Key Insights

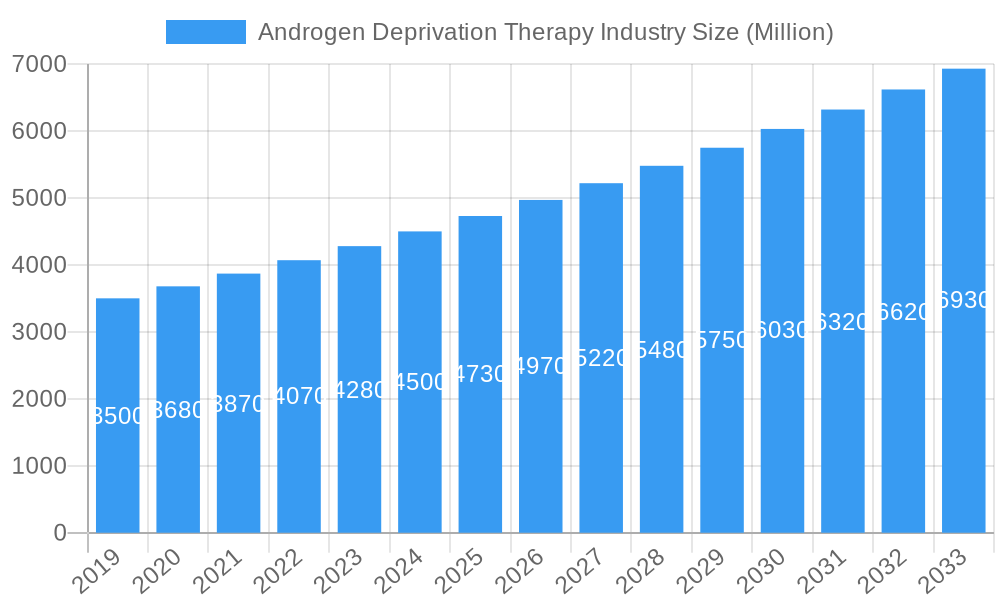

The global Androgen Deprivation Therapy (ADT) market is set for significant expansion, projected to reach a market size of $8.31 billion by 2025. This growth is underpinned by a projected compound annual growth rate (CAGR) of 6% from 2025 to 2033. Key factors driving this trajectory include the rising global incidence of prostate cancer, advancements in therapeutic formulations enhancing patient outcomes, and an aging global population more susceptible to hormone-sensitive cancers. Innovations in drug delivery, particularly long-acting injectables, are improving treatment efficacy and patient compliance, thereby boosting market penetration. Furthermore, increased awareness and enhanced diagnostic capabilities for prostate cancer are facilitating earlier detection and wider adoption of ADT.

Androgen Deprivation Therapy Industry Market Size (In Billion)

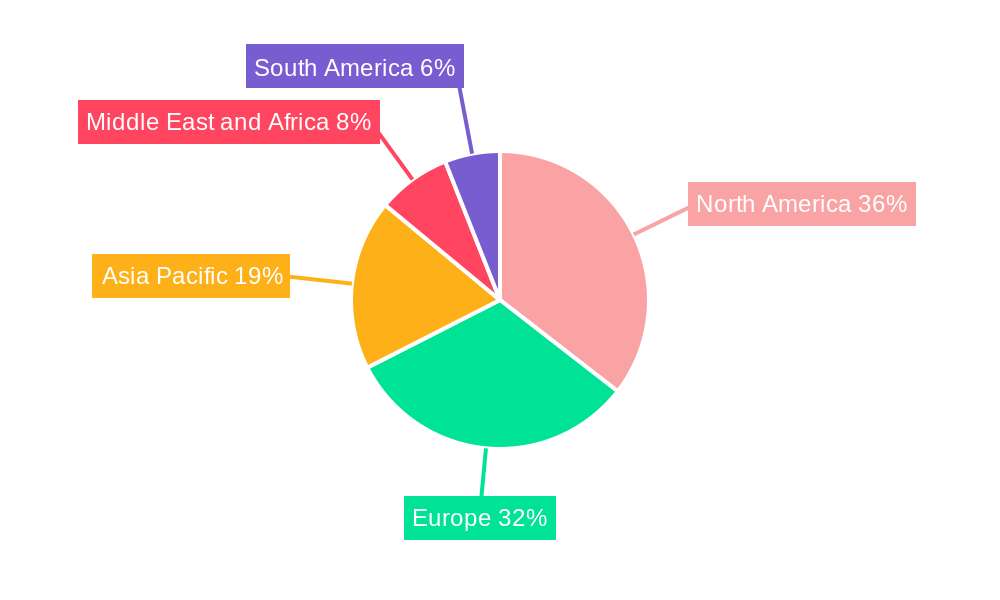

The ADT market is segmented by treatment type, including LHRH agonists, antiandrogens, and surgical interventions. Injectable and oral formulations are dominant, with a noted trend towards long-acting injectables for improved patient adherence. North America and Europe currently lead the market due to robust healthcare infrastructure and high healthcare spending. However, the Asia Pacific region is expected to exhibit the fastest growth driven by a growing patient population, improving healthcare access, and the adoption of innovative ADT treatments. Potential restraints include side effects associated with ADT and the availability of alternative treatments for advanced prostate cancer. Despite these challenges, ongoing research and development by leading pharmaceutical companies in novel drug discoveries and combination therapies are anticipated to sustain positive market growth.

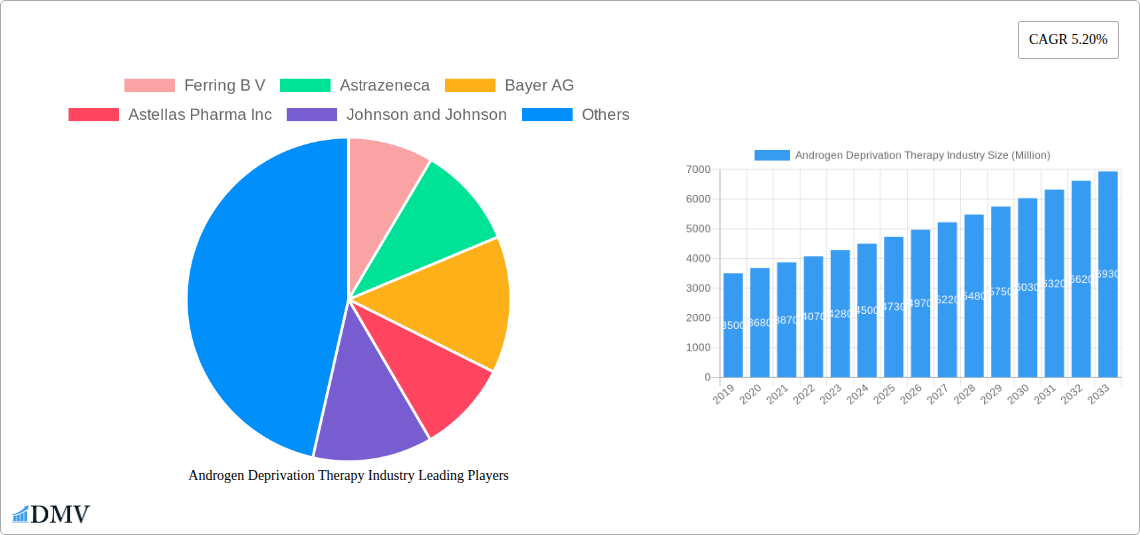

Androgen Deprivation Therapy Industry Company Market Share

Androgen Deprivation Therapy Industry Market Composition & Trends

The Androgen Deprivation Therapy (ADT) market is characterized by a dynamic interplay of established pharmaceutical giants and emerging innovators, driving significant advancements in prostate cancer treatment and expanding into related fields like androgenic alopecia. Market concentration remains a key factor, with leading companies vying for substantial market share through product differentiation and strategic partnerships. The projected market size for ADT is estimated to reach over $XX Million by 2033, with a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Innovation catalysts are primarily fueled by ongoing research into novel drug classes, improved delivery mechanisms, and combination therapies that enhance efficacy and minimize side effects. The regulatory landscape, while stringent, provides a clear pathway for approved therapies, with recent approvals like Nubeqa (darolutamide) underscoring the industry's growth potential. Substitute products, though present, are gradually being outperformed by the targeted efficacy of advanced ADT. End-user profiles are increasingly diverse, encompassing not only prostate cancer patients but also individuals seeking solutions for androgenic alopecia. Mergers and Acquisitions (M&A) activities are expected to see substantial deal values, potentially exceeding $XX Million, as companies seek to consolidate their market positions and acquire promising pipeline assets.

- Market Share Distribution: Leading players are expected to command a collective market share of over XX% in the base year 2025.

- M&A Deal Values: Projections indicate M&A deal values could reach $XX Million to $XX Million within the forecast period.

Androgen Deprivation Therapy Industry Industry Evolution

The Androgen Deprivation Therapy (ADT) industry has witnessed a transformative evolution, driven by a relentless pursuit of improved patient outcomes and a broader understanding of androgen-driven conditions. From its inception as a primary treatment for advanced prostate cancer, ADT has branched into a sophisticated therapeutic modality, impacting hormone-sensitive cancers and conditions like androgenic alopecia. The historical period from 2019 to 2024 laid the groundwork for current market dynamics, marked by incremental improvements in LHRH agonists and antagonists, alongside the emergence of newer antiandrogen agents. The base year, 2025, represents a pivotal point where established therapies are being augmented by next-generation treatments, leading to projected significant market expansion.

The market growth trajectory is strongly influenced by an aging global population, which inherently increases the incidence of prostate cancer, a primary driver for ADT demand. Furthermore, enhanced diagnostic capabilities allow for earlier detection, leading to a larger patient pool eligible for therapeutic intervention. Technological advancements have been instrumental in this evolution. The development of oral formulations, offering greater patient convenience and adherence compared to traditional injectable methods, has been a significant leap. Injectable formulations, particularly long-acting depots, continue to hold a substantial market share due to their efficacy in maintaining consistent hormone suppression.

Consumer demand has shifted towards therapies with improved safety profiles and reduced side effects. Patients are increasingly seeking options that minimize the impact on quality of life, prompting pharmaceutical companies to invest heavily in research and development of drugs with targeted mechanisms of action and fewer systemic adverse events. This includes exploring therapies that can mitigate common side effects such as hot flashes, fatigue, and bone loss. The rise of personalized medicine also plays a crucial role, with ongoing research into genetic markers and biomarkers to predict treatment response and tailor therapeutic strategies to individual patients. This nuanced approach is expected to drive further innovation and market segmentation. The overall adoption metrics for ADT therapies are projected to see a steady increase, reflecting both the growing incidence of relevant conditions and the expanding therapeutic arsenal available to clinicians. This continuous innovation cycle, coupled with increasing healthcare expenditure and a growing awareness of androgen-related health issues, positions the ADT market for sustained and robust growth.

Leading Regions, Countries, or Segments in Androgen Deprivation Therapy Industry

The global Androgen Deprivation Therapy (ADT) market is characterized by significant regional variations in growth, adoption, and therapeutic preferences. Among the various segments, the Drug Class: Luteinizing Hormone-Releasing Hormone (LHRH) agonists and antagonists consistently emerges as a dominant force, accounting for a substantial portion of the market share in the base year 2025, estimated at over XX%. This dominance is attributed to their long-standing efficacy in prostate cancer management and their established role in clinical guidelines. The injectable route of administration, predominantly for these LHRH therapies, also holds a leading position, favored for its predictable hormone suppression and ease of monitoring.

Key Drivers of Dominance for LHRH Agonists/Antagonists and Injectable Formulations:

- Established Clinical Efficacy and Guidelines: LHRH therapies have a proven track record of efficacy in managing hormone-sensitive prostate cancer, making them a cornerstone of treatment protocols worldwide. Major medical societies consistently recommend their use in various stages of the disease.

- Long-Acting Formulations: The availability of long-acting injectable depots (e.g., monthly, quarterly, or even yearly administrations) significantly improves patient compliance and reduces the burden of frequent dosing, a critical factor for chronic disease management.

- Reimbursement and Insurance Coverage: Established LHRH therapies generally benefit from robust reimbursement policies and insurance coverage in developed markets, ensuring broader patient access.

- Healthcare Infrastructure: Developed regions with well-established healthcare infrastructure and a high density of urologists and oncologists are better equipped to administer and monitor injectable therapies effectively.

North America and Europe currently lead the ADT market, driven by factors such as a high prevalence of prostate cancer, advanced healthcare systems, significant R&D investment, and favorable reimbursement policies. The United States, in particular, represents the largest single market due to its large patient population and early adoption of innovative therapies. The increasing adoption of newer oral antiandrogens and advanced androgen receptor inhibitors is gradually expanding the market for oral administration routes, especially in the treatment of metastatic castration-resistant prostate cancer (mCRPC). However, the sheer volume of patients requiring foundational hormonal manipulation for hormone-sensitive prostate cancer ensures the continued leadership of LHRH agonists and antagonists, predominantly delivered via injection.

Androgen Deprivation Therapy Industry Product Innovations

The Androgen Deprivation Therapy (ADT) landscape is continually reshaped by groundbreaking product innovations designed to enhance efficacy, improve safety profiles, and expand therapeutic applications. Recent advancements include the development of novel oral androgen receptor inhibitors (ARIs) that offer a more targeted approach to blocking androgen signaling. These innovations are not only improving treatment outcomes for prostate cancer but also opening new avenues, such as the development of therapies for androgenic alopecia by modulating androgen receptor expression. The focus remains on reducing side effects like hot flashes and bone loss, thereby improving patient quality of life. This includes the exploration of combination therapies and improved delivery mechanisms for sustained and effective androgen suppression.

Propelling Factors for Androgen Deprivation Therapy Industry Growth

The Androgen Deprivation Therapy (ADT) industry is propelled by a confluence of powerful growth drivers. Technological advancements in drug discovery and development are leading to more targeted and effective therapies with improved safety profiles. The rising global incidence of prostate cancer, particularly in aging populations, directly translates to increased demand for ADT. Furthermore, growing awareness and earlier diagnosis of prostate cancer, coupled with advances in diagnostic imaging and biomarker identification, expand the eligible patient pool. Favorable reimbursement policies and increasing healthcare expenditure in developed and emerging economies also play a crucial role. Finally, supportive regulatory frameworks that facilitate the approval of innovative ADT treatments further fuel market expansion.

Obstacles in the Androgen Deprivation Therapy Industry Market

Despite its robust growth, the Androgen Deprivation Therapy (ADT) market faces several significant obstacles. Stringent regulatory hurdles and lengthy approval processes can delay the market entry of novel therapies, increasing development costs and risks. High research and development costs associated with bringing new ADT drugs to market present a substantial financial barrier for smaller companies. The emergence of treatment resistance in advanced stages of prostate cancer necessitates continuous innovation and can limit the long-term effectiveness of existing therapies. Competitive pressures from a growing number of pharmaceutical players, including generics, can lead to price erosion. Side effects associated with ADT, such as hot flashes, bone loss, and cardiovascular issues, can impact patient adherence and necessitate the development of supportive care strategies. Supply chain disruptions and the complexity of global pharmaceutical distribution can also pose challenges.

Future Opportunities in Androgen Deprivation Therapy Industry

The future of the Androgen Deprivation Therapy (ADT) industry is ripe with emerging opportunities. The expansion of ADT into new therapeutic areas, such as the treatment of androgenic alopecia, presents a significant growth avenue. The development of next-generation oral ARIs with enhanced efficacy and reduced side effects will cater to evolving patient preferences for convenience and improved quality of life. Advancements in personalized medicine, including the use of genetic profiling and liquid biopsies, will enable more precise patient selection and treatment tailoring, leading to better outcomes. Exploring novel combination therapies with immunotherapy or chemotherapy is another promising area for improving treatment efficacy in resistant cancers. Furthermore, penetration into emerging markets with increasing healthcare infrastructure and growing awareness of prostate cancer offers substantial untapped potential.

Major Players in the Androgen Deprivation Therapy Industry Ecosystem

Ferring B V Astrazeneca Bayer AG Astellas Pharma Inc Johnson and Johnson Foresee Pharmaceuticals Co Ltd Myovant Sciences GmbH Viatris Verity Pharmaceuticals Inc AbbVie Inc Bristol-Myers Squibb Company Tolmar Pharmaceuticals Inc

Key Developments in Androgen Deprivation Therapy Industry Industry

- March 2023: The European Commission approved Nubeqa (darolutamide), an oral androgen receptor inhibitor (ARi), plus androgen deprivation therapy (ADT) in combination with docetaxel, for the treatment of patients with metastatic hormone-sensitive prostate cancer (mHSPC). This development signifies a major step forward in treating advanced prostate cancer with a novel oral therapeutic option.

- March 2023: OliX Pharmaceuticals, Inc. announced that it received approval from the Human Research Ethics Committee (HREC) in Australia to initiate a Phase 1 clinical trial of OLX72021. This groundbreaking development targets androgenic alopecia, also known as male-pattern baldness. OLX72021's mechanism of action, which suppresses hormone activity that causes androgenic alopecia by reducing androgen receptor expression, opens a new frontier for ADT applications beyond cancer.

Strategic Androgen Deprivation Therapy Industry Market Forecast

The strategic outlook for the Androgen Deprivation Therapy (ADT) market is exceptionally positive, fueled by a combination of expanding indications, groundbreaking product innovations, and a growing global patient base. The forecast period of 2025–2033 is poised for significant growth, with projected market expansion driven by the increasing prevalence of prostate cancer and the development of next-generation oral androgen receptor inhibitors offering enhanced patient convenience and efficacy. The exploration of ADT in non-oncological conditions, such as androgenic alopecia, presents a substantial untapped market. Strategic investments in research and development, coupled with favorable regulatory pathways for novel therapies, will continue to be pivotal in shaping market dynamics. The industry's focus on personalized medicine and combination therapies promises to unlock further growth opportunities, solidifying ADT's role as a cornerstone in managing androgen-driven conditions.

Androgen Deprivation Therapy Industry Segmentation

-

1. Treatment

-

1.1. By Drug Class

- 1.1.1. Luteiniz

- 1.1.2. Antiandrogens

- 1.2. By Surgery

-

1.1. By Drug Class

-

2. Route of Administration

- 2.1. Injectable

- 2.2. Oral

Androgen Deprivation Therapy Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Androgen Deprivation Therapy Industry Regional Market Share

Geographic Coverage of Androgen Deprivation Therapy Industry

Androgen Deprivation Therapy Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Prostrate Cancer; Rising Research and Development Activities

- 3.3. Market Restrains

- 3.3.1. Poor Reimbursement and Increasing Side Effects

- 3.4. Market Trends

- 3.4.1. Antiandrogen Sub Segment Within Drug Class Segment is Expected to Witness a Strong Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Androgen Deprivation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Treatment

- 5.1.1. By Drug Class

- 5.1.1.1. Luteiniz

- 5.1.1.2. Antiandrogens

- 5.1.2. By Surgery

- 5.1.1. By Drug Class

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Injectable

- 5.2.2. Oral

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Treatment

- 6. North America Androgen Deprivation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Treatment

- 6.1.1. By Drug Class

- 6.1.1.1. Luteiniz

- 6.1.1.2. Antiandrogens

- 6.1.2. By Surgery

- 6.1.1. By Drug Class

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Injectable

- 6.2.2. Oral

- 6.1. Market Analysis, Insights and Forecast - by Treatment

- 7. Europe Androgen Deprivation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Treatment

- 7.1.1. By Drug Class

- 7.1.1.1. Luteiniz

- 7.1.1.2. Antiandrogens

- 7.1.2. By Surgery

- 7.1.1. By Drug Class

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Injectable

- 7.2.2. Oral

- 7.1. Market Analysis, Insights and Forecast - by Treatment

- 8. Asia Pacific Androgen Deprivation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Treatment

- 8.1.1. By Drug Class

- 8.1.1.1. Luteiniz

- 8.1.1.2. Antiandrogens

- 8.1.2. By Surgery

- 8.1.1. By Drug Class

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Injectable

- 8.2.2. Oral

- 8.1. Market Analysis, Insights and Forecast - by Treatment

- 9. Middle East and Africa Androgen Deprivation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Treatment

- 9.1.1. By Drug Class

- 9.1.1.1. Luteiniz

- 9.1.1.2. Antiandrogens

- 9.1.2. By Surgery

- 9.1.1. By Drug Class

- 9.2. Market Analysis, Insights and Forecast - by Route of Administration

- 9.2.1. Injectable

- 9.2.2. Oral

- 9.1. Market Analysis, Insights and Forecast - by Treatment

- 10. South America Androgen Deprivation Therapy Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Treatment

- 10.1.1. By Drug Class

- 10.1.1.1. Luteiniz

- 10.1.1.2. Antiandrogens

- 10.1.2. By Surgery

- 10.1.1. By Drug Class

- 10.2. Market Analysis, Insights and Forecast - by Route of Administration

- 10.2.1. Injectable

- 10.2.2. Oral

- 10.1. Market Analysis, Insights and Forecast - by Treatment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ferring B V

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Astrazeneca

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayer AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Astellas Pharma Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Johnson and Johnson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Foresee Pharmaceuticals Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Myovant Sciences GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Viatris

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Verity Pharmaceuticals Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AbbVie Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bristol-Myers Squibb Company*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Tolmar Pharmaceuticals Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Ferring B V

List of Figures

- Figure 1: Global Androgen Deprivation Therapy Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Androgen Deprivation Therapy Industry Revenue (billion), by Treatment 2025 & 2033

- Figure 3: North America Androgen Deprivation Therapy Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 4: North America Androgen Deprivation Therapy Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 5: North America Androgen Deprivation Therapy Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 6: North America Androgen Deprivation Therapy Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Androgen Deprivation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Androgen Deprivation Therapy Industry Revenue (billion), by Treatment 2025 & 2033

- Figure 9: Europe Androgen Deprivation Therapy Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 10: Europe Androgen Deprivation Therapy Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 11: Europe Androgen Deprivation Therapy Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 12: Europe Androgen Deprivation Therapy Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Androgen Deprivation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Androgen Deprivation Therapy Industry Revenue (billion), by Treatment 2025 & 2033

- Figure 15: Asia Pacific Androgen Deprivation Therapy Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 16: Asia Pacific Androgen Deprivation Therapy Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 17: Asia Pacific Androgen Deprivation Therapy Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 18: Asia Pacific Androgen Deprivation Therapy Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Androgen Deprivation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Androgen Deprivation Therapy Industry Revenue (billion), by Treatment 2025 & 2033

- Figure 21: Middle East and Africa Androgen Deprivation Therapy Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 22: Middle East and Africa Androgen Deprivation Therapy Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 23: Middle East and Africa Androgen Deprivation Therapy Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 24: Middle East and Africa Androgen Deprivation Therapy Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Androgen Deprivation Therapy Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Androgen Deprivation Therapy Industry Revenue (billion), by Treatment 2025 & 2033

- Figure 27: South America Androgen Deprivation Therapy Industry Revenue Share (%), by Treatment 2025 & 2033

- Figure 28: South America Androgen Deprivation Therapy Industry Revenue (billion), by Route of Administration 2025 & 2033

- Figure 29: South America Androgen Deprivation Therapy Industry Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 30: South America Androgen Deprivation Therapy Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Androgen Deprivation Therapy Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 2: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 3: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 5: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 6: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 11: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 12: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 20: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 21: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 29: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 30: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 35: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Route of Administration 2020 & 2033

- Table 36: Global Androgen Deprivation Therapy Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Androgen Deprivation Therapy Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Androgen Deprivation Therapy Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Androgen Deprivation Therapy Industry?

Key companies in the market include Ferring B V, Astrazeneca, Bayer AG, Astellas Pharma Inc, Johnson and Johnson, Foresee Pharmaceuticals Co Ltd, Myovant Sciences GmbH, Viatris, Verity Pharmaceuticals Inc, AbbVie Inc, Bristol-Myers Squibb Company*List Not Exhaustive, Tolmar Pharmaceuticals Inc.

3. What are the main segments of the Androgen Deprivation Therapy Industry?

The market segments include Treatment, Route of Administration.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Prostrate Cancer; Rising Research and Development Activities.

6. What are the notable trends driving market growth?

Antiandrogen Sub Segment Within Drug Class Segment is Expected to Witness a Strong Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Poor Reimbursement and Increasing Side Effects.

8. Can you provide examples of recent developments in the market?

March 2023: The European Commission approved Nubeqa (darolutamide), an oral androgen receptor inhibitor (ARi), plus androgen deprivation therapy (ADT) in combination with docetaxel, for the treatment of patients with metastatic hormone-sensitive prostate cancer (mHSPC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Androgen Deprivation Therapy Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Androgen Deprivation Therapy Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Androgen Deprivation Therapy Industry?

To stay informed about further developments, trends, and reports in the Androgen Deprivation Therapy Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence