Key Insights

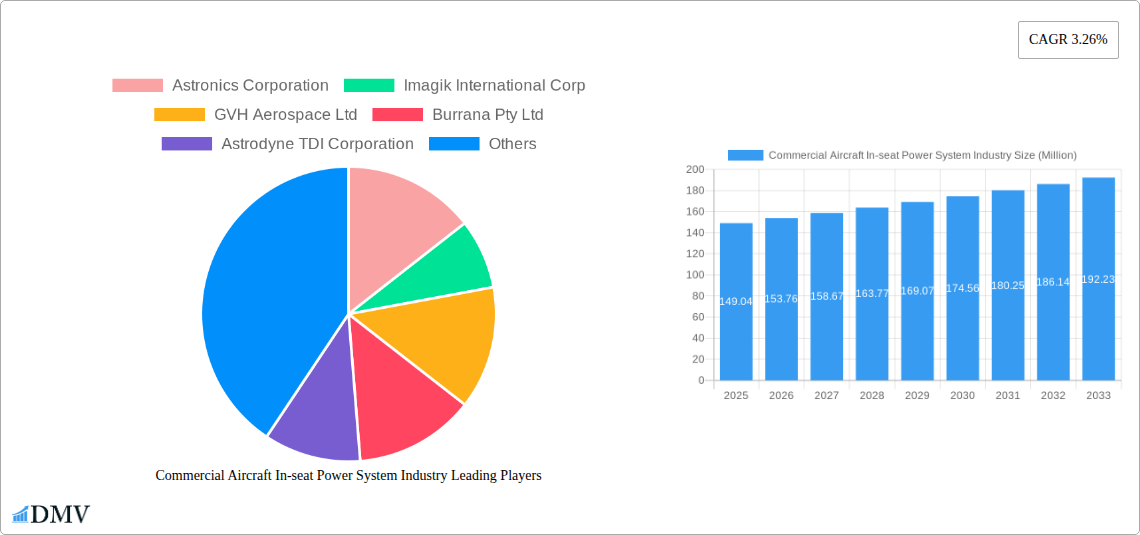

The global commercial aircraft in-seat power system market is poised for steady growth, projected to reach \$149.04 million in 2025 and expand at a compound annual growth rate (CAGR) of 3.26% from 2025 to 2033. This growth is driven by several key factors. Firstly, the increasing demand for in-flight connectivity and passenger comfort is fueling the adoption of in-seat power systems. Passengers now expect to charge their electronic devices during long-haul flights, creating a strong market pull. Secondly, technological advancements are resulting in lighter, more efficient, and safer power systems, enhancing their appeal to both airlines and aircraft manufacturers. The integration of USB ports and AC power outlets is becoming standard across various seating classes, further driving market expansion. Finally, the rising number of air travelers globally, particularly in emerging economies, contributes to this positive market outlook. The market is segmented by seating class (economy, premium economy, business, first) and sales mode (OEM, aftermarket), with the business and first-class segments exhibiting higher adoption rates due to higher passenger expectations and willingness to pay.

Commercial Aircraft In-seat Power System Industry Market Size (In Million)

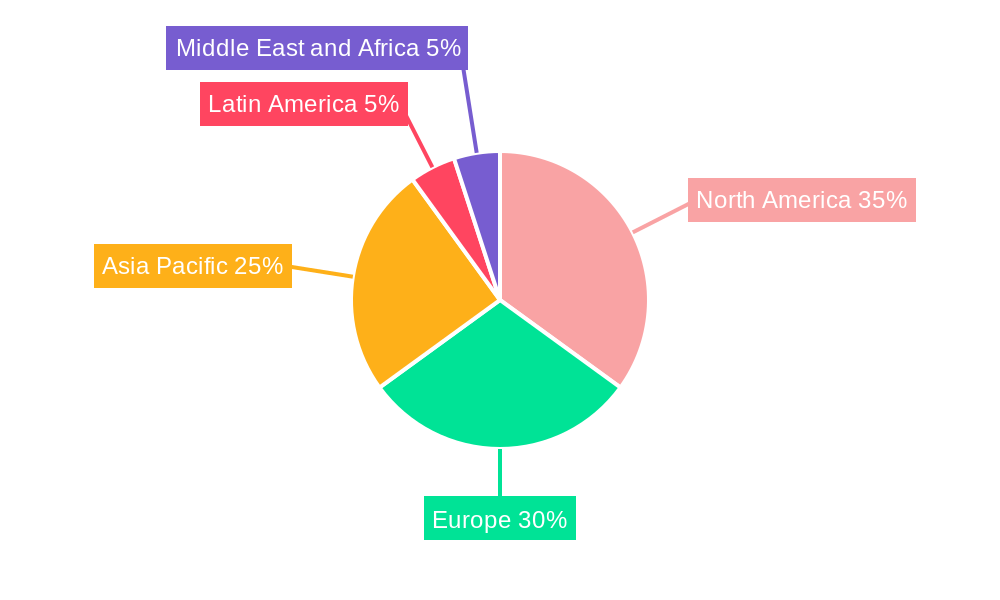

However, certain restraints exist. High initial investment costs for airlines to retrofit existing aircraft with in-seat power systems can hinder widespread adoption, especially for smaller airlines with tighter budgets. Moreover, the complexity of integrating these systems into aircraft interiors can pose technical challenges and potentially increase maintenance costs. Nevertheless, the long-term benefits of enhanced passenger satisfaction and increased ancillary revenue are likely to outweigh these challenges, propelling market growth. The aftermarket segment holds significant growth potential as airlines increasingly upgrade their fleets to meet evolving passenger demands. Geographic analysis reveals North America and Europe currently dominate the market, due to a larger number of established airlines and higher aircraft density, but rapid growth is anticipated in the Asia-Pacific region driven by expanding air travel and increasing disposable incomes. Companies like Astronics Corporation, Imagik International Corp, and GVH Aerospace Ltd are key players shaping the market landscape through innovation and product diversification.

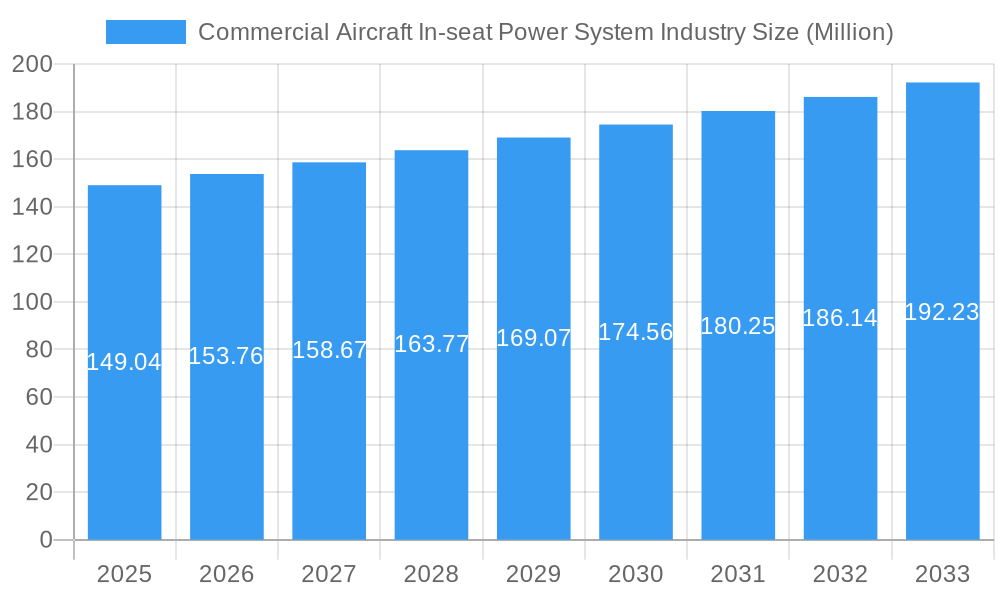

Commercial Aircraft In-seat Power System Industry Company Market Share

Commercial Aircraft In-seat Power System Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Commercial Aircraft In-seat Power System industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The report values the market at $XX Million in 2025, projecting significant growth to $XX Million by 2033. This detailed analysis incorporates historical data from 2019-2024.

Commercial Aircraft In-seat Power System Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, and end-user preferences within the commercial aircraft in-seat power system market. The market is moderately concentrated, with key players including Astronics Corporation, Imagik International Corp, GVH Aerospace Ltd, and others holding significant market share. Market share distribution in 2025 is estimated as follows: Astronics Corporation (XX%), Imagik International Corp (XX%), GVH Aerospace Ltd (XX%), Others (XX%). Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging $XX Million over the past five years. Innovation is driven by increasing passenger demand for power and connectivity, alongside advancements in lightweight and energy-efficient power technologies. Regulatory landscapes vary by region, impacting certification and compliance. While Wi-Fi offers a substitute for some power needs, the demand for dedicated in-seat power remains strong. Key end-users are airlines and aircraft manufacturers.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Catalysts: Increased passenger demand for power and connectivity, technological advancements in lightweight and energy-efficient power systems.

- Regulatory Landscape: Varies by region, influencing certification and compliance.

- Substitute Products: Wi-Fi offers some substitution, but dedicated in-seat power remains crucial.

- End-User Profiles: Primarily airlines and aircraft manufacturers.

- M&A Activity: Moderate activity with average deal values of $XX Million.

Commercial Aircraft In-seat Power System Industry Industry Evolution

The commercial aircraft in-seat power system market has witnessed substantial growth, driven by several factors. Passenger demand for in-flight power for devices like laptops and tablets has propelled growth, resulting in a CAGR of XX% during the historical period (2019-2024). This trend is expected to continue, with a projected CAGR of XX% during the forecast period (2025-2033). Technological advancements, such as the adoption of USB-C power delivery and higher-wattage outputs, have significantly enhanced the passenger experience and influenced market growth. The increasing integration of in-seat power systems with in-flight entertainment (IFE) systems further contributes to the market's evolution. The shift towards more personalized in-flight experiences is another key driver. The adoption rate of in-seat power systems across different seating classes has increased, with premium classes having higher adoption rates compared to economy. The rise of low-cost carriers is also a major factor influencing market dynamics, as they adopt the technology at a slower pace than legacy airlines.

Leading Regions, Countries, or Segments in Commercial Aircraft In-seat Power System Industry

North America holds the dominant position in the commercial aircraft in-seat power system market, driven by a strong aircraft manufacturing base and high passenger demand for advanced in-flight amenities.

Key Drivers for North America's Dominance:

- High aircraft manufacturing activity.

- Strong passenger demand for advanced in-flight features.

- Significant investments in airport infrastructure.

- Favorable regulatory environment.

Seating Class Analysis: Business and First Class segments currently show higher adoption rates due to higher willingness to pay and airline focus on premium passenger experience. However, growing demand from economy and premium economy classes is expected to drive future growth.

Mode of Sales: The OEM segment holds a larger market share due to initial aircraft installations, while the aftermarket segment offers significant potential for growth with retrofitting initiatives.

Commercial Aircraft In-seat Power System Industry Product Innovations

Recent innovations include increased power output capacities (up to 100W via USB-C), integration with in-flight entertainment systems, and the development of lighter and more energy-efficient power solutions. These improvements cater to passengers' increasing reliance on electronic devices during flights and enhance the overall passenger experience. Unique selling propositions include faster charging capabilities, improved safety features, and customized power distribution systems.

Propelling Factors for Commercial Aircraft In-seat Power System Industry Growth

Technological advancements like higher power output and USB-C integration, alongside the rising demand for enhanced passenger experience, are driving growth. Economic factors such as increased air travel and disposable income further fuel market expansion. Favorable regulatory environments that support adoption in specific regions and economic incentives also contribute to growth. For instance, the agreement between Panasonic and United Airlines for the Astrova IFE system showcases the rising demand and technological advancements in the field.

Obstacles in the Commercial Aircraft In-seat Power System Industry Market

High initial investment costs for integrating in-seat power systems present a significant barrier. Supply chain disruptions caused by global events can impact the availability and cost of components. Intense competition amongst various power system providers necessitates innovation and cost-effectiveness for survival.

Future Opportunities in Commercial Aircraft In-seat Power System Industry

Expansion into emerging markets with growing air travel, development of more integrated and versatile power systems capable of supporting various devices, and the exploration of wireless charging technologies represent future opportunities. Increased focus on sustainability and energy efficiency will drive innovation in the field, offering a profitable avenue for companies.

Major Players in the Commercial Aircraft In-seat Power System Industry Ecosystem

- Astronics Corporation

- Imagik International Corp

- GVH Aerospace Ltd

- Burrana Pty Ltd

- Astrodyne TDI Corporation

- IFPL Group Limited

- Inflight Canada Inc

- Mid-Continent Instrument Co Inc

- KID-Systeme GmbH

Key Developments in Commercial Aircraft In-seat Power System Industry Industry

- June 2023: Panasonic Avionics Corporation partnered with United Airlines to integrate its Astrova IFE solution, offering 100W USB-C power, impacting market dynamics through increased adoption of high-power systems.

- June 2022: Astronics Corporation secured a contract with Southwest Airlines to provide EMPOWER in-seat power systems for 475 aircraft, signifying significant market penetration.

Strategic Commercial Aircraft In-seat Power System Industry Market Forecast

The market is poised for substantial growth, fueled by technological innovation, rising passenger demand for enhanced connectivity and power, and increasing aircraft deliveries. The integration of in-seat power systems with IFE systems will become increasingly prevalent, offering further growth opportunities. The market's trajectory indicates strong potential for continued expansion throughout the forecast period.

Commercial Aircraft In-seat Power System Industry Segmentation

-

1. Seating Class

- 1.1. Economy Class

- 1.2. Premium Economy Class

- 1.3. Business Class

- 1.4. First Class

-

2. Mode of Sales

- 2.1. OEM

- 2.2. Aftermarket

Commercial Aircraft In-seat Power System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Qatar

- 5.4. Rest of Middle East and Africa

Commercial Aircraft In-seat Power System Industry Regional Market Share

Geographic Coverage of Commercial Aircraft In-seat Power System Industry

Commercial Aircraft In-seat Power System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Economy Class Segment Will Showcase the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Aircraft In-seat Power System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Seating Class

- 5.1.1. Economy Class

- 5.1.2. Premium Economy Class

- 5.1.3. Business Class

- 5.1.4. First Class

- 5.2. Market Analysis, Insights and Forecast - by Mode of Sales

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Seating Class

- 6. North America Commercial Aircraft In-seat Power System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Seating Class

- 6.1.1. Economy Class

- 6.1.2. Premium Economy Class

- 6.1.3. Business Class

- 6.1.4. First Class

- 6.2. Market Analysis, Insights and Forecast - by Mode of Sales

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Seating Class

- 7. Europe Commercial Aircraft In-seat Power System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Seating Class

- 7.1.1. Economy Class

- 7.1.2. Premium Economy Class

- 7.1.3. Business Class

- 7.1.4. First Class

- 7.2. Market Analysis, Insights and Forecast - by Mode of Sales

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Seating Class

- 8. Asia Pacific Commercial Aircraft In-seat Power System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Seating Class

- 8.1.1. Economy Class

- 8.1.2. Premium Economy Class

- 8.1.3. Business Class

- 8.1.4. First Class

- 8.2. Market Analysis, Insights and Forecast - by Mode of Sales

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Seating Class

- 9. Latin America Commercial Aircraft In-seat Power System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Seating Class

- 9.1.1. Economy Class

- 9.1.2. Premium Economy Class

- 9.1.3. Business Class

- 9.1.4. First Class

- 9.2. Market Analysis, Insights and Forecast - by Mode of Sales

- 9.2.1. OEM

- 9.2.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Seating Class

- 10. Middle East and Africa Commercial Aircraft In-seat Power System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Seating Class

- 10.1.1. Economy Class

- 10.1.2. Premium Economy Class

- 10.1.3. Business Class

- 10.1.4. First Class

- 10.2. Market Analysis, Insights and Forecast - by Mode of Sales

- 10.2.1. OEM

- 10.2.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Seating Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Astronics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Imagik International Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GVH Aerospace Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burrana Pty Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Astrodyne TDI Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IFPL Group Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Inflight Canada Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mid-Continent Instrument Co Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KID-Systeme GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Astronics Corporation

List of Figures

- Figure 1: Global Commercial Aircraft In-seat Power System Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Aircraft In-seat Power System Industry Revenue (Million), by Seating Class 2025 & 2033

- Figure 3: North America Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Seating Class 2025 & 2033

- Figure 4: North America Commercial Aircraft In-seat Power System Industry Revenue (Million), by Mode of Sales 2025 & 2033

- Figure 5: North America Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Mode of Sales 2025 & 2033

- Figure 6: North America Commercial Aircraft In-seat Power System Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Aircraft In-seat Power System Industry Revenue (Million), by Seating Class 2025 & 2033

- Figure 9: Europe Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Seating Class 2025 & 2033

- Figure 10: Europe Commercial Aircraft In-seat Power System Industry Revenue (Million), by Mode of Sales 2025 & 2033

- Figure 11: Europe Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Mode of Sales 2025 & 2033

- Figure 12: Europe Commercial Aircraft In-seat Power System Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue (Million), by Seating Class 2025 & 2033

- Figure 15: Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Seating Class 2025 & 2033

- Figure 16: Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue (Million), by Mode of Sales 2025 & 2033

- Figure 17: Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Mode of Sales 2025 & 2033

- Figure 18: Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Aircraft In-seat Power System Industry Revenue (Million), by Seating Class 2025 & 2033

- Figure 21: Latin America Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Seating Class 2025 & 2033

- Figure 22: Latin America Commercial Aircraft In-seat Power System Industry Revenue (Million), by Mode of Sales 2025 & 2033

- Figure 23: Latin America Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Mode of Sales 2025 & 2033

- Figure 24: Latin America Commercial Aircraft In-seat Power System Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue (Million), by Seating Class 2025 & 2033

- Figure 27: Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Seating Class 2025 & 2033

- Figure 28: Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue (Million), by Mode of Sales 2025 & 2033

- Figure 29: Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Mode of Sales 2025 & 2033

- Figure 30: Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Seating Class 2020 & 2033

- Table 2: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Mode of Sales 2020 & 2033

- Table 3: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Seating Class 2020 & 2033

- Table 5: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Mode of Sales 2020 & 2033

- Table 6: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Seating Class 2020 & 2033

- Table 10: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Mode of Sales 2020 & 2033

- Table 11: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Germany Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Seating Class 2020 & 2033

- Table 17: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Mode of Sales 2020 & 2033

- Table 18: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Seating Class 2020 & 2033

- Table 25: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Mode of Sales 2020 & 2033

- Table 26: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Mexico Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Seating Class 2020 & 2033

- Table 31: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Mode of Sales 2020 & 2033

- Table 32: Global Commercial Aircraft In-seat Power System Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Qatar Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East and Africa Commercial Aircraft In-seat Power System Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Aircraft In-seat Power System Industry?

The projected CAGR is approximately 3.26%.

2. Which companies are prominent players in the Commercial Aircraft In-seat Power System Industry?

Key companies in the market include Astronics Corporation, Imagik International Corp, GVH Aerospace Ltd, Burrana Pty Ltd, Astrodyne TDI Corporation, IFPL Group Limited, Inflight Canada Inc, Mid-Continent Instrument Co Inc, KID-Systeme GmbH.

3. What are the main segments of the Commercial Aircraft In-seat Power System Industry?

The market segments include Seating Class, Mode of Sales.

4. Can you provide details about the market size?

The market size is estimated to be USD 149.04 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Economy Class Segment Will Showcase the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

June 2023: Panasonic Avionics Corporation signed an agreement with United Airlines (United) as its first customer in the Americas for its new Astrova in-flight engagement (IFE) solution. The airline plans to install Astrova on new Boeing 787 and Airbus A321XLR aircraft beginning in 2025. United's passengers will enjoy up to 100 W of DC power via USB-C at their seats which provides the ability to fast charge the latest phones and tablets, and laptops through all phases of the flight.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Aircraft In-seat Power System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Aircraft In-seat Power System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Aircraft In-seat Power System Industry?

To stay informed about further developments, trends, and reports in the Commercial Aircraft In-seat Power System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence