Key Insights

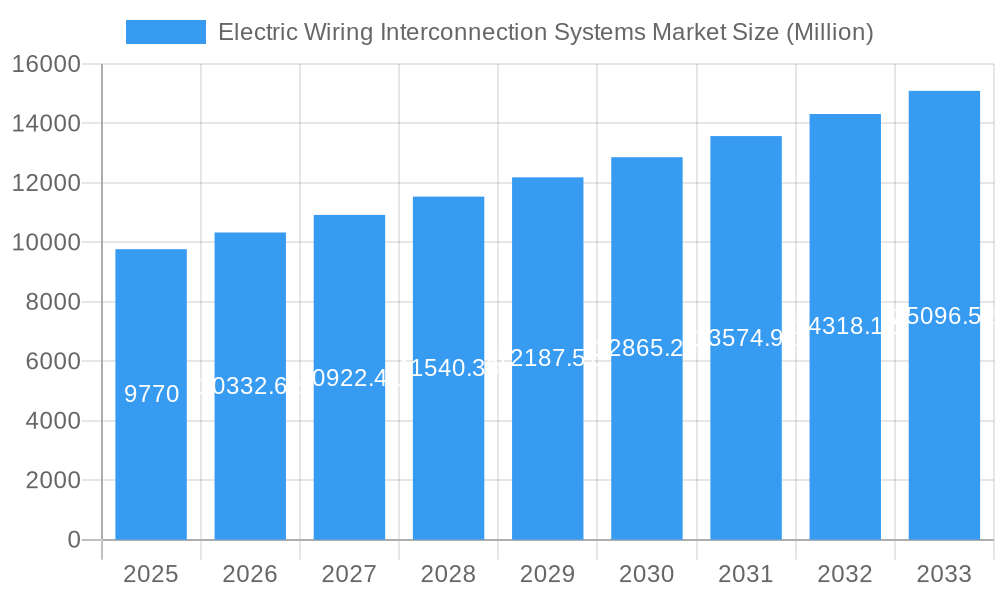

The Electric Wiring Interconnection Systems market is experiencing robust growth, projected to reach a market size of $9.77 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.46% from 2019 to 2033. This expansion is fueled by several key drivers. The increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) is a significant catalyst, requiring sophisticated and reliable wiring interconnection systems to manage the complex electrical architecture. Furthermore, the growth of renewable energy sources, particularly solar and wind power, necessitates advanced interconnection systems for efficient energy distribution and grid stability. The aerospace and defense industries also contribute substantially to market growth, driven by the increasing sophistication of aircraft electrical systems and the need for lightweight, high-performance components. Stringent safety regulations and the demand for improved fuel efficiency are further propelling market expansion.

Electric Wiring Interconnection Systems Market Market Size (In Billion)

The market is witnessing several emerging trends. The adoption of lightweight materials, such as composites and aluminum, is gaining traction to reduce vehicle weight and enhance fuel efficiency. Furthermore, the integration of advanced technologies, including sensor integration and data analytics, is improving system reliability and facilitating predictive maintenance. Miniaturization and the development of high-density connectors are addressing the space constraints in modern vehicles and devices. However, the market faces some restraints, including high initial investment costs associated with adopting new technologies and the potential for supply chain disruptions. Despite these challenges, the long-term growth prospects for the Electric Wiring Interconnection Systems market remain positive, driven by the ongoing technological advancements and increasing demand across various end-use sectors. Key players such as TE Connectivity Ltd, GKN Aerospace Services Limited, and Amphenol Corporation are actively shaping the market landscape through innovation and strategic partnerships.

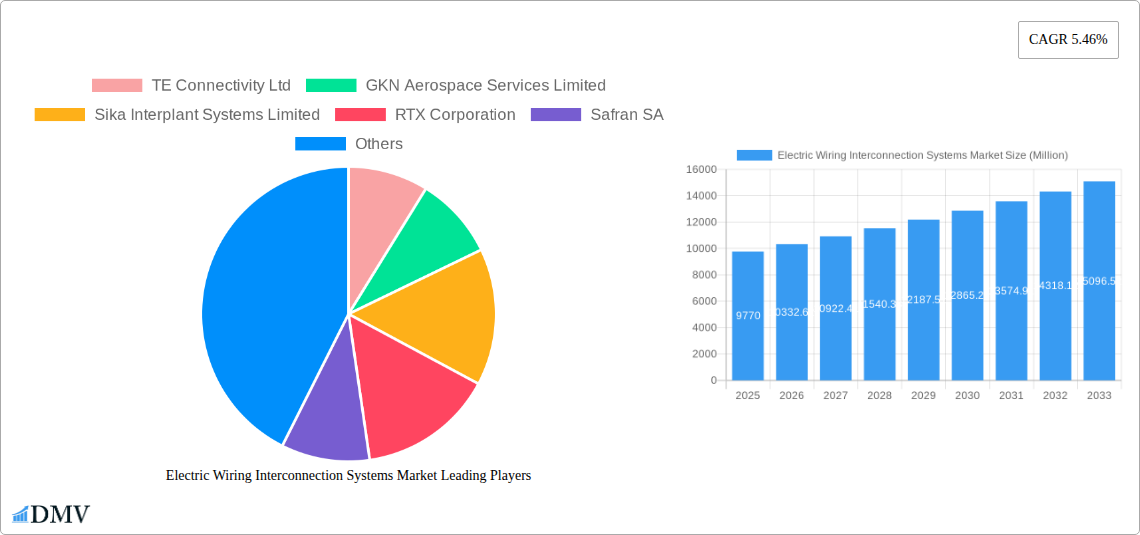

Electric Wiring Interconnection Systems Market Company Market Share

Electric Wiring Interconnection Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Electric Wiring Interconnection Systems (EWIS) market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033, demonstrating significant growth potential.

Electric Wiring Interconnection Systems Market Composition & Trends

This section delves into the intricate composition of the EWIS market, examining market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and M&A activities. We analyze the market share distribution among key players, revealing a moderately consolidated landscape with TE Connectivity Ltd, Amphenol Corporation, and others holding significant shares. The report quantifies the impact of recent M&A activities, estimating their total value at approximately xx Million over the historical period. Innovation is driven by the increasing demand for lightweight, high-performance EWIS in electric vehicles and aerospace. Stringent regulatory compliance standards, especially in aviation and automotive sectors, significantly shape market dynamics. Substitute products like wireless communication technologies pose a moderate threat, but the overall demand for reliable wired connections remains substantial. End-users include automotive manufacturers, aerospace companies, and industrial equipment producers.

- Market Concentration: Moderately consolidated, with top players holding xx% market share.

- Innovation Catalysts: Lightweighting, miniaturization, high-voltage capabilities.

- Regulatory Landscape: Stringent safety and performance standards in key industries.

- Substitute Products: Wireless technologies, but limited impact due to reliability requirements.

- End-User Profiles: Automotive, aerospace, industrial equipment manufacturers.

- M&A Activity: xx Million in deal value (2019-2024), with significant implications for market consolidation.

Electric Wiring Interconnection Systems Market Industry Evolution

The Electric Wiring Interconnection Systems (EWIS) market is experiencing a dynamic and accelerating trajectory of growth, significantly propelled by the global shift towards electrification across multiple critical industries. The burgeoning demand for electric vehicles (EVs), characterized by their complex power and data distribution needs, is a primary growth engine. Simultaneously, the robust expansion of the aerospace sector, with its increasing reliance on advanced electrical systems for both commercial and defense applications, contributes substantially. Furthermore, the pervasive integration of automation in manufacturing, robotics, and industrial processes is creating new avenues for EWIS adoption. Between 2019 and 2024, the market demonstrated robust momentum, achieving a Compound Annual Growth Rate (CAGR) of [Insert Specific CAGR Here]. This expansion has been further amplified by relentless technological innovation, notably the development and implementation of cutting-edge materials engineered for high-voltage resistance, extreme temperature tolerance, and enhanced durability. The persistent consumer and industry demand for end-products that offer superior energy efficiency, reduced weight, and uncompromising safety features continues to be a powerful catalyst for innovation within the EWIS landscape. Looking ahead, the forecast period spanning from 2025 to 2033 anticipates sustained and accelerated market expansion, with a projected CAGR of [Insert Specific CAGR Here]. This optimistic outlook is underpinned by the accelerating adoption rates of electric and autonomous vehicles, coupled with ongoing advancements and diversification in aerospace technology and the expanding scope of smart infrastructure.

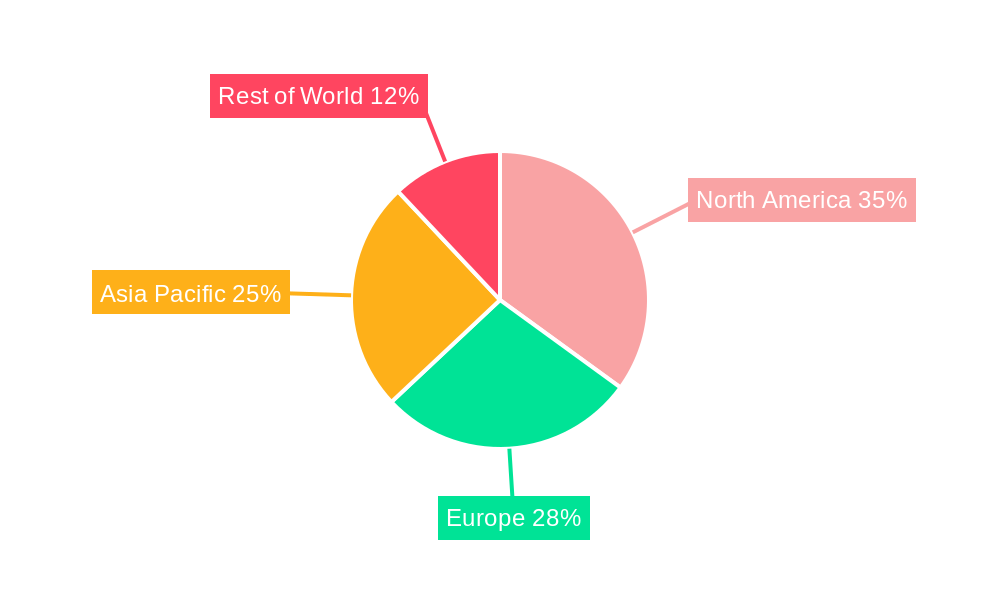

Leading Regions, Countries, or Segments in Electric Wiring Interconnection Systems Market

The report identifies [Region Name], particularly [Country Name], as the dominant region/country in the EWIS market. This dominance stems from several key factors:

- High Automotive Production: A significant concentration of automotive manufacturing plants drives demand for EWIS.

- Government Incentives: Supportive government policies and financial incentives for electric vehicle adoption and aerospace development.

- Strong R&D Investment: Extensive research and development efforts by both local and international companies in the region contribute to technological advancements.

- Established Supply Chain: A robust and well-established supply chain network efficiently supports production.

The robust growth in the automotive and aerospace sectors within this region significantly contributes to its market leadership, outpacing other regions in terms of both production volume and technological innovation.

Electric Wiring Interconnection Systems Market Product Innovations

Recent breakthroughs and ongoing research in the EWIS sector are primarily focused on delivering enhanced performance, superior reliability, and greater adaptability, particularly within the challenging operational environments of aerospace and automotive applications. Manufacturers are at the forefront of developing ultra-lightweight materials, significantly reducing the overall weight of electrical systems without compromising integrity. Alongside material advancements, there's a strong emphasis on pioneering improved insulation technologies that offer better thermal management and electrical isolation. Furthermore, the design and production of advanced connectors are evolving to efficiently and safely handle increasingly higher voltages and operate under extreme temperature fluctuations. These critical advancements are directly addressing the stringent requirements of the electric vehicle and aerospace industries, where miniaturization, weight reduction, and enhanced safety are paramount. Key innovations also include the development of systems with significantly improved resistance to vibration, shock, and corrosive elements, ensuring long-term operational integrity. The unique selling propositions (USPs) that differentiate market leaders often revolve around demonstrable superiority in key performance metrics, such as reduced system weight, extended durability in harsh conditions, and meticulously enhanced signal integrity for complex data transmission.

Propelling Factors for Electric Wiring Interconnection Systems Market Growth

The EWIS market's growth is propelled by several key factors:

- Rise of Electric Vehicles: The global shift toward electric vehicles significantly boosts demand for high-performance EWIS.

- Growth of the Aerospace Industry: Increasing production of aircraft and the development of electric aircraft create substantial demand.

- Automation and Robotics: The growing automation and robotics industry necessitates sophisticated EWIS solutions.

- Government Regulations: Stricter safety regulations and emission standards further stimulate market growth.

Obstacles in the Electric Wiring Interconnection Systems Market

The Electric Wiring Interconnection Systems market, while experiencing robust growth, is not without its significant challenges. Navigating these hurdles is crucial for sustained success and innovation:

- Supply Chain Vulnerabilities: The global interconnectedness of supply chains presents a persistent challenge. Disruptions caused by geopolitical events, natural disasters, or unforeseen logistical issues can severely impact the availability of critical raw materials and components, leading to production delays and increased costs.

- Raw Material Price Volatility: The market is highly susceptible to fluctuations in the prices of key raw materials, such as copper, aluminum, and specialized polymers. Unpredictable price swings directly affect manufacturing expenses, making long-term cost planning and competitive pricing more complex.

- Intense Market Competition: The EWIS landscape is characterized by a highly competitive environment. The presence of a multitude of established global players alongside agile emerging competitors necessitates continuous innovation, aggressive pricing strategies, and superior customer service to maintain market share and profitability.

- Regulatory Compliance and Standardization: Meeting diverse and evolving regulatory standards across different geographical regions and industries (e.g., automotive safety standards, aerospace certifications) can be a complex and resource-intensive undertaking.

- Technological Obsolescence: The rapid pace of technological advancement, particularly in areas like electrification and data transfer, poses a risk of product obsolescence. Companies must invest heavily in research and development to stay ahead of the curve and offer solutions that align with future industry needs.

Future Opportunities in Electric Wiring Interconnection Systems Market

Future opportunities reside in:

- Next-Generation Electric Vehicles: The development and production of advanced electric vehicles, including autonomous and flying cars.

- Expansion into New Applications: Exploring opportunities in renewable energy infrastructure, smart grids, and other emerging sectors.

- Technological Advancements: Continued innovation in materials science, miniaturization, and connectivity technologies.

Major Players in the Electric Wiring Interconnection Systems Market Ecosystem

The Electric Wiring Interconnection Systems market ecosystem is populated by a diverse array of leading companies, each contributing specialized expertise and innovative solutions. These key players are instrumental in driving technological advancements and fulfilling the complex demands of various industries. Some of the prominent entities include:

- TE Connectivity Ltd

- GKN Aerospace Services Limited

- Sika Interplant Systems Limited

- RTX Corporation

- Safran SA

- E I S Electronics GmbH

- Amphenol Corporation

- AMETEK Inc

- LATECOERE

- Radiall SA

- L3Harris Technologies Inc

- Smiths Group PL

- Honeywell International Inc.

- Sumitomo Electric Industries, Ltd.

- The Phoenix Companies, Inc.

- Belden Inc.

Key Developments in Electric Wiring Interconnection Systems Market Industry

- May 2024: GKN Aerospace delivered the first fully integrated wings, empennage, and EWIS for Eviation's Alice all-electric aircraft, showcasing advanced composite technology.

- September 2023: Rosenberger secured a contract to supply high-voltage electrical harness systems for Lilium NV's all-electric vertical take-off and landing jet.

Strategic Electric Wiring Interconnection Systems Market Forecast

The EWIS market is poised for significant growth, driven by the increasing demand for electric vehicles and the continued expansion of the aerospace industry. Technological advancements, coupled with supportive government policies, will further fuel market expansion. The market is expected to witness sustained growth throughout the forecast period (2025-2033), presenting substantial opportunities for key players to capitalize on the increasing demand for high-performance, reliable EWIS solutions.

Electric Wiring Interconnection Systems Market Segmentation

-

1. Component

- 1.1. Wires and Cables

- 1.2. Connectors and Connector Accessories

- 1.3. Terminals and Splices

- 1.4. Other Components

-

2. Platform

-

2.1. Aviation

- 2.1.1. Military Aviation

- 2.1.2. Civil and Commercial Aviation

- 2.2. Defense

- 2.3. Marine

-

2.1. Aviation

Electric Wiring Interconnection Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Electric Wiring Interconnection Systems Market Regional Market Share

Geographic Coverage of Electric Wiring Interconnection Systems Market

Electric Wiring Interconnection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Defense Segment is Expected to Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Wiring Interconnection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Wires and Cables

- 5.1.2. Connectors and Connector Accessories

- 5.1.3. Terminals and Splices

- 5.1.4. Other Components

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Aviation

- 5.2.1.1. Military Aviation

- 5.2.1.2. Civil and Commercial Aviation

- 5.2.2. Defense

- 5.2.3. Marine

- 5.2.1. Aviation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Electric Wiring Interconnection Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Wires and Cables

- 6.1.2. Connectors and Connector Accessories

- 6.1.3. Terminals and Splices

- 6.1.4. Other Components

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Aviation

- 6.2.1.1. Military Aviation

- 6.2.1.2. Civil and Commercial Aviation

- 6.2.2. Defense

- 6.2.3. Marine

- 6.2.1. Aviation

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Electric Wiring Interconnection Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Wires and Cables

- 7.1.2. Connectors and Connector Accessories

- 7.1.3. Terminals and Splices

- 7.1.4. Other Components

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Aviation

- 7.2.1.1. Military Aviation

- 7.2.1.2. Civil and Commercial Aviation

- 7.2.2. Defense

- 7.2.3. Marine

- 7.2.1. Aviation

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Electric Wiring Interconnection Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Wires and Cables

- 8.1.2. Connectors and Connector Accessories

- 8.1.3. Terminals and Splices

- 8.1.4. Other Components

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Aviation

- 8.2.1.1. Military Aviation

- 8.2.1.2. Civil and Commercial Aviation

- 8.2.2. Defense

- 8.2.3. Marine

- 8.2.1. Aviation

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Electric Wiring Interconnection Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Wires and Cables

- 9.1.2. Connectors and Connector Accessories

- 9.1.3. Terminals and Splices

- 9.1.4. Other Components

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Aviation

- 9.2.1.1. Military Aviation

- 9.2.1.2. Civil and Commercial Aviation

- 9.2.2. Defense

- 9.2.3. Marine

- 9.2.1. Aviation

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Electric Wiring Interconnection Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Wires and Cables

- 10.1.2. Connectors and Connector Accessories

- 10.1.3. Terminals and Splices

- 10.1.4. Other Components

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Aviation

- 10.2.1.1. Military Aviation

- 10.2.1.2. Civil and Commercial Aviation

- 10.2.2. Defense

- 10.2.3. Marine

- 10.2.1. Aviation

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TE Connectivity Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 GKN Aerospace Services Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sika Interplant Systems Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RTX Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Safran SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 E I S Electronics GmbH

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amphenol Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AMETEK Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LATECOERE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Radiall SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 L3Harris Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Smiths Group PL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 TE Connectivity Ltd

List of Figures

- Figure 1: Global Electric Wiring Interconnection Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Electric Wiring Interconnection Systems Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Electric Wiring Interconnection Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 4: North America Electric Wiring Interconnection Systems Market Volume (Billion), by Component 2025 & 2033

- Figure 5: North America Electric Wiring Interconnection Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Electric Wiring Interconnection Systems Market Volume Share (%), by Component 2025 & 2033

- Figure 7: North America Electric Wiring Interconnection Systems Market Revenue (Million), by Platform 2025 & 2033

- Figure 8: North America Electric Wiring Interconnection Systems Market Volume (Billion), by Platform 2025 & 2033

- Figure 9: North America Electric Wiring Interconnection Systems Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: North America Electric Wiring Interconnection Systems Market Volume Share (%), by Platform 2025 & 2033

- Figure 11: North America Electric Wiring Interconnection Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Electric Wiring Interconnection Systems Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Electric Wiring Interconnection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Electric Wiring Interconnection Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Electric Wiring Interconnection Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 16: Europe Electric Wiring Interconnection Systems Market Volume (Billion), by Component 2025 & 2033

- Figure 17: Europe Electric Wiring Interconnection Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 18: Europe Electric Wiring Interconnection Systems Market Volume Share (%), by Component 2025 & 2033

- Figure 19: Europe Electric Wiring Interconnection Systems Market Revenue (Million), by Platform 2025 & 2033

- Figure 20: Europe Electric Wiring Interconnection Systems Market Volume (Billion), by Platform 2025 & 2033

- Figure 21: Europe Electric Wiring Interconnection Systems Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Europe Electric Wiring Interconnection Systems Market Volume Share (%), by Platform 2025 & 2033

- Figure 23: Europe Electric Wiring Interconnection Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Electric Wiring Interconnection Systems Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Electric Wiring Interconnection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Electric Wiring Interconnection Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Electric Wiring Interconnection Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 28: Asia Pacific Electric Wiring Interconnection Systems Market Volume (Billion), by Component 2025 & 2033

- Figure 29: Asia Pacific Electric Wiring Interconnection Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 30: Asia Pacific Electric Wiring Interconnection Systems Market Volume Share (%), by Component 2025 & 2033

- Figure 31: Asia Pacific Electric Wiring Interconnection Systems Market Revenue (Million), by Platform 2025 & 2033

- Figure 32: Asia Pacific Electric Wiring Interconnection Systems Market Volume (Billion), by Platform 2025 & 2033

- Figure 33: Asia Pacific Electric Wiring Interconnection Systems Market Revenue Share (%), by Platform 2025 & 2033

- Figure 34: Asia Pacific Electric Wiring Interconnection Systems Market Volume Share (%), by Platform 2025 & 2033

- Figure 35: Asia Pacific Electric Wiring Interconnection Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Electric Wiring Interconnection Systems Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Electric Wiring Interconnection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Electric Wiring Interconnection Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Electric Wiring Interconnection Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 40: Latin America Electric Wiring Interconnection Systems Market Volume (Billion), by Component 2025 & 2033

- Figure 41: Latin America Electric Wiring Interconnection Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 42: Latin America Electric Wiring Interconnection Systems Market Volume Share (%), by Component 2025 & 2033

- Figure 43: Latin America Electric Wiring Interconnection Systems Market Revenue (Million), by Platform 2025 & 2033

- Figure 44: Latin America Electric Wiring Interconnection Systems Market Volume (Billion), by Platform 2025 & 2033

- Figure 45: Latin America Electric Wiring Interconnection Systems Market Revenue Share (%), by Platform 2025 & 2033

- Figure 46: Latin America Electric Wiring Interconnection Systems Market Volume Share (%), by Platform 2025 & 2033

- Figure 47: Latin America Electric Wiring Interconnection Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Electric Wiring Interconnection Systems Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Latin America Electric Wiring Interconnection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Electric Wiring Interconnection Systems Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Electric Wiring Interconnection Systems Market Revenue (Million), by Component 2025 & 2033

- Figure 52: Middle East and Africa Electric Wiring Interconnection Systems Market Volume (Billion), by Component 2025 & 2033

- Figure 53: Middle East and Africa Electric Wiring Interconnection Systems Market Revenue Share (%), by Component 2025 & 2033

- Figure 54: Middle East and Africa Electric Wiring Interconnection Systems Market Volume Share (%), by Component 2025 & 2033

- Figure 55: Middle East and Africa Electric Wiring Interconnection Systems Market Revenue (Million), by Platform 2025 & 2033

- Figure 56: Middle East and Africa Electric Wiring Interconnection Systems Market Volume (Billion), by Platform 2025 & 2033

- Figure 57: Middle East and Africa Electric Wiring Interconnection Systems Market Revenue Share (%), by Platform 2025 & 2033

- Figure 58: Middle East and Africa Electric Wiring Interconnection Systems Market Volume Share (%), by Platform 2025 & 2033

- Figure 59: Middle East and Africa Electric Wiring Interconnection Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Electric Wiring Interconnection Systems Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Electric Wiring Interconnection Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Electric Wiring Interconnection Systems Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 5: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 8: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Component 2020 & 2033

- Table 9: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 10: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 11: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 18: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Component 2020 & 2033

- Table 19: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 20: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 21: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Germany Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Component 2020 & 2033

- Table 35: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 36: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 37: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: India Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: South Korea Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 50: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Component 2020 & 2033

- Table 51: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 52: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 53: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Brazil Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Latin America Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Latin America Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Component 2020 & 2033

- Table 60: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Component 2020 & 2033

- Table 61: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 62: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 63: Global Electric Wiring Interconnection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Electric Wiring Interconnection Systems Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: United Arab Emirates Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: United Arab Emirates Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Saudi Arabia Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Saudi Arabia Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Egypt Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Egypt Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East and Africa Electric Wiring Interconnection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East and Africa Electric Wiring Interconnection Systems Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Wiring Interconnection Systems Market?

The projected CAGR is approximately 5.46%.

2. Which companies are prominent players in the Electric Wiring Interconnection Systems Market?

Key companies in the market include TE Connectivity Ltd, GKN Aerospace Services Limited, Sika Interplant Systems Limited, RTX Corporation, Safran SA, E I S Electronics GmbH, Amphenol Corporation, AMETEK Inc, LATECOERE, Radiall SA, L3Harris Technologies Inc, Smiths Group PL.

3. What are the main segments of the Electric Wiring Interconnection Systems Market?

The market segments include Component, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Defense Segment is Expected to Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2024: GKN Aerospace reached an important milestone in its collaboration with Eviation (United States) by delivering the first fully integrated wings, empennage, and EWIS for the Alice all-electric aircraft. The wings and empennage featured advanced composite technology and were the first fully integrated structures offered by GKN Aerospace.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Wiring Interconnection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Wiring Interconnection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Wiring Interconnection Systems Market?

To stay informed about further developments, trends, and reports in the Electric Wiring Interconnection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence