Key Insights

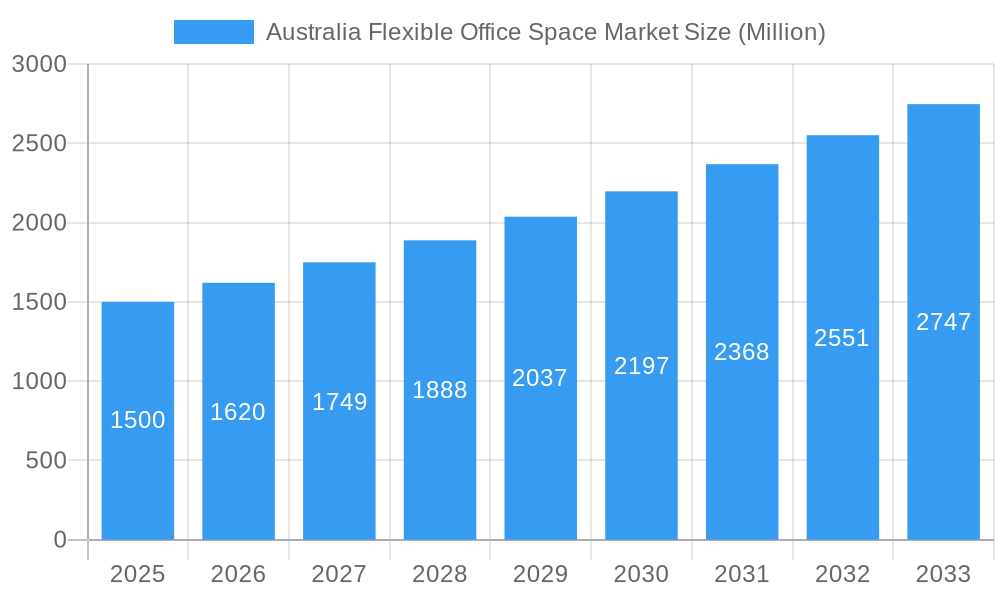

The Australian flexible office space market is experiencing robust growth, driven by a shift towards agile working models and increasing demand from diverse sectors. The market, valued at approximately $X million (estimated based on provided CAGR and market size data) in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% through 2033. This expansion is fueled by several key factors. The rise of remote work and hybrid work models has significantly boosted the demand for flexible workspace solutions, including private offices, co-working spaces, and virtual offices. Furthermore, the IT and Telecommunications, Media and Entertainment, and Retail and Consumer Goods sectors are major contributors to this market's growth, as businesses seek cost-effective and adaptable work environments. Significant expansion is observed in major Australian cities like Sydney, Melbourne, and Brisbane, reflecting the concentration of businesses and a thriving startup ecosystem. The presence of established players like Servcorp, WeWork, and IWG PLC, alongside local providers such as Flexible Workspace Australia and Hub Australia, fosters competition and drives innovation within the sector. This competitive landscape ensures a diverse range of options for businesses of all sizes, catering to various budgetary needs and operational preferences.

Australia Flexible Office Space Market Market Size (In Billion)

However, challenges remain. While the market's growth is positive, economic fluctuations and potential changes in government regulations regarding commercial real estate could introduce uncertainties. The increasing availability of flexible office spaces may also lead to intensified competition, potentially impacting pricing and profitability for some providers. Nevertheless, the long-term outlook for the Australian flexible office space market remains optimistic, driven by evolving work cultures and the sustained demand for adaptable and efficient workspaces. The market's segmentation by type of space (private, co-working, virtual), end-user industry, and city provides valuable insights for investors and stakeholders seeking to capitalize on this burgeoning sector. Further analysis into specific sub-segments would reveal even greater opportunities within this dynamic market.

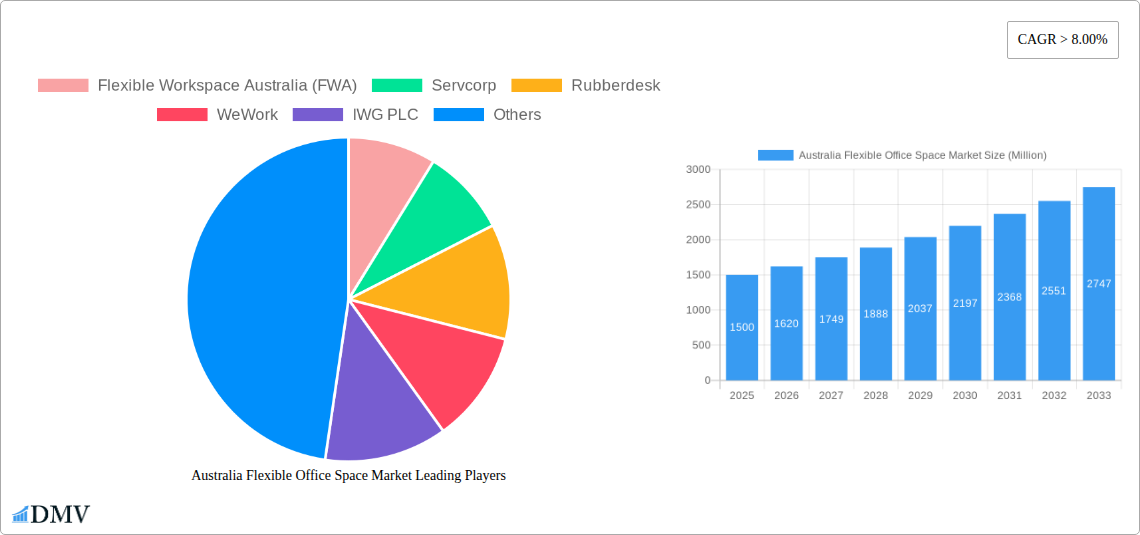

Australia Flexible Office Space Market Company Market Share

Australia Flexible Office Space Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Australia flexible office space market, projecting significant growth from 2025 to 2033. It delves into market dynamics, competitive landscapes, and future trends, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers key segments including private offices, co-working spaces, and virtual offices, across major cities like Sydney, Melbourne, Brisbane, and Perth, and analyzes leading players such as WeWork, IWG PLC, and Servcorp. The comprehensive study period from 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, offers a robust understanding of historical performance and future projections. The market size is projected to reach xx Million by 2033.

Australia Flexible Office Space Market Composition & Trends

This section dissects the Australian flexible office space market's structure, highlighting key trends shaping its evolution. We analyze market concentration, revealing the market share distribution among major players like WeWork, IWG PLC, and Servcorp, and identify emerging players impacting the competitive landscape. The report also examines the influence of innovation catalysts, such as technological advancements in workspace design and management software, and assesses the regulatory landscape's impact on market growth. Furthermore, we explore the prevalence of substitute products and their competitive threats and profile end-user industries, including IT & Telecommunications, Media & Entertainment, and Retail & Consumer Goods. Finally, we analyze mergers and acquisitions (M&A) activity in the sector, examining deal values and their strategic implications.

- Market Share Distribution (2025): WeWork (xx%), IWG PLC (xx%), Servcorp (xx%), Others (xx%).

- M&A Deal Value (2019-2024): xx Million

- Key End-User Industries: IT & Telecommunications, Media & Entertainment, Retail & Consumer Goods.

- Innovation Catalysts: Smart office technology, flexible lease terms, co-working space design innovations.

Australia Flexible Office Space Market Industry Evolution

This section presents a comprehensive analysis of the Australian flexible office space market's growth trajectory from 2019 to 2033. We explore the market's historical performance, examining growth rates and key drivers during the historical period (2019-2024). The report then analyzes the market's projected growth during the forecast period (2025-2033), considering various factors such as technological advancements (e.g., adoption of workspace management platforms), evolving consumer preferences (e.g., demand for hybrid work models), and macroeconomic conditions. We provide detailed data points on growth rates, adoption metrics for new technologies, and shifts in end-user demand. The analysis also includes insights into the competitive landscape, including the entry of new players and the strategic responses of established companies.

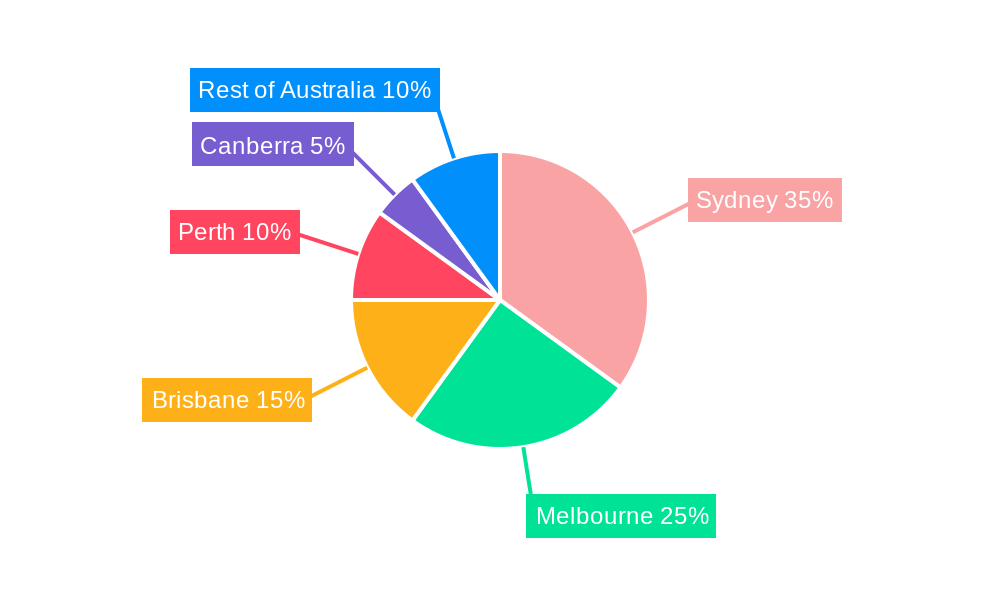

Leading Regions, Countries, or Segments in Australia Flexible Office Space Market

This section identifies the leading regions, countries, and segments within the Australian flexible office space market.

By City:

- Sydney: Dominates due to its strong economy, high concentration of businesses, and large talent pool. Investment in infrastructure and supportive government policies further enhance its position.

- Melbourne: A strong second position, driven by similar factors to Sydney, although potentially with slightly lower growth rates.

- Brisbane, Perth, Canberra: Exhibit significant but less rapid growth compared to Sydney and Melbourne.

By Type:

- Co-working Spaces: The largest segment, fueled by demand from freelancers, startups, and small businesses seeking flexible and cost-effective solutions.

- Private Offices: Attracts larger enterprises seeking more privacy and control.

- Virtual Offices: Provides cost-effective solutions for businesses with remote teams.

By End User:

- IT & Telecommunications: This segment displays strong growth, as technology companies adapt to flexible work models.

- Media & Entertainment: Significant adoption, driven by the need for collaborative workspaces.

- Retail & Consumer Goods: Increasing adoption rates due to flexible work policies in many companies.

Australia Flexible Office Space Market Product Innovations

This report explores the latest product innovations shaping the Australian flexible office space market. This includes advancements in workspace design promoting collaboration and productivity, integration of smart building technologies enhancing efficiency and sustainability, and the development of innovative workspace management software streamlining operations and enhancing user experiences. Unique selling propositions (USPs) are identified, differentiating offerings and catering to diverse client needs. The adoption rate of these innovative solutions is quantified by analyzing market penetration and their impact on market growth.

Propelling Factors for Australia Flexible Office Space Market Growth

The growth of the Australian flexible office space market is driven by several key factors. The rising adoption of hybrid and remote work models is a major catalyst, as companies seek to optimize their real estate costs and enhance employee satisfaction. Technological advancements, such as smart office technology and booking systems, contribute to improved efficiency and convenience. Furthermore, supportive government policies and initiatives promoting flexible work arrangements accelerate market growth. The strong Australian economy, with a thriving entrepreneurial ecosystem, also plays a significant role.

Obstacles in the Australia Flexible Office Space Market

While the Australian flexible office space market presents significant opportunities, certain challenges hinder its growth. Competition among providers can lead to price wars and reduced profitability. Supply chain disruptions, particularly in construction and fit-out, can delay project timelines and increase costs. Regulatory hurdles, such as zoning regulations and building codes, can create barriers to entry and limit expansion. Economic downturns or uncertain economic conditions can also affect demand.

Future Opportunities in Australia Flexible Office Space Market

The future of the Australian flexible office space market holds promising opportunities. Expansion into regional areas and underserved markets can unlock significant growth potential. The integration of advanced technologies, like AI-powered workspace management systems and automation, will improve efficiency and user experience. The increasing focus on sustainability and environmentally friendly practices presents a further opportunity for differentiation and growth. Catering to evolving consumer preferences for flexible and personalized workspace solutions will also drive innovation and expansion.

Major Players in the Australia Flexible Office Space Market Ecosystem

- Flexible Workspace Australia (FWA)

- Servcorp

- Rubberdesk

- WeWork

- IWG PLC

- interoffice Australia

- DeskSpace

- JustCo

- Hub Australia

- workspace 365 Australia

Key Developments in Australia Flexible Office Space Market Industry

- 2022 Q4: WeWork announces expansion into regional markets.

- 2023 Q1: Servcorp launches a new flexible workspace management platform.

- 2023 Q3: IWG PLC acquires a smaller competitor in Sydney.

- 2024 Q2: Significant government investment in smart city initiatives.

Strategic Australia Flexible Office Space Market Forecast

The Australian flexible office space market is poised for sustained growth over the forecast period (2025-2033). Technological advancements, evolving workplace trends, and government support will drive this expansion. Opportunities exist in expanding into regional markets, offering specialized workspace solutions, and embracing sustainable practices. The market's future is bright, presenting significant investment opportunities for stakeholders.

Australia Flexible Office Space Market Segmentation

-

1. Type

- 1.1. Private Offices

- 1.2. Co-working Spaces

- 1.3. Virtual Offices

-

2. End User

- 2.1. IT and Telecommunications

- 2.2. Media and Entertainment

- 2.3. Retail and Consumer Goods

- 2.4. Other End-Users

-

3. City

- 3.1. Sydney

- 3.2. Melbourne

- 3.3. Brisbane

- 3.4. Perth

- 3.5. Canberra

- 3.6. Rest of Australia

Australia Flexible Office Space Market Segmentation By Geography

- 1. Australia

Australia Flexible Office Space Market Regional Market Share

Geographic Coverage of Australia Flexible Office Space Market

Australia Flexible Office Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Demand for Larger Spaces driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Flexible Office Space Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Private Offices

- 5.1.2. Co-working Spaces

- 5.1.3. Virtual Offices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunications

- 5.2.2. Media and Entertainment

- 5.2.3. Retail and Consumer Goods

- 5.2.4. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by City

- 5.3.1. Sydney

- 5.3.2. Melbourne

- 5.3.3. Brisbane

- 5.3.4. Perth

- 5.3.5. Canberra

- 5.3.6. Rest of Australia

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Flexible Workspace Australia (FWA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Servcorp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rubberdesk

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WeWork

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IWG PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 interoffice Australia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DeskSpace

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JustCo**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hub Australia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 workspace 365 Australia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Flexible Workspace Australia (FWA)

List of Figures

- Figure 1: Australia Flexible Office Space Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Flexible Office Space Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Flexible Office Space Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Australia Flexible Office Space Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Australia Flexible Office Space Market Revenue undefined Forecast, by City 2020 & 2033

- Table 4: Australia Flexible Office Space Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Australia Flexible Office Space Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Australia Flexible Office Space Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Australia Flexible Office Space Market Revenue undefined Forecast, by City 2020 & 2033

- Table 8: Australia Flexible Office Space Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Flexible Office Space Market?

The projected CAGR is approximately 7.84%.

2. Which companies are prominent players in the Australia Flexible Office Space Market?

Key companies in the market include Flexible Workspace Australia (FWA), Servcorp, Rubberdesk, WeWork, IWG PLC, interoffice Australia, DeskSpace, JustCo**List Not Exhaustive, Hub Australia, workspace 365 Australia.

3. What are the main segments of the Australia Flexible Office Space Market?

The market segments include Type, End User, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Demand for Larger Spaces driving the market.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Flexible Office Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Flexible Office Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Flexible Office Space Market?

To stay informed about further developments, trends, and reports in the Australia Flexible Office Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence