Key Insights

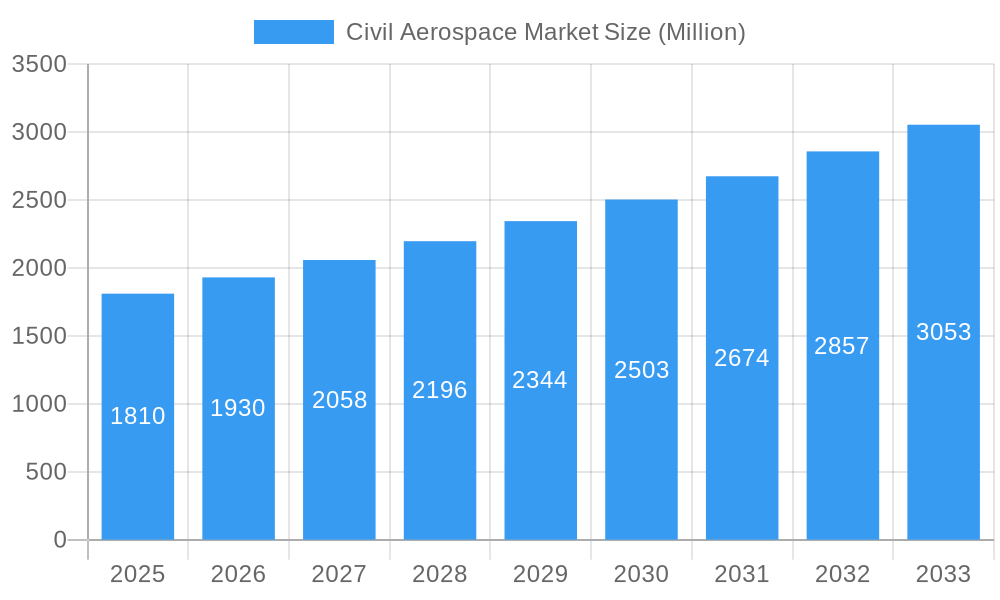

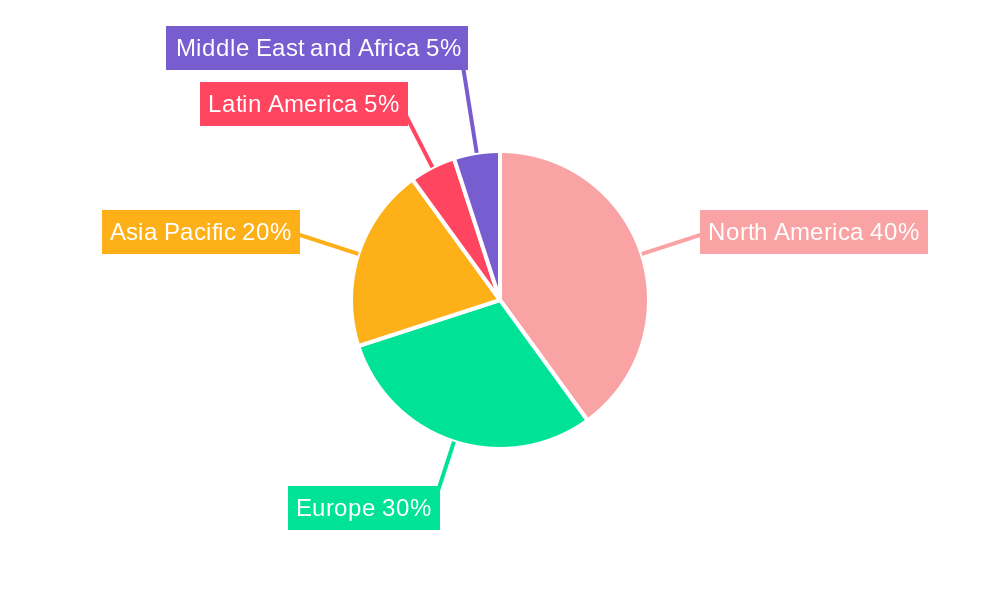

The global civil aerospace market, valued at $1.81 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.64% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for air travel globally, particularly in emerging economies in Asia-Pacific and the Middle East, is a significant driver. Secondly, technological advancements in flight simulation and training devices, including the development of more sophisticated Full Flight Simulators (FFS) and Flight Training Devices (FTDs), are enhancing pilot training efficiency and safety, thus stimulating market growth. Furthermore, the rising adoption of advanced aircraft technologies necessitates improved training infrastructure, further bolstering market demand. The commercial aviation segment currently dominates the market, reflecting the substantial training needs of the airline industry. However, the space exploration segment is expected to witness significant growth in the coming years, propelled by increasing private sector investment and government initiatives.

Civil Aerospace Market Market Size (In Billion)

While the market outlook remains positive, certain restraints could impact growth. These include the high initial investment costs associated with purchasing and maintaining sophisticated simulation equipment, particularly FFS systems. Furthermore, regulatory hurdles and standardization challenges related to flight simulation technologies can create obstacles for market penetration. Nevertheless, the long-term growth trajectory remains promising, driven by factors like ongoing technological innovation, increasing airline operations, and a growing demand for skilled pilots. The market is characterized by several key players, including L3Harris Technologies Inc, Raytheon Technologies Corporation, Lockheed Martin Corporation, and CAE Inc., among others, engaged in continuous product development and market expansion strategies across different geographical regions. North America and Europe are currently the largest markets, yet Asia-Pacific is expected to demonstrate significant growth potential, considering the rapid expansion of its aviation industry.

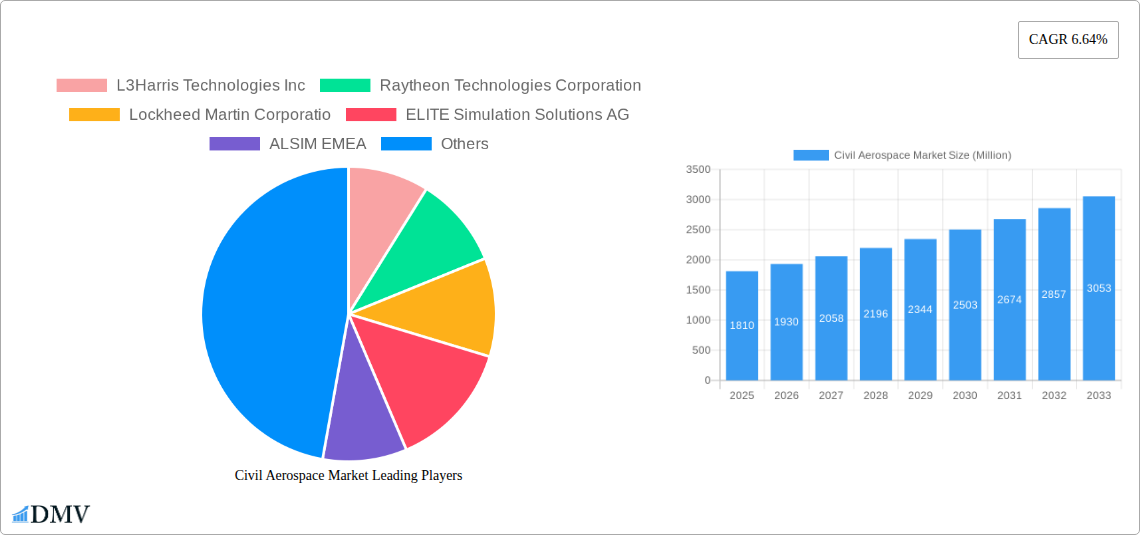

Civil Aerospace Market Company Market Share

Civil Aerospace Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Civil Aerospace Market, encompassing market size, segmentation, leading players, technological advancements, and future growth projections from 2019 to 2033. The study includes a comprehensive assessment of market dynamics, highlighting key trends, challenges, and opportunities for stakeholders across various segments, including Full Flight Simulators (FFS), Flight Training Devices (FTD), and other training devices, within both commercial aviation and space applications. With a base year of 2025 and an estimated year of 2025, this report offers a crucial roadmap for businesses navigating this dynamic sector. The forecast period spans 2025-2033, building upon historical data from 2019-2024. The market is expected to reach xx Million by 2033.

Civil Aerospace Market Market Composition & Trends

The Civil Aerospace Market exhibits a moderately concentrated landscape, with key players like L3Harris Technologies Inc, Raytheon Technologies Corporation, Lockheed Martin Corporation, and CAE Inc. holding significant market share. The exact distribution is dynamic and subject to ongoing M&A activity, with total M&A deal values exceeding xx Million in the past five years. Innovation is driven by the need for enhanced realism in simulators, improved training efficiency, and compliance with evolving safety regulations. The regulatory landscape, particularly concerning simulator certification and training standards, significantly influences market growth. Substitute products, such as augmented reality (AR) and virtual reality (VR) training tools, are emerging but currently represent a small segment of the overall market. End-users include airlines, flight schools, military training academies, and space agencies.

- Market Share Distribution (2024 Estimate):

- L3Harris Technologies Inc: xx%

- Raytheon Technologies Corporation: xx%

- Lockheed Martin Corporation: xx%

- CAE Inc: xx%

- Others: xx%

- M&A Activity (2019-2024): xx deals totaling over xx Million.

- Key Regulatory Bodies: [List key regulatory bodies and their impact]

Civil Aerospace Market Industry Evolution

The Civil Aerospace Market has witnessed robust growth over the historical period (2019-2024), driven by factors like rising air passenger traffic, increased demand for pilot training, and technological advancements in simulation technology. The Compound Annual Growth Rate (CAGR) for the period was approximately xx%. This growth is projected to continue, although at a slightly moderated pace, during the forecast period (2025-2033), with a projected CAGR of xx%. Technological advancements, including the integration of AI, improved haptic feedback systems, and more realistic visual environments, are enhancing the effectiveness and appeal of flight simulators. Furthermore, consumer demand is shifting toward more sophisticated and immersive training solutions, driving the adoption of higher-fidelity simulators and training devices. Specific data points, such as adoption rates of FFS and FTDs across different regions, are included in the detailed report.

Leading Regions, Countries, or Segments in Civil Aerospace Market

North America currently dominates the Civil Aerospace Market, driven by factors such as a large commercial aviation sector, robust investment in pilot training infrastructure, and the presence of key simulator manufacturers. Europe and Asia-Pacific also represent significant markets. Among simulator types, Full Flight Simulators (FFS) command the largest market share, owing to their high fidelity and comprehensive training capabilities. Within application segments, commercial aviation represents the dominant area, though the space segment is exhibiting promising growth, particularly in astronaut training programs.

- Key Drivers of North American Dominance:

- High concentration of major simulator manufacturers.

- Significant investment in pilot training by airlines.

- Stringent aviation safety regulations.

- Factors driving FFS segment leadership:

- High fidelity and comprehensive training capabilities.

- Required for pilot certification in many jurisdictions.

- Growth potential within Space Application:

- Increased space exploration activities.

- Demand for specialized astronaut training simulations.

Civil Aerospace Market Product Innovations

Recent innovations focus on enhancing the realism and effectiveness of simulators. This includes advancements in visual systems, improved haptic feedback mechanisms, and the incorporation of AI-driven adaptive training scenarios. New products are being introduced with more flexible configurations to meet the diverse needs of various training facilities. These innovations offer improved training outcomes, reduced training costs, and increased efficiency. Unique selling propositions include features like advanced atmospheric modelling, customizable training scenarios, and seamless integration with other training platforms.

Propelling Factors for Civil Aerospace Market Growth

The Civil Aerospace Market is propelled by several key factors: Firstly, the sustained growth of the global air travel industry fuels the demand for pilot training. Secondly, technological advancements in simulation technology continue to improve the accuracy and effectiveness of training, leading to wider adoption. Finally, stringent safety regulations mandate high-quality training programs, further stimulating market expansion.

Obstacles in the Civil Aerospace Market Market

Key obstacles include the high cost of acquiring and maintaining sophisticated simulators. Supply chain disruptions can impact the availability of critical components, leading to project delays. Furthermore, intense competition among major players and emerging entrants can put downward pressure on prices.

Future Opportunities in Civil Aerospace Market

Future opportunities lie in the expansion of simulation technology into new sectors, such as drone training and unmanned aerial vehicle (UAV) operations. Integration of advanced technologies like VR/AR and AI offers further avenues for growth. The increasing demand for customized training solutions and the development of more sustainable and energy-efficient simulator technologies will also drive future market expansion.

Major Players in the Civil Aerospace Market Ecosystem

- L3Harris Technologies Inc

- Raytheon Technologies Corporation

- Lockheed Martin Corporation

- ELITE Simulation Solutions AG

- ALSIM EMEA

- CAE Inc

- Multi Pilot Simulations BV

- Indra Sistemas S A

- FlightSafety International Inc

- The Boeing Company

Key Developments in Civil Aerospace Market Industry

- 2024 Q3: CAE Inc. announces a new generation of FFS with advanced visual systems.

- 2023 Q4: L3Harris Technologies Inc. acquires a smaller simulation company, expanding its product portfolio.

- 2022 Q2: Raytheon Technologies Corporation unveils a new FTD designed for regional aircraft training.

- [Add more relevant developments with dates]

Strategic Civil Aerospace Market Market Forecast

The Civil Aerospace Market is poised for continued growth over the forecast period. Technological advancements, regulatory pressures, and the ongoing expansion of the air travel industry will drive demand for sophisticated training solutions. Emerging technologies, like AI and VR/AR, present significant opportunities for innovation and market expansion, ensuring a robust and dynamic market outlook for the next decade.

Civil Aerospace Market Segmentation

-

1. Simulator Type

- 1.1. Full Flight Simulator (FFS)

- 1.2. Flight Training Devices (FTD)

- 1.3. Other Training Devices

-

2. Application

- 2.1. Commercial Aviation

- 2.2. Space

Civil Aerospace Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Turkey

- 5.4. Rest of Middle East and Africa

Civil Aerospace Market Regional Market Share

Geographic Coverage of Civil Aerospace Market

Civil Aerospace Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Full Flight Simulator (FFS) Segment Expected to Account for the Highest Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Civil Aerospace Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 5.1.1. Full Flight Simulator (FFS)

- 5.1.2. Flight Training Devices (FTD)

- 5.1.3. Other Training Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial Aviation

- 5.2.2. Space

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6. North America Civil Aerospace Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Simulator Type

- 6.1.1. Full Flight Simulator (FFS)

- 6.1.2. Flight Training Devices (FTD)

- 6.1.3. Other Training Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Commercial Aviation

- 6.2.2. Space

- 6.1. Market Analysis, Insights and Forecast - by Simulator Type

- 7. Europe Civil Aerospace Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Simulator Type

- 7.1.1. Full Flight Simulator (FFS)

- 7.1.2. Flight Training Devices (FTD)

- 7.1.3. Other Training Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Commercial Aviation

- 7.2.2. Space

- 7.1. Market Analysis, Insights and Forecast - by Simulator Type

- 8. Asia Pacific Civil Aerospace Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Simulator Type

- 8.1.1. Full Flight Simulator (FFS)

- 8.1.2. Flight Training Devices (FTD)

- 8.1.3. Other Training Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Commercial Aviation

- 8.2.2. Space

- 8.1. Market Analysis, Insights and Forecast - by Simulator Type

- 9. Latin America Civil Aerospace Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Simulator Type

- 9.1.1. Full Flight Simulator (FFS)

- 9.1.2. Flight Training Devices (FTD)

- 9.1.3. Other Training Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Commercial Aviation

- 9.2.2. Space

- 9.1. Market Analysis, Insights and Forecast - by Simulator Type

- 10. Middle East and Africa Civil Aerospace Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Simulator Type

- 10.1.1. Full Flight Simulator (FFS)

- 10.1.2. Flight Training Devices (FTD)

- 10.1.3. Other Training Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Commercial Aviation

- 10.2.2. Space

- 10.1. Market Analysis, Insights and Forecast - by Simulator Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Raytheon Technologies Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lockheed Martin Corporatio

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ELITE Simulation Solutions AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ALSIM EMEA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CAE Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Multi Pilot Simulations BV

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Indra Sistemas S A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 FlightSafety International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Boeing Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Civil Aerospace Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Civil Aerospace Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 3: North America Civil Aerospace Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 4: North America Civil Aerospace Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Civil Aerospace Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Civil Aerospace Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Civil Aerospace Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Civil Aerospace Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 9: Europe Civil Aerospace Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 10: Europe Civil Aerospace Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Civil Aerospace Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Civil Aerospace Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Civil Aerospace Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Civil Aerospace Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 15: Asia Pacific Civil Aerospace Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 16: Asia Pacific Civil Aerospace Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Civil Aerospace Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Civil Aerospace Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Civil Aerospace Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Civil Aerospace Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 21: Latin America Civil Aerospace Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 22: Latin America Civil Aerospace Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Latin America Civil Aerospace Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Latin America Civil Aerospace Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Civil Aerospace Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Civil Aerospace Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 27: Middle East and Africa Civil Aerospace Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 28: Middle East and Africa Civil Aerospace Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East and Africa Civil Aerospace Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Civil Aerospace Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Civil Aerospace Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Civil Aerospace Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 2: Global Civil Aerospace Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Civil Aerospace Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Civil Aerospace Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 5: Global Civil Aerospace Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Civil Aerospace Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Civil Aerospace Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 10: Global Civil Aerospace Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Civil Aerospace Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Civil Aerospace Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 17: Global Civil Aerospace Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Civil Aerospace Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Civil Aerospace Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 25: Global Civil Aerospace Market Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Civil Aerospace Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Civil Aerospace Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 30: Global Civil Aerospace Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Civil Aerospace Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Turkey Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Middle East and Africa Civil Aerospace Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Civil Aerospace Market?

The projected CAGR is approximately 6.64%.

2. Which companies are prominent players in the Civil Aerospace Market?

Key companies in the market include L3Harris Technologies Inc, Raytheon Technologies Corporation, Lockheed Martin Corporatio, ELITE Simulation Solutions AG, ALSIM EMEA, CAE Inc, Multi Pilot Simulations BV, Indra Sistemas S A, FlightSafety International Inc, The Boeing Company.

3. What are the main segments of the Civil Aerospace Market?

The market segments include Simulator Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Full Flight Simulator (FFS) Segment Expected to Account for the Highest Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Civil Aerospace Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Civil Aerospace Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Civil Aerospace Market?

To stay informed about further developments, trends, and reports in the Civil Aerospace Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence