Key Insights

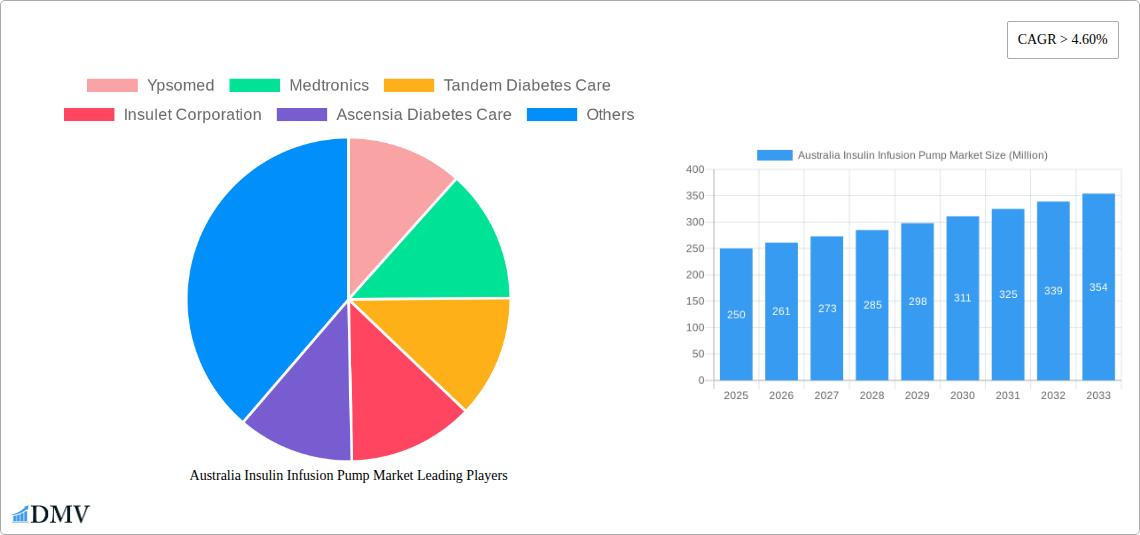

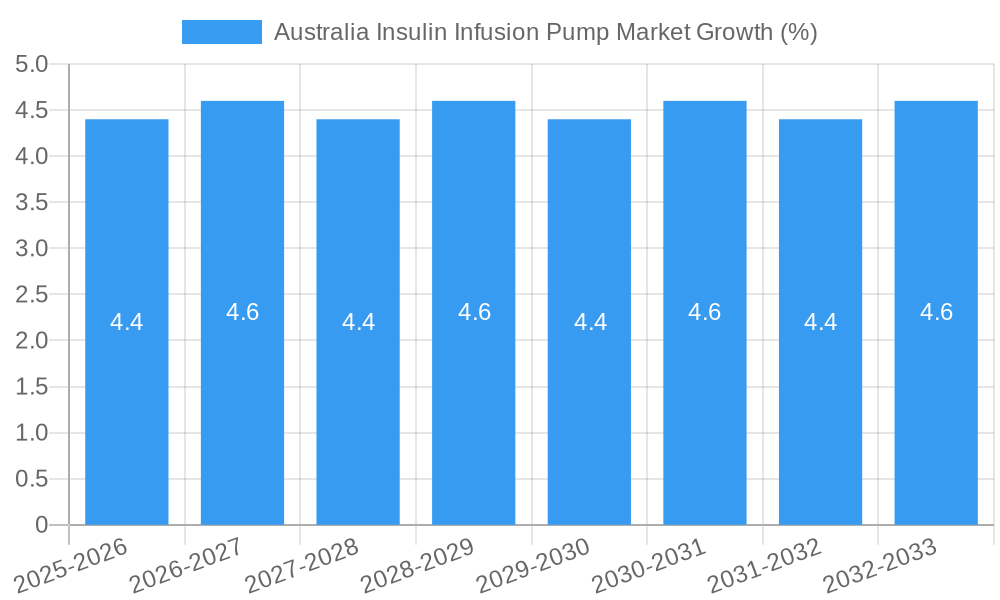

The Australian insulin infusion pump market is poised for significant growth, driven by an increasing prevalence of diabetes and a growing adoption of advanced diabetes management technologies. With a substantial market size and a projected Compound Annual Growth Rate (CAGR) exceeding 4.60%, the market is expected to witness robust expansion throughout the forecast period of 2025-2033. This upward trajectory is primarily fueled by the increasing demand for continuous glucose monitoring (CGM) integration and automated insulin delivery systems, offering enhanced convenience and improved glycemic control for individuals with diabetes. The rising awareness among healthcare professionals and patients about the benefits of insulin pumps over traditional injection methods, such as reduced risk of hypoglycemia and improved quality of life, further underpins this market expansion. Furthermore, supportive government initiatives and reimbursement policies aimed at improving diabetes care accessibility contribute to the positive market outlook.

The market is segmented into key component types, including insulin pump devices, infusion sets, and reservoirs, with insulin pump devices expected to dominate due to continuous innovation in miniaturization, connectivity, and user-friendliness. End-user segments like hospitals/clinics and home care are both vital, with home care settings showing substantial growth as more individuals opt for self-management of their diabetes. Major global players such as Medtronics, Tandem Diabetes Care, and Ypsomed are actively investing in research and development, introducing next-generation pumps with enhanced features and improved patient outcomes. Despite the promising growth, potential restraints include the high initial cost of insulin pumps and the need for comprehensive patient training and ongoing support. However, ongoing technological advancements and increasing health consciousness are expected to mitigate these challenges, solidifying the Australian insulin infusion pump market's strong growth potential.

This in-depth report provides a definitive analysis of the Australia Insulin Infusion Pump Market, offering critical insights for stakeholders navigating this dynamic sector. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report delves into market composition, industry evolution, leading segments, product innovations, growth drivers, challenges, and future opportunities. Leverage our expert analysis to understand insulin pump adoption in Australia, diabetes management technology Australia, and the NDSS subsidy impact on insulin pump accessibility.

Australia Insulin Infusion Pump Market Market Composition & Trends

The Australia Insulin Infusion Pump Market is characterized by a moderate level of concentration, with key players like Ypsomed, Medtronics, Tandem Diabetes Care, Insulet Corporation, and Ascensia Diabetes Care dominating market share. Innovation catalysts are primarily driven by technological advancements in miniaturization, connectivity, and user-friendliness, alongside supportive government initiatives. The regulatory landscape is evolving to facilitate broader access to advanced diabetes technologies. Substitute products, such as traditional injection pens, still hold a significant share, but the convenience and improved glycemic control offered by insulin pumps are gradually shifting preferences. End-user profiles are diverse, ranging from individuals managing their diabetes at home to patients within hospital settings seeking precise insulin delivery. Mergers and acquisitions (M&A) activities, while not yet widespread, are anticipated to shape market consolidation and technological integration in the coming years. The market share distribution is heavily influenced by the subsidized insulin pumps Australia schemes.

- Market Concentration: Moderate, with 3-5 major players holding a substantial combined market share.

- Innovation Catalysts: Miniaturization, Bluetooth connectivity for continuous glucose monitoring (CGM) integration, AI-powered predictive algorithms, and enhanced user interface design.

- Regulatory Landscape: Increasingly supportive of novel diabetes technologies, with ongoing review of reimbursement policies.

- Substitute Products: Traditional insulin pens and syringes remain prevalent but are facing increasing competition from pump therapy.

- End-User Profiles: A growing segment of Type 1 and Type 2 diabetes patients seeking advanced glycemic control, healthcare professionals in hospitals and clinics, and homecare providers.

- M&A Activities: Limited, but potential for strategic alliances and acquisitions to gain market access and technological synergy.

Australia Insulin Infusion Pump Market Industry Evolution

The Australia Insulin Infusion Pump Market has witnessed significant evolution, driven by increasing awareness of diabetes management, technological breakthroughs, and crucial government interventions. Over the historical period (2019–2024), the market experienced steady growth as more Australians recognized the benefits of continuous insulin delivery over traditional methods. The adoption rate for insulin pumps has been gradually increasing, fueled by improving device efficacy, enhanced patient comfort, and a growing understanding of their role in reducing long-term diabetes complications. The National Diabetes Services Scheme (NDSS) subsidy has been a pivotal factor in this evolution, making these advanced devices more accessible and affordable.

The forecast period (2025–2033) is poised for accelerated expansion. Technological advancements are at the forefront, with the integration of smart features like automated insulin delivery (AID) systems and real-time data sharing capabilities becoming increasingly standard. These advancements are not only improving glycemic control but also empowering individuals with diabetes to lead more flexible and fulfilling lives. The shift towards personalized medicine and proactive health management further amplifies the demand for sophisticated insulin delivery solutions. Furthermore, the rising prevalence of diabetes in Australia, coupled with an aging population, creates a sustained and growing patient pool requiring advanced diabetes care. The market's trajectory is clearly defined by a commitment to innovative solutions that simplify diabetes management and improve patient outcomes, making the best insulin pumps Australia a key focus for both patients and healthcare providers.

Leading Regions, Countries, or Segments in Australia Insulin Infusion Pump Market

Within the Australia Insulin Infusion Pump Market, the Home Care end-user segment is emerging as the most dominant force, driven by a confluence of factors that prioritize patient convenience, autonomy, and improved quality of life. While Hospitals/Clinics play a crucial role in initial diagnosis and prescription, the majority of insulin pump usage and long-term management occurs within the comfort of patients' homes. This trend is further bolstered by ongoing technological advancements that enhance the user-friendliness and portability of insulin pumps, making them ideal for everyday living. The Insulin Pump Device component type also commands a significant share, as it represents the core technology driving the market.

Several key drivers contribute to the dominance of the Home Care segment and the Insulin Pump Device component:

- Government Subsidies and Reimbursement Policies: The NDSS subsidy for insulin pumps has dramatically increased accessibility for Australians managing diabetes at home. Initiatives like the subsidy for next-generation Omnipod systems directly empower individuals to manage their condition independently. This financial support reduces the out-of-pocket expenses, making pump therapy a viable option for a much larger demographic.

- Technological Advancements for Home Use: Modern insulin pumps are increasingly designed with user-friendliness and discretion in mind. Features such as wireless connectivity for CGM integration Australia, smartphone app control, and longer wear times (like the Omnipod's disposable pods) are specifically tailored to facilitate seamless management outside of clinical settings. The focus is on enabling patients to live an active lifestyle without constant medical supervision.

- Improved Glycemic Control and Reduced Complications: Patients using insulin pumps at home often achieve better glycemic control compared to those relying on multiple daily injections. This leads to a reduced incidence of diabetes-related complications, such as hypoglycemia and hyperglycemia, which in turn reduces the need for frequent hospital visits and reinforces the preference for home-based management.

- Growing Awareness and Patient Empowerment: Increased patient education and advocacy have empowered individuals to take a more proactive role in their diabetes management. They are actively seeking out technologies like insulin pumps that offer greater control and flexibility, leading to a higher demand for devices suitable for home use.

- Product Innovation in Pump Devices: The continuous innovation in the insulin pump device itself, focusing on smaller form factors, improved battery life, and enhanced safety features, directly fuels its market dominance. Companies are investing heavily in R&D to create devices that are more intuitive and less intrusive for daily wear.

Australia Insulin Infusion Pump Market Product Innovations

Product innovations in the Australia Insulin Infusion Pump Market are revolutionizing diabetes management. Manufacturers are focusing on developing smarter insulin pumps Australia with advanced algorithms for automated insulin delivery, integrating seamlessly with continuous glucose monitors (CGMs) for closed-loop systems. Examples include waterproof, discreet pods like the Omnipod DASH, controlled via smartphone apps, offering unparalleled convenience. Enhanced battery life, smaller form factors, and improved safety features are also key areas of development, ensuring diabetes tech Australia meets the evolving needs of users seeking better glycemic control and an improved quality of life.

Propelling Factors for Australia Insulin Infusion Pump Market Growth

The Australia Insulin Infusion Pump Market is experiencing robust growth fueled by several key factors. A primary driver is the increasing prevalence of diabetes, necessitating advanced treatment options. Government initiatives, such as the NDSS subsidy for insulin pumps, play a crucial role by enhancing affordability and accessibility for a wider patient population, particularly for Type 1 diabetes. Technological advancements in smart insulin pumps Australia, including improved connectivity, miniaturization, and automated insulin delivery (AID) systems, are enhancing user experience and glycemic control. Growing patient awareness and a preference for convenient, proactive diabetes management solutions further propel market expansion.

Obstacles in the Australia Insulin Infusion Pump Market Market

Despite significant growth, the Australia Insulin Infusion Pump Market faces several obstacles. High upfront costs for some advanced pump systems, even with subsidies, can still be a barrier for a segment of the population. Stringent regulatory approval processes for new devices can delay market entry and innovation. The need for ongoing training and education for both patients and healthcare providers to effectively utilize complex insulin pump technology presents a challenge. Furthermore, potential supply chain disruptions for essential components and disposables can impact availability. Insurance coverage limitations for certain devices or ongoing supply costs can also hinder widespread adoption.

Future Opportunities in Australia Insulin Infusion Pump Market

The future of the Australia Insulin Infusion Pump Market is ripe with opportunities. The expanding integration with CGM technology Australia to create sophisticated AID systems presents a significant avenue for growth, offering near-automatic glycemic management. The development of more affordable and user-friendly pump solutions could unlock a larger patient demographic. Increased adoption of pumps for Type 2 diabetes management, beyond Type 1, represents a substantial untapped market. Furthermore, advancements in telehealth and remote patient monitoring will enhance the support and accessibility of insulin pump therapy, creating new service opportunities within the diabetes management solutions Australia landscape.

Major Players in the Australia Insulin Infusion Pump Market Ecosystem

- Ypsomed

- Medtronics

- Tandem Diabetes Care

- Insulet Corporation

- Ascensia Diabetes Care

Key Developments in Australia Insulin Infusion Pump Market Industry

- November 2022: The Albanese Government is subsidizing the next generation of Omnipod insulin pumps for the 130,000 Australians living with type 1 diabetes. The Government is subsidizing the disposable pods through the National Diabetes Services Scheme (NDSS) at community pharmacies. The Omnipod DASH Insulin Management system includes a waterproof adhesive pod that delivers insulin to the patient alongside a touchscreen device to program and control the pod.

- July 2022: The Albanese Government is delivering on its election commitment to give all 130,000 Australians with Type 1 diabetes access to subsidized CGM products under the National Diabetes Services Scheme (NDSS). This is an AUD 273.1 (USD 177.47) million investment over four years to support people living with Type 1 diabetes, which includes expanded access to the Insulin Pump Program.

Strategic Australia Insulin Infusion Pump Market Market Forecast

- November 2022: The Albanese Government is subsidizing the next generation of Omnipod insulin pumps for the 130,000 Australians living with type 1 diabetes. The Government is subsidizing the disposable pods through the National Diabetes Services Scheme (NDSS) at community pharmacies. The Omnipod DASH Insulin Management system includes a waterproof adhesive pod that delivers insulin to the patient alongside a touchscreen device to program and control the pod.

- July 2022: The Albanese Government is delivering on its election commitment to give all 130,000 Australians with Type 1 diabetes access to subsidized CGM products under the National Diabetes Services Scheme (NDSS). This is an AUD 273.1 (USD 177.47) million investment over four years to support people living with Type 1 diabetes, which includes expanded access to the Insulin Pump Program.

Strategic Australia Insulin Infusion Pump Market Market Forecast

The strategic forecast for the Australia Insulin Infusion Pump Market indicates substantial growth propelled by an aging population, increasing diabetes incidence, and a highly supportive government reimbursement framework like the NDSS. The continuous advancement in AID systems and wearable diabetes technology, alongside greater patient demand for enhanced glycemic control and lifestyle flexibility, will be key growth catalysts. Market expansion will also be driven by increased penetration into Type 2 diabetes management and the ongoing innovation in device features, such as miniaturization and improved connectivity, making diabetes care Australia more accessible and effective.

Australia Insulin Infusion Pump Market Segmentation

-

1. Component Type

- 1.1. Insulin Pump Device

- 1.2. Infusion Set

- 1.3. Reservoir

-

2. End Users

- 2.1. Hospitals/Clinics

- 2.2. Home Care

- 2.3. Others

Australia Insulin Infusion Pump Market Segmentation By Geography

- 1. Australia

Australia Insulin Infusion Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing prevalence of Chronic Diseases; Recent Technological Innovations (at the component level) and the Fast-Tracking of Regulatory Approvals in the Field of Wearables; Growth in Demand for Home Care Monitoring

- 3.3. Market Restrains

- 3.3.1. User Readiness and Unresponsiveness of Some Monitoring Devices; Competitive Pricing Pressure and Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Insulin Pump is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Insulin Infusion Pump Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Insulin Pump Device

- 5.1.2. Infusion Set

- 5.1.3. Reservoir

- 5.2. Market Analysis, Insights and Forecast - by End Users

- 5.2.1. Hospitals/Clinics

- 5.2.2. Home Care

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ypsomed

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tandem Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Insulet Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascensia Diabetes Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ypsomed

List of Figures

- Figure 1: Australia Insulin Infusion Pump Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Insulin Infusion Pump Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Component Type 2019 & 2032

- Table 5: Australia Insulin Infusion Pump Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 6: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by End Users 2019 & 2032

- Table 7: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Component Type 2019 & 2032

- Table 12: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Component Type 2019 & 2032

- Table 13: Australia Insulin Infusion Pump Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 14: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by End Users 2019 & 2032

- Table 15: Australia Insulin Infusion Pump Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Insulin Infusion Pump Market?

The projected CAGR is approximately > 4.60%.

2. Which companies are prominent players in the Australia Insulin Infusion Pump Market?

Key companies in the market include Ypsomed, Medtronics, Tandem Diabetes Care, Insulet Corporation, Ascensia Diabetes Care.

3. What are the main segments of the Australia Insulin Infusion Pump Market?

The market segments include Component Type, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing prevalence of Chronic Diseases; Recent Technological Innovations (at the component level) and the Fast-Tracking of Regulatory Approvals in the Field of Wearables; Growth in Demand for Home Care Monitoring.

6. What are the notable trends driving market growth?

Insulin Pump is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

User Readiness and Unresponsiveness of Some Monitoring Devices; Competitive Pricing Pressure and Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: The Albanese Government is subsidizing the next generation of Omnipod insulin pumps for the 130,000 Australians living with type 1 diabetes. The Government is subsidizing the disposable pods through the National Diabetes Services Scheme (NDSS) at community pharmacies. The Omnipod DASH Insulin Management system includes a waterproof adhesive pod that delivers insulin to the patient alongside a touchscreen device to program and control the pod.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Insulin Infusion Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Insulin Infusion Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Insulin Infusion Pump Market?

To stay informed about further developments, trends, and reports in the Australia Insulin Infusion Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence