Key Insights

The Asia-Pacific aircraft engine maintenance, repair, and overhaul (MRO) market is poised for significant expansion, driven by escalating air travel and a growing commercial and military aircraft fleet. Projections indicate a market size of $28,696.4 million by 2024, with a Compound Annual Growth Rate (CAGR) of 6.5%. Key growth catalysts include increased flight operations, stringent regulatory compliance mandating regular maintenance, and a rising demand for efficient, cost-effective MRO solutions. Major economies such as China, India, and Japan are leading this growth, supported by their expanding aviation sectors and favorable government initiatives. Despite challenges like substantial initial investments for advanced MRO infrastructure and potential talent shortages, the long-term outlook remains exceptionally strong. Diverse market segments, encompassing commercial, military, and general aviation, along with variations in engine types (turbine and piston), offer ample opportunities for specialized MRO providers. The competitive arena features global leaders like Rolls Royce, Safran, and GE, alongside strong regional players such as SIA Engineering Company and GMF AeroAsia, fostering an environment ripe for organic growth and strategic consolidations.

Asia-Pacific Aircraft Engine MRO Market Market Size (In Billion)

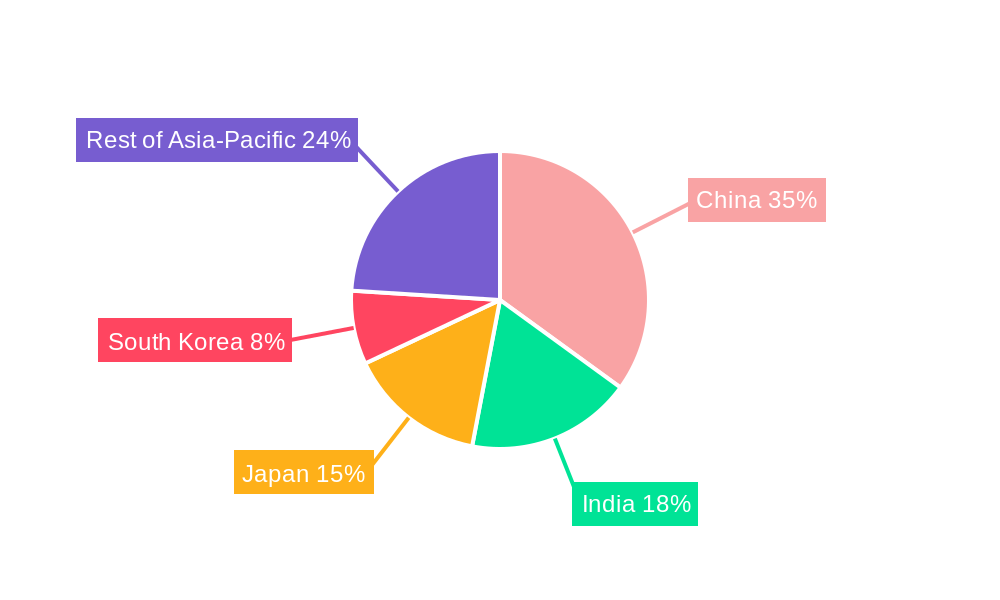

Technological advancements in engine design, the widespread adoption of predictive maintenance strategies, and the overall vitality of the regional aviation industry will significantly shape the market's future. The competitive landscape is marked by a robust mix of global and regional entities, intensifying competition and emphasizing the delivery of specialized, highly efficient services. Segmentation by engine type underscores the distinct maintenance needs of turbine versus piston engines, creating specialized niches within the broader market. While China, India, and Japan are anticipated to retain their positions as dominant national markets, countries like South Korea and Singapore are also experiencing considerable growth. Future expansion will be contingent upon regional economic stability, supportive government aviation policies, and advancements in MRO technologies, including the integration of digital tools and data analytics for optimized maintenance scheduling and enhanced operational efficiency. The increasing complexity of contemporary aircraft engines necessitates a skilled workforce and specialized training, presenting both opportunities and hurdles for sustained market growth.

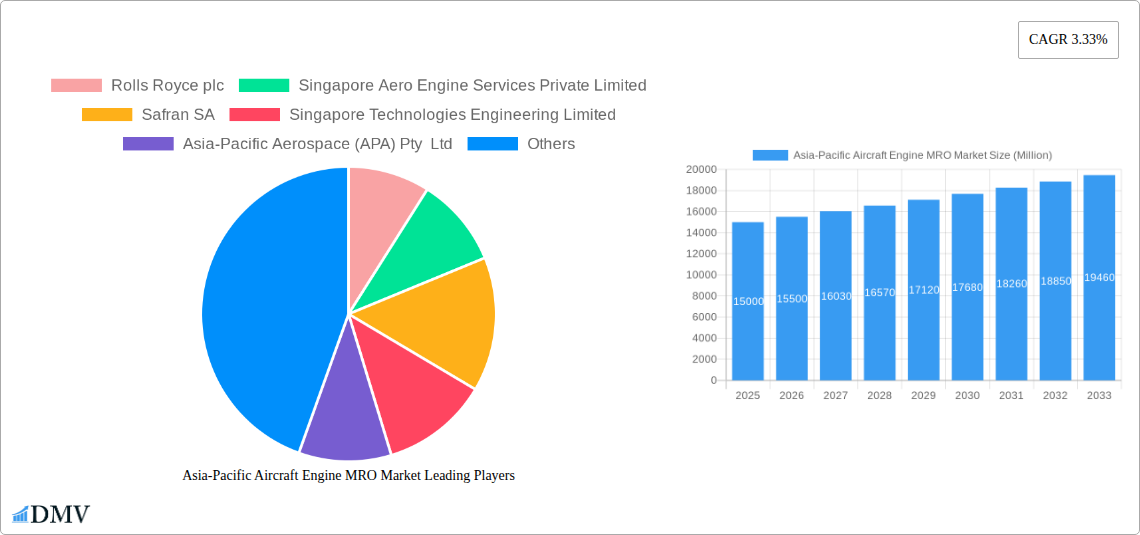

Asia-Pacific Aircraft Engine MRO Market Company Market Share

Asia-Pacific Aircraft Engine MRO Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific Aircraft Engine Maintenance, Repair, and Overhaul (MRO) market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this study is essential for stakeholders seeking to understand market dynamics, investment opportunities, and competitive landscapes. The market is projected to reach xx Million by 2033, exhibiting significant growth potential driven by factors detailed within.

Asia-Pacific Aircraft Engine MRO Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific Aircraft Engine MRO market, examining key trends shaping its evolution. We analyze market concentration, revealing the market share distribution among leading players such as Rolls Royce plc, Safran SA, and General Electric Company. The report further explores innovation catalysts, including advancements in engine technology and digital MRO solutions. Regulatory landscapes across various Asia-Pacific nations are scrutinized, highlighting their impact on market operations. The analysis also considers substitute products and their influence, along with a detailed profile of end-users across commercial, military, and general aviation sectors. Finally, we examine M&A activities, providing an overview of significant deals and their estimated values (xx Million USD in total for the period 2019-2024).

- Market Concentration: Highly concentrated with top 5 players holding approximately xx% market share in 2025.

- Innovation Catalysts: Focus on predictive maintenance, digital twins, and AI-driven solutions.

- Regulatory Landscape: Varying regulations across countries impacting certification and operational costs.

- Substitute Products: Limited viable substitutes, maintaining high market demand.

- End-User Profiles: Dominated by commercial aviation, followed by military and general aviation.

- M&A Activity: Significant consolidation observed in the historical period, with an average deal value of xx Million USD.

Asia-Pacific Aircraft Engine MRO Market Industry Evolution

The Asia-Pacific Aircraft Engine MRO market has witnessed substantial growth throughout the historical period (2019-2024), primarily driven by the burgeoning aviation industry in the region. The increasing fleet size, particularly in rapidly developing economies like China and India, has fueled demand for MRO services. Technological advancements, such as the adoption of advanced materials and digital technologies, are streamlining maintenance processes and enhancing operational efficiency. Changing consumer demands for faster turnaround times and cost-effective solutions are also shaping the industry. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is further bolstered by increasing government investments in infrastructure and supportive regulatory frameworks. The adoption of new technologies is projected to increase by xx% annually, significantly improving efficiency and reducing downtime.

Leading Regions, Countries, or Segments in Asia-Pacific Aircraft Engine MRO Market

China and India emerge as dominant markets within the Asia-Pacific region, driven by their rapidly expanding aviation sectors. Singapore, with its established aerospace ecosystem, also plays a crucial role. Commercial aviation represents the largest segment, fueled by increasing air travel demand.

- Key Drivers (China): Massive domestic air travel growth, government investments in airport infrastructure, and a burgeoning domestic aircraft manufacturing industry.

- Key Drivers (India): Rapid economic growth, increasing air passenger traffic, and government initiatives to boost the aviation sector.

- Key Drivers (Commercial Aviation): Growing air passenger traffic, increased fleet size of airlines, and stringent airworthiness regulations.

- In-depth Analysis: China's dominance stems from its sheer market size and the government's supportive policies. India's growth trajectory is fueled by its rising middle class and increased affordability of air travel.

Asia-Pacific Aircraft Engine MRO Market Product Innovations

Recent innovations encompass advanced diagnostics, predictive maintenance technologies, and the integration of digital platforms for streamlined MRO operations. These advancements offer improved engine performance, reduced downtime, and optimized maintenance schedules. The adoption of additive manufacturing is also gaining traction, enabling faster and more cost-effective repairs.

Propelling Factors for Asia-Pacific Aircraft Engine MRO Market Growth

Several factors are driving market growth. Firstly, the region's expanding air travel demand is a major contributor. Secondly, increasing government investments in aviation infrastructure are improving the sector’s overall efficiency. Lastly, technological advancements like predictive maintenance are improving operational efficiency and reducing costs.

Obstacles in the Asia-Pacific Aircraft Engine MRO Market

Challenges include the high initial investment costs associated with advanced technologies, potential supply chain disruptions due to geopolitical factors, and intense competition among existing and emerging players. These factors could potentially restrain market growth by approximately xx% annually if not addressed proactively.

Future Opportunities in Asia-Pacific Aircraft Engine MRO Market

The market presents opportunities in providing MRO services for next-generation aircraft, expanding into newer markets within the Asia-Pacific region, and developing specialized MRO solutions for specific engine types. The integration of emerging technologies like blockchain and IoT also presents significant opportunities for innovative service offerings.

Major Players in the Asia-Pacific Aircraft Engine MRO Market Ecosystem

- Rolls Royce plc

- Singapore Aero Engine Services Private Limited

- Safran SA

- Singapore Technologies Engineering Limited

- Asia-Pacific Aerospace (APA) Pty Ltd

- SIA Engineering Company

- HAECO Group

- Mitsubishi Heavy Industries Aero Engines Ltd

- GMF AeroAsi

- General Electric Company

Key Developments in Asia-Pacific Aircraft Engine MRO Market Industry

- July 2022: Hindustan Aeronautics Limited (HAL) secures a USD 100 Million+ contract with Honeywell for TPE331-12B engines and maintenance services for HTT-40 aircraft. This significantly boosts the Indian MRO market for smaller turbine engines.

- March 2023: Pratt & Whitney expands its GTF engine MRO capacity in Japan through Mitsubishi Heavy Industries Aero Engines Limited (MHIAEL), increasing monthly capacity from 5-6 units to 10 by 2026 and 15 units subsequently. This signifies the growing importance of the Japanese MRO market and commitment to GTF engine maintenance.

Strategic Asia-Pacific Aircraft Engine MRO Market Forecast

The Asia-Pacific Aircraft Engine MRO market is poised for sustained growth, driven by the region's expanding aviation industry and technological advancements. Future opportunities lie in adopting innovative MRO technologies, expanding into less-penetrated segments, and capitalizing on the region's increasing air travel demand. This will lead to significant market expansion, with the market size projected to reach xx Million by 2033.

Asia-Pacific Aircraft Engine MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Aircraft Engine MRO Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Aircraft Engine MRO Market Regional Market Share

Geographic Coverage of Asia-Pacific Aircraft Engine MRO Market

Asia-Pacific Aircraft Engine MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Turbine Engine Segment Held the Highest Shares in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Aircraft Engine MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rolls Royce plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Singapore Aero Engine Services Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Safran SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Singapore Technologies Engineering Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asia-Pacific Aerospace (APA) Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SIA Engineering Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HAECO Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi Heavy Industries Aero Engines Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GMF AeroAsi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 General Electric Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rolls Royce plc

List of Figures

- Figure 1: Asia-Pacific Aircraft Engine MRO Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Aircraft Engine MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Aircraft Engine MRO Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Aircraft Engine MRO Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Aircraft Engine MRO Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Asia-Pacific Aircraft Engine MRO Market?

Key companies in the market include Rolls Royce plc, Singapore Aero Engine Services Private Limited, Safran SA, Singapore Technologies Engineering Limited, Asia-Pacific Aerospace (APA) Pty Ltd, SIA Engineering Company, HAECO Group, Mitsubishi Heavy Industries Aero Engines Ltd, GMF AeroAsi, General Electric Company.

3. What are the main segments of the Asia-Pacific Aircraft Engine MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 28696.4 million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Turbine Engine Segment Held the Highest Shares in the Market.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

July 2022: Hindustan Aeronautics Limited (HAL) has signed a contract worth over USD 100 million with Honeywell International Inc. to supply and manufacture 88 TPE331-12B engines and kits along with maintenance and support services to power the Hindustan Trainer Aircraft (HTT-40).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Aircraft Engine MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Aircraft Engine MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Aircraft Engine MRO Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Aircraft Engine MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence