Key Insights

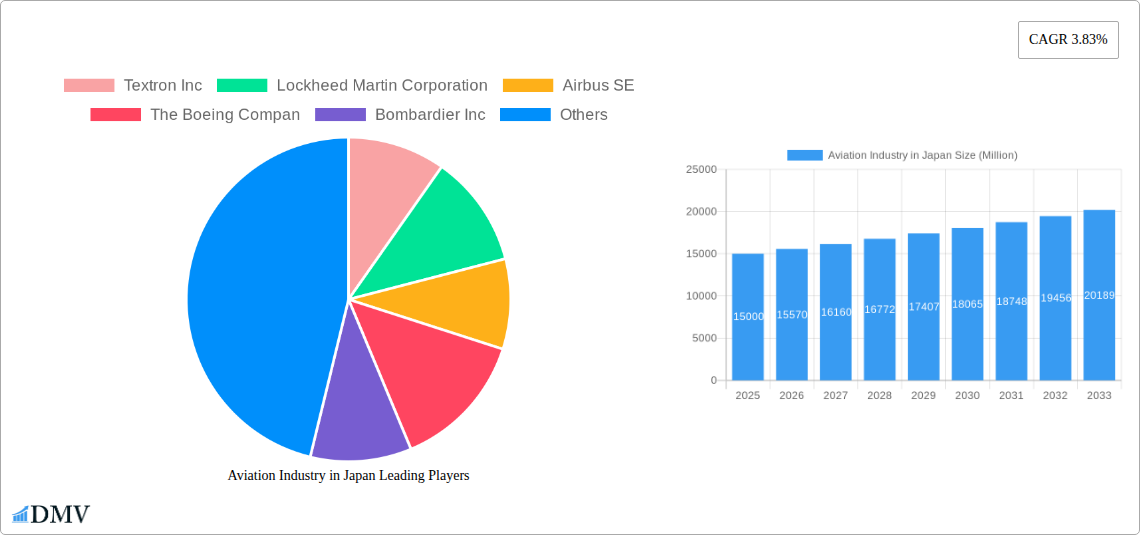

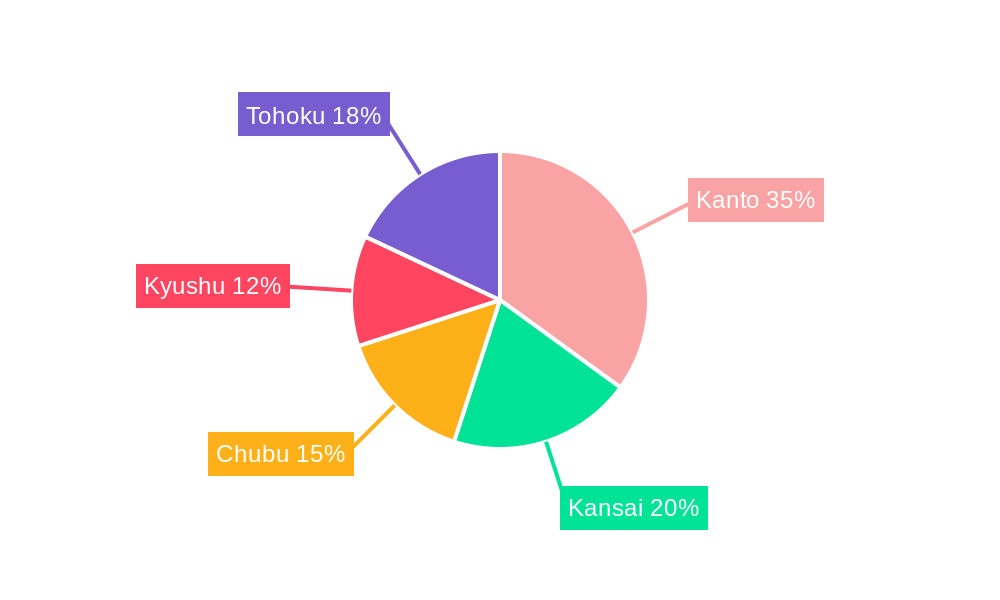

The Japanese aviation industry, encompassing commercial and other aviation segments, is poised for significant expansion. Projections indicate a robust market size, with a Compound Annual Growth Rate (CAGR) of 6.7%. The market was valued at 16.9 billion in the base year of 2024. Key growth drivers include escalating domestic and international air travel demand, propelled by Japan's thriving tourism sector and expanding business activities. Government investments in airport infrastructure modernization and a commitment to sustainable aviation technologies will further catalyze market growth. Commercial aviation demonstrates strong participation, reflecting the influence of major Japanese airlines and the nation's role as a pivotal transit hub in Asia. Potential constraints may arise from fuel price volatility, regulatory complexities, and global economic uncertainties impacting travel trends. Leading market participants, including Textron, Lockheed Martin, Airbus, Boeing, Bombardier, ATR, and Kawasaki, are actively driving innovation and forming strategic alliances. Regional analysis highlights Kanto, Kansai, Chubu, Kyushu, and Tohoku as key areas with varying market dynamics influenced by population density, economic output, and airport infrastructure.

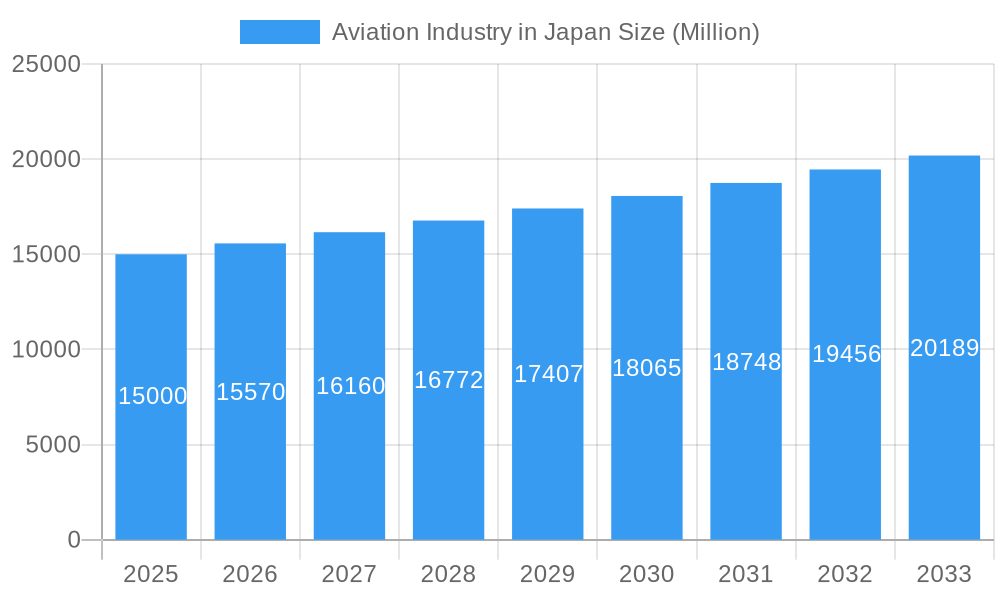

Aviation Industry in Japan Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained industry expansion, with the projected CAGR underscoring a steady increase in market value. Strategic planning for industry stakeholders must address critical challenges. Maintaining operational efficiency amidst fluctuating fuel costs, adapting to evolving environmental regulations, and embracing technological advancements in areas such as aircraft maintenance and air traffic management are essential for sustained growth. Regional strategies should be tailored to leverage local strengths and mitigate unique challenges. Continuous monitoring of travel patterns and economic indicators will be crucial for accurate future market performance prediction. The competitive landscape is expected to witness further consolidation, strategic alliances among established players, and the emergence of new entrants focusing on specific niche markets.

Aviation Industry in Japan Company Market Share

Aviation Industry in Japan: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Japanese aviation industry, encompassing market trends, leading players, and future growth projections. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. Discover crucial insights into market composition, technological advancements, and key obstacles impacting this dynamic sector. This report is invaluable for stakeholders seeking to understand the current landscape and future potential of the Japanese aviation market. The report uses Million (M) for all monetary values.

Aviation Industry in Japan Market Composition & Trends

This section delves into the competitive landscape of the Japanese aviation industry, examining market concentration, innovation drivers, regulatory frameworks, and significant M&A activities. We analyze the distribution of market share among key players, providing insights into the competitive dynamics and strategic positioning. The report also examines the influence of substitute products and end-user profiles on market growth.

- Market Concentration: The Japanese aviation market exhibits a [xx]% concentration ratio, with [xx] M in total market value in 2024. [xx]% is controlled by the top three players.

- Innovation Catalysts: Government initiatives promoting sustainable aviation and technological advancements in aircraft manufacturing are key drivers.

- Regulatory Landscape: Stringent safety regulations and environmental policies shape industry practices and investment decisions.

- Substitute Products: High-speed rail networks represent a significant substitute for short-haul air travel, impacting market growth in specific segments.

- End-User Profiles: The report profiles various end-users, including commercial airlines, private jet operators, and the military, analyzing their specific needs and preferences.

- M&A Activities: Significant M&A activity is observed in [xx] with a total deal value of [xx]M in 2024, driven by strategic consolidation and expansion efforts.

Aviation Industry in Japan Industry Evolution

This section meticulously analyzes the evolutionary trajectory of the Japanese aviation industry. We delve into historical growth patterns from 2019 to 2024, projecting future growth trajectories for the forecast period (2025-2033). The report incorporates technological advancements, such as the adoption of more fuel-efficient aircraft and advanced air mobility solutions, and their influence on market dynamics. Further analysis involves examining how evolving consumer preferences and demands for enhanced travel experiences impact the industry. The report features detailed data on growth rates and adoption metrics for specific technologies. The Japanese aviation market exhibited a CAGR of [xx]% during the historical period (2019-2024), and is projected to achieve a CAGR of [xx]% from 2025-2033, reaching a market size of [xx]M by 2033.

Leading Regions, Countries, or Segments in Aviation Industry in Japan

This section identifies the dominant regions, countries, and segments within the Japanese aviation industry, specifically focusing on Commercial Aviation and Other segments. The analysis uses a combination of bullet points for highlighting key drivers and paragraphs for detailed explanations of dominance factors.

Commercial Aviation: The commercial aviation segment dominates the Japanese aviation market due to its extensive network of domestic and international flights, supported by robust infrastructure and increasing passenger demand.

Key Drivers for Commercial Aviation Dominance:

- Significant investment in airport infrastructure and expansion projects.

- Government support for the development of the aviation sector.

- High passenger traffic volumes fueled by tourism and business travel.

Other Segment: The 'Other' segment which encompasses maintenance, repair, and overhaul (MRO) services, aviation training, and general aviation activities also shows substantial growth driven by [xx].

Aviation Industry in Japan Product Innovations

Recent product innovations in the Japanese aviation sector include the development of advanced materials for aircraft manufacturing, which improve efficiency and fuel economy. Furthermore, the integration of innovative technologies such as advanced flight control systems and predictive maintenance are enhancing safety and operational efficiency, leading to the development of unique selling propositions (USPs) for various products and services.

Propelling Factors for Aviation Industry in Japan Growth

Several factors propel the growth of the Japanese aviation industry. Technological advancements in aircraft manufacturing, coupled with increased investment in airport infrastructure and expanding air travel demand, significantly contribute to its growth. Furthermore, favorable government policies aimed at fostering growth within the industry act as catalysts for expansion.

Obstacles in the Aviation Industry in Japan Market

The Japanese aviation industry faces challenges like stringent regulations leading to increased operational costs and environmental concerns that demand investment in sustainable practices. Supply chain vulnerabilities, exacerbated by global events, are also a major factor, as well as intense competition among various players. These constraints pose significant hurdles to sustainable growth.

Future Opportunities in Aviation Industry in Japan

The Japanese aviation industry presents promising opportunities. Growth in low-cost carriers, the increasing adoption of advanced air mobility (AAM) solutions, and the expansion of regional air connectivity will create new market segments and growth avenues. Further innovation in sustainable aviation fuels and technologies will present new opportunities for growth and investment in the coming years.

Major Players in the Aviation Industry in Japan Ecosystem

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Bombardier Inc

- ATR

- Kawasaki Heavy Industries Ltd

Key Developments in Aviation Industry in Japan Industry

- November 2022: Boeing secured a contract to deliver two additional KC-46A Pegasus tankers to the Japan Air Self-Defense Force (JASDF), increasing Japan's contracted total to six. This development strengthens Boeing's position in the Japanese defense aviation market.

- November 2022: Bell Textron Inc. signed an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF), showcasing the global demand for Bell's products.

- December 2022: The US Army awarded Textron Inc.'s Bell unit a contract to supply next-generation helicopters, indicating the confidence in Bell's technology and its impact on future helicopter procurements.

Strategic Aviation Industry in Japan Market Forecast

The Japanese aviation industry is poised for robust growth, driven by rising passenger numbers, increasing investments in infrastructure, and ongoing technological advancements. The market's expansion will be propelled by sustainable aviation fuel adoption and the development of new air routes. The predicted growth trajectory indicates a significant increase in market size, creating lucrative opportunities for industry players over the forecast period.

Aviation Industry in Japan Segmentation

-

1. Aircraft Type

-

1.1. Commercial Aviation

-

1.1.1. By Sub Aircraft Type

- 1.1.1.1. Freighter Aircraft

-

1.1.1.2. Passenger Aircraft

-

1.1.1.2.1. By Body Type

- 1.1.1.2.1.1. Narrowbody Aircraft

- 1.1.1.2.1.2. Widebody Aircraft

-

1.1.1.2.1. By Body Type

-

1.1.1. By Sub Aircraft Type

-

1.2. General Aviation

-

1.2.1. Business Jets

- 1.2.1.1. Large Jet

- 1.2.1.2. Light Jet

- 1.2.1.3. Mid-Size Jet

- 1.2.2. Piston Fixed-Wing Aircraft

- 1.2.3. Others

-

1.2.1. Business Jets

-

1.3. Military Aviation

- 1.3.1. Multi-Role Aircraft

- 1.3.2. Training Aircraft

- 1.3.3. Transport Aircraft

-

1.3.4. Rotorcraft

- 1.3.4.1. Multi-Mission Helicopter

- 1.3.4.2. Transport Helicopter

-

1.1. Commercial Aviation

Aviation Industry in Japan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aviation Industry in Japan Regional Market Share

Geographic Coverage of Aviation Industry in Japan

Aviation Industry in Japan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Commercial Aviation

- 5.1.1.1. By Sub Aircraft Type

- 5.1.1.1.1. Freighter Aircraft

- 5.1.1.1.2. Passenger Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1.2.1.1. Narrowbody Aircraft

- 5.1.1.1.2.1.2. Widebody Aircraft

- 5.1.1.1.2.1. By Body Type

- 5.1.1.1. By Sub Aircraft Type

- 5.1.2. General Aviation

- 5.1.2.1. Business Jets

- 5.1.2.1.1. Large Jet

- 5.1.2.1.2. Light Jet

- 5.1.2.1.3. Mid-Size Jet

- 5.1.2.2. Piston Fixed-Wing Aircraft

- 5.1.2.3. Others

- 5.1.2.1. Business Jets

- 5.1.3. Military Aviation

- 5.1.3.1. Multi-Role Aircraft

- 5.1.3.2. Training Aircraft

- 5.1.3.3. Transport Aircraft

- 5.1.3.4. Rotorcraft

- 5.1.3.4.1. Multi-Mission Helicopter

- 5.1.3.4.2. Transport Helicopter

- 5.1.1. Commercial Aviation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. North America Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Commercial Aviation

- 6.1.1.1. By Sub Aircraft Type

- 6.1.1.1.1. Freighter Aircraft

- 6.1.1.1.2. Passenger Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1.2.1.1. Narrowbody Aircraft

- 6.1.1.1.2.1.2. Widebody Aircraft

- 6.1.1.1.2.1. By Body Type

- 6.1.1.1. By Sub Aircraft Type

- 6.1.2. General Aviation

- 6.1.2.1. Business Jets

- 6.1.2.1.1. Large Jet

- 6.1.2.1.2. Light Jet

- 6.1.2.1.3. Mid-Size Jet

- 6.1.2.2. Piston Fixed-Wing Aircraft

- 6.1.2.3. Others

- 6.1.2.1. Business Jets

- 6.1.3. Military Aviation

- 6.1.3.1. Multi-Role Aircraft

- 6.1.3.2. Training Aircraft

- 6.1.3.3. Transport Aircraft

- 6.1.3.4. Rotorcraft

- 6.1.3.4.1. Multi-Mission Helicopter

- 6.1.3.4.2. Transport Helicopter

- 6.1.1. Commercial Aviation

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. South America Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Commercial Aviation

- 7.1.1.1. By Sub Aircraft Type

- 7.1.1.1.1. Freighter Aircraft

- 7.1.1.1.2. Passenger Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1.2.1.1. Narrowbody Aircraft

- 7.1.1.1.2.1.2. Widebody Aircraft

- 7.1.1.1.2.1. By Body Type

- 7.1.1.1. By Sub Aircraft Type

- 7.1.2. General Aviation

- 7.1.2.1. Business Jets

- 7.1.2.1.1. Large Jet

- 7.1.2.1.2. Light Jet

- 7.1.2.1.3. Mid-Size Jet

- 7.1.2.2. Piston Fixed-Wing Aircraft

- 7.1.2.3. Others

- 7.1.2.1. Business Jets

- 7.1.3. Military Aviation

- 7.1.3.1. Multi-Role Aircraft

- 7.1.3.2. Training Aircraft

- 7.1.3.3. Transport Aircraft

- 7.1.3.4. Rotorcraft

- 7.1.3.4.1. Multi-Mission Helicopter

- 7.1.3.4.2. Transport Helicopter

- 7.1.1. Commercial Aviation

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Europe Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Commercial Aviation

- 8.1.1.1. By Sub Aircraft Type

- 8.1.1.1.1. Freighter Aircraft

- 8.1.1.1.2. Passenger Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1.2.1.1. Narrowbody Aircraft

- 8.1.1.1.2.1.2. Widebody Aircraft

- 8.1.1.1.2.1. By Body Type

- 8.1.1.1. By Sub Aircraft Type

- 8.1.2. General Aviation

- 8.1.2.1. Business Jets

- 8.1.2.1.1. Large Jet

- 8.1.2.1.2. Light Jet

- 8.1.2.1.3. Mid-Size Jet

- 8.1.2.2. Piston Fixed-Wing Aircraft

- 8.1.2.3. Others

- 8.1.2.1. Business Jets

- 8.1.3. Military Aviation

- 8.1.3.1. Multi-Role Aircraft

- 8.1.3.2. Training Aircraft

- 8.1.3.3. Transport Aircraft

- 8.1.3.4. Rotorcraft

- 8.1.3.4.1. Multi-Mission Helicopter

- 8.1.3.4.2. Transport Helicopter

- 8.1.1. Commercial Aviation

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Middle East & Africa Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Commercial Aviation

- 9.1.1.1. By Sub Aircraft Type

- 9.1.1.1.1. Freighter Aircraft

- 9.1.1.1.2. Passenger Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1.2.1.1. Narrowbody Aircraft

- 9.1.1.1.2.1.2. Widebody Aircraft

- 9.1.1.1.2.1. By Body Type

- 9.1.1.1. By Sub Aircraft Type

- 9.1.2. General Aviation

- 9.1.2.1. Business Jets

- 9.1.2.1.1. Large Jet

- 9.1.2.1.2. Light Jet

- 9.1.2.1.3. Mid-Size Jet

- 9.1.2.2. Piston Fixed-Wing Aircraft

- 9.1.2.3. Others

- 9.1.2.1. Business Jets

- 9.1.3. Military Aviation

- 9.1.3.1. Multi-Role Aircraft

- 9.1.3.2. Training Aircraft

- 9.1.3.3. Transport Aircraft

- 9.1.3.4. Rotorcraft

- 9.1.3.4.1. Multi-Mission Helicopter

- 9.1.3.4.2. Transport Helicopter

- 9.1.1. Commercial Aviation

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Asia Pacific Aviation Industry in Japan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Commercial Aviation

- 10.1.1.1. By Sub Aircraft Type

- 10.1.1.1.1. Freighter Aircraft

- 10.1.1.1.2. Passenger Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1.2.1.1. Narrowbody Aircraft

- 10.1.1.1.2.1.2. Widebody Aircraft

- 10.1.1.1.2.1. By Body Type

- 10.1.1.1. By Sub Aircraft Type

- 10.1.2. General Aviation

- 10.1.2.1. Business Jets

- 10.1.2.1.1. Large Jet

- 10.1.2.1.2. Light Jet

- 10.1.2.1.3. Mid-Size Jet

- 10.1.2.2. Piston Fixed-Wing Aircraft

- 10.1.2.3. Others

- 10.1.2.1. Business Jets

- 10.1.3. Military Aviation

- 10.1.3.1. Multi-Role Aircraft

- 10.1.3.2. Training Aircraft

- 10.1.3.3. Transport Aircraft

- 10.1.3.4. Rotorcraft

- 10.1.3.4.1. Multi-Mission Helicopter

- 10.1.3.4.2. Transport Helicopter

- 10.1.1. Commercial Aviation

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Airbus SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Boeing Compan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bombardier Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ATR

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kawasaki Heavy Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Aviation Industry in Japan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 3: North America Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 4: North America Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 7: South America Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 8: South America Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 11: Europe Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 12: Europe Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 15: Middle East & Africa Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 16: Middle East & Africa Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aviation Industry in Japan Revenue (billion), by Aircraft Type 2025 & 2033

- Figure 19: Asia Pacific Aviation Industry in Japan Revenue Share (%), by Aircraft Type 2025 & 2033

- Figure 20: Asia Pacific Aviation Industry in Japan Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Aviation Industry in Japan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 2: Global Aviation Industry in Japan Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 4: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 9: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 14: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 25: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Aviation Industry in Japan Revenue billion Forecast, by Aircraft Type 2020 & 2033

- Table 33: Global Aviation Industry in Japan Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Aviation Industry in Japan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation Industry in Japan?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Aviation Industry in Japan?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Bombardier Inc, ATR, Kawasaki Heavy Industries Ltd.

3. What are the main segments of the Aviation Industry in Japan?

The market segments include Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

December 2022: The US Army was awarded a contract to supply next-generation helicopters to Textron Inc.'s Bell unit. The Army`s "Future Vertical Lift" competition aimed at finding a replacement as the Army looks to retire more than 2,000 medium-class UH-60 Black Hawk utility helicopters.November 2022: Boeing was awarded a contract to deliver two additional KC-46A Pegasus tankers to the Japan Air Self-Defense Force (JASDF), bringing the total on contract for Japan to six.November 2022: Bell Textron Inc., a company of Textron Inc., forged an agreement to sell 10 Bell 505 helicopters to the Royal Jordanian Air Force (RJAF) at the Forces Exhibition and Conference. Combat Air Force (SOFEX) in Aqaba, Jordan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation Industry in Japan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation Industry in Japan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation Industry in Japan?

To stay informed about further developments, trends, and reports in the Aviation Industry in Japan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence