Key Insights

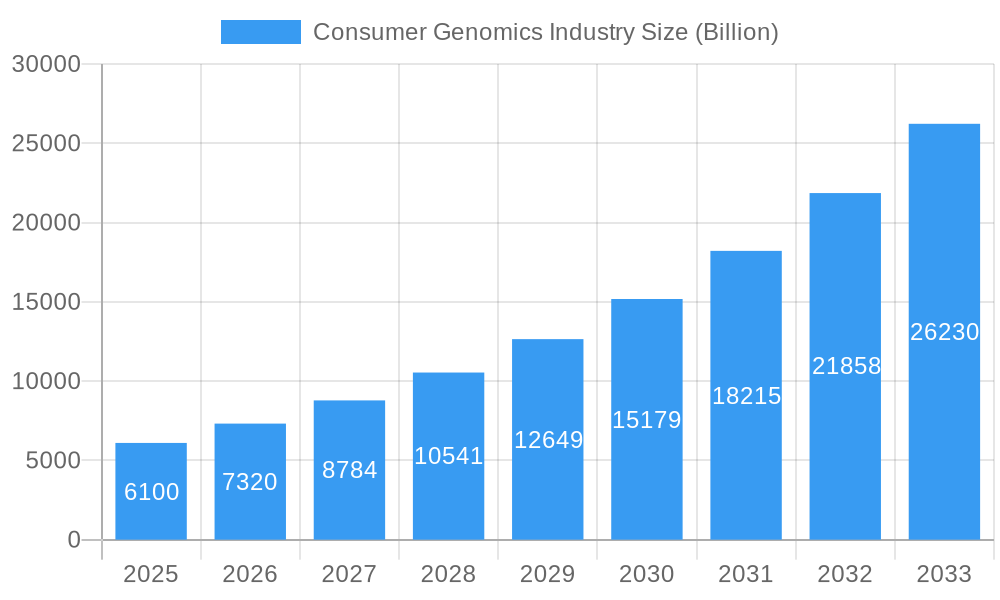

The global Consumer Genomics market is poised for substantial expansion, projected to reach an estimated $6.1 billion in 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 20.00%. This robust growth trajectory is primarily fueled by escalating consumer interest in personalized health and wellness solutions, coupled with advancements in DNA sequencing technologies making them more accessible and affordable. The "Genetic Relatedness" and "Diagnostics" segments are expected to lead this surge, driven by the increasing demand for ancestry tracing, disease predisposition insights, and early detection of health conditions. Furthermore, the growing awareness of the link between genetics and lifestyle choices, including wellness, nutrition, and sports performance, is creating new avenues for market penetration. The personalized medicine and pharmacogenetic testing segments are also gaining significant traction as healthcare providers increasingly leverage genetic information to tailor treatment plans, thereby improving efficacy and minimizing adverse drug reactions.

Consumer Genomics Industry Market Size (In Billion)

The market's growth is further propelled by key players like 23andMe Inc., Helix OpCo LLC, and MyHeritage Ltd., who are continuously innovating and expanding their service offerings. These companies are investing heavily in research and development to enhance the accuracy and utility of their genomic insights, thereby fostering greater consumer trust and adoption. Emerging trends such as direct-to-consumer (DTC) genetic testing kits, at-home DNA testing, and the integration of genomic data with wearable health devices are shaping the future of this industry. Despite the promising outlook, challenges such as data privacy concerns, ethical considerations surrounding genetic information, and the need for clear regulatory frameworks may pose some restraints. However, the overarching demand for proactive health management and a deeper understanding of individual genetic predispositions is expected to outweigh these limitations, ensuring a dynamic and expanding Consumer Genomics market throughout the forecast period.

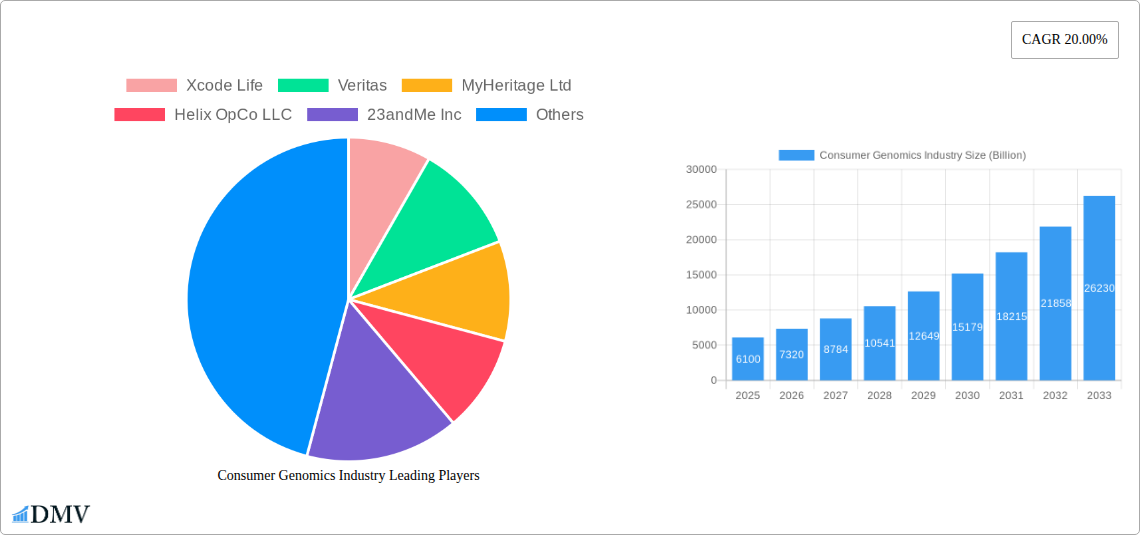

Consumer Genomics Industry Company Market Share

Consumer Genomics Industry Market Composition & Trends

The global consumer genomics market is experiencing dynamic growth, driven by increasing consumer awareness of genetic predispositions and the burgeoning demand for personalized health solutions. Market concentration is moderately fragmented, with a few key players like 23andMe Inc, Helix OpCo LLC, and Illumina Inc holding significant influence, alongside innovative startups such as Xcode Life and Pathway Genomics. Innovation catalysts include advancements in DNA sequencing technologies, AI-driven data analysis, and the expansion of direct-to-consumer (DTC) testing platforms. The regulatory landscape is evolving, with varying approaches across regions impacting market access and data privacy. Substitute products, such as traditional medical diagnostics, are increasingly being complemented by genomic insights. End-user profiles are diversifying, encompassing individuals seeking ancestry information, health diagnostics, lifestyle optimization, and personalized wellness plans. Mergers and acquisitions (M&A) are active, with significant deal values being observed as companies aim to consolidate market share, acquire new technologies, and expand their service offerings. For instance, a hypothetical M&A deal in 2024 could involve a large diagnostics company acquiring a DTC genetics firm for an estimated value of $5 Billion. Market share distribution is witnessing a steady rise in segments like personalized medicine and wellness.

Consumer Genomics Industry Industry Evolution

The consumer genomics industry has undergone a profound evolution, transforming from a niche area of scientific curiosity into a mainstream health and wellness tool. Over the study period of 2019–2033, the market has witnessed a consistent upward trajectory in growth, fueled by continuous technological advancements and a seismic shift in consumer demand towards proactive and personalized health management. The base year, 2025, serves as a crucial benchmark, with the market projected to reach an estimated value of $XX Billion by then, reflecting significant expansion from historical figures. The forecast period, 2025–2033, anticipates a Compound Annual Growth Rate (CAGR) of approximately 15-20%, driven by enhanced affordability of genetic testing, improved accuracy of genomic analysis, and the integration of genetic data into broader healthcare ecosystems.

Technological breakthroughs have been paramount in this evolution. The plummeting cost of DNA sequencing, from thousands of dollars per genome a decade ago to mere hundreds, has democratized access to genetic information. Innovations in bioinformatics and machine learning have enabled more sophisticated interpretation of raw genetic data, translating complex sequences into actionable insights for consumers. This has allowed for the development of diverse applications, ranging from understanding familial predispositions to diseases, optimizing athletic performance through Sports Nutrition & Health insights, and tailoring Wellness, & Nutrition plans based on individual genetic makeup. The expansion of Personalized Medicine & Pharmacogenetic Testing is a testament to this, as consumers increasingly seek to understand how their genes influence drug responses and treatment efficacy. Furthermore, the growing emphasis on preventative healthcare and the desire to unlock ancestral connections through Ancestry testing have broadened the appeal of consumer genomics beyond purely medical applications. The market has also seen a rise in specialized platforms and integrated solutions that offer a more holistic approach to genetic information utilization. The Other Application Types segment is also gaining traction as new uses for genomic data emerge. The historical period (2019–2024) laid the groundwork for this accelerated growth, characterized by initial consumer education and a gradual increase in adoption rates. The continuous refinement of testing methodologies and the growing trust in DTC genetic companies are key factors contributing to the industry's robust evolution.

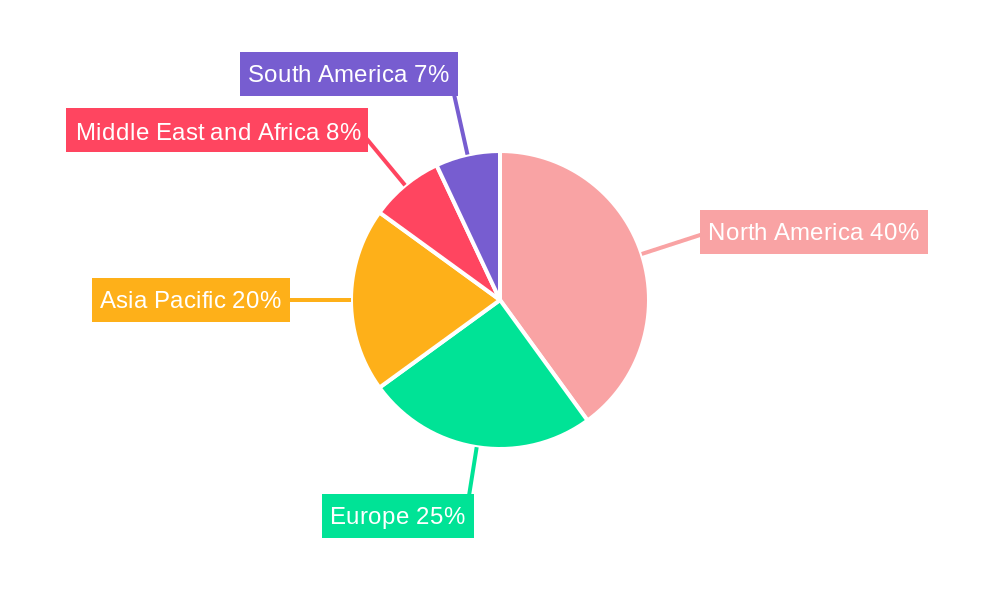

Leading Regions, Countries, or Segments in Consumer Genomics Industry

The North America region stands out as a dominant force in the global consumer genomics industry, with the United States leading the charge in market penetration and innovation. This regional dominance is underpinned by several key drivers.

- Strong Investment Trends: The US boasts a vibrant venture capital ecosystem that actively funds disruptive technologies in the life sciences, including consumer genomics. Significant investments have poured into companies developing advanced sequencing technologies, user-friendly platforms, and novel applications for genetic data. This financial backing fuels research and development, leading to a continuous stream of product innovations and market expansion.

- Regulatory Support (with nuances): While regulatory oversight exists, it has often fostered an environment conducive to innovation, particularly for direct-to-consumer (DTC) offerings. The FDA's evolving stance on DTC genetic tests has, over time, allowed for increased product approvals in areas like health and wellness, albeit with varying degrees of scrutiny depending on the claims made. This has provided a relatively clearer pathway for companies to bring their products to market compared to some other regions.

- High Consumer Awareness and Adoption: American consumers generally exhibit a higher level of health consciousness and a greater willingness to adopt new technologies for personal well-being. The widespread availability of online information, coupled with effective marketing campaigns by leading companies, has significantly raised awareness about the benefits of understanding one's genetic makeup. This has translated into high adoption rates for various consumer genomics applications.

Within the applications segment, Personalized Medicine & Pharmacogenetic Testing and Lifestyle, Wellness, & Nutrition are spearheading the growth in North America and globally. Personalized medicine, driven by the desire to optimize drug efficacy and minimize adverse reactions, is gaining significant traction. Pharmacogenetic testing, in particular, allows individuals to understand how their genes influence their response to medications, enabling healthcare providers to prescribe more targeted and effective treatments. This application directly contributes to better patient outcomes and reduced healthcare costs, making it a highly valued service.

Simultaneously, the Lifestyle, Wellness, & Nutrition segment has exploded in popularity. Consumers are increasingly seeking to leverage their genetic predispositions to make informed decisions about diet, exercise, and overall well-being. Companies are offering tailored recommendations for everything from macronutrient intake and exercise routines to sleep patterns and stress management, all based on an individual's unique genetic profile. The accessibility and affordability of these tests have made them a popular choice for individuals looking to proactively manage their health and optimize their daily lives. While Ancestry testing remains a strong foundational segment, the increasing focus on actionable health insights is driving the growth of these two segments to the forefront. Diagnostics is also a critical area, with advancements in identifying genetic predispositions to various diseases, further solidifying the importance of this segment.

Consumer Genomics Industry Product Innovations

Product innovations in consumer genomics are rapidly expanding the scope and accessibility of genetic insights. Companies are introducing advanced DNA sequencing kits with higher accuracy and faster turnaround times, enabling users to receive comprehensive genetic reports. Unique selling propositions include the integration of AI-powered interpretation engines that translate complex genomic data into easy-to-understand reports on health risks, ancestry, and trait predispositions. For instance, the development of comprehensive reports that link genetic markers to specific dietary needs or fitness regimens represents a significant technological advancement in personalized wellness. These innovations are enhancing the user experience and empowering individuals with actionable information for proactive health management.

Propelling Factors for Consumer Genomics Industry Growth

Several key factors are propelling the growth of the consumer genomics industry. Firstly, technological advancements in DNA sequencing and bioinformatics have dramatically reduced costs and increased accuracy, making genetic testing more accessible. Secondly, a growing consumer demand for personalized health and wellness solutions is a significant driver, as individuals seek to understand their genetic predispositions and optimize their lifestyles. Thirdly, favorable regulatory developments, although varied, are gradually creating clearer pathways for product approval and market entry. Lastly, increasing awareness and education surrounding the benefits of genetic insights, coupled with strategic marketing by industry players, are fostering wider adoption.

Obstacles in the Consumer Genomics Industry Market

Despite its promising growth, the consumer genomics market faces several obstacles. Regulatory challenges remain a significant hurdle, with varying data privacy laws and varying approval processes for health-related claims across different jurisdictions. Consumer concerns regarding data privacy and security can also deter adoption, necessitating robust safeguards and transparent data handling practices. Furthermore, interpretational limitations and the risk of genetic determinism require careful communication to avoid oversimplification or misinterpretation of genetic information. High upfront costs for certain advanced tests and the need for clearer reimbursement pathways in healthcare settings also present barriers to broader market penetration.

Future Opportunities in Consumer Genomics Industry

Emerging opportunities in the consumer genomics industry are abundant. The expansion into emerging markets in Asia and Latin America, where awareness and disposable income are growing, presents significant potential. Technological advancements in multi-omics integration, combining genomics with other biological data like epigenomics and proteomics, will unlock deeper insights into health and disease. The increasing role of genomics in preventative healthcare and chronic disease management offers substantial growth avenues. Furthermore, the development of novel therapeutic applications based on individual genetic profiles, though still nascent for DTC, holds long-term promise, alongside the continued evolution of personalized nutrition and sports performance solutions.

Major Players in the Consumer Genomics Industry Ecosystem

- Xcode Life

- Veritas

- MyHeritage Ltd

- Helix OpCo LLC

- 23andMe Inc

- Pathway Genomics

- Illumina Inc

- Positive Biosciences Ltd

- Futura Genetics

- Toolbox Genomics

Key Developments in Consumer Genomics Industry Industry

- October 2022: GC LabTech FDA-registered specialty laboratory with life-saving plasma tests selected 1health.io to deliver its innovative new lab tests direct-to-consumers. (Impact: Increased access to specialized diagnostic testing through a DTC platform, highlighting strategic partnerships for wider reach).

- May 2022: Genetic Technologies Limited acquired the direct-to-consumer eCommerce business and distribution rights associated with AffinityDNA. (Impact: Consolidation within the DTC space, indicating a trend towards market expansion and brand acquisition to capture a larger customer base).

Strategic Consumer Genomics Industry Market Forecast

The strategic market forecast for the consumer genomics industry is exceptionally bright, driven by a confluence of accelerating technological advancements and a profound shift in consumer health paradigms. The increasing affordability and accessibility of genetic testing, coupled with sophisticated AI-driven data interpretation, are poised to democratize personalized health insights. The growing demand for proactive wellness, precise diagnostics, and tailored lifestyle interventions will fuel robust growth across key segments like personalized medicine and nutrition. Emerging markets and novel applications, such as integrating multi-omics data, present significant untapped potential. Strategic partnerships and ongoing innovation in product development will be crucial for capturing market share and addressing evolving consumer needs, ensuring sustained growth in the coming years.

Consumer Genomics Industry Segmentation

-

1. Application

- 1.1. Genetic Relatedness

- 1.2. Diagnostics

- 1.3. Lifestyle, Wellness, & Nutrition

- 1.4. Ancestry

- 1.5. Personalized Medicine & Pharmacogenetic Testing

- 1.6. Sports Nutrition & Health

- 1.7. Other Application Types

Consumer Genomics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Consumer Genomics Industry Regional Market Share

Geographic Coverage of Consumer Genomics Industry

Consumer Genomics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 30.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Interest of Consumers & Physicians in DTC kits; Advancements in Technology; Increasing Applications of Consumer Genomics and Favorable Government Policies; Growing Trend of Personalized Genomics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Challenges; Misleading Results Create Challenges in Adoption of Home-based Genetic Tests

- 3.4. Market Trends

- 3.4.1. Genetic Relatedness Expected to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Genetic Relatedness

- 5.1.2. Diagnostics

- 5.1.3. Lifestyle, Wellness, & Nutrition

- 5.1.4. Ancestry

- 5.1.5. Personalized Medicine & Pharmacogenetic Testing

- 5.1.6. Sports Nutrition & Health

- 5.1.7. Other Application Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Genetic Relatedness

- 6.1.2. Diagnostics

- 6.1.3. Lifestyle, Wellness, & Nutrition

- 6.1.4. Ancestry

- 6.1.5. Personalized Medicine & Pharmacogenetic Testing

- 6.1.6. Sports Nutrition & Health

- 6.1.7. Other Application Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Genetic Relatedness

- 7.1.2. Diagnostics

- 7.1.3. Lifestyle, Wellness, & Nutrition

- 7.1.4. Ancestry

- 7.1.5. Personalized Medicine & Pharmacogenetic Testing

- 7.1.6. Sports Nutrition & Health

- 7.1.7. Other Application Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Genetic Relatedness

- 8.1.2. Diagnostics

- 8.1.3. Lifestyle, Wellness, & Nutrition

- 8.1.4. Ancestry

- 8.1.5. Personalized Medicine & Pharmacogenetic Testing

- 8.1.6. Sports Nutrition & Health

- 8.1.7. Other Application Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East and Africa Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Genetic Relatedness

- 9.1.2. Diagnostics

- 9.1.3. Lifestyle, Wellness, & Nutrition

- 9.1.4. Ancestry

- 9.1.5. Personalized Medicine & Pharmacogenetic Testing

- 9.1.6. Sports Nutrition & Health

- 9.1.7. Other Application Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. South America Consumer Genomics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Genetic Relatedness

- 10.1.2. Diagnostics

- 10.1.3. Lifestyle, Wellness, & Nutrition

- 10.1.4. Ancestry

- 10.1.5. Personalized Medicine & Pharmacogenetic Testing

- 10.1.6. Sports Nutrition & Health

- 10.1.7. Other Application Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Xcode Life

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Veritas

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MyHeritage Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Helix OpCo LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 23andMe Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pathway Genomics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Illumina Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Positive Biosciences Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Futura Genetics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Toolbox Genomics*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Xcode Life

List of Figures

- Figure 1: Global Consumer Genomics Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: Europe Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: Europe Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: Asia Pacific Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Asia Pacific Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Middle East and Africa Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Middle East and Africa Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Middle East and Africa Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Consumer Genomics Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: South America Consumer Genomics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: South America Consumer Genomics Industry Revenue (undefined), by Country 2025 & 2033

- Figure 21: South America Consumer Genomics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Consumer Genomics Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 9: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Germany Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Spain Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: China Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Australia Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: GCC Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Africa Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Middle East and Africa Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Consumer Genomics Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Consumer Genomics Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Brazil Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Argentina Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Consumer Genomics Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Consumer Genomics Industry?

The projected CAGR is approximately 30.4%.

2. Which companies are prominent players in the Consumer Genomics Industry?

Key companies in the market include Xcode Life, Veritas, MyHeritage Ltd, Helix OpCo LLC, 23andMe Inc, Pathway Genomics, Illumina Inc, Positive Biosciences Ltd, Futura Genetics, Toolbox Genomics*List Not Exhaustive.

3. What are the main segments of the Consumer Genomics Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Interest of Consumers & Physicians in DTC kits; Advancements in Technology; Increasing Applications of Consumer Genomics and Favorable Government Policies; Growing Trend of Personalized Genomics.

6. What are the notable trends driving market growth?

Genetic Relatedness Expected to Witness High Growth.

7. Are there any restraints impacting market growth?

Stringent Regulatory Challenges; Misleading Results Create Challenges in Adoption of Home-based Genetic Tests.

8. Can you provide examples of recent developments in the market?

October 2022: GC LabTech FDA-registered specialty laboratory with life-saving plasma tests selected 1health.io to deliver its innovative new lab tests direct-to-consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Consumer Genomics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Consumer Genomics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Consumer Genomics Industry?

To stay informed about further developments, trends, and reports in the Consumer Genomics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence