Key Insights

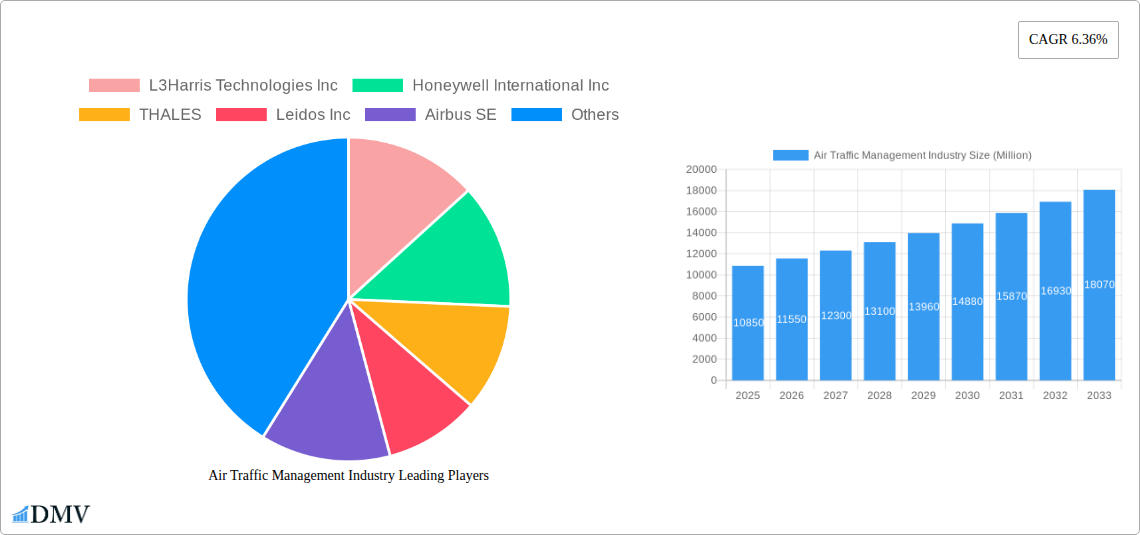

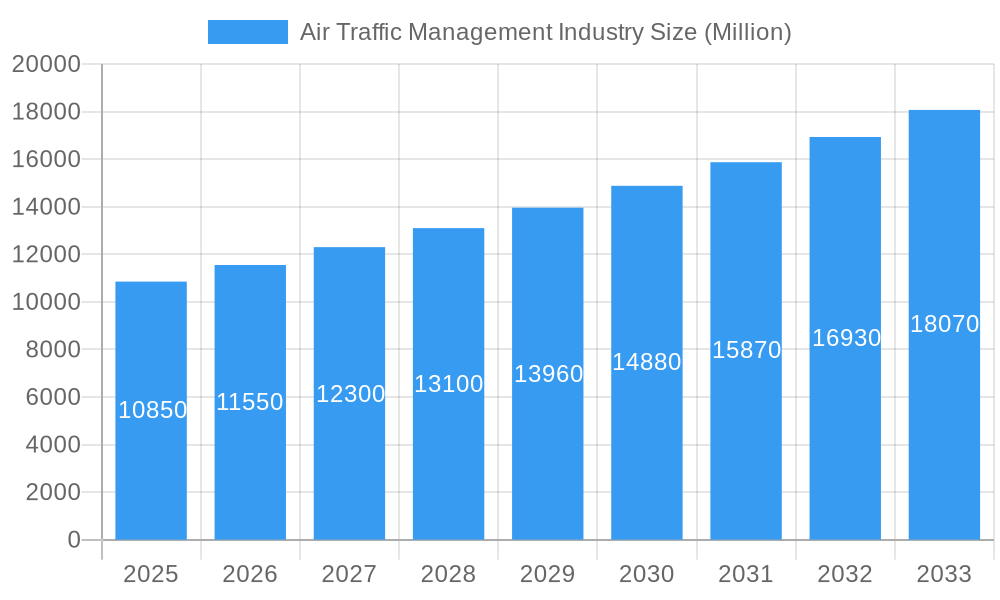

The Air Traffic Management (ATM) industry, valued at $10.85 billion in 2025, is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.36% from 2025 to 2033. This expansion is driven by several key factors. Increasing air passenger traffic globally necessitates more sophisticated and efficient ATM systems to handle the growing volume of flights and ensure safety. The integration of advanced technologies such as Artificial Intelligence (AI), machine learning, and data analytics is revolutionizing ATM operations, improving efficiency, reducing delays, and enhancing safety protocols. Furthermore, the rising adoption of Next Generation Air Transportation System (NextGen) initiatives worldwide is fueling demand for upgraded hardware and software solutions. Stringent government regulations aimed at enhancing air safety and reducing environmental impact also contribute to market growth. However, high initial investment costs associated with implementing new ATM technologies, along with the complexity of integrating legacy systems with modern infrastructure, present significant challenges for the industry. The development and implementation of cybersecurity measures to protect critical ATM infrastructure from potential threats also pose a restraint to growth.

Air Traffic Management Industry Market Size (In Billion)

The ATM market is segmented by domain (Air Traffic Control, Air Traffic Flow Management, Aeronautical Information Management) and component (Hardware, Software). Hardware accounts for a larger segment share due to the need for continuous upgrades and installations of radar systems, communication equipment, and navigation aids. The software segment is experiencing faster growth, driven by the increasing demand for advanced air traffic management solutions and the increasing adoption of software-defined networking within the ATM ecosystem. Geographically, North America and Europe currently dominate the market, owing to established infrastructure and advanced technology adoption. However, the Asia-Pacific region is expected to witness significant growth in the coming years, fueled by rapid economic expansion, rising air travel demand, and government investments in modernizing ATM systems in countries like China and India. Key players in the market, including L3Harris Technologies Inc, Honeywell International Inc, Thales, and Airbus SE, are investing heavily in research and development to maintain their competitive advantage and capitalize on emerging market opportunities.

Air Traffic Management Industry Company Market Share

Air Traffic Management (ATM) Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Air Traffic Management (ATM) industry, encompassing market size, growth drivers, technological advancements, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach $XX Million by 2033.

Air Traffic Management Industry Market Composition & Trends

The global Air Traffic Management (ATM) market, valued at $XX Million in 2025, exhibits a moderately concentrated structure. Key players like L3Harris Technologies Inc, Honeywell International Inc, THALES, and Leidos Inc hold significant market share, but a diverse range of smaller companies and regional players also contribute. Market share distribution is dynamic, influenced by ongoing mergers and acquisitions (M&A) activity. Recent M&A deals, totaling approximately $XX Million in value during the historical period (2019-2024), reflect consolidation trends and the pursuit of technological synergies.

Innovation in areas such as AI-powered air traffic control systems, NextGen technologies, and satellite-based communication systems are key drivers of market evolution. Stringent regulatory frameworks, established by bodies like the FAA and EUROCONTROL, significantly shape industry practices and investment strategies. The presence of substitute products and technologies, although limited, presents a degree of competitive pressure. The end-user profile is diverse, encompassing airlines, airports, air navigation service providers (ANSPs), and government agencies.

- Market Concentration: Moderately concentrated, with major players holding significant share but a presence of smaller players.

- Innovation Catalysts: AI, NextGen technologies, Satellite-based communication.

- Regulatory Landscape: Stringent and influential, impacting investment and operations.

- Substitute Products: Limited, but existing technological alternatives pose some pressure.

- End-User Profile: Airlines, airports, ANSPs, government agencies.

- M&A Activity: Significant, totaling approximately $XX Million (2019-2024), driven by consolidation and technology acquisition.

Air Traffic Management Industry Evolution

The ATM industry has witnessed significant growth from 2019 to 2024, expanding at a Compound Annual Growth Rate (CAGR) of XX%. This growth is primarily attributed to rising air travel demand, increasing investments in ATM infrastructure modernization, and the adoption of new technologies aimed at enhancing safety, efficiency, and capacity. The global shift towards automation and digitalization is also driving market expansion, exemplified by the increasing implementation of sophisticated air traffic control systems and data management solutions.

Technological advancements such as the integration of artificial intelligence (AI) and machine learning (ML) for predictive maintenance, improved trajectory prediction, and conflict resolution are revolutionizing ATM operations. Furthermore, the growing adoption of satellite-based augmentation systems (SBAS) and the development of NextGen technologies are bolstering sector-wide efficiency. The changing needs and expectations of airlines and air navigation service providers (ANSPs) also contribute significantly to the market's evolution, with heightened focus on safety, reduced operational costs, and enhanced passenger experience. We project a CAGR of XX% for the forecast period (2025-2033). Adoption metrics for key technologies, such as AI-powered systems, are expected to increase by XX% annually over this period.

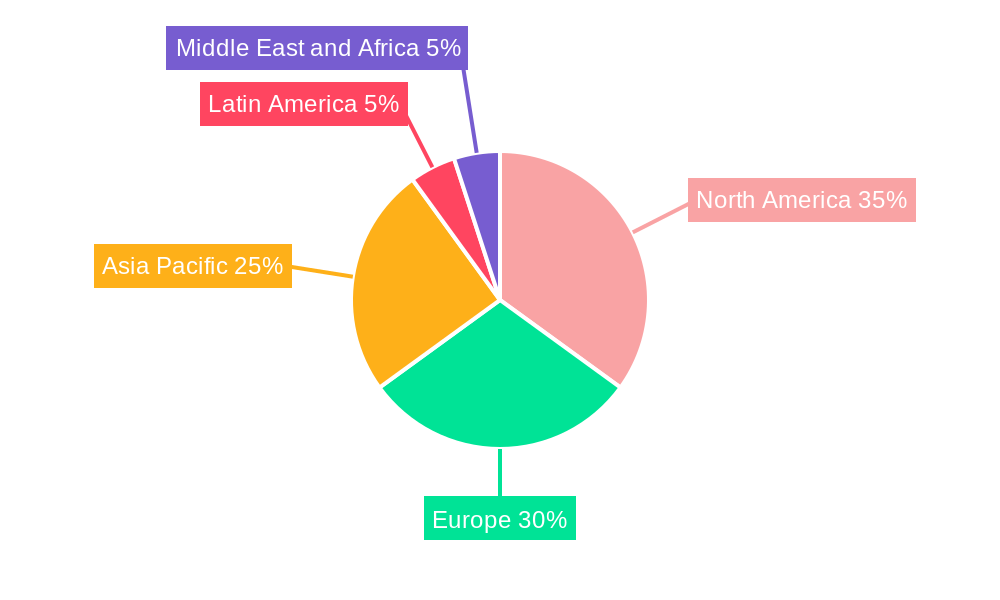

Leading Regions, Countries, or Segments in Air Traffic Management Industry

North America currently holds the leading position in the global Air Traffic Management (ATM) market. This dominance is attributed to substantial investments in transformative initiatives like the NextGen air traffic control system, coupled with the significant presence of major industry players and a well-established technological infrastructure. Europe closely follows, demonstrating a strong commitment to modernizing its airspace through programs such as the Single European Sky ATM Research (SESAR) initiative and other strategic modernization efforts aimed at enhancing efficiency and capacity. The Asia-Pacific region is emerging as a powerhouse of growth potential, propelled by the exponential increase in air travel demand, extensive infrastructure development projects, and supportive government policies fostering aviation expansion.

Key Drivers by Region:

- North America: High-level investment in NextGen, a robust ecosystem of established industry leaders, and rapid adoption of advanced technologies are key differentiators.

- Europe: The ongoing implementation of SESAR, a comprehensive and harmonized regulatory framework, and a continuous focus on airspace modernization are central to its progress.

- Asia-Pacific: The region benefits from unparalleled rapid air travel growth, ambitious infrastructure development plans, and proactive government initiatives supporting the aviation sector.

Segment Dominance and Growth:

Air Traffic Control (ATC) continues to be the largest and most critical segment within the ATM industry, projected to account for a significant portion of the market share in the coming years. Its dominance stems from its indispensable role in ensuring the safety, security, and efficiency of air navigation. Concurrently, the Air Traffic Flow Management (ATFM) segment is experiencing accelerated growth. This surge is driven by an increasing global emphasis on optimizing airspace utilization, minimizing delays, and enhancing overall network efficiency. Within the broader ATM industry, the software component is anticipated to witness faster expansion compared to hardware. This trend is fueled by the growing reliance on sophisticated software-defined networks, advanced data analytics for predictive capabilities, and the increasing demand for intelligent and adaptable ATM solutions.

Air Traffic Management Industry Product Innovations

The Air Traffic Management industry is witnessing a wave of cutting-edge innovations designed to enhance safety, efficiency, and capacity. Significant advancements include the development of highly sophisticated surveillance systems, leveraging a fusion of technologies such as advanced radar, Automatic Dependent Surveillance-Broadcast (ADS-B), and other innovative sensors to provide unparalleled situational awareness for air traffic controllers. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing traffic flow management, enabling predictive analytics for proactive conflict resolution and optimized airspace utilization. Furthermore, new software platforms are emerging with advanced functionalities, encompassing automated flight planning, real-time performance monitoring, and dynamic, optimized route scheduling. These innovations collectively contribute to substantial improvements in operational efficiency, a marked reduction in flight delays, and a smaller environmental footprint. The unique selling propositions of these innovative products lie in their ability to significantly elevate safety standards, boost operational efficiency, and demonstrably reduce environmental impact.

Propelling Factors for Air Traffic Management Industry Growth

Several factors are driving the growth of the ATM industry. Technological advancements like AI and machine learning are improving efficiency and safety. Economic factors, such as increasing air passenger traffic and the need to optimize airspace utilization, stimulate investment in ATM infrastructure and solutions. Stringent regulatory requirements from bodies like the FAA and EUROCONTROL mandate modernization and adoption of new technologies to enhance safety and reduce environmental impact. For example, the implementation of NextGen in the US and SESAR in Europe is driving significant market growth.

Obstacles in the Air Traffic Management Industry Market

The ATM industry faces challenges including high initial investment costs for new technologies, regulatory complexities that can hinder swift adoption, and the potential for supply chain disruptions impacting the timely delivery of equipment and software. Moreover, intense competition among established players and new entrants creates pressure on pricing and profitability. These factors can significantly impact market expansion. For instance, supply chain issues could lead to delays in project implementation, potentially impacting the overall market growth by XX% in a given year.

Future Opportunities in Air Traffic Management Industry

The future landscape of the Air Traffic Management industry is rich with opportunities, particularly in expanding into rapidly developing emerging markets, with the Asia-Pacific region standing out as a prime example. The strategic development and seamless integration of novel technologies, such as Unmanned Aerial Vehicle (UAV) traffic management systems, are poised to create entirely new market segments and operational paradigms. The application of blockchain technology for secure and transparent data sharing across stakeholders is another significant avenue for growth and enhanced trust. Emerging trends, including the widespread adoption of sustainable aviation fuels and a growing societal demand for an improved passenger experience, will further catalyze innovation and drive substantial market growth. These evolving needs present a fertile ground for new solutions and service offerings within the ATM ecosystem.

Major Players in the Air Traffic Management Industry Ecosystem

- L3Harris Technologies Inc

- Honeywell International Inc

- THALES

- Leidos Inc

- Airbus SE

- ANPC (Air Navigation Service Provider of Portugal)

- RTX Corporation (formerly Raytheon Technologies)

- SIT (Servizi Italiani di Telecomunicazioni)

- Adacel Technologies Limited

- Indra Sistemas S A

- Northrop Grumman Corporation

- Saab AB

Key Developments in Air Traffic Management Industry Industry

- October 2023: Biju Patnaik International Airport in Bhubaneswar, India, installed a new air traffic management automation system, boosting operational efficiency.

- January 2024: EasyJet partnered with the ESA's Iris program and Viasat, utilizing advanced satellite technology for ATM modernization. This signifies a significant shift towards satellite-based communication in ATM.

Strategic Air Traffic Management Industry Market Forecast

The Air Traffic Management industry is on a trajectory of sustained and robust growth, propelled by relentless technological advancements, the escalating global demand for air travel, and increasingly stringent regulatory requirements focused on safety and efficiency. The forecast period, spanning from 2025 to 2033, anticipates significant expansion, driven by the widespread adoption of transformative solutions. These include the integration of Artificial Intelligence (AI) for intelligent operations, the continued evolution of NextGen-like initiatives in various regions, and the deployment of advanced satellite-based technologies for enhanced navigation and communication. The market's potential is substantial, offering diverse opportunities for growth across various operational segments and geographic regions. The emergence of new market entrants and the formation of strategic partnerships are expected to intensify innovation and foster healthy competition, further shaping the future of ATM.

Air Traffic Management Industry Segmentation

-

1. Domain

- 1.1. Air Traffic Control

- 1.2. Air Traffic Flow Management

- 1.3. Aeronautical Information Management

-

2. Component

- 2.1. Hardware

- 2.2. Software

Air Traffic Management Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Qatar

- 5.4. South Africa

- 5.5. Rest of Middle East and Africa

Air Traffic Management Industry Regional Market Share

Geographic Coverage of Air Traffic Management Industry

Air Traffic Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Air Traffic Flow Management Segment To Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Domain

- 5.1.1. Air Traffic Control

- 5.1.2. Air Traffic Flow Management

- 5.1.3. Aeronautical Information Management

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Domain

- 6. North America Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Domain

- 6.1.1. Air Traffic Control

- 6.1.2. Air Traffic Flow Management

- 6.1.3. Aeronautical Information Management

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Hardware

- 6.2.2. Software

- 6.1. Market Analysis, Insights and Forecast - by Domain

- 7. Europe Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Domain

- 7.1.1. Air Traffic Control

- 7.1.2. Air Traffic Flow Management

- 7.1.3. Aeronautical Information Management

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Hardware

- 7.2.2. Software

- 7.1. Market Analysis, Insights and Forecast - by Domain

- 8. Asia Pacific Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Domain

- 8.1.1. Air Traffic Control

- 8.1.2. Air Traffic Flow Management

- 8.1.3. Aeronautical Information Management

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Hardware

- 8.2.2. Software

- 8.1. Market Analysis, Insights and Forecast - by Domain

- 9. Latin America Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Domain

- 9.1.1. Air Traffic Control

- 9.1.2. Air Traffic Flow Management

- 9.1.3. Aeronautical Information Management

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Hardware

- 9.2.2. Software

- 9.1. Market Analysis, Insights and Forecast - by Domain

- 10. Middle East and Africa Air Traffic Management Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Domain

- 10.1.1. Air Traffic Control

- 10.1.2. Air Traffic Flow Management

- 10.1.3. Aeronautical Information Management

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Hardware

- 10.2.2. Software

- 10.1. Market Analysis, Insights and Forecast - by Domain

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Technologies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Honeywell International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 THALES

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Leidos Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ANPC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RTX Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SIT

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Adacel Technologies Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indra Sistemas S A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Northrop Grumman Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Saab AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Air Traffic Management Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 3: North America Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 4: North America Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 5: North America Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 6: North America Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 9: Europe Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 10: Europe Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 11: Europe Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 15: Asia Pacific Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 16: Asia Pacific Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 17: Asia Pacific Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 18: Asia Pacific Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 21: Latin America Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 22: Latin America Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 23: Latin America Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 24: Latin America Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Air Traffic Management Industry Revenue (Million), by Domain 2025 & 2033

- Figure 27: Middle East and Africa Air Traffic Management Industry Revenue Share (%), by Domain 2025 & 2033

- Figure 28: Middle East and Africa Air Traffic Management Industry Revenue (Million), by Component 2025 & 2033

- Figure 29: Middle East and Africa Air Traffic Management Industry Revenue Share (%), by Component 2025 & 2033

- Figure 30: Middle East and Africa Air Traffic Management Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Air Traffic Management Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 2: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 3: Global Air Traffic Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 5: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 6: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 10: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 11: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 18: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 19: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Asia Pacific Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 26: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 27: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Mexico Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Brazil Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Latin America Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Air Traffic Management Industry Revenue Million Forecast, by Domain 2020 & 2033

- Table 32: Global Air Traffic Management Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 33: Global Air Traffic Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: United Arab Emirates Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Saudi Arabia Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Qatar Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Air Traffic Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Air Traffic Management Industry?

The projected CAGR is approximately 6.36%.

2. Which companies are prominent players in the Air Traffic Management Industry?

Key companies in the market include L3Harris Technologies Inc, Honeywell International Inc, THALES, Leidos Inc, Airbus SE, ANPC, RTX Corporation, SIT, Adacel Technologies Limited, Indra Sistemas S A, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the Air Traffic Management Industry?

The market segments include Domain, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.85 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Air Traffic Flow Management Segment To Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024: Easy Jet announced that they are the first airline partner of the Iris program, which is an initiative led by the European Space Agency (ESA) as well as the global communications company Viasat. Moreover, both of these organizations are now making use of the latest generation of satellite technologies to help modernize air traffic management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Air Traffic Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Air Traffic Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Air Traffic Management Industry?

To stay informed about further developments, trends, and reports in the Air Traffic Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence