Key Insights

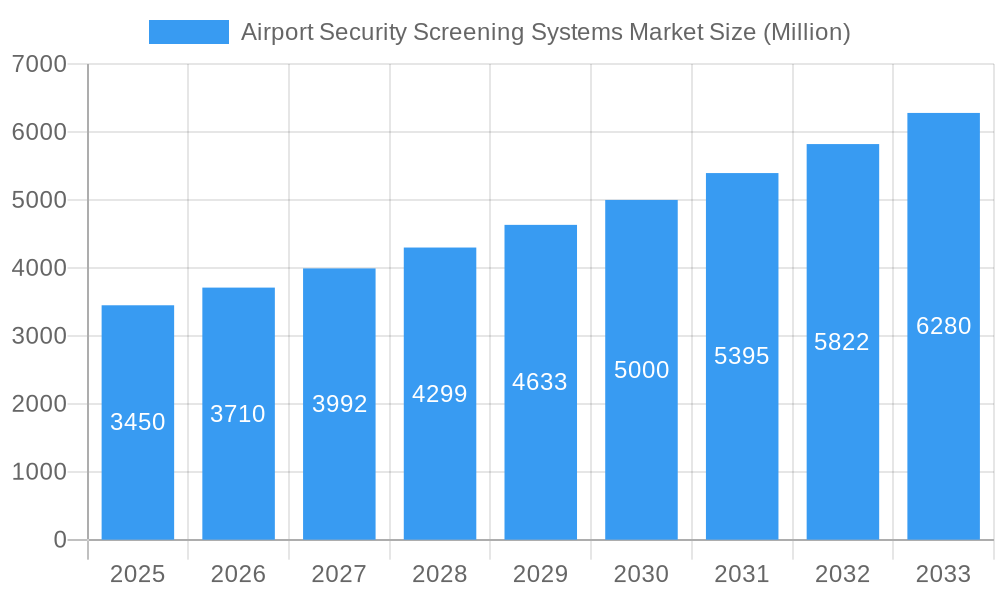

The Airport Security Screening Systems market is experiencing robust growth, projected to reach a market size of $3.45 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 7.32% from 2025 to 2033. This expansion is driven by several factors. Increased passenger traffic globally, stringent security regulations post-9/11 and other terrorist attacks, and the continuous advancement of technologies like advanced imaging technology (AIT), millimeter-wave scanners, and explosive trace detection (ETD) systems are key drivers. Furthermore, the growing adoption of automated screening systems to enhance efficiency and reduce processing times at airports is significantly boosting market growth. The market is segmented by screening type (passenger, vehicle, baggage), with passenger screening dominating due to the high volume of passengers requiring security checks. While the rising adoption of advanced technologies presents opportunities, the high initial investment cost associated with these systems and the need for skilled personnel to operate and maintain them represent key restraints. The integration of Artificial Intelligence (AI) and machine learning (ML) is emerging as a key trend, promising improved accuracy, speed, and threat detection capabilities, further shaping the market's trajectory. North America and Europe currently hold significant market shares due to established infrastructure and stringent security protocols, but the Asia-Pacific region is expected to witness substantial growth fueled by increasing air travel and infrastructure development.

Airport Security Screening Systems Market Market Size (In Billion)

The competitive landscape is marked by a mix of established players and emerging innovative companies. Key players like Leidos, Smiths Group, OSI Systems, and Nuctech are actively involved in developing and deploying advanced security systems, constantly vying for market share through technological advancements, strategic partnerships, and geographical expansion. The forecast period (2025-2033) is projected to witness the continued adoption of technologically sophisticated screening solutions and geographical diversification by major players, solidifying the long-term growth outlook of the Airport Security Screening Systems market. The market's future success hinges on the ability of companies to innovate, adapt to evolving security threats, and meet the growing demands of a rapidly expanding global air travel industry.

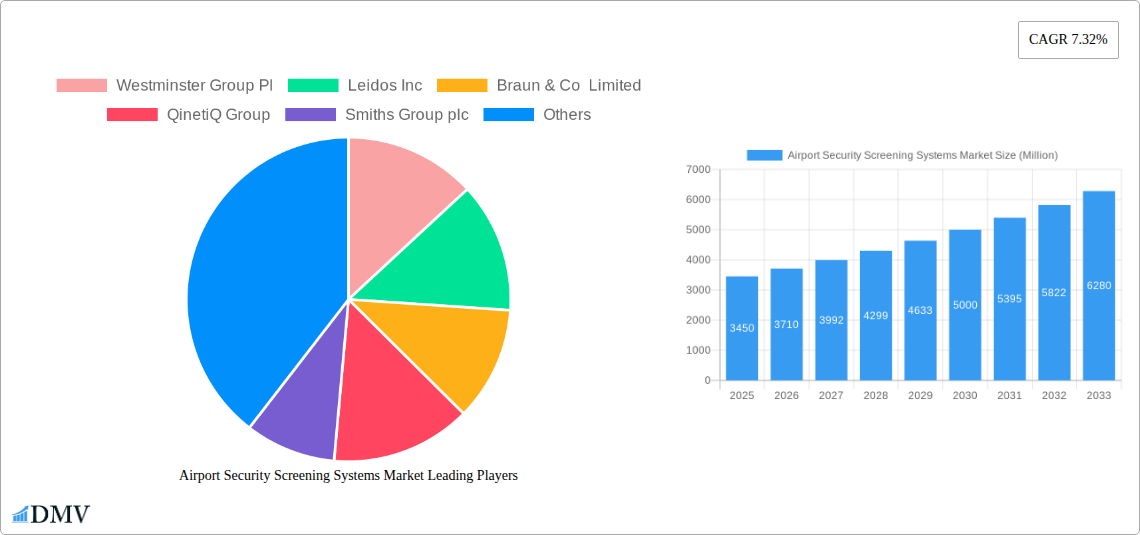

Airport Security Screening Systems Market Company Market Share

Airport Security Screening Systems Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Airport Security Screening Systems Market, offering a comprehensive overview of market dynamics, technological advancements, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, building upon the historical period of 2019-2024. This report is crucial for stakeholders seeking to understand the evolving landscape of airport security and capitalize on emerging opportunities within this vital sector. The market is projected to reach xx Million by 2033.

Airport Security Screening Systems Market Market Composition & Trends

The Airport Security Screening Systems Market exhibits a moderately concentrated landscape, with key players holding significant market share. The market share distribution among the top five players is estimated to be around 45% in 2025, indicating room for both consolidation and new entrants. Innovation is a key driver, fueled by advancements in technologies like millimeter-wave scanners, advanced imaging technology (AIT), and explosive trace detection (ETD). Stringent regulatory frameworks, particularly concerning passenger and baggage security, significantly influence market growth and product development. Substitute products are limited, primarily confined to enhanced physical inspections, highlighting the crucial role of screening systems. End-users primarily include airport authorities, airlines, and security contractors. M&A activity is moderate, with deal values averaging around xx Million in recent years. Specific examples include the recent integration of Liberty Defense’s Hexwave technology.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 45% market share (2025).

- Innovation Catalysts: Millimeter-wave scanners, AIT, ETD.

- Regulatory Landscape: Stringent and influential on market growth.

- Substitute Products: Limited, mainly physical inspections.

- End-User Profiles: Airport authorities, airlines, security contractors.

- M&A Activity: Moderate, average deal value around xx Million.

Airport Security Screening Systems Market Industry Evolution

The Airport Security Screening Systems Market has witnessed consistent growth, driven by increasing passenger traffic and heightened security concerns globally. The market experienced a Compound Annual Growth Rate (CAGR) of approximately xx% during the historical period (2019-2024). Technological advancements have played a pivotal role, with a shift from traditional X-ray machines towards more sophisticated technologies offering enhanced detection capabilities and reduced passenger inconvenience. Consumer demands for faster, more efficient, and less intrusive screening processes are shaping product development and market trends. Adoption of advanced technologies is increasing, with an estimated xx% of major airports globally deploying AIT systems by 2025. This trend is further bolstered by government initiatives and investments aimed at improving airport security infrastructure. The forecast period (2025-2033) anticipates continued growth, driven by factors like increasing air travel and technological innovations. The market is projected to witness a CAGR of approximately xx% during this period.

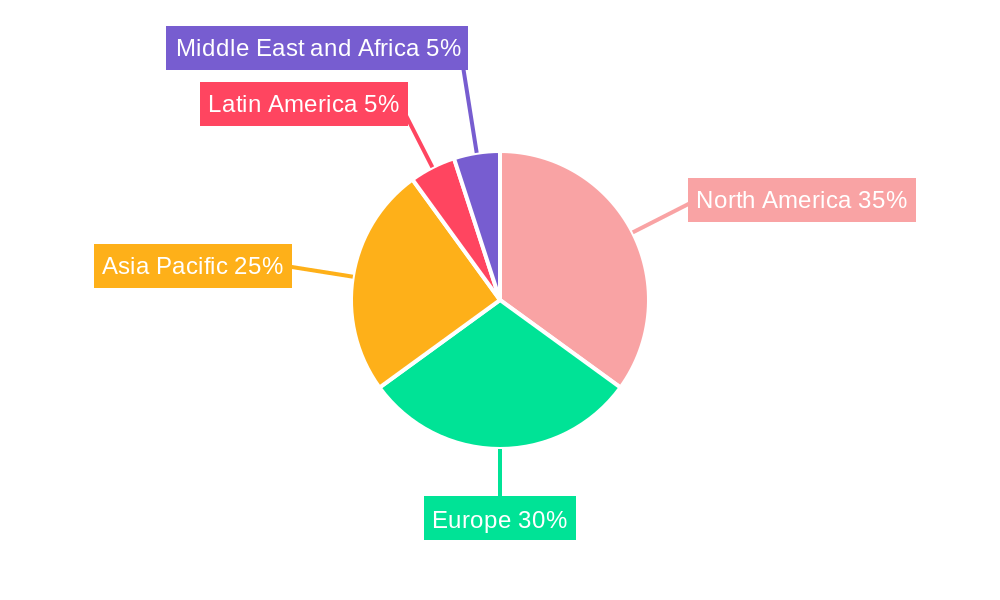

Leading Regions, Countries, or Segments in Airport Security Screening Systems Market

North America currently commands a dominant position in the Airport Security Screening Systems Market. This leadership is a direct result of substantial, ongoing investments in modernizing airport infrastructure, coupled with the implementation and enforcement of stringent security regulations designed to safeguard air travel. The region's consistently high passenger volume and the adherence to robust, multi-layered security protocols are significant catalysts fueling sustained market demand. Europe stands as another crucial market, demonstrating a consistent and progressive adoption of cutting-edge screening technologies, driven by a similar emphasis on passenger safety and operational efficiency. Within market segmentation, the Passenger Screening segment indisputably holds the largest share. This dominance is attributed to the sheer volume of passenger traffic processed daily and the paramount necessity for both efficient, seamless, and exceptionally secure screening processes that minimize delays while maximizing safety.

- Key Drivers for North America's Dominance:

- Substantial and continuous investment in upgrading and expanding airport infrastructure.

- Strict and evolving government regulations and mandates concerning aviation security.

- Consistently high and growing passenger volume, demanding scalable security solutions.

- Technological innovation and early adoption of advanced screening solutions.

- Key Drivers for Passenger Screening Segment Dominance:

- Extremely high passenger traffic volume requiring efficient processing.

- Critical need for both rapid and highly secure screening methods.

- Continuous technological advancements specifically tailored to enhance passenger screening capabilities and user experience.

- Focus on non-intrusive technologies that balance security with passenger comfort.

Airport Security Screening Systems Market Product Innovations

Recent and ongoing innovations within the Airport Security Screening Systems Market are strategically focused on a trifecta of critical objectives: significantly enhancing passenger and baggage throughput, dramatically improving the accuracy of threat detection while minimizing false alarms, and crucially, minimizing passenger inconvenience and wait times. Advanced Imaging Technology (AIT) systems are at the forefront, offering superior image clarity and detail, thereby enabling more precise identification of threats and a substantial reduction in nuisance alarms when compared to conventional X-ray systems. Furthermore, millimeter-wave scanners have emerged as a highly effective non-invasive solution, adept at detecting concealed weapons, explosives, and other prohibited items without requiring passengers to remove clothing or unpack belongings. The integration of sophisticated Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing detection accuracy and the automation of threat assessment processes, allowing security personnel to focus on more complex situations. These collective innovations are paramount in streamlining the entire screening process, significantly enhancing overall airport security posture, and concurrently reducing passenger congestion and frustrating wait times. The unique selling propositions of these advanced systems often revolve around their unparalleled speed, exceptional accuracy, and intuitive ease of use for both operators and passengers.

Propelling Factors for Airport Security Screening Systems Market Growth

The Airport Security Screening Systems Market is experiencing robust growth propelled by a confluence of significant factors. The continuous and substantial increase in global air passenger traffic worldwide inherently necessitates a corresponding enhancement in screening capabilities to manage the escalating volume safely and efficiently. Government regulations and legally mandated security protocols at airports worldwide are a primary driver, compelling airports to adopt and upgrade to the latest advanced technologies. Technological advancements, particularly in areas like AI-powered threat detection and sophisticated sensor technology, are dramatically improving both the accuracy and operational efficiency of screening procedures. Furthermore, robust economic growth observed in many emerging markets is stimulating significant investment in expanding and modernizing airport infrastructure, including critical security systems, thereby creating substantial opportunities for market expansion.

Obstacles in the Airport Security Screening Systems Market Market

The market faces challenges including high initial investment costs for advanced systems, concerns over passenger privacy related to certain screening technologies, and potential supply chain disruptions impacting procurement and maintenance. Furthermore, competitive pressures among various vendors influence pricing and market share. The impact of these restraints can be seen in the slow adoption rate of some advanced technologies, particularly in smaller airports with limited budgets.

Future Opportunities in Airport Security Screening Systems Market

The Airport Security Screening Systems Market is ripe with future opportunities. A significant avenue for growth lies in the expansion into emerging markets where air travel is experiencing rapid growth, requiring substantial investment in security infrastructure. The development of even more efficient, rapid, and less intrusive screening technologies will continue to be a key focus, aiming to enhance both security and passenger experience. The further integration of AI and machine learning holds immense potential for predictive threat detection, automated analysis, and intelligent response systems. There is a growing emphasis on passenger experience improvements, moving towards a more seamless and less stressful journey through the security checkpoint. Looking ahead, the development and adoption of self-screening technologies, coupled with the seamless integration of biometric identification systems, could fundamentally revolutionize the airport security landscape, creating highly efficient, personalized, and secure travel environments.

Major Players in the Airport Security Screening Systems Market Ecosystem

- Westminster Group Pl

- Leidos Inc

- Braun & Co Limited

- QinetiQ Group

- Smiths Group plc

- Adani Group

- OSI Systems Inc

- Autoclear LLC

- Chemring Group plc

- Nuctech Company Limited

- Teledyne FLIR LLC

Key Developments in Airport Security Screening Systems Market Industry

- July 2023: Micro-X Inc. secured a USD 21 Million contract extension from the US Department of Homeland Security (DHS) for developing passenger self-screening checkpoint modules. This signifies a major investment in innovative self-screening solutions.

- August 2023: K2 Security Screening Group partnered with Liberty Defense Holdings to integrate the Hexwave system into US airports, expanding its service portfolio and demonstrating the market's interest in advanced walkthrough screening technologies.

Strategic Airport Security Screening Systems Market Market Forecast

The Airport Security Screening Systems Market is poised for robust growth, driven by technological advancements, rising passenger numbers, and increasing investments in airport security infrastructure. The market is expected to witness significant expansion, particularly in the adoption of advanced technologies like AI-powered threat detection and self-screening solutions. This will contribute to improved security and enhanced passenger experience, shaping the future of air travel security.

Airport Security Screening Systems Market Segmentation

-

1. Type

- 1.1. Passenger Screening

- 1.2. Vehicle Screening

- 1.3. Baggage Screening

Airport Security Screening Systems Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. Egypt

- 5.5. Rest of Middle East and Africa

Airport Security Screening Systems Market Regional Market Share

Geographic Coverage of Airport Security Screening Systems Market

Airport Security Screening Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Passenger Screening Segment to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Security Screening Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Passenger Screening

- 5.1.2. Vehicle Screening

- 5.1.3. Baggage Screening

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Airport Security Screening Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Passenger Screening

- 6.1.2. Vehicle Screening

- 6.1.3. Baggage Screening

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Airport Security Screening Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Passenger Screening

- 7.1.2. Vehicle Screening

- 7.1.3. Baggage Screening

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Airport Security Screening Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Passenger Screening

- 8.1.2. Vehicle Screening

- 8.1.3. Baggage Screening

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Airport Security Screening Systems Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Passenger Screening

- 9.1.2. Vehicle Screening

- 9.1.3. Baggage Screening

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Airport Security Screening Systems Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Passenger Screening

- 10.1.2. Vehicle Screening

- 10.1.3. Baggage Screening

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Westminster Group Pl

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leidos Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Braun & Co Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 QinetiQ Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Smiths Group plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adani Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OSI Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Autoclear LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chemring Group plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nuctech Company Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teledyne FLIR LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Westminster Group Pl

List of Figures

- Figure 1: Global Airport Security Screening Systems Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Airport Security Screening Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Airport Security Screening Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Airport Security Screening Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Airport Security Screening Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Airport Security Screening Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 7: Europe Airport Security Screening Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Airport Security Screening Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Airport Security Screening Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Airport Security Screening Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Airport Security Screening Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Airport Security Screening Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Airport Security Screening Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Airport Security Screening Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Latin America Airport Security Screening Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Airport Security Screening Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Airport Security Screening Systems Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Airport Security Screening Systems Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Middle East and Africa Airport Security Screening Systems Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Middle East and Africa Airport Security Screening Systems Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Airport Security Screening Systems Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Airport Security Screening Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Airport Security Screening Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Airport Security Screening Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Airport Security Screening Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: US Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Airport Security Screening Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Airport Security Screening Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: UK Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Spain Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Russia Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Airport Security Screening Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 16: Global Airport Security Screening Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: India Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Japan Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: South Korea Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Airport Security Screening Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Airport Security Screening Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Mexico Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Brazil Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Latin America Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Airport Security Screening Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 28: Global Airport Security Screening Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: United Arab Emirates Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Qatar Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Egypt Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Airport Security Screening Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Security Screening Systems Market?

The projected CAGR is approximately 7.32%.

2. Which companies are prominent players in the Airport Security Screening Systems Market?

Key companies in the market include Westminster Group Pl, Leidos Inc, Braun & Co Limited, QinetiQ Group, Smiths Group plc, Adani Group, OSI Systems Inc, Autoclear LLC, Chemring Group plc, Nuctech Company Limited, Teledyne FLIR LLC.

3. What are the main segments of the Airport Security Screening Systems Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Passenger Screening Segment to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

August 2023: K2 Security Screening Group entered into an agreement with Liberty Defense Holdings to introduce Liberty’s Hexwave system at US airports. Under this arrangement, K2 will augment its security services portfolio by incorporating the Hexwave walkthrough people screening system. K2 Security Screening Group specializes in planning, managing, installing, and integrating security screening systems for airport passengers and checked baggage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Security Screening Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Security Screening Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Security Screening Systems Market?

To stay informed about further developments, trends, and reports in the Airport Security Screening Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence