Key Insights

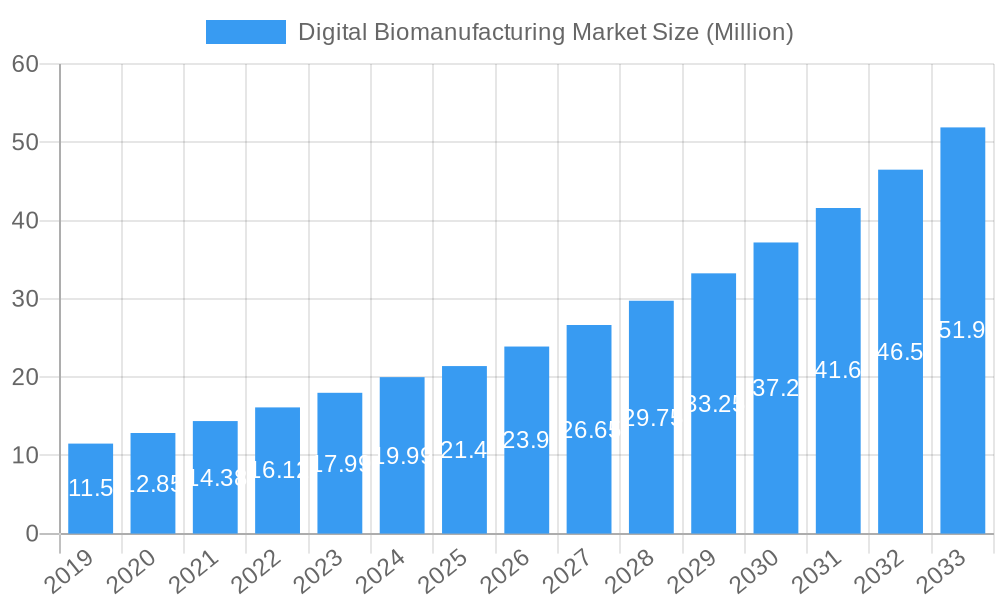

The Digital Biomanufacturing Market is poised for robust expansion, projected to reach an estimated $21.40 million by 2025, with a significant Compound Annual Growth Rate (CAGR) of 11.60% through 2033. This impressive growth is fueled by a confluence of powerful drivers, primarily the increasing demand for biologics and personalized medicines, which necessitates advanced manufacturing processes for efficiency and quality. The trend towards sophisticated bioprocess optimization and the automation of complex biomanufacturing operations are also major contributors. As research institutes and biopharmaceutical companies increasingly adopt digital solutions for enhanced process control, real-time monitoring, and data analytics, the market is experiencing a paradigm shift towards smarter, more connected production environments. Furthermore, the growing emphasis on regulatory compliance and the need for reduced operational costs are pushing organizations to invest in digital technologies that streamline workflows and improve yield. Contract manufacturing organizations (CMOs) are also a significant end-user segment, leveraging digital biomanufacturing to offer scalable and agile production services to a diverse client base.

Digital Biomanufacturing Market Market Size (In Million)

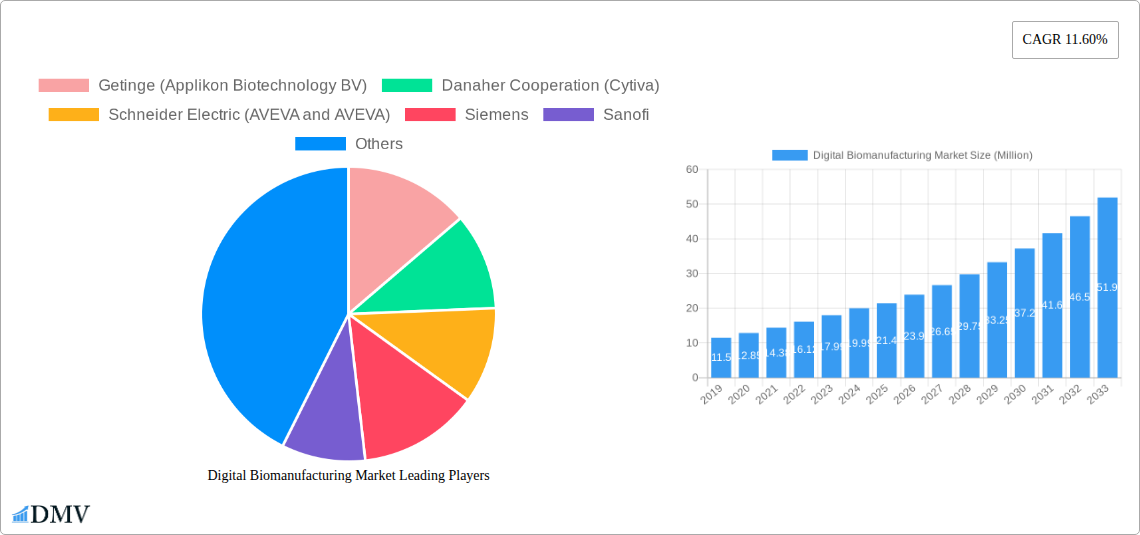

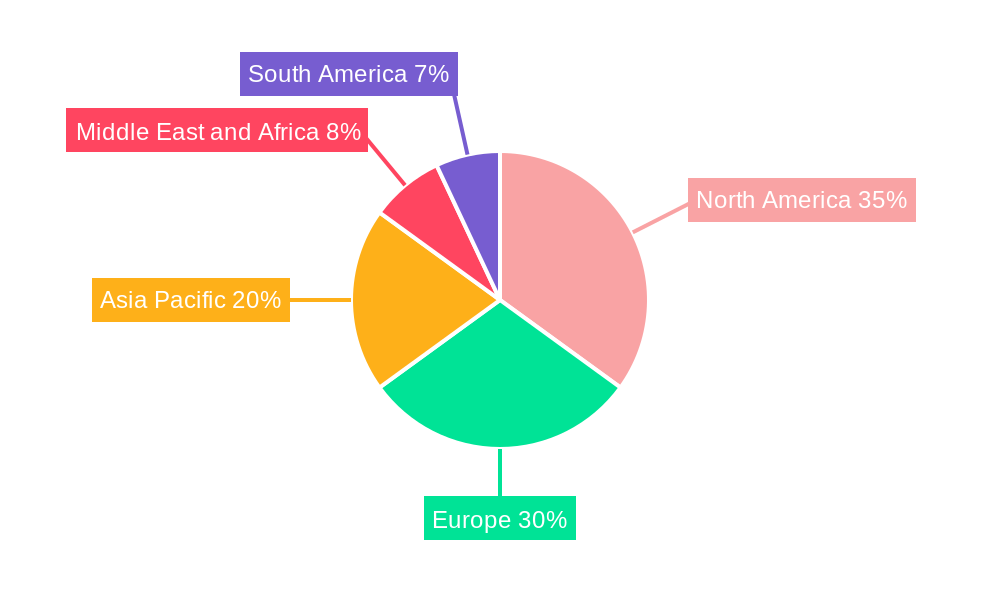

The market is segmented across key technological areas, including Manufacturing Technologies, Analytical and Process Control Technologies, and other specialized solutions. In terms of applications, Bioprocess Optimization and Biomanufacturing Process Automation and Control are expected to dominate, reflecting the industry's focus on improving efficiency and precision. While the market is expanding globally, North America and Europe currently hold substantial market shares due to the presence of leading biopharmaceutical companies and strong research infrastructure. Asia Pacific, however, is emerging as a high-growth region, driven by government initiatives supporting biomanufacturing innovation and increasing investments in the life sciences sector. Restraints, such as the high initial investment costs for implementing digital solutions and the need for skilled personnel to manage these advanced systems, are being addressed through strategic partnerships, technological advancements, and increasing availability of cloud-based solutions. Leading companies like Getinge, Danaher Corporation, Schneider Electric, and Siemens are actively driving innovation and market penetration.

Digital Biomanufacturing Market Company Market Share

Unlocking the Future: A Comprehensive Report on the Digital Biomanufacturing Market

This in-depth report provides an indispensable analysis of the Digital Biomanufacturing Market, a rapidly evolving sector critical for the future of pharmaceuticals, biotech, and advanced therapies. Leveraging a meticulous Study Period from 2019–2033, with a Base Year of 2025 and a detailed Forecast Period of 2025–2033, this research offers unparalleled insights into market dynamics, growth trajectories, and strategic opportunities. Discover how advanced manufacturing technologies, bioprocess optimization, and biomanufacturing process automation and control are reshaping the industry. Essential for Biopharmaceutical Companies, Contract Manufacturing Organizations, and Research Institutes, this report illuminates the path to success in a digitally transformed biomanufacturing landscape.

Digital Biomanufacturing Market Market Composition & Trends

The Digital Biomanufacturing Market is characterized by a dynamic and increasingly concentrated landscape, driven by relentless innovation and strategic consolidation. Key players are investing heavily in digital biomanufacturing solutions to enhance efficiency, reduce costs, and accelerate drug development. Market concentration is evident through ongoing mergers and acquisitions, with significant deal values observed in recent years, including potential acquisitions or strategic partnerships valued in the tens to hundreds of millions. Innovation catalysts include the pervasive need for faster time-to-market for novel therapeutics, stringent regulatory compliance demands, and the drive for sustainable manufacturing practices. The regulatory landscape is continuously evolving to accommodate these advancements, fostering a climate of trust and adoption. Substitute products are emerging, primarily in the form of incremental improvements to traditional methods, but are largely outpaced by the transformative potential of digital integration. End-user profiles reveal a growing reliance on sophisticated analytical and process control technologies by both established biopharma giants and agile contract manufacturing organizations (CMOs). The integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) are not merely trends but fundamental pillars of market growth, enabling predictive maintenance, real-time process monitoring, and optimized yield.

- Market Share Distribution: While specific figures are proprietary, leading companies are actively vying for dominance, with significant market share held by integrated solution providers.

- M&A Deal Values: Recent M&A activities in the digital biomanufacturing space have seen valuations ranging from tens of millions to over a hundred million dollars, reflecting the strategic importance of acquiring advanced digital capabilities.

- Regulatory Environment: Increasingly favorable towards digital adoption, with initiatives promoting data integrity, cybersecurity, and smart manufacturing principles.

- End-User Adoption Metrics: Growing adoption rates are evident in the increased deployment of cloud-based platforms and automated data collection systems within biopharmaceutical facilities.

Digital Biomanufacturing Market Industry Evolution

The digital biomanufacturing market has undergone a dramatic transformation, evolving from fragmented, manually operated processes to highly integrated, automated, and intelligent production systems. The historical period (2019-2024) witnessed the foundational adoption of digital tools, driven by the need for greater reproducibility and efficiency in complex biological processes. Early investments focused on data acquisition and basic automation. The base year, 2025, marks a pivotal point where biomanufacturing process automation and control have become mainstream, with sophisticated software suites and IoT-enabled devices playing integral roles. The forecast period (2025-2033) is set to be characterized by exponential growth, propelled by advancements in AI, machine learning, and predictive analytics, all converging to enable truly “smart” biomanufacturing. This evolution is directly responding to shifting consumer demands for personalized medicine, faster drug approvals, and more sustainable production methods. For instance, the increasing complexity of biologics, such as gene and cell therapies, necessitates advanced manufacturing capabilities that digital solutions uniquely provide. Growth rates for the digital biomanufacturing market are projected to be robust, with CAGR expected to be in the high teens to low twenties percentages throughout the forecast period. Adoption metrics highlight a significant increase in the implementation of digital twins for process simulation and optimization, alongside a surge in the use of advanced analytics for real-time quality control. The market's evolution is also shaped by the imperative to reduce the cost of goods for life-saving therapies, making digital integration not just a choice but a necessity for economic viability. Furthermore, the increasing global demand for biologics, coupled with the need for resilient supply chains, further fuels the adoption of digital solutions that offer enhanced visibility and control. The convergence of automation, data analytics, and AI is creating a self-optimizing manufacturing environment, paving the way for fully autonomous bioprocessing in the latter half of the forecast period. This paradigm shift is crucial for addressing the growing burden of chronic diseases and the emergence of novel therapeutic modalities.

Leading Regions, Countries, or Segments in Digital Biomanufacturing Market

The Digital Biomanufacturing Market is experiencing robust growth across key segments, driven by strategic investments, technological advancements, and a growing demand for advanced therapeutics. Among the segments, Manufacturing Technologies are witnessing particularly strong adoption, as companies seek to modernize their production facilities with smart equipment and automated workflows. This is closely followed by Analytical and Process Control Technologies, which are crucial for ensuring product quality, optimizing yields, and maintaining regulatory compliance. The segment of Biomanufacturing Process Automation and Control is also a significant driver, reflecting the industry's push towards Industry 4.0 principles.

North America, particularly the United States, consistently emerges as a leading region due to its well-established biopharmaceutical ecosystem, high R&D expenditure, and supportive regulatory environment for innovative technologies. The presence of major biopharmaceutical companies and a robust network of contract manufacturing organizations fuels the demand for advanced digital solutions.

- Key Drivers in North America:

- High R&D Investment: Significant funding allocated to research and development of novel biologics and therapies.

- Regulatory Support: Favorable policies and guidelines from agencies like the FDA that encourage technological adoption.

- Presence of Key Players: A concentrated number of leading biopharmaceutical companies and technology providers.

- Demand for Advanced Therapies: Growing market for complex treatments like gene and cell therapies requiring sophisticated manufacturing.

In terms of end-users, Biopharmaceutical Companies represent the largest and most influential segment. Their direct need for efficient, scalable, and compliant manufacturing processes makes them primary adopters of digital biomanufacturing solutions. Contract Manufacturing Organizations (CMOs) are also rapidly expanding their digital capabilities to serve the growing outsourcing needs of the biopharma industry, often acting as early adopters of cutting-edge technologies. Research Institutes are increasingly leveraging digital tools for process development, pilot-scale manufacturing, and data analysis, contributing to the overall market expansion. The application of digital biomanufacturing in Bioprocess Optimization is paramount, enabling manufacturers to fine-tune parameters for maximum yield and quality. Similarly, the focus on Biomanufacturing Process Automation and Control is critical for achieving consistent, reproducible results and reducing human error.

Digital Biomanufacturing Market Product Innovations

The Digital Biomanufacturing Market is abuzz with innovative solutions designed to revolutionize how biological drugs are produced. Companies are unveiling modular and scalable bioprocessing platforms that are fully digitally integrated and automated, addressing critical industry challenges like flexibility and efficiency. These innovations often feature advanced sensors, AI-driven process control, and real-time data analytics, enabling predictive maintenance and optimized production workflows. For instance, the development of next-generation biomanufacturing technologies for plasmid DNA production showcases the industry's commitment to accelerating the development of novel therapeutics, like those for genetic medicines. These advancements offer enhanced performance metrics, including reduced batch cycle times, improved product consistency, and higher yields, all contributing to lower manufacturing costs and faster market entry for life-saving treatments.

Propelling Factors for Digital Biomanufacturing Market Growth

The Digital Biomanufacturing Market is experiencing significant growth propelled by several key factors. The escalating demand for biologics and advanced therapies, such as gene and cell therapies, necessitates more efficient and scalable production methods, which digital solutions provide. Technological advancements, including the proliferation of AI, machine learning, IoT, and cloud computing, are enabling sophisticated automation, real-time process monitoring, and predictive analytics. Furthermore, stringent regulatory requirements for data integrity, process validation, and quality control are driving the adoption of digital tools that offer enhanced traceability and compliance. Economic drivers, such as the need to reduce manufacturing costs and accelerate time-to-market for new drugs, also play a crucial role.

Obstacles in the Digital Biomanufacturing Market Market

Despite its immense potential, the Digital Biomanufacturing Market faces several significant obstacles. Regulatory challenges remain a concern, as the evolving nature of digital technologies can outpace the development of clear regulatory guidelines, creating uncertainty for implementation. The integration of disparate legacy systems with new digital platforms can be complex and costly, requiring substantial IT infrastructure investment. Cybersecurity threats pose a serious risk to sensitive intellectual property and patient data, necessitating robust security measures. Moreover, a shortage of skilled personnel with expertise in both bioprocessing and digital technologies can hinder adoption and efficient utilization of advanced systems. High initial investment costs for implementing sophisticated digital solutions can also be a barrier, particularly for smaller organizations.

Future Opportunities in Digital Biomanufacturing Market

The Digital Biomanufacturing Market is ripe with future opportunities driven by emerging trends and unmet needs. The increasing prevalence of personalized medicine and orphan drugs will demand highly flexible and adaptable manufacturing platforms, where digital solutions can offer unprecedented agility. The growing focus on sustainability and green manufacturing practices presents an opportunity for digital technologies to optimize resource utilization and reduce waste. Advancements in AI and machine learning will unlock further potential in areas like predictive quality control, autonomous process optimization, and novel drug discovery acceleration. Expansion into emerging markets with growing healthcare infrastructure and increasing demand for biologics also represents a significant growth avenue. The continuous development of new therapeutic modalities, such as mRNA-based vaccines and therapies, will require sophisticated digital manufacturing capabilities.

Major Players in the Digital Biomanufacturing Market Ecosystem

- Getinge (Applikon Biotechnology BV)

- Danaher Cooperation (Cytiva)

- Schneider Electric (AVEVA and AVEVA)

- Siemens

- Sanofi

- Mettler Toledo

- IDBS

- Aspen Technology Inc

- GE Healthcare

Key Developments in Digital Biomanufacturing Market Industry

- June 2024: The Syntegon subsidiary Pharmatec reported the launch of its new modular bioprocessing platform (MBP). Developed to address the current challenges in biopharmaceutical production, the MBP is a highly flexible, fully digitally integrated, and automated solution for biological drug substances.

- March 2024: Novel Bio, next-generation biomanufacturing technology for plasmid DNA for use in genetic medicines, reported a partnership with Culture Biosciences to accelerate the development of scalable fermentation processes for the proprietary NBx Platform for plasmid DNA production.

Strategic Digital Biomanufacturing Market Market Forecast

The Digital Biomanufacturing Market is poised for exceptional growth, driven by an unyielding demand for advanced biologics and a continuous drive for manufacturing excellence. Strategic investments in biomanufacturing process automation and control will remain a cornerstone, supported by the accelerating adoption of AI and ML for predictive analytics and real-time optimization. The increasing complexity of novel therapeutics, including gene and cell therapies, will necessitate highly flexible and digitally integrated manufacturing solutions. Furthermore, the global push for resilient and sustainable supply chains will further fuel the demand for digitized processes that offer enhanced visibility, traceability, and efficiency. The market's trajectory suggests a significant expansion in the deployment of end-to-end digital platforms, transforming traditional biomanufacturing into an intelligent, data-driven ecosystem, ultimately accelerating the delivery of life-saving medicines to patients worldwide.

Digital Biomanufacturing Market Segmentation

-

1. Type

- 1.1. Manufacturing Technologies

- 1.2. Analytical and Process Control Technologies

- 1.3. Other Types

-

2. Application

- 2.1. Bioprocess Optimization

- 2.2. Biomanufacturing Process Automation and Control

- 2.3. Other Applications

-

3. End User

- 3.1. Biopharmaceutical Companies

- 3.2. Contract Manufacturing Organizations

- 3.3. Research Institutes

Digital Biomanufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Digital Biomanufacturing Market Regional Market Share

Geographic Coverage of Digital Biomanufacturing Market

Digital Biomanufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Digital Biomanufacturing; Increasing Biologics and Biosimilars Approvals

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Digital Biomanufacturing; Increasing Biologics and Biosimilars Approvals

- 3.4. Market Trends

- 3.4.1. The Process Analytical Technologies Segment is Expected to Show Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Digital Biomanufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Manufacturing Technologies

- 5.1.2. Analytical and Process Control Technologies

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bioprocess Optimization

- 5.2.2. Biomanufacturing Process Automation and Control

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Biopharmaceutical Companies

- 5.3.2. Contract Manufacturing Organizations

- 5.3.3. Research Institutes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Digital Biomanufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Manufacturing Technologies

- 6.1.2. Analytical and Process Control Technologies

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bioprocess Optimization

- 6.2.2. Biomanufacturing Process Automation and Control

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Biopharmaceutical Companies

- 6.3.2. Contract Manufacturing Organizations

- 6.3.3. Research Institutes

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Digital Biomanufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Manufacturing Technologies

- 7.1.2. Analytical and Process Control Technologies

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bioprocess Optimization

- 7.2.2. Biomanufacturing Process Automation and Control

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Biopharmaceutical Companies

- 7.3.2. Contract Manufacturing Organizations

- 7.3.3. Research Institutes

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Digital Biomanufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Manufacturing Technologies

- 8.1.2. Analytical and Process Control Technologies

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bioprocess Optimization

- 8.2.2. Biomanufacturing Process Automation and Control

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Biopharmaceutical Companies

- 8.3.2. Contract Manufacturing Organizations

- 8.3.3. Research Institutes

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Digital Biomanufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Manufacturing Technologies

- 9.1.2. Analytical and Process Control Technologies

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bioprocess Optimization

- 9.2.2. Biomanufacturing Process Automation and Control

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Biopharmaceutical Companies

- 9.3.2. Contract Manufacturing Organizations

- 9.3.3. Research Institutes

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Digital Biomanufacturing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Manufacturing Technologies

- 10.1.2. Analytical and Process Control Technologies

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bioprocess Optimization

- 10.2.2. Biomanufacturing Process Automation and Control

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Biopharmaceutical Companies

- 10.3.2. Contract Manufacturing Organizations

- 10.3.3. Research Institutes

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Getinge (Applikon Biotechnology BV)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Danaher Cooperation (Cytiva)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Schneider Electric (AVEVA and AVEVA)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Siemens

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sanofi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mettler Toledo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IDBS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aspen Technology Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GE Healthcare*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Getinge (Applikon Biotechnology BV)

List of Figures

- Figure 1: Global Digital Biomanufacturing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Digital Biomanufacturing Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Digital Biomanufacturing Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Digital Biomanufacturing Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Digital Biomanufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Digital Biomanufacturing Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Digital Biomanufacturing Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Digital Biomanufacturing Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Digital Biomanufacturing Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Digital Biomanufacturing Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Digital Biomanufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 12: North America Digital Biomanufacturing Market Volume (Billion), by End User 2025 & 2033

- Figure 13: North America Digital Biomanufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America Digital Biomanufacturing Market Volume Share (%), by End User 2025 & 2033

- Figure 15: North America Digital Biomanufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Digital Biomanufacturing Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Digital Biomanufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Digital Biomanufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Digital Biomanufacturing Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Digital Biomanufacturing Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Digital Biomanufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Digital Biomanufacturing Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Digital Biomanufacturing Market Revenue (Million), by Application 2025 & 2033

- Figure 24: Europe Digital Biomanufacturing Market Volume (Billion), by Application 2025 & 2033

- Figure 25: Europe Digital Biomanufacturing Market Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Digital Biomanufacturing Market Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Digital Biomanufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 28: Europe Digital Biomanufacturing Market Volume (Billion), by End User 2025 & 2033

- Figure 29: Europe Digital Biomanufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe Digital Biomanufacturing Market Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe Digital Biomanufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Digital Biomanufacturing Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Digital Biomanufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Digital Biomanufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Digital Biomanufacturing Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Pacific Digital Biomanufacturing Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Asia Pacific Digital Biomanufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Digital Biomanufacturing Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Digital Biomanufacturing Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Asia Pacific Digital Biomanufacturing Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Asia Pacific Digital Biomanufacturing Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Digital Biomanufacturing Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Digital Biomanufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 44: Asia Pacific Digital Biomanufacturing Market Volume (Billion), by End User 2025 & 2033

- Figure 45: Asia Pacific Digital Biomanufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific Digital Biomanufacturing Market Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific Digital Biomanufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Digital Biomanufacturing Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Digital Biomanufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Digital Biomanufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Digital Biomanufacturing Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East and Africa Digital Biomanufacturing Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East and Africa Digital Biomanufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East and Africa Digital Biomanufacturing Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East and Africa Digital Biomanufacturing Market Revenue (Million), by Application 2025 & 2033

- Figure 56: Middle East and Africa Digital Biomanufacturing Market Volume (Billion), by Application 2025 & 2033

- Figure 57: Middle East and Africa Digital Biomanufacturing Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Digital Biomanufacturing Market Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Digital Biomanufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 60: Middle East and Africa Digital Biomanufacturing Market Volume (Billion), by End User 2025 & 2033

- Figure 61: Middle East and Africa Digital Biomanufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 62: Middle East and Africa Digital Biomanufacturing Market Volume Share (%), by End User 2025 & 2033

- Figure 63: Middle East and Africa Digital Biomanufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Digital Biomanufacturing Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East and Africa Digital Biomanufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Digital Biomanufacturing Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Digital Biomanufacturing Market Revenue (Million), by Type 2025 & 2033

- Figure 68: South America Digital Biomanufacturing Market Volume (Billion), by Type 2025 & 2033

- Figure 69: South America Digital Biomanufacturing Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: South America Digital Biomanufacturing Market Volume Share (%), by Type 2025 & 2033

- Figure 71: South America Digital Biomanufacturing Market Revenue (Million), by Application 2025 & 2033

- Figure 72: South America Digital Biomanufacturing Market Volume (Billion), by Application 2025 & 2033

- Figure 73: South America Digital Biomanufacturing Market Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Digital Biomanufacturing Market Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Digital Biomanufacturing Market Revenue (Million), by End User 2025 & 2033

- Figure 76: South America Digital Biomanufacturing Market Volume (Billion), by End User 2025 & 2033

- Figure 77: South America Digital Biomanufacturing Market Revenue Share (%), by End User 2025 & 2033

- Figure 78: South America Digital Biomanufacturing Market Volume Share (%), by End User 2025 & 2033

- Figure 79: South America Digital Biomanufacturing Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Digital Biomanufacturing Market Volume (Billion), by Country 2025 & 2033

- Figure 81: South America Digital Biomanufacturing Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Digital Biomanufacturing Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Digital Biomanufacturing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Digital Biomanufacturing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Digital Biomanufacturing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Digital Biomanufacturing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Digital Biomanufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Digital Biomanufacturing Market Volume Billion Forecast, by End User 2020 & 2033

- Table 7: Global Digital Biomanufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Digital Biomanufacturing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Digital Biomanufacturing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Digital Biomanufacturing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Digital Biomanufacturing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Digital Biomanufacturing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: Global Digital Biomanufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Digital Biomanufacturing Market Volume Billion Forecast, by End User 2020 & 2033

- Table 15: Global Digital Biomanufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Digital Biomanufacturing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Digital Biomanufacturing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Digital Biomanufacturing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global Digital Biomanufacturing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Digital Biomanufacturing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global Digital Biomanufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 28: Global Digital Biomanufacturing Market Volume Billion Forecast, by End User 2020 & 2033

- Table 29: Global Digital Biomanufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Digital Biomanufacturing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Germany Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: France Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Italy Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Spain Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Digital Biomanufacturing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Digital Biomanufacturing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Digital Biomanufacturing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Global Digital Biomanufacturing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 47: Global Digital Biomanufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 48: Global Digital Biomanufacturing Market Volume Billion Forecast, by End User 2020 & 2033

- Table 49: Global Digital Biomanufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Digital Biomanufacturing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: China Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Japan Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: India Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Australia Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: South Korea Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global Digital Biomanufacturing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Digital Biomanufacturing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 65: Global Digital Biomanufacturing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 66: Global Digital Biomanufacturing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 67: Global Digital Biomanufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 68: Global Digital Biomanufacturing Market Volume Billion Forecast, by End User 2020 & 2033

- Table 69: Global Digital Biomanufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Digital Biomanufacturing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: GCC Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: South Africa Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Global Digital Biomanufacturing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 78: Global Digital Biomanufacturing Market Volume Billion Forecast, by Type 2020 & 2033

- Table 79: Global Digital Biomanufacturing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 80: Global Digital Biomanufacturing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 81: Global Digital Biomanufacturing Market Revenue Million Forecast, by End User 2020 & 2033

- Table 82: Global Digital Biomanufacturing Market Volume Billion Forecast, by End User 2020 & 2033

- Table 83: Global Digital Biomanufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Digital Biomanufacturing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 85: Brazil Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: Argentina Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Digital Biomanufacturing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Digital Biomanufacturing Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Biomanufacturing Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Digital Biomanufacturing Market?

Key companies in the market include Getinge (Applikon Biotechnology BV), Danaher Cooperation (Cytiva), Schneider Electric (AVEVA and AVEVA), Siemens, Sanofi, Mettler Toledo, IDBS, Aspen Technology Inc, GE Healthcare*List Not Exhaustive.

3. What are the main segments of the Digital Biomanufacturing Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Digital Biomanufacturing; Increasing Biologics and Biosimilars Approvals.

6. What are the notable trends driving market growth?

The Process Analytical Technologies Segment is Expected to Show Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Growing Adoption of Digital Biomanufacturing; Increasing Biologics and Biosimilars Approvals.

8. Can you provide examples of recent developments in the market?

June 2024: The Syntegon subsidiary Pharmatec reported the launch of its new modular bioprocessing platform (MBP). Developed to address the current challenges in biopharmaceutical production, the MBP is a highly flexible, fully digitally integrated, and automated solution for biological drug substances.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Digital Biomanufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Digital Biomanufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Digital Biomanufacturing Market?

To stay informed about further developments, trends, and reports in the Digital Biomanufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence