Key Insights

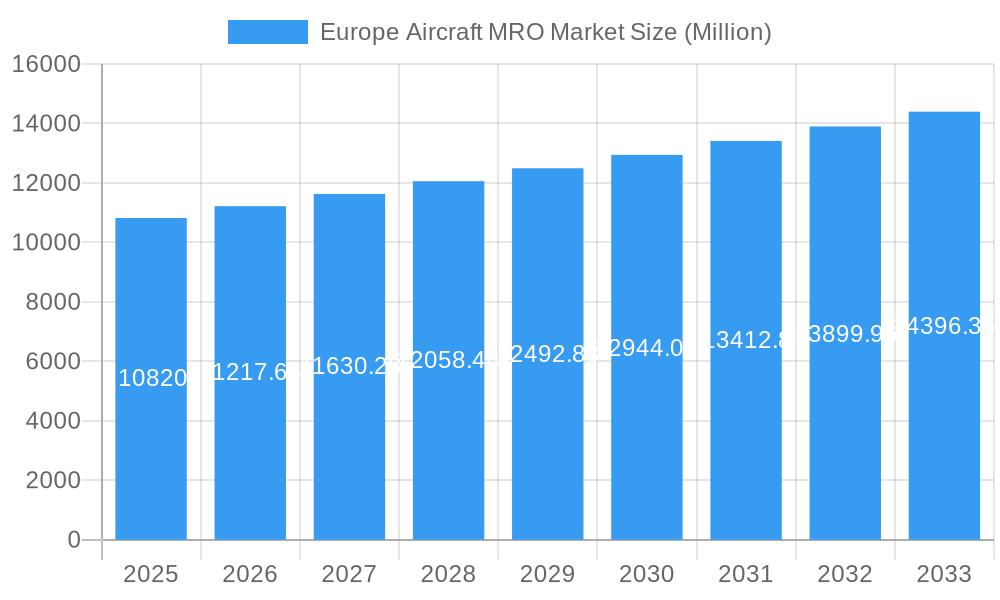

The European Aircraft Maintenance, Repair, and Overhaul (MRO) market, valued at €10.82 billion in 2025, is poised for steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.42% from 2025 to 2033. This growth is driven by several factors. The aging commercial aircraft fleet across Europe necessitates increased maintenance and repair activities. Furthermore, stringent safety regulations and a growing focus on predictive maintenance technologies are boosting demand for sophisticated MRO services. The increasing adoption of sustainable aviation fuels (SAF) and the development of more fuel-efficient aircraft designs also indirectly contribute to market expansion, as these initiatives prolong the lifespan of aircraft, requiring more maintenance over time. Growth is further fueled by the robust presence of established MRO providers such as Lufthansa Technik AG, Airbus SE, and Safran SA, who continuously invest in advanced technologies and expand their service capabilities. Competition is strong, however, requiring providers to focus on efficiency, specialization, and technological innovation to maintain profitability. Market segmentation reveals that commercial aircraft MRO holds the largest market share, followed by military and general aviation segments, reflecting the size and operational intensity of the commercial airline industry in Europe. Germany, France, and the UK remain the key markets within Europe due to their large airline presence and well-established MRO infrastructure.

Europe Aircraft MRO Market Market Size (In Billion)

The market is not without its challenges. Fluctuations in fuel prices, economic downturns, and geopolitical instability can impact airline operations and, consequently, MRO spending. Furthermore, the increasing complexity of modern aircraft necessitates specialized skills and advanced technologies, potentially limiting the entry of new players. However, the ongoing modernization of European fleets and the growing adoption of digital solutions for MRO activities, such as AI-powered predictive maintenance and digital twins, are expected to mitigate some of these challenges. The integration of these technologies will optimize maintenance schedules, reduce downtime, and improve overall operational efficiency. The long-term forecast suggests continued, albeit moderate, growth for the European aircraft MRO market, driven by sustained demand from the commercial aviation sector and advancements in maintenance technologies.

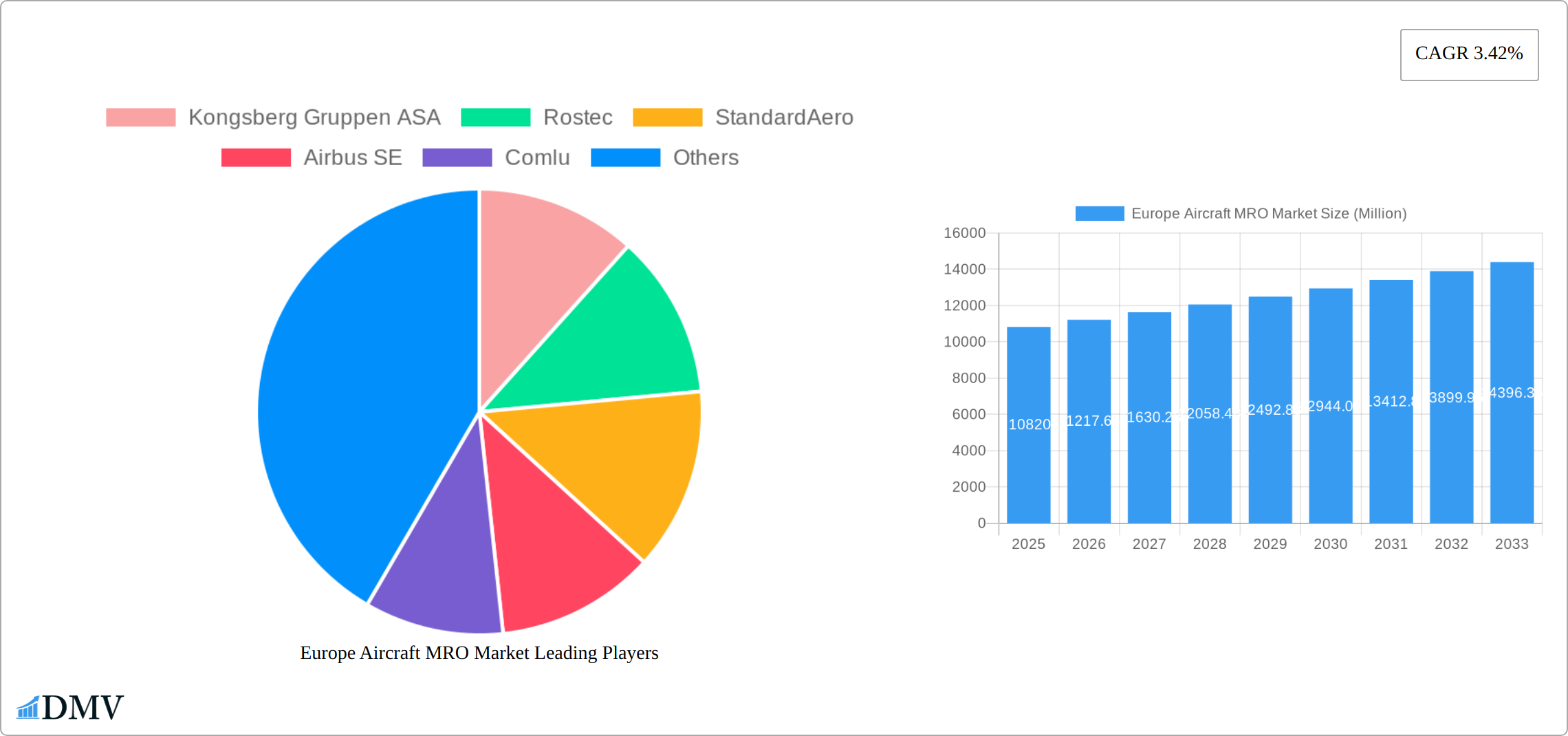

Europe Aircraft MRO Market Company Market Share

Europe Aircraft MRO Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Aircraft Maintenance, Repair, and Overhaul (MRO) market, offering a comprehensive overview of its current state and future trajectory. With a study period spanning 2019-2033, a base year of 2025, and a forecast period from 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on this dynamic market. The report meticulously analyzes market size, segmentation, key players, and future growth prospects, providing actionable intelligence for informed decision-making. Total market value is projected to reach xx Million by 2033.

Europe Aircraft MRO Market Composition & Trends

This section delves into the intricate landscape of the European Aircraft MRO market, evaluating its concentration, innovation drivers, regulatory environment, substitute products, and end-user profiles. We analyze mergers and acquisitions (M&A) activities, providing insights into market share distribution and deal values. The highly fragmented nature of the market presents both opportunities and challenges for established players and newcomers.

- Market Concentration: The European Aircraft MRO market exhibits a moderately concentrated structure, with a handful of major players commanding significant market share, while numerous smaller specialized firms cater to niche segments. Market share is approximately distributed as follows: Top 5 players hold 45% of the market, next 10 players hold 30%, and remaining players hold 25%.

- Innovation Catalysts: Technological advancements, such as the adoption of predictive maintenance, digital twin technology, and advanced materials, are driving innovation and efficiency gains.

- Regulatory Landscape: Stringent safety regulations and compliance requirements imposed by the European Union Aviation Safety Agency (EASA) significantly influence market dynamics.

- Substitute Products: The emergence of alternative maintenance and repair solutions, such as 3D printing for component manufacturing, presents both challenges and opportunities for traditional MRO providers.

- End-User Profiles: The market is served by a diverse range of end-users, including airlines, military organizations, and general aviation operators. The specific needs and demands of each segment significantly impact service requirements.

- M&A Activities: The past five years have witnessed significant M&A activity in the European Aircraft MRO sector, with deal values averaging approximately xx Million per transaction. Examples include the acquisition of the Shannon division of Lufthansa Technik by Atlantic Aviation Group in October 2021.

Europe Aircraft MRO Market Industry Evolution

The European Aircraft MRO market has demonstrated a robust and evolving landscape. Over the past five years, it has witnessed consistent expansion, propelled by the resurgence of air travel demand and the continued operation of an aging, yet significant, aircraft fleet. Key technological advancements are revolutionizing MRO operations. The adoption of predictive maintenance, leveraging AI and IoT sensors, allows for proactive issue identification, significantly enhancing operational efficiency and substantially reducing unplanned downtime and overall maintenance costs. Furthermore, the integration of big data analytics enables deeper insights into fleet performance, optimizing maintenance schedules and resource allocation. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033), with an anticipated valuation exceeding XX Million by 2033. This sustained growth is underpinned by the enduring global demand for air travel and the strategic expansion of low-cost carriers across the continent. Evolving consumer preferences, characterized by a growing demand for personalized MRO solutions and enhanced transparency in service delivery, are also playing a pivotal role in shaping market dynamics. By 2033, the adoption of advanced digital technologies within the MRO sector is expected to reach approximately XX%, signifying a transformative shift towards a more connected and data-driven industry.

Leading Regions, Countries, or Segments in Europe Aircraft MRO Market

This section provides a detailed analysis of the leading geographical areas, specific countries, and crucial segments within the European Aircraft MRO market. The assessment considers the granular breakdown of MRO types, including Engine MRO, Components MRO, Airframe MRO, and Other MRO Types, as well as the diverse aircraft types such as Commercial Aircraft, Military Aircraft, and General Aviation Aircraft.

-

Dominant Region: Western Europe stands as the preeminent force in the market, with Germany, France, and the United Kingdom spearheading its dominance. This leadership is attributed to the strategic presence of major global MRO providers and the extensive operational fleet of aircraft within these nations.

-

Key Drivers:

- High Aircraft Density: The sheer volume of aircraft operating within these key European regions directly translates into substantial and sustained demand for comprehensive MRO services.

- Robust Aviation Infrastructure: The presence of world-class airports, extensive logistics networks, and well-developed support facilities creates a highly conducive and enabling environment for MRO businesses to thrive and innovate.

- Governmental Support and Investments: Strategic governmental support, coupled with significant investments in aviation research and development (R&D) and the implementation of supportive regulatory policies, actively facilitates and accelerates market growth.

-

Dominant Segments:

- Commercial Aircraft: This segment commands the largest market share, driven by the sheer magnitude of commercial aircraft in active operation across Europe, necessitating continuous and extensive MRO support.

- Engine MRO: The inherent high cost, intricate design, and critical role of aircraft engines generate an exceptionally high demand for specialized and highly skilled MRO services, making it a cornerstone of the market.

Europe Aircraft MRO Market Product Innovations

Recent innovations include advancements in predictive maintenance technologies, utilizing data analytics to optimize maintenance schedules and minimize downtime. The adoption of augmented and virtual reality (AR/VR) technologies for training and maintenance procedures enhances efficiency and safety. 3D printing is emerging as a disruptive technology, enabling the rapid production of customized components, reducing lead times, and lowering costs. The unique selling proposition of these innovations lies in their ability to improve operational efficiency, reduce maintenance costs, and enhance safety.

Propelling Factors for Europe Aircraft MRO Market Growth

A confluence of powerful factors is synergistically propelling the growth trajectory of the European Aircraft MRO market. The escalating average age of the global aircraft fleet inherently necessitates more frequent and sophisticated maintenance, repair, and overhaul activities. Simultaneously, the robust and ongoing increase in air passenger traffic directly fuels the demand for highly efficient, reliable, and safe aircraft operations, underscoring the critical role of MRO providers. Furthermore, the stringent and ever-evolving safety regulations imposed by aviation authorities mandate adherence to the highest maintenance standards, driving investments in quality MRO services. Technological advancements, particularly the widespread adoption of predictive maintenance strategies and comprehensive digitalization initiatives, are continuously enhancing operational efficiency and reducing turnaround times. Coupled with these operational drivers, supportive governmental policies and targeted incentives for the aviation industry are also instrumental in fostering a conducive environment for sustained MRO market expansion.

Obstacles in the Europe Aircraft MRO Market

The European Aircraft MRO market faces challenges such as supply chain disruptions impacting the availability of parts and materials. Stringent regulatory requirements can increase compliance costs. Intense competition among MRO providers puts pressure on pricing and margins. Economic fluctuations and uncertainties impact airline investment in maintenance and upgrades. These factors collectively affect market growth.

Future Opportunities in Europe Aircraft MRO Market

The future landscape of the European Aircraft MRO market is ripe with emerging opportunities. The increasing global focus on sustainability is leading to the growing adoption of Sustainable Aviation Fuels (SAFs), which will necessitate new MRO protocols and expertise. The pervasive rise of digital technologies, including AI-driven diagnostics, augmented reality for remote assistance, and blockchain for supply chain transparency, presents significant avenues for innovation and efficiency gains. Expansion into new and developing markets within Europe and beyond holds considerable growth potential. Furthermore, continuous investment in the research and development of novel maintenance technologies and advanced MRO service offerings will unlock new revenue streams and solidify competitive advantages for forward-thinking players in the market.

Major Players in the Europe Aircraft MRO Market Ecosystem

- Kongsberg Gruppen ASA

- Rostec

- StandardAero

- Airbus SE

- Comlu

- MTU Aero Engines AG

- Safran SA

- BAE Systems PLC

- Lufthansa Technik AG

- Bombardier Inc

- TAP Maintenance & Engineering

- Sabena technics S A

- Rolls-Royce Holding PLC

Key Developments in Europe Aircraft MRO Market Industry

- January 2022: Airbus Helicopters opened a new MRO service center near Paris Charles de Gaulle airport, enhancing service capabilities.

- October 2021: Atlantic Aviation Group acquired the Shannon division of Lufthansa Technik, expanding its service offerings to include Boeing 787 Dreamliners and Airbus A320s.

Strategic Europe Aircraft MRO Market Forecast

The European Aircraft MRO market is poised for continued growth, driven by an aging aircraft fleet, rising air travel demand, and technological advancements. The adoption of predictive maintenance, digital twins, and other innovative solutions will improve operational efficiency and reduce maintenance costs. The market will witness further consolidation through M&A activity, leading to larger, more integrated MRO providers. Overall, the outlook for the European Aircraft MRO market remains positive, with significant opportunities for growth and expansion in the coming years.

Europe Aircraft MRO Market Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Components MRO

- 1.3. Airframe MRO

- 1.4. Other MRO Types

-

2. Aircraft Type

- 2.1. Commercial Aircraft

- 2.2. Military Aircraft

- 2.3. General Aviation Aircraft

Europe Aircraft MRO Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Russia

- 5. Rest of Europe

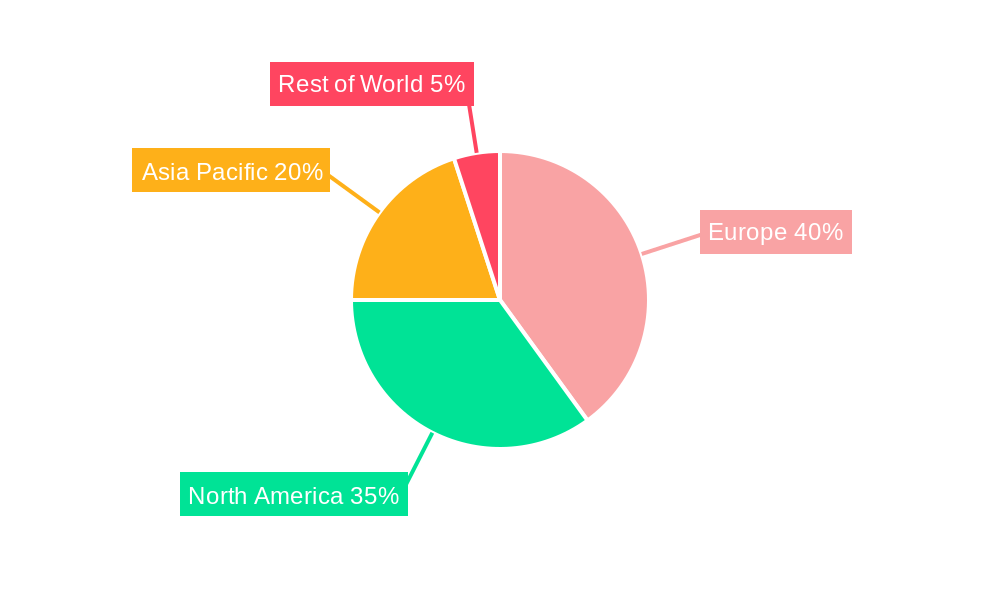

Europe Aircraft MRO Market Regional Market Share

Geographic Coverage of Europe Aircraft MRO Market

Europe Aircraft MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Engine MRO Segment is Expected to Witness Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Components MRO

- 5.1.3. Airframe MRO

- 5.1.4. Other MRO Types

- 5.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.2.1. Commercial Aircraft

- 5.2.2. Military Aircraft

- 5.2.3. General Aviation Aircraft

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Russia

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. United Kingdom Europe Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Components MRO

- 6.1.3. Airframe MRO

- 6.1.4. Other MRO Types

- 6.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.2.1. Commercial Aircraft

- 6.2.2. Military Aircraft

- 6.2.3. General Aviation Aircraft

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Germany Europe Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Components MRO

- 7.1.3. Airframe MRO

- 7.1.4. Other MRO Types

- 7.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.2.1. Commercial Aircraft

- 7.2.2. Military Aircraft

- 7.2.3. General Aviation Aircraft

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. France Europe Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Components MRO

- 8.1.3. Airframe MRO

- 8.1.4. Other MRO Types

- 8.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.2.1. Commercial Aircraft

- 8.2.2. Military Aircraft

- 8.2.3. General Aviation Aircraft

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Russia Europe Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Components MRO

- 9.1.3. Airframe MRO

- 9.1.4. Other MRO Types

- 9.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.2.1. Commercial Aircraft

- 9.2.2. Military Aircraft

- 9.2.3. General Aviation Aircraft

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Rest of Europe Europe Aircraft MRO Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Components MRO

- 10.1.3. Airframe MRO

- 10.1.4. Other MRO Types

- 10.2. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.2.1. Commercial Aircraft

- 10.2.2. Military Aircraft

- 10.2.3. General Aviation Aircraft

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kongsberg Gruppen ASA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rostec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 StandardAero

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Comlu

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MTU Aero Engines AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Safran SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 BAE Systems PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lufthansa Technik AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bombardier Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TAP Maintenance & Engineering

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sabena technics S A

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rolls-Royce Holding PLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Kongsberg Gruppen ASA

List of Figures

- Figure 1: Europe Aircraft MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Aircraft MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 2: Europe Aircraft MRO Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 3: Europe Aircraft MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 5: Europe Aircraft MRO Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 6: Europe Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 8: Europe Aircraft MRO Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 9: Europe Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 11: Europe Aircraft MRO Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 12: Europe Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 14: Europe Aircraft MRO Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 15: Europe Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Aircraft MRO Market Revenue Million Forecast, by MRO Type 2020 & 2033

- Table 17: Europe Aircraft MRO Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 18: Europe Aircraft MRO Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Aircraft MRO Market?

The projected CAGR is approximately 3.42%.

2. Which companies are prominent players in the Europe Aircraft MRO Market?

Key companies in the market include Kongsberg Gruppen ASA, Rostec, StandardAero, Airbus SE, Comlu, MTU Aero Engines AG, Safran SA, BAE Systems PLC, Lufthansa Technik AG, Bombardier Inc, TAP Maintenance & Engineering, Sabena technics S A, Rolls-Royce Holding PLC.

3. What are the main segments of the Europe Aircraft MRO Market?

The market segments include MRO Type, Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.82 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Engine MRO Segment is Expected to Witness Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2022, Airbus helicopters began operations at its new MRO Service center in the AeroliansParis business park in Tremblay-en-France near Roissy Charles de Gaulle airport. The site's proximity to Paris Charles de Gaulle airport and to the resources of aeronautical repair companies in the vicinity allows Airbus Helicopters and its logistics partner, Daher, to further improve services to the international customer base.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Aircraft MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Aircraft MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Aircraft MRO Market?

To stay informed about further developments, trends, and reports in the Europe Aircraft MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence