Key Insights

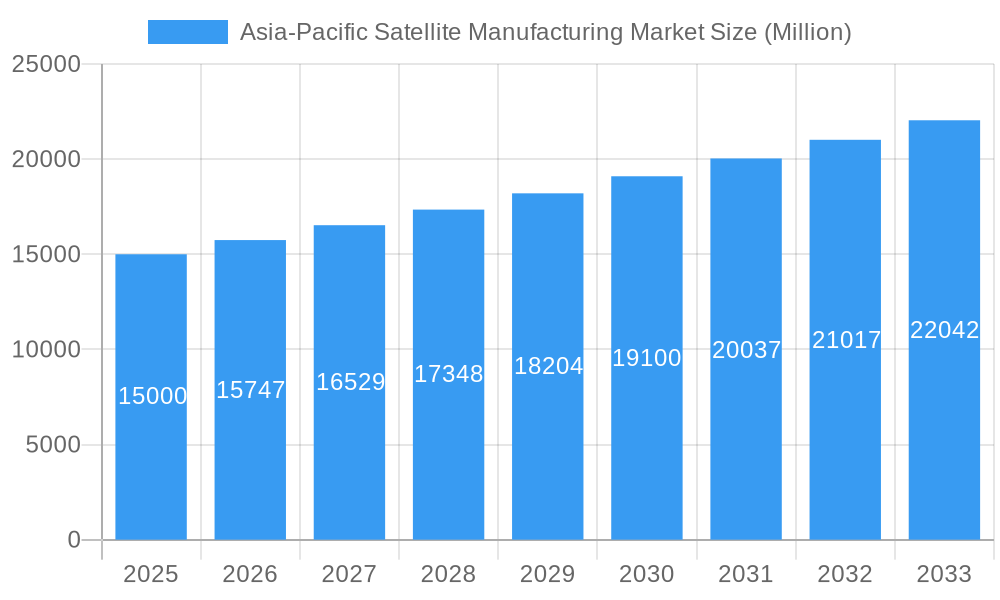

The Asia-Pacific satellite manufacturing market is projected for substantial expansion, driven by escalating demand for satellite-based communication, navigation, and earth observation services. A compound annual growth rate (CAGR) of 31% from 2025 to 2033 underscores this robust trajectory. Key growth catalysts include significant government investment in national space programs, particularly in China, India, and Japan, alongside the vibrant commercial space sector and the widespread adoption of small satellites for varied applications. The market segmentation includes satellite mass, orbit class, end-user, satellite subsystem, propulsion technology, and country. Notably, the small satellite segment (<100kg) is experiencing accelerated growth, supporting the proliferation of satellite constellations for internet connectivity and Earth observation. The adoption of electric propulsion technology further bolsters market expansion by offering cost-effective and efficient satellite operations. By 2033, the market size is estimated at $3.79 billion, indicating a significant economic value within the region. Intense competition exists among established manufacturers like Mitsubishi Heavy Industries and CASC, and emerging players such as MinoSpace Technology.

Asia-Pacific Satellite Manufacturing Market Market Size (In Billion)

Continued growth in the Asia-Pacific satellite manufacturing market will be propelled by advancements in technologies such as sophisticated imaging sensors and miniaturized electronics, enhancing satellite capabilities and reducing manufacturing costs. Public-private collaborations are fostering innovation and stimulating sector investment. Despite inherent challenges, including high development and launch costs, regulatory complexities, and potential supply chain disruptions, the long-term outlook for the Asia-Pacific satellite manufacturing market remains optimistic. This positive outlook is underpinned by increasing demand for advanced satellite technologies and services, with significant growth potential anticipated across all segments, including emerging applications like IoT connectivity and space-based solar power.

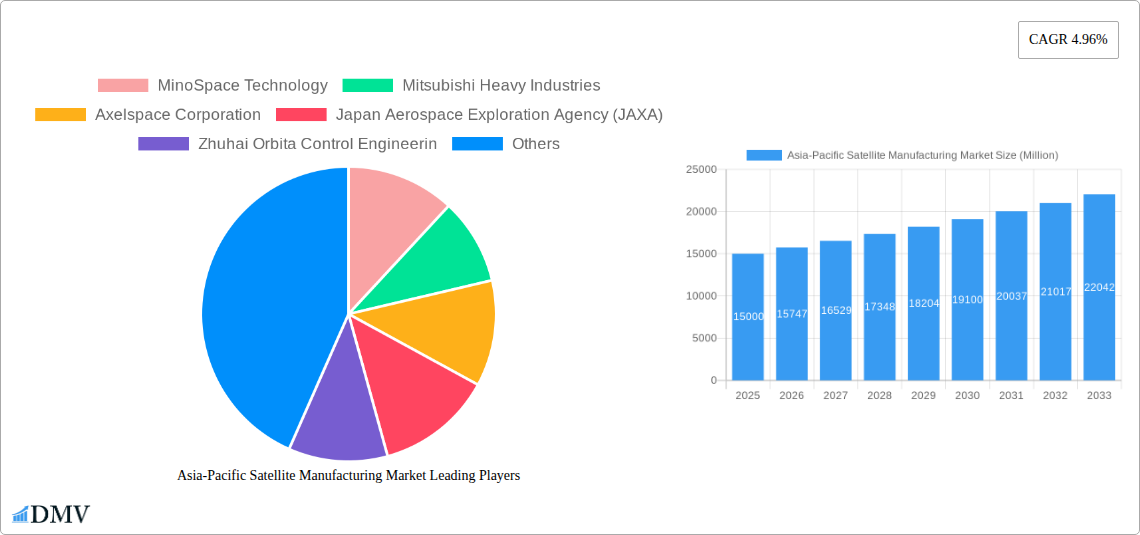

Asia-Pacific Satellite Manufacturing Market Company Market Share

Asia-Pacific Satellite Manufacturing Market Market Composition & Trends

This comprehensive report delves into the dynamic Asia-Pacific satellite manufacturing market, providing a detailed analysis of its composition and key trends from 2019 to 2033. The study period (2019-2024) provides a historical perspective, while the forecast period (2025-2033), with a base year of 2025 and estimated year of 2025, projects future growth. We examine market concentration, revealing the market share distribution among key players like MinoSpace Technology, Maxar Technologies Inc, and CASC. The report also assesses the impact of innovation, including advancements in propulsion technology (electric, gas-based, liquid fuel) and satellite subsystems (bus & subsystems, solar arrays, structures), on market dynamics. Furthermore, it analyzes the regulatory landscape across various countries (Australia, China, India, Japan, New Zealand, Singapore, South Korea), considering its influence on market expansion. The competitive landscape is scrutinized through an examination of M&A activities, highlighting significant deals like Maxar Technologies' acquisition and their impact on market consolidation. Substitute products and their potential market disruption are also considered. Finally, the report profiles end-users across commercial, military & government, and other sectors, providing insights into their individual needs and market influence.

- Market Concentration: Analysis of market share distribution among major players. XX% of the market is controlled by the top 5 players in 2025.

- M&A Activity: Detailed examination of significant mergers and acquisitions, including deal values (e.g., Maxar Technologies' USD 6.4 Billion acquisition).

- Regulatory Landscape: Country-specific regulatory analysis impacting market access and growth.

- Substitute Products: Assessment of potential threats from alternative technologies.

- End-User Profiles: Segmentation and analysis of demand patterns across different end-user segments.

Asia-Pacific Satellite Manufacturing Market Industry Evolution

The Asia-Pacific satellite manufacturing market is experiencing significant transformation fueled by technological advancements and evolving consumer demands. This report charts the market's growth trajectory from 2019 to 2033, analyzing historical performance and forecasting future trends. We examine the rapid adoption of smaller, lighter satellites (below 10kg, 10-100kg) driven by the increasing demand for low Earth orbit (LEO) constellations for applications like internet of things (IoT) and earth observation. The market is also seeing growth in larger satellites (above 1000kg) for geostationary orbit (GEO) applications like communication and broadcasting. Technological advancements such as improved electric propulsion systems, miniaturized satellite busses and enhanced solar array technologies are driving down costs and improving performance, stimulating market expansion. Shifting consumer demands are reflected in an increasing preference for customized, agile satellite solutions tailored to specific missions and end-user requirements. This report analyzes these trends, providing specific data points on growth rates (e.g., CAGR of xx% for LEO segment during 2025-2033) and adoption metrics (e.g., increased number of deployed LEO satellites annually). The influence of government initiatives and investments promoting space exploration and commercialization significantly impacts growth projections.

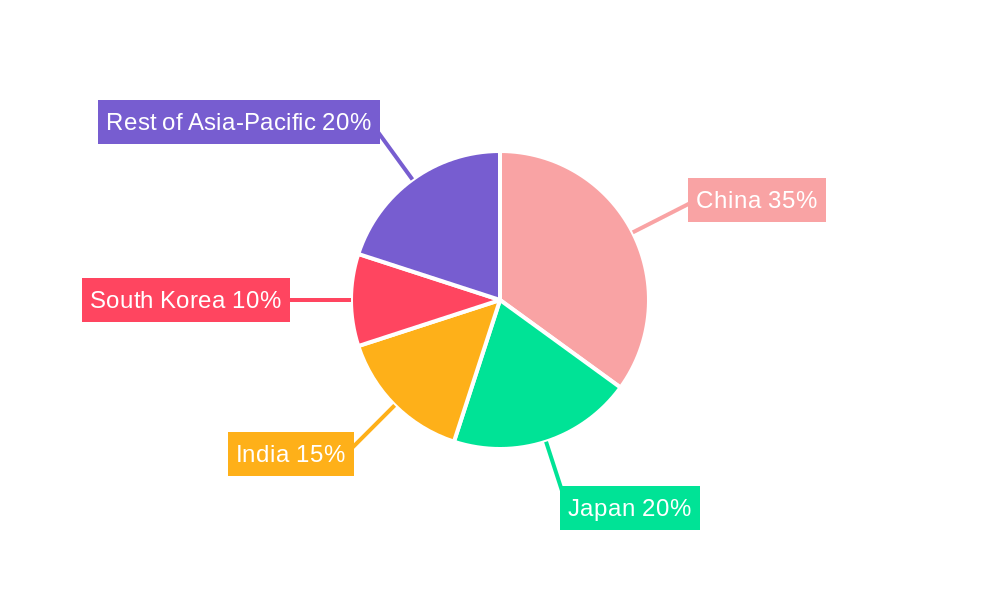

Leading Regions, Countries, or Segments in Asia-Pacific Satellite Manufacturing Market

China is currently the leading country in the Asia-Pacific satellite manufacturing market, driven by substantial government investment in space programs, a robust domestic manufacturing base, and a growing commercial space sector. However, other nations like India and Japan are rapidly catching up, contributing to a more competitive landscape.

Key Drivers:

- High Government Investment: Significant funding allocated to space programs in China, India, and Japan.

- Regulatory Support: Favorable policies and regulations promoting domestic satellite manufacturing.

- Growing Commercial Demand: Increased adoption of satellite technology across various sectors (communication, earth observation, navigation).

Dominance Factors:

- China: Strong domestic manufacturing capabilities, extensive government support, and a large domestic market.

- India: ISRO's successful space programs and a focus on developing indigenous technologies.

- Japan: Established aerospace industry, technological expertise, and partnerships with international players.

Segment Analysis:

- Satellite Mass: The 10-100kg segment is experiencing the highest growth rate, driven by the demand for smallsat constellations.

- Orbit Class: LEO is the fastest-growing orbit class, outpacing GEO and MEO segments due to the rise of smallsat constellations.

- End User: The commercial sector is the dominant end-user, fuelled by the increasing adoption of satellite technology in various commercial applications.

Asia-Pacific Satellite Manufacturing Market Product Innovations

The Asia-Pacific satellite manufacturing market witnesses continuous innovation, characterized by the development of smaller, lighter, and more cost-effective satellites. Advancements in electric propulsion, improved satellite bus designs, and higher efficiency solar arrays are enhancing satellite performance and extending mission lifespans. These innovations are crucial in facilitating the deployment of large satellite constellations for applications such as high-speed broadband internet access and enhanced earth observation capabilities. The focus is shifting towards modular and customizable satellite platforms enabling quicker and more efficient deployment, reducing manufacturing costs, and tailoring solutions for diverse applications. Unique selling propositions include enhanced payload capabilities, reduced launch costs, and improved operational efficiency.

Propelling Factors for Asia-Pacific Satellite Manufacturing Market Growth

Technological advancements, supportive government policies, and robust economic growth within the region are all significantly contributing to the expansion of the Asia-Pacific satellite manufacturing market. The development of more efficient and cost-effective satellite propulsion systems, such as electric propulsion, plays a vital role. Government initiatives that prioritize space exploration and technological development are also driving investment and innovation. The expanding commercial applications of satellite technology in areas like communication, navigation, and earth observation are fueling considerable demand. The increasing affordability and accessibility of satellite technology further broadens its adoption across various sectors.

Obstacles in the Asia-Pacific Satellite Manufacturing Market Market

Challenges remain in the Asia-Pacific satellite manufacturing market despite its considerable growth. Regulatory hurdles and varying standards across different countries can create barriers to entry and hinder market consolidation. Supply chain disruptions and material shortages can impact manufacturing timelines and costs. Intense competition among domestic and international players necessitates continuous innovation and cost optimization to maintain competitiveness. Finally, the high initial investment costs and specialized skills required for satellite manufacturing can pose significant barriers to entry for smaller companies.

Future Opportunities in Asia-Pacific Satellite Manufacturing Market

Future opportunities in the Asia-Pacific satellite manufacturing market lie in the expansion of new applications, technologies, and markets. The growth of IoT and the demand for high-speed internet access in remote areas are opening up significant avenues for satellite-based communication solutions. Advancements in artificial intelligence (AI) and machine learning (ML) integrated into satellite systems are driving innovation in various applications. The development of new satellite constellations for diverse purposes is creating growth opportunities in the LEO segment. Furthermore, the expansion of government space programs and increased private sector investment are expected to continue stimulating growth within the region.

Major Players in the Asia-Pacific Satellite Manufacturing Market Ecosystem

- MinoSpace Technology

- Mitsubishi Heavy Industries

- Axelspace Corporation

- Japan Aerospace Exploration Agency (JAXA)

- Zhuhai Orbita Control Engineering

- China Aerospace Science and Technology Corporation (CASC)

- Maxar Technologies Inc

- Chang Guang Satellite Technology Co Ltd

- Spacety Aerospace Co

- Indian Space Research Organisation (ISRO)

- Guodian Gaoke

Key Developments in Asia-Pacific Satellite Manufacturing Market Industry

- December 2022: Maxar Technologies' acquisition by Advent International for USD 6.4 Billion signifies significant market consolidation.

- November 2022: EchoStar Corporation's agreement with Maxar Technologies for the manufacture of the EchoStar XXIV satellite highlights continued demand for advanced communication satellites.

- January 2023: MinoSpace Technology's Pre-B funding round of USD 47 Million signals increased investment in the smallsat manufacturing sector and its plans to scale production for 500 kg class satellites.

Strategic Asia-Pacific Satellite Manufacturing Market Market Forecast

The Asia-Pacific satellite manufacturing market is poised for sustained growth, driven by continuous technological advancements, increased government investment, and the growing demand for satellite-based services across various sectors. The market will witness a significant expansion in the coming years, fueled by the increasing adoption of smallsat constellations for various applications and the development of innovative technologies. The focus on cost reduction and efficiency improvements in satellite manufacturing will further stimulate market growth. The expanding commercial applications and strategic partnerships between governments and private companies will create a robust and dynamic ecosystem driving the market towards substantial future potential.

Asia-Pacific Satellite Manufacturing Market Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Satellite Mass

- 2.1. 10-100kg

- 2.2. 100-500kg

- 2.3. 500-1000kg

- 2.4. Below 10 Kg

- 2.5. above 1000kg

-

3. Orbit Class

- 3.1. GEO

- 3.2. LEO

- 3.3. MEO

-

4. End User

- 4.1. Commercial

- 4.2. Military & Government

- 4.3. Other

-

5. Satellite Subsystem

- 5.1. Propulsion Hardware and Propellant

- 5.2. Satellite Bus & Subsystems

- 5.3. Solar Array & Power Hardware

- 5.4. Structures, Harness & Mechanisms

-

6. Propulsion Tech

- 6.1. Electric

- 6.2. Gas based

- 6.3. Liquid Fuel

Asia-Pacific Satellite Manufacturing Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Satellite Manufacturing Market Regional Market Share

Geographic Coverage of Asia-Pacific Satellite Manufacturing Market

Asia-Pacific Satellite Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Satellite Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Satellite Mass

- 5.2.1. 10-100kg

- 5.2.2. 100-500kg

- 5.2.3. 500-1000kg

- 5.2.4. Below 10 Kg

- 5.2.5. above 1000kg

- 5.3. Market Analysis, Insights and Forecast - by Orbit Class

- 5.3.1. GEO

- 5.3.2. LEO

- 5.3.3. MEO

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Military & Government

- 5.4.3. Other

- 5.5. Market Analysis, Insights and Forecast - by Satellite Subsystem

- 5.5.1. Propulsion Hardware and Propellant

- 5.5.2. Satellite Bus & Subsystems

- 5.5.3. Solar Array & Power Hardware

- 5.5.4. Structures, Harness & Mechanisms

- 5.6. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.6.1. Electric

- 5.6.2. Gas based

- 5.6.3. Liquid Fuel

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MinoSpace Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Heavy Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Axelspace Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Japan Aerospace Exploration Agency (JAXA)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zhuhai Orbita Control Engineerin

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China Aerospace Science and Technology Corporation (CASC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Maxar Technologies Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chang Guang Satellite Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Spacety Aerospace Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indian Space Research Organisation (ISRO)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Guodian Gaoke

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 MinoSpace Technology

List of Figures

- Figure 1: Asia-Pacific Satellite Manufacturing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Satellite Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 3: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 4: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 5: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 6: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 7: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Application 2020 & 2033

- Table 9: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Satellite Mass 2020 & 2033

- Table 10: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 11: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Satellite Subsystem 2020 & 2033

- Table 13: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 14: Asia-Pacific Satellite Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: China Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Japan Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: South Korea Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: India Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Australia Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: New Zealand Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Indonesia Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Malaysia Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Singapore Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Thailand Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Vietnam Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Philippines Asia-Pacific Satellite Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Satellite Manufacturing Market?

The projected CAGR is approximately 31%.

2. Which companies are prominent players in the Asia-Pacific Satellite Manufacturing Market?

Key companies in the market include MinoSpace Technology, Mitsubishi Heavy Industries, Axelspace Corporation, Japan Aerospace Exploration Agency (JAXA), Zhuhai Orbita Control Engineerin, China Aerospace Science and Technology Corporation (CASC), Maxar Technologies Inc, Chang Guang Satellite Technology Co Ltd, Spacety Aerospace Co, Indian Space Research Organisation (ISRO), Guodian Gaoke.

3. What are the main segments of the Asia-Pacific Satellite Manufacturing Market?

The market segments include Application, Satellite Mass, Orbit Class, End User, Satellite Subsystem, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Minospace Technology Co. Ltd announced that it had closed a Pre-B funding round of approximately USD 47 million in August 2021. Following this funding round, MinoSpace announced that it would scale its mass production capacity for 500 kg class satellites.December 2022: Maxar Technologies entered into a definitive merger agreement to be acquired by Advent International (Advent), one of the largest and most experienced companies in the world, with an enterprise value of approximately USD 6.4 billion.November 2022: EchoStar Corporation announced a revised agreement with Maxar Technologies to manufacture the EchoStar XXIV satellite, also known as JUPITER™ 3. The satellite, designed for EchoStar's Hughes Network Systems division, is being manufactured at Maxar's facility in Palo Alto, California.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Satellite Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Satellite Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Satellite Manufacturing Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Satellite Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence