Key Insights

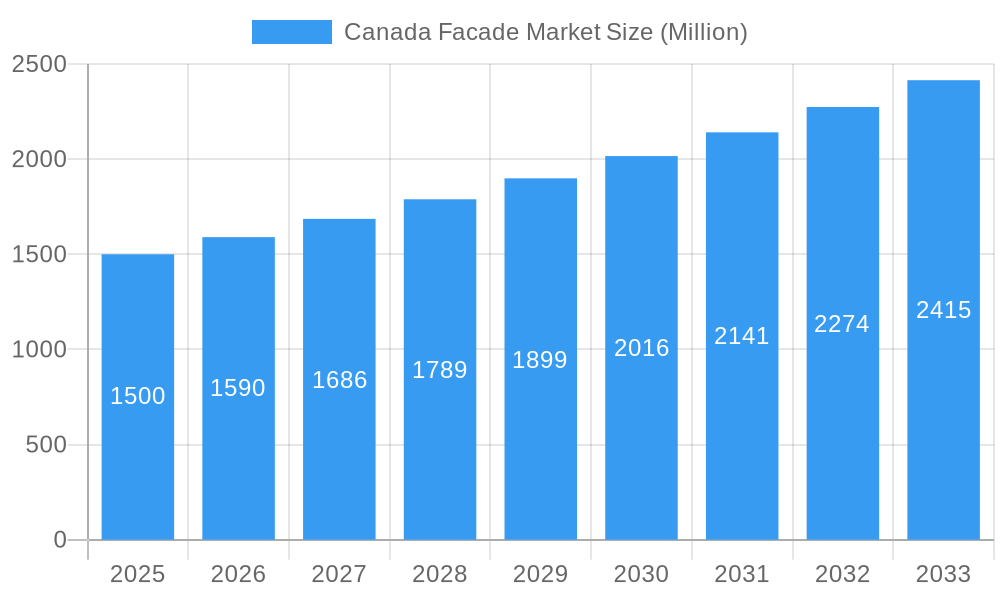

The Canadian façade market is projected to reach $349.83 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.7% from 2025 to 2033. This growth is primarily driven by heightened construction activity in residential and commercial sectors, particularly in urban hubs like Toronto and Vancouver. Government mandates promoting energy-efficient and sustainable building practices are accelerating the adoption of advanced façade materials, including insulated panels and high-performance glazing, further influenced by the growing preference for green building certifications like LEED. Technological advancements in façade design and manufacturing are also contributing to innovative solutions offering enhanced durability, aesthetics, and energy efficiency, collectively fostering a positive market outlook.

Canada Facade Market Market Size (In Billion)

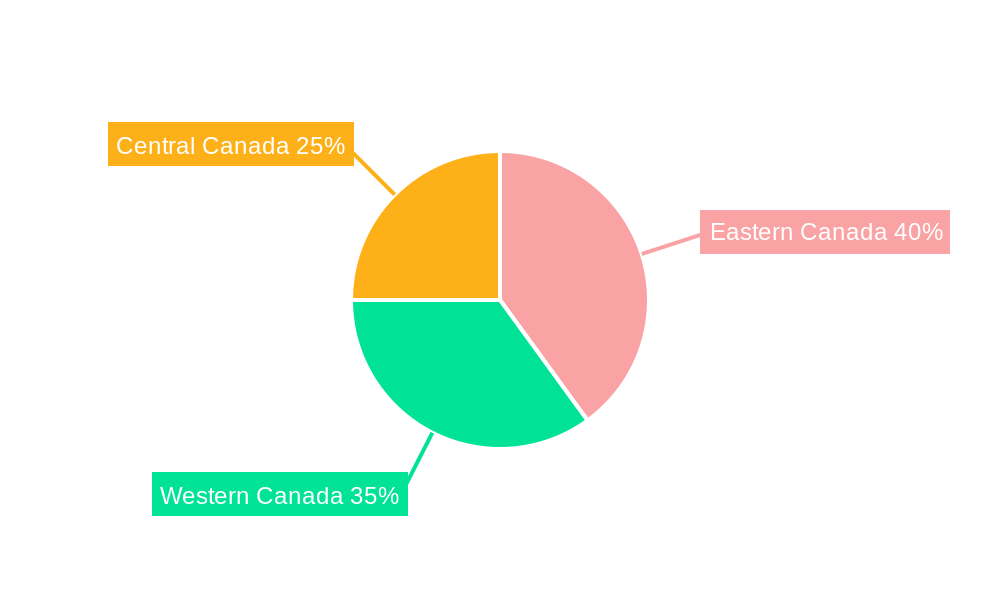

Despite robust growth prospects, the market faces potential restraints from escalating material costs, especially for metals and imported goods, alongside supply chain volatility and labor shortages impacting project execution. However, the inherent strength of Canada's construction industry, significant infrastructure investments, and a strong focus on sustainable development are expected to counterbalance these challenges, ensuring sustained market expansion. Ventilated façades demonstrate significant demand due to their excellent thermal performance and design adaptability. Glass and metal remain the leading material segments, valued for their inherent durability and design versatility. The market is also observing increased integration of sustainable materials such as plastics and fibers, driven by environmental consciousness. Leading companies including Reynaers, Trimo, Schuco, and Saint-Gobain are instrumental in shaping market dynamics through innovation and strategic growth. Construction activity and population density contribute to Eastern and Western Canada holding substantial market share.

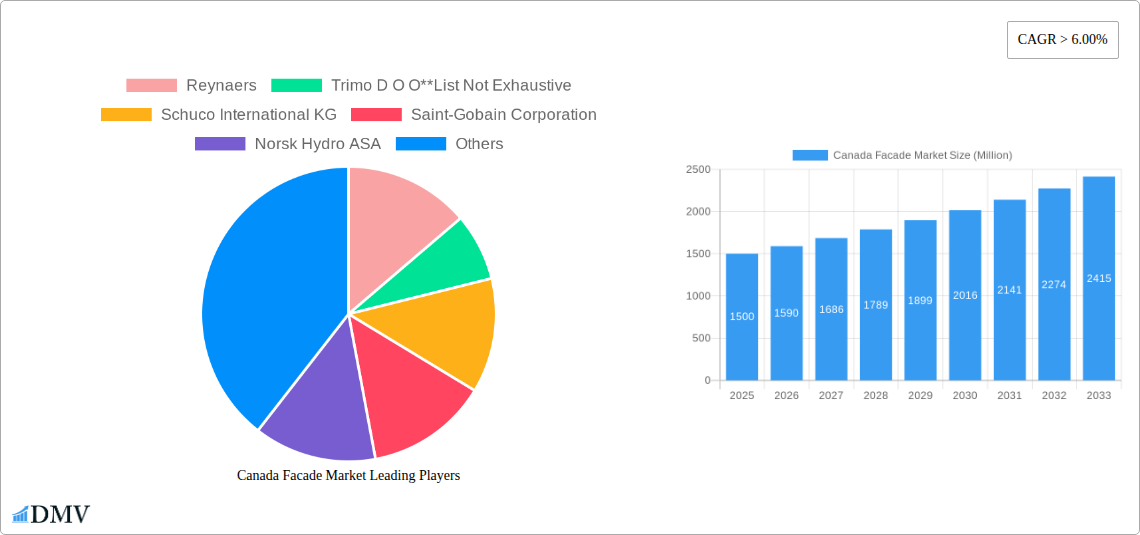

Canada Facade Market Company Market Share

Canada Facade Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canada facade market, offering invaluable insights for stakeholders across the value chain. From market sizing and segmentation to key player analysis and future projections, this report is your essential guide to navigating this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Canada Facade Market Composition & Trends

The Canadian facade market exhibits a moderately concentrated landscape, with key players like Reynaers, Trimo D O O, Schuco International KG, Saint-Gobain Corporation, Norsk Hydro ASA, Kawneer Company Inc, YKK AP Inc, Rockwool Rockpanel B V, Wienerberger, and Skanska AB holding significant market share. Market share distribution is currently estimated at xx% for the top 5 players, with the remaining share distributed among numerous smaller players. Innovation is driven by advancements in materials science, energy efficiency regulations, and aesthetic demands. The regulatory landscape, including building codes and energy efficiency standards, significantly influences material choices and design specifications. Substitute products such as traditional brickwork and stucco continue to compete, but their market share is gradually declining due to the superior performance and aesthetic appeal of modern facades. End-user profiles range from commercial buildings (offices, retail spaces) to residential developments and specialized sectors (hospitals, educational institutions).

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Innovation Catalysts: Advancements in materials, energy efficiency regulations, and aesthetic trends.

- Regulatory Landscape: Building codes and energy standards drive material and design choices.

- Substitute Products: Traditional brickwork and stucco face competition from modern facade systems.

- End-User Profiles: Commercial, residential, and specialized sectors.

- M&A Activities: Recent activity includes Saint-Gobain's acquisition of Kaycan (May 2022), influencing market dynamics with a deal value of xx Million.

Canada Facade Market Industry Evolution

The Canadian facade market has witnessed steady growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors, including increasing construction activity, rising demand for energy-efficient buildings, and a growing preference for aesthetically appealing facade designs. Technological advancements, such as the development of Building Integrated Photovoltaics (BIPV), are transforming the industry. The adoption of BIPV is expected to increase significantly in the forecast period, with an estimated xx% adoption rate by 2033. Shifting consumer demands, including a greater emphasis on sustainability and eco-friendly building materials, are also influencing market trends. The market is expected to continue its growth trajectory, driven by continued investment in infrastructure projects, government initiatives promoting sustainable building practices, and rising disposable incomes. Furthermore, the increasing adoption of smart building technologies that integrate facade systems with building management systems is driving innovation and market expansion.

Leading Regions, Countries, or Segments in Canada Facade Market

The Commercial segment dominates the Canadian facade market, accounting for xx% of the total market value in 2025. This dominance is driven by large-scale construction projects, particularly in major urban centers like Toronto, Vancouver, and Montreal. The Ventilated facade type holds a significant market share due to its superior thermal performance and aesthetic flexibility. Within materials, Glass and Metal are the leading segments, owing to their durability, aesthetic appeal, and suitability for various architectural designs.

- Key Drivers for Commercial Segment Dominance:

- High construction activity in major urban centers.

- Demand for modern and energy-efficient buildings in commercial spaces.

- Increased investment in infrastructure projects.

- Key Drivers for Ventilated Facade Dominance:

- Superior thermal performance leading to energy savings.

- Design flexibility and aesthetic appeal.

- Growing awareness of energy efficiency benefits.

- Key Drivers for Glass and Metal Material Dominance:

- Durability and longevity.

- Aesthetic appeal and design versatility.

- Suitability for various architectural styles.

Canada Facade Market Product Innovations

Recent innovations include advancements in BIPV technology, offering integrated solar solutions that contribute to energy generation and reduced carbon footprint. Self-cleaning glass coatings and high-performance insulation materials are improving facade efficiency and reducing maintenance costs. The focus is on sustainable, energy-efficient, and aesthetically pleasing designs, meeting the growing demand for green building solutions. Manufacturers are also incorporating smart features, such as integrated sensors for monitoring building performance and optimizing energy consumption.

Propelling Factors for Canada Facade Market Growth

Several factors propel the growth of the Canadian facade market. Firstly, rising construction activity, particularly in urban areas, fuels demand. Secondly, increasing government incentives for energy-efficient buildings stimulate the adoption of high-performance facade systems. Thirdly, growing awareness of sustainability and environmental concerns drives the demand for eco-friendly materials and designs. Lastly, technological advancements lead to innovative facade solutions, boosting market attractiveness.

Obstacles in the Canada Facade Market

Supply chain disruptions caused by global events can lead to material shortages and price increases, impacting project timelines and budgets. Regulatory complexities and stringent building codes can increase project costs and lead to delays. Intense competition among established players and emerging entrants can put pressure on pricing and profit margins. Furthermore, fluctuations in raw material prices can affect the overall cost of facade systems.

Future Opportunities in Canada Facade Market

Emerging opportunities include growth in the residential sector, driven by rising disposable incomes and increasing demand for aesthetically pleasing homes. The increasing adoption of smart building technologies presents significant opportunities for innovation in facade systems. The growing focus on sustainability creates demand for eco-friendly materials and designs.

Major Players in the Canada Facade Market Ecosystem

- Reynaers

- Trimo D O O

- Schuco International KG

- Saint-Gobain Corporation

- Norsk Hydro ASA

- Kawneer Company Inc

- YKK AP Inc

- Rockwool Rockpanel B V

- Wienerberger

- Skanska AB

Key Developments in Canada Facade Market Industry

- August 2022: Saint-Gobain's acquisition of Kaycan, a significant player in exterior building materials, expands its market presence and product portfolio.

- April 2022: Mitrex's BIPV project at St. Mary's University showcases the growing adoption of sustainable and energy-efficient facade technologies in Canada. This is a significant step towards integrating renewable energy solutions into building design.

Strategic Canada Facade Market Forecast

The Canadian facade market is poised for robust growth over the forecast period (2025-2033). Continued construction activity, government support for sustainable building practices, and technological advancements will drive market expansion. The increasing focus on energy efficiency and sustainable building materials presents significant opportunities for market players to capitalize on. The rising demand for aesthetically pleasing and innovative facade solutions will further fuel market growth.

Canada Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Others

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastics and Fibres

- 2.4. Stones

- 2.5. Others

-

3. End User

- 3.1. Commercial

- 3.2. Residential

- 3.3. Others

Canada Facade Market Segmentation By Geography

- 1. Canada

Canada Facade Market Regional Market Share

Geographic Coverage of Canada Facade Market

Canada Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance

- 3.3. Market Restrains

- 3.3.1. 4.; Rising cost of construction materials.

- 3.4. Market Trends

- 3.4.1. Increasing Technological Development in Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Facade Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastics and Fibres

- 5.2.4. Stones

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Reynaers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Trimo D O O**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schuco International KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saint-Gobain Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Norsk Hydro ASA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kawneer Company Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 YKK AP Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rockwool Rockpanel B V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wienerberger

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Skanska AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Reynaers

List of Figures

- Figure 1: Canada Facade Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Facade Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Canada Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Canada Facade Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Canada Facade Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Facade Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Canada Facade Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Canada Facade Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Canada Facade Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Facade Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Canada Facade Market?

Key companies in the market include Reynaers, Trimo D O O**List Not Exhaustive, Schuco International KG, Saint-Gobain Corporation, Norsk Hydro ASA, Kawneer Company Inc, YKK AP Inc, Rockwool Rockpanel B V, Wienerberger, Skanska AB.

3. What are the main segments of the Canada Facade Market?

The market segments include Type, Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 349.83 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing manufacturing sites4.; The increasing middle-income group and access to mortgage finance.

6. What are the notable trends driving market growth?

Increasing Technological Development in Construction Industry.

7. Are there any restraints impacting market growth?

4.; Rising cost of construction materials..

8. Can you provide examples of recent developments in the market?

August 2022: The purchase of Kaycan, a producer and retailer of exterior construction materials in Canada and the US, by Saint-Gobain was finalized on May 31, 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Facade Market?

To stay informed about further developments, trends, and reports in the Canada Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence