Key Insights

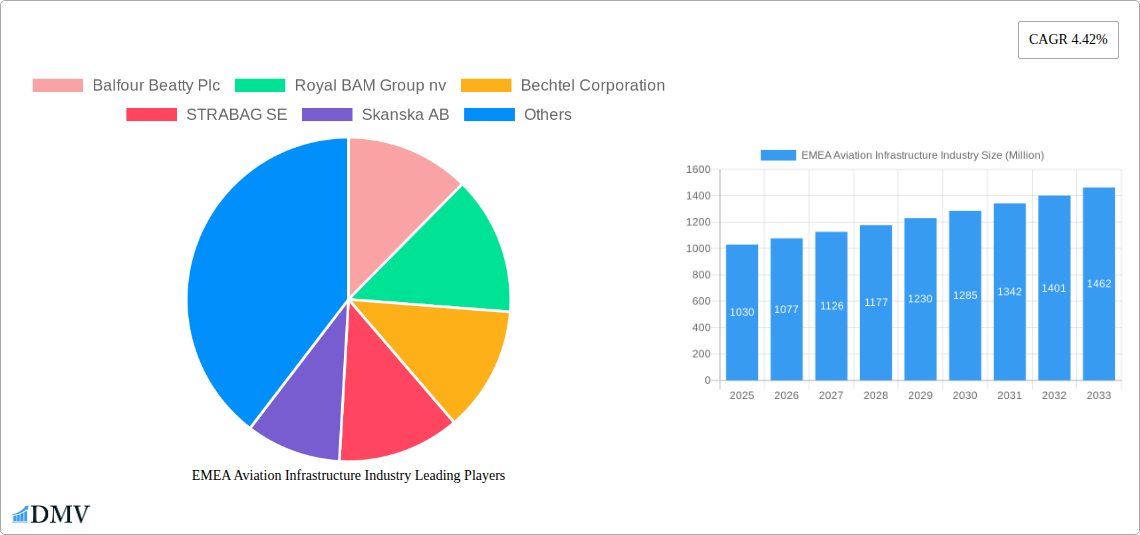

The EMEA (Europe, Middle East, and Africa) aviation infrastructure market, valued at $1.03 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, government investments in airport modernization and expansion, and the burgeoning tourism sector across the region. Significant expansion is anticipated in major hubs like London, Paris, Frankfurt, and Dubai, alongside the development of new airports in rapidly growing economies within the Middle East and Africa. The market's segmentation reveals strong demand across various infrastructure types, including terminals, runways, taxiways, and aprons, reflecting the comprehensive nature of airport development projects. Commercial airports will continue to dominate the market share, although investments in military and general aviation infrastructure are also expected to contribute to overall market growth. Competition among major players like Balfour Beatty, Bechtel, and Vinci Airports will remain intense, focusing on securing large-scale projects and demonstrating expertise in sustainable and technologically advanced solutions.

EMEA Aviation Infrastructure Industry Market Size (In Billion)

The market's Compound Annual Growth Rate (CAGR) of 4.42% from 2025 to 2033 indicates a steady but substantial expansion. However, potential restraints such as economic downturns, geopolitical instability in certain regions, and the ongoing impact of global events could influence the growth trajectory. Nevertheless, the long-term outlook remains positive, particularly given the anticipated increase in air travel demand and the strategic importance of efficient aviation infrastructure for economic development across EMEA. The focus on sustainable airport development, incorporating renewable energy sources and eco-friendly construction materials, will further shape market dynamics and attract investment in the coming years. Specific regional growth will vary, with established markets like Europe showing consistent growth, while the Middle East and Africa are expected to witness accelerated expansion due to rapid urbanization and economic development.

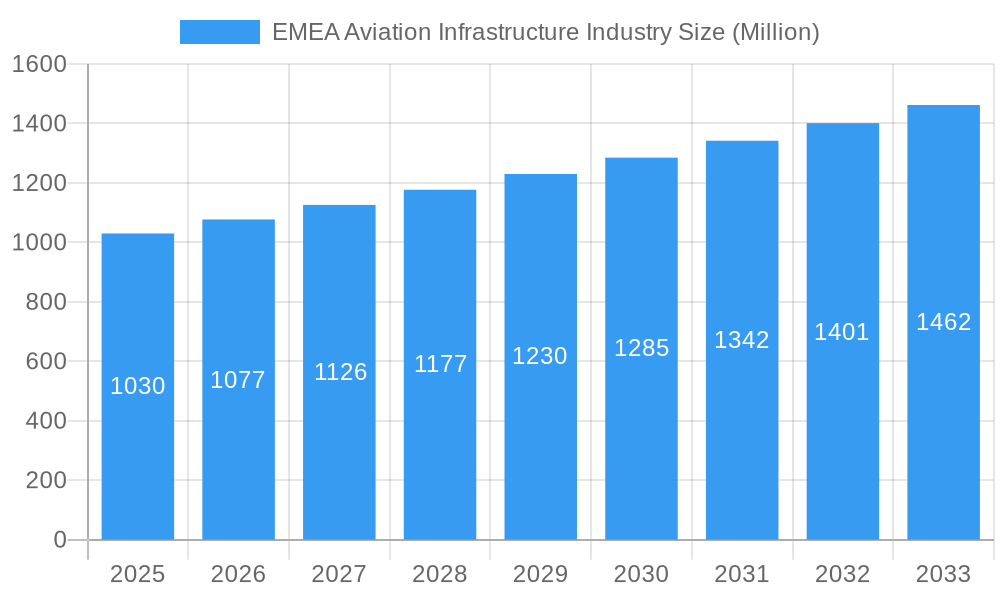

EMEA Aviation Infrastructure Industry Company Market Share

EMEA Aviation Infrastructure Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the EMEA Aviation Infrastructure industry, offering a comprehensive overview of market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report's findings are based on rigorous research and analysis, incorporating real-world examples and quantifiable data to provide actionable insights. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

EMEA Aviation Infrastructure Industry Market Composition & Trends

This section delves into the competitive landscape of the EMEA aviation infrastructure market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. The report also examines M&A activity, providing data on deal values and market share distribution amongst key players. The market is characterized by a relatively concentrated structure with several large players dominating various segments.

- Market Concentration: The top 5 companies hold an estimated xx% market share in 2025.

- Innovation Catalysts: Growing passenger traffic, increasing demand for enhanced passenger experience, and the need for sustainable infrastructure are key drivers of innovation.

- Regulatory Landscape: Stringent safety regulations and environmental compliance requirements significantly influence market dynamics.

- Substitute Products: Limited direct substitutes exist, but alternative materials and construction techniques are continuously being explored.

- End-User Profiles: Key end-users include airport authorities, airlines, and government agencies.

- M&A Activity: The total value of M&A deals in the EMEA aviation infrastructure sector reached approximately xx Million in 2024. Examples include [Insert Specific Examples if available, or state "Specific details on recent mergers and acquisitions are analyzed within the full report"].

EMEA Aviation Infrastructure Industry Industry Evolution

This section analyzes the historical and projected growth trajectory of the EMEA aviation infrastructure market. It explores the impact of technological advancements such as automation, data analytics, and sustainable building materials on market growth. Further, it examines evolving consumer preferences, focusing on the demand for more efficient, sustainable, and passenger-friendly infrastructure. The market exhibits a steady growth rate, fueled by increasing air travel demand and infrastructure development initiatives. The CAGR for the period 2019-2024 was xx%, and it's projected to be xx% between 2025 and 2033. Detailed analysis of specific technological advancements and adoption rates are included within the full report.

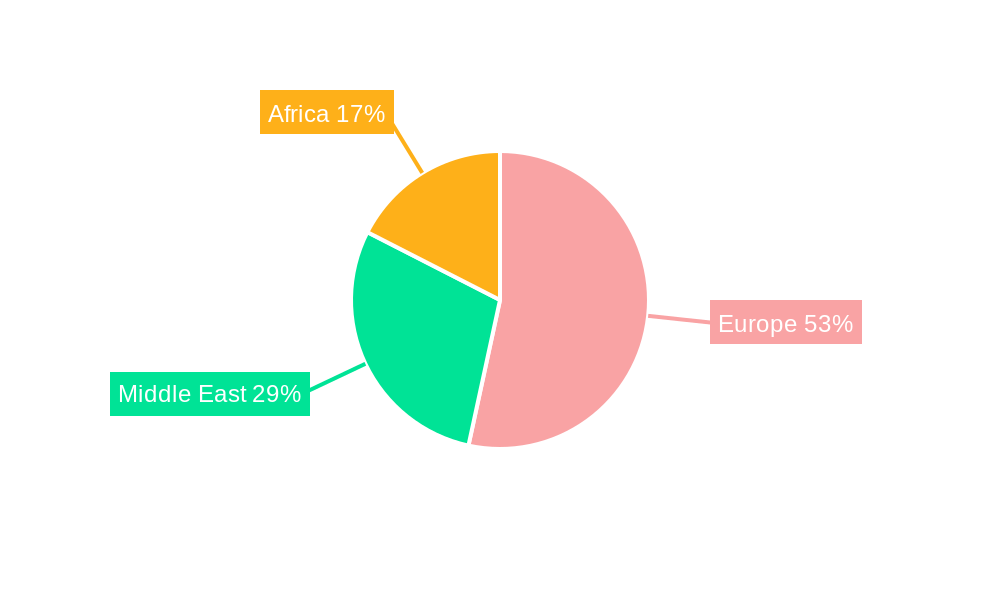

Leading Regions, Countries, or Segments in EMEA Aviation Infrastructure Industry

This section identifies the leading regions, countries, and segments within the EMEA aviation infrastructure market. The report analyzes key drivers, including investment trends and regulatory support, for each dominant segment.

- Dominant Regions: Western Europe and the Middle East are expected to remain dominant regions due to robust economic growth and significant infrastructure investments. Further regional breakdowns with quantifiable market share data are provided in the full report.

- Dominant Airport Type: Commercial airports constitute the largest segment, driven by the ongoing expansion of air travel.

- Dominant Infrastructure Type: Terminal buildings represent the largest infrastructure segment, followed by runway and taxiway developments.

Key Drivers:

- Significant Government Investments: Numerous government initiatives across EMEA are funding massive airport expansion projects.

- Increased Air Passenger Traffic: The continuous growth in air travel necessitates upgrading and expanding existing infrastructure.

- Private Sector Investments: Private investors increasingly participate in airport and aviation infrastructure development projects.

EMEA Aviation Infrastructure Industry Product Innovations

Recent innovations focus on enhancing airport efficiency, improving passenger experience, and optimizing infrastructure sustainability. This includes advancements in building materials, baggage handling systems, security technologies, and sustainable energy solutions. For example, the adoption of Building Information Modeling (BIM) is transforming design and construction processes. These innovations lead to increased efficiency, reduced operational costs, and a more sustainable future for the industry.

Propelling Factors for EMEA Aviation Infrastructure Industry Growth

Several factors are driving growth within the EMEA aviation infrastructure market.

- Increased Air Travel Demand: Growth in air travel, particularly in emerging economies, fuels the demand for new and upgraded infrastructure.

- Government Investments in Infrastructure: Significant government funding is allocated to airport and aviation-related projects across the region.

- Technological Advancements: The adoption of innovative technologies leads to improved efficiency, sustainability, and passenger experience.

Obstacles in the EMEA Aviation Infrastructure Industry Market

Challenges facing the industry include:

- Regulatory Hurdles: Complex permitting processes and stringent regulations can delay project implementation.

- Supply Chain Disruptions: Global supply chain disruptions can impact the timely completion of projects and increase costs.

- Competitive Pressure: Intense competition among major players can pressure profit margins.

Future Opportunities in EMEA Aviation Infrastructure Industry

Future opportunities include:

- Expansion in Emerging Markets: Significant growth potential exists in emerging economies within the EMEA region.

- Sustainable Infrastructure Development: Growing focus on sustainable practices creates opportunities for eco-friendly solutions.

- Integration of New Technologies: Adoption of AI, IoT, and other technologies offers numerous efficiency and cost-saving opportunities.

Major Players in the EMEA Aviation Infrastructure Industry Ecosystem

- Balfour Beatty Plc

- Royal BAM Group nv

- Bechtel Corporation

- STRABAG SE

- Skanska AB

- VINCI Airports

- Limak Group of Companies

- ALEC Engineering & Contracting LL

- BIC Contracting LLC

- Bouygues Construction S A

- TAV Construction

- Eiffage S A

- Impresa Pizzarotti & C S p A

Key Developments in EMEA Aviation Infrastructure Industry Industry

- May 2023: Poland announces plans for the USD 870 Million Solidarity Hub (CPK) airport in Warsaw, significantly impacting Central and Eastern European air transit.

- February 2023: The Airport Council of Europe allocates USD 440 Million to expand Zvartnots International Airport's capacity, attracting both low-cost and premium airlines.

Strategic EMEA Aviation Infrastructure Industry Market Forecast

The EMEA aviation infrastructure market is poised for sustained growth, driven by increasing air travel demand, substantial government investment in airport infrastructure, and the adoption of innovative technologies. The forecast period (2025-2033) anticipates significant expansion, with opportunities in emerging markets and sustainable infrastructure solutions. The market is expected to experience robust growth, fueled by both organic expansion and mergers & acquisitions activity.

EMEA Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

EMEA Aviation Infrastructure Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdon

- 1.2. Germany

- 1.3. France

- 1.4. Russia

- 1.5. Italy

- 1.6. Denmark

- 1.7. Rest of Europe

-

2. Middle East and Africa

- 2.1. Saudi Arabia

- 2.2. United Arab Emirates

- 2.3. Egypt

- 2.4. Qatar

- 2.5. Turkey

- 2.6. South Africa

- 2.7. Rest of Middle East and Africa

EMEA Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of EMEA Aviation Infrastructure Industry

EMEA Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Commercial Airport to Dominate Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.3.2. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. Europe EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Middle East and Africa EMEA Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Competitive Analysis

- 8.1. Global Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Balfour Beatty Plc

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Royal BAM Group nv

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 Bechtel Corporation

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 STRABAG SE

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Skanska AB

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 VINCI Airports

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Limak Group of Companies

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 ALEC Engineering & Contracting LL

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 BIC Contracting LLC

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Bouygues Construction S A

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 TAV Construction

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Eiffage S A

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Impresa Pizzarotti & C S p A

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.1 Balfour Beatty Plc

List of Figures

- Figure 1: Global EMEA Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: Europe EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Europe EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Middle East and Africa EMEA Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdon EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Italy EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Denmark EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 15: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 16: Global EMEA Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Arab Emirates EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Egypt EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Turkey EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Middle East and Africa EMEA Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EMEA Aviation Infrastructure Industry?

The projected CAGR is approximately 4.42%.

2. Which companies are prominent players in the EMEA Aviation Infrastructure Industry?

Key companies in the market include Balfour Beatty Plc, Royal BAM Group nv, Bechtel Corporation, STRABAG SE, Skanska AB, VINCI Airports, Limak Group of Companies, ALEC Engineering & Contracting LL, BIC Contracting LLC, Bouygues Construction S A, TAV Construction, Eiffage S A, Impresa Pizzarotti & C S p A.

3. What are the main segments of the EMEA Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.03 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Commercial Airport to Dominate Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: Poland announced its plans to build a state-of-the-art airport in Warsaw. The Solidarity Hub, or CPK, which will serve as the Central and Eastern European main air transit hub, is scheduled to become operational in the summer of 2028. The CPK, with a price tag of around USD 870 million, is one of the costliest infrastructure projects currently being built in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EMEA Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EMEA Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EMEA Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the EMEA Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence