Key Insights

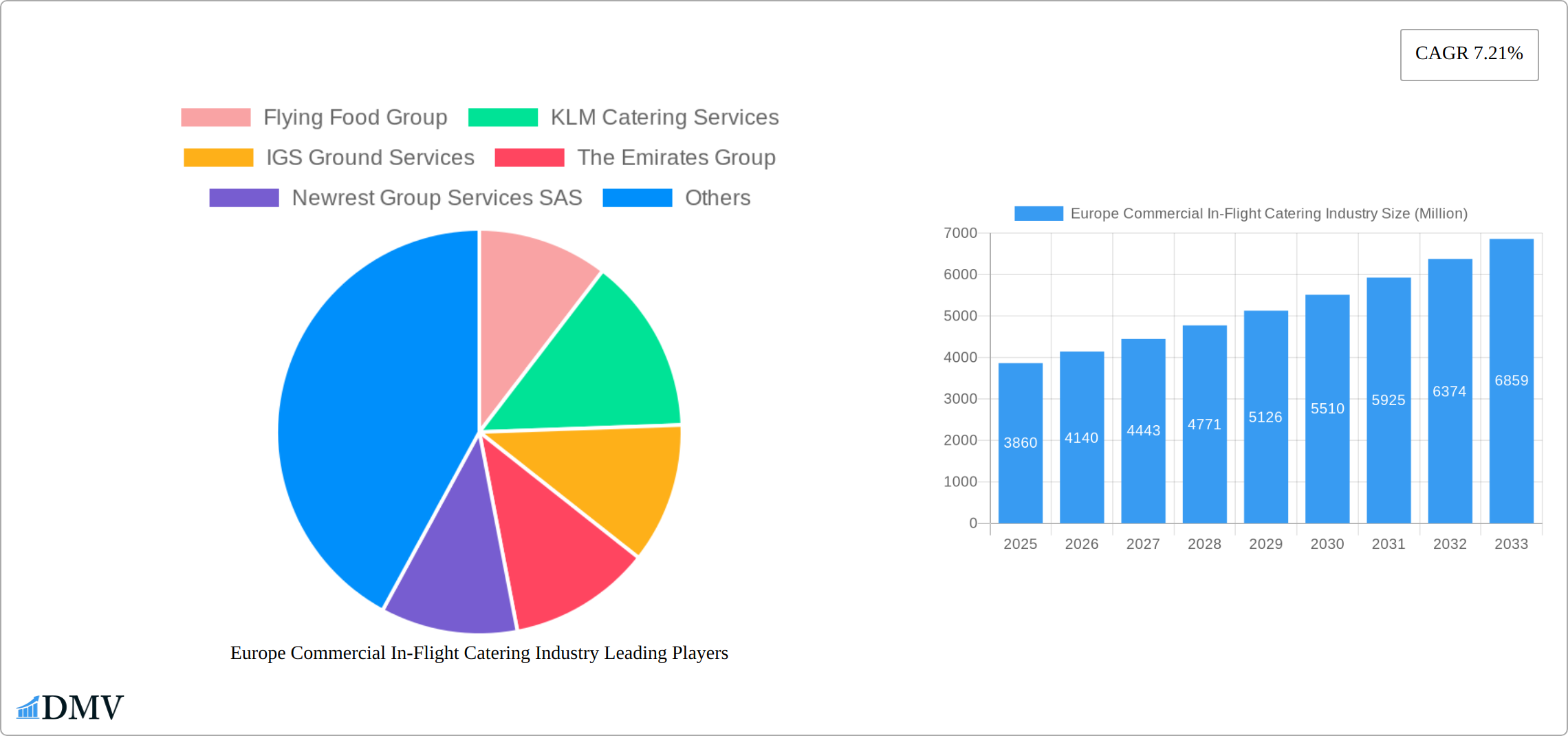

The European commercial in-flight catering market, valued at €3.86 billion in 2025, is projected to experience robust growth, driven by the resurgence of air travel post-pandemic and a rising preference for premium onboard dining experiences. A Compound Annual Growth Rate (CAGR) of 7.21% is anticipated from 2025 to 2033, indicating a significant market expansion. This growth is fueled by several factors: the increasing number of air passengers, particularly in the burgeoning low-cost carrier segment which is increasingly offering paid meal options, the expansion of full-service carriers into new routes and markets, and the growing demand for diverse and high-quality meal options catering to various dietary needs and preferences. The market segmentation reveals significant opportunities within the meals and bakery/confectionery categories, with business and first-class segments driving premium pricing and revenue streams. Key players like Flying Food Group, KLM Catering Services, and Gategroup are actively investing in innovative solutions, such as sustainable packaging and personalized menus, to cater to evolving consumer demands and enhance their market position. However, challenges such as fluctuating fuel prices, economic downturns impacting travel, and stringent regulations regarding food safety and hygiene remain potential restraints on market growth.

Europe Commercial In-Flight Catering Industry Market Size (In Billion)

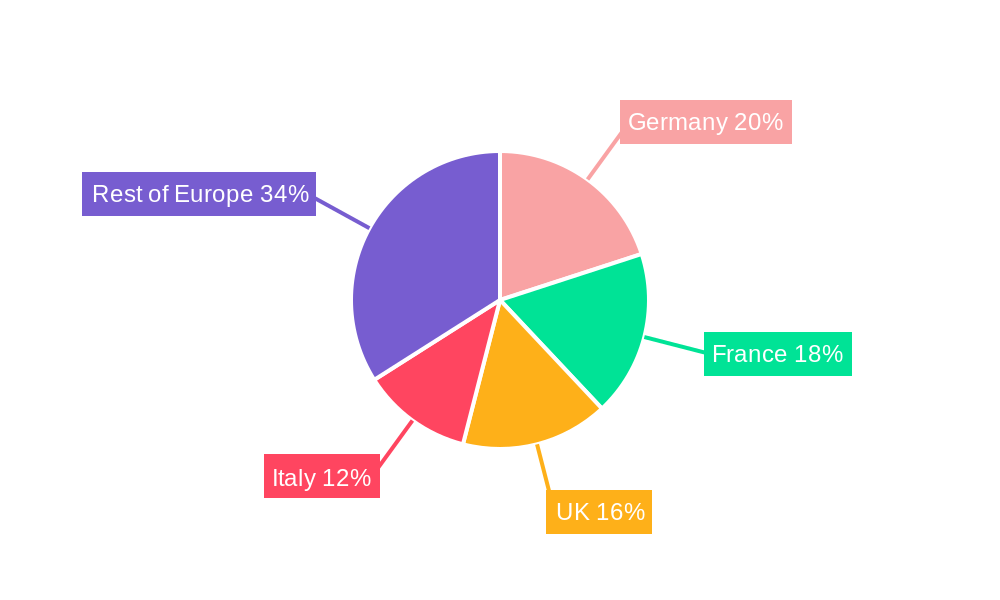

The geographical distribution within Europe shows a concentration of market share across major economies like Germany, France, the United Kingdom, and Italy, reflecting the high volume of air travel in these regions. However, significant growth potential exists in other European markets, offering opportunities for expansion and market penetration by established players and new entrants. The competitive landscape is characterized by a mix of large multinational corporations and specialized regional caterers. The ongoing consolidation and strategic partnerships within the industry suggest a future trajectory of increased market concentration and a greater focus on efficiency, scalability, and premium service offerings to meet the evolving needs of airlines and their passengers.

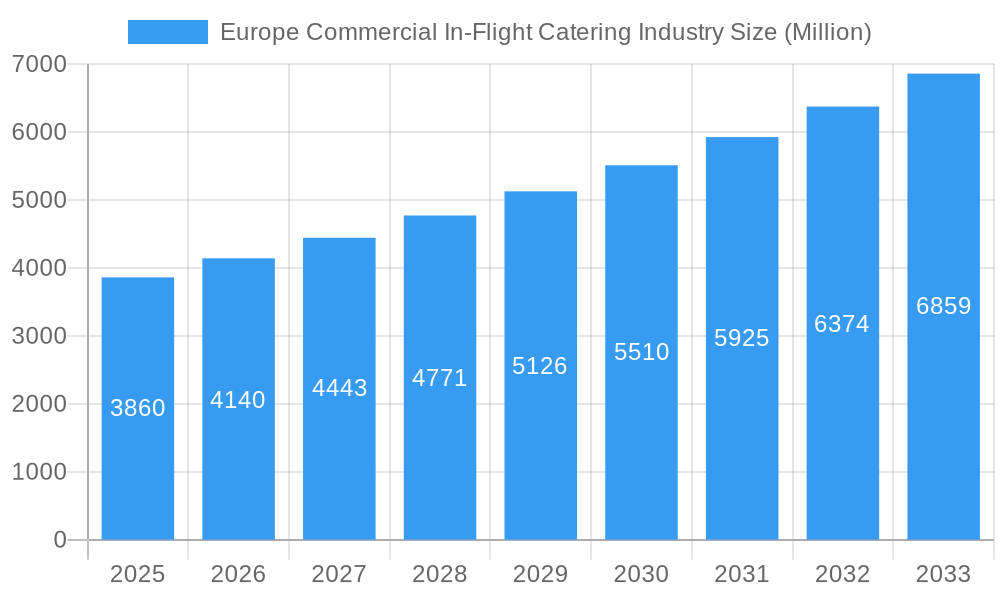

Europe Commercial In-Flight Catering Industry Company Market Share

Europe Commercial In-Flight Catering Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Commercial In-Flight Catering industry, offering a comprehensive overview of market trends, key players, and future growth prospects. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The total market value is predicted to reach xx Million by 2033.

Europe Commercial In-Flight Catering Industry Market Composition & Trends

The European commercial in-flight catering market is characterized by a moderate level of concentration, with several major players holding significant market share. The top five companies—Gategroup, Newrest Group Services SAS, Flying Food Group, KLM Catering Services, and The Emirates Group—control approximately xx% of the market in 2025, while numerous smaller regional players fill the remaining share. Innovation is driven by increasing consumer demand for higher-quality, healthier, and more sustainable meal options, leading to investments in advanced food technologies and sustainable packaging. Stringent regulations regarding food safety and hygiene, along with evolving consumer preferences, are shaping the competitive landscape. Substitutes, such as onboard snack options offered by airlines independently or through partnerships, exert a moderate impact. The primary end-users are full-service and low-cost carriers, with varying demands depending on the class of service (economy, business, and first class). Mergers and acquisitions (M&A) are a prominent feature, with deal values exceeding xx Million in recent years. Notable examples include the Gategroup acquisition of LSG Group's European operations (July 2021).

- Market Concentration: Top 5 players hold xx% market share (2025).

- M&A Activity: Deal values exceeding xx Million in recent years.

- Key Innovation Drivers: Consumer demand for healthier, sustainable options.

- Regulatory Landscape: Stringent food safety and hygiene regulations.

Europe Commercial In-Flight Catering Industry Industry Evolution

The European in-flight catering market exhibits a steady growth trajectory, driven by increasing air passenger traffic, particularly in the full-service segment. The historical period (2019-2024) witnessed a Compound Annual Growth Rate (CAGR) of xx%, although the COVID-19 pandemic caused a temporary downturn. The market is recovering strongly, with projected growth of xx% CAGR between 2025 and 2033. Technological advancements, such as improved food preservation techniques and customized meal ordering systems, are enhancing efficiency and customer satisfaction. Shifting consumer preferences towards healthier and more personalized food choices are pushing caterers to innovate their offerings. The adoption of sustainable practices, including reduced waste and eco-friendly packaging, is also gaining traction. Growth is uneven across segments, with full-service carriers showing higher growth rates compared to low-cost carriers due to their focus on premium meal options.

Leading Regions, Countries, or Segments in Europe Commercial In-Flight Catering Industry

The United Kingdom and Germany dominate the European in-flight catering market, driven by high passenger volumes and a robust airline industry. France and Spain also contribute significantly to overall market size. Within the various segments, Meals represent the largest revenue share, followed by Beverages. Full-service carriers account for a significant percentage of the market due to their provision of more extensive meal services in all seating classes (Economy, Business, and First Class). The Business and First Class segments are the most lucrative due to higher per-passenger spending.

- Key Drivers (UK & Germany): High passenger volumes, established airline hubs.

- Dominant Segments: Meals (largest revenue share), Full-Service Carriers (higher spending).

- Lucrative Segments: Business and First Class (high per-passenger spending).

Europe Commercial In-Flight Catering Industry Product Innovations

Recent innovations are revolutionizing the inflight dining experience, prioritizing passenger satisfaction through highly personalized meal selections, the integration of nutrient-rich and wholesome ingredients, and the development of advanced packaging solutions designed to minimize environmental impact while elevating visual appeal. Leading companies are strategically implementing cutting-edge technologies such as precision pre-portioned meals, sophisticated temperature regulation systems, and dynamic meal customization engines that adapt to individual passenger preferences and dietary requirements. The core value propositions are firmly rooted in delivering unparalleled convenience, catering to a growing health consciousness among travelers, and significantly enhancing the overall passenger journey. Furthermore, significant strides in food preservation techniques and innovative packaging materials are not only contributing to substantial cost reductions but are also instrumental in maintaining and improving the superior quality of inflight cuisine.

Propelling Factors for Europe Commercial In-Flight Catering Industry Growth

Growth is propelled by rising air passenger numbers, especially in budget airlines, which are increasing their food and beverage offerings. Technological advancements such as improved food preservation, efficient logistics and automation are improving efficiency and quality. Government support and investment in the aviation industry contribute to overall growth. Increasing demand for healthier and personalized meal choices is fostering innovation and attracting investment.

Obstacles in the Europe Commercial In-Flight Catering Industry Market

Challenges include fluctuating fuel prices which impact airline profitability and in turn the demand for catering services. Supply chain disruptions, particularly post-pandemic, and increasing raw material costs are pressing concerns. Intense competition among caterers necessitates a constant focus on cost efficiency and innovation to maintain profitability. Stringent food safety regulations add complexity and require significant investment in compliance.

Future Opportunities in Europe Commercial In-Flight Catering Industry

The burgeoning demand for dining options that are both sustainable and ethically sourced presents a substantial and compelling avenue for significant growth within the European inflight catering sector. Strategic expansion into emerging European markets, coupled with a focused approach to serving niche consumer segments, including those with specific dietary restrictions or preferences, offers considerable untapped potential. Furthermore, strategic investments in advanced technologies aimed at optimizing inventory management and driving significant waste reduction initiatives are poised to substantially bolster profitability and operational efficiency across the industry.

Major Players in the Europe Commercial In-Flight Catering Industry Ecosystem

- Flying Food Group

- KLM Catering Services

- IGS Ground Services

- The Emirates Group

- Newrest Group Services SAS

- Fleury Michon Airline Catering

- DO & CO Aktiengesellschaft

- Carlos Aviation Catering Network GmbH

- SATS Ltd

- Gategroup

Key Developments in Europe Commercial In-Flight Catering Industry Industry

- July 2021: Gategroup's strategic acquisition of LSG Group's European operations has demonstrably reshaped the market's competitive landscape and significant market share distribution.

- January 2022: Scandinavian Airlines has formalized a pivotal partnership with Newrest, a move that strategically expands Newrest's operational footprint and influence within the Scandinavian region.

Strategic Europe Commercial In-Flight Catering Industry Market Forecast

The European commercial in-flight catering market is on a trajectory for robust and sustained growth, primarily fueled by the resurgence of air passenger traffic and a continually escalating demand for premium and diverse meal offerings. Significant opportunities are emerging from the increasing passenger preference for highly personalized, health-conscious, and environmentally sustainable food choices. Success within this dynamic and competitive arena will be critically dependent on forging strategic alliances and making astute investments in transformative technologies. The market is projected to experience a compelling Compound Annual Growth Rate (CAGR) of approximately XX% between 2025 and 2033, ultimately reaching an estimated total market value of XX Million Euros.

Europe Commercial In-Flight Catering Industry Segmentation

-

1. Food Type

- 1.1. Meals

- 1.2. Bakery and Confectionary

- 1.3. Beverages

- 1.4. Other Food Types

-

2. Flight Type

- 2.1. Full-service Carriers

- 2.2. Low-cost Carriers

-

3. Aircraft Seating Class

- 3.1. Economy Class

- 3.2. Business Class

- 3.3. First Class

Europe Commercial In-Flight Catering Industry Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Italy

- 6. Spain

- 7. Rest of Europe

Europe Commercial In-Flight Catering Industry Regional Market Share

Geographic Coverage of Europe Commercial In-Flight Catering Industry

Europe Commercial In-Flight Catering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Bakery and Confectionery Segment is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 5.1.1. Meals

- 5.1.2. Bakery and Confectionary

- 5.1.3. Beverages

- 5.1.4. Other Food Types

- 5.2. Market Analysis, Insights and Forecast - by Flight Type

- 5.2.1. Full-service Carriers

- 5.2.2. Low-cost Carriers

- 5.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 5.3.1. Economy Class

- 5.3.2. Business Class

- 5.3.3. First Class

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.4.2. Germany

- 5.4.3. France

- 5.4.4. Russia

- 5.4.5. Italy

- 5.4.6. Spain

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Food Type

- 6. United Kingdom Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 6.1.1. Meals

- 6.1.2. Bakery and Confectionary

- 6.1.3. Beverages

- 6.1.4. Other Food Types

- 6.2. Market Analysis, Insights and Forecast - by Flight Type

- 6.2.1. Full-service Carriers

- 6.2.2. Low-cost Carriers

- 6.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 6.3.1. Economy Class

- 6.3.2. Business Class

- 6.3.3. First Class

- 6.1. Market Analysis, Insights and Forecast - by Food Type

- 7. Germany Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 7.1.1. Meals

- 7.1.2. Bakery and Confectionary

- 7.1.3. Beverages

- 7.1.4. Other Food Types

- 7.2. Market Analysis, Insights and Forecast - by Flight Type

- 7.2.1. Full-service Carriers

- 7.2.2. Low-cost Carriers

- 7.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 7.3.1. Economy Class

- 7.3.2. Business Class

- 7.3.3. First Class

- 7.1. Market Analysis, Insights and Forecast - by Food Type

- 8. France Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 8.1.1. Meals

- 8.1.2. Bakery and Confectionary

- 8.1.3. Beverages

- 8.1.4. Other Food Types

- 8.2. Market Analysis, Insights and Forecast - by Flight Type

- 8.2.1. Full-service Carriers

- 8.2.2. Low-cost Carriers

- 8.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 8.3.1. Economy Class

- 8.3.2. Business Class

- 8.3.3. First Class

- 8.1. Market Analysis, Insights and Forecast - by Food Type

- 9. Russia Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 9.1.1. Meals

- 9.1.2. Bakery and Confectionary

- 9.1.3. Beverages

- 9.1.4. Other Food Types

- 9.2. Market Analysis, Insights and Forecast - by Flight Type

- 9.2.1. Full-service Carriers

- 9.2.2. Low-cost Carriers

- 9.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 9.3.1. Economy Class

- 9.3.2. Business Class

- 9.3.3. First Class

- 9.1. Market Analysis, Insights and Forecast - by Food Type

- 10. Italy Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 10.1.1. Meals

- 10.1.2. Bakery and Confectionary

- 10.1.3. Beverages

- 10.1.4. Other Food Types

- 10.2. Market Analysis, Insights and Forecast - by Flight Type

- 10.2.1. Full-service Carriers

- 10.2.2. Low-cost Carriers

- 10.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 10.3.1. Economy Class

- 10.3.2. Business Class

- 10.3.3. First Class

- 10.1. Market Analysis, Insights and Forecast - by Food Type

- 11. Spain Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Food Type

- 11.1.1. Meals

- 11.1.2. Bakery and Confectionary

- 11.1.3. Beverages

- 11.1.4. Other Food Types

- 11.2. Market Analysis, Insights and Forecast - by Flight Type

- 11.2.1. Full-service Carriers

- 11.2.2. Low-cost Carriers

- 11.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 11.3.1. Economy Class

- 11.3.2. Business Class

- 11.3.3. First Class

- 11.1. Market Analysis, Insights and Forecast - by Food Type

- 12. Rest of Europe Europe Commercial In-Flight Catering Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Food Type

- 12.1.1. Meals

- 12.1.2. Bakery and Confectionary

- 12.1.3. Beverages

- 12.1.4. Other Food Types

- 12.2. Market Analysis, Insights and Forecast - by Flight Type

- 12.2.1. Full-service Carriers

- 12.2.2. Low-cost Carriers

- 12.3. Market Analysis, Insights and Forecast - by Aircraft Seating Class

- 12.3.1. Economy Class

- 12.3.2. Business Class

- 12.3.3. First Class

- 12.1. Market Analysis, Insights and Forecast - by Food Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Flying Food Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 KLM Catering Services

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IGS Ground Services

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 The Emirates Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Newrest Group Services SAS

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fleury Michon Airline Catering

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 DO & CO Aktiengesellschaf

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Carlos Aviation Catering Network Gmb

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 SATS Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Gategroup

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Flying Food Group

List of Figures

- Figure 1: Europe Commercial In-Flight Catering Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Commercial In-Flight Catering Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 2: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 3: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 4: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 6: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 7: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 8: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 10: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 11: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 12: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 14: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 15: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 16: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 18: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 19: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 20: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 22: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 23: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 24: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 26: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 27: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 28: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Food Type 2020 & 2033

- Table 30: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Flight Type 2020 & 2033

- Table 31: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Aircraft Seating Class 2020 & 2033

- Table 32: Europe Commercial In-Flight Catering Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Commercial In-Flight Catering Industry?

The projected CAGR is approximately 7.21%.

2. Which companies are prominent players in the Europe Commercial In-Flight Catering Industry?

Key companies in the market include Flying Food Group, KLM Catering Services, IGS Ground Services, The Emirates Group, Newrest Group Services SAS, Fleury Michon Airline Catering, DO & CO Aktiengesellschaf, Carlos Aviation Catering Network Gmb, SATS Ltd, Gategroup.

3. What are the main segments of the Europe Commercial In-Flight Catering Industry?

The market segments include Food Type, Flight Type, Aircraft Seating Class.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.86 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Bakery and Confectionery Segment is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Scandinavian Airlines partnered with Newrest for its inflight catering services. Under the agreement, the company would provide inflight catering services to SAS in the capital cities of Sweden, Norway, and Denmark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Commercial In-Flight Catering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Commercial In-Flight Catering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Commercial In-Flight Catering Industry?

To stay informed about further developments, trends, and reports in the Europe Commercial In-Flight Catering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence