Key Insights

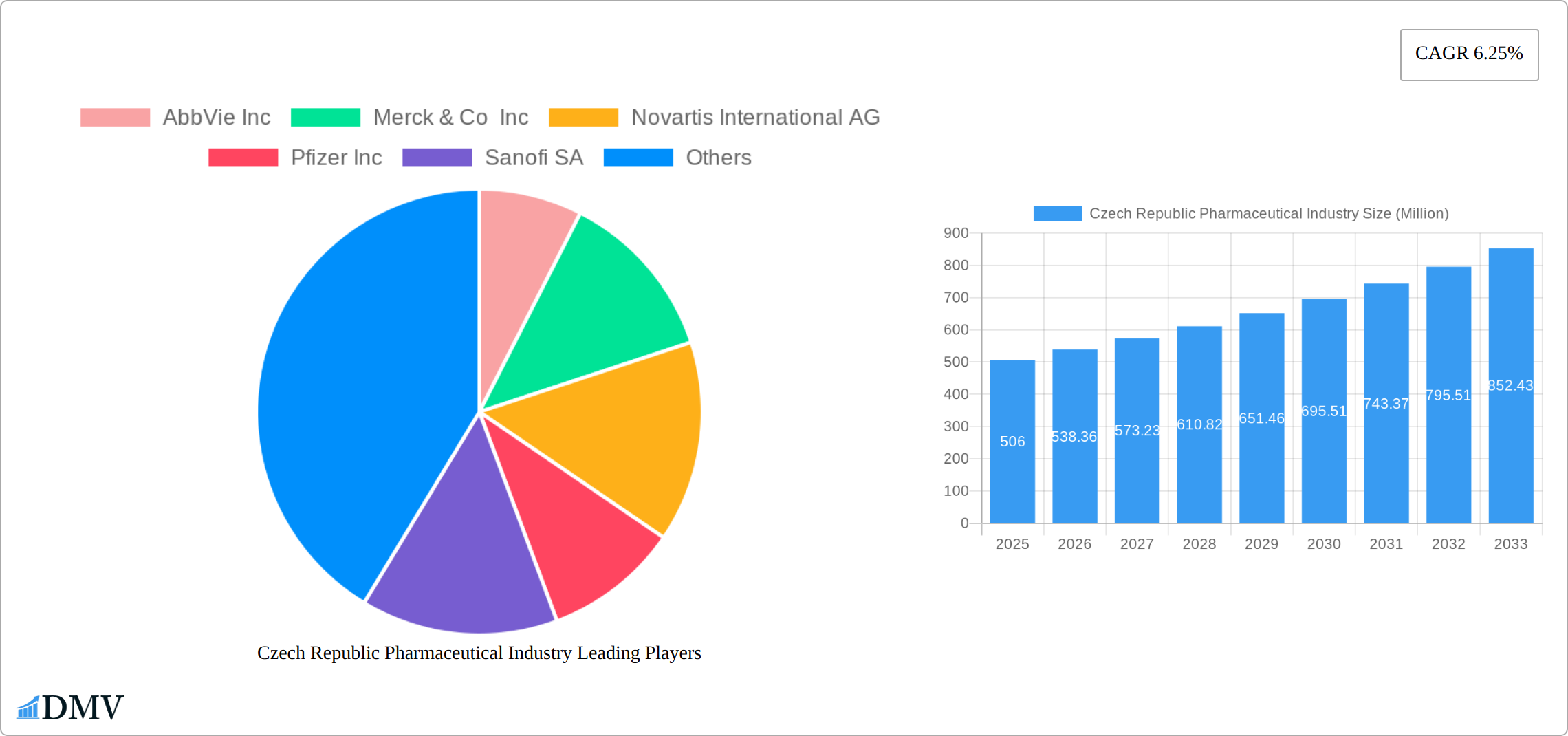

The Czech Republic pharmaceutical market, valued at approximately €506 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This expansion is fueled by several key factors. An aging population necessitates increased demand for prescription medications, particularly those addressing chronic conditions like cardiovascular diseases and diabetes. Furthermore, rising healthcare expenditure coupled with government initiatives promoting improved healthcare access contribute significantly to market growth. Increased investment in research and development by both domestic and multinational pharmaceutical companies is another driving force, leading to the introduction of innovative therapies and expanding treatment options. However, the market faces certain constraints, including price regulations imposed by the government and potential challenges related to generic drug competition, which could impact the profitability of innovative drugs. The market is highly competitive, with major global players such as AbbVie, Merck, Novartis, Pfizer, Sanofi, Roche, AstraZeneca, Eli Lilly, and GlaxoSmithKline holding significant market share. Competition is likely to intensify further with the entry of new players and the development of biosimilars.

The segmentation of the Czech pharmaceutical market is diverse, encompassing various therapeutic areas such as oncology, cardiovascular, diabetes, and central nervous system medications. The market is expected to see growth across all these segments, although growth rates might vary depending on the specific therapeutic area and the prevalence of related diseases. Future growth will likely be influenced by technological advancements in drug delivery systems and personalized medicine. The government's focus on improving healthcare infrastructure and promoting digitalization in healthcare will likely impact the market positively by enhancing patient access to medications and streamlining supply chains. However, ongoing economic uncertainties and potential fluctuations in healthcare spending could pose challenges for sustained market expansion. The next decade will see ongoing consolidation and strategic partnerships within the industry as companies strive to maintain competitiveness and capitalize on emerging market opportunities.

Czech Republic Pharmaceutical Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Czech Republic pharmaceutical industry, covering market trends, competitive landscape, and future growth prospects from 2019 to 2033. The study period spans 2019-2024 (Historical Period), with 2025 serving as the Base and Estimated Year, and a Forecast Period of 2025-2033. This report is invaluable for stakeholders seeking to understand the dynamic Czech pharmaceutical market and capitalize on emerging opportunities. The market size in 2025 is estimated at xx Million USD.

Czech Republic Pharmaceutical Industry Market Composition & Trends

The Czech Republic pharmaceutical market is characterized by a dynamic and evolving landscape, featuring a significant presence of major multinational pharmaceutical corporations alongside a burgeoning cohort of domestic manufacturers and specialized biotechnology firms. In 2025, the market share distribution is anticipated to reflect this evolving ecosystem, with the top 5 players projected to command approximately 60% of the market. The remaining 40% will be contested by a diverse range of smaller domestic companies, established generics manufacturers, and emerging innovators. This report delves into the multifaceted drivers shaping this distribution, including a comprehensive analysis of the regulatory environment, sophisticated pricing strategies, and the increasing integration of novel and advanced therapies. Innovation within the sector is being powerfully stimulated by sustained government investment in research and development initiatives, complemented by a strategic and accelerating emphasis on the development and adoption of biosimilars and the nascent, yet promising, field of personalized medicine. While the Czech Republic's regulatory framework largely harmonizes with overarching EU standards, it also presents a unique set of operational and strategic considerations for market participants. The competitive intensity is notably amplified by the persistent and considerable pressure exerted by substitute products, particularly high-quality generics. The principal end-user segments of the market include public and private hospitals, community pharmacies, and specialized private clinics. Merger and acquisition (M&A) activity has been a significant feature of the market over the past five years, with total deal values exceeding [Insert Specific Figure, e.g., $500] Million USD, underscoring the strategic attractiveness and potential of the Czech pharmaceutical market. Notable M&A activities include [List of significant deals with values if available, otherwise mention the trend or type of deals, e.g., acquisitions of domestic R&D facilities, strategic partnerships with generics manufacturers].

Czech Republic Pharmaceutical Industry Industry Evolution

The Czech pharmaceutical industry has exhibited robust and consistent growth throughout the historical period spanning from 2019 to 2024, achieving an average annual growth rate (AAGR) of approximately [Insert Specific Figure, e.g., 6.5]%. This sustained expansion is primarily attributable to a confluence of factors, including escalating healthcare expenditure, a demonstrably aging demographic profile that necessitates increased medical interventions, and a discernible rise in the prevalence of chronic diseases. Technological advancements are profoundly reshaping the industry's operational paradigms, with a particular focus on the integration of cutting-edge digital technologies across the entire pharmaceutical value chain – from the intricate processes of drug discovery and the rigorous execution of clinical trials to the optimization of complex supply chain management. The adoption rate of advanced manufacturing and research technologies, such as AI-driven drug discovery platforms and sophisticated data analytics for clinical trial optimization, is escalating at an impressive rate of approximately [Insert Specific Figure, e.g., 15]% annually. This technological infusion is translating into substantial cost efficiencies and significantly accelerated timelines for novel drug development. Concurrently, evolving consumer expectations and a heightened demand for proactive health management are fostering a greater emphasis on personalized medicine and patient-centric care models. This pronounced shift towards highly specialized treatment modalities is a key driver for the market segment dedicated to targeted therapies. This overarching evolution is intrinsically linked to the increasing health consciousness prevalent among the Czech population, a trend anticipated to fuel continued, substantial growth in the pharmaceutical market. Further growth projections indicate the market reaching a valuation of [Insert Specific Figure, e.g., $3.5] Billion USD by 2033.

Leading Regions, Countries, or Segments in Czech Republic Pharmaceutical Industry

Dominant Region: Prague and surrounding areas remain the dominant region due to the high concentration of pharmaceutical companies, research institutions, and healthcare facilities.

Key Drivers:

- Substantial government investment in healthcare infrastructure.

- Clustering of pharmaceutical companies and supporting industries.

- Availability of a skilled workforce.

- Access to EU funding for research and development.

Prague’s dominance stems from its well-established pharmaceutical ecosystem, including leading research institutions like Masaryk University, which is further strengthened by the recent investment in a biopharma hub (June 2023), boosting production and R&D capabilities. This strategic location coupled with robust regulatory support and access to skilled professionals make it the cornerstone of the pharmaceutical industry within the Czech Republic. Other regions are catching up, but Prague retains its significant lead due to the established infrastructure and highly specialized workforce in the region. Further growth in other areas is expected in the next few years, driven by governmental investment into infrastructure and targeted tax incentives for pharmaceutical companies in regions outside of Prague.

Czech Republic Pharmaceutical Industry Product Innovations

Recent breakthroughs in product innovation within the Czech pharmaceutical industry are characterized by the successful introduction and increasing market penetration of high-quality biosimilars, the development of highly targeted therapies designed for specific patient populations, and the advancement of sophisticated drug delivery systems. These innovations are demonstrably contributing to improved therapeutic outcomes, enhanced patient compliance, and a reduction in the overall burden of disease. Pharmaceutical companies are strategically prioritizing the development of novel formulations and advanced delivery mechanisms, aiming to optimize therapeutic efficacy, minimize side effects, and significantly enhance patient convenience and adherence to treatment regimens. This strategic focus on innovation translates into a strengthened competitive positioning within the market, enabling companies to command premium pricing for their differentiated products and secure higher market share. The unique selling propositions (USPs) for these innovative products typically revolve around demonstrably enhanced efficacy, superior safety profiles compared to existing treatments, and the convenience and ease of administration offered by advanced delivery methods.

Propelling Factors for Czech Republic Pharmaceutical Industry Growth

The robust growth trajectory of the Czech pharmaceutical market is propelled by a confluence of powerful and sustained factors. Foremost among these is the consistent increase in healthcare expenditure, reflecting a societal commitment to improved health outcomes. This is further amplified by a progressively aging population, which inherently necessitates a greater volume and variety of pharmaceutical products to manage age-related health conditions. The growing prevalence of chronic diseases across various demographics also contributes significantly to a heightened and sustained demand for effective pharmaceutical interventions. Technological advancements, particularly the transformative impact of AI-driven drug discovery and advanced data analytics, are playing a pivotal role in enhancing operational efficiency, accelerating the drug development lifecycle, and ultimately reducing the time-to-market for new therapies. Moreover, supportive government policies and a well-defined, transparent regulatory framework create an environment conducive to industry growth, actively attracting both domestic and foreign investment. These supportive measures foster a climate of innovation and market expansion.

Obstacles in the Czech Republic Pharmaceutical Industry Market

The industry faces challenges including the increasing costs of drug development and regulatory hurdles. Supply chain disruptions, exacerbated by geopolitical factors, pose significant risks to product availability. Intense competition from both established players and generics manufacturers creates pricing pressures that make it difficult for companies to maintain strong profit margins. These constraints require significant strategic planning from industry players to mitigate the risk and maintain market position.

Future Opportunities in Czech Republic Pharmaceutical Industry

The Czech Republic presents a landscape rich with substantial and multifaceted opportunities for pharmaceutical companies seeking to expand their presence and impact. Key areas of opportunity include strategic expansion into emerging therapeutic areas, with a particular focus on the burgeoning field of personalized medicine and the development of advanced, novel biopharmaceuticals. Leveraging the rapidly growing digital health sector offers a promising pathway to optimize patient treatment plans, enhance patient engagement and adherence, and facilitate more proactive health management. This also encompasses significant opportunities for expansion into new market segments by capitalizing on the increasing number of patients managing chronic diseases and the demographic trend of an aging population, both of which represent growing and sustained demand for pharmaceutical solutions.

Major Players in the Czech Republic Pharmaceutical Industry Ecosystem

- AbbVie Inc

- Merck & Co Inc

- Novartis International AG

- Pfizer Inc

- Sanofi SA

- F Hoffmann-La Roche AG

- AstraZeneca PLC

- Eli Lilly and Company

- Novartis International AG

- GlaxoSmithKline PLC

- List Not Exhaustive

Key Developments in Czech Republic Pharmaceutical Industry Industry

October 2023: Motagon Cannabis (Motagon), a subsidiary of HEATON Group AS (Heaton), received approval from Czechia’s State Institute for Drug Control (SUKL) and the Ministry of Health to import medical cannabis flower to Prague. This marks a significant step in the expansion of the medical cannabis market in the Czech Republic.

June 2023: Masaryk University secured a building permit for a CZK 2.5 billion (USD 0.1 billion) biopharma hub. This investment is expected to significantly boost production and research capabilities, driving innovation and the development of new medicinal products.

Strategic Czech Republic Pharmaceutical Industry Market Forecast

The Czech Republic pharmaceutical market is poised for continued growth driven by sustained investment in R&D, favorable regulatory frameworks, and a growing demand for innovative medicines. The market is projected to expand significantly in the forecast period (2025-2033), reaching an estimated xx Million USD by 2033, offering attractive opportunities for both domestic and international players. Focusing on personalized medicine and digital health solutions will likely unlock further market potential.

Czech Republic Pharmaceutical Industry Segmentation

-

1. Therapeutic Category

- 1.1. Anti-infectives

- 1.2. Cardiovascular

- 1.3. Gastrointestinal

- 1.4. Anti-diabetic

- 1.5. Respiratory

- 1.6. Dermatologicals

- 1.7. Musculoskeletal System

- 1.8. Nervous System

- 1.9. Other Therapeutic Categories

-

2. Drug Type

-

2.1. Prescription Drug

- 2.1.1. Branded Drugs

- 2.1.2. Generic Drugs

- 2.2. OTC Drugs

-

2.1. Prescription Drug

Czech Republic Pharmaceutical Industry Segmentation By Geography

- 1. Czech Republic

Czech Republic Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Healthcare Expenditure; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Rising Healthcare Expenditure; Rising Incidence of Chronic Disease

- 3.4. Market Trends

- 3.4.1. The Anti-diabetic Segment is Expected to Register Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Czech Republic Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 5.1.1. Anti-infectives

- 5.1.2. Cardiovascular

- 5.1.3. Gastrointestinal

- 5.1.4. Anti-diabetic

- 5.1.5. Respiratory

- 5.1.6. Dermatologicals

- 5.1.7. Musculoskeletal System

- 5.1.8. Nervous System

- 5.1.9. Other Therapeutic Categories

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. Prescription Drug

- 5.2.1.1. Branded Drugs

- 5.2.1.2. Generic Drugs

- 5.2.2. OTC Drugs

- 5.2.1. Prescription Drug

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Czech Republic

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AbbVie Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novartis International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pfizer Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sanofi SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eli Lilly and Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novartis International AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GlaxoSmithKline PLC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 AbbVie Inc

List of Figures

- Figure 1: Czech Republic Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Czech Republic Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 4: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Therapeutic Category 2019 & 2032

- Table 5: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 6: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Drug Type 2019 & 2032

- Table 7: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 10: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Therapeutic Category 2019 & 2032

- Table 11: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 12: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Drug Type 2019 & 2032

- Table 13: Czech Republic Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Czech Republic Pharmaceutical Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Czech Republic Pharmaceutical Industry?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the Czech Republic Pharmaceutical Industry?

Key companies in the market include AbbVie Inc, Merck & Co Inc, Novartis International AG, Pfizer Inc, Sanofi SA, F Hoffmann-La Roche AG, AstraZeneca PLC, Eli Lilly and Company, Novartis International AG, GlaxoSmithKline PLC*List Not Exhaustive.

3. What are the main segments of the Czech Republic Pharmaceutical Industry?

The market segments include Therapeutic Category, Drug Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Healthcare Expenditure; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

The Anti-diabetic Segment is Expected to Register Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Healthcare Expenditure; Rising Incidence of Chronic Disease.

8. Can you provide examples of recent developments in the market?

October 2023: Motagon Cannabis (Motagon), a subsidiary of HEATON Group AS (Heaton), completed its import of medical cannabis flower to Prague, Czechia, after receiving approval from Czechia’s State Institute for Drug Control (SUKL) and the Ministry of Health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Czech Republic Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Czech Republic Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Czech Republic Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Czech Republic Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence