and pharmaceutical companies will foster innovation and expedite the translation of research into clinical applications.

Major Players in the Europe Epigenetics Industry Ecosystem

- Zymo Research Corporation

- Qiagen

- Diagenode Inc

- F Hoffmann-La Roche AG

- Epitherapeutics

- Illumina Inc

- Merck & Co

- Thermo Fisher Scientific

Key Developments in Europe Epigenetics Industry Industry

- [Date]: Launch of a new epigenetic diagnostic test by [Company Name].

- [Date]: Acquisition of [Company A] by [Company B] expanding market share in [Specific Area].

- [Date]: Publication of key research findings highlighting the role of epigenetics in [Specific Disease].

- [Date]: Approval of a new epigenetic therapy by European Medicines Agency (EMA).

Strategic Europe Epigenetics Industry Market Forecast

The future of the Europe epigenetics industry is bright, driven by continuous technological innovation, increasing awareness of epigenetics’ role in disease, and substantial investment in research and development. The market is poised for significant growth in the coming years, with the potential to revolutionize healthcare and therapeutic interventions. Continued focus on developing more sensitive and specific assays, along with advances in data analysis, will unlock new opportunities for personalized medicine and disease management. The increasing demand for diagnostics and therapies within the oncology sector is projected to remain a major driver of market growth throughout the forecast period.

Europe Epigenetics Industry Segmentation

-

1. Product

-

1.1. By Kits

- 1.1.1. Bisulfite Conversion Kits

- 1.1.2. Chip-seq Kits

- 1.1.3. RNA Sequencing Market

- 1.1.4. Whole Genome Amplification Market

- 1.1.5. 5-HMC and 5-MC Analysis Kits

- 1.1.6. Other Kits

-

1.2. By Reagents

- 1.2.1. Antibodies

- 1.2.2. Buffers

- 1.2.3. Histones

- 1.2.4. Magnetic Beads

- 1.2.5. Primers

- 1.2.6. Other Reagents

-

1.3. By Enzymes

- 1.3.1. DNA - Modifying Enzymes

- 1.3.2. Protein Modifying Enzymes

- 1.3.3. RNA Modifying Enzymes

-

1.4. By Instruments

- 1.4.1. Mass Spectrometer

- 1.4.2. Sonicators

- 1.4.3. Next Generation Sequencers

- 1.4.4. Other Instruments

-

1.1. By Kits

-

2. Application

- 2.1. Oncology

-

2.2. Non-Oncology

- 2.2.1. Inflammatory Diseases

- 2.2.2. Metabolic Diseases

- 2.2.3. Infectious Diseases

- 2.2.4. Cardiovascular Diseases

- 2.2.5. Other Non-Oncology Applications

- 2.3. Developmental Biology

- 2.4. Other Research Areas

-

3. Technology

- 3.1. DNA Methylation

- 3.2. Histone Methylation

- 3.3. Histone Acetylation

- 3.4. Large noncoding RNA

- 3.5. MicroRNA modification

- 3.6. Chromatin Structures

Europe Epigenetics Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Epigenetics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases

- 3.3. Market Restrains

- 3.3.1. ; Rising Cost of Instruments; Dearth of Skilled Researchers

- 3.4. Market Trends

- 3.4.1. Oncology is Expected to Grow Faster in the Application Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Kits

- 5.1.1.1. Bisulfite Conversion Kits

- 5.1.1.2. Chip-seq Kits

- 5.1.1.3. RNA Sequencing Market

- 5.1.1.4. Whole Genome Amplification Market

- 5.1.1.5. 5-HMC and 5-MC Analysis Kits

- 5.1.1.6. Other Kits

- 5.1.2. By Reagents

- 5.1.2.1. Antibodies

- 5.1.2.2. Buffers

- 5.1.2.3. Histones

- 5.1.2.4. Magnetic Beads

- 5.1.2.5. Primers

- 5.1.2.6. Other Reagents

- 5.1.3. By Enzymes

- 5.1.3.1. DNA - Modifying Enzymes

- 5.1.3.2. Protein Modifying Enzymes

- 5.1.3.3. RNA Modifying Enzymes

- 5.1.4. By Instruments

- 5.1.4.1. Mass Spectrometer

- 5.1.4.2. Sonicators

- 5.1.4.3. Next Generation Sequencers

- 5.1.4.4. Other Instruments

- 5.1.1. By Kits

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Oncology

- 5.2.2. Non-Oncology

- 5.2.2.1. Inflammatory Diseases

- 5.2.2.2. Metabolic Diseases

- 5.2.2.3. Infectious Diseases

- 5.2.2.4. Cardiovascular Diseases

- 5.2.2.5. Other Non-Oncology Applications

- 5.2.3. Developmental Biology

- 5.2.4. Other Research Areas

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. DNA Methylation

- 5.3.2. Histone Methylation

- 5.3.3. Histone Acetylation

- 5.3.4. Large noncoding RNA

- 5.3.5. MicroRNA modification

- 5.3.6. Chromatin Structures

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Epigenetics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Zymo Research Corporation*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Qiagen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Diagenode Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 F Hoffmann-La Roche AG

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Epitherapeutics

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Illumina Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Merck & Co

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Thermo Fisher Scientific

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Zymo Research Corporation*List Not Exhaustive

List of Figures

- Figure 1: Europe Epigenetics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Epigenetics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Epigenetics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Epigenetics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Epigenetics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Epigenetics Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 5: Europe Epigenetics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Epigenetics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Epigenetics Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 15: Europe Epigenetics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Epigenetics Industry Revenue Million Forecast, by Technology 2019 & 2032

- Table 17: Europe Epigenetics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: UK Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Epigenetics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Epigenetics Industry?

The projected CAGR is approximately 14.50%.

2. Which companies are prominent players in the Europe Epigenetics Industry?

Key companies in the market include Zymo Research Corporation*List Not Exhaustive, Qiagen, Diagenode Inc, F Hoffmann-La Roche AG, Epitherapeutics, Illumina Inc, Merck & Co, Thermo Fisher Scientific.

3. What are the main segments of the Europe Epigenetics Industry?

The market segments include Product, Application, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Incidence and Prevalence of Cancer; Increasing Funding for R&D in Healthcare; Rising Epigenetic Applications in Non-Oncology Diseases.

6. What are the notable trends driving market growth?

Oncology is Expected to Grow Faster in the Application Segment.

7. Are there any restraints impacting market growth?

; Rising Cost of Instruments; Dearth of Skilled Researchers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Epigenetics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Epigenetics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Epigenetics Industry?

To stay informed about further developments, trends, and reports in the Europe Epigenetics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence