Key Insights

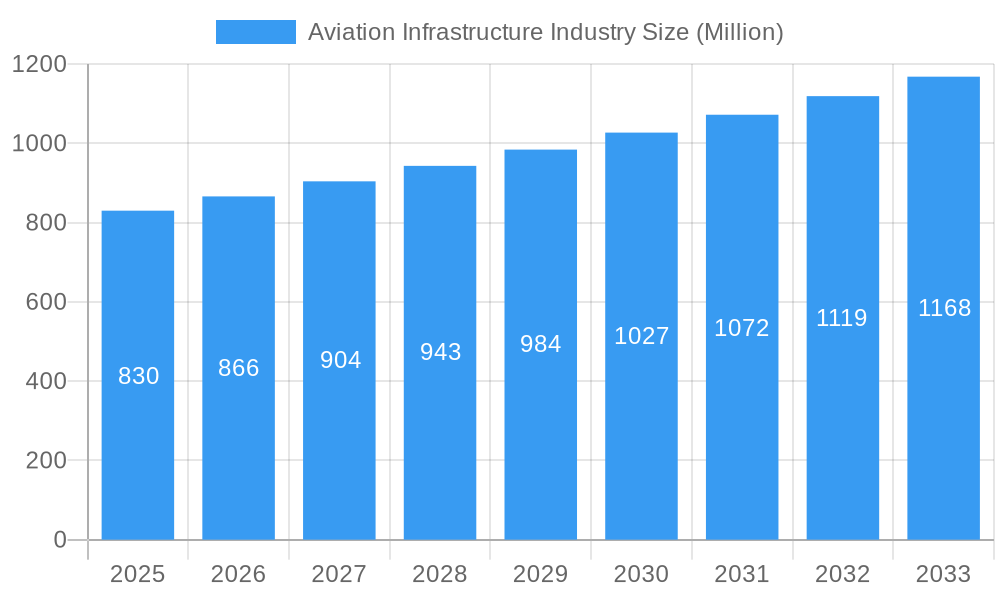

The global aviation infrastructure market, valued at $0.83 billion in 2025, is projected to experience robust growth, driven by increasing air passenger traffic, expansion of existing airports, and the development of new airport infrastructure globally. A Compound Annual Growth Rate (CAGR) of 4.40% from 2025 to 2033 signifies a substantial market expansion, reaching an estimated value exceeding $1.2 billion by 2033. Key growth drivers include rising disposable incomes leading to increased air travel, government initiatives promoting airport modernization and expansion, and technological advancements in airport operations and safety. The market is segmented by infrastructure type (terminals, control towers, taxiways/runways, aprons, hangars, and other infrastructure) and airport type (commercial, military, and general aviation). Commercial airports are expected to dominate the market due to the high volume of passenger and cargo traffic. Regional variations are expected, with North America and Asia-Pacific anticipated to exhibit significant growth due to substantial investments in airport infrastructure development and a rising middle class fueling air travel demand. However, economic downturns and geopolitical instability could pose potential restraints to market growth.

Aviation Infrastructure Industry Market Size (In Million)

Major players like PCL Constructors Inc., Manhattan Construction Group Inc., and AECOM are actively shaping the market through their involvement in large-scale airport construction and renovation projects. Competition is intense, with companies focusing on innovation, cost-effectiveness, and efficient project management to secure contracts. The market is also witnessing increased adoption of sustainable building practices and technologies to reduce the environmental impact of aviation infrastructure development. Future growth will be significantly influenced by factors such as technological advancements in airport design and construction, stringent safety regulations, and the successful integration of smart airport technologies. This will lead to a greater demand for specialized services and expertise in the construction and management of efficient, sustainable, and technologically advanced airports.

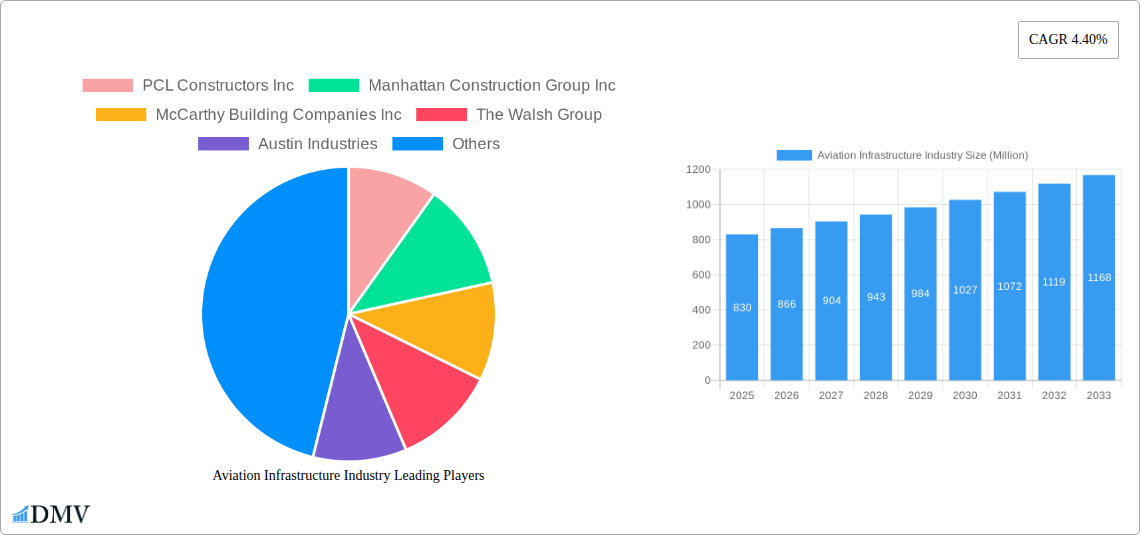

Aviation Infrastructure Industry Company Market Share

Aviation Infrastructure Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Aviation Infrastructure Industry, projecting robust growth from $XX Million in 2025 to $XX Million by 2033. We analyze market trends, technological advancements, and key players shaping this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for stakeholders seeking to understand and capitalize on the immense opportunities within the aviation infrastructure market.

Aviation Infrastructure Industry Market Composition & Trends

The aviation infrastructure market, valued at $XX Million in 2025, exhibits a moderately concentrated landscape. Key players, including PCL Constructors Inc, Manhattan Construction Group Inc, and McCarthy Building Companies Inc, hold significant market share, though the presence of numerous smaller specialized firms contributes to a competitive dynamic. Innovation is primarily driven by advancements in materials science (lighter, stronger components for runways and terminals), sustainable construction practices (reducing carbon footprint), and digitalization (smart airports leveraging IoT and AI). Regulatory frameworks, varying across nations, significantly influence project timelines and costs. Substitute products are limited, mainly concerning material choices with similar performance characteristics. End-users comprise government agencies (military and civilian airports), airport operators, and private investors.

Mergers and acquisitions (M&A) activity is moderate, with deal values averaging $XX Million annually during the historical period (2019-2024). Notable M&A deals include:

- 2022: Acquisition of X Company by Y Company ($XX Million).

- 2023: Merger of A Company and B Company ($XX Million).

Market share distribution:

- Top 5 players: XX%

- Next 10 players: XX%

- Remaining players: XX%

Aviation Infrastructure Industry Industry Evolution

The aviation infrastructure industry has witnessed consistent growth throughout the historical period (2019-2024), driven by rising passenger traffic, increased air freight, and government investments in airport modernization and expansion. The annual growth rate (AGR) averaged approximately XX% during 2019-2024, and is projected to remain robust at XX% during the forecast period (2025-2033), reaching $XX Million by 2033. Technological advancements, particularly in sustainable building materials and smart airport technologies, have significantly impacted the industry, accelerating construction timelines and enhancing operational efficiency.

Passenger demands for enhanced airport experiences – including smoother check-in processes, improved amenities, and sustainable infrastructure – have created pressure for innovation. Airports are actively investing in technologies like AI-powered baggage handling systems, biometric security, and data analytics for optimizing passenger flow and resource allocation. The adoption rate of sustainable construction materials has steadily increased, reaching approximately XX% in 2024, with projections of XX% by 2033. The shift toward greener airports is not only driven by environmental concerns but also by cost savings and enhanced brand image.

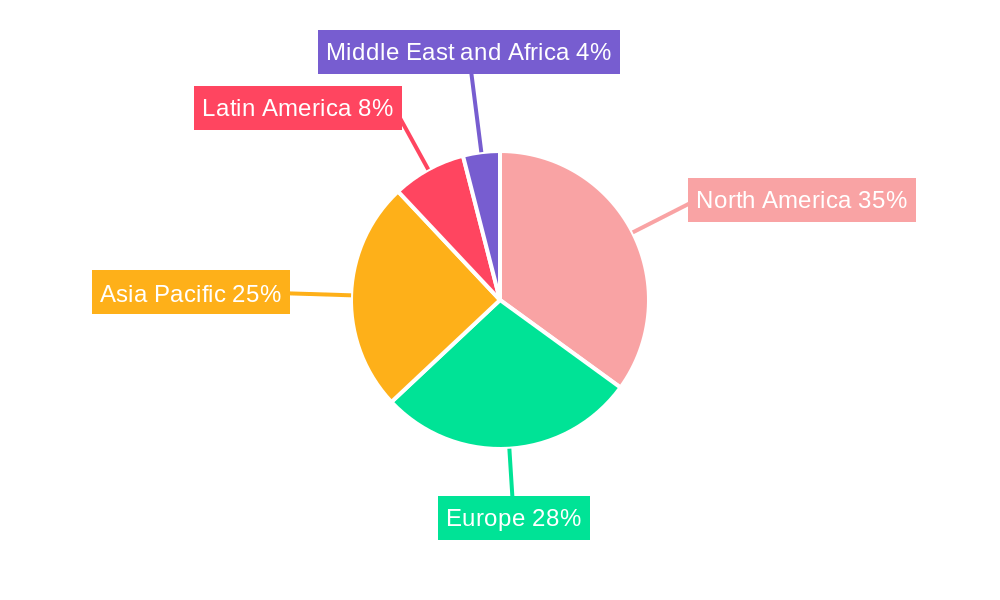

Leading Regions, Countries, or Segments in Aviation Infrastructure Industry

The Asia-Pacific region dominates the aviation infrastructure market, driven by rapid economic growth, rising air travel demand, and substantial government investment in airport infrastructure development. Within this region, countries like China and India show exceptional growth potential.

Key Drivers:

- High Investment: Significant government spending on airport modernization and new airport construction.

- Regulatory Support: Favorable policies promoting private sector participation and foreign investment.

- Rising Air Travel: Continuous increase in air passenger traffic fueling the demand for larger and more efficient airports.

Segment Dominance:

- Infrastructure Type: Commercial airport terminals account for the largest segment share, followed by taxiways and runways.

- Airport Type: Commercial airports constitute the largest share due to high passenger traffic and related infrastructure needs.

Other regions, such as North America and Europe, while mature markets, also contribute significantly, with ongoing investments focused on capacity expansion and infrastructure upgrades.

Aviation Infrastructure Industry Product Innovations

Recent innovations encompass lightweight, high-strength materials for runways, self-healing concrete technology minimizing maintenance, and advanced air traffic control systems optimizing flight operations and minimizing delays. These improvements enhance airport operational efficiency, reduce construction time, and decrease lifecycle costs. Unique selling propositions focus on durability, sustainability, and operational efficiency gains.

Propelling Factors for Aviation Infrastructure Industry Growth

Several factors drive the industry's expansion. Firstly, the escalating global air passenger traffic necessitates continuous airport expansion and modernization. Secondly, government initiatives promoting sustainable aviation practices are fueling demand for eco-friendly infrastructure solutions. Thirdly, technological innovations, such as the implementation of smart airport technologies, are boosting efficiency and enhancing passenger experience.

Obstacles in the Aviation Infrastructure Industry Market

Significant obstacles include fluctuating material costs, complex regulatory approvals leading to prolonged project timelines, and potential supply chain disruptions impacting project delivery. These challenges can lead to budget overruns and project delays. Competitive pressures among construction firms also influence pricing and profitability.

Future Opportunities in Aviation Infrastructure Industry

Emerging opportunities lie in the growing demand for sustainable infrastructure, the adoption of smart airport technologies, and the expansion of air travel in developing economies. The increasing integration of digital technologies within airport operations also presents lucrative prospects.

Major Players in the Aviation Infrastructure Industry Ecosystem

- PCL Constructors Inc

- Manhattan Construction Group Inc

- McCarthy Building Companies Inc

- The Walsh Group

- Austin Industries

- Hill International Inc

- The Sundt Companies Inc

- Hensel Phelps

- Royal BAM Group NV

- Turner Construction Company

- J E Dunn Construction Company

- Skanska

- BIC Contracting LLC

- TAV Construction

- AECOM

- ALEC Engineering and Contracting

Key Developments in Aviation Infrastructure Industry Industry

- 2023 Q3: Introduction of a new sustainable concrete mix by X Company reducing carbon footprint by XX%.

- 2022 Q4: Successful completion of the new terminal at Y Airport, featuring advanced passenger flow management systems.

- 2021 Q2: Merger of two leading airport design firms resulting in a combined market share of XX%.

Strategic Aviation Infrastructure Industry Market Forecast

The aviation infrastructure market is poised for significant growth, driven by continuous expansion of air travel, ongoing investments in airport modernization and new constructions, and the adoption of cutting-edge technologies. This convergence of factors creates ample opportunities for players across the value chain, particularly those focusing on sustainable and technologically advanced solutions. The market is projected to surpass $XX Million by 2033, solidifying its position as a key sector within the global infrastructure landscape.

Aviation Infrastructure Industry Segmentation

-

1. Airport Type

- 1.1. Commercial Airport

- 1.2. Military Airport

- 1.3. General Aviation Airport

-

2. Infrastructure Type

- 2.1. Terminal

- 2.2. Control Tower

- 2.3. Taxiway and Runway

- 2.4. Apron

- 2.5. Hangar

- 2.6. Other Infrastructure Types

Aviation Infrastructure Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Aviation Infrastructure Industry Regional Market Share

Geographic Coverage of Aviation Infrastructure Industry

Aviation Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Terminal Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 5.1.1. Commercial Airport

- 5.1.2. Military Airport

- 5.1.3. General Aviation Airport

- 5.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 5.2.1. Terminal

- 5.2.2. Control Tower

- 5.2.3. Taxiway and Runway

- 5.2.4. Apron

- 5.2.5. Hangar

- 5.2.6. Other Infrastructure Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Airport Type

- 6. North America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 6.1.1. Commercial Airport

- 6.1.2. Military Airport

- 6.1.3. General Aviation Airport

- 6.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 6.2.1. Terminal

- 6.2.2. Control Tower

- 6.2.3. Taxiway and Runway

- 6.2.4. Apron

- 6.2.5. Hangar

- 6.2.6. Other Infrastructure Types

- 6.1. Market Analysis, Insights and Forecast - by Airport Type

- 7. Europe Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 7.1.1. Commercial Airport

- 7.1.2. Military Airport

- 7.1.3. General Aviation Airport

- 7.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 7.2.1. Terminal

- 7.2.2. Control Tower

- 7.2.3. Taxiway and Runway

- 7.2.4. Apron

- 7.2.5. Hangar

- 7.2.6. Other Infrastructure Types

- 7.1. Market Analysis, Insights and Forecast - by Airport Type

- 8. Asia Pacific Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 8.1.1. Commercial Airport

- 8.1.2. Military Airport

- 8.1.3. General Aviation Airport

- 8.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 8.2.1. Terminal

- 8.2.2. Control Tower

- 8.2.3. Taxiway and Runway

- 8.2.4. Apron

- 8.2.5. Hangar

- 8.2.6. Other Infrastructure Types

- 8.1. Market Analysis, Insights and Forecast - by Airport Type

- 9. Latin America Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 9.1.1. Commercial Airport

- 9.1.2. Military Airport

- 9.1.3. General Aviation Airport

- 9.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 9.2.1. Terminal

- 9.2.2. Control Tower

- 9.2.3. Taxiway and Runway

- 9.2.4. Apron

- 9.2.5. Hangar

- 9.2.6. Other Infrastructure Types

- 9.1. Market Analysis, Insights and Forecast - by Airport Type

- 10. Middle East and Africa Aviation Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 10.1.1. Commercial Airport

- 10.1.2. Military Airport

- 10.1.3. General Aviation Airport

- 10.2. Market Analysis, Insights and Forecast - by Infrastructure Type

- 10.2.1. Terminal

- 10.2.2. Control Tower

- 10.2.3. Taxiway and Runway

- 10.2.4. Apron

- 10.2.5. Hangar

- 10.2.6. Other Infrastructure Types

- 10.1. Market Analysis, Insights and Forecast - by Airport Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PCL Constructors Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Manhattan Construction Group Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 McCarthy Building Companies Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Walsh Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Austin Industries

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hill International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Sundt Companies Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hensel Phelps

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Royal BAM Group NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Turner Construction Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 J E Dunn Construction Company

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Skanska

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 BIC Contracting LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TAV Construction

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AECOM

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ALEC Engineering and Contracting

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 PCL Constructors Inc

List of Figures

- Figure 1: Global Aviation Infrastructure Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 3: North America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 4: North America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 5: North America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 6: North America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 9: Europe Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 10: Europe Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 11: Europe Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 12: Europe Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 15: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 16: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 17: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 18: Asia Pacific Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 21: Latin America Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 22: Latin America Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 23: Latin America Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 24: Latin America Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Airport Type 2025 & 2033

- Figure 27: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Airport Type 2025 & 2033

- Figure 28: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Infrastructure Type 2025 & 2033

- Figure 29: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Infrastructure Type 2025 & 2033

- Figure 30: Middle East and Africa Aviation Infrastructure Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Aviation Infrastructure Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 2: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 3: Global Aviation Infrastructure Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 5: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 6: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 10: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 11: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 17: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 18: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 25: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 26: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aviation Infrastructure Industry Revenue Million Forecast, by Airport Type 2020 & 2033

- Table 30: Global Aviation Infrastructure Industry Revenue Million Forecast, by Infrastructure Type 2020 & 2033

- Table 31: Global Aviation Infrastructure Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: United Arab Emirates Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Saudi Arabia Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Middle East and Africa Aviation Infrastructure Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Infrastructure Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Aviation Infrastructure Industry?

Key companies in the market include PCL Constructors Inc, Manhattan Construction Group Inc, McCarthy Building Companies Inc, The Walsh Group, Austin Industries, Hill International Inc, The Sundt Companies Inc, Hensel Phelps, Royal BAM Group NV, Turner Construction Company, J E Dunn Construction Company, Skanska, BIC Contracting LLC, TAV Construction, AECOM, ALEC Engineering and Contracting.

3. What are the main segments of the Aviation Infrastructure Industry?

The market segments include Airport Type, Infrastructure Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Terminal Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Infrastructure Industry?

To stay informed about further developments, trends, and reports in the Aviation Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence