Key Insights

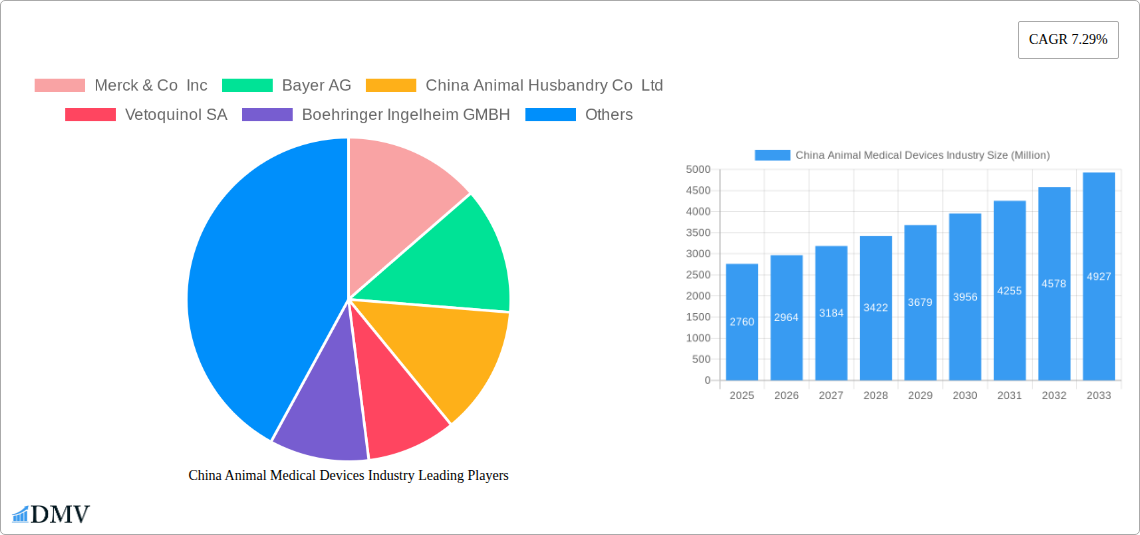

The China animal medical devices market is experiencing robust growth, projected to reach a substantial size driven by several key factors. The market's Compound Annual Growth Rate (CAGR) of 7.29% from 2019 to 2024 indicates a consistently expanding market. This growth is fueled by increasing pet ownership, rising pet healthcare expenditure, and a growing awareness of animal health among Chinese consumers. Furthermore, government initiatives promoting the development of the veterinary sector and advancements in diagnostic and therapeutic technologies are contributing to this upward trajectory. The market is segmented by product type (therapeutics, diagnostics, other) and animal type (dogs and cats, horses, ruminants, swine, poultry, other animals). The dominance of dogs and cats in the pet ownership segment is a significant driver for the therapeutics and diagnostics sub-markets. The increasing demand for advanced veterinary care, particularly in urban areas, presents lucrative opportunities for both domestic and international players. Large corporations like Merck & Co Inc, Bayer AG, and Zoetis Inc, alongside prominent Chinese companies like China Animal Husbandry Co Ltd, are key players shaping the market's competitive landscape. This competition fosters innovation and drives the development of more sophisticated and effective animal medical devices, furthering market expansion.

China Animal Medical Devices Industry Market Size (In Billion)

The forecast period of 2025-2033 anticipates continued growth, though the CAGR may slightly fluctuate based on economic conditions and evolving veterinary practices. The expanding middle class in China continues to increase disposable income, allowing for greater investment in pet healthcare. This, in combination with the growing professionalization of veterinary services and ongoing research and development in animal health technology, will likely contribute to sustained market expansion. However, potential restraints include regulatory hurdles, competition among existing players, and the potential for price sensitivity in certain market segments. Addressing these challenges effectively will be key for companies to capitalize on the significant opportunities within the expanding China animal medical devices market.

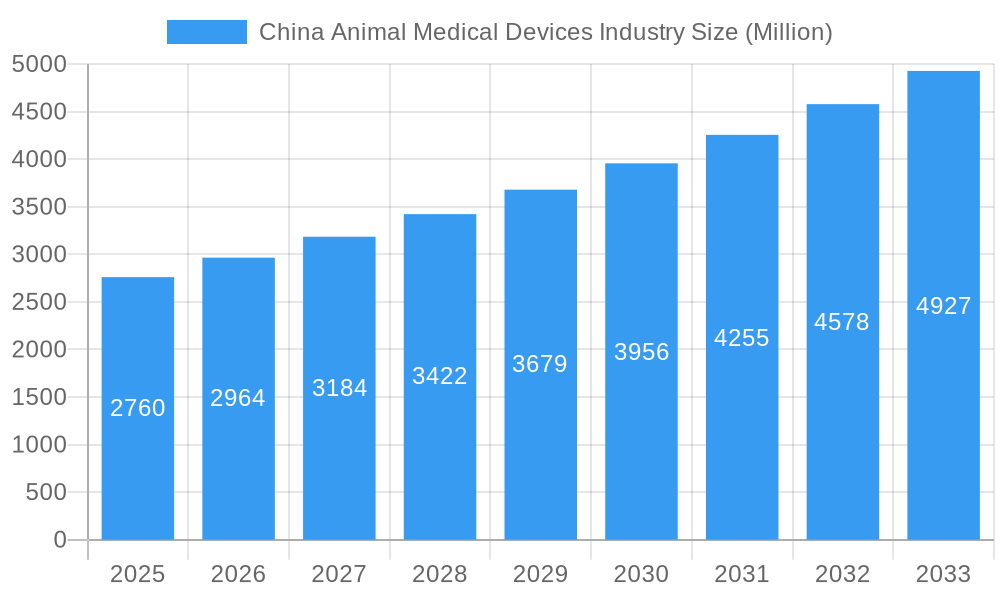

China Animal Medical Devices Industry Company Market Share

China Animal Medical Devices Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning China animal medical devices industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. With a comprehensive study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report delivers a robust understanding of past performance, current trends, and future projections. The market value is projected to reach xx Million by 2033, demonstrating significant growth potential.

China Animal Medical Devices Industry Market Composition & Trends

This section delves into the intricate structure of the China animal medical devices market, examining key aspects influencing its evolution. We analyze market concentration, identifying major players and their respective market shares. Innovation drivers, regulatory landscapes, and the impact of substitute products are thoroughly investigated. Further, end-user profiles are characterized, offering a granular understanding of market demand across various animal types. Finally, a comprehensive analysis of M&A activities, including deal values and their implications for market dynamics, is presented.

- Market Share Distribution: Analysis of market share held by leading companies like Merck & Co Inc, Bayer AG, and Zoetis Inc. The top 5 players are estimated to hold xx% of the market in 2025.

- M&A Activity: Detailed overview of mergers and acquisitions, including deal values exceeding xx Million in the period of 2019-2024. The average deal value is estimated at xx Million.

- Regulatory Landscape: Examination of Chinese regulations impacting the animal medical device sector and their influence on market access and product development.

- Innovation Catalysts: Identification of key technological advancements and their impact on market growth, specifically focusing on areas like diagnostics and therapeutics.

China Animal Medical Devices Industry Industry Evolution

This section provides a comprehensive overview of the evolutionary trajectory of the China animal medical devices market from 2019 to 2033. We analyze the historical growth rates, technological advancements, and shifting consumer demands that have shaped the industry. The report further projects future growth trajectories, factoring in emerging technologies and changing market dynamics. We will also evaluate the impact of increasing pet ownership and rising awareness of animal health on market growth. Specific data points, including year-over-year growth rates and adoption metrics for specific technologies, will be provided. The CAGR for the period 2025-2033 is estimated at xx%.

Leading Regions, Countries, or Segments in China Animal Medical Devices Industry

This section identifies the dominant regions, countries, and segments within the China animal medical devices market. We analyze the leading segments across product categories (Therapeutics, Diagnostics, Other Therapeutics) and animal types (Dogs and Cats, Horses, Ruminants, Swine, Poultry, Other Animals). The factors driving the dominance of specific segments will be thoroughly discussed.

- Key Drivers:

- Investment Trends: Analysis of investment patterns in different segments, pinpointing areas receiving significant funding.

- Regulatory Support: Examination of government policies and initiatives that favour specific segments.

- Dominance Factors: In-depth analysis explaining the reasons behind the leadership position of specific segments. For example, the high growth in the pet care market is expected to significantly boost the demand for medical devices for dogs and cats.

China Animal Medical Devices Industry Product Innovations

This section showcases recent product innovations within the Chinese animal medical device market, focusing on advanced diagnostics, novel therapeutics, and cutting-edge technologies enhancing treatment efficacy. The discussion will highlight unique selling propositions, technological advancements driving improved performance metrics, and applications of these new products in various animal types.

Propelling Factors for China Animal Medical Devices Industry Growth

Several factors contribute to the remarkable growth of the China animal medical devices industry. Technological advancements, particularly in diagnostics and therapeutics, are driving improved animal health outcomes. Economic expansion and rising disposable incomes are fueling increased spending on pet care, while supportive government regulations are fostering innovation and market entry. The increasing awareness of animal welfare is also a key factor.

Obstacles in the China Animal Medical Devices Industry Market

Despite its potential, the China animal medical devices market faces certain challenges. Stringent regulatory requirements and navigating complex approval processes can hinder market entry. Supply chain disruptions, particularly in the context of global events, pose a significant threat. Additionally, intense competition among established and emerging players necessitates strategic differentiation.

Future Opportunities in China Animal Medical Devices Industry

The future of the China animal medical devices industry holds significant promise. Untapped markets in rural areas offer considerable potential for expansion. The adoption of advanced technologies, such as telemedicine and AI-powered diagnostics, presents substantial opportunities for growth. Furthermore, the increasing prevalence of companion animals fuels demand for advanced veterinary care and sophisticated medical devices.

Major Players in the China Animal Medical Devices Industry Ecosystem

- Merck & Co Inc

- Bayer AG

- China Animal Husbandry Co Ltd

- Vetoquinol SA

- Boehringer Ingelheim GMBH

- Virbac Corporation

- BioChek BV

- Ceva Sante Animale

- Elanco Animal Health Incorporated

- Zoetis Inc

Key Developments in China Animal Medical Devices Industry Industry

- September 2020: Boehringer Ingelheim acquired an equity stake in New Ruipeng Group (NRP Group), expanding its reach in the Chinese animal health market.

- May 2021: Boehringer Ingelheim launched GastroGard (omeprazole oral paste) in China, marking the first imported equine drug approved in the country.

Strategic China Animal Medical Devices Industry Market Forecast

The China animal medical devices market is poised for robust growth, driven by rising pet ownership, increasing veterinary care spending, and technological advancements. Future opportunities lie in developing innovative products tailored to the specific needs of the Chinese market and capitalizing on the growing demand for advanced diagnostic and therapeutic solutions. The market's future potential is substantial, with projections indicating significant expansion over the forecast period.

China Animal Medical Devices Industry Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

China Animal Medical Devices Industry Segmentation By Geography

- 1. China

China Animal Medical Devices Industry Regional Market Share

Geographic Coverage of China Animal Medical Devices Industry

China Animal Medical Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Pet Adoption; Advanced Technology in Animal Healthcare; Rise in the number of Initiatives by Governments and Animal Welfare Associations

- 3.3. Market Restrains

- 3.3.1. Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Care

- 3.4. Market Trends

- 3.4.1. The Dogs and Cats Segment Dominates the China Veterinary Healthcare Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Animal Medical Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Merck & Co Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Animal Husbandry Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vetoquinol SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Boehringer Ingelheim GMBH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Virbac Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BioChek BV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ceva Sante Animale

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Elanco Animal Health Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zoetis Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Merck & Co Inc

List of Figures

- Figure 1: China Animal Medical Devices Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Animal Medical Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: China Animal Medical Devices Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: China Animal Medical Devices Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: China Animal Medical Devices Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: China Animal Medical Devices Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 5: China Animal Medical Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Animal Medical Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: China Animal Medical Devices Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 8: China Animal Medical Devices Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: China Animal Medical Devices Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 10: China Animal Medical Devices Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 11: China Animal Medical Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Animal Medical Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Animal Medical Devices Industry?

The projected CAGR is approximately 7.29%.

2. Which companies are prominent players in the China Animal Medical Devices Industry?

Key companies in the market include Merck & Co Inc, Bayer AG, China Animal Husbandry Co Ltd, Vetoquinol SA, Boehringer Ingelheim GMBH, Virbac Corporation, BioChek BV, Ceva Sante Animale, Elanco Animal Health Incorporated, Zoetis Inc.

3. What are the main segments of the China Animal Medical Devices Industry?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Pet Adoption; Advanced Technology in Animal Healthcare; Rise in the number of Initiatives by Governments and Animal Welfare Associations.

6. What are the notable trends driving market growth?

The Dogs and Cats Segment Dominates the China Veterinary Healthcare Market.

7. Are there any restraints impacting market growth?

Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Care.

8. Can you provide examples of recent developments in the market?

In May 2021, Boehringer Ingelheim has launched GastroGard(omeprazole oral paste) in the Chinese market, has been granted by the Registration Certificate of Imported Veterinary Drug by the Ministry of Agriculture and Rural Affairs of China, making it the first equine drug approved to be imported into the China market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Animal Medical Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Animal Medical Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Animal Medical Devices Industry?

To stay informed about further developments, trends, and reports in the China Animal Medical Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence