Key Insights

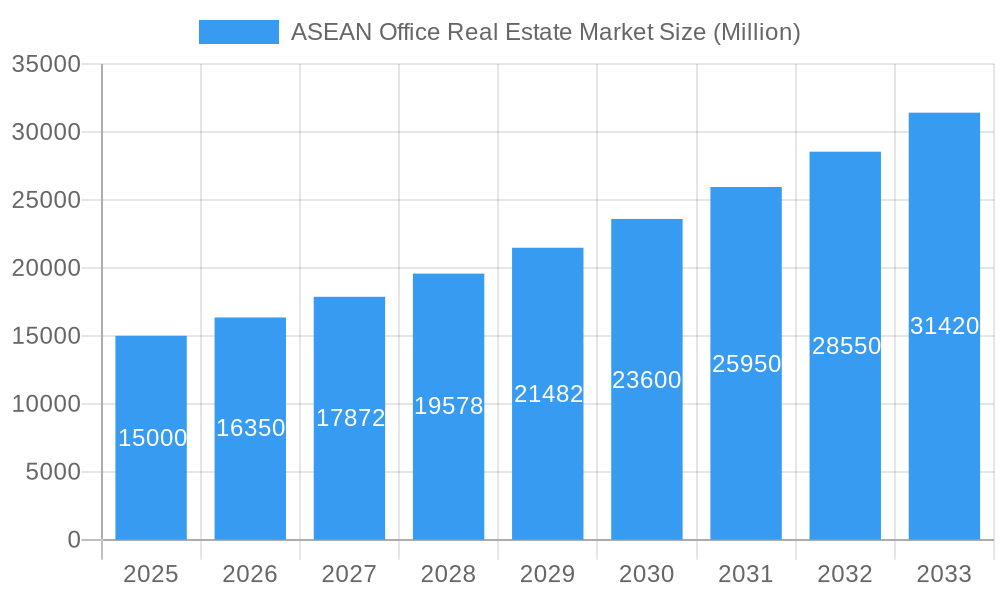

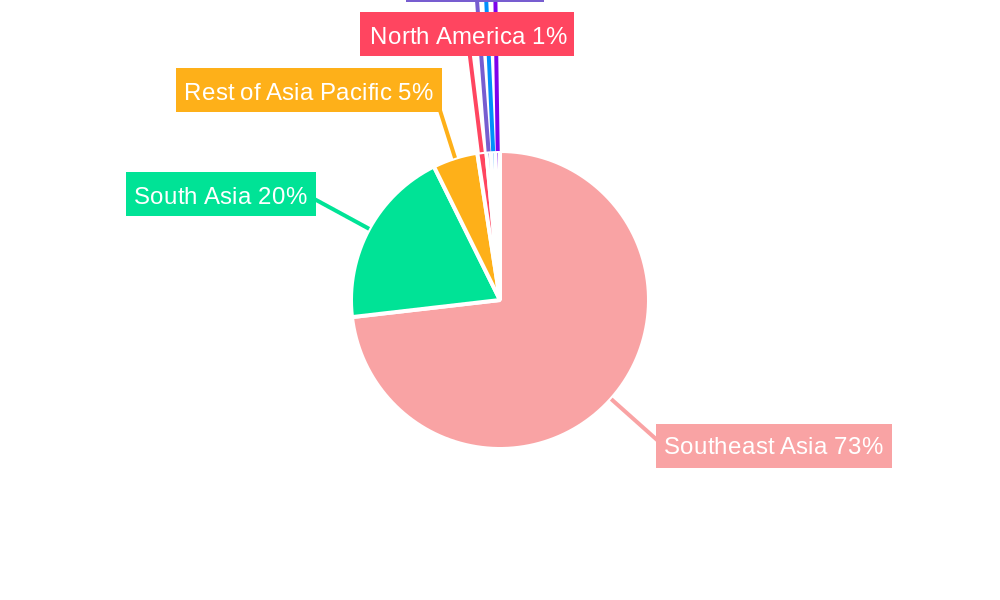

The ASEAN office real estate market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 9% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the region's burgeoning economies, particularly in Southeast Asia, are attracting significant foreign direct investment (FDI) and fostering the growth of multinational corporations (MNCs) and SMEs, fueling demand for modern office spaces. Secondly, urbanization and population growth within major ASEAN cities are creating a concentrated demand for high-quality office accommodations. Thirdly, improving infrastructure and connectivity within the region are further enhancing its attractiveness for businesses. The market is segmented by office grade (A, B, and C), location (Southeast Asia and South Asia), and end-user (corporate offices, SMEs, and government agencies). While Grade A offices command premium prices due to their superior amenities and locations, the demand for Grade B and C offices remains strong, catering to a broader range of businesses. South East Asia currently dominates the market share, due to its rapid economic development and concentration of major business hubs. However, South Asia is expected to witness significant growth in the coming years as its economies continue to expand. The presence of established international real estate players like Savills Vietnam, Hines, and CBRE Vietnam, alongside local developers, indicates a mature and competitive market landscape.

ASEAN Office Real Estate Market Market Size (In Billion)

Despite the positive outlook, certain challenges persist. Competition for prime office space in key cities can drive up rental costs, potentially impacting smaller businesses. Furthermore, economic fluctuations and geopolitical uncertainties can influence investment decisions and overall market growth. Sustaining the current growth trajectory will require continued investment in infrastructure, the development of sustainable and technologically advanced office spaces, and effective management of regulatory frameworks to encourage both domestic and foreign investment. The ongoing shift towards hybrid working models may also influence future office space demand, necessitating adaptability within the real estate sector to meet evolving business needs. Despite these challenges, the long-term prospects for the ASEAN office real estate market remain exceptionally positive, driven by the region's underlying economic fundamentals and demographic trends.

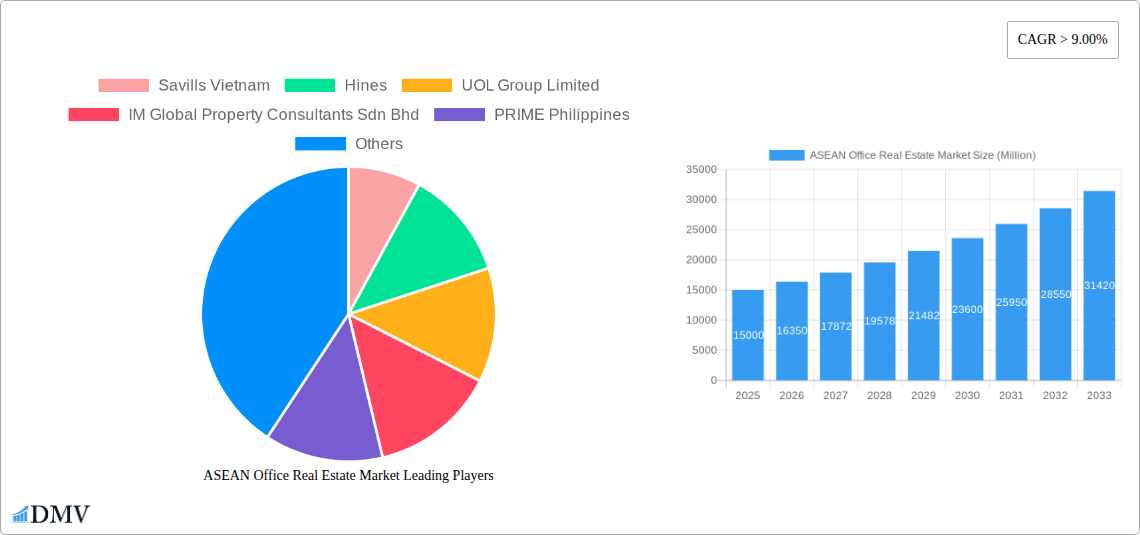

ASEAN Office Real Estate Market Company Market Share

ASEAN Office Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the ASEAN office real estate market, covering the period from 2019 to 2033, with a focus on the pivotal year 2025. It offers invaluable data and projections for stakeholders seeking to understand market dynamics, investment opportunities, and future growth potential in this dynamic region. The report meticulously examines market composition, industry evolution, leading segments, product innovations, and key challenges, empowering informed decision-making across the ASEAN landscape.

ASEAN Office Real Estate Market Composition & Trends

This section evaluates the ASEAN office real estate market's competitive landscape, encompassing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity. We analyze market share distribution among key players like Savills Vietnam, Hines, UOL Group Limited, and CBRE Vietnam, examining the impact of their strategies on the overall market. M&A activity is analyzed based on deal values and their implications for market consolidation. The report also considers factors such as the increasing adoption of smart building technologies and the influence of government regulations on office space development. The study period (2019-2024) and forecast period (2025-2033) provide a comprehensive historical and future perspective.

- Market Share Distribution: Grade A offices hold an estimated xx% market share in 2025, followed by Grade B offices at xx% and Grade C at xx%. This distribution is analyzed across Southeast Asia and South Asia.

- M&A Deal Values: Total M&A deal value in the ASEAN office market in 2024 is estimated at USD xx Million. Key deals are analyzed for their impact on market dynamics and future consolidation.

- End-User Segmentation: Analysis of office space demand from corporate offices, SMEs, and government agencies, including their preferences for office types and locations.

ASEAN Office Real Estate Market Industry Evolution

This section delves into the evolution of the ASEAN office real estate market, examining growth trajectories, technological advancements, and evolving consumer demands. We analyze historical growth rates (2019-2024) and project future growth rates (2025-2033) for various office segments and locations. The impact of technological innovations such as smart building technologies, flexible workspaces, and digital platforms is evaluated, considering their adoption rates and effects on market dynamics. Data points will illustrate the shift in consumer demand towards sustainable and technologically advanced office spaces. Factors influencing market growth, such as economic growth in the region and changes in urbanization patterns, are also explored. The analysis encompasses factors such as changing work styles, increasing demand for flexible workspaces, and the growing importance of sustainability in office design.

Leading Regions, Countries, or Segments in ASEAN Office Real Estate Market

This section identifies the dominant regions, countries, and segments within the ASEAN office real estate market. We examine the key factors contributing to their dominance, focusing on investment trends, regulatory support, and market characteristics.

By Type: The factors driving the prominence of Grade A offices (e.g., high demand from multinational corporations, premium amenities) are analyzed. Similarly, the analysis covers Grade B and Grade C offices.

By Location: A comparative analysis of Southeast Asia and South Asia's office markets, highlighting the unique characteristics and growth drivers of each region.

By End-User: An in-depth analysis of the demand for office space from corporate offices, SMEs, and government agencies, and the factors influencing their preferences.

Key Drivers: Investment inflows, government initiatives promoting real estate development, and favorable economic conditions are analyzed in detail.

ASEAN Office Real Estate Market Product Innovations

This section highlights notable product innovations, applications, and performance metrics within the ASEAN office real estate market. We focus on the unique selling propositions of new office developments and technological advancements, such as smart building technologies, flexible workspace solutions, and sustainable design features. The section explores how these innovations are shaping market competition and consumer preferences.

Propelling Factors for ASEAN Office Real Estate Market Growth

Several key factors drive the growth of the ASEAN office real estate market. These include strong economic growth in several ASEAN countries, increasing urbanization, and rising foreign direct investment (FDI). Government initiatives to improve infrastructure and attract businesses also contribute. Technological advancements, such as smart building technologies and flexible workspaces, are further fueling market expansion.

Obstacles in the ASEAN Office Real Estate Market

The ASEAN office real estate market faces several challenges. These include regulatory hurdles in certain countries, supply chain disruptions affecting construction materials, and intense competition among developers. These factors can impact project timelines, costs, and overall market growth, with potential quantifiable impacts on profitability and investment returns being analyzed.

Future Opportunities in ASEAN Office Real Estate Market

The ASEAN office real estate market presents significant future opportunities. Growth is anticipated in emerging markets within the region, driven by increasing urbanization and economic expansion. The adoption of sustainable and technologically advanced office spaces will also open new avenues for growth. Demand from e-commerce and technology companies is expected to create further opportunities.

Major Players in the ASEAN Office Real Estate Market Ecosystem

- Savills Vietnam

- Hines

- UOL Group Limited

- IM Global Property Consultants Sdn Bhd

- PRIME Philippines

- Frasers Property

- City Developments Limited

- PT Ciputra Development Tbk

- CBRE Vietnam

- Malton Berhad

Key Developments in ASEAN Office Real Estate Market Industry

- September 2022: Ciputra International inaugurated the Propan Tower in Jakarta, a 17-floor project spanning 7.4 hectares with 10 buildings (6 offices, 3 apartments, 1 hotel). This reflects growing demand for office space in Jakarta.

- February 2022: Hulic acquired Trust Beneficiary Rights in the Shintomicho Building in Tokyo for USD 25.4 Million, demonstrating cross-border investment activity impacting the ASEAN market indirectly through capital flows.

Strategic ASEAN Office Real Estate Market Forecast

The ASEAN office real estate market is poised for sustained growth over the forecast period (2025-2033). Continued economic expansion, urbanization, and technological advancements will drive demand for modern, sustainable, and technologically advanced office spaces. The increasing adoption of flexible workspaces and the emergence of new markets within the region will further contribute to market growth. The market's evolution will be shaped by the interplay of these factors, resulting in significant potential for investment and development.

ASEAN Office Real Estate Market Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Vietnam

- 1.4. Indonesia

- 1.5. Malaysia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Office Real Estate Market Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Vietnam

- 4. Indonesia

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

ASEAN Office Real Estate Market Regional Market Share

Geographic Coverage of ASEAN Office Real Estate Market

ASEAN Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Demand for Co-Working Spaces Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Vietnam

- 5.1.4. Indonesia

- 5.1.5. Malaysia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Vietnam

- 5.2.4. Indonesia

- 5.2.5. Malaysia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Vietnam

- 6.1.4. Indonesia

- 6.1.5. Malaysia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Vietnam

- 7.1.4. Indonesia

- 7.1.5. Malaysia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Vietnam ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Vietnam

- 8.1.4. Indonesia

- 8.1.5. Malaysia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Indonesia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Vietnam

- 9.1.4. Indonesia

- 9.1.5. Malaysia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Malaysia ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Vietnam

- 10.1.4. Indonesia

- 10.1.5. Malaysia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Vietnam

- 11.1.4. Indonesia

- 11.1.5. Malaysia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Vietnam

- 12.1.4. Indonesia

- 12.1.5. Malaysia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Savills Vietnam

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hines

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 UOL Group Limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 IM Global Property Consultants Sdn Bhd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PRIME Philippines

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Frasers Property

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 City Developments Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PT Ciputra Development Tbk

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 CBRE Vietnam

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Malton Berhad

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Savills Vietnam

List of Figures

- Figure 1: Global ASEAN Office Real Estate Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 3: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 4: Singapore ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: Singapore ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Thailand ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Thailand ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Thailand ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Vietnam ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 11: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Vietnam ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Vietnam ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Indonesia ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Indonesia ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Indonesia ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Malaysia ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 19: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Malaysia ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Malaysia ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Philippines ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Philippines ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of ASEAN ASEAN Office Real Estate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 27: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 28: Rest of ASEAN ASEAN Office Real Estate Market Revenue (undefined), by Country 2025 & 2033

- Figure 29: Rest of ASEAN ASEAN Office Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 2: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Office Real Estate Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Office Real Estate Market?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the ASEAN Office Real Estate Market?

Key companies in the market include Savills Vietnam, Hines, UOL Group Limited, IM Global Property Consultants Sdn Bhd, PRIME Philippines, Frasers Property, City Developments Limited, PT Ciputra Development Tbk, CBRE Vietnam, Malton Berhad.

3. What are the main segments of the ASEAN Office Real Estate Market?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Demand for Co-Working Spaces Driving the Market.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

September 2022 - Ciputra International (a real estate company), inaugurated the Propan Tower. This project has 17 floors and is spread across 7.4 hectares, consisting of 10 buildings, 6 offices, 3 apartments, and 1 hotel. The project was developed to meet the increasing demand for office space in Jakarta.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Office Real Estate Market?

To stay informed about further developments, trends, and reports in the ASEAN Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence