Key Insights

The global Business Aviation Maintenance, Repair, and Overhaul (MRO) market is projected for robust expansion, driven by the increasing operational fleet size of business jets and the critical need for regular maintenance to ensure safety and optimize performance. With a projected compound annual growth rate (CAGR) of 4.75%, the market is set to reach a size of 90.85 billion by 2033. Key growth catalysts include the aging global business jet fleet, requiring more comprehensive MRO services, and escalating demand for technological upgrades and modifications to enhance efficiency and sustainability. The market is segmented by MRO type, with engine MRO anticipated to command the largest share due to its complexity and cost. Component, airframe, and interior MRO are also significant segments, complemented by essential field maintenance services for rapid turnaround. Leading providers are innovating to offer integrated solutions and advanced services to capture market share.

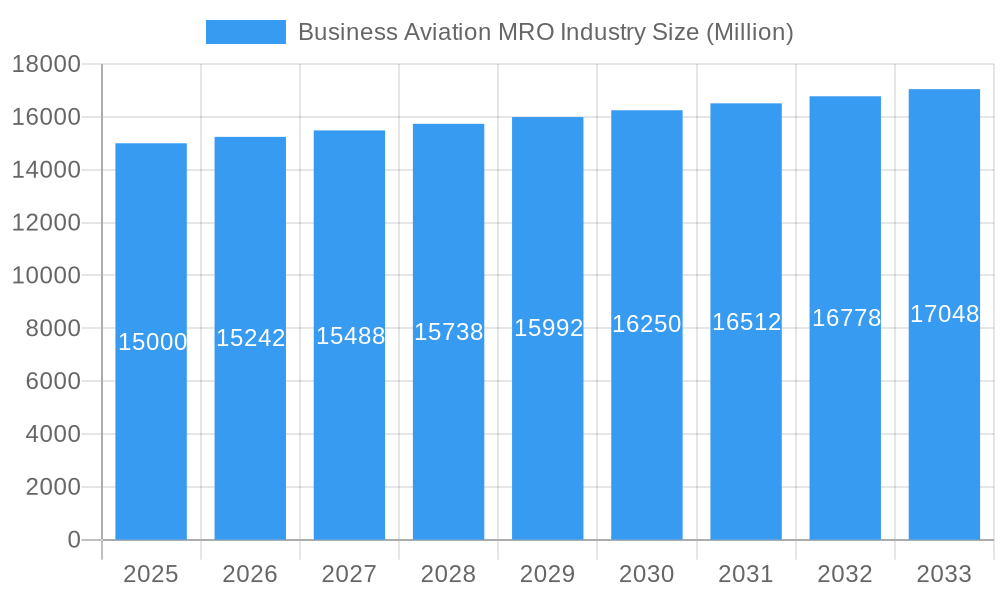

Business Aviation MRO Industry Market Size (In Billion)

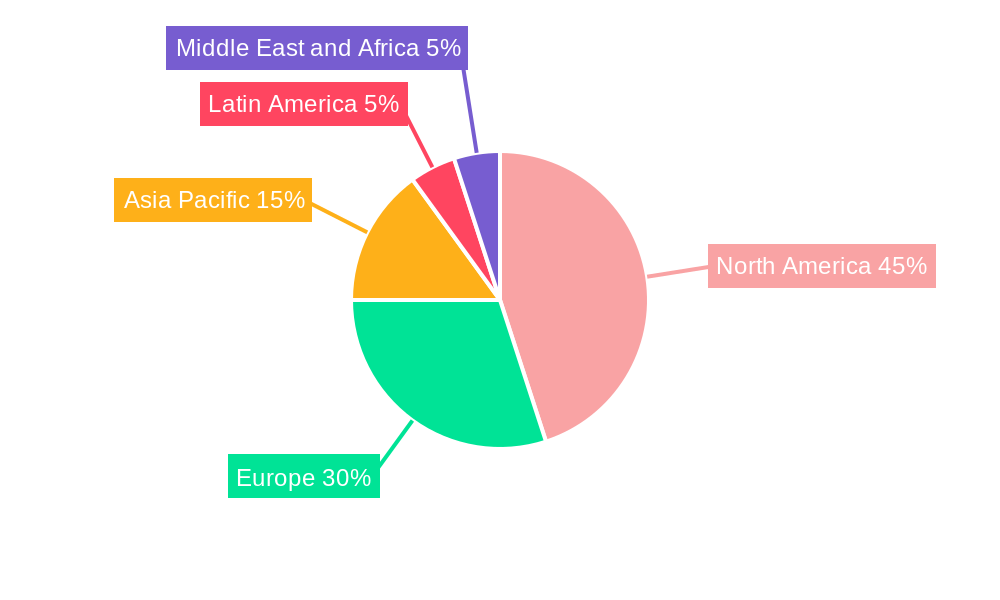

Geographically, North America and Europe currently lead the market due to their high concentration of business aircraft and well-established MRO infrastructures. However, the Asia-Pacific region is poised for substantial growth, fueled by increasing wealth and a rising demand for private aviation. While overall market expansion is steady, specialized segments focusing on sustainable aviation technologies and advanced diagnostics are experiencing accelerated growth. Market impediments include fluctuating fuel costs, geopolitical instability, and potential supply chain disruptions affecting parts and skilled labor availability. Despite these challenges, the long-term outlook for Business Aviation MRO remains highly favorable, supported by technological advancements, evolving operational demands, and fleet expansion.

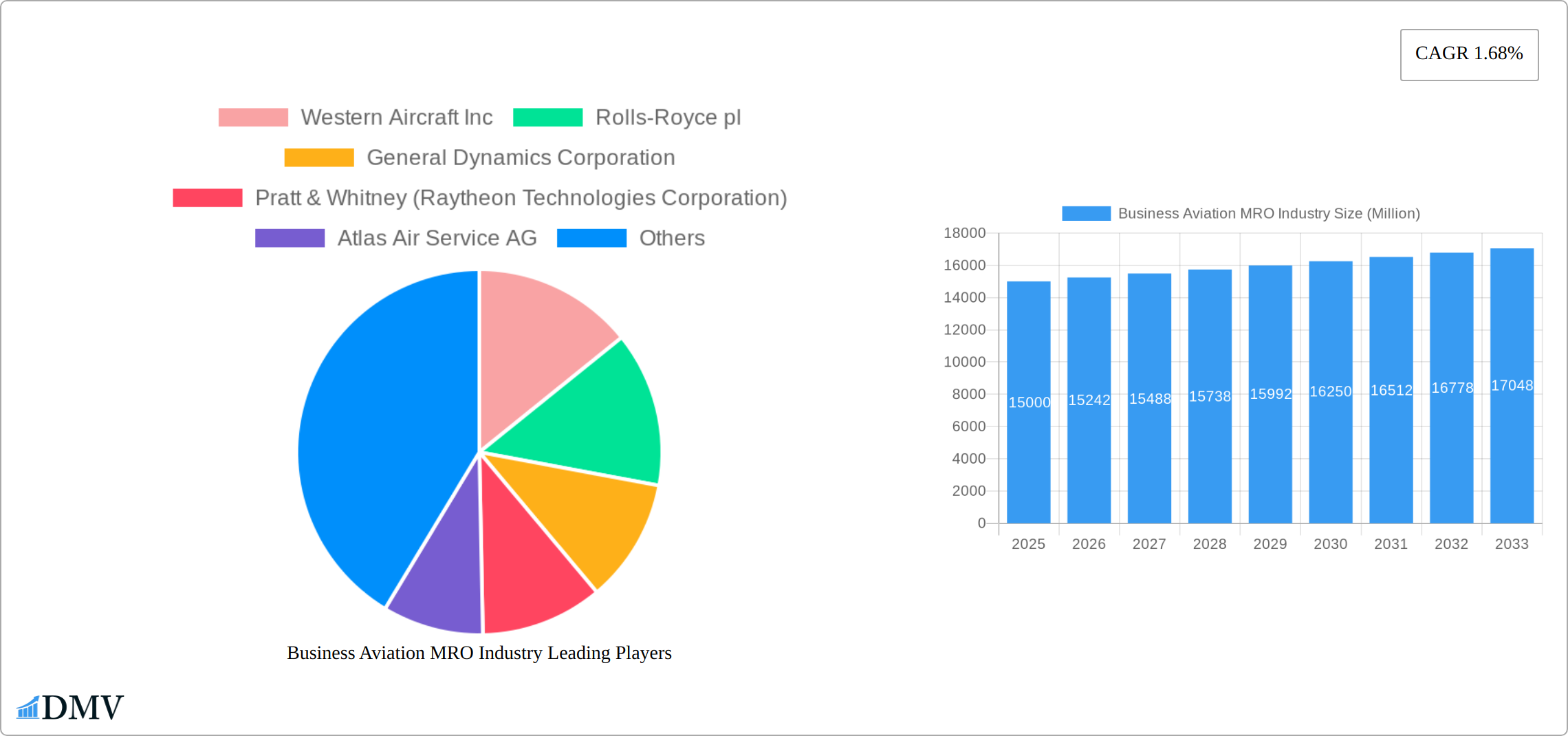

Business Aviation MRO Industry Company Market Share

Business Aviation MRO Market Analysis: Size, Growth, and Forecast (2024-2033)

This comprehensive market report offers an in-depth analysis of the Business Aviation MRO industry, detailing market trends, key stakeholders, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2024 and a forecast period of 2024-2033, this report is an essential resource for stakeholders aiming to understand and leverage this dynamic market. The analysis meticulously examines key MRO segments, including Engine MRO, Component MRO, Interior MRO, Airframe MRO, and Field Maintenance, alongside prominent industry players. The market size is estimated to be 90.85 billion by 2033.

Business Aviation MRO Industry Market Composition & Trends

The Business Aviation MRO market is characterized by a moderately concentrated structure, with established global players holding substantial market share. This dynamic landscape is continuously shaped by strategic mergers and acquisitions (M&A), driving consolidation and evolving competitive strategies. Innovation is a critical differentiator, propelled by advancements in digital technologies, including sophisticated predictive maintenance algorithms and integrated digital solutions designed to optimize aircraft availability and minimize operational disruptions. The industry operates under a stringent regulatory framework, with a paramount focus on safety and environmental compliance, which significantly influences operational expenditures and strategic investment priorities. While direct substitutes are limited, operators can explore options such as the strategic outsourcing of specialized MRO functions or the adoption of extended service intervals, carefully balancing cost-effectiveness with operational demands. The end-user spectrum is diverse, encompassing operators of fractional ownership programs and individual private jet owners, each presenting unique and evolving maintenance requirements.

- Market Share Distribution (2025 Projection): The top three industry leaders are anticipated to collectively command approximately XX% of the global market share. The remaining portion of the market is distributed among a robust network of specialized and regional MRO providers.

- M&A Activity (2019-2024 Overview): This period witnessed a significant number of M&A transactions, totaling XX deals with an aggregate value estimated at XX Million USD. These strategic consolidations highlight the industry's ongoing trend towards increased market integration and expanded service capabilities.

Business Aviation MRO Industry Industry Evolution

The Business Aviation MRO industry has experienced robust expansion between 2019 and 2024, marked by a Compound Annual Growth Rate (CAGR) of approximately XX%. This impressive growth trajectory is attributed to a confluence of factors, including a sustained increase in global business aviation traffic, a heightened demand for premium and specialized maintenance services, and the transformative impact of technological innovations. Modern maintenance practices are being revolutionized by the integration of advanced analytics, ushering in an era of proactive, predictive maintenance and significantly enhancing overall operational efficiency. Concurrently, evolving customer expectations, with a pronounced emphasis on service speed, cost optimization, and the digitalization of maintenance workflows, are acting as powerful catalysts for innovation, compelling service providers to re-evaluate and enhance their offerings.

Looking ahead, the market is projected to reach a substantial value of XX Million USD by 2033. This growth will be predominantly driven by the anticipated expansion of the global business aircraft fleet and the continued adoption of cutting-edge technological advancements. The integration of advanced analytics for predictive maintenance is expected to see widespread adoption, reaching an estimated XX% penetration rate by 2033.

Leading Regions, Countries, or Segments in Business Aviation MRO Industry

North America remains the dominant region in the Business Aviation MRO industry, largely driven by a robust business aviation fleet and a strong presence of major MRO providers. Within this region, the United States is the leading country. However, significant growth is expected in the Asia-Pacific region due to rising affluence and increased business travel.

- Key Drivers for North America's Dominance:

- High concentration of business aircraft and MRO providers

- Robust regulatory framework and support for aviation

- Strong investments in technological advancements within the sector

- Airframe MRO is the largest segment within the MRO type, accounting for xx% of the total market value in 2025, driven by the longevity of aircraft and need for periodic inspections and maintenance.

The dominance of specific segments is influenced by various factors such as aircraft technology, economic conditions, and operational requirements. We project that Airframe MRO will continue its leading position, propelled by sustained growth in the business aviation fleet.

Business Aviation MRO Industry Product Innovations

Recent innovations focus on enhancing operational efficiency, reducing costs, and improving safety. This includes the introduction of advanced diagnostic tools, predictive maintenance software, and specialized repair techniques. Key players are also focusing on developing sustainable and environmentally friendly MRO solutions, responding to the growing awareness of carbon emissions in the aviation industry. These innovations translate into faster turnaround times, reduced maintenance costs, and optimized aircraft availability, leading to competitive advantages.

Propelling Factors for Business Aviation MRO Industry Growth

Several factors drive the growth of the Business Aviation MRO industry. Firstly, the expanding global business aviation fleet necessitates regular maintenance and repairs, ensuring continued operational capability. Secondly, technological advancements in areas such as predictive maintenance and big data analytics optimize maintenance schedules, reduce downtime, and improve overall efficiency. Lastly, supportive government regulations regarding aviation safety and maintenance standards create a stable environment for industry growth.

Obstacles in the Business Aviation MRO Industry Market

The Business Aviation MRO industry faces challenges such as fluctuations in the global economy impacting the demand for business aviation services. Supply chain disruptions can cause delays and increased costs for maintenance parts and repairs. Furthermore, intense competition from established and new players pressures profit margins and necessitates constant innovation and efficiency improvements.

Future Opportunities in Business Aviation MRO Industry

Significant future opportunities exist in strategically expanding MRO capabilities into burgeoning markets, particularly in the Asia-Pacific and Middle East regions, where business aviation is experiencing accelerated growth. Investment in transformative technologies such as Artificial Intelligence (AI) and advanced machine learning algorithms holds immense potential to revolutionize maintenance processes, dramatically enhancing predictive accuracy and operational foresight. Furthermore, the proactive adoption of sustainable and environmentally responsible practices within MRO operations not only contributes to ecological preservation but also unlocks access to new market segments and potentially lucrative government incentives and certifications.

Major Players in the Business Aviation MRO Industry Ecosystem

- Western Aircraft Inc

- Rolls-Royce plc

- General Dynamics Corporation

- Pratt & Whitney (Raytheon Technologies Corporation)

- Atlas Air Service AG

- ExecuJet Aviation Group AG

- Lufthansa Technik AG

- DC Aviation GmbH

- Bombardier Inc

- Flying Colours Corp

- Constant Aviation LLC

- Comlux Aviation Services LLC

Key Developments in Business Aviation MRO Industry Industry

- December 2022: Embraer-X collaborated with Pulse Aviation to integrate Beacon, an advanced maintenance coordination platform, significantly improving operational efficiency and accelerating return-to-service timelines for aircraft.

- March 2022: Embraer introduced a comprehensive service agreement designed to support Avantto's executive jet fleet through its Embraer Executive Care Program, providing customers with predictable and streamlined maintenance budgeting solutions.

- December 2021: ExecuJet MRO Services Malaysia announced the ambitious development of a new, state-of-the-art MRO facility spanning 144,000 square feet in Subang, Kuala Lumpur. The facility is slated for completion in 2023, expanding its service capacity in the region.

Strategic Business Aviation MRO Industry Market Forecast

The Business Aviation MRO market is poised for continued growth driven by increasing business aviation traffic, technological advancements, and expanding fleet size. Emerging markets and the adoption of innovative technologies, such as AI-powered predictive maintenance, present significant opportunities for market expansion and improved operational efficiency. The strategic focus on sustainability and technological innovation will be crucial for continued success in this dynamic and competitive landscape.

Business Aviation MRO Industry Segmentation

-

1. MRO Type

- 1.1. Engine MRO

- 1.2. Component MRO

- 1.3. Interior MRO

- 1.4. Airframe MRO

- 1.5. Field Maintenance

Business Aviation MRO Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Business Aviation MRO Industry Regional Market Share

Geographic Coverage of Business Aviation MRO Industry

Business Aviation MRO Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Components MRO Segment of the Market is Expected to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 5.1.1. Engine MRO

- 5.1.2. Component MRO

- 5.1.3. Interior MRO

- 5.1.4. Airframe MRO

- 5.1.5. Field Maintenance

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by MRO Type

- 6. North America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 6.1.1. Engine MRO

- 6.1.2. Component MRO

- 6.1.3. Interior MRO

- 6.1.4. Airframe MRO

- 6.1.5. Field Maintenance

- 6.1. Market Analysis, Insights and Forecast - by MRO Type

- 7. Europe Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 7.1.1. Engine MRO

- 7.1.2. Component MRO

- 7.1.3. Interior MRO

- 7.1.4. Airframe MRO

- 7.1.5. Field Maintenance

- 7.1. Market Analysis, Insights and Forecast - by MRO Type

- 8. Asia Pacific Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 8.1.1. Engine MRO

- 8.1.2. Component MRO

- 8.1.3. Interior MRO

- 8.1.4. Airframe MRO

- 8.1.5. Field Maintenance

- 8.1. Market Analysis, Insights and Forecast - by MRO Type

- 9. Latin America Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 9.1.1. Engine MRO

- 9.1.2. Component MRO

- 9.1.3. Interior MRO

- 9.1.4. Airframe MRO

- 9.1.5. Field Maintenance

- 9.1. Market Analysis, Insights and Forecast - by MRO Type

- 10. Middle East and Africa Business Aviation MRO Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 10.1.1. Engine MRO

- 10.1.2. Component MRO

- 10.1.3. Interior MRO

- 10.1.4. Airframe MRO

- 10.1.5. Field Maintenance

- 10.1. Market Analysis, Insights and Forecast - by MRO Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Western Aircraft Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rolls-Royce pl

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Dynamics Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pratt & Whitney (Raytheon Technologies Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Atlas Air Service AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ExecuJet Aviation Group AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lufthansa Technik AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DC Aviation GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bombardier Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flying Colours Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Constant Aviation LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Comlux Aviation Services LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Western Aircraft Inc

List of Figures

- Figure 1: Global Business Aviation MRO Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 3: North America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 4: North America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 7: Europe Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 8: Europe Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 11: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 12: Asia Pacific Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 15: Latin America Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 16: Latin America Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by MRO Type 2025 & 2033

- Figure 19: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by MRO Type 2025 & 2033

- Figure 20: Middle East and Africa Business Aviation MRO Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Business Aviation MRO Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 2: Global Business Aviation MRO Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 4: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 6: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 8: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 10: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Business Aviation MRO Industry Revenue billion Forecast, by MRO Type 2020 & 2033

- Table 12: Global Business Aviation MRO Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Business Aviation MRO Industry?

The projected CAGR is approximately 4.75%.

2. Which companies are prominent players in the Business Aviation MRO Industry?

Key companies in the market include Western Aircraft Inc, Rolls-Royce pl, General Dynamics Corporation, Pratt & Whitney (Raytheon Technologies Corporation), Atlas Air Service AG, ExecuJet Aviation Group AG, Lufthansa Technik AG, DC Aviation GmbH, Bombardier Inc, Flying Colours Corp, Constant Aviation LLC, Comlux Aviation Services LLC.

3. What are the main segments of the Business Aviation MRO Industry?

The market segments include MRO Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 90.85 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Components MRO Segment of the Market is Expected to Witness Highest Growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: Embraer-X signed a contract with Pulse Aviation for the use of Beacon, the maintenance coordination platform connecting resources and professionals for faster return-to-service aircraft. Pulse Aviation, a Florida-based business aviation company that offers MRO services, will use Beacon to improve maintenance coordination, make it easier to communicate about maintenance events involving all different types of aircraft models, foster teamwork, enhance knowledge sharing, and speed up workflows related to maintenance events.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Business Aviation MRO Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Business Aviation MRO Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Business Aviation MRO Industry?

To stay informed about further developments, trends, and reports in the Business Aviation MRO Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence