Key Insights

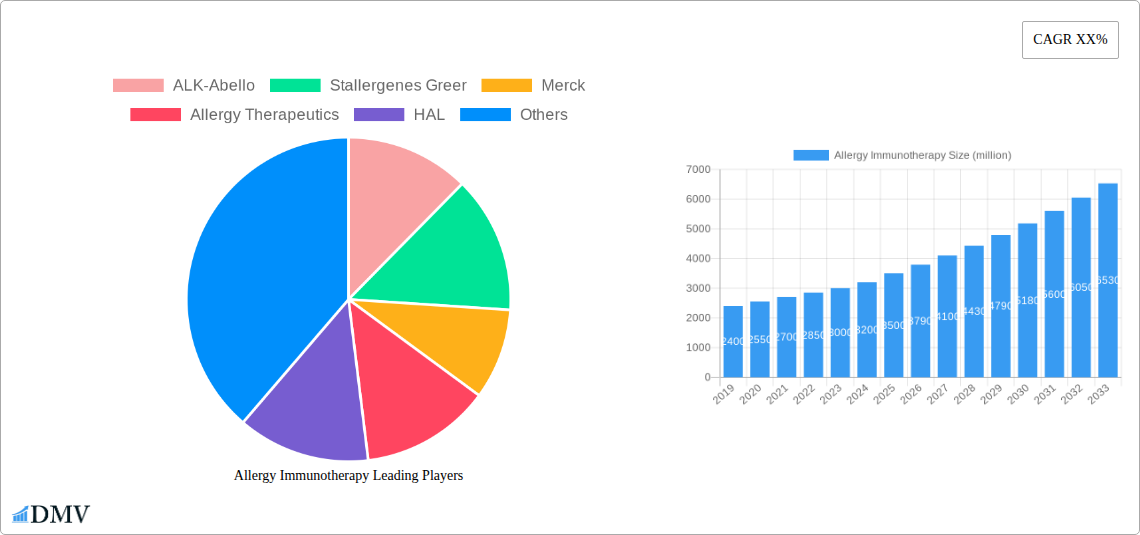

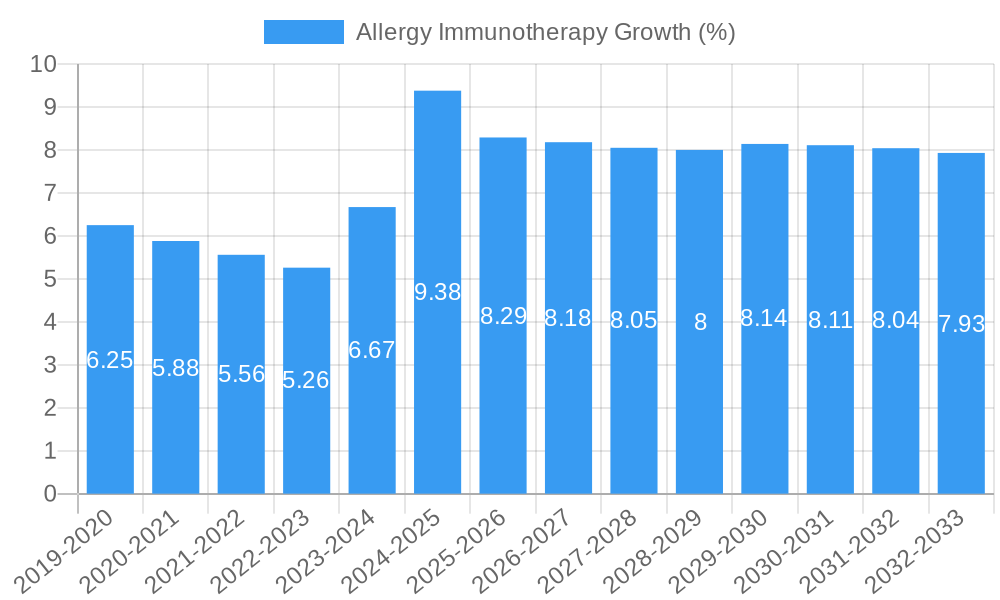

The global Allergy Immunotherapy market is poised for significant expansion, projected to reach an estimated market size of USD 3,500 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This dynamic growth is primarily fueled by the increasing prevalence of allergic diseases worldwide, including allergic rhinitis and allergic asthma, coupled with a growing patient and physician preference for immunotherapy as a long-term, disease-modifying treatment option over symptom management. Advances in immunotherapy delivery methods, such as the development of more convenient sublingual formulations and the refinement of subcutaneous immunotherapy protocols, are further driving market adoption. Moreover, rising healthcare expenditure and improved diagnostic capabilities are contributing to earlier and more accurate diagnosis of allergies, subsequently boosting demand for effective treatment modalities like immunotherapy. The market is also benefiting from increased awareness campaigns and a growing understanding of the potential of immunotherapy to alter the natural course of allergic diseases.

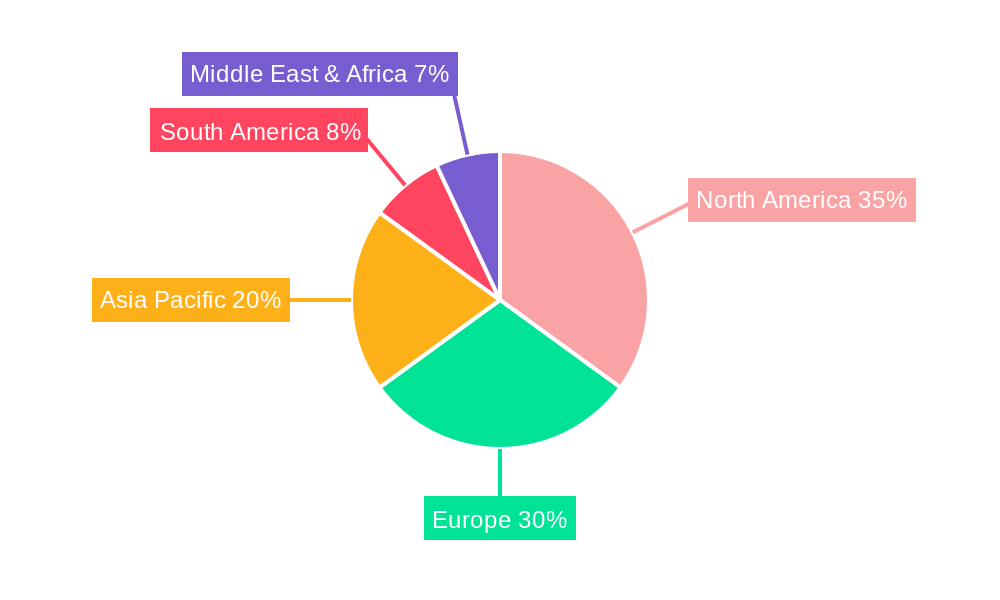

Despite the optimistic outlook, the market faces certain restraints, including the relatively high cost of immunotherapy treatments compared to conventional symptomatic therapies and the longer treatment duration required for optimal outcomes. Patient adherence to long-term treatment regimens can also be a challenge. However, ongoing research and development efforts aimed at enhancing treatment efficacy, reducing adverse events, and improving patient convenience are expected to mitigate these challenges. Key players such as ALK-Abello, Stallergenes Greer, and Merck are actively investing in R&D, strategic collaborations, and market expansion initiatives to capitalize on the burgeoning opportunities. The market is segmented by application into Allergic Rhinitis, Allergic Asthma, and Others, with Allergic Rhinitis and Allergic Asthma holding dominant shares due to their widespread occurrence. Subcutaneous Immunotherapy and Sublingual Immunotherapy represent the primary types, with Sublingual Immunotherapy witnessing increasing traction due to its ease of administration and improved safety profile. Geographically, North America and Europe are expected to lead the market, driven by advanced healthcare infrastructure, high disease prevalence, and strong research capabilities, while the Asia Pacific region presents a significant growth opportunity due to its large population base and improving healthcare access.

Comprehensive Allergy Immunotherapy Market Report: Analysis, Forecasts, and Strategic Insights (2019–2033)

This in-depth report provides a comprehensive analysis of the global Allergy Immunotherapy market, offering critical insights for stakeholders aiming to navigate this dynamic sector. Covering a study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report delves into market composition, industry evolution, regional dominance, product innovation, growth drivers, challenges, future opportunities, key players, and strategic market forecasts. Our analysis leverages data up to 2024 and projects forward, ensuring actionable intelligence for strategic decision-making.

Allergy Immunotherapy Market Composition & Trends

The Allergy Immunotherapy market is characterized by a moderately concentrated landscape, with key players like ALK-Abello, Stallergenes Greer, Merck, Allergy Therapeutics, HAL, Holister Stier, and Leti vying for market share. Innovation catalysts are primarily driven by advancements in formulation technologies and a growing understanding of the immunological mechanisms underlying allergic diseases. The regulatory landscape, while stringent, is evolving to accommodate novel treatment modalities, fostering market expansion. Substitute products, such as antihistamines and corticosteroids, remain prevalent but are increasingly being complemented or replaced by immunotherapy's disease-modifying potential. End-user profiles span a broad spectrum, from children suffering from early-onset allergies to adults seeking long-term relief from chronic conditions. Mergers and acquisitions (M&A) activity has been significant, with recent deals valued in the hundreds of millions, aiming to consolidate portfolios and expand geographical reach.

- Market Share Distribution: Dominant players hold an estimated XX% of the market share.

- M&A Deal Values: Recent transactions have ranged from $50 million to over $500 million.

- Key Innovation Focus: Novel adjuvant technologies and allergen standardization.

- Regulatory Landscape: FDA and EMA approvals for new immunotherapy products are key milestones.

Allergy Immunotherapy Industry Evolution

The Allergy Immunotherapy industry has witnessed remarkable evolution, transitioning from a niche treatment to a mainstream therapeutic option for millions worldwide. This growth trajectory is underpinned by increasing disease prevalence, a heightened awareness of the limitations of symptomatic treatments, and significant scientific breakthroughs. The market has experienced an average annual growth rate of approximately 7.8% over the historical period. Technological advancements in allergen extraction, purification, and standardization have been pivotal, leading to safer and more effective immunotherapy products. Furthermore, the development of novel delivery methods, including sublingual tablets and improved subcutaneous formulations, has enhanced patient compliance and accessibility. Shifting consumer demands, driven by a desire for long-term, sustainable allergy relief rather than just symptom management, have further propelled the adoption of immunotherapy. The market is projected to continue its upward trend, reaching an estimated value of $4.5 billion by 2033. The increasing diagnosis of allergic rhinitis and allergic asthma, accounting for an estimated 75% and 20% of immunotherapy applications respectively, are significant contributors to this expansion.

Leading Regions, Countries, or Segments in Allergy Immunotherapy

North America, particularly the United States, currently dominates the Allergy Immunotherapy market, driven by high prevalence rates of allergic diseases, robust healthcare infrastructure, and significant investment in research and development. Europe follows closely, with countries like Germany, France, and the UK exhibiting strong market penetration due to favorable reimbursement policies and a well-established network of allergy specialists.

Dominant Segments by Application:

- Allergic Rhinitis: This segment accounts for the largest share of the Allergy Immunotherapy market, estimated at over 70%, owing to its widespread occurrence and the significant impact on quality of life.

- Allergic Asthma: Contributing approximately 25% to the market, allergic asthma is another major application area where immunotherapy demonstrates significant efficacy in reducing exacerbations and improving lung function.

- Others: This segment, encompassing conditions like atopic dermatitis and insect sting allergies, represents a smaller but growing portion of the market, with an estimated 5% share.

Dominant Segments by Type:

- Subcutaneous Immunotherapy (SCIT): Historically the dominant form, SCIT still holds a substantial market share due to its proven efficacy and established treatment protocols.

- Sublingual Immunotherapy (SLIT): This segment has experienced rapid growth due to its convenience, improved safety profile, and increasing patient preference. It is projected to capture a larger market share in the coming years.

Key drivers of this regional and segmental dominance include proactive government initiatives promoting allergen-specific immunotherapy, substantial R&D investments by leading pharmaceutical companies like Merck and Allergy Therapeutics, and an increasing number of clinical studies validating the long-term benefits of immunotherapy, leading to greater physician and patient confidence. The projected market growth in North America is expected to be around 8.2% annually, while Europe is anticipated to grow at approximately 7.5% per annum.

Allergy Immunotherapy Product Innovations

Recent product innovations in Allergy Immunotherapy are revolutionizing patient care. Companies are focusing on developing novel recombinant allergens and advanced adjuvant systems to enhance efficacy and reduce treatment duration. For instance, new sublingual tablet formulations are offering improved patient convenience and adherence, with clinical trials demonstrating significant reductions in symptom scores and medication use. Performance metrics highlight a decrease in allergic rhinitis symptoms by up to 50% and a substantial reduction in asthma exacerbations. Unique selling propositions include the potential for long-term remission and a shift from symptom management to disease modification, positioning immunotherapy as a cornerstone treatment for allergic diseases.

Propelling Factors for Allergy Immunotherapy Growth

Several key factors are propelling the growth of the Allergy Immunotherapy market. Firstly, the escalating global prevalence of allergic diseases, driven by urbanization and environmental changes, creates a burgeoning patient pool seeking effective treatments. Secondly, increasing patient and physician awareness regarding the disease-modifying potential of immunotherapy, as opposed to purely symptomatic relief, is driving adoption. Thirdly, ongoing technological advancements in allergen purification, recombinant DNA technology, and novel delivery systems are enhancing product efficacy, safety, and convenience. Finally, supportive regulatory frameworks and expanding reimbursement coverage in key markets are further facilitating market penetration. The estimated market growth is projected at approximately 7.9% CAGR from 2025 to 2033.

Obstacles in the Allergy Immunotherapy Market

Despite its promising growth, the Allergy Immunotherapy market faces several obstacles. Regulatory hurdles associated with the development and approval of new immunotherapy products can be lengthy and costly. Supply chain disruptions, particularly for specialized allergens, can impact product availability and manufacturing timelines. Furthermore, the lengthy treatment duration of immunotherapy (typically 3-5 years) can present a challenge for patient adherence and physician prescription. Competitive pressures from established symptomatic treatments, which offer immediate relief at a lower perceived upfront cost, also pose a restraint. These challenges collectively contribute to an estimated market penetration rate of only 5% in some regions.

Future Opportunities in Allergy Immunotherapy

The Allergy Immunotherapy market is poised for significant future opportunities. The development of personalized immunotherapy approaches, tailoring treatments to individual patient genetic profiles and specific allergen sensitivities, presents a major growth avenue. Advancements in mRNA-based immunotherapy and the exploration of novel adjuvant technologies promise to further enhance efficacy and reduce treatment timelines. Expansion into emerging markets, where the prevalence of allergic diseases is rising and access to advanced therapies is growing, offers substantial untapped potential. Furthermore, the increasing focus on treating a broader spectrum of allergic conditions beyond rhinitis and asthma, such as atopic dermatitis and food allergies, will unlock new market segments.

Major Players in the Allergy Immunotherapy Ecosystem

- ALK-Abello

- Stallergenes Greer

- Merck

- Allergy Therapeutics

- HAL

- Holister Stier

- Leti

Key Developments in Allergy Immunotherapy Industry

- 2023 October: ALK-Abello receives FDA approval for a new indication for its allergy immunotherapy product.

- 2022 November: Stallergenes Greer announces positive results from a Phase III clinical trial for a novel sublingual immunotherapy.

- 2021 July: Allergy Therapeutics secures significant funding to advance its pipeline of novel immunotherapy treatments.

- 2020 May: Merck expands its allergy portfolio through a strategic acquisition valued at approximately $300 million.

- 2019 December: HAL launches a new allergen immunotherapy product in the European market, targeting a broader patient population.

Strategic Allergy Immunotherapy Market Forecast

The strategic Allergy Immunotherapy market forecast indicates a robust expansion driven by a convergence of factors including rising allergy prevalence, sophisticated product innovations, and increasing patient demand for long-term solutions. The market is projected to experience a steady CAGR of approximately 7.9% from 2025 to 2033, with an estimated market size of $4.5 billion by the end of the forecast period. Key growth catalysts include the ongoing shift towards personalized medicine, advancements in subcutaneous and sublingual immunotherapy formulations, and expanding global market access. The increasing focus on immunotherapy's disease-modifying capabilities, offering sustained relief and potentially preventing the progression of allergic diseases, positions it as a critical therapeutic modality for the future.

Allergy Immunotherapy Segmentation

-

1. Application

- 1.1. Allergic Rhinitis

- 1.2. Allergic Asthma

- 1.3. Others

-

2. Types

- 2.1. Subcutaneous Immunotherapy

- 2.2. Sublingual Immunotherapy

Allergy Immunotherapy Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Allergy Immunotherapy REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Allergy Immunotherapy Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Allergic Rhinitis

- 5.1.2. Allergic Asthma

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Subcutaneous Immunotherapy

- 5.2.2. Sublingual Immunotherapy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Allergy Immunotherapy Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Allergic Rhinitis

- 6.1.2. Allergic Asthma

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Subcutaneous Immunotherapy

- 6.2.2. Sublingual Immunotherapy

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Allergy Immunotherapy Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Allergic Rhinitis

- 7.1.2. Allergic Asthma

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Subcutaneous Immunotherapy

- 7.2.2. Sublingual Immunotherapy

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Allergy Immunotherapy Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Allergic Rhinitis

- 8.1.2. Allergic Asthma

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Subcutaneous Immunotherapy

- 8.2.2. Sublingual Immunotherapy

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Allergy Immunotherapy Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Allergic Rhinitis

- 9.1.2. Allergic Asthma

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Subcutaneous Immunotherapy

- 9.2.2. Sublingual Immunotherapy

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Allergy Immunotherapy Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Allergic Rhinitis

- 10.1.2. Allergic Asthma

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Subcutaneous Immunotherapy

- 10.2.2. Sublingual Immunotherapy

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ALK-Abello

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stallergenes Greer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allergy Therapeutics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HAL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Holister Stier

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leti

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 ALK-Abello

List of Figures

- Figure 1: Global Allergy Immunotherapy Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Allergy Immunotherapy Revenue (million), by Application 2024 & 2032

- Figure 3: North America Allergy Immunotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Allergy Immunotherapy Revenue (million), by Types 2024 & 2032

- Figure 5: North America Allergy Immunotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Allergy Immunotherapy Revenue (million), by Country 2024 & 2032

- Figure 7: North America Allergy Immunotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Allergy Immunotherapy Revenue (million), by Application 2024 & 2032

- Figure 9: South America Allergy Immunotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Allergy Immunotherapy Revenue (million), by Types 2024 & 2032

- Figure 11: South America Allergy Immunotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Allergy Immunotherapy Revenue (million), by Country 2024 & 2032

- Figure 13: South America Allergy Immunotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Allergy Immunotherapy Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Allergy Immunotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Allergy Immunotherapy Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Allergy Immunotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Allergy Immunotherapy Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Allergy Immunotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Allergy Immunotherapy Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Allergy Immunotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Allergy Immunotherapy Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Allergy Immunotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Allergy Immunotherapy Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Allergy Immunotherapy Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Allergy Immunotherapy Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Allergy Immunotherapy Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Allergy Immunotherapy Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Allergy Immunotherapy Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Allergy Immunotherapy Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Allergy Immunotherapy Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Allergy Immunotherapy Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Allergy Immunotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Allergy Immunotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Allergy Immunotherapy Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Allergy Immunotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Allergy Immunotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Allergy Immunotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Allergy Immunotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Allergy Immunotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Allergy Immunotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Allergy Immunotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Allergy Immunotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Allergy Immunotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Allergy Immunotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Allergy Immunotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Allergy Immunotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Allergy Immunotherapy Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Allergy Immunotherapy Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Allergy Immunotherapy Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Allergy Immunotherapy Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Allergy Immunotherapy?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Allergy Immunotherapy?

Key companies in the market include ALK-Abello, Stallergenes Greer, Merck, Allergy Therapeutics, HAL, Holister Stier, Leti.

3. What are the main segments of the Allergy Immunotherapy?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Allergy Immunotherapy," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Allergy Immunotherapy report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Allergy Immunotherapy?

To stay informed about further developments, trends, and reports in the Allergy Immunotherapy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence