Key Insights

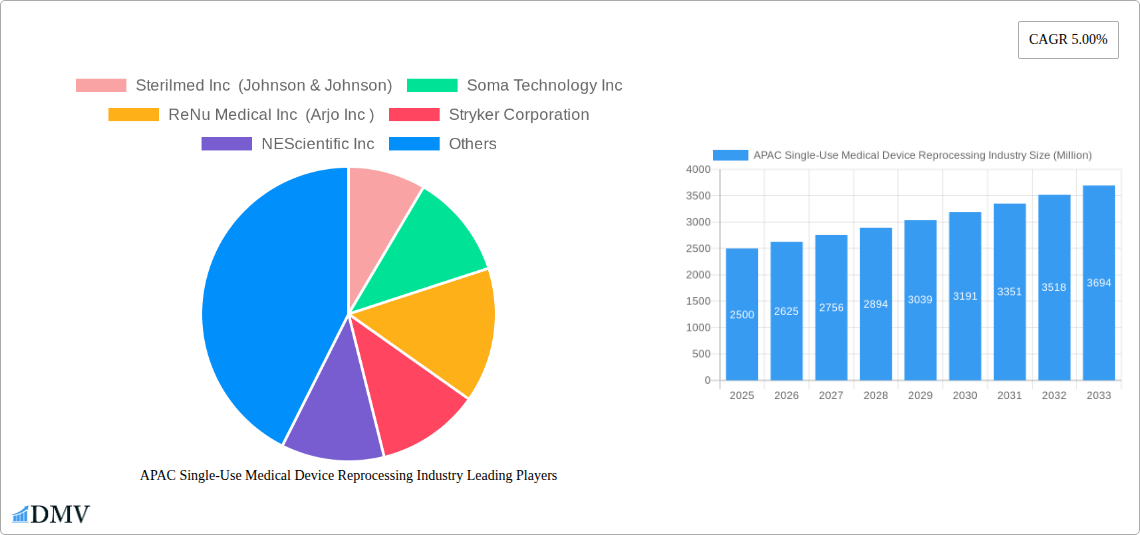

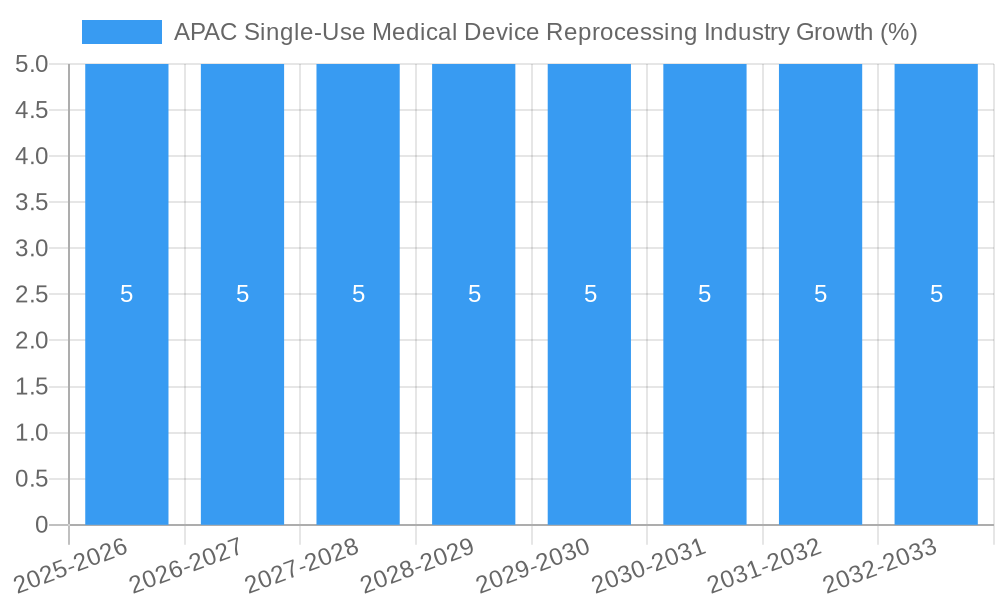

The APAC Single-Use Medical Device Reprocessing Industry is poised for substantial growth, estimated at XX million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.00% through 2033. This expansion is primarily fueled by the escalating demand for cost-effective healthcare solutions across the Asia-Pacific region, coupled with increasing awareness regarding the environmental impact of medical waste. The drive towards reprocessing is further intensified by stringent regulatory frameworks emerging in key markets, encouraging sustainable practices in healthcare. Growing adoption of minimally invasive surgical procedures, which often utilize single-use devices, also contributes to the overall market volume, creating a fertile ground for reprocessing services to thrive. The industry benefits from advancements in reprocessing technologies, enhancing the efficacy and safety of reprocessed devices, thus building greater trust among healthcare providers.

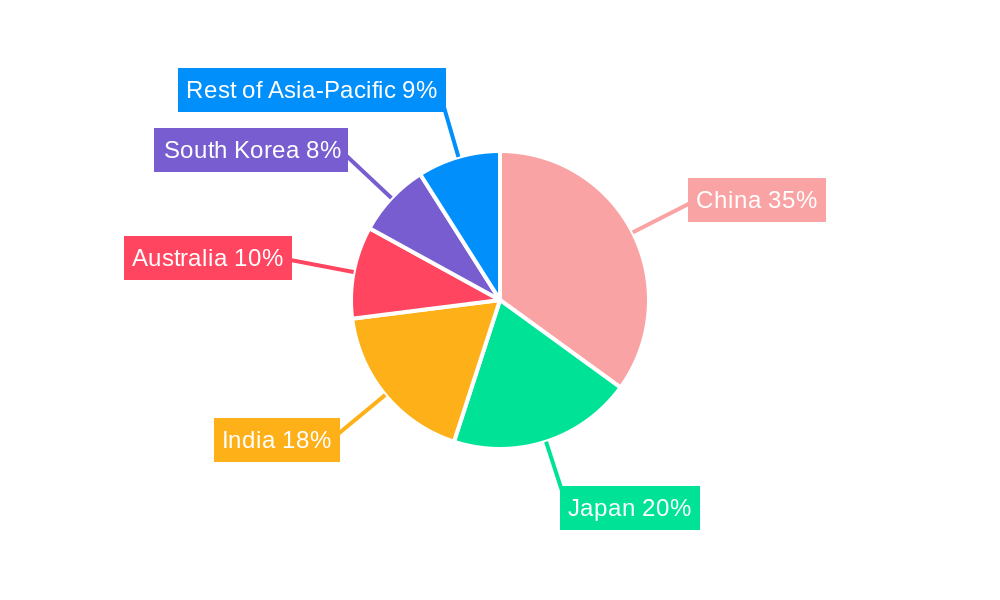

The market segmentation reveals a strong emphasis on Class II devices, such as pulse oximeter sensors, sequential compression sleeves, and catheters/guidewires, which are frequently reprocessed due to their moderate complexity and high volume of use. Class I devices, including laparoscopic graspers, forceps, and scissors, also represent a significant segment, offering opportunities for reprocessing. Geographically, China is anticipated to lead the market, driven by its vast population, expanding healthcare infrastructure, and a growing emphasis on cost containment. Japan and India are also expected to witness robust growth, supported by favorable government initiatives and an increasing number of healthcare facilities adopting reprocessing practices. While the market benefits from cost savings and environmental advantages, challenges such as varying regulatory landscapes across different countries and potential concerns regarding the reliability of reprocessed devices by some healthcare professionals act as restraints. However, continuous technological innovation and strategic collaborations among key players are expected to mitigate these challenges and propel the industry forward.

Report Description:

Dive deep into the dynamic APAC Single-Use Medical Device Reprocessing Industry with this comprehensive report. Covering the historical period of 2019–2024 and forecasting through 2033, with a base and estimated year of 2025, this analysis offers unparalleled insights into market composition, growth trajectories, and future opportunities within this burgeoning sector. Stakeholders will gain a strategic advantage by understanding key drivers, competitive landscapes, and emerging trends shaping the reprocessing of single-use medical devices across China, Japan, India, Australia, and South Korea.

This report is meticulously crafted for medical device manufacturers, reprocessing service providers, healthcare institutions, investors, and regulatory bodies seeking to navigate the complexities and capitalize on the immense potential of the APAC single-use medical device reprocessing market. With a focus on high-ranking keywords such as "medical device reprocessing APAC," "single-use device reuse," "healthcare infection control," "sterilization services," and "medical waste management," this document is optimized for maximum search visibility and engagement.

APAC Single-Use Medical Device Reprocessing Industry Market Composition & Trends

The APAC single-use medical device reprocessing industry is characterized by a growing market concentration, driven by increasing adoption of cost-effective healthcare solutions and a heightened awareness of medical waste management. Innovation catalysts include advancements in sterilization technologies and the development of robust quality control protocols. The regulatory landscape, while evolving, is becoming more defined, fostering trust and encouraging wider acceptance of reprocessing. Substitute products are primarily new single-use devices, but the economic and environmental benefits of reprocessing present a compelling alternative. End-user profiles range from large hospital networks seeking to optimize budgets to smaller clinics aiming for sustainable practices. Mergers and acquisitions (M&A) activities are on the rise as established players acquire specialized reprocessing capabilities or expand their geographic reach. While specific M&A deal values are subject to private transactions, the strategic imperative for consolidation is evident, indicating a market poised for significant growth and evolution. The market share distribution is dynamic, with leading reprocessing companies actively seeking to secure substantial portions through service excellence and technological superiority.

APAC Single-Use Medical Device Reprocessing Industry Industry Evolution

The evolution of the APAC single-use medical device reprocessing industry is marked by a steady growth trajectory, driven by a confluence of economic, environmental, and healthcare-specific factors. Over the historical period (2019–2024) and projected into the forecast period (2025–2033), the market has witnessed significant expansion, fueled by the inherent advantages of reprocessing. Economically, the ability to reuse medical devices that were previously designated for single use offers substantial cost savings for healthcare facilities, particularly in price-sensitive markets within the Asia-Pacific region. This economic imperative has become a primary driver for adoption, allowing hospitals to reallocate budgets towards other critical healthcare needs.

Technological advancements have been pivotal in this evolution. Sophisticated cleaning, disinfection, and sterilization methods, including advanced autoclaving, ethylene oxide (EtO) sterilization, and emerging plasma technologies, have significantly enhanced the safety and efficacy of reprocessing. These innovations have addressed initial concerns regarding device integrity and patient safety, paving the way for broader clinical acceptance. Furthermore, the development of sophisticated tracking and tracing systems ensures the provenance and quality of reprocessed devices, bolstering confidence among healthcare providers and patients.

Shifting consumer demands, particularly the growing global awareness of environmental sustainability and the pressing issue of medical waste disposal, have also played a crucial role. The sheer volume of single-use medical devices generated annually presents a significant environmental challenge. Reprocessing offers a sustainable alternative, reducing landfill burden and conserving resources. This aligns with the broader corporate social responsibility (CSR) initiatives of healthcare organizations and the increasing demand from the public for eco-friendly healthcare practices. Adoption metrics for reprocessing services have seen a consistent upward trend, with a projected compound annual growth rate (CAGR) of approximately 8-10% during the forecast period. Specific data points indicate that by 2025, an estimated 15-20% of eligible single-use medical devices in major APAC markets are expected to be reprocessed, a figure projected to climb to over 30% by 2033. This significant uptake underscores the industry's robust growth potential and its critical role in modern healthcare.

Leading Regions, Countries, or Segments in APAC Single-Use Medical Device Reprocessing Industry

Within the APAC single-use medical device reprocessing industry, China emerges as the dominant force, driven by a massive healthcare infrastructure, a burgeoning population, and increasing government initiatives focused on cost containment and sustainable healthcare practices. The sheer scale of China's healthcare sector translates into a vast number of single-use medical devices being utilized, presenting a significant opportunity for reprocessing services. Furthermore, the Chinese government's emphasis on reducing medical costs and its growing commitment to environmental protection policies create a fertile ground for the widespread adoption of medical device reprocessing. Investment trends in China are particularly strong, with both domestic and international companies actively exploring partnerships and expanding their reprocessing capabilities to cater to the immense demand. Regulatory support, while still developing, is progressively aligning with international standards, providing a clearer framework for reprocessing operations.

Device Type Dominance: Within the device segments, Class II Devices, particularly Catheters and Guidewires, are exhibiting substantial growth in reprocessing. The complexity of these devices often makes outright disposal costly, and their design lends itself well to meticulous reprocessing. Their widespread use in interventional cardiology, radiology, and other specialized procedures contributes to their high reprocessing volume. However, Class I Devices, such as Laparoscopic Graspers and Forceps, also represent a significant and growing segment due to their high frequency of use in a wide range of surgical procedures. The reprocessing of these instruments offers considerable cost savings and reduces the environmental impact associated with their disposal.

Geographic Drivers:

- China: Its vast population, expanding healthcare network, and government focus on cost reduction and sustainability make it the leading market. Significant investment from both local and international entities further fuels its dominance.

- India: The rapidly growing healthcare sector, coupled with increasing awareness of medical waste management and cost-effective solutions, positions India as a key growth market. Government initiatives supporting healthcare infrastructure development also contribute.

- Japan: Known for its advanced healthcare system and stringent quality standards, Japan is a mature market where reprocessing is increasingly accepted for its economic and environmental benefits.

- South Korea: A technologically advanced nation with a strong focus on innovation, South Korea sees growing adoption of reprocessing services, particularly for specialized medical devices.

- Australia: With a well-established healthcare system and a commitment to sustainability, Australia presents a steady and growing market for reprocessing solutions.

- Rest of Asia-Pacific: Emerging economies in this region are gradually embracing reprocessing as healthcare access expands and cost-saving measures become more critical.

The dominance of China is further amplified by its large-scale reprocessing facilities and the increasing integration of reprocessing services into the broader healthcare supply chain. The segment of Class II Devices, particularly those with complex functionalities, is gaining traction due to the significant cost-benefit analysis favoring reprocessing over purchasing new devices. This multifaceted interplay of geography, device type, and evolving market dynamics underscores the intricate yet promising landscape of the APAC single-use medical device reprocessing industry.

APAC Single-Use Medical Device Reprocessing Industry Product Innovations

Product innovations in APAC single-use medical device reprocessing are primarily focused on enhancing safety, efficiency, and validation. Companies are developing advanced cleaning chemistries and automated cleaning systems that minimize manual handling and improve the thoroughness of debris removal. Novel disinfection and sterilization technologies, such as low-temperature plasma sterilization and advanced peracetic acid systems, are gaining traction for their efficacy on heat-sensitive devices, while also reducing cycle times. Furthermore, there's an increasing emphasis on digital tracking and validation platforms. These innovations allow for real-time monitoring of reprocessing cycles, detailed record-keeping, and end-to-end traceability, ensuring compliance with stringent regulatory requirements and building greater confidence among healthcare providers. Unique selling propositions often revolve around achieving superior sterilization assurance levels, faster turnaround times, and the ability to reprocess a wider range of device types, all while adhering to strict quality control measures.

Propelling Factors for APAC Single-Use Medical Device Reprocessing Industry Growth

The APAC single-use medical device reprocessing industry is propelled by several key factors:

- Economic Imperative: Significant cost savings for healthcare providers by reducing expenditure on new devices. This is particularly critical in emerging economies within APAC.

- Environmental Sustainability: Growing awareness and regulatory pressure regarding medical waste management and the need to reduce the environmental footprint of healthcare.

- Technological Advancements: Development of more effective and safer cleaning, disinfection, and sterilization technologies, enhancing the reliability and acceptance of reprocessed devices.

- Increasing Healthcare Expenditure: As healthcare access expands across APAC, the volume of medical devices used increases, creating a larger pool of devices eligible for reprocessing.

- Regulatory Support: Evolving and increasingly harmonized regulations in key APAC countries are creating a more favorable environment for reprocessing operations.

Obstacles in the APAC Single-Use Medical Device Reprocessing Industry Market

Despite robust growth, the APAC single-use medical device reprocessing industry faces several obstacles:

- Perception and Trust: Lingering concerns among some healthcare professionals and patients regarding the safety and efficacy of reprocessed devices compared to new ones.

- Regulatory Hurdles: While improving, regulatory frameworks for reprocessing can be fragmented and vary significantly across different APAC countries, creating compliance challenges.

- Infrastructure Limitations: In some regions, the necessary infrastructure for advanced reprocessing, including specialized equipment and trained personnel, may be underdeveloped.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of raw materials and specialized components required for reprocessing.

- Reimbursement Policies: Inconsistent or inadequate reimbursement policies for reprocessing services can hinder adoption by healthcare facilities.

Future Opportunities in APAC Single-Use Medical Device Reprocessing Industry

The future presents numerous opportunities for the APAC single-use medical device reprocessing industry. Emerging markets within Southeast Asia and other developing nations offer vast untapped potential as their healthcare sectors grow and cost-consciousness increases. The development of new reprocessing technologies for a wider range of complex and high-value devices, such as robotics and advanced surgical instruments, represents a significant avenue for growth. Increased collaboration between reprocessing companies and medical device manufacturers can lead to integrated solutions and enhanced product designs optimized for reprocessing. Furthermore, a growing consumer demand for sustainable healthcare will continue to drive the adoption of reprocessing services.

Major Players in the APAC Single-Use Medical Device Reprocessing Industry Ecosystem

- Sterilmed Inc (Johnson & Johnson)

- Soma Technology Inc

- ReNu Medical Inc (Arjo Inc )

- Stryker Corporation

- NEScientific Inc

- Medline Industries Inc

Key Developments in APAC Single-Use Medical Device Reprocessing Industry Industry

- August 2022: Ecolab Inc. expanded its Healthcare division to serve hospitals and healthcare facilities in Southeast Asia. A leader in infection prevention solutions and services, Ecolab Healthcare, offers a comprehensive array of hygiene and infection prevention solutions for hospitals, surgical centers, and healthcare facilities. They also provide instrument & endoscopy reprocessing, surgical drapes, and environmental hand hygiene.

- April 2022: The 'state-of-the-art' Central Sterile Services Department (CSSD) of AIIMS Bhubaneswar received 2nd prize under the Government Health Care Organization category in the Consortium of Accredited Health Care Organizations Awareness Compliances and Excellence (CAHO-ACE) program for the year 2021.

Strategic APAC Single-Use Medical Device Reprocessing Industry Market Forecast

The strategic forecast for the APAC single-use medical device reprocessing industry indicates robust growth, driven by an increasing convergence of economic pressures, environmental consciousness, and technological advancements in healthcare sterilization and infection control. As healthcare systems across the region prioritize cost optimization without compromising patient safety, reprocessing will become an indispensable component of medical supply chain management. Innovations in automated reprocessing systems and advanced validation technologies will further enhance trust and efficiency, leading to broader adoption across diverse device categories. The expanding regulatory clarity and support for reprocessing in key markets like China and India will act as significant catalysts, unlocking substantial market potential and solidifying reprocessing as a cornerstone of sustainable and affordable healthcare in APAC.

APAC Single-Use Medical Device Reprocessing Industry Segmentation

-

1. Device Type

-

1.1. Class I Devices

- 1.1.1. Laparoscopic Graspers

- 1.1.2. Forceps

- 1.1.3. Scissors

- 1.1.4. Other Class I Devices

-

1.2. Class II Device

- 1.2.1. Pulse Oximeter Sensors

- 1.2.2. Sequential Compression Sleeves

- 1.2.3. Catheters and Guidewires

- 1.2.4. Other Class II Devices

-

1.1. Class I Devices

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. Australia

- 2.5. South Korea

- 2.6. Rest of Asia-Pacific

APAC Single-Use Medical Device Reprocessing Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

APAC Single-Use Medical Device Reprocessing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Significance of Medical Waste Minimization; Reprocessing Single-use Devices Results in Environment Sustainability; Cost-Saving through Reprocessing Single-use Devices

- 3.3. Market Restrains

- 3.3.1. Poor Regulation of SUD Reprocessing in Emerging Markets; Preconceived Notion regarding the Quality of Reprocessed Single-use Medical Devices

- 3.4. Market Trends

- 3.4.1. Sequential Compression Sleeves Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Class I Devices

- 5.1.1.1. Laparoscopic Graspers

- 5.1.1.2. Forceps

- 5.1.1.3. Scissors

- 5.1.1.4. Other Class I Devices

- 5.1.2. Class II Device

- 5.1.2.1. Pulse Oximeter Sensors

- 5.1.2.2. Sequential Compression Sleeves

- 5.1.2.3. Catheters and Guidewires

- 5.1.2.4. Other Class II Devices

- 5.1.1. Class I Devices

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. Australia

- 5.2.5. South Korea

- 5.2.6. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. South Korea

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. China APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Class I Devices

- 6.1.1.1. Laparoscopic Graspers

- 6.1.1.2. Forceps

- 6.1.1.3. Scissors

- 6.1.1.4. Other Class I Devices

- 6.1.2. Class II Device

- 6.1.2.1. Pulse Oximeter Sensors

- 6.1.2.2. Sequential Compression Sleeves

- 6.1.2.3. Catheters and Guidewires

- 6.1.2.4. Other Class II Devices

- 6.1.1. Class I Devices

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. Australia

- 6.2.5. South Korea

- 6.2.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Japan APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Class I Devices

- 7.1.1.1. Laparoscopic Graspers

- 7.1.1.2. Forceps

- 7.1.1.3. Scissors

- 7.1.1.4. Other Class I Devices

- 7.1.2. Class II Device

- 7.1.2.1. Pulse Oximeter Sensors

- 7.1.2.2. Sequential Compression Sleeves

- 7.1.2.3. Catheters and Guidewires

- 7.1.2.4. Other Class II Devices

- 7.1.1. Class I Devices

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. Australia

- 7.2.5. South Korea

- 7.2.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. India APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Class I Devices

- 8.1.1.1. Laparoscopic Graspers

- 8.1.1.2. Forceps

- 8.1.1.3. Scissors

- 8.1.1.4. Other Class I Devices

- 8.1.2. Class II Device

- 8.1.2.1. Pulse Oximeter Sensors

- 8.1.2.2. Sequential Compression Sleeves

- 8.1.2.3. Catheters and Guidewires

- 8.1.2.4. Other Class II Devices

- 8.1.1. Class I Devices

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. Australia

- 8.2.5. South Korea

- 8.2.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Australia APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Class I Devices

- 9.1.1.1. Laparoscopic Graspers

- 9.1.1.2. Forceps

- 9.1.1.3. Scissors

- 9.1.1.4. Other Class I Devices

- 9.1.2. Class II Device

- 9.1.2.1. Pulse Oximeter Sensors

- 9.1.2.2. Sequential Compression Sleeves

- 9.1.2.3. Catheters and Guidewires

- 9.1.2.4. Other Class II Devices

- 9.1.1. Class I Devices

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. Australia

- 9.2.5. South Korea

- 9.2.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. South Korea APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Class I Devices

- 10.1.1.1. Laparoscopic Graspers

- 10.1.1.2. Forceps

- 10.1.1.3. Scissors

- 10.1.1.4. Other Class I Devices

- 10.1.2. Class II Device

- 10.1.2.1. Pulse Oximeter Sensors

- 10.1.2.2. Sequential Compression Sleeves

- 10.1.2.3. Catheters and Guidewires

- 10.1.2.4. Other Class II Devices

- 10.1.1. Class I Devices

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. Australia

- 10.2.5. South Korea

- 10.2.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 11.1.1. Class I Devices

- 11.1.1.1. Laparoscopic Graspers

- 11.1.1.2. Forceps

- 11.1.1.3. Scissors

- 11.1.1.4. Other Class I Devices

- 11.1.2. Class II Device

- 11.1.2.1. Pulse Oximeter Sensors

- 11.1.2.2. Sequential Compression Sleeves

- 11.1.2.3. Catheters and Guidewires

- 11.1.2.4. Other Class II Devices

- 11.1.1. Class I Devices

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. Japan

- 11.2.3. India

- 11.2.4. Australia

- 11.2.5. South Korea

- 11.2.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Device Type

- 12. North America APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Europe APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. South America APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. North America APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. MEA APAC Single-Use Medical Device Reprocessing Industry Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. undefined

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Sterilmed Inc (Johnson & Johnson)

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Soma Technology Inc

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 ReNu Medical Inc (Arjo Inc )

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Stryker Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 NEScientific Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Medline Industries Inc

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.1 Sterilmed Inc (Johnson & Johnson)

List of Figures

- Figure 1: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global APAC Single-Use Medical Device Reprocessing Industry Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: South America APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: South America APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: North America APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: North America APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 27: China APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Device Type 2024 & 2032

- Figure 28: China APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Device Type 2024 & 2032

- Figure 29: China APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Device Type 2024 & 2032

- Figure 30: China APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Device Type 2024 & 2032

- Figure 31: China APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Geography 2024 & 2032

- Figure 32: China APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 33: China APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 34: China APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Geography 2024 & 2032

- Figure 35: China APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: China APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 37: China APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: China APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Japan APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Device Type 2024 & 2032

- Figure 40: Japan APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Device Type 2024 & 2032

- Figure 41: Japan APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Device Type 2024 & 2032

- Figure 42: Japan APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Device Type 2024 & 2032

- Figure 43: Japan APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Geography 2024 & 2032

- Figure 44: Japan APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 45: Japan APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 46: Japan APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Geography 2024 & 2032

- Figure 47: Japan APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 48: Japan APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 49: Japan APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 50: Japan APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 51: India APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Device Type 2024 & 2032

- Figure 52: India APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Device Type 2024 & 2032

- Figure 53: India APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Device Type 2024 & 2032

- Figure 54: India APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Device Type 2024 & 2032

- Figure 55: India APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Geography 2024 & 2032

- Figure 56: India APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 57: India APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 58: India APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Geography 2024 & 2032

- Figure 59: India APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 60: India APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 61: India APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: India APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 63: Australia APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Device Type 2024 & 2032

- Figure 64: Australia APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Device Type 2024 & 2032

- Figure 65: Australia APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Device Type 2024 & 2032

- Figure 66: Australia APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Device Type 2024 & 2032

- Figure 67: Australia APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Geography 2024 & 2032

- Figure 68: Australia APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 69: Australia APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 70: Australia APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Geography 2024 & 2032

- Figure 71: Australia APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 72: Australia APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 73: Australia APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 74: Australia APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 75: South Korea APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Device Type 2024 & 2032

- Figure 76: South Korea APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Device Type 2024 & 2032

- Figure 77: South Korea APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Device Type 2024 & 2032

- Figure 78: South Korea APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Device Type 2024 & 2032

- Figure 79: South Korea APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Geography 2024 & 2032

- Figure 80: South Korea APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 81: South Korea APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 82: South Korea APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Geography 2024 & 2032

- Figure 83: South Korea APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: South Korea APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 85: South Korea APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: South Korea APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Device Type 2024 & 2032

- Figure 88: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Device Type 2024 & 2032

- Figure 89: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Device Type 2024 & 2032

- Figure 90: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Device Type 2024 & 2032

- Figure 91: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Geography 2024 & 2032

- Figure 92: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Geography 2024 & 2032

- Figure 93: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Geography 2024 & 2032

- Figure 94: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Geography 2024 & 2032

- Figure 95: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue (Million), by Country 2024 & 2032

- Figure 96: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume (K Unit), by Country 2024 & 2032

- Figure 97: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 98: Rest of Asia Pacific APAC Single-Use Medical Device Reprocessing Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 4: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 5: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 22: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 23: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 25: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 28: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 29: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 31: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 34: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 35: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 37: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 40: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 41: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 43: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 45: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 46: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 47: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 48: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 49: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Device Type 2019 & 2032

- Table 52: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Device Type 2019 & 2032

- Table 53: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 55: Global APAC Single-Use Medical Device Reprocessing Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global APAC Single-Use Medical Device Reprocessing Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Single-Use Medical Device Reprocessing Industry?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the APAC Single-Use Medical Device Reprocessing Industry?

Key companies in the market include Sterilmed Inc (Johnson & Johnson), Soma Technology Inc, ReNu Medical Inc (Arjo Inc ), Stryker Corporation, NEScientific Inc, Medline Industries Inc.

3. What are the main segments of the APAC Single-Use Medical Device Reprocessing Industry?

The market segments include Device Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Significance of Medical Waste Minimization; Reprocessing Single-use Devices Results in Environment Sustainability; Cost-Saving through Reprocessing Single-use Devices.

6. What are the notable trends driving market growth?

Sequential Compression Sleeves Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Poor Regulation of SUD Reprocessing in Emerging Markets; Preconceived Notion regarding the Quality of Reprocessed Single-use Medical Devices.

8. Can you provide examples of recent developments in the market?

August 2022- Ecolab Inc. expanded its Healthcare division to serve hospitals and healthcare facilities in Southeast Asia. A leader in infection prevention solutions and services, Ecolab Healthcare, offers a comprehensive array of hygiene and infection prevention solutions for hospitals, surgical centers, and healthcare facilities. They also provide instrument & endoscopy reprocessing, surgical drapes, and environmental hand hygiene.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Single-Use Medical Device Reprocessing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Single-Use Medical Device Reprocessing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Single-Use Medical Device Reprocessing Industry?

To stay informed about further developments, trends, and reports in the APAC Single-Use Medical Device Reprocessing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence