Key Insights

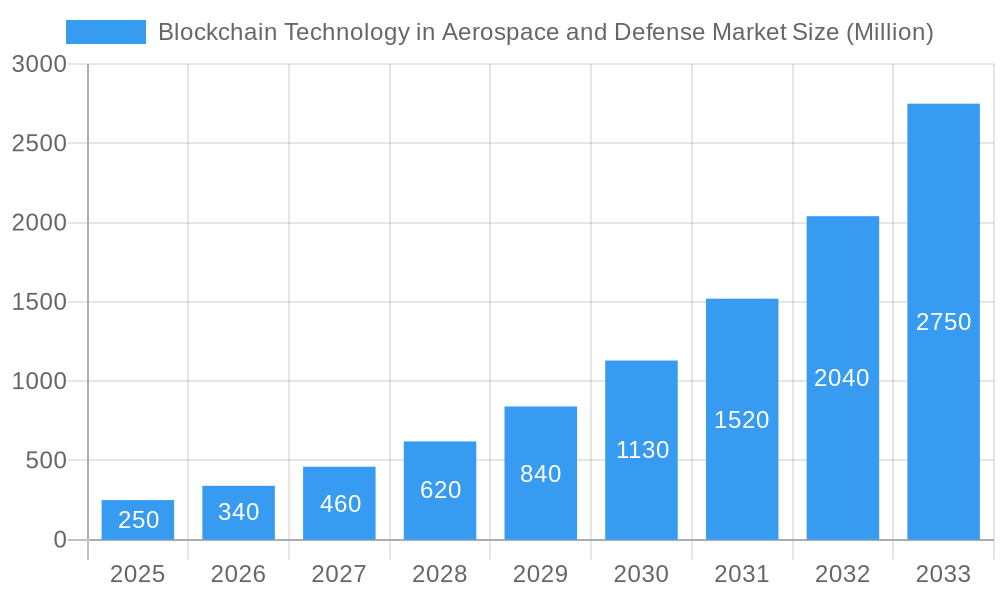

The global Blockchain Technology in Aerospace and Defense market is projected for substantial expansion, estimated to reach $4.7 billion by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 41.08% through 2033. This growth is propelled by the critical demand for heightened security, unparalleled transparency, and unwavering data integrity within these stringent industries. Blockchain's inherent decentralized and immutable characteristics provide robust solutions for sophisticated supply chain management, secure information exchange, and enhanced traceability of vital components, thereby mitigating risks from counterfeiting and fraud. The aerospace sector, characterized by its intricate global supply chains and rigorous quality control, will witness significant benefits from blockchain's capability to meticulously track parts from origin to installation, ensuring authenticity and averting operational disruptions. Concurrently, the defense sector can harness blockchain for secure communication channels, encrypted data repositories, and streamlined management of sensitive information across diverse agencies and contractors. Despite initial integration complexities and regulatory considerations, the long-term prospects for augmented efficiency, cost reduction, and fortified security underscore sustained market growth.

Blockchain Technology in Aerospace and Defense Market Market Size (In Billion)

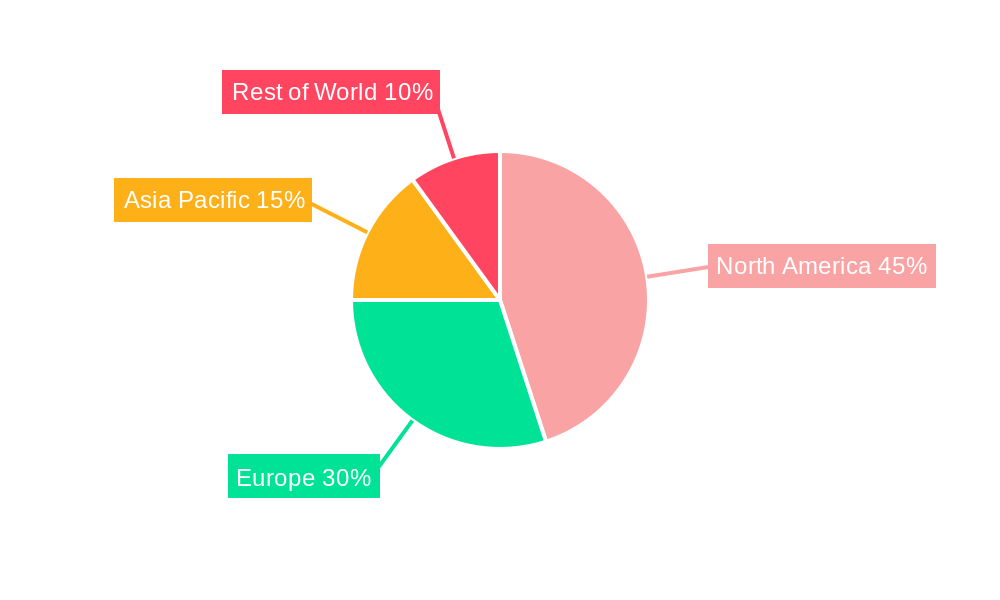

Market segmentation highlights robust expansion across both aerospace and defense segments. North America is expected to lead, driven by early technology adoption and the presence of key industry players. Europe is poised for significant growth, fueled by defense modernization investments and cybersecurity advancements. The Asia Pacific region, while experiencing a more gradual initial trajectory, anticipates considerable acceleration later in the forecast period, supported by increasing digitalization within its aerospace and defense industries. Leading technology providers and specialized blockchain firms are spearheading innovation, while a dynamic ecosystem of startups and established companies fuels market expansion and competitive advancement. Overall market projections indicate a significant valuation increase, cementing blockchain's role as a pivotal and transformative technology in the aerospace and defense sectors.

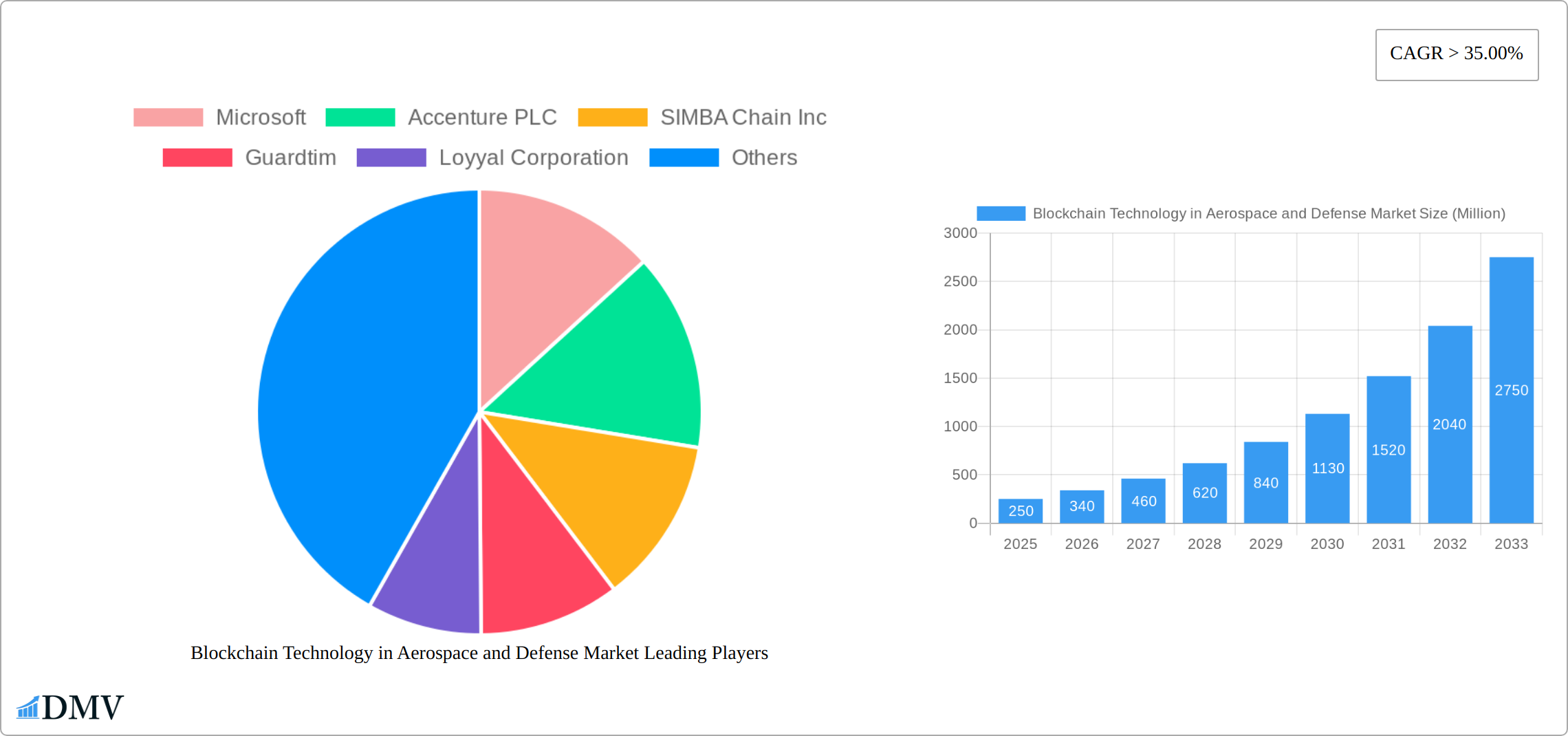

Blockchain Technology in Aerospace and Defense Market Company Market Share

Blockchain Technology in Aerospace and Defense Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Blockchain Technology in Aerospace and Defense Market, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a data-driven perspective on market trends, growth drivers, and future opportunities. The market is estimated to be valued at $xx Million in 2025.

Blockchain Technology in Aerospace and Defense Market Market Composition & Trends

This section offers a comprehensive analysis of the Blockchain Technology in Aerospace and Defense Market, examining critical aspects such as market concentration, driving forces for innovation, the evolving regulatory environment, potential substitute technologies, the profiles of end-users, and merger and acquisition (M&A) activities. The market landscape is characterized by a moderately concentrated structure, with established technology giants like Microsoft, Accenture PLC, and IBM commanding a significant portion of the market share. Concurrently, a burgeoning ecosystem of agile startups and specialized firms is actively fueling innovation and introducing novel solutions.

The current market share distribution is estimated as follows: Microsoft (xx%), Accenture PLC (xx%), IBM (xx%), Others (xx%). The regulatory framework surrounding blockchain adoption within aerospace and defense is in a dynamic state of evolution, with varying levels of acceptance and distinct regulatory approaches being implemented across different nations. This presents both strategic opportunities and inherent challenges for market participants. While traditional database systems represent a potential substitute technology, the inherent strengths of blockchain, particularly its unparalleled security features and transparent data management capabilities, are proving to be compelling drivers for its increasing integration.

Historically, M&A activities within this sector have been relatively subdued, with a total deal value approximating $xx Million during the period of 2019-2024. However, a notable acceleration in M&A activity is anticipated for the forecast period (2025-2033) as major industry players strategically aim to expand their market footprint, consolidate their technological prowess, and secure competitive advantages through targeted acquisitions and partnerships.

- Market Concentration: The market is moderately concentrated, with dominant players holding substantial market share, yet a growing number of innovative smaller entities are contributing to market dynamism.

- Innovation Catalysts: Key drivers include the emergence of innovative startups, proactive government initiatives focused on digital transformation and security, and the escalating demand for robust, secure, and transparent data management solutions.

- Regulatory Landscape: The regulatory environment is continuously evolving, with varying national frameworks influencing the pace and scope of market penetration and adoption.

- Substitute Products: Traditional database systems pose a competitive challenge, but the unique value proposition of blockchain in enhancing security and data integrity is often superseding these alternatives.

- End-User Profiles: The primary adopters are established aerospace and defense organizations, governmental agencies responsible for national security, and leading research and development institutions.

- M&A Activities: While historically moderate, M&A activity is projected to increase significantly in the upcoming forecast period as companies seek strategic consolidation and market expansion.

Blockchain Technology in Aerospace and Defense Market Industry Evolution

The Blockchain Technology in Aerospace and Defense Market has experienced a period of substantial expansion in recent years. This growth is primarily propelled by the critical and escalating need for highly secure and transparent data management protocols within these inherently regulated and sensitive sectors. Between 2019 and 2024, the market demonstrated a robust Compound Annual Growth Rate (CAGR) of xx%. This upward trajectory has been significantly influenced by advancements in blockchain technology itself, the expanding adoption of blockchain in intricate supply chain management processes, and a heightened awareness of the pervasive and evolving nature of cybersecurity threats.

The adoption rate of blockchain solutions within aerospace and defense companies has seen a remarkable surge, with a reported xx% increase in usage observed from 2021 to 2024. This positive momentum is projected to persist and accelerate into the forecast period (2025-2033), with an estimated CAGR of xx%. This sustained growth is expected to be fueled by several pivotal factors, including ongoing technological advancements leading to more scalable and efficient blockchain architectures, increased government investment in cutting-edge research and development initiatives, and the persistent and growing imperative for secure and transparent data sharing across a complex web of stakeholders.

Furthermore, the market is witnessing a discernible rise in demand from end-users for enhanced security guarantees and verifiable data provenance, which is actively pushing for the broader adoption of blockchain-based solutions across the industry.

Leading Regions, Countries, or Segments in Blockchain Technology in Aerospace and Defense Market

Currently, the North American region, with a strong emphasis on the United States, stands as the undisputed leader in the Blockchain Technology in Aerospace and Defense Market. This preeminence can be attributed to a confluence of powerful factors:

- High Level of Technological Advancement: The United States possesses a sophisticated technological infrastructure, a deep talent pool, and extensive expertise in the development and implementation of blockchain technologies.

- Robust Government Support: Significant and sustained government investments in research and development, particularly those focused on national security and advanced technology, provide a fertile ground for blockchain innovation.

- Stringent Regulatory Landscape: The inherent requirement for highly secure, verifiable, and auditable data within the aerospace and defense industries naturally drives the adoption of blockchain solutions that meet these rigorous standards.

- Concentration of Major Players: The presence of leading industry giants such as Microsoft, IBM, and numerous other key aerospace and defense companies, either headquartered or with substantial operational bases within the US, further bolsters market growth and innovation.

This region's market leadership is further cemented by the substantial concentration of aerospace and defense enterprises and a well-developed ecosystem comprising blockchain developers, solution providers, and academic institutions. Nevertheless, other significant regions, including Europe and the Asia-Pacific, are exhibiting accelerating adoption rates. This growth is being propelled by increasing governmental support for digital transformation initiatives and a heightened awareness of the multifaceted benefits offered by blockchain technology.

Analysis by industry segment reveals that the defense segment currently demonstrates a higher adoption rate compared to the aerospace segment. This is primarily due to the mission-critical requirements for absolute data security and unwavering supply chain transparency inherent in defense operations.

Blockchain Technology in Aerospace and Defense Market Product Innovations

Recent innovations include the development of permissioned blockchain platforms specifically designed to meet the stringent security requirements of the aerospace and defense industries. These platforms offer enhanced features like improved scalability, faster transaction speeds, and robust data privacy mechanisms. Moreover, integration with existing enterprise systems is simplifying adoption and enhancing usability. Key performance indicators (KPIs) focusing on transaction speed, security breaches, and data integrity are paramount in driving the adoption of these platforms. Unique selling propositions center on enhanced security, immutable data records, and improved traceability and transparency throughout the supply chain.

Propelling Factors for Blockchain Technology in Aerospace and Defense Market Growth

Several factors are driving the growth of this market. The rising need for enhanced data security and transparency in supply chains, coupled with increasing government investments in blockchain R&D, are significant catalysts. Stringent regulatory requirements within the aerospace and defense sectors are also pushing the adoption of secure and auditable blockchain-based solutions. Technological advancements, such as the development of more scalable and efficient blockchain platforms, further contribute to this market expansion.

Obstacles in the Blockchain Technology in Aerospace and Defense Market Market

Despite significant potential, several barriers hinder wider adoption. High implementation costs, especially for integrating blockchain technology into existing legacy systems, pose a challenge. Regulatory uncertainties and a lack of standardized blockchain protocols can also hinder broader adoption. Furthermore, concerns around interoperability between different blockchain platforms and the potential for security vulnerabilities remain significant hurdles. These factors contribute to the relatively slow adoption rate compared to other industries.

Future Opportunities in Blockchain Technology in Aerospace and Defense Market

Future opportunities lie in the expansion into new applications, such as secure identity management, asset tracking, and autonomous systems. The integration of blockchain with other emerging technologies, such as Artificial Intelligence (AI) and the Internet of Things (IoT), holds significant promise. Furthermore, the growing demand for data provenance and traceability across global supply chains presents a substantial opportunity for blockchain adoption within the aerospace and defense sectors. Exploring new markets, especially in developing economies, is another significant area of growth.

Major Players in the Blockchain Technology in Aerospace and Defense Market Ecosystem

- Microsoft

- Accenture PLC

- SIMBA Chain Inc

- Guardtim

- Loyyal Corporation

- Winding Tree

- Aeron Labs

- IBM

- BRUcloud

- Ozone

Key Developments in Blockchain Technology in Aerospace and Defense Market Industry

- January 2023: Microsoft unveiled a groundbreaking blockchain-based platform designed to enhance secure supply chain management within the aerospace sector, promising improved traceability and integrity of critical components.

- June 2022: Accenture PLC forged a strategic partnership with a prominent aerospace manufacturer, focusing on the implementation of blockchain technology to meticulously track and verify the authenticity of critical aircraft parts throughout their lifecycle.

- October 2021: IBM introduced an advanced blockchain solution engineered to bolster data security and integrity for a wide range of defense applications, addressing critical vulnerabilities in sensitive information management.

- [Add further key developments with precise dates as available to enrich the timeline.]

- [Consider including developments related to specific use cases like secure maintenance records, verifiable pilot certifications, or autonomous system data integrity.]

Strategic Blockchain Technology in Aerospace and Defense Market Forecast

The Blockchain Technology in Aerospace and Defense Market is poised for significant growth in the coming years. Driven by technological advancements, increasing security concerns, and greater regulatory clarity, the market is expected to experience robust expansion. The convergence of blockchain with other technologies, such as AI and IoT, will unlock new applications and further accelerate market growth. This will lead to enhanced operational efficiency, improved security protocols, and a greater level of trust and transparency throughout the industry's supply chains and operations.

Blockchain Technology in Aerospace and Defense Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Blockchain Technology in Aerospace and Defense Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blockchain Technology in Aerospace and Defense Market Regional Market Share

Geographic Coverage of Blockchain Technology in Aerospace and Defense Market

Blockchain Technology in Aerospace and Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 41.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. The Aerospace Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blockchain Technology in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Blockchain Technology in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Blockchain Technology in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Blockchain Technology in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Blockchain Technology in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Blockchain Technology in Aerospace and Defense Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Microsoft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Accenture PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SIMBA Chain Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guardtim

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Loyyal Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Winding Tree

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aeron Labs

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IBM

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BRUcloud

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ozone

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Microsoft

List of Figures

- Figure 1: Global Blockchain Technology in Aerospace and Defense Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 3: North America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 5: North America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 15: South America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 17: South America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 27: Europe Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Europe Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Brazil Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Argentina Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: France Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Italy Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Spain Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Russia Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Benelux Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Nordics Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: Turkey Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Israel Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: GCC Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: North Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: South Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Blockchain Technology in Aerospace and Defense Market Revenue billion Forecast, by Country 2020 & 2033

- Table 58: China Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 59: India Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: Japan Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 61: South Korea Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 63: Oceania Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Blockchain Technology in Aerospace and Defense Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blockchain Technology in Aerospace and Defense Market?

The projected CAGR is approximately 41.08%.

2. Which companies are prominent players in the Blockchain Technology in Aerospace and Defense Market?

Key companies in the market include Microsoft, Accenture PLC, SIMBA Chain Inc, Guardtim, Loyyal Corporation, Winding Tree, Aeron Labs, IBM, BRUcloud, Ozone.

3. What are the main segments of the Blockchain Technology in Aerospace and Defense Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.7 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

The Aerospace Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blockchain Technology in Aerospace and Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blockchain Technology in Aerospace and Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blockchain Technology in Aerospace and Defense Market?

To stay informed about further developments, trends, and reports in the Blockchain Technology in Aerospace and Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence